Global Packaging Pumps And Dispensers Market

Market Size in USD Billion

CAGR :

%

USD

9.50 Billion

USD

12.81 Billion

2025

2033

USD

9.50 Billion

USD

12.81 Billion

2025

2033

| 2026 –2033 | |

| USD 9.50 Billion | |

| USD 12.81 Billion | |

|

|

|

|

Packaging Pumps and Dispensers Market Size

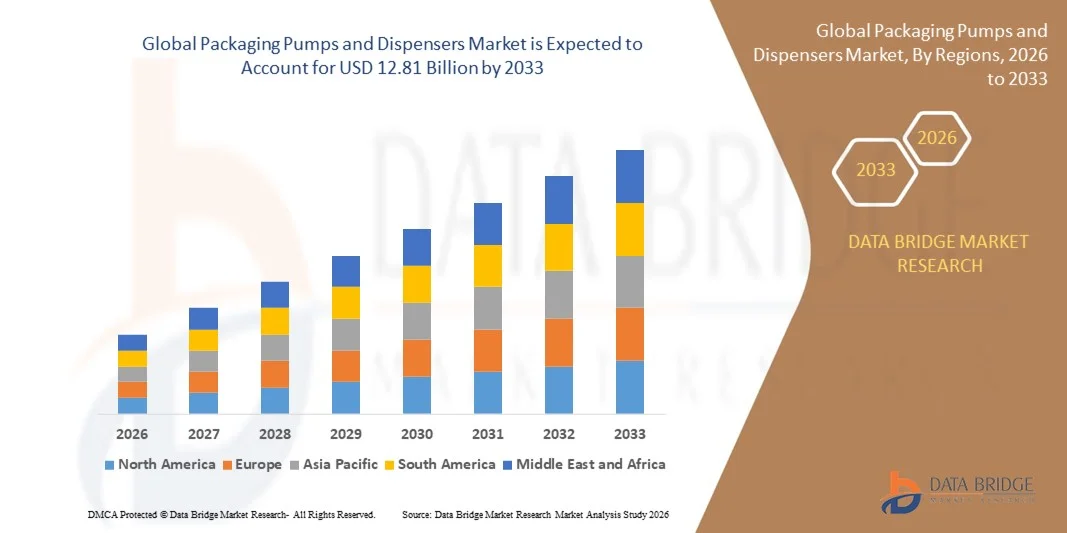

- The global packaging pumps and dispensers market size was valued at USD 9.50 billion in 2025 and is expected to reach USD 12.81 billion by 2033, at a CAGR of 3.80% during the forecast period

- The market growth is largely fueled by increasing demand for convenient, hygienic, and sustainable dispensing solutions across personal care, cosmetics, pharmaceuticals, and household products. Rising awareness of product safety and user-friendly packaging is driving manufacturers to innovate in pump and dispenser designs

- Furthermore, growing emphasis on sustainability, recyclable materials, and eco-friendly packaging is encouraging adoption of advanced dispensing systems. These converging factors are accelerating the uptake of high-performance, customizable, and environmentally responsible pumps and dispensers, thereby significantly boosting the industry's growth

Packaging Pumps and Dispensers Market Analysis

- Pumps and dispensers, providing controlled and hygienic delivery of liquids, creams, and other flowable products, are increasingly essential components of modern packaging solutions in personal care, pharmaceutical, and food & beverage sectors due to their convenience, precise dosing, and enhanced product protection

- The escalating demand for pumps and dispensers is primarily fueled by rising consumer preference for easy-to-use and spill-proof packaging, growing penetration of premium and hygiene-focused products, and the increasing adoption of sustainable, recyclable, and refillable packaging systems

- Asia-Pacific dominated the packaging pumps and dispensers market with a share of 38.95% in 2025, due to rapid growth in the personal care, cosmetics, and pharmaceutical sectors, increasing demand for convenient and hygienic dispensing solutions, and a strong manufacturing base in the region

- North America is expected to be the fastest growing region in the packaging pumps and dispensers market during the forecast period due to rising demand for convenient and hygienic dispensing systems in pharmaceuticals, personal care, and food & beverage sectors

- Plastic segment dominated the market with a market share of 65.7% in 2025, due to its lightweight nature, cost-effectiveness, and versatility in molding into various pump designs. Plastic dispensers also support a wide range of chemical compatibilities and are widely recycled in line with sustainability initiatives, which appeals to environmentally conscious brands and consumers. The increasing demand for customizable and branded packaging further reinforces the market preference for plastic-based pumps and dispensers

Report Scope and Packaging Pumps and Dispensers Market Segmentation

|

Attributes |

Packaging Pumps and Dispensers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaging Pumps and Dispensers Market Trends

Adoption of Sustainable and Recyclable Dispensers

- A notable trend in the packaging pumps and dispensers market is the increasing shift toward sustainable, eco-friendly, and recyclable dispenser solutions driven by growing environmental awareness and regulatory pressures. Manufacturers are exploring materials that reduce carbon footprint while maintaining product functionality, thereby addressing both consumer expectations and sustainability goals

- For instance, AptarGroup has introduced recyclable and bio-based pump dispensers for personal care and household products, supporting brands in reducing plastic waste and meeting circular economy targets. These dispensers enhance brand image while delivering consistent performance and reliability across high-demand applications

- The adoption of lightweight and refillable dispensers is rising as they reduce transportation costs, storage requirements, and packaging waste. This trend is encouraging manufacturers to innovate in modular and refillable pump designs that align with sustainability commitments

- In personal care and cosmetics, premium brands are increasingly using visually appealing recyclable pumps that combine functionality with eco-conscious design, enhancing product appeal and market differentiation. This is fostering a broader consumer acceptance of sustainable packaging without compromising convenience or aesthetics

- Across household cleaning and food packaging segments, the demand for hygienic and reusable pumps is influencing dispenser design, ensuring safe handling and controlled dispensing. Manufacturers are investing in technology that prevents contamination and supports long-term product usability

- The overall market is witnessing strong momentum in sustainable dispenser adoption, where regulatory support, consumer preference, and corporate sustainability strategies are converging to drive widespread integration of recyclable and eco-friendly pumps across industries

Packaging Pumps and Dispensers Market Dynamics

Driver

Rising Demand for Convenient and Hygienic Packaging

- The market is propelled by growing consumer preference for convenient, user-friendly, and hygienic packaging solutions that enable controlled dispensing and reduce contamination risks. Consumers increasingly prioritize products that offer ease of use while maintaining safety and product integrity

- For instance, Procter & Gamble incorporates advanced pump dispensers in its personal care lines to provide precise, mess-free dispensing and enhance user convenience. These innovations strengthen customer satisfaction and loyalty while meeting hygiene standards in household and beauty products

- The surge in e-commerce and on-the-go consumption is driving packaging innovation, encouraging manufacturers to develop dispensers that are leak-proof, portable, and compatible with various product formulations. This convenience-focused approach supports brand competitiveness in crowded marketplaces

- Premium product segments are increasingly adopting pumps with ergonomic designs that provide intuitive use, thereby improving consumer experience and reinforcing brand positioning. Enhanced functionality is creating differentiation and supporting premium pricing strategies

- The trend toward health-conscious and hygiene-oriented lifestyles is fueling demand for dispensers with antimicrobial coatings and tamper-evident features. These design enhancements ensure product safety, extend shelf life, and meet regulatory and consumer expectations

Restraint/Challenge

High Production Costs of Advanced Dispensers

- The packaging pumps and dispensers market faces challenges due to the elevated costs associated with producing advanced and sustainable dispensing mechanisms. High-precision components, specialized materials, and sophisticated assembly processes contribute to overall production expenses

- For instance, companies such as Silgan Dispensing Systems implement complex molding and finishing technologies for high-end dispensers, which increase manufacturing costs and affect pricing flexibility. These expenditures can constrain adoption, particularly in cost-sensitive segments

- The integration of recyclable, bio-based, or refillable materials requires additional R&D investment, specialized sourcing, and compliance with environmental regulations, further elevating production costs. These factors can limit scalability for smaller manufacturers and new entrants

- Maintaining consistent quality, reliability, and performance in advanced dispensers involves rigorous testing and quality control protocols that extend production timelines. This adds operational complexity and reduces overall manufacturing efficiency

- Balancing the trade-off between sustainability, functionality, and affordability remains a key challenge, with manufacturers needing to optimize production processes while meeting consumer expectations for eco-friendly, convenient, and hygienic dispensing solutions

Packaging Pumps and Dispensers Market Scope

The market is segmented on the basis of product type, material type, application, and end users.

- By Product Type

On the basis of product type, the packaging pumps and dispensers market is segmented into lotion and cream pumps, spray and trigger pumps, aerosol caps, valve closures, push-pull closures, and other dispensing closures. The lotion and cream pumps segment dominated the market with the largest revenue share in 2025, driven by the rising demand for skincare and personal care products and the convenience they provide for controlled dispensing. These pumps are preferred for their compatibility with various viscosities, ease of use, and ability to maintain product hygiene, making them widely adopted by both premium and mass-market brands. Consumer preference for consistent dosing and the growing trend of travel-friendly packaging further reinforce the dominance of lotion and cream pumps.

The spray and trigger pumps segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in homecare and cleaning product segments. For instance, companies such as SC Johnson leverage spray and trigger mechanisms for liquid cleaners and disinfectants, enabling convenient application and wide surface coverage. Their ergonomic design, adjustable spray options, and suitability for large-volume usage contribute to their growing popularity across commercial and residential applications.

- By Material Type

On the basis of material type, the packaging pumps and dispensers market is segmented into plastic, metal, and glass. The plastic segment dominated the market with the largest share of 65.7% in 2025 due to its lightweight nature, cost-effectiveness, and versatility in molding into various pump designs. Plastic dispensers also support a wide range of chemical compatibilities and are widely recycled in line with sustainability initiatives, which appeals to environmentally conscious brands and consumers. The increasing demand for customizable and branded packaging further reinforces the market preference for plastic-based pumps and dispensers.

The metal segment is expected to witness the fastest growth from 2026 to 2033, driven by premium personal care and cosmetic products that emphasize durability, aesthetics, and a luxury appeal. For instance, L'Oreal integrates metal pump components in high-end skincare bottles to enhance visual appeal and provide a more robust dispensing mechanism, supporting the growth of this segment.

- By Application

On the basis of application, the packaging pumps and dispensers market is segmented into body lotions, hand care lotions, reagents, perfumes and deodorants, liquid soap, shampoos and conditioners, and others. The body lotions segment dominated the market in 2025 due to the widespread use of lotions for daily skincare routines and the rising demand for hygiene and personal care products. These dispensers offer accurate dosing, help maintain product integrity, and improve user convenience, driving high adoption across households and commercial facilities. Growing awareness of skincare and expanding product portfolios from major personal care brands reinforce the segment’s dominance.

The liquid soap segment is expected to witness the fastest growth from 2026 to 2033, fueled by hygiene-focused trends and rising demand in both residential and commercial spaces. For instance, Procter & Gamble enhances liquid soap dispensing systems to improve user convenience, reduce spillage, and support refillable bottle initiatives, which propels adoption of specialized pumps and dispensers in this application.

- By End Users

On the basis of end users, the packaging pumps and dispensers market is segmented into cosmetics and personal care, homecare, pharmaceutical, chemicals and fertilizers, laboratories, automotive, and others. The cosmetics and personal care segment dominated the market in 2025 due to the rapid growth of skincare, haircare, and hygiene products globally, coupled with consumers’ preference for convenient and hygienic dispensing solutions. Brands prioritize aesthetic appeal, functional design, and precise dosing, which increases demand for high-quality pumps and dispensers in this sector. Innovations in refillable, eco-friendly, and customizable packaging further support dominance of this end-user segment.

The homecare segment is expected to witness the fastest growth from 2026 to 2033, driven by increased consumption of cleaning agents, disinfectants, and surface care products in both households and commercial facilities. For instance, Henkel incorporates ergonomic trigger and spray pumps in cleaning products to ensure easy application, enhance safety, and improve overall user experience, contributing to the segment’s rapid adoption.

Packaging Pumps and Dispensers Market Regional Analysis

- Asia-Pacific dominated the packaging pumps and dispensers market with the largest revenue share of 38.95% in 2025, driven by rapid growth in the personal care, cosmetics, and pharmaceutical sectors, increasing demand for convenient and hygienic dispensing solutions, and a strong manufacturing base in the region

- The region’s cost-effective production capabilities, rising investments in automation, and expanding exports of personal care and pharmaceutical products are accelerating market growth

- The availability of skilled labor, favorable government policies, and rising urbanization across developing economies are contributing to increased adoption of advanced pump and dispenser solutions

China Packaging Pumps and Dispensers Market Insight

China held the largest share in the Asia-Pacific packaging pumps and dispensers market in 2025, owing to its strong industrial base, dominance in cosmetics and personal care manufacturing, and extensive export capabilities. The country’s robust infrastructure, government incentives for manufacturing modernization, and adoption of smart dispensing technologies are key growth drivers. Rising domestic consumption and increasing focus on product differentiation further support market expansion.

India Packaging Pumps and Dispensers Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a booming pharmaceutical and personal care sector, rising urban population, and increasing awareness of hygiene and convenience. For instance, companies such as Godrej Consumer Products are investing in innovative pump and dispenser solutions to cater to growing consumer demand. Initiatives promoting local manufacturing, coupled with expanding retail networks, are strengthening market growth.

Europe Packaging Pumps and Dispensers Market Insight

The Europe market is expanding steadily, supported by stringent regulations on packaging safety, rising consumer preference for sustainable and ergonomic dispensing solutions, and growing investments in automation. High emphasis on quality and environmental compliance, particularly in cosmetics and pharmaceuticals, is boosting adoption. In addition, increasing demand for premium and refillable packaging systems enhances market development.

Germany Packaging Pumps and Dispensers Market Insight

Germany’s market is driven by its leadership in high-precision manufacturing, strong chemical and personal care industry heritage, and export-oriented production model. Well-established R&D networks and partnerships between industry and academia foster continuous innovation in dispenser technologies. Demand is particularly strong for use in pharmaceutical, cosmetic, and home care applications.

U.K. Packaging Pumps and Dispensers Market Insight

The U.K. market is supported by a mature personal care and pharmaceutical industry, efforts to localize supply chains post-Brexit, and increasing focus on sustainable packaging solutions. For instance, Reckitt Benckiser is advancing refillable and hygienic pump systems for household and personal care products. Investments in R&D, innovative dispensing designs, and regulatory compliance strengthen the country’s market presence.

North America Packaging Pumps and Dispensers Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for convenient and hygienic dispensing systems in pharmaceuticals, personal care, and food & beverage sectors. Focus on innovation, smart packaging, and high-precision manufacturing boosts adoption. In addition, reshoring of production and increasing collaborations between cosmetic and pharmaceutical companies enhance market expansion.

U.S. Packaging Pumps and Dispensers Market Insight

The U.S. accounted for the largest share in North America in 2025, underpinned by a robust personal care and pharmaceutical industry, strong R&D infrastructure, and significant investment in advanced dispensing technologies. For instance, Procter & Gamble continues to innovate in airless and precision pump systems to meet consumer convenience and hygiene standards. Presence of key manufacturers, mature distribution networks, and sustainability-focused initiatives solidify the U.S.'s leading position in the region.

Packaging Pumps and Dispensers Market Share

The packaging pumps and dispensers industry is primarily led by well-established companies, including:

- Silgan Dispensing Systems (U.S.)

- AptarGroup, Inc. (U.S.)

- Rieke Packaging Systems (U.K.)

- Frapak Packaging B.V. (Netherlands)

- Guala Dispensing S.p.A. (Italy)

- LUMSON S.p.A. (Italy)

- HCP Packaging (China)

- APC Packaging (Ireland)

- Albéa (France)

- Quadpack (Spain)

- Qosmedix (U.S.)

- Nemera (France)

- LABLABO (France)

- C.L. Smith Company (U.S.)

- Darin Co. Ltd (Japan)

- Richmond Containers CTP Ltd (U.K.)

- TAPLAST S.r.l. (Italy)

- RAEPAK Ltd (U.K.)

- Prosking Plastic Products Inc. (U.S.)

- UNICOM International Ltd (U.K.)

Latest Developments in Global Packaging Pumps and Dispensers Market

- In January 2025, TriMas Packaging, the largest operating group of TriMas, expanded its portfolio of sustainable dispensing solutions by launching a new foaming pump under its patented Singolo product line. The fully recyclable, all-plastic dispenser enhances the company’s position in the eco-friendly packaging segment, catering to growing demand from personal care and hygiene brands for sustainable, high-performance dispensing systems. This innovation strengthens TriMas Packaging’s market presence and addresses the rising consumer and regulatory emphasis on environmentally responsible packaging solutions

- In October 2024, Vaseline integrated a new recyclable pump into its Intensive Care lotion products in the U.S. and Canada. This initiative aligns with Unilever’s broader sustainability goal to ensure 100% of its rigid plastic packaging is reusable, recyclable, or compostable by 2030. The move reinforces the adoption of environmentally conscious dispensing solutions in the personal care market, setting a benchmark for large consumer goods companies to prioritize sustainability in their packaging strategies

- In July 2024, Silgan Holdings Inc., a leading provider of sustainable rigid packaging for essential consumer goods, agreed to acquire Weener Plastics Holdings BV for an enterprise value of USD 906 million. Weener Plastics’ expertise in specialized dispensing solutions for personal care, food, and healthcare products, combined with its global network of 19 facilities employing approximately 4,000 people, significantly strengthens Silgan’s footprint in the packaging pumps and dispensers market. The acquisition is expected to enhance Silgan’s product offerings, expand its global reach, and support growing demand for innovative and sustainable dispensing technologies

- In June 2024, Aptar Beauty introduced Maya, its latest aerosol actuator designed for high performance, user-friendly functionality, and customizable branding opportunities. The actuator’s clean aesthetic and twist-to-lock technology position Aptar Beauty as a leader in innovative dispensing solutions, addressing increasing consumer demand for both convenience and premium packaging experiences. The launch reinforces market competitiveness and sets a new standard for functionality and brand differentiation in the personal care dispensing segment

- In March 2024, APC Packaging announced the release of its EAPP EcoReady All Plastic Airless Pump, an eco-friendly dispensing solution made entirely from plastic and engineered with airless technology. The launch reflects the growing market trend toward sustainable packaging solutions and addresses brand and consumer demand for environmentally responsible dispensers. By combining functionality with sustainability, APC Packaging strengthens its position in the global packaging pumps and dispensers market and supports the shift toward fully recyclable and resource-efficient product offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaging Pumps And Dispensers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaging Pumps And Dispensers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaging Pumps And Dispensers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.