Global Ophthalmic Ultrasound Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.01 Billion

USD

6.08 Billion

2025

2033

USD

4.01 Billion

USD

6.08 Billion

2025

2033

| 2026 –2033 | |

| USD 4.01 Billion | |

| USD 6.08 Billion | |

|

|

|

|

Ophthalmic Ultrasound Devices Market Size

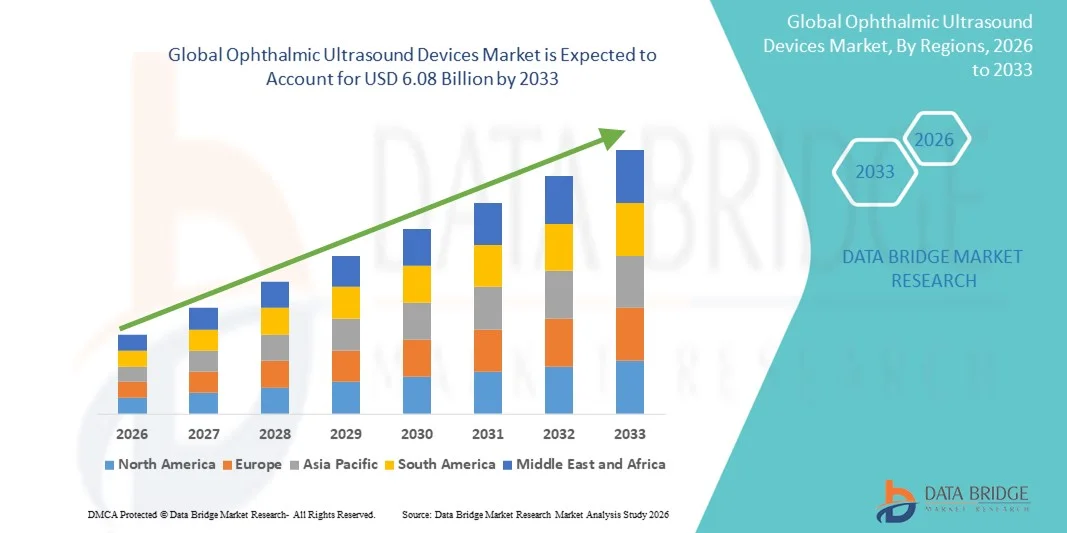

- The global ophthalmic ultrasound devices market size was valued at USD 4.01 billion in 2025 and is expected to reach USD 6.08 billion by 2033, at a CAGR of 5.36% during the forecast period

- The market growth is largely fueled by the increasing prevalence of eye disorders, rising geriatric population, and technological advancements in ophthalmic imaging devices, leading to enhanced diagnostic accuracy and improved patient outcomes

- Furthermore, rising demand for non-invasive, high-resolution diagnostic tools in hospitals, clinics, and ophthalmology centers is establishing ophthalmic ultrasound devices as essential components in modern eye care. These converging factors are accelerating the uptake of Ophthalmic Ultrasound Devices solutions, thereby significantly boosting the industry's growth

Ophthalmic Ultrasound Devices Market Analysis

- Ophthalmic ultrasound devices, providing high-resolution imaging for the anterior and posterior segments of the eye, are increasingly vital tools in modern ophthalmology due to their precision, non-invasive diagnostics, and ability to guide surgical planning and disease management

- The escalating demand for ophthalmic ultrasound devices is primarily fueled by the rising prevalence of eye disorders, increasing geriatric population, and growing adoption of advanced diagnostic imaging technologies in clinics and hospitals

- North America dominated the ophthalmic ultrasound devices market with the largest revenue share of 42.5% in 2025, supported by advanced healthcare infrastructure, strong ophthalmology research, and early adoption of innovative diagnostic technologies in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the ophthalmic ultrasound devices market during the forecast period, driven by increasing ophthalmic healthcare facilities, rising incidence of eye diseases, and growing investments in diagnostic imaging technologies, particularly in countries like China and India

- The Standalone segment dominated the market in 2025, accounting for nearly 56.7% of total revenue.

Report Scope and Ophthalmic Ultrasound Devices Market Segmentation

|

Attributes |

Ophthalmic Ultrasound Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Haag-Streit (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ophthalmic Ultrasound Devices Market Trends

Advancements in Ophthalmic Imaging and Diagnostic Precision

- A significant and accelerating trend in the global Ophthalmic Ultrasound Devices market is the adoption of advanced imaging technologies and portable diagnostic solutions designed to enhance clinical precision, improve patient outcomes, and support ophthalmologists in both hospital and clinic settings

- For instance, high-frequency ultrasound biomicroscopy (UBM) devices and compact A/B-scan systems are increasingly being used for anterior and posterior segment imaging, glaucoma assessment, and preoperative evaluations for cataract and retinal surgeries

- The trend toward miniaturized, high-resolution, and user-friendly ophthalmic ultrasound devices is enabling broader application in outpatient clinics, mobile eye care units, and remote healthcare setups

- Integration with digital imaging software and enhanced visualization tools allows ophthalmologists to obtain more accurate measurements, monitor disease progression, and make informed clinical decisions

- This trend toward precision, portability, and improved diagnostic capability is reshaping expectations for ophthalmic imaging equipment. Consequently, manufacturers are developing ophthalmic ultrasound devices with higher resolution probes, improved ergonomic design, and compatibility with electronic health record (EHR) systems

- The demand for advanced ophthalmic ultrasound devices is growing globally across hospitals, specialty eye clinics, and diagnostic centers as healthcare providers increasingly prioritize rapid, accurate, and non-invasive diagnostic solutions

Ophthalmic Ultrasound Devices Market Dynamics

Driver

Rising Prevalence of Eye Disorders and Expanding Ophthalmology Services

- The growing prevalence of eye disorders, including cataract, glaucoma, diabetic retinopathy, and retinal detachment, is a significant driver supporting the growth of the ophthalmic ultrasound devices market worldwide

- For instance, according to the World Health Organization, the global incidence of diabetic retinopathy is expected to rise steadily over the next decade, increasing demand for diagnostic imaging solutions in ophthalmology clinics

- Expanding healthcare infrastructure, rising awareness of early diagnosis, and increasing adoption of advanced imaging technologies in emerging markets are significantly boosting demand for ophthalmic ultrasound devices

- Furthermore, the growing number of eye care centers, ambulatory surgical centers, and mobile eye clinics is creating a need for compact, easy-to-use, and portable ultrasound systems that support efficient workflows and patient management

- The expansion of ophthalmic specialty services, coupled with increasing patient volumes in both developed and developing regions, is a critical factor propelling market growth globally

Restraint/Challenge

High Cost of Devices and Need for Skilled Operation

- The relatively high cost of advanced ophthalmic ultrasound devices, including high-frequency UBM and combined A/B-scan systems, is a significant challenge to broader adoption, particularly for small clinics and budget-conscious healthcare facilities in developing regions

- For instance, smaller eye care centers often face financial constraints that limit their ability to invest in high-end diagnostic imaging equipment, leading them to continue using traditional or less advanced imaging solutions

- In additional, operating ophthalmic ultrasound devices requires trained personnel and specialized expertise, making it challenging for healthcare facilities with limited staff or training resources to fully utilize these systems

- Maintenance requirements, periodic calibration, and the need for technical support further add to the total cost of ownership and may act as a barrier to adoption

- Addressing these challenges through cost-effective, portable device designs, simplified user interfaces, and targeted training programs for healthcare professionals will be critical for sustained growth in the global Ophthalmic Ultrasound Devices market

Ophthalmic Ultrasound Devices Market Scope

The market is segmented on the basis of mobility outlook, product, and end user.

- By Product

On the basis of product, the Ophthalmic Ultrasound Devices market is segmented into OCT, Fundus Camera, Ultrasound, Ophthalmoscope, Phoropter, Slit Lamp, Perimeter, Keratometer, Tonometer, IOL, Excimer Laser, OVDs, and Phacoemulsification. The Ultrasound segment dominated the market with a revenue share of approximately 38.5% in 2025. This dominance is driven by its essential role in the diagnosis and monitoring of a wide range of ocular disorders, including retinal detachment, vitreous hemorrhage, and cataracts. Ultrasound devices are highly valued for their precision, ease of integration with clinical workflows, and ability to assist in pre-operative and intraoperative procedures. Hospitals, ambulatory surgical centers, and ophthalmic clinics extensively use these devices due to their reliability, long-term performance, and compatibility with advanced imaging software. The segment also benefits from consistent technological enhancements that improve imaging clarity, depth measurement, and patient outcomes. Rising prevalence of eye disorders globally, combined with increased investments in ophthalmic diagnostic infrastructure, further strengthens the dominance of ultrasound devices in 2025.

The OCT segment is expected to witness the fastest CAGR of 21.4% from 2026 to 2033, owing to rapid technological advancements such as spectral-domain OCT, swept-source OCT, and AI-based image analysis. OCT devices are increasingly adopted for the detection and monitoring of retinal diseases, glaucoma, and macular degeneration, enabling ophthalmologists to provide early diagnosis and precise treatment plans. The growing demand for non-invasive, high-resolution imaging solutions is fueling adoption in hospitals, specialized eye clinics, and research centers. In addition, integration of OCT systems with electronic medical records, teleophthalmology platforms, and portable screening tools enhances workflow efficiency and accessibility. The segment’s growth is also supported by increasing awareness among patients regarding regular eye examinations and proactive disease management.

- By Mobility Outlook

On the basis of mobility, the market is segmented into Standalone and Portable/Handheld devices. The Standalone segment dominated the market in 2025, accounting for nearly 56.7% of total revenue. This dominance is driven by widespread installation in large hospitals, ophthalmic centers, and ambulatory surgical facilities. Standalone systems are preferred for their comprehensive functionality, superior image quality, and ability to integrate multiple ophthalmic diagnostic tools into one platform. These devices support high patient throughput, detailed reporting, and advanced surgical planning, making them the go-to choice for healthcare providers managing complex eye conditions. Their robustness, long service life, and compatibility with hospital IT infrastructure also contribute to sustained demand. Furthermore, institutional procurement budgets and preference for multi-functional systems strengthen the revenue share of standalone devices in 2025.

The Portable/Handheld segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by rising demand for point-of-care diagnostics and home-based eye screenings. Portable devices are particularly attractive for outreach programs, rural clinics, and teleophthalmology services, as they enable accurate diagnosis outside traditional hospital settings. Advancements in miniaturized sensors, battery efficiency, and wireless connectivity have enhanced the functionality of handheld ultrasound and OCT devices, allowing ophthalmologists to deliver high-quality imaging in compact form factors. Growing awareness of preventive eye care and government initiatives to improve vision care accessibility further accelerate adoption of portable devices globally.

- By End User

On the basis of end user, the market is segmented into Hospitals, Ambulatory Surgical Centers, Ophthalmic Clinics, Consumers, and Others. The Hospitals segment dominated in 2025 with a revenue share of around 45.9%, owing to high patient volume, sophisticated diagnostic requirements, and large-scale adoption of multi-device ophthalmic suites. Hospitals invest in ultrasound, OCT, slit lamp, and other devices to manage complex ocular disorders and surgical procedures efficiently. The dominance is supported by institutional budgets, long-term service contracts, and the presence of specialized ophthalmology departments. Moreover, hospitals benefit from centralized maintenance, integrated software platforms, and the ability to provide comprehensive eye care, which strengthens the segment’s leading position in 2025.

The Ophthalmic Clinics segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, fueled by the growth of specialized eye care facilities and outpatient services. Clinics increasingly adopt compact ultrasound and OCT devices to enhance operational efficiency, provide timely diagnostics, and serve a growing patient base in urban and semi-urban areas. The rise of vision care awareness campaigns, insurance coverage for preventive ophthalmology, and demand for early detection of retinal and glaucoma-related disorders are key growth drivers. Technological advancements enabling smaller, cost-effective, and portable devices also encourage adoption in clinic settings, ensuring rapid market expansion over the forecast period.

Ophthalmic Ultrasound Devices Market Regional Analysis

- The North America ophthalmic ultrasound devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by advanced healthcare infrastructure, strong ophthalmology research, and early adoption of innovative diagnostic technologies

- Healthcare providers are increasingly adopting ophthalmic ultrasound solutions to improve diagnosis accuracy, enhance patient care, and streamline clinical workflows

- Growth is being observed across hospitals, specialty clinics, and diagnostic centers, with automation and advanced imaging systems being integrated into both newly built facilities and existing healthcare infrastructure modernization initiatives

U.S. Ophthalmic Ultrasound Devices Market Insight

The U.S. ophthalmic ultrasound devices market captured the largest revenue share of 42.5% in 2025 within North America, fueled by the early adoption of advanced diagnostic technologies, strong research in ophthalmology, and widespread implementation of ophthalmic ultrasound systems in hospitals and specialized clinics. The increasing prevalence of eye disorders, along with rising investments in ophthalmic healthcare facilities, is further strengthening market expansion.

Europe Ophthalmic Ultrasound Devices Market Insight

The Europe ophthalmic ultrasound devices market is projected to expand at a substantial CAGR during the forecast period, driven by increasing awareness about eye care, rising prevalence of ocular diseases, and the demand for technologically advanced diagnostic solutions. European healthcare facilities are increasingly integrating ophthalmic ultrasound devices into clinical workflows to improve diagnostic efficiency and patient outcomes.

U.K. Ophthalmic Ultrasound Devices Market Insight

The U.K. ophthalmic ultrasound devices market is expected to grow at a noteworthy CAGR, supported by a robust healthcare infrastructure, strong government initiatives for eye care, and increasing adoption of advanced diagnostic imaging technologies across hospitals and ophthalmology clinics.

Germany Ophthalmic Ultrasound Devices Market Insight

The Germany ophthalmic ultrasound devices market is anticipated to expand at a considerable CAGR, driven by technological advancements in ophthalmology, rising prevalence of eye disorders, and strong investments in healthcare infrastructure. Integration of high-precision imaging systems and diagnostic automation is fueling market adoption in hospitals and specialized clinics.

Asia Pacific Ophthalmic Ultrasound Devices Market Insight

The Asia-Pacific ophthalmic ultrasound devices market is poised to grow at the fastest CAGR during the forecast period, driven by increasing ophthalmic healthcare facilities, rising incidence of eye diseases, and growing investments in diagnostic imaging technologies. Healthcare providers in countries such as China, Japan, and India are rapidly adopting advanced ophthalmic ultrasound devices to improve diagnostic accuracy and patient care.

Japan Ophthalmic Ultrasound Devices Market Insight

The Japan ophthalmic ultrasound devices market is gaining momentum due to rapid technological adoption, high standards of healthcare infrastructure, and the growing need for accurate ophthalmic diagnostics. Integration of advanced ultrasound systems with clinical workflows is further enhancing patient outcomes.

China Ophthalmic Ultrasound Devices Market Insight

The China ophthalmic ultrasound devices market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by expanding ophthalmic healthcare infrastructure, rising prevalence of eye disorders, and strong domestic and international investments in diagnostic imaging technologies. China is emerging as a key market for innovative ophthalmic ultrasound devices, supported by government initiatives and increasing healthcare accessibility.

Ophthalmic Ultrasound Devices Market Share

The Ophthalmic Ultrasound Devices industry is primarily led by well-established companies, including:

• Haag-Streit (Switzerland)

• Topcon Corporation (Japan)

• Nidek Co., Ltd. (Japan)

• Carl Zeiss Meditec AG (Germany)

• Canon Medical Systems Corporation (Japan)

• Optovue, Inc. (U.S.)

• Ellex Medical Lasers Ltd. (Australia)

• Tomey Corporation (Japan)

• Reichert Technologies (U.S.)

• CSO Italy (Italy)

• Kowa Company, Ltd. (Japan)

• Bausch + Lomb (U.S.)

• Inami & Co., Ltd. (Japan)

• Micromedical Technologies (U.S.)

• Accutome, Inc. (U.S.)

• Sonomed Escalon (U.S.)

• Keeler Ltd. (U.K.)

• Marco Ophthalmic, Inc. (U.S.)

• Luneau Technology Group (France)

• Meditron, Inc. (U.S.)

Latest Developments in Global Ophthalmic Ultrasound Devices Market

- In March 2023, Topcon Corporation launched the Sonovue 700 portable ophthalmic ultrasound device, designed to deliver high‑resolution imaging of both the anterior and posterior segments of the eye for improved diagnostics in clinical and surgical settings. This device expanded portable diagnostic capabilities, supporting faster, more accurate assessments in hospitals and ophthalmic practices globally, responding to the rising demand for mobility and precision

- In January 2023, Chongqing Sunkingdom Medical Instrument’s Ophthalmic Ultrasound Examination Instruments (models SK‑3000A, SK‑3000B, SK‑3000C, SK‑2000AP, SK‑2000A, and SK‑2000P) received FDA clearance in the United States, enabling broader clinical use of its A‑scan, B‑scan, and pachymetry ultrasound devices in ophthalmic diagnostics. This regulatory milestone opened new pathways for market expansion of multi‑mode ultrasound systems

- In May 2024, ArcScan, Inc.’s Insight 100 ophthalmic ultrasound imaging system received National Medical Products Administration (NMPA) certification in China, making it one of the first high‑frequency computer‑controlled ultrasound devices approved for detailed anterior segment imaging in the Chinese market. This approval is significant as it supports enhanced management of myopia and other anterior segment conditions in a region with one of the world’s largest populations of eye care patients

- In May 2024, Quantel Medical introduced the POCKET III handheld ophthalmic ultrasound pachymeter, a next‑generation device that weighs only about 60 grams and measures corneal thickness with ±5 µm accuracy, offering clinicians a highly portable and precise tool for corneal assessment. This launch highlights innovation trends toward miniaturized, point‑of‑care ultrasound solutions

- In September 2024, Clarius Mobile Health signed an agreement with EyeProGPO to expand distribution of its Clarius wireless handheld ultrasound systems tailored for ophthalmic applications, strengthening access to advanced ultrasound technology for eye care professionals and clinics across the United States

- In March 2025, Quantel Medical and Topcon Corporation announced a strategic partnership to co‑develop advanced ophthalmic ultrasound biometry solutions, aimed at improving automated intraocular lens calculations and workflow integration for cataract and refractive surgery planning. This collaboration reflects a broader industry focus on multimodal imaging integration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.