Global Oxygen Therapy Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.33 Billion

USD

4.74 Billion

2025

2033

USD

2.33 Billion

USD

4.74 Billion

2025

2033

| 2026 –2033 | |

| USD 2.33 Billion | |

| USD 4.74 Billion | |

|

|

|

|

Oxygen Therapy Equipment Market Size

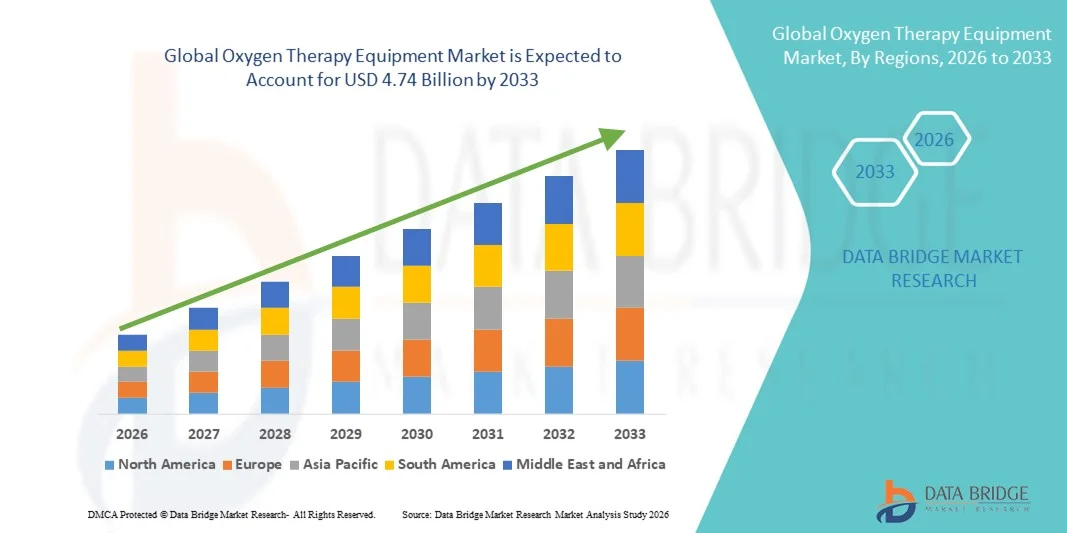

- The global Oxygen Therapy Equipment market size was valued at USD 2.33 billion in 2025 and is expected to reach USD 4.74 billion by 2033, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory conditions such as COPD, asthma, and sleep apnea, which has intensified the demand for advanced oxygen delivery systems across both hospital and homecare settings. The rising geriatric population globally further adds to the high need for continuous oxygen therapy, driving consistent market expansion

- Furthermore, ongoing technological advancements in oxygen concentrators, portable oxygen cylinders, and wearable oxygen therapy solutions are enhancing patient comfort and mobility. These innovations are enabling healthcare providers to offer more efficient and personalized treatment, thus accelerating the uptake of oxygen therapy equipment solutions and significantly boosting the industry's growth

Oxygen Therapy Equipment Market Analysis

- The Oxygen Therapy Equipment market is experiencing significant growth, driven by the increasing prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea, as well as rising pollution levels and an aging global population

- The rising demand for home-based oxygen therapy solutions, coupled with technological advancements in portable oxygen concentrators, is reshaping patient care by providing mobility, comfort, and better health outcomes, especially for elderly and chronic patients

- North America dominated the oxygen therapy equipment market, accounting for the largest revenue share of 38.7% in 2025, driven by a high prevalence of chronic respiratory diseases, advanced healthcare infrastructure, and growing adoption of home-based oxygen therapy. The U.S. continues to lead regional growth due to supportive reimbursement policies, widespread availability of advanced oxygen delivery systems, and increasing patient awareness

- Asia-Pacific is projected to be the fastest-growing region in the oxygen therapy equipment market during the forecast period, expanding at a CAGR of 10.1% from 2026 to 2033, supported by rapid urbanization, rising air pollution levels, increasing government and private healthcare expenditure, and a growing elderly population in countries such as China, India, and Japan

- The Oxygen Source Equipment segment dominated the largest market revenue share of 57.6% in 2025, driven by the growing prevalence of chronic respiratory diseases and the demand for continuous oxygen delivery in hospitals, clinics, and home care settings

Report Scope and Oxygen Therapy Equipment Market Segmentation

|

Attributes |

Oxygen Therapy Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Oxygen Therapy Equipment Market Trends

Increasing Adoption of Home-Based Oxygen Therapy Solutions

- A significant and accelerating trend in the global Oxygen Therapy Equipment market is the rising adoption of home-based oxygen therapy, driven by the growing prevalence of chronic respiratory conditions such as COPD, sleep apnea, and pulmonary fibrosis

- The COVID-19 pandemic further intensified the need for at-home oxygen support, pushing healthcare providers and patients to shift from hospital-based to portable and home-based solutions for long-term respiratory care

- Leading manufacturers are now focused on developing lightweight, user-friendly portable oxygen concentrators (POCs) that provide mobility and convenience for patients, enabling greater adherence to treatment and improved quality of life

- In addition, increased awareness campaigns by respiratory health organizations and governments are helping to destigmatize oxygen therapy use at home, thereby encouraging early intervention and better disease management

- The development of battery-operated and wearable oxygen therapy devices is gaining traction, especially among elderly populations and patients in rural or remote areas with limited access to continuous hospital care

- As healthcare systems worldwide shift toward value-based care, oxygen therapy equipment is becoming central to strategies aimed at reducing hospital readmission rates and managing chronic respiratory illnesses more cost-effectively

Oxygen Therapy Equipment Market Dynamics

Driver

Growing Need Due to Rising Respiratory Disorders and Home-Based Care Demand

- The increasing prevalence of chronic respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea is a major driver for the rising demand for oxygen therapy equipment worldwide

- The global burden of respiratory disorders has heightened the need for accessible oxygen support, especially among the aging population and patients with comorbidities such as cardiovascular diseases

- The trend toward home-based healthcare has further propelled the adoption of oxygen concentrators and portable oxygen cylinders, which allow patients to receive continuous respiratory support outside of hospital settings

- Favorable reimbursement policies, especially in developed countries like the U.S., Germany, and Japan, are supporting the use of oxygen therapy equipment in both chronic care management and post-acute recovery scenarios

- Technological advancements in oxygen delivery systems, such as portable oxygen concentrators with extended battery life, auto-adjust flow rates, and integrated monitoring, are enhancing patient compliance and convenience

Restraint/Challenge

High Initial Costs and Limited Awareness in Low-Income Regions

- The high upfront cost of advanced oxygen therapy equipment such as portable oxygen concentrators remains a significant barrier, particularly in low- and middle-income countries where access to medical infrastructure is limited

- For instance, In rural and underserved areas, lack of awareness and education about the benefits of oxygen therapy often results in underdiagnosis and delayed treatment of respiratory illnesses

- Supply chain challenges, including delays in device delivery and shortages of medical-grade oxygen in critical regions, especially during health emergencies, have disrupted access to therapy

- Infrastructure limitations, such as unreliable electricity or insufficient training for device usage and maintenance, hinder widespread adoption in resource-limited settings

- Concerns over long-term affordability for consumables and refills, such as nasal cannulas, masks, and oxygen cylinders, add to the economic burden for patients and caregivers

- To overcome these challenges, stakeholders must focus on cost-effective device innovation, government-supported oxygen delivery programs, and capacity-building initiatives in primary care settings to ensure equitable access to oxygen therapy worldwide

Oxygen Therapy Equipment Market Scope

The market is segmented on the basis of product type, portability, application, and end user.

- By Product Type

On the basis of product type, the Oxygen Therapy Equipment market is segmented into Bag-Valve Mask and Oxygen Source Equipment. The Oxygen Source Equipment segment dominated the largest market revenue share of 57.6% in 2025, driven by the growing prevalence of chronic respiratory diseases and the demand for continuous oxygen delivery in hospitals, clinics, and home care settings. Oxygen concentrators and stationary delivery systems are widely used for treating conditions such as COPD, pneumonia, and respiratory distress syndrome. The segment benefits from advancements in energy-efficient concentrators, improved flow regulation, and patient monitoring integration. Hospitals and ambulatory centers prefer oxygen source equipment due to reliability and high-capacity supply. The availability of government subsidies and insurance reimbursement for chronic care further supports adoption. Increasing awareness among healthcare providers and patients about oxygen therapy benefits boosts revenue. Oxygen source equipment dominates the market due to essential role in long-term respiratory care. The rising geriatric population and prevalence of pulmonary diseases drive segment demand globally. Continuous innovations in sensor-based monitoring enhance safety and efficiency. Overall, oxygen source equipment remains the leading product type in the market.

The Bag-Valve Mask segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, fueled by growing emergency care and pre-hospital interventions. Bag-valve masks are essential for resuscitation, trauma response, and emergency oxygen delivery. Their portability and ease of use make them suitable for ambulatory surgical centers, home care, and ambulance services. Increasing adoption of basic life support (BLS) training and emergency preparedness programs drives demand. Lightweight and ergonomic designs enhance usability and patient safety. Expanding emergency healthcare services in emerging regions further supports growth. Overall, bag-valve masks represent the fastest-growing product segment due to rising emergency care requirements and portable oxygen delivery demand.

- By Portability

On the basis of portability, the market is segmented into Portable and Stationary equipment. The Stationary segment held the largest market revenue share of 54.1% in 2025, attributed to their widespread use in hospitals, clinics, and long-term home care settings. Stationary equipment offers higher oxygen output, reliability, and integration with hospital monitoring systems. Increasing chronic respiratory disease burden drives consistent demand. Hospitals prefer stationary concentrators for ICU and long-term oxygen therapy. Technological innovations, including automated alarms and oxygen sensors, enhance patient safety. Integration with electronic health records supports better patient management. Overall, stationary equipment dominates due to high capacity, reliability, and extensive clinical use.

The Portable segment is expected to witness the fastest CAGR of 13.4% from 2026 to 2033, fueled by rising preference for home care, mobility, and outdoor use. Portable oxygen concentrators allow patients with COPD, cystic fibrosis, or post-operative respiratory needs to maintain mobility. Increased awareness of patient-centered care and aging population support growth. Technological enhancements, such as lightweight materials and longer battery life, improve portability. Adoption in home care and ambulatory services accelerates demand. Overall, portable devices represent the fastest-growing segment due to convenience, mobility, and expanding home healthcare infrastructure.

- By Application

On the basis of application, the market is segmented into Asthma, Pneumonia, Chronic Obstructive Pulmonary Disease (COPD), Respiratory Distress Syndrome, Cystic Fibrosis, and Others. The COPD segment accounted for the largest market revenue share of 41.7% in 2025, driven by the high prevalence of chronic respiratory disorders globally and the necessity of long-term oxygen therapy. COPD patients require consistent oxygen supplementation to manage hypoxemia and improve quality of life. Hospitals, home care providers, and ambulatory centers prioritize COPD care solutions. Government programs and insurance coverage facilitate adoption. Technological advancements in flow regulation and patient monitoring enhance clinical outcomes. Overall, COPD remains the dominant application segment due to prevalence and long-term therapy requirements.

The Asthma segment is projected to witness the fastest CAGR of 11.9% from 2026 to 2033, driven by rising asthma incidence in children and adults and increased adoption of home oxygen therapy devices. Portable concentrators and oxygen accessories allow asthma patients to manage acute exacerbations efficiently. Awareness campaigns and preventive care initiatives further boost market adoption. Overall, asthma represents the fastest-growing application segment due to increasing prevalence and early intervention needs.

- By End User

On the basis of end user, the market is segmented into Hospitals & Clinics, Ambulatory Surgical Centers, Home Care Settings, and Others. The Hospitals & Clinics segment held the largest market revenue share of 48.5% in 2025, owing to their high patient throughput, need for continuous oxygen therapy, and integration with clinical monitoring systems. Hospitals remain key buyers due to critical care requirements and regulatory compliance. Expansion of healthcare infrastructure in emerging markets strengthens segment dominance.

The Home Care Settings segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, fueled by rising adoption of home oxygen therapy, telemedicine integration, and increasing patient preference for home-based care. Portable oxygen devices and remote monitoring systems support patient independence and reduce hospital visits. Growth in geriatric population and chronic respiratory conditions further accelerates segment growth. Overall, home care settings represent the fastest-growing end-user segment due to convenience, mobility, and healthcare decentralization.

Oxygen Therapy Equipment Market Regional Analysis

- North America dominated the oxygen therapy equipment market, accounting for the largest revenue share of 38.7% in 2025

- Driven by a high prevalence of chronic respiratory diseases, advanced healthcare infrastructure, and growing adoption of home-based oxygen therapy. The U.S. continues to lead regional growth due to supportive reimbursement policies, widespread availability of advanced oxygen delivery systems, and increasing patient awareness

- Veterans of the healthcare sector, including hospitals, clinics, and home healthcare providers, are increasingly adopting portable and stationary oxygen concentrators. For example, in 2024, Philips Respironics expanded its home oxygen therapy product line with compact, energy-efficient concentrators suitable for chronic respiratory patients

U.S. Oxygen Therapy Equipment Market Insight

The U.S. oxygen therapy equipment market captured the largest revenue share within North America, fueled by rising cases of COPD, asthma, and other chronic respiratory conditions, alongside high adoption of home healthcare solutions. Companies such as Invacare Corporation and ResMed are offering advanced oxygen concentrators and portable oxygen systems that improve patient mobility and quality of life.

Europe Oxygen Therapy Equipment Market Insight

Europe oxygen therapy equipment market is expected to expand steadily due to increasing prevalence of respiratory diseases, growing geriatric populations, and well-established healthcare infrastructure. Countries like Germany, France, and the U.K. are increasingly incorporating home oxygen therapy programs and hospital-based oxygen delivery systems to support chronic respiratory patients. For example, Fisher & Paykel Healthcare introduced energy-efficient oxygen concentrators for European clinics in 2023.

U.K. Oxygen Therapy Equipment Market Insight

The U.K. oxygen therapy equipment market is anticipated to grow due to high COPD incidence, aging population, and increasing demand for home-based oxygen therapy. Healthcare providers are investing in both portable and stationary oxygen systems to support patient compliance and reduce hospital readmissions.

Germany Oxygen Therapy Equipment Market Insight

Germany’s oxygen therapy equipment market growth is supported by advanced healthcare infrastructure, government reimbursement schemes, and rising patient awareness of oxygen therapy benefits. Hospitals and homecare services are increasingly adopting compact, user-friendly oxygen concentrators from manufacturers like Drägerwerk AG & Co. to enhance patient convenience and mobility.

Asia-Pacific Oxygen Therapy Equipment Market Insight

Asia-Pacific oxygen therapy equipment market is projected to be the fastest-growing region during 2026–2033, expanding at a CAGR of 10.1%, supported by rapid urbanization, rising air pollution levels, increasing government and private healthcare expenditure, and a growing elderly population in countries such as China, India, and Japan. For instance, Mindray Medical International launched cost-effective oxygen concentrators for hospitals and homecare settings in China and India to meet rising demand.

Japan Oxygen Therapy Equipment Market Insight

Japan’s oxygen therapy equipment market is growing due to an aging population, increasing respiratory disease prevalence, and a strong preference for home-based healthcare. Hospitals and elderly care facilities are adopting portable oxygen systems to provide patient-centric care and improve mobility for long-term oxygen therapy users.

China Oxygen Therapy Equipment Market Insight

China oxygen therapy equipment market accounted for the largest market share in Asia-Pacific in 2025, driven by increasing COPD cases, rising healthcare spending, and urbanization. Domestic and multinational companies are expanding production and distribution of oxygen therapy devices to meet the growing demand for both hospital and home-based oxygen delivery systems.

Oxygen Therapy Equipment Market Share

The Oxygen Therapy Equipment industry is primarily led by well-established companies, including:

- Philips Respironics (Netherlands)

- ResMed Inc. (U.S.)

- Invacare Corporation (U.S.)

- Drive DeVilbiss Healthcare (U.S.)

- CAIRE Inc. (U.S.)

- Nidek Medical Products, Inc. (U.S.)

- O2 Concepts, LLC (U.S.)

- Inogen, Inc. (U.S.)

- Fisher & Paykel Healthcare Corporation Limited (New Zealand)

- Messer Group GmbH (Germany)

- Air Liquide (France)

- GCE Group (Sweden)

- Precision Medical, Inc. (U.S.)

- BESCO Medical Limited (China)

- Sanrai International (India)

Latest Developments in Global Oxygen Therapy Equipment Market

- In January 2025, Caire announced the launch of its new IntenOxy 5 stationary oxygen concentrator, making the device available in the United States and Puerto Rico with plans for expansion into Canada. This development aimed to provide a more efficient, reliable stationary oxygen solution for long‑term care patients

- In June 2025, Inogen, Inc., a leading provider of respiratory solutions, unveiled the Voxi 5 stationary oxygen concentrator, designed to enhance access to high‑quality oxygen therapy for long‑term care patients in the United States, strengthening its product lineup beyond portable units

- In June 2025, VARON introduced a new oxygen therapy platform specifically targeted at the Mexican market, addressing the growing need for reliable home oxygen therapy amid rising chronic respiratory conditions

- In March 2025, Philips Respironics launched its next‑generation portable oxygen concentrator, featuring enhanced battery life and integrated IoT capabilities for remote patient monitoring and telehealth support, reflecting a move toward connectivity in oxygen therapy devices

- In January 2025, Inogen introduced the Inogen One G5+, a lightweight, wearable oxygen concentrator with AI‑driven oxygen flow adjustment to improve personalized therapy, meeting growing demand for advanced portable solutions

- In November 2024, CAIRE Inc. received FDA clearance for its Elite 5 portable oxygen concentrator, which incorporates improved membrane technology to reduce noise and enhance oxygen purity, marking a regulatory milestone for portable oxygen therapy devices

- In August 2023, Drive DeVilbiss Healthcare announced a partnership with a digital health startup to develop AI‑powered oxygen delivery systems, focusing on optimizing oxygen dosing through real‑time sensor analysis—moving toward smarter, data‑driven oxygen therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.