Global Organic Soy Yogurt Market

Market Size in USD Million

CAGR :

%

USD

525.43 Million

USD

782.24 Million

2025

2033

USD

525.43 Million

USD

782.24 Million

2025

2033

| 2026 –2033 | |

| USD 525.43 Million | |

| USD 782.24 Million | |

|

|

|

|

What is the Global Organic Soy Yogurt Market Size and Growth Rate?

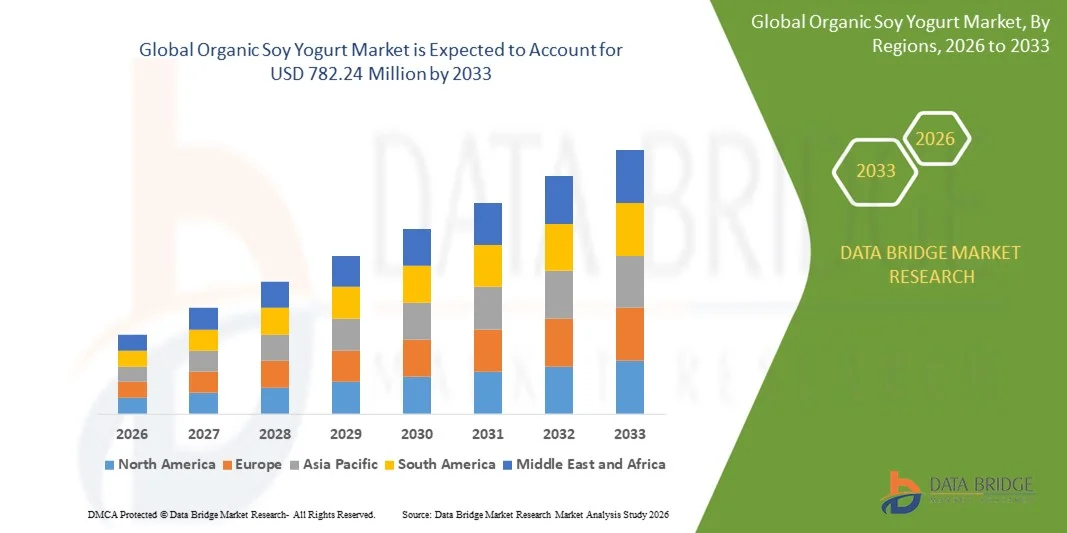

- The global organic soy yogurt market size was valued at USD 525.43 million in 2025 and is expected to reach USD 782.24 million by 2033, at a CAGR of5.10% during the forecast period

- The increase in the inclination towards dairy-free products among millennials across the globe acts as one of the major factors driving the growth of the organic soy yogurt market

- The rise in consumer spending on plant-based products because of the rising prevalence of disorders, including milk allergies among the common mass, especially in developed economies, and the increase in the incidences of lactose intolerance among the population accelerate the market growth

What are the Major Takeaways of Organic Soy Yogurt Market?

- The rise in awareness about the nutritional benefits of an animal-free diet and numerous non-government organizations (NGOs) promoting the welfare of farm animals further influence the market

- In addition, change in consumer lifestyle, increase in soymilk consumption, rise in population globally, urbanization, the surge in disposable income, and increased awareness positively affect the organic soy yogurt market. Furthermore, the launch of an increasing variety of soy yogurt extends profitable opportunities to the market players

- Europe dominated the organic soy yogurt market with a 34.26% revenue share in 2025, driven by strong adoption of plant-based diets, growing consumer preference for organic and clean-label products, and well-established retail and distribution networks across countries such as Germany, France, and the U.K

- Asia-Pacific is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rapid urbanization, rising disposable income, expanding middle-class population, and growing adoption of plant-based diets across China, Japan, India, South Korea, and Southeast Asia

- The Vanilla segment dominated the market with an estimated 34.8% share in 2025, as it remains the most widely accepted and versatile flavor among consumers across all age groups

Report Scope and Organic Soy Yogurt Market Segmentation

|

Attributes |

Organic Soy Yogurt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic Soy Yogurt Market?

Increasing Shift Toward Clean-Label, High-Protein, and Functional Organic Soy Yogurts

- The organic soy yogurt market is witnessing strong adoption of clean-label, non-GMO, and organic-certified soy yogurts that cater to health-conscious and plant-based consumers

- Manufacturers are introducing high-protein, probiotic-rich, and fortified formulations to enhance gut health, immunity, and overall nutritional value

- Growing demand for dairy-free, lactose-free, and vegan-friendly alternatives is accelerating product innovation across retail and foodservice channels

- For instance, companies such as Danone, Hain Celestial, Oatly, Vitasoy, and Yoplait are expanding organic soy yogurt portfolios with improved taste, texture, and functional benefits

- Rising focus on sustainability, soy traceability, and environmentally responsible sourcing is influencing purchasing decisions globally

- As consumers increasingly prioritize plant-based nutrition and digestive health, organic soy yogurt is expected to remain a core category within the dairy-alternative market

What are the Key Drivers of Organic Soy Yogurt Market?

- Rising consumer awareness regarding cholesterol management, lactose intolerance, and plant-based protein intake

- For instance, during 2024–2025, several global brands launched organic, unsweetened, and low-sugar soy yogurt variants to meet clean-eating trends

- Growing adoption of vegan, flexitarian, and dairy-free diets across North America, Europe, and Asia-Pacific is boosting market demand

- Advancements in fermentation technology and flavor-masking techniques are improving taste and mouthfeel of soy-based yogurts

- Increasing availability through supermarkets, specialty health stores, and online retail platforms is strengthening market penetration

- Supported by rising disposable income and strong demand for functional foods, the Organic Soy Yogurt market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Organic Soy Yogurt Market?

- Taste perception issues and beany flavor profile of soy remain a barrier for some consumers

- For instance, during 2024–2025, brands invested heavily in R&D and natural flavor enhancements to improve consumer acceptance

- Higher pricing of organic-certified soy yogurt compared to conventional dairy yogurt limits adoption in price-sensitive markets

- Concerns related to soy allergies and GMO-related misconceptions can negatively impact purchasing decisions

- Intense competition from almond, coconut, oat, and cashew-based yogurts reduces product differentiation

- To address these challenges, manufacturers are focusing on flavor innovation, consumer education, transparent labeling, and competitive pricing strategies to expand global adoption of organic soy yogurt

How is the Organic Soy Yogurt Market Segmented?

The market is segmented on the basis of flavour, application, and distribution channel.

- By Flavour

On the basis of flavour, the organic soy yogurt market is segmented into Vanilla, Strawberry, Mixed Berry, Raspberry, Peach, and Others. The Vanilla segment dominated the market with an estimated 34.8% share in 2025, as it remains the most widely accepted and versatile flavor among consumers across all age groups. Vanilla organic soy yogurt is commonly used as a standalone snack, breakfast option, and base ingredient for smoothies and desserts, driving high repeat purchases. Its mild taste also helps mask the natural beany notes of soy, increasing consumer preference.

The Mixed Berry segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for fruit-infused, antioxidant-rich, and flavorful plant-based yogurts. Increasing interest in premium, indulgent, and functional flavor combinations is accelerating adoption, particularly among younger and health-conscious consumers.

- By Application

Based on application, the organic soy yogurt market is segmented into Frozen Dessert, Food, Beverages, and Others. The Food segment dominated the market with a 41.6% share in 2025, driven by widespread consumption of organic soy yogurt as a breakfast item, snack, and meal accompaniment. Its use in bowls, parfaits, baking, and culinary recipes supports strong household and foodservice demand. Growing preference for dairy-free daily nutrition further reinforces dominance.

The Frozen Dessert segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for plant-based frozen treats, soy yogurt ice creams, and healthy dessert alternatives. Innovation in textures, flavors, and clean-label frozen products is driving rapid growth.

- By Distribution Channel

On the basis of distribution channel, the organic soy yogurt market is segmented into Hypermarkets and Supermarkets, Convenience Stores, Online Stores, and Others. The Hypermarkets and Supermarkets segment accounted for the largest share of 46.9% in 2025, supported by strong product visibility, wide brand availability, and consumer preference for one-stop grocery shopping. In-store promotions and refrigeration infrastructure further support sales.

The Online Stores segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing e-commerce adoption, subscription-based grocery models, and rising preference for home delivery of organic and specialty food products.

Which Region Holds the Largest Share of the Organic Soy Yogurt Market?

- Europe dominated the organic soy yogurt market with a 34.26% revenue share in 2025, driven by strong adoption of plant-based diets, growing consumer preference for organic and clean-label products, and well-established retail and distribution networks across countries such as Germany, France, and the U.K. High awareness of health, sustainability, and functional nutrition continues to fuel demand for organic soy yogurts in supermarkets, specialty stores, and foodservice channels

- Leading companies in Europe are introducing innovative formulations, high-protein variants, and probiotic-rich products, strengthening the region’s technological and product advantage. Continuous investment in R&D, sustainability initiatives, and marketing campaigns drives long-term market expansion

- Strong regulatory frameworks, extensive organic certification programs, and high disposable income levels further reinforce regional market leadership

Germany Organic Soy Yogurt Market Insight

Germany is the largest contributor in Europe, supported by high plant-based consumption, robust organic supply chains, and extensive distribution networks. Increasing demand for functional, high-protein, and low-sugar soy yogurts drives market growth. Retailers and manufacturers are expanding private-label and premium product offerings, further boosting adoption.

France Organic Soy Yogurt Market Insight

France contributes significantly to regional growth, driven by growing health-conscious consumer base, government-supported organic programs, and expansion of plant-based dairy alternatives. Supermarkets, organic stores, and online channels are increasingly stocking organic soy yogurts, promoting widespread usage.

U.K. Organic Soy Yogurt Market Insight

The U.K. shows steady growth supported by rising vegan and flexitarian diets, high awareness of environmental sustainability, and strong retail penetration. Product innovation in flavors, functional ingredients, and packaging formats reinforces long-term market expansion.

Asia-Pacific Organic Soy Yogurt Market

Asia-Pacific is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rapid urbanization, rising disposable income, expanding middle-class population, and growing adoption of plant-based diets across China, Japan, India, South Korea, and Southeast Asia. High-volume production of soy-based beverages, desserts, and snacks increases demand for functional organic soy yogurts. Growth in health awareness, e-commerce retail, and sustainable food initiatives continues to accelerate market penetration across the region.

China Organic Soy Yogurt Market Insight

China is the largest contributor to Asia-Pacific due to rapid adoption of plant-based diets, government initiatives promoting organic food, and expansion of e-commerce and modern retail channels. Rising demand for innovative flavors, fortified soy yogurts, and convenient packaging supports market growth.

Japan Organic Soy Yogurt Market Insight

Japan shows steady growth supported by advanced retail infrastructure, high consumer health awareness, and premiumization trends. Increasing interest in probiotics, functional foods, and natural ingredients drives adoption of organic soy yogurts.

India Organic Soy Yogurt Market Insight

India is emerging as a growth hub, driven by rising urbanization, increasing health-conscious population, and expansion of organized retail and e-commerce platforms. Adoption of plant-based alternatives and functional nutrition products accelerates market growth.

South Korea Organic Soy Yogurt Market Insight

South Korea contributes significantly due to high awareness of healthy diets, growing vegan and flexitarian trends, and rapid e-commerce adoption. Rising demand for fortified and flavored organic soy yogurts further strengthens market penetration.

Which are the Top Companies in Organic Soy Yogurt Market?

The organic soy yogurt industry is primarily led by well-established companies, including:

- Danone S.A. (France)

- COYO Pty. Ltd. (Australia)

- Forager Project (U.S.)

- The Coconut Collaborative (U.K.)

- Lavva (U.S.)

- Good Karma Foods Inc. (U.S.)

- NANCY’s (U.S.)

- Hain Celestial (U.S.)

- Daiya Foods Inc. (Canada)

- Oatly AB (Sweden)

- YOSO (Canada)

- Amande Cultured Almond Milk (U.S.)

- Vitasoy (Hong Kong)

- WhiteWave Services (U.S.)

- Yoplait (U.S.)

What are the Recent Developments in Global Organic Soy Yogurt Market?

- In May 2025, Clover Sonoma launched its new Greek yogurt made from fresh, pasture-raised organic milk sourced from its family farms in California, with each 32-ounce container providing 22 grams of protein per serving, zero added sugar, and live active cultures to promote gut health, strengthening its position in the organic Greek yogurt segment

- In May 2025, Yeo Valley Organic introduced a fruited extension of its Greek Recipe organic yogurt range in 200g single-serve pots, delivering 15 grams of protein per serving, available in Tropical Mango and Strawberry & Passion Fruit flavors at select U.K. stores, enhancing its portfolio of convenient, high-protein yogurts

- In February 2024, Danone Canada’s Silk brand launched a protein-rich plant-based yogurt incorporating Canadian pea protein, with 12 grams of protein per 175g serving and a thick Greek-style texture, available in Key Lime and Vanilla flavors, while updating its coconut-based line with new flavors and sizes, expanding its plant-based offerings

- In October 2023, Marvelous Foods rolled out its Yeyo plant-based coconut yogurt products at Ole supermarkets, China’s largest premium supermarket chain with 100 stores in 31 cities and over 10 million members, initially available in Beijing, driving the brand’s penetration into high-end retail markets

- In April 2022, MISTA, an innovation platform based in San Francisco, launched its first member-co-created high-performance plant-based yogurt base, developed in collaboration with AAK, Givaudan, Chr. Hansen, and Ingredion, Inc., integrating fava and pea proteins, flavor masking, texturizing cultures, and functional fats for a dairy-such as taste and improved mouthfeel, enhancing the technological capabilities of plant-based yogurt formulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Soy Yogurt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Soy Yogurt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Soy Yogurt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.