Global Optical Biometry Devices Market

Market Size in USD Billion

CAGR :

%

USD

351.01 Billion

USD

545.26 Billion

2025

2033

USD

351.01 Billion

USD

545.26 Billion

2025

2033

| 2026 –2033 | |

| USD 351.01 Billion | |

| USD 545.26 Billion | |

|

|

|

|

Optical Biometry Devices Market Size

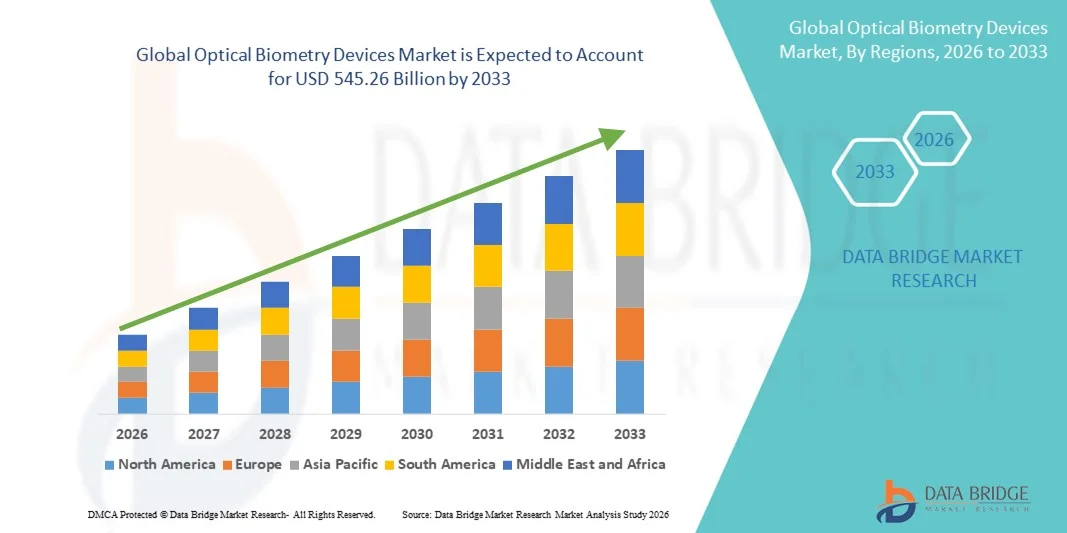

- The global optical biometry devices market size was valued at USD 351.01 billion in 2025 and is expected to reach USD 545.26 billion by 2033, at a CAGR of 5.66% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced ophthalmic diagnostic technologies and continuous technological advancements in optical biometry devices, leading to improved accuracy and efficiency in ocular measurements across hospitals and eye care clinics

- Furthermore, rising demand for precise preoperative assessment for cataract and refractive surgeries, along with growing prevalence of age-related eye disorders and myopia, is establishing optical biometry devices as essential tools in modern ophthalmology. These converging factors are accelerating the uptake of optical biometry device solutions, thereby significantly boosting overall market growth

Optical Biometry Devices Market Analysis

- Optical biometry devices, which provide non-contact and highly precise ocular measurements, are increasingly vital components of modern ophthalmic diagnostics in hospitals, eye clinics, and ambulatory surgical centers due to their superior accuracy, speed, and improved patient comfort compared to ultrasound-based methods

- The growing demand for optical biometry devices is primarily driven by the rising volume of cataract and refractive surgeries, increasing prevalence of age-related eye disorders, and continuous technological advancements such as swept-source OCT and AI-enabled measurement platforms

- North America dominated the optical biometry devices market with the largest revenue share of approximately 41.3% in 2025, supported by advanced healthcare infrastructure, high adoption of cutting-edge ophthalmic technologies, strong reimbursement frameworks, and the presence of leading device manufacturers, with the U.S. accounting for a significant portion of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the optical biometry devices market during the forecast period, registering a CAGR of 19.8%, driven by a rapidly aging population, increasing cataract surgery volumes, expanding access to eye care services, and rising investments in healthcare infrastructure across emerging economies

- The non-contact type segment dominated the largest market revenue share of 58.7% in 2025, driven by its superior patient comfort and reduced risk of infection

Report Scope and Optical Biometry Devices Market Segmentation

|

Attributes |

Optical Biometry Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Optical Biometry Devices Market Trends

Rising Adoption of Advanced Optical Diagnostic Technologies

- A significant and accelerating trend in the global optical biometry devices market is the increasing adoption of advanced, non-contact optical measurement technologies for accurate ocular diagnostics. These devices enable precise measurement of axial length, corneal curvature, anterior chamber depth, and lens thickness, which are critical for cataract surgery planning and refractive procedures

- For instance, modern optical biometry systems are increasingly replacing traditional ultrasound-based methods due to their higher accuracy, faster measurement capabilities, and improved patient comfort. Their non-invasive nature minimizes examination time while enhancing clinical workflow efficiency

- Optical biometry devices support improved surgical outcomes by enabling more precise intraocular lens (IOL) power calculations, reducing postoperative refractive errors. This has led to growing adoption across ophthalmology clinics, ambulatory surgical centers, and hospitals worldwide

- The integration of optical biometry devices into comprehensive ophthalmic diagnostic platforms allows clinicians to streamline preoperative assessments and improve diagnostic consistency. This centralized approach enhances clinical decision-making and supports higher procedural volumes

- This trend toward precise, patient-friendly, and technologically advanced ophthalmic diagnostics is reshaping expectations for eye care delivery. As a result, manufacturers are focusing on enhancing measurement accuracy, device reliability, and ease of use

- The demand for optical biometry devices continues to rise across both developed and emerging healthcare markets, driven by increasing surgical volumes and growing emphasis on high-quality ophthalmic care

Optical Biometry Devices Market Dynamics

Driver

Rising Prevalence of Cataracts and Growing Demand for Refractive Surgeries

- The increasing prevalence of cataracts and refractive disorders, particularly among the aging global population, is a major driver fueling demand for optical biometry devices. Accurate ocular measurements are essential for successful cataract and refractive surgeries, making optical biometry a critical diagnostic tool

- For instance, the rising number of cataract surgeries performed annually worldwide is driving healthcare providers to adopt advanced optical biometry devices to improve surgical precision and patient outcome

- Growing awareness of vision correction procedures and improvements in surgical techniques are further accelerating the adoption of optical biometry devices across ophthalmic care settings

- In addition, expanding access to eye care services, increasing healthcare expenditure, and the growth of specialized eye hospitals and clinics are supporting market expansion

- The demand for faster diagnostics, improved workflow efficiency, and enhanced patient experience continues to propel the adoption of optical biometry devices in both public and private healthcare facilities

Restraint/Challenge

High Equipment Costs and Limited Accessibility in Developing Regions

- The high cost of advanced optical biometry devices remains a significant restraint, particularly for small clinics and healthcare facilities with limited capital budgets

- For instance, premium optical biometry systems require substantial upfront investment, which can deter adoption among independent ophthalmology practices in low- and middle-income regions

- In addition, the need for skilled ophthalmic technicians to operate and interpret device outputs can limit usage. For instance, facilities lacking trained personnel may continue to rely on traditional ultrasound biometry methods despite their lower accuracy

- Ongoing costs related to device maintenance, calibration, and software upgrades may further restrict adoption, especially where reimbursement policies for advanced diagnostics are limited

- Overcoming these challenges through cost-effective device development, training programs, and improved healthcare funding mechanisms will be crucial for sustained growth of the Optical Biometry Devices market

Optical Biometry Devices Market Scope

The market is segmented on the basis of type, product, application, and end user.

- By Type

On the basis of type, the Global Optical Biometry Devices market is segmented into swept-source optical coherence tomography, optical low-coherence reflectometry, and partial coherence interferometry. The swept-source optical coherence tomography segment dominated the largest market revenue share of 46.3% in 2025, driven by its superior imaging depth and high measurement accuracy. This technology enables faster data acquisition and enhanced visualization of ocular structures. Ophthalmologists prefer swept-source systems due to improved performance in dense cataracts. The ability to deliver precise axial length measurements supports accurate intraocular lens calculations. Increasing adoption in advanced ophthalmic practices strengthens dominance. Continuous technological advancements further enhance clinical reliability. High compatibility with modern diagnostic workflows supports integration. Growing demand for premium cataract surgery solutions drives adoption. Hospitals and specialty clinics increasingly invest in swept-source devices. Higher reimbursement acceptance also supports market leadership. As a result, swept-source OCT remains the dominant type segment.

The optical low-coherence reflectometry segment is anticipated to witness the fastest growth rate at a CAGR of 21.6% from 2026 to 2033, fueled by its cost-effectiveness and reliable measurement accuracy. This technology is widely adopted in mid-range ophthalmology clinics. Ease of use and shorter learning curves support adoption. Growing cataract surgery volumes increase demand. Improved device portability further accelerates uptake. Expanding ophthalmic infrastructure in emerging markets supports growth. Increased preference for efficient diagnostic tools drives expansion. Advancements in signal processing enhance accuracy. Rising focus on early diagnosis boosts usage. Lower maintenance costs attract clinics. Increasing manufacturer investments support innovation. Overall, optical low-coherence reflectometry is expected to grow rapidly.

- By Product

On the basis of product, the Global Optical Biometry Devices market is segmented into contact type and non-contact type. The non-contact type segment dominated the largest market revenue share of 58.7% in 2025, driven by its superior patient comfort and reduced risk of infection. Non-contact devices eliminate corneal contact, improving safety and hygiene. Ophthalmologists prefer non-contact systems for faster patient throughput. Reduced patient anxiety further supports adoption. High accuracy in biometric measurements enhances clinical outcomes. These devices are widely used in high-volume surgical centers. Increasing demand for painless diagnostics strengthens dominance. Compatibility with advanced imaging technologies supports growth. Non-contact systems reduce procedural variability. Higher patient compliance improves efficiency. Continuous product innovation sustains leadership. Thus, non-contact devices remain the dominant product segment.

The contact type segment is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by its affordability and availability in cost-sensitive markets. Contact devices are widely used in smaller clinics and rural healthcare settings. Lower acquisition costs support adoption. Improved probe design enhances patient safety. Growing ophthalmic service expansion increases demand. Training familiarity among clinicians supports continued use. Rising cataract prevalence drives testing volumes. Increasing outreach programs support deployment. Manufacturers are improving sterilization features. Expanding healthcare access boosts adoption. Contact devices remain relevant in developing regions. Overall, the contact type segment is poised for steady rapid growth.

- By Application

On the basis of application, the Global Optical Biometry Devices market is segmented into intraocular lens placement and intraocular lens power calculation. The intraocular lens power calculation segment dominated the largest market revenue share of 52.4% in 2025, driven by the critical role of precise measurements in cataract surgery outcomes. Accurate IOL power calculation reduces post-surgical refractive errors. Increasing cataract surgery volumes globally support dominance. Surgeons rely heavily on optical biometry for reliable calculations. Technological advancements improve predictive accuracy. Growing patient demand for premium lenses drives testing needs. Integration with surgical planning software enhances adoption. Increased focus on personalized vision correction supports usage. Hospitals prioritize devices that minimize revision surgeries. Strong clinical validation reinforces trust. Rising aging population increases procedure demand. Therefore, IOL power calculation remains the dominant application.

The intraocular lens placement segment is anticipated to witness the fastest growth rate at a CAGR of 22.3% from 2026 to 2033, driven by rising adoption of image-guided surgical systems. Precision alignment of lenses improves visual outcomes. Increasing use of toric and multifocal lenses supports demand. Advanced surgical planning tools enhance placement accuracy. Growing premium cataract surgery market drives growth. Surgeons seek tools that reduce intraoperative errors. Improved imaging technologies support adoption. Expansion of ambulatory surgical centers boosts usage. Rising patient expectations accelerate adoption. Continuous workflow integration supports efficiency. Technological innovation enhances surgeon confidence. As a result, IOL placement applications are expected to grow rapidly.

- By End User

On the basis of end user, the Global Optical Biometry Devices market is segmented into hospitals, ophthalmology clinics, ambulatory surgical centers, and others. The hospitals segment accounted for the largest market revenue share of 40.8% in 2025, driven by high patient volumes and advanced diagnostic infrastructure. Hospitals perform a large number of cataract and refractive surgeries. Availability of skilled ophthalmologists supports adoption. Higher budgets allow investment in advanced biometry systems. Integration with hospital information systems improves workflow. Strong reimbursement support enhances usage. Hospitals serve as referral centers for complex cases. Increasing surgical capacity supports growth. Advanced training programs encourage adoption. Rising prevalence of vision disorders boosts demand. Multidisciplinary care settings support dominance. Hence, hospitals remain the leading end-user segment.

The ophthalmology clinics segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by rapid expansion of specialty eye care centers. Clinics increasingly adopt optical biometry devices to improve diagnostic efficiency. Rising outpatient cataract surgeries support growth. Lower setup costs encourage clinic adoption. Growing preference for specialized care drives patient inflow. Technological advancements make devices clinic-friendly. Improved affordability supports smaller practices. Expansion in urban and semi-urban areas boosts demand. Clinics emphasize patient comfort and speed. Increased awareness of early eye diagnosis supports growth. Strong private investment accelerates expansion. As a result, ophthalmology clinics are the fastest-growing end-user segment.

Optical Biometry Devices Market Regional Analysis

- North America dominated the optical biometry devices market with the largest revenue share of approximately 41.3% in 2025, supported by advanced healthcare infrastructure, high adoption of cutting-edge ophthalmic diagnostic technologies, strong reimbursement frameworks, and the presence of leading medical device manufacturers

- The region benefits from widespread adoption of non-contact optical biometry systems across hospitals, ambulatory surgical centers, and specialty eye clinics, driven by the need for highly accurate preoperative measurements for cataract and refractive surgeries

- High awareness among ophthalmologists regarding the clinical advantages of optical biometry—such as improved intraocular lens (IOL) power calculation accuracy and reduced examination variability—has further strengthened market penetration

U.S. Optical Biometry Devices Market Insight

The U.S. optical biometry devices market accounted for the largest share of approximately 81% of North American revenue in 2025, driven by the country’s high cataract surgery volume, strong presence of ophthalmology-focused hospitals, and rapid adoption of advanced diagnostic technologies. Ophthalmic practices in the U.S. increasingly prioritize optical biometry for preoperative planning due to its non-invasive nature, superior accuracy, and ability to improve postoperative visual outcomes. The growing preference for premium and toric intraocular lenses further amplifies demand, as these procedures require precise ocular measurements. In addition, the presence of major manufacturers, continuous product upgrades, and a strong focus on clinical outcomes and patient safety continue to propel market growth in the U.S.

Europe Optical Biometry Devices Market Insight

The Europe optical biometry devices market is expected to expand at a steady CAGR during the forecast period, driven by rising cataract prevalence, aging demographics, and increasing adoption of advanced ophthalmic diagnostics. European healthcare systems emphasize precision-driven and non-invasive diagnostic technologies, supporting the transition from ultrasound biometry to optical biometry in both public and private healthcare facilities. Growth is further supported by ongoing investments in ophthalmology departments, technological modernization of hospitals, and the increasing use of optical biometry systems in routine preoperative cataract assessments across the region.

U.K. Optical Biometry Devices Market Insight

The U.K. optical biometry devices market is anticipated to grow at a noteworthy CAGR, supported by rising demand for cataract surgeries and the National Health Service’s (NHS) focus on improving surgical accuracy and patient outcomes. The growing adoption of day-care cataract surgeries and the expansion of private ophthalmology clinics are increasing demand for fast, reliable, and non-contact diagnostic solutions such as optical biometry devices. In addition, heightened awareness among clinicians regarding refractive accuracy and postoperative visual quality is reinforcing the uptake of advanced optical measurement systems across the U.K.

Germany Optical Biometry Devices Market Insight

The Germany optical biometry devices market is projected to grow at a considerable CAGR, driven by the country’s strong medical technology ecosystem, emphasis on diagnostic precision, and well-developed healthcare infrastructure. German ophthalmology centers are early adopters of technologically advanced diagnostic tools, including optical biometry systems, to support high surgical standards and improved patient outcomes. The increasing focus on quality-driven healthcare delivery, combined with growing cataract surgery volumes, continues to support market expansion in Germany.

Asia-Pacific Optical Biometry Devices Market Insight

The Asia-Pacific region is expected to be the fastest-growing market for Optical Biometry Devices during the forecast period, registering a CAGR of approximately 19.8%, driven by a rapidly aging population, increasing cataract surgery volumes, and expanding access to eye care services. Rising healthcare investments, growing awareness of advanced ophthalmic diagnostics, and improving availability of specialized eye hospitals across emerging economies are significantly contributing to market growth. Countries such as China, Japan, and India are witnessing increased adoption of optical biometry systems as healthcare providers shift toward non-contact, high-precision diagnostic solutions for cataract and refractive surgery planning.

Japan Optical Biometry Devices Market Insight

The Japan optical biometry devices market is experiencing steady growth, supported by the country’s advanced healthcare infrastructure, high adoption of medical technologies, and rapidly aging population. Japan places strong emphasis on precision diagnostics and minimally invasive procedures, making optical biometry a preferred choice for preoperative ocular assessment. The increasing demand for cataract surgeries among elderly patients and the focus on improving surgical accuracy are key factors driving adoption in both hospital and specialty eye clinic settings.

China Optical Biometry Devices Market Insight

The China optical biometry devices market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding healthcare infrastructure, and rising prevalence of age-related eye disorders. China’s growing network of ophthalmology hospitals and vision care centers is accelerating the adoption of optical biometry devices to meet increasing cataract surgery demand. In addition, rising government investments in healthcare modernization and the presence of domestic and international medical device manufacturers are improving accessibility and affordability of optical biometry systems across the country.

Optical Biometry Devices Market Share

The Optical Biometry Devices industry is primarily led by well-established companies, including:

- Carl Zeiss Meditec (Germany)

- Haag-Streit Group (Switzerland)

- NIDEK Co., Ltd. (Japan)

- Topcon Corporation (Japan)

- Alcon (Switzerland)

- Johnson & Johnson Vision (U.S.)

- Bausch + Lomb (U.S.)

- Canon Medical Systems (Japan)

- Optovue (U.S.)

- Quantel Medical (France)

- Reichert Technologies (U.S.)

- Ziemer Ophthalmic Systems (Switzerland)

- Heidelberg Engineering (Germany)

- Oculus Optikgeräte (Germany)

- Meda Co., Ltd. (China)

- CSO – Costruzione Strumenti Oftalmici (Italy)

- Suoer Electronic Technology (China)

- EssilorLuxottica (France)

Latest Developments in Global Optical Biometry Devices Market

- In February 2023, NIDEK Co., Ltd. announced the launch of the AL-Scan M Optical Biometer along with the MV-1 Myopia Viewer software, designed to support axial length measurement and myopia progression analysis. The system integrates biometric data with predictive analytics to enhance early diagnosis and longitudinal monitoring of refractive changes. This launch reflected NIDEK’s strategic focus on pediatric ophthalmology and preventive eye care. The AL-Scan M was promoted globally through ophthalmic congresses and distributor networks, strengthening NIDEK’s footprint in optical biometry innovation

- In March 2023, Haag-Streit introduced a portable optical biometry solution aimed at rural and resource-limited healthcare settings, particularly in Asia and Africa. The device enabled reliable biometric measurements in outreach programs and smaller clinics with limited infrastructure. This launch supported global eye-care accessibility initiatives and expanded optical biometry adoption beyond tertiary hospitals. Portability and robustness were key differentiators

- In October 2023, Bausch + Lomb announced a strategic partnership with Ziemer Ophthalmic Systems to integrate Galilei diagnostic and biometry platforms into cataract surgery workflows. The collaboration focused on improving preoperative planning accuracy and surgical outcomes. This partnership reflected growing industry trends toward integrated digital ophthalmology ecosystems. It strengthened combined offerings for refractive and cataract surgeons

- In June 2024, Carl Zeiss Meditec officially introduced the IOLMaster 800 with advanced swept-source OCT technology to global markets, following earlier regional deployments. The device offers faster acquisition speeds, deeper tissue penetration, and higher measurement accuracy for intraocular lens (IOL) power calculation. The launch targeted cataract surgeons seeking enhanced refractive outcomes. The IOLMaster 800 reinforced ZEISS’s leadership in premium optical biometry solutions and advanced surgical planning systems

- In May 2024, Haag-Streit announced the expansion of its manufacturing facility in Köniz, Switzerland, to increase production capacity for Lenstar optical biometry devices. The facility upgrade aimed to support growing global demand for high-precision ophthalmic diagnostics. This development enabled improved supply chain efficiency and faster order fulfillment for hospitals and ophthalmology clinics worldwide. The investment highlighted Haag-Streit’s long-term commitment to scaling optical biometry manufacturing

- In August 2024, Topcon Corporation received U.S. FDA 510(k) clearance for its Aladdin-M optical biometer, allowing commercial sales across the United States. The Aladdin-M combines optical biometry with corneal topography, enabling comprehensive preoperative cataract assessment. FDA approval significantly strengthened Topcon’s competitive position in the North American optical biometry market. This regulatory milestone expanded clinical adoption opportunities in high-value healthcare settings

- In June 2024, Optovue (a Vision Source company) launched the Solix Biometry Module for its swept-source OCT platform, enabling integrated ocular imaging and biometric measurement on a single device. The module supports axial length, anterior chamber depth, and lens thickness assessment. This development addressed growing demand for multi-functional diagnostic platforms in ophthalmology clinics. It also reduced workflow complexity by consolidating imaging and biometry functions

- In September 2024, Tomey Corporation announced the European commercial launch of its OA-2000 Optical Biometer, featuring multi-wavelength measurement technology. The device was designed to improve IOL calculation accuracy and reduce measurement variability in dense cataracts. The launch expanded Tomey’s presence across Europe and strengthened competition in mid-range biometry systems. The OA-2000 gained traction among clinics seeking cost-effective precision tools

- In April 2024, Carl Zeiss Meditec AG completed the acquisition of Dutch Ophthalmic Research Center (D.O.R.C.), expanding its ophthalmic surgery and diagnostics portfolio. While D.O.R.C. primarily focuses on vitreoretinal surgery, the acquisition strengthened ZEISS’s integrated workflow strategy, indirectly supporting optical biometry adoption. The deal reinforced ZEISS’s long-term commitment to connected ophthalmic ecosystems

- In November 2024, multiple industry reports highlighted increasing merger and acquisition activity within the optical biometry and ophthalmic diagnostics sector, driven by demand for AI-enabled and hybrid imaging-biometry platforms. Larger players actively pursued niche innovators to enhance technological capabilities and geographic reach. This consolidation trend supported faster innovation cycles and broader product portfolios

- In March 2025, Haag-Streit launched an advanced corneal mapping feature for the Lenstar 900 optical biometer, enhancing anterior segment analysis for toric and premium IOL selection. The software upgrade allowed more comprehensive corneal curvature assessment from a single scan. This development improved diagnostic depth without additional hardware investment. Existing Lenstar users could access the feature through software upgrades

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.