Global Ophthalmology Drugs Devices Market

Market Size in USD Billion

CAGR :

%

USD

92.60 Billion

USD

145.37 Billion

2025

2033

USD

92.60 Billion

USD

145.37 Billion

2025

2033

| 2026 –2033 | |

| USD 92.60 Billion | |

| USD 145.37 Billion | |

|

|

|

|

Ophthalmology Drugs and Devices Market Size

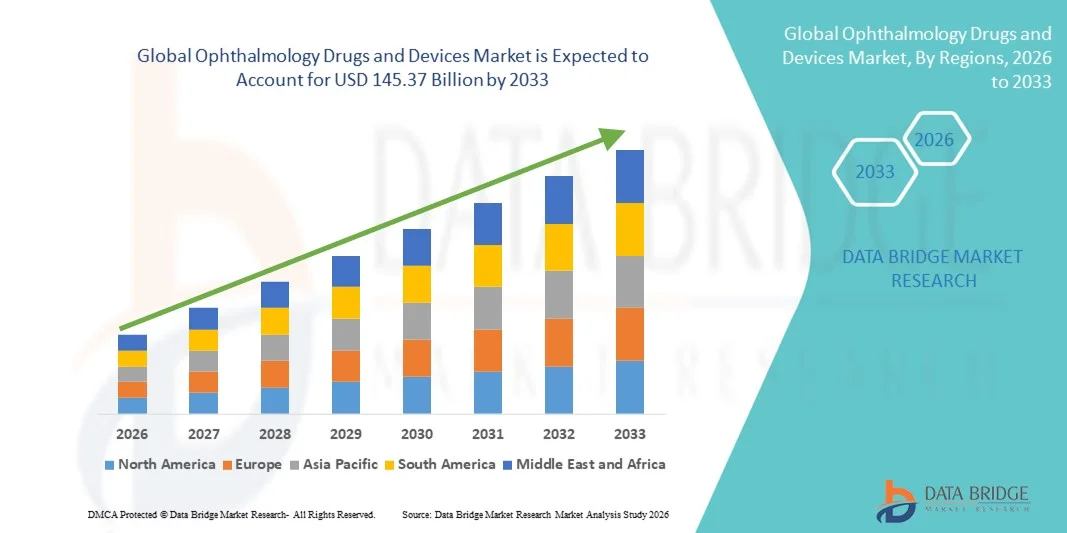

- The global ophthalmology drugs and devices market size was valued at USD 92.6 billion in 2025 and is expected to reach USD 145.37 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of ophthalmic disorders such as glaucoma, cataract, age-related macular degeneration (AMD), diabetic retinopathy, and dry eye disease, along with increasing geriatric population and growing awareness regarding early diagnosis and treatment of vision-related conditions. Continuous advancements in drug formulations, sustained-release therapies, minimally invasive surgical devices, and diagnostic technologies are further accelerating adoption across hospitals and specialty eye clinics

- Furthermore, increasing patient demand for effective, minimally invasive, and long-lasting treatment solutions, along with expanding access to eye care services and favorable reimbursement policies in developed markets, is establishing ophthalmology drugs and devices as essential components of modern vision care. These converging factors are accelerating the uptake of Ophthalmology Drugs and Devices solutions, thereby significantly boosting overall market growth

Ophthalmology Drugs and Devices Market Analysis

- Ophthalmology drugs and devices, including anti-VEGF therapies, corticosteroids, glaucoma medications, intraocular lenses, and advanced surgical equipment, are increasingly vital components of modern eye care across hospitals, specialty eye clinics, and ambulatory surgical centers due to their role in preventing vision loss, improving treatment outcomes, and enabling minimally invasive procedures

- The escalating demand for ophthalmology drugs and devices is primarily fueled by the rising prevalence of age-related eye disorders such as glaucoma, cataract, diabetic retinopathy, and macular degeneration, growing geriatric population, increasing awareness regarding early eye disease diagnosis, and continuous technological advancements in drug delivery systems and precision surgical devices

- North America dominated the ophthalmology drugs and devices market with the largest revenue share of 37.8% in 2025, characterized by advanced healthcare infrastructure, high adoption of innovative ophthalmic therapies and surgical technologies, favorable reimbursement policies, and strong presence of leading pharmaceutical and medical device companies, with the U.S. accounting for a significant portion of regional revenue

- Asia-Pacific is expected to be the fastest growing region in the ophthalmology drugs and devices market during the forecast period, driven by rising incidence of vision disorders, expanding healthcare access, growing medical tourism, increasing disposable incomes, and improving ophthalmic care infrastructure in countries such as China, India, and Japan

- The Eye Drops segment dominated with a 52.6% revenue share in 2025, attributed to its widespread use in glaucoma, dry eye, infections, and allergic conjunctivitis treatment. Eye drops provide direct drug delivery to ocular tissues with minimal systemic exposure

Report Scope and Ophthalmology Drugs and Devices Market Segmentation

|

Attributes |

Ophthalmology Drugs and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ophthalmology Drugs and Devices Market Trends

Advancements in Targeted Therapies and Minimally Invasive Ophthalmic Technologies

- A significant and accelerating trend in the global ophthalmology drugs and devices market is the growing development of targeted biologic therapies and precision-based ophthalmic devices designed to improve treatment outcomes for chronic and vision-threatening conditions. Innovations in drug delivery systems, sustained-release implants, and minimally invasive surgical devices are transforming the management of retinal disorders, glaucoma, and dry eye disease

- For instance, long-acting intravitreal injections and sustained-release corticosteroid implants are reducing the frequency of hospital visits for patients with age-related macular degeneration (AMD) and diabetic retinopathy. Similarly, advancements in micro-invasive glaucoma surgery (MIGS) devices are enabling safer and more efficient intraocular pressure control with reduced recovery times

- The integration of advanced diagnostic imaging technologies, such as optical coherence tomography (OCT), with therapeutic decision-making is enabling ophthalmologists to personalize treatment regimens. These technologies facilitate early disease detection, precise monitoring of retinal thickness, and timely intervention, ultimately improving visual prognosis

- Furthermore, the increasing adoption of combination therapies and biologics targeting vascular endothelial growth factor (VEGF) pathways is enhancing treatment efficacy in retinal diseases. The shift toward patient-centric treatment approaches, including sustained drug delivery and outpatient-based surgical procedures, is improving patient compliance and overall quality of car

- This trend toward innovative pharmacological formulations and minimally invasive ophthalmic devices is reshaping clinical practice patterns and elevating standards of care across hospitals, specialty eye clinics, and ambulatory surgical centers

- The demand for advanced ophthalmology drugs and technologically sophisticated devices continues to rise globally as healthcare systems prioritize early diagnosis, improved therapeutic precision, and better long-term vision outcomes

Ophthalmology Drugs and Devices Market Dynamics

Driver

Increasing Prevalence of Ophthalmic Disorders and Aging Population

- The rising global burden of ophthalmic disorders, including cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration, is a major driver of growth in the Ophthalmology Drugs and Devices market. The expanding geriatric population, which is more susceptible to vision impairment and chronic eye diseases, significantly contributes to sustained demand for both pharmacological treatments and surgical interventions

- For instance, the growing incidence of diabetic retinopathy has led to increased utilization of anti-VEGF injections such as bevacizumab for retinal vascular conditions, while cataract cases are driving higher volumes of phacoemulsification procedures using advanced intraocular lenses (IOLs). In addition, glaucoma management increasingly involves the use of minimally invasive surgical devices to reduce intraocular pressure and prevent optic nerve damage

- Increasing incidence of diabetes and lifestyle-related disorders has led to a higher prevalence of diabetic eye diseases, thereby driving demand for anti-VEGF drugs, laser therapy devices, and vitrectomy systems. Healthcare providers are prioritizing early diagnosis and timely treatment to prevent irreversible vision loss

- Technological advancements in surgical equipment, including femtosecond lasers and minimally invasive glaucoma devices, are encouraging higher procedural volumes and improved patient outcomes. These innovations reduce surgical complications, shorten recovery times, and enhance precision during ophthalmic procedures

- Government initiatives aimed at preventing blindness and expanding access to eye care services, particularly in developing economies, are further supporting market expansion. Screening programs and public health campaigns are increasing awareness about the importance of regular eye examinations

- In addition, the growing demand for premium intraocular lenses (IOLs) and refractive correction procedures is contributing to increased adoption of advanced ophthalmic devices. The combination of rising disease prevalence, technological progress, and expanding healthcare access continues to propel market growth globally

Restraint/Challenge

High Treatment Costs and Limited Access in Developing Regions

- The high cost associated with advanced ophthalmology drugs, particularly biologics and sustained-release formulations, presents a significant challenge for widespread adoption. Premium surgical devices and diagnostic equipment also require substantial capital investment, limiting accessibility for smaller healthcare facilities

- For instance, repeated intravitreal injections of branded anti-VEGF biologics can significantly increase annual treatment expenses for patients with macular degeneration, while advanced femtosecond laser-assisted cataract surgery systems involve high procurement and maintenance costs for hospitals. In many low- and middle-income countries, limited insurance coverage further restricts patient access to these advanced therapies

- Many innovative therapies for retinal disorders require repeated intravitreal injections, increasing overall treatment expenses and creating affordability concerns for uninsured or underinsured patient populations. Reimbursement limitations in certain regions further restrict access to advanced therapies

- In developing countries, inadequate healthcare infrastructure and a shortage of skilled ophthalmologists hinder timely diagnosis and treatment of eye diseases. Limited availability of advanced diagnostic equipment can delay intervention and negatively impact patient outcomes

- Potential side effects and procedural risks associated with intraocular surgeries and biologic therapies may also discourage some patients from opting for treatment, especially when awareness about disease progression is low

- Regulatory complexities and lengthy approval timelines for novel ophthalmic drugs and devices can slow product commercialization, affecting market expansion. Overcoming these challenges through cost-effective innovations, expanded reimbursement coverage, and improved healthcare infrastructure will be critical to ensuring sustainable growth in the Ophthalmology Drugs and Devices market

Ophthalmology Drugs and Devices Market Scope

The market is segmented on the basis of devices, drug, delivery type, and end use.

- By Devices

On the basis of devices, the Global Ophthalmology Drugs and Devices Market is segmented into Surgical Devices, Diagnostics & Monitoring Devices, and Vision Care. The Surgical Devices segment dominated the largest market revenue share of 46.8% in 2025, driven by the rising number of ophthalmic surgeries such as cataract, glaucoma, and refractive procedures. Increasing global prevalence of age-related eye disorders significantly boosts surgical volumes. Technological advancements in minimally invasive ophthalmic surgery enhance precision and patient outcomes. Adoption of femtosecond lasers and phacoemulsification systems strengthens demand. Expanding geriatric population globally contributes to higher surgical intervention rates. Improved healthcare infrastructure in emerging economies supports segment expansion. Favorable reimbursement policies in developed regions further accelerate adoption. Growing awareness regarding early surgical correction of vision problems also sustains revenue growth. Investments by hospitals in advanced ophthalmic operating equipment reinforce procurement. Rising cases of diabetic retinopathy and retinal detachment stimulate surgical device usage. Continuous innovation and product approvals ensure competitive advancements. These combined factors enabled surgical devices to maintain market leadership in 2025.

The Diagnostics & Monitoring Devices segment is anticipated to witness the fastest growth at a CAGR of 9.7% from 2026 to 2033, driven by increasing emphasis on early detection of eye disorders. Rising prevalence of glaucoma and retinal diseases encourages routine screening. Advanced imaging technologies such as OCT and fundus cameras enhance diagnostic accuracy. Growing adoption of AI-based diagnostic tools improves workflow efficiency. Expansion of specialized eye clinics globally strengthens demand. Tele-ophthalmology services support remote screening programs. Government initiatives promoting preventive eye care further boost uptake. Increasing diabetic population drives retinal monitoring requirements. Portable and handheld diagnostic devices expand accessibility in rural regions. Continuous product innovation enhances affordability and precision. Growing awareness regarding regular eye check-ups supports market penetration. These factors collectively position diagnostics as the fastest-growing device segment.

- By Drug

On the basis of drug, the market is segmented into Glaucoma Drugs, Retinal Disorder Drugs, Dry Eye Drugs, Allergic Conjunctivitis and Inflammation Drugs, and Other Drugs. The Glaucoma Drugs segment held the largest revenue share of 34.5% in 2025, owing to the high global prevalence of glaucoma and the lifelong need for medication management. Increasing aging population significantly contributes to disease incidence. Strong pipeline of prostaglandin analogs and combination therapies enhances treatment options. Favorable reimbursement in developed countries supports prescription volumes. Early diagnosis initiatives increase patient pool size. Growing awareness regarding vision loss prevention accelerates adherence. Pharmaceutical innovations improve drug efficacy and reduce side effects. Expansion of healthcare access in emerging markets supports demand. Rising screening programs drive earlier treatment initiation. Long-term chronic therapy requirement ensures recurring revenue streams. Strategic collaborations among pharmaceutical companies strengthen distribution. These dynamics enabled glaucoma drugs to dominate in 2025.

The Retinal Disorder Drugs segment is projected to witness the fastest growth at a CAGR of 10.8% from 2026 to 2033, driven by increasing incidence of age-related macular degeneration and diabetic retinopathy. Expanding diabetic population globally accelerates retinal disease cases. Strong adoption of anti-VEGF therapies fuels segment expansion. Advancements in biologics and sustained-release formulations improve treatment outcomes. Rising awareness regarding early retinal intervention boosts demand. Increased healthcare spending in emerging economies supports accessibility. Growth in specialty ophthalmology centers strengthens drug administration volumes. Ongoing clinical trials and new product approvals expand therapeutic options. Favorable regulatory pathways for innovative biologics enhance commercialization. Improved patient assistance programs increase affordability. Expanding geriatric demographics further reinforce growth momentum. These factors collectively drive the segment’s rapid CAGR during the forecast period.

- By Delivery Type

On the basis of delivery type, the market is segmented into Capsules & Tablets, Gels, Eye Drops, Eye Ointment, and Eye Solutions. The Eye Drops segment dominated with a 52.6% revenue share in 2025, attributed to its widespread use in glaucoma, dry eye, infections, and allergic conjunctivitis treatment. Eye drops provide direct drug delivery to ocular tissues with minimal systemic exposure. Ease of administration enhances patient compliance. Availability of over-the-counter and prescription formulations strengthens accessibility. Rapid onset of action supports therapeutic effectiveness. Continuous innovation in preservative-free formulations improves safety. Strong distribution through pharmacies and hospitals supports sales. Growing prevalence of chronic eye disorders sustains recurring demand. Pediatric and geriatric suitability further broadens adoption. Expansion of branded and generic alternatives enhances affordability. Increased awareness regarding early treatment promotes usage. These factors contributed to the segment’s leadership in 2025.

The Gels segment is expected to witness the fastest growth at a CAGR of 9.9% from 2026 to 2033, driven by longer ocular retention time and improved therapeutic efficacy. Gels provide sustained drug release compared to conventional drops. Increasing demand for enhanced patient comfort supports adoption. Rising cases of severe dry eye conditions accelerate product uptake. Technological advancements in viscosity-modifying agents strengthen innovation. Growing preference for reduced dosing frequency improves compliance. Expanding R&D investments encourage formulation advancements. Specialty ophthalmic clinics increasingly recommend gel-based therapies. Improved packaging and dosing applicators enhance convenience. Increasing awareness regarding advanced ocular therapies supports growth. Favorable regulatory approvals for novel gel formulations expand market entry. These drivers collectively position gels as the fastest-growing delivery type segment.

- By End Use

On the basis of end use, the market is segmented into Hospitals, Diagnostic Centres, and Others. The Hospitals segment accounted for the largest market revenue share of 48.9% in 2025, driven by high patient inflow for surgical procedures and chronic eye disease management. Availability of advanced ophthalmic infrastructure strengthens treatment capacity. Skilled ophthalmologists and multidisciplinary teams support complex interventions. Strong reimbursement frameworks enhance service accessibility. Hospitals conduct large-scale cataract and retinal surgeries, increasing device demand. Integration of diagnostic and therapeutic services under one roof improves efficiency. Increasing government funding for public hospitals supports procurement. Rising emergency and trauma eye cases sustain utilization. Adoption of advanced imaging and surgical systems reinforces growth. Academic hospital affiliations promote innovation and clinical trials. Expanding healthcare infrastructure in developing regions further supports dominance. These combined factors enabled hospitals to lead in 2025.

The Diagnostic Centres segment is anticipated to witness the fastest growth at a CAGR of 10.2% from 2026 to 2033, driven by increasing demand for specialized eye screening services. Growing awareness regarding preventive eye care accelerates patient visits. Expansion of standalone ophthalmic diagnostic chains strengthens accessibility. Adoption of advanced imaging technologies enhances diagnostic precision. Rising diabetic and geriatric population increases screening frequency. Cost-effective outpatient services attract large patient volumes. Tele-ophthalmology initiatives expand rural outreach programs. Public health campaigns promoting early glaucoma detection support growth. Increasing collaborations with hospitals enhance referral networks. Technological integration with AI-based analytics improves workflow efficiency. Growing insurance coverage for diagnostic procedures further boosts demand. These factors collectively position diagnostic centres as the fastest-growing end-use segment during the forecast period.

Ophthalmology Drugs and Devices Market Regional Analysis

- North America dominated the ophthalmology drugs and devices market with the largest revenue share of 37.8% in 2025, characterized by highly advanced healthcare infrastructure, strong adoption of innovative ophthalmic therapies, and the widespread use of technologically advanced surgical equipment. The region benefits from favorable reimbursement policies, well-established screening programs for early detection of vision disorders, and a strong presence of leading pharmaceutical and medical device companies. Continuous research and development activities, coupled with high healthcare expenditure, support the rapid commercialization of novel ophthalmic drugs and minimally invasive surgical technologies. The U.S. accounts for a significant portion of the regional revenue, driven by large patient volumes and early adoption of premium treatment solutions

- Healthcare providers in the region emphasize early diagnosis and precision-based treatment, leading to high utilization of anti-VEGF biologics, premium intraocular lenses (IOLs), and advanced diagnostic imaging systems such as optical coherence tomography (OCT). The presence of specialized ophthalmology clinics and ambulatory surgical centers further strengthens regional demand for both drugs and devices

- This widespread adoption is further supported by strong insurance coverage, continuous technological innovation, and a growing aging population susceptible to cataracts, glaucoma, and age-related macular degeneration. The combination of clinical expertise, advanced infrastructure, and supportive regulatory frameworks reinforces North America’s leadership in the global Ophthalmology Drugs and Devices market

U.S. Ophthalmology Drugs and Devices Market Insight

The U.S. ophthalmology drugs and devices market captured the largest revenue share in 2025 within North America, driven by extensive deployment of advanced ophthalmic therapeutics and surgical technologies across hospitals and specialty eye care centers. The country demonstrates high adoption of innovative treatments for retinal diseases, glaucoma, and refractive errors, supported by strong reimbursement systems and patient awareness. The increasing prevalence of chronic conditions such as diabetes has significantly raised the incidence of diabetic retinopathy and macular edema, leading to strong demand for intravitreal injections and laser-based treatment systems. In addition, rising preference for premium cataract surgeries using multifocal and toric intraocular lenses is contributing to procedural growth. The presence of leading biotechnology and medical device manufacturers, along with robust clinical research infrastructure, continues to drive product innovation and early access to next-generation ophthalmic solutions in the U.S. market.

Europe Ophthalmology Drugs and Devices Market Insight

The Europe ophthalmology drugs and devices market is projected to expand at a substantial CAGR throughout the forecast period, supported by growing investments in healthcare modernization and increasing awareness regarding early eye disease diagnosis. Countries across the region are implementing public health initiatives to reduce preventable blindness and improve access to advanced ophthalmic care. The rising geriatric population and increasing burden of chronic eye disorders such as glaucoma and macular degeneration are driving demand for both pharmacological therapies and surgical devices. In addition, adoption of minimally invasive surgical techniques and digital diagnostic tools is steadily increasing across hospitals and specialty clinics. The region is also witnessing greater demand for premium intraocular lenses and advanced refractive correction procedures, particularly in Western European countries with higher healthcare spending capacity.

U.K. Ophthalmology Drugs and Devices Market Insight

The U.K. ophthalmology drugs and devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for cataract surgeries, glaucoma management, and retinal disease treatments. Government-supported healthcare services and structured screening programs are facilitating early detection and timely intervention for vision disorders. Increasing investments in modern surgical equipment, including laser-assisted cataract systems and minimally invasive glaucoma devices, are enhancing procedural efficiency and patient outcomes. The growing elderly population and increasing diabetes prevalence are further contributing to sustained demand for ophthalmic drugs and devices.

Germany Ophthalmology Drugs and Devices Market Insight

The Germany ophthalmology drugs and devices market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s technologically advanced healthcare system and strong emphasis on precision medicine. Germany’s well-established hospital infrastructure and skilled ophthalmic workforce encourage the adoption of advanced surgical systems and innovative biologic therapies. The country is witnessing steady growth in procedures involving premium intraocular lenses and minimally invasive glaucoma surgeries. In addition, strong regulatory standards and continuous investments in medical research contribute to the introduction of cutting-edge ophthalmic devices and pharmaceuticals.

Asia-Pacific Ophthalmology Drugs and Devices Market Insight

The Asia-Pacific ophthalmology drugs and devices market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by the rising incidence of vision disorders, expanding healthcare access, and increasing healthcare expenditure across emerging economies. Rapid urbanization, changing lifestyles, and growing diabetic populations are significantly increasing the prevalence of retinal diseases and refractive errors. Governments in countries such as China, India, and Japan are investing heavily in healthcare infrastructure development and specialized eye care services. The region is also benefiting from growing medical tourism, particularly for cost-effective cataract and refractive surgeries. Improving insurance coverage, rising disposable incomes, and expanding awareness campaigns related to eye health are further accelerating adoption of advanced ophthalmic drugs and surgical technologies across the region.

Japan Ophthalmology Drugs and Devices Market Insight

The Japan ophthalmology drugs and devices market is gaining momentum due to the country’s aging demographic profile and strong demand for high-precision medical technologies. Japan has one of the highest proportions of elderly individuals globally, leading to increased incidence of cataracts, glaucoma, and macular degeneration. Healthcare providers in Japan prioritize early detection and advanced treatment modalities, driving the adoption of innovative diagnostic imaging systems and minimally invasive surgical devices. In addition, strong domestic manufacturing capabilities and research initiatives support continuous product advancements in the ophthalmology segment.

China Ophthalmology Drugs and Devices Market Insight

The China ophthalmology drugs and devices market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid healthcare infrastructure expansion and a large patient population suffering from refractive errors and chronic eye diseases. The increasing prevalence of myopia, particularly among younger populations, is significantly contributing to demand for corrective treatments and surgical interventions. Government initiatives aimed at strengthening primary and tertiary eye care facilities are improving access to advanced ophthalmic services. The presence of domestic manufacturers and growing investments in biotechnology research are enhancing product availability and affordability. Overall, Asia-Pacific is expected to emerge as the fastest-growing region in the global Ophthalmology Drugs and Devices market, supported by rising disease burden, expanding healthcare coverage, and continuous improvements in ophthalmic care infrastructure.

Ophthalmology Drugs and Devices Market Share

The Ophthalmology Drugs and Devices industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Bayer AG (Germany)

- Pfizer Inc. (U.S.)

- Allergan (AbbVie Inc.) (U.S.)

- Johnson & Johnson Vision (U.S.)

- Alcon Inc. (Switzerland)

- Bausch + Lomb Corporation (Canada)

- Carl Zeiss Meditec AG (Germany)

- Topcon Corporation (Japan)

- Nidek Co., Ltd. (Japan)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Aerie Pharmaceuticals, Inc. (U.S.)

- Hoya Corporation (Japan)

Latest Developments in Global Ophthalmology Drugs and Devices Market

- In February 2025, Teva Pharmaceuticals entered into a strategic collaboration with Klinge Biopharma and Formycon to commercialize FYB203, a biosimilar candidate to the anti-VEGF drug aflibercept (Eylea), for European and Israeli markets — marking a significant push into biosimilar retinal therapies that could expand access and reduce treatment costs

- In March 2025, Neurotech Pharmaceuticals announced the FDA approval of ENCELTO (revakinagene taroretcel-lwey), the first-ever treatment for Macular Telangiectasia type 2 (MacTel), a rare retinal disease. The therapy uses encapsulated cell immunotherapy to deliver ciliary neurotrophic factor directly to the retina, representing a major breakthrough for a previously untreatable condition

- In June 2025, the global ophthalmology drugs market was reported to be expanding, fueled by several strategic developments, including launches and regulatory approvals of biosimilars and next-generation retinal therapies, reflecting a rising emphasis on addressing prevalent ocular diseases such as age-related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion (RVO)

- In July 2025, Genentech announced FDA approval of Susvimo (ranibizumab implant) for diabetic retinopathy (DR), expanding the use of its continuous delivery ranibizumab system beyond its earlier indications for wet AMD and DME — highlighting the trend toward long-acting sustained delivery systems in ophthalmic therapeutics

- In May 2024, Samsung Bioepis and Biogen received European Commission approval for the aflibercept biosimilar OPUVIZ, indicated for adult patients with neovascular AMD, macular edema secondary to RVO, DME, and myopic choroidal neovascularization — representing an important biosimilar entrant into the European retinal disease treatment landscape

- In October 2024, Novaliq and Laboratoires Théa announced EU approval for Vevizye (ciclosporin 0.1% eye drops), the first water-free ciclosporin formulation for treatment of moderate to severe dry eye disease, addressing a major unmet need for patients with chronic ocular surface disease

- In July 2024, the U.S. FDA approved Vabysmo® (faricimab-svoa) 6.0 mg single-dose prefilled syringe (PFS) for treatment of wet AMD, DME, and macular edema following RVO — enhancing ease of administration for these leading causes of vision loss and increasing treatment flexibility for clinicians and patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.