Global Oncology Based In Vivo Contract Research Organization Cro Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

2.23 Billion

2025

2033

USD

1.29 Billion

USD

2.23 Billion

2025

2033

| 2026 –2033 | |

| USD 1.29 Billion | |

| USD 2.23 Billion | |

|

|

|

|

Oncology Based In-Vivo Contract Research Organization (CRO) Market Size

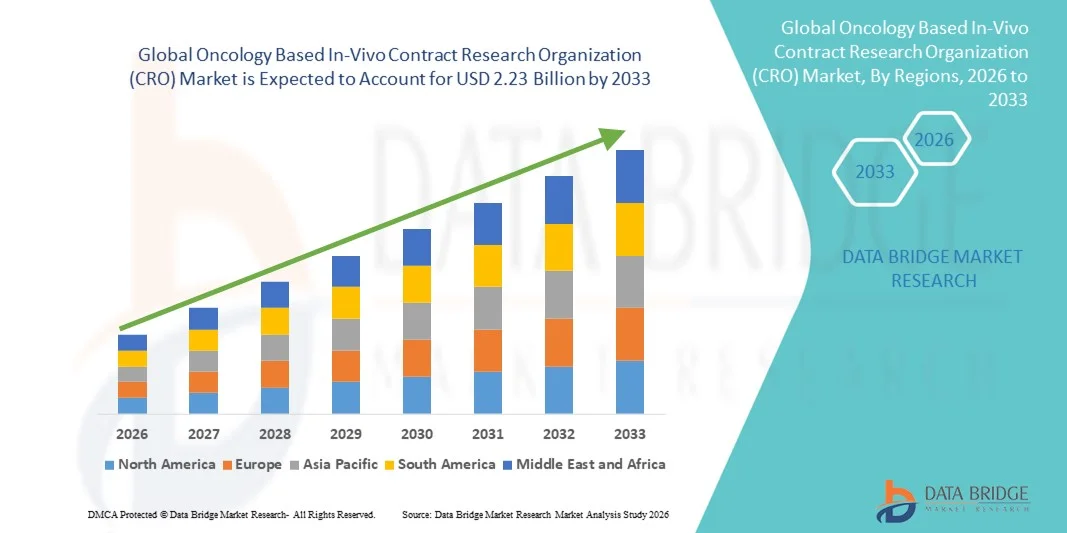

- The global oncology based In-Vivo contract research organization (CRO) market size was valued at USD 1.29 billion in 2025 and is expected to reach USD 2.23 billion by 2033, at a CAGR of 7.09% during the forecast period

- The market growth is largely fueled by the increasing demand for specialized preclinical oncology research and the rising complexity of cancer drug development, driving pharmaceutical and biotechnology companies to outsource in-vivo studies to expert service providers

- Furthermore, growing adoption of advanced animal models, precision oncology approaches, and regulatory compliance requirements is establishing Oncology Based In-Vivo Contract Research Organizations (CROs) as critical partners in accelerating drug discovery and development. These converging factors are accelerating the uptake of Oncology Based In-Vivo Contract Research Organization (CRO) solutions, thereby significantly boosting the industry's growth

Oncology Based In-Vivo Contract Research Organization (CRO) Market Analysis

- Oncology Based In-Vivo Contract Research Organizations (CROs) provide specialized preclinical services, including animal studies, tumor models, and pharmacokinetics analysis, which are increasingly vital for accelerating oncology drug discovery and development across pharmaceutical and biotechnology companies

- The escalating demand for CRO services is primarily fueled by the rising prevalence of cancer, increasing investments in oncology R&D, and the need for cost-effective and efficient preclinical testing. Growing adoption of advanced animal models, precision oncology approaches, and regulatory compliance requirements are further driving the market’s expansion

- North America dominated the oncology based in-vivo contract research organization (CRO) market with the largest revenue share of approximately 41.5% in 2025, supported by a well-established pharmaceutical ecosystem, high R&D investments, and the presence of leading CRO service providers in the U.S. The region benefits from advanced research infrastructure, experienced workforce, and early adoption of innovative preclinical oncology models

- Asia-Pacific is expected to be the fastest-growing region in the oncology based in-vivo contract Research Organization (CRO) market, registering a CAGR of around 10.3% during the forecast period. Growth is driven by expanding pharmaceutical R&D, increasing clinical trial activities, growing investments in contract research facilities, and rising adoption of modern in-vivo oncology models in countries such as China, India, and Japan

- The Patient Derived Xenograft (PDX) segment dominated the largest market revenue share of 48.5% in 2025, driven by its ability to closely mimic human tumor biology and heterogeneity.

Report Scope and Oncology Based In-Vivo Contract Research Organization (CRO) Market Segmentation

|

Attributes |

Oncology Based In-Vivo Contract Research Organization (CRO) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Oncology Based In-Vivo Contract Research Organization (CRO) Market Trends

Expansion of Oncology-Based In-Vivo Studies for Drug Development

- A significant and accelerating trend in the global Oncology Based In-Vivo Contract Research Organization (CRO) market is the increasing reliance on in-vivo preclinical models to support oncology drug development

- Pharmaceutical and biotechnology companies are increasingly outsourcing these studies to specialized CROs to ensure accuracy, reproducibility, and compliance with regulatory standards

- For instance, in 2024, Charles River Laboratories expanded its oncology in-vivo services by incorporating patient-derived xenograft (PDX) models, allowing biopharma companies to evaluate tumor responses in more clinically relevant settings. Such initiatives are helping CROs strengthen their global presence and support faster drug development timelines

- Advancements in animal modeling, high-throughput in-vivo screening, and integration with genomic and molecular profiling technologies are enabling CROs to deliver more precise efficacy and toxicity data

- Furthermore, the trend of outsourcing preclinical oncology studies is growing due to the increasing complexity of cancer therapeutics, including targeted therapies and immuno-oncology agents, which require specialized expertise and infrastructure

- This focus on high-quality in-vivo oncology studies is shaping the competitive landscape, as CROs invest in state-of-the-art laboratories, standardized protocols, and regulatory-compliant practices to meet client expectations

- The expanding demand for predictive and translational preclinical models is expected to continue driving the adoption of specialized oncology in-vivo CRO services worldwide

Oncology Based In-Vivo Contract Research Organization (CRO) Market Dynamics

Driver

Rising Global Investment in Oncology Drug Development

- The growing incidence of cancer worldwide and the surge in oncology drug pipelines are major drivers for the oncology in-vivo CRO market. Biopharma companies require robust preclinical testing to assess efficacy and safety before clinical trials

- For instance, in 2025, a leading biotechnology firm partnered with Envigo CROs to conduct PDX-based tumor efficacy studies across multiple global sites, accelerating drug candidate selection for immuno-oncology therapies

- Outsourcing in-vivo oncology studies helps companies reduce costs, access specialized expertise, and shorten development timelines

- Increasing focus on precision medicine, targeted therapies, and immuno-oncology agents has further intensified the demand for high-quality preclinical models

- Expansion of clinical pipelines, rising R&D expenditure in North America, Europe, and Asia-Pacific, and growing collaborations between CROs and pharmaceutical companies are supporting sustained market growth

Restraint/Challenge

High Costs and Regulatory Compliance Challenges

- The high cost of establishing and maintaining specialized in-vivo facilities is a key restraint for both CROs and clients. Oncology in-vivo studies require advanced infrastructure, trained personnel, and strict adherence to ethical guidelines, which can increase operational expenses

- For instance, some mid-sized CROs in emerging markets face challenges in meeting GLP (Good Laboratory Practice) and other international regulatory standards, which can limit their ability to attract global clients

- Complex regulatory frameworks across regions, including animal welfare and preclinical study guidelines, add to the operational burden and require continuous investment in compliance

- Managing supply chains for specialized reagents, tumor models, and lab animals also poses logistical challenges, particularly for CROs operating in multiple countries

- Addressing these challenges through infrastructure investment, training programs, regulatory support services, and scalable outsourcing models will be critical to enhance market penetration and support global growth of oncology in-vivo CRO services

Oncology Based In-Vivo Contract Research Organization (CRO) Market Scope

The market is segmented on the basis of indication and model.

- By Indication

On the basis of indication, the Oncology Based In-Vivo CRO market is segmented into Blood Cancer, Solid Tumors, and Others. The Blood Cancer segment dominated the largest market revenue share of 44.1% in 2025, driven by the increasing prevalence of leukemia, lymphoma, and myeloma globally. Blood cancers require highly specialized in-vivo models for preclinical testing of targeted therapies, immunotherapies, and small molecules. Contract research organizations provide customized syngeneic and xenograft models to evaluate drug efficacy and safety before clinical trials. The segment benefits from strong R&D investment in hematological malignancies by pharmaceutical and biotech companies. Advanced imaging techniques and biomarker-based evaluations enhance preclinical research quality. Adoption is high in developed regions due to established oncology research infrastructure and reimbursement policies. Increasing focus on precision medicine and immuno-oncology therapies drives demand. Collaboration with academic institutions accelerates innovation. Regulatory approvals for preclinical studies support confidence in CRO services. The segment maintains high repeat business from ongoing clinical pipeline development. Integration with pharmacokinetics and pharmacodynamics studies improves translational relevance. Emerging markets are gradually adopting blood cancer models, further supporting revenue dominance.

The Solid Tumors segment is expected to witness the fastest growth, with a CAGR of 18.9% from 2026 to 2033, due to the rising incidence of breast, lung, colorectal, and pancreatic cancers. Solid tumors require complex orthotopic and patient-derived xenograft (PDX) models to replicate tumor microenvironment and heterogeneity. CROs are increasingly offering advanced PDX and syngeneic models for immunotherapy and combination therapy development. Growth is fueled by pharmaceutical companies’ focus on novel targeted therapies and checkpoint inhibitors. Technological advancements in tumor imaging, molecular profiling, and biomarker identification enhance model relevance. Emerging markets are investing in oncology research infrastructure, providing new opportunities. Faster adoption of PDX models in clinical pipelines ensures better predictive outcomes. Strategic partnerships between biotech companies and CROs accelerate preclinical study throughput. Personalized medicine initiatives increase the demand for tumor-specific models. Improved survival rates and longer-term studies create repeat business. Regulatory frameworks in major markets support safe and effective preclinical testing. Expansion of CRO capabilities into multi-site studies strengthens growth.

- By Model

On the basis of model, the Oncology Based In-Vivo CRO market is segmented into Syngeneic Model, Patient Derived Xenograft (PDX), and Xenograft. The Patient Derived Xenograft (PDX) segment dominated the largest market revenue share of 48.5% in 2025, driven by its ability to closely mimic human tumor biology and heterogeneity. PDX models are widely used for translational oncology research, drug response prediction, and personalized medicine development. Pharmaceutical and biotech companies prefer PDX models to evaluate immunotherapy efficacy and resistance mechanisms. High adoption is observed in North America and Europe due to advanced infrastructure, regulatory compliance, and availability of patient tumor tissue. PDX models support combination therapy evaluation, biomarker discovery, and longitudinal studies. Integration with imaging modalities and omics-based analysis enhances preclinical data quality. CROs offering PDX platforms attract long-term partnerships with top-tier oncology drug developers. The segment benefits from growing clinical pipeline activities and increasing cancer incidence. Reproducibility and predictive accuracy of PDX models make them a gold standard for oncology research. Government funding for translational research supports adoption. Emerging biotech firms are increasingly outsourcing PDX studies to specialized CROs.

The Syngeneic Model segment is expected to witness the fastest growth, registering a CAGR of 17.6% from 2026 to 2033, driven by the increasing need for immuno-oncology and tumor microenvironment studies. Syngeneic models allow researchers to study tumor-immune system interactions in immunocompetent animals, crucial for checkpoint inhibitor and CAR-T therapy development. Pharmaceutical companies are expanding R&D programs in immunotherapies, fueling adoption. Technological improvements in genetic engineering and mouse modeling enhance tumor reproducibility. CROs are offering tailored syngeneic platforms for high-throughput screening and combinatorial drug testing. Growth is supported by rising clinical trial volumes and demand for more predictive preclinical models. Integration with biomarker analysis and AI-driven tumor profiling improves decision-making. Expansion in Asia-Pacific and emerging regions contributes to high CAGR. Collaboration with academic research centers accelerates innovation. Syngeneic models are increasingly used for mechanistic studies, optimizing therapy schedules. Regulatory acceptance of preclinical immuno-oncology studies ensures continued adoption.

Oncology Based In-Vivo Contract Research Organization (CRO) Market Regional Analysis

- North America dominated the oncology based in-vivo CRO market with the largest revenue share of approximately 41.5% in 2025

- This growth is supported by a well-established pharmaceutical ecosystem, high R&D investments, and the presence of leading CRO service providers in the U.S.

- The region benefits from advanced research infrastructure, an experienced workforce, and early adoption of innovative preclinical oncology models, contributing to sustained market expansion

U.S. Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

The U.S. oncology based in-vivo CRO market captured the majority of North America’s revenue in 2025, driven by high clinical trial activity, advanced oncology research facilities, and the rapid adoption of modern in-vivo oncology models. Continuous investments in preclinical research and the presence of top-tier CRO service providers have made the U.S. the leading market contributor within the region.

Europe Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

Europe’s oncology based in-vivo CRO market is projected to grow steadily over the forecast period, supported by a robust pharmaceutical sector, increasing clinical trial activities, and expanding adoption of advanced preclinical oncology models. Countries such as the U.K. and Germany are leading growth due to strong research infrastructure, high R&D investments, and supportive regulatory frameworks.

U.K. Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

The U.K. oncology based in-vivo CRO market is anticipated to register significant growth, driven by increasing oncology research activities, well-established academic and clinical research institutions, and rising collaboration with global pharmaceutical companies.

Germany Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

Germany oncology based in-vivo CRO market is expected to expand at a notable rate during the forecast period, owing to strong healthcare research infrastructure, growing investments in oncology-focused CRO services, and increasing demand for preclinical oncology studies.

Asia-Pacific Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

Asia-Pacific oncology based in-vivo CRO market is expected to be the fastest-growing region in the Oncology Based In-Vivo CRO market, registering a CAGR of around 10.3% during the forecast period. Growth is driven by expanding pharmaceutical R&D, increasing clinical trial activities, rising investments in contract research facilities, and growing adoption of modern in-vivo oncology models in countries such as China, India, and Japan.

Japan Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

Japan’s oncology based in-vivo CRO market is gaining momentum due to advanced pharmaceutical research infrastructure, rising clinical trial initiatives, and high adoption of preclinical oncology models. The country’s focus on precision medicine and oncology innovation supports continued market expansion.

China Oncology Based In-Vivo Contract Research Organization (CRO) Market Insight

China oncology based in-vivo CRO market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by the country’s rapidly expanding pharmaceutical R&D, increasing number of clinical trials, growing investments in contract research facilities, and accelerated adoption of modern in-vivo oncology models. The presence of strong domestic CRO providers further fuels market growth

Oncology Based In-Vivo Contract Research Organization (CRO) Market Share

The Oncology Based In-Vivo Contract Research Organization (CRO) industry is primarily led by well-established companies, including:

• Charles River Laboratories (U.S.)

• ICON plc (Ireland)

• Parexel International Corporation (U.S.)

• WuXi AppTec (China)

• Syngene International (India)

• Eurofins Scientific (Luxembourg)

• Medpace Holdings, Inc. (U.S.)

• Pharmaron (China)

• Crown Bioscience (U.S.)

• Taconic Biosciences (U.S.)

• Envigo (U.S.)

• Inotiv, Inc. (U.S.)

• Reaction Biology Corporation (U.S.)

• Xenometrics LLC (U.S.)

• Oncodesign (France)

• Explora BioLabs (U.S.)

• GenScript Biotech Corporation (China)

• SRI International (U.S.)

• Biomere (U.S.)

Latest Developments in Global Oncology Based In-Vivo Contract Research Organization (CRO) Market

- In October 2021, Crown Bioscience launched its 3D Ex Vivo Patient Tissue Platform to advance immuno‑oncology drug testing by combining three‑dimensional tumor models with high‑content imaging, improving preclinical response prediction and translational relevance for oncology drug developers. This new platform helped CRO clients better evaluate drug efficacy using more physiologically relevant tumor models, addressing early drug development challenges

- In March 2023, ClinChoice Medical Development, a U.S.‑based contract research organization, acquired Cromsource S.r.l., expanding its oncology in‑vivo service network with additional delivery hubs in Europe and the U.S. This acquisition broadened ClinChoice’s global capacity to support oncology preclinical studies, strengthening its service footprint for multinational sponsors

- In August 2025, WuXi AppTec introduced next‑generation in‑vivo oncology research platforms that integrate AI‑based tumor growth analytics and imaging capabilities, improving study accuracy and predictive power for oncology preclinical endpoints

- In September 2025, Charles River Laboratories further expanded its oncology in‑vivo CRO offerings with advanced mouse and rat tumor models, aimed at supporting immuno‑oncology and targeted therapy preclinical testing with greater translational relevance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.