Global Organic Shrimp Market

Market Size in USD Billion

CAGR :

%

USD

8.96 Billion

USD

16.22 Billion

2025

2033

USD

8.96 Billion

USD

16.22 Billion

2025

2033

| 2026 –2033 | |

| USD 8.96 Billion | |

| USD 16.22 Billion | |

|

|

|

|

Organic Shrimp Market Size

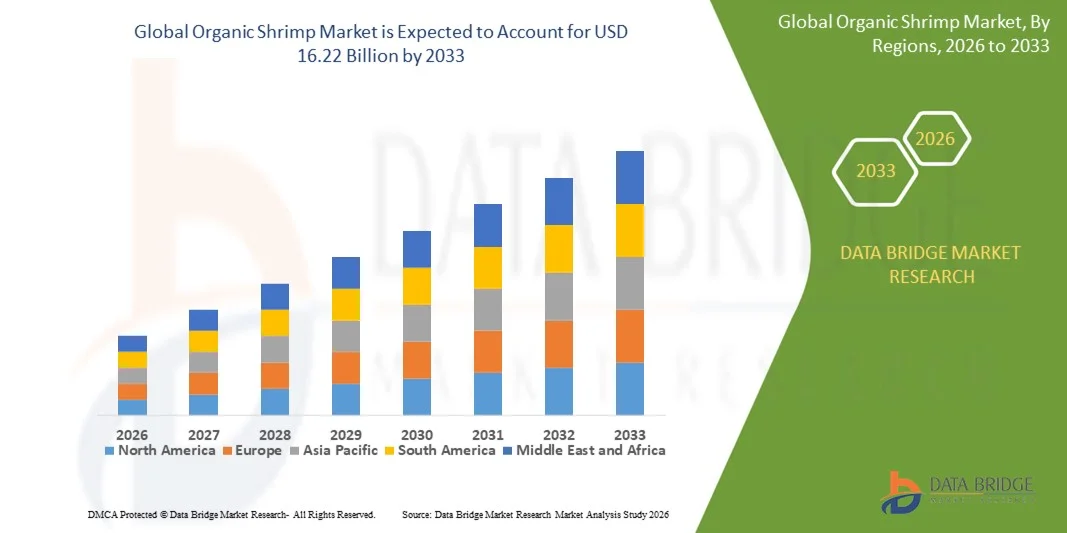

- The global organic shrimp market size was valued at USD 8.96 billion in 2025 and is expected to reach USD 16.22 billion by 2033, at a CAGR of 7.7% during the forecast period

- The market growth is largely driven by the rising consumer preference for sustainably sourced, chemical-free seafood and increasing awareness of the environmental and health benefits associated with organic shrimp consumption

- Furthermore, growing demand for certified organic food products, coupled with expanding international trade and premium pricing for organic shrimp, is strengthening adoption across retail and foodservice channels, thereby significantly supporting overall market growth

Organic Shrimp Market Analysis

- Organic shrimp, produced without synthetic chemicals, antibiotics, or genetically modified inputs, is becoming an essential component of the global sustainable seafood landscape due to its perceived health benefits, traceability, and lower environmental impact

- The increasing demand for organic shrimp is primarily fueled by heightened health consciousness, stricter food safety regulations, and a strong shift toward ethical and environmentally responsible aquaculture practices across both developed and emerging markets

- Asia-Pacific dominated the organic shrimp market in 2025, due to extensive aquaculture activities, favorable climatic conditions, and strong export-oriented shrimp farming economies

- North America is expected to be the fastest growing region in the organic shrimp market during the forecast period due to rising consumer demand for organic, non-GMO, and sustainably farmed seafood

- White leg shrimp segment dominated the market with a market share of 62.5% in 2025, due to its high farming efficiency, consistent size, and strong global consumer acceptance. White leg shrimp is widely preferred by organic aquaculture producers due to its adaptability to controlled farming conditions and relatively lower disease risk. Its mild taste and uniform texture support extensive use across retail and foodservice channels. Strong export demand from North America, Europe, and Asia-Pacific further reinforces the segment’s dominance

Report Scope and Organic Shrimp Market Segmentation

|

Attributes |

Organic Shrimp Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Shrimp Market Trends

Rising Demand for Certified Sustainable and Organic Seafood

- A key trend in the organic shrimp market is the rising demand for certified sustainable and organic seafood, driven by increasing consumer awareness regarding food safety, environmental impact, and ethical aquaculture practices. Consumers are showing a strong preference for shrimp produced without antibiotics, synthetic chemicals, or genetically modified feed, positioning organic shrimp as a premium protein choice

- For instance, Albert Heijn has expanded its sustainably farmed shrimp offerings through collaboration with Klaas Puul, Skretting, Veramaris, Protix, and Cofimar, strengthening certified organic shrimp availability in European retail channels. Such initiatives enhance supply chain transparency and reinforce consumer trust in certified organic seafood

- The trend is further supported by growing adoption of internationally recognized certifications such as ASC and organic labels, which assure traceability and responsible farming practices. These certifications are increasingly influencing purchasing decisions in developed markets

- Foodservice operators and premium restaurants are integrating organic shrimp into their menus to align with sustainability commitments and evolving consumer expectations. This is increasing demand from hospitality and institutional buyers seeking responsibly sourced seafood

- Retailers are also expanding organic seafood portfolios to differentiate offerings and capture higher margins associated with organic products. This trend is reinforcing the shift toward sustainable aquaculture and strengthening long-term demand for organic shrimp

- Overall, the rising emphasis on sustainability, transparency, and ethical sourcing is positioning organic shrimp as a key growth segment within the global seafood market

Organic Shrimp Market Dynamics

Driver

Growing Consumer Preference for Chemical-Free and Traceable Protein Sources

- The organic shrimp market is strongly driven by growing consumer preference for chemical-free and traceable protein sources, supported by rising health consciousness and concerns over antibiotic residues in conventional seafood. Consumers increasingly value transparency in food origin, production methods, and safety standards

- For instance, Seajoy has invested significantly in organic-certified shrimp farming and traceability systems to meet rising demand from health-focused consumers in North America and Europe. Such initiatives improve consumer confidence and strengthen brand positioning in premium seafood segments

- The expansion of organic food retail chains and clean-label product lines is further accelerating demand for organic shrimp. These channels actively promote traceable and responsibly farmed seafood as part of broader wellness-oriented consumption trends

- Export-oriented producers are aligning farming practices with strict organic and sustainability standards to access high-value international markets. This alignment is driving investments in organic aquaculture infrastructure and certification compliance

- The continued shift toward healthier and more transparent food systems is positioning chemical-free shrimp as a preferred protein option, strengthening overall market expansion

Restraint/Challenge

High Production Costs and Limited Availability of Certified Organic Feed

- The organic shrimp market faces challenges due to high production costs associated with organic farming practices and the limited availability of certified organic feed. Organic aquaculture requires strict adherence to feed composition, stocking density, and disease management protocols, increasing operational complexity

- For instance, Charoen Pokphand Foods PCL has highlighted the higher costs involved in sourcing certified organic feed ingredients and maintaining compliance with organic aquaculture standards. These cost pressures impact scalability and price competitiveness compared to conventional shrimp farming

- Limited suppliers of certified organic feed restrict supply flexibility and expose producers to price volatility. This challenge is particularly significant in regions where organic feed production infrastructure is still developing

- Organic shrimp farming also experiences higher risks related to disease management due to restrictions on antibiotic use, potentially affecting yield consistency. These factors contribute to higher per-unit production costs

- The challenge of balancing affordability with strict organic standards continues to limit wider adoption, particularly in price-sensitive markets. Overcoming feed supply constraints and improving cost efficiency remain critical for sustained market growth

Organic Shrimp Market Scope

The market is segmented on the basis of species, form, source, type, application, and distribution channel.

- By Species

On the basis of species, the organic shrimp market is segmented into giant tiger prawn and white leg shrimp. The white leg shrimp segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its high farming efficiency, consistent size, and strong global consumer acceptance. White leg shrimp is widely preferred by organic aquaculture producers due to its adaptability to controlled farming conditions and relatively lower disease risk. Its mild taste and uniform texture support extensive use across retail and foodservice channels. Strong export demand from North America, Europe, and Asia-Pacific further reinforces the segment’s dominance.

The giant tiger prawn segment is expected to witness the fastest growth from 2026 to 2033, supported by rising demand for premium and specialty organic seafood. Consumers associate giant tiger prawns with superior flavor, larger size, and high nutritional value, encouraging uptake in high-end restaurants and gourmet retail. Growth is also supported by improving organic farming practices that address earlier challenges related to yield and disease management.

- By Form

On the basis of form, the organic shrimp market is segmented into fresh and processed. The fresh segment dominated the market in 2025, driven by strong consumer preference for minimally processed, natural, and chemical-free seafood. Fresh organic shrimp is perceived as higher quality with better taste, texture, and nutritional integrity, aligning with clean-label and health-conscious consumption trends. Demand remains strong in coastal regions and premium urban markets where cold-chain infrastructure is well developed. Restaurants and specialty seafood retailers also favor fresh shrimp to meet expectations for authenticity and freshness.

The processed segment is projected to register the fastest growth during the forecast period, fueled by increasing demand for convenience-oriented organic food products. Processed organic shrimp offers extended shelf life, easier storage, and reduced preparation time, supporting adoption among working consumers. Innovations in organic processing techniques that preserve quality while meeting certification standards further accelerate this segment’s growth.

- By Source

On the basis of source, the organic shrimp market is segmented into warm water and cold water. The warm water segment held the dominant market share in 2025, supported by large-scale organic shrimp farming across tropical and subtropical regions. Warm water environments enable higher production volumes, faster growth cycles, and year-round harvesting, improving supply stability. Countries in Asia-Pacific and Latin America play a major role in meeting global demand through warm water organic shrimp exports. Cost efficiencies and established aquaculture infrastructure strengthen the segment’s leading position.

The cold water segment is anticipated to grow at the fastest rate from 2026 to 2033, driven by rising demand for wild-caught and specialty organic shrimp varieties. Consumers increasingly associate cold water shrimp with distinct flavor profiles and premium quality. Expanding sustainable harvesting practices and traceability standards further support growth in this segment.

- By Types

On the basis of types, the organic shrimp market is segmented into farmed white leg shrimps, royal red shrimps, gulf shrimps, banded coral shrimps, and others. Farmed white leg shrimps dominated the market in 2025 due to their high availability, cost efficiency, and compatibility with certified organic aquaculture systems. Their consistent quality and scalable production support widespread use across retail, foodservice, and export markets. Strong demand from supermarkets and quick-service restaurants further reinforces dominance.

Royal red shrimps are expected to witness the fastest growth over the forecast period, supported by increasing consumer interest in premium and niche organic seafood offerings. Their deep-water origin, rich taste, and high mineral content attract health-focused and gourmet consumers. Limited supply combined with rising awareness contributes to higher value growth for this segment.

- By Application

On the basis of application, the organic shrimp market is segmented into pharmaceutical, cosmetics, food, and others. The food segment dominated the market in 2025, driven by widespread consumption of organic shrimp as a high-protein, low-fat seafood option. Growing preference for sustainably sourced and chemical-free food products supports strong demand across households and foodservice establishments. Organic shrimp is increasingly incorporated into ready meals, frozen foods, and premium dining menus.

The pharmaceutical segment is expected to grow at the fastest rate from 2026 to 2033, supported by rising use of shrimp-derived compounds in nutraceuticals and medical applications. Chitosan and other bioactive components extracted from organic shrimp shells are gaining traction for their antimicrobial and biocompatible properties. Increased research and demand for natural raw materials accelerate growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the organic shrimp market is segmented into supermarket/hypermarkets, retail stores, and others. Supermarkets and hypermarkets accounted for the largest market share in 2025, driven by their wide product assortment, strong cold-chain facilities, and consumer trust in certified organic labeling. These channels offer better visibility and accessibility for organic shrimp products, supporting higher sales volumes. Promotional activities and private-label organic seafood further enhance dominance.

Retail stores are projected to witness the fastest growth during the forecast period, fueled by rising preference for local, specialty, and organic-focused outlets. Consumers increasingly seek personalized service, traceability information, and freshly sourced organic shrimp from neighborhood retailers. Expansion of organized retail in emerging economies further supports this growth trend.

Organic Shrimp Market Regional Analysis

- Asia-Pacific dominated the organic shrimp market with the largest revenue share in 2025, driven by extensive aquaculture activities, favorable climatic conditions, and strong export-oriented shrimp farming economies

- The region’s large coastline availability, cost-efficient organic farming practices, and rising global demand for sustainably sourced seafood are accelerating market expansion

- Supportive government initiatives promoting organic aquaculture, improving cold-chain infrastructure, and increasing investments in sustainable seafood production are contributing to higher consumption and exports of organic shrimp

China Organic Shrimp Market Insight

China held a significant share in the Asia-Pacific organic shrimp market in 2025, supported by its vast aquaculture base and growing focus on certified organic seafood production. The country’s strong domestic consumption, expanding middle-class population, and increasing preference for safe and traceable food products are key growth drivers. Continuous improvements in organic farming standards and export capabilities further strengthen China’s position in the regional market.

India Organic Shrimp Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by its strong position as a leading shrimp exporter and increasing adoption of organic aquaculture practices. Government support for sustainable fisheries, rising demand from the U.S. and Europe, and expanding coastal farming infrastructure are driving market growth. In addition, growing awareness among farmers about premium pricing for organic shrimp is accelerating production.

Europe Organic Shrimp Market Insight

The Europe organic shrimp market is expanding steadily, supported by high consumer awareness regarding sustainability, strict food safety regulations, and strong demand for certified organic seafood. European consumers place significant emphasis on traceability, ethical sourcing, and environmental impact, which favors organic shrimp imports. Growth is further supported by premium pricing and rising consumption through retail and foodservice channels.

Germany Organic Shrimp Market Insight

Germany’s organic shrimp market is driven by its well-developed organic food sector and strong consumer preference for sustainably sourced protein products. The country’s robust retail network for organic foods and high purchasing power support consistent demand. Germany also serves as a key import hub, distributing organic shrimp across neighboring European markets.

U.K. Organic Shrimp Market Insight

The U.K. market is supported by increasing demand for organic and responsibly sourced seafood, along with growing penetration of organic products in supermarkets and specialty stores. Rising health consciousness and preference for clean-label food products are strengthening organic shrimp consumption. Imports play a major role, supported by strong cold-chain logistics and established seafood distribution channels.

North America Organic Shrimp Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer demand for organic, non-GMO, and sustainably farmed seafood. Increasing awareness of environmental impact, coupled with strong certification standards, is boosting organic shrimp adoption. Expansion of premium seafood offerings across retail and foodservice sectors further supports regional growth.

U.S. Organic Shrimp Market Insight

The U.S. accounted for the largest share in the North America organic shrimp market in 2025, underpinned by high per capita seafood consumption and strong demand for organic protein sources. Growing preference for transparency in food sourcing, coupled with well-established organic certification frameworks, is driving market expansion. The presence of large seafood importers, distributors, and premium retail chains further reinforces the U.S.’s leading position in the region.

Organic Shrimp Market Share

The organic shrimp industry is primarily led by well-established companies, including:

- Omarsa (Ecuador)

- MORUBEL (Belgium)

- Seajoy (Ecuador)

- Orchid Marine (India)

- Charoen Pokphand Foods PCL (Thailand)

- High Liner Foods (Canada)

- Maruha Nichiro Corporation (Japan)

- BLUE STAR SEAFOOD CO. LTD. (Thailand)

- The Clover Leaf Seafoods Family (Canada)

- NISSUI (Japan)

- Cooke Aquaculture (Canada)

- Seacore Seafood Inc. (U.S.)

Latest Developments in Global Organic Shrimp Market

- In September 2024, Albert Heijn’s introduction of sustainably farmed shrimp through a multi-stakeholder value chain consortium strengthened the organic and sustainable shrimp market by improving supply chain transparency and scalability. Collaboration between feed innovators, ingredient suppliers, and Ecuador-based organic farming operations enhances credibility, supports circular feed solutions, and accelerates mainstream retail adoption of responsibly farmed shrimp in Europe

- In April 2023, Kemin AquaScience launched Pathorol across multiple Asian countries, positively impacting the organic and farmed shrimp market by improving shrimp health management without reliance on antibiotics. The phytogenic feed additive supports hepatopancreatic health and reduces parasitic impact, helping farmers improve survival rates, productivity, and compliance with organic and sustainability standards

- In April 2021, New Wave Foods’ plan to unveil plant-based shrimp across U.S. foodservice companies influenced the broader shrimp market by introducing alternative protein solutions aimed at reducing pressure on wild and farmed shrimp supply. This development supports sustainability goals and responds to rising consumer demand for environmentally friendly seafood substitutes

- In January 2021, New Wave Foods highlighted the commercial potential of its seaweed- and plant-protein-based shrimp alternative, signaling a shift in consumer preferences and encouraging innovation within the shrimp market. The development underscores growing concerns around overfishing and environmental impact, indirectly driving interest in organic and sustainable shrimp production

- In February 2020, the establishment of Austria’s first fully organic shrimp farm using Xylem’s advanced water treatment and breeding technology marked a milestone for land-based organic aquaculture in Europe. Chemical- and antibiotic-free production in a non-coastal region demonstrated the feasibility of localized, sustainable shrimp farming, supporting premium organic shrimp supply and reducing dependence on imports

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Shrimp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Shrimp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Shrimp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.