Global Pacs And Ris Market

Market Size in USD Billion

CAGR :

%

USD

5.36 Billion

USD

8.94 Billion

2025

2033

USD

5.36 Billion

USD

8.94 Billion

2025

2033

| 2026 –2033 | |

| USD 5.36 Billion | |

| USD 8.94 Billion | |

|

|

|

|

ACS and RIS Market Size

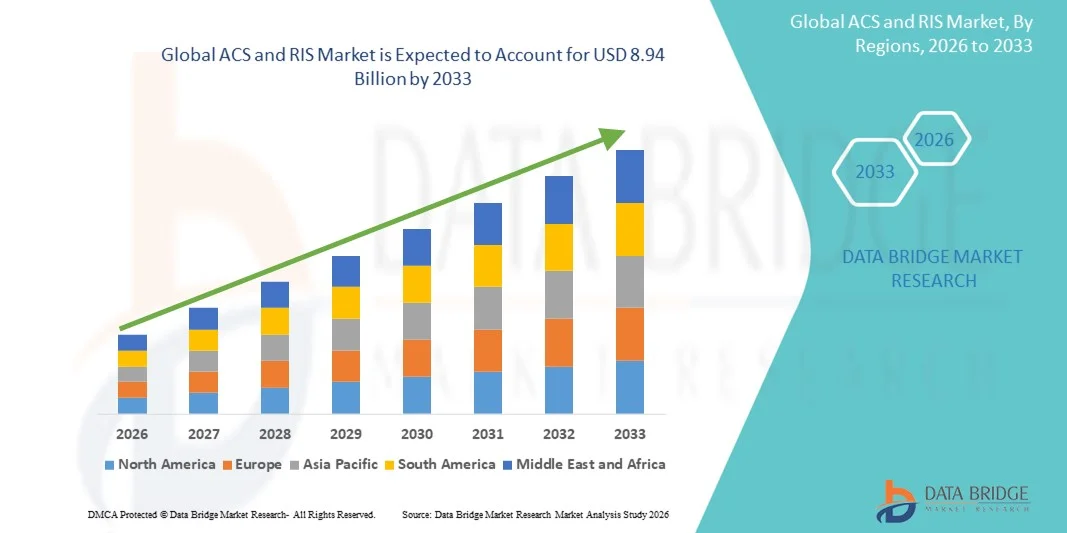

- The global ACS and RIS market size was valued at USD 5.36 billion in 2025 and is expected to reach USD 8.94 billion by 2033, at a CAGR of 6.61% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced healthcare IT infrastructure and rapid technological progress in diagnostic imaging and radiology workflows, leading to greater digitalization and automation across hospitals, diagnostic centers, and imaging facilities

- Furthermore, rising demand for efficient patient data management, streamlined imaging workflows, improved diagnostic accuracy, and seamless integration with hospital information systems is establishing ACS and RIS solutions as critical components of modern healthcare delivery. These converging factors are accelerating the uptake of ACS and RIS solutions, thereby significantly boosting the industry’s growth

ACS and RIS Market Analysis

- ACS and RIS, which enable automated image archiving, workflow management, reporting, and seamless data exchange across radiology departments, are increasingly vital components of modern healthcare IT infrastructure in hospitals and diagnostic centers due to their ability to improve operational efficiency, diagnostic accuracy, and patient care coordination

- The escalating demand for ACS and RIS solutions is primarily fueled by the rising volume of medical imaging procedures, growing adoption of digital radiology, increasing focus on workflow optimization, and the need for integrated systems that support interoperability with HIS, EMR, and PACS platforms

- North America dominated the ACS and RIS market with the largest revenue share of approximately 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of digital imaging technologies, strong presence of leading healthcare IT vendors, and widespread implementation of integrated radiology information systems across hospitals and imaging networks in the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the ACS and RIS market during the forecast period, registering a strong CAGR of around 9.8%, driven by expanding healthcare infrastructure, rising diagnostic imaging volumes, increasing healthcare IT investments, and rapid adoption of digital health solutions in countries such as China, India, and Southeast Asia

- The PACS segment dominated the largest market revenue share of approximately 61.4% in 2025, driven by the rapid digitization of medical imaging and the increasing volume of diagnostic imaging procedures worldwide

Report Scope and ACS and RIS Market Segmentation

|

Attributes |

ACS and RIS Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• GE HealthCare (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

ACS and RIS Market Trends

Expansion of Integrated and Networked Security Infrastructure

- A significant and accelerating trend in the global ACS and RIS market is the increasing deployment of integrated access control systems and radio intercom solutions across residential, commercial, industrial, and public infrastructure environments to enhance perimeter security, monitoring, and controlled access

- For instance, large-scale commercial complexes, transportation hubs, and multi-tenant residential developments across North America, Europe, and Asia-Pacific are increasingly adopting integrated ACS and RIS platforms to manage entry points, visitor communication, and centralized security operations more efficiently

- The convergence of ACS and RIS with building management systems and surveillance platforms is enabling organizations to streamline access permissions, improve situational awareness, and reduce manual security interventions

- The growing adoption of network-based and IP-enabled ACS and RIS solutions allows centralized management across multiple locations, supporting scalability for enterprises with geographically distributed facilities

- This shift toward interoperable and centralized security infrastructure is reshaping expectations around facility safety, operational efficiency, and regulatory compliance. Consequently, global security solution providers are expanding their ACS and RIS portfolios to support multi-site deployment, system interoperability, and long-term infrastructure modernization

- The demand for reliable, scalable, and integrated ACS and RIS solutions is increasing steadily across both public and private sectors as organizations prioritize robust access management and real-time communication capabilities

ACS and RIS Market Dynamics

Driver

Rising Demand for Enhanced Security and Infrastructure Modernization

- The growing need to secure critical infrastructure, commercial facilities, residential complexes, and government buildings is a major driver fueling demand for ACS and RIS solutions worldwide

- For instance, in 2024, several airport authorities and public transit operators across Europe and Asia announced upgrades to their access control and intercom systems to strengthen security protocols and improve passenger safety, supporting market growth

- Rising urbanization, increased construction of smart commercial buildings, and expansion of industrial facilities are further accelerating the adoption of ACS and RIS systems

- Governments and regulatory bodies across regions are enforcing stricter security and access compliance standards, prompting organizations to invest in modern access control and communication systems

- In addition, the need for controlled access, visitor management, and secure internal communication in healthcare facilities, educational institutions, and corporate campuses continues to propel global ACS and RIS market expansion

Restraint/Challenge

High Implementation Costs and System Integration Complexity

- The high initial cost associated with deploying comprehensive ACS and RIS solutions, including hardware installation, system integration, and maintenance, remains a key challenge to broader market adoption

- For instance, small and medium-sized enterprises in emerging economies often delay implementation of advanced ACS and RIS systems due to budget constraints and limited access to skilled installation services

- Complex integration requirements with existing security infrastructure and legacy systems can increase deployment time and operational disruptions, discouraging rapid adoption

- Ongoing maintenance costs, system upgrades, and the need for trained personnel to manage and operate ACS and RIS platforms further add to the total cost of ownership

- Overcoming these challenges through modular system designs, cost-effective deployment models, improved system compatibility, and greater awareness of long-term security benefits will be critical for sustained growth of the global ACS and RIS market

ACS and RIS Market Scope

The market is segmented on the basis of product, component, deployment, and end user.

- By Product

On the basis of product, the PACS and RIS market is segmented into Picture Archiving and Communication System (PACS) and Radiology Information System (RIS). The PACS segment dominated the largest market revenue share of approximately 61.4% in 2025, driven by the rapid digitization of medical imaging and the increasing volume of diagnostic imaging procedures worldwide. PACS enables efficient storage, retrieval, and sharing of medical images across healthcare networks, improving workflow efficiency and clinical collaboration. Hospitals increasingly rely on PACS to manage large imaging datasets from modalities such as CT, MRI, X-ray, and ultrasound. Integration with electronic health records (EHRs) and advanced visualization tools further strengthens PACS adoption. The growing prevalence of chronic diseases and aging populations has increased imaging demand, reinforcing PACS dominance. Additionally, regulatory mandates for digital recordkeeping and image archiving support widespread deployment. Large hospitals and diagnostic centers prefer PACS due to scalability and interoperability. Continuous upgrades, including AI-enabled image analysis and advanced visualization, also contribute to sustained market leadership.

The RIS segment is expected to witness the fastest CAGR of around 11.9% from 2026 to 2033, driven by the growing need for streamlined radiology workflow management and patient scheduling systems. RIS improves operational efficiency by automating patient registration, appointment scheduling, reporting, billing, and data analytics. Rising imaging volumes require better coordination between radiologists, technicians, and referring physicians, accelerating RIS adoption. The shift toward value-based healthcare models emphasizes workflow optimization and error reduction, favoring RIS implementation. Integration of RIS with PACS and hospital information systems (HIS) enhances its value proposition. Cloud-based RIS solutions are gaining traction among small and mid-sized diagnostic centers. Increasing investments in digital radiology infrastructure across emerging economies further support rapid growth. Regulatory compliance and reporting accuracy also drive adoption.

- By Component

On the basis of component, the PACS and RIS market is segmented into Hardware, Software, and Services. The Software segment dominated the market with a revenue share of nearly 54.6% in 2025, driven by the central role of imaging software in image management, reporting, analytics, and system integration. PACS and RIS software platforms enable seamless workflow automation, real-time image access, and interoperability across departments. Advanced software functionalities such as AI-assisted diagnostics, 3D visualization, and automated reporting enhance clinical efficiency and diagnostic accuracy. Hospitals increasingly prioritize software upgrades to support digital transformation initiatives. The shift toward cloud-based and web-based software solutions further accelerates adoption. Continuous updates, cybersecurity features, and compliance requirements also sustain demand. Software scalability makes it suitable for both large hospitals and smaller diagnostic centers. Vendor innovation and subscription-based licensing models further reinforce software dominance.

The Services segment is anticipated to register the fastest CAGR of approximately 12.7% from 2026 to 2033, fueled by increasing demand for installation, maintenance, system integration, training, and managed services. Healthcare providers seek third-party expertise to manage complex PACS and RIS infrastructures efficiently. Outsourcing services reduce operational burden and ensure system uptime and regulatory compliance. The growing adoption of cloud-based deployments increases reliance on vendor-managed services. Data migration, cybersecurity management, and interoperability support further drive service demand. Emerging markets increasingly depend on service providers due to limited in-house IT expertise. Long-term service contracts and recurring revenue models contribute to sustained growth. The rise of AI and advanced analytics also increases service complexity, boosting demand.

- By Deployment

On the basis of deployment, the PACS and RIS market is segmented into Web-Based, Cloud-Based, and On-Premise solutions. The On-Premise segment dominated the market with a revenue share of about 48.9% in 2025, driven by strong data security requirements and full control over imaging infrastructure. Large hospitals and academic medical centers prefer on-premise systems to manage high imaging volumes with minimal latency. Regulatory concerns related to patient data privacy encourage on-site data storage. Existing legacy infrastructure investments also support continued dominance. On-premise solutions allow customization and seamless integration with internal IT systems. Facilities with stable budgets favor long-term ownership over subscription models. High performance and reliability make on-premise deployments suitable for mission-critical imaging environments. These factors collectively maintain segment leadership.

The Cloud-Based segment is expected to witness the fastest CAGR of around 14.3% from 2026 to 2033, driven by flexibility, scalability, and cost efficiency. Cloud solutions reduce upfront capital expenditure and enable rapid deployment. Remote access to imaging data supports tele-radiology and multi-site collaboration. Small and mid-sized diagnostic centers increasingly adopt cloud-based PACS and RIS due to lower maintenance requirements. Advancements in cybersecurity and compliance certifications improve trust in cloud deployments. Growing adoption of AI and big data analytics further supports cloud scalability. Emerging markets favor cloud solutions to overcome infrastructure limitations. These advantages accelerate cloud adoption globally.

- By End Users

On the basis of end users, the PACS and RIS market is segmented into Hospitals, Diagnostic Centers, Research and Academic Institutes, and Ambulatory Surgical Centers. The Hospitals segment accounted for the largest market revenue share of approximately 52.1% in 2025, driven by high imaging volumes and comprehensive radiology departments. Hospitals rely on PACS and RIS to manage complex imaging workflows across multiple specialties. Integration with EHRs, HIS, and laboratory systems enhances operational efficiency. Rising patient admissions and chronic disease prevalence increase diagnostic imaging demand. Large hospitals possess higher IT budgets, supporting advanced system deployments. Teaching hospitals and tertiary care centers further contribute to dominance. Regulatory compliance and quality assurance requirements reinforce system adoption. Continuous technology upgrades maintain leadership.

The Diagnostic Centers segment is projected to grow at the fastest CAGR of nearly 13.6% from 2026 to 2033, driven by the expansion of independent imaging facilities worldwide. Rising demand for outpatient diagnostic services supports growth. Diagnostic centers prioritize efficiency, fast reporting, and cost optimization, favoring PACS and RIS adoption. Cloud-based solutions enable multi-location operations and rapid scalability. Increasing preventive screening programs boost imaging volumes. Technological advancements allow smaller centers to access enterprise-grade systems. Growth in emerging economies further accelerates demand. These factors collectively position diagnostic centers as the fastest-growing end-user segment.

ACS and RIS Market Regional Analysis

- North America dominated the ACS and RIS market with the largest revenue share of approximately 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of digital imaging technologies, and the strong presence of leading healthcare IT vendors

- The region has witnessed widespread implementation of integrated archive communication systems and radiology information systems across hospitals, diagnostic imaging centers, and large healthcare networks

- Increasing diagnostic imaging volumes, growing emphasis on workflow optimization, and regulatory support for healthcare digitization are further driving the adoption of ACS and RIS solutions across the U.S. and Canada

U.S. ACS and RIS Market Insight

The U.S. ACS and RIS market captured the largest revenue share within North America in 2025, driven by early adoption of advanced medical imaging IT solutions and the strong penetration of enterprise-wide radiology information systems. Hospitals and imaging networks in the U.S. are increasingly integrating ACS and RIS with electronic health records (EHRs), picture archiving and communication systems (PACS), and AI-enabled diagnostic tools to improve operational efficiency and clinical outcomes. Continued investments in healthcare IT modernization, along with the growing demand for interoperable and cloud-based imaging solutions, are further supporting market growth.

Europe ACS and RIS Market Insight

The Europe ACS and RIS market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing healthcare digitization initiatives and the rising demand for efficient medical imaging data management. European healthcare providers are actively upgrading legacy radiology systems to integrated ACS and RIS platforms to enhance diagnostic accuracy, reduce reporting turnaround times, and improve patient data accessibility. Growth is being observed across public hospitals, private diagnostic centers, and academic institutions, supported by favorable government policies promoting digital health adoption.

U.K. ACS and RIS Market Insight

The U.K. ACS and RIS market is anticipated to grow at a notable CAGR during the forecast period, supported by National Health Service (NHS)-led digital transformation initiatives and increasing investments in diagnostic imaging infrastructure. The adoption of centralized radiology information systems and enterprise imaging platforms is improving data sharing across healthcare facilities and reducing operational inefficiencies. Rising imaging workloads, combined with the need for standardized and interoperable radiology solutions, are further accelerating the deployment of ACS and RIS systems across the country.

Germany ACS and RIS Market Insight

The Germany ACS and RIS market is expected to expand at a considerable CAGR during the forecast period, fueled by strong government support for healthcare IT modernization and the country’s emphasis on precision diagnostics. German healthcare providers are increasingly adopting advanced radiology information systems to support high imaging volumes and complex clinical workflows. The integration of ACS and RIS with hospital information systems and AI-driven diagnostic tools is gaining traction, aligning with Germany’s focus on innovation, data security, and high-quality patient care.

Asia-Pacific ACS and RIS Market Insight

The Asia-Pacific ACS and RIS market is expected to be the fastest growing region during the forecast period, registering a strong CAGR of around 9.8%, driven by rapidly expanding healthcare infrastructure and rising diagnostic imaging volumes. Increasing healthcare IT investments, growing awareness of digital imaging solutions, and government initiatives promoting healthcare digitization are accelerating the adoption of ACS and RIS systems across hospitals and diagnostic centers. Countries such as China, India, and those in Southeast Asia are witnessing strong demand for scalable and cost-effective radiology information systems.

Japan ACS and RIS Market Insight

The Japan ACS and RIS market is gaining steady momentum due to the country’s advanced healthcare system and high utilization of diagnostic imaging procedures. Japanese healthcare providers are increasingly adopting integrated ACS and RIS platforms to improve workflow efficiency, enhance diagnostic accuracy, and support aging population needs. The emphasis on interoperability, data precision, and integration with advanced imaging modalities is driving sustained adoption across hospitals and specialty clinics.

China ACS and RIS Market Insight

The China ACS and RIS market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid expansion of healthcare infrastructure and increasing deployment of digital imaging technologies. The country’s growing number of hospitals and diagnostic centers, combined with rising imaging volumes, is driving demand for robust archive communication and radiology information systems. Government-led healthcare modernization programs and increasing investments by domestic healthcare IT vendors are further propelling market growth in China.

ACS and RIS Market Share

The ACS and RIS industry is primarily led by well-established companies, including:

• GE HealthCare (U.S.)

• Siemens Healthineers (Germany)

• Philips Healthcare (Netherlands)

• Fujifilm Holdings Corporation (Japan)

• Agfa-Gevaert Group (Belgium)

• Canon Medical Systems Corporation (Japan)

• Carestream Health (U.S.)

• Sectra AB (Sweden)

• McKesson Corporation (U.S.)

• Change Healthcare (U.S.)

• IBM Watson Health (U.S.)

• Cerner Corporation (U.S.)

• Epic Systems Corporation (U.S.)

• Allscripts Healthcare Solutions (U.S.)

• INFINITT Healthcare (South Korea)

• Novarad Corporation (U.S.)

• RamSoft Inc. (Canada)

• MedInformatix (U.S.)

• Visage Imaging (Australia)

Latest Developments in Global ACS and RIS Market

- In August 2021, GE HealthCare, a leading global medical technology company, launched Edison True PACS, a next-generation Picture Archiving and Communication System designed to support comprehensive diagnostic imaging and radiology workflow solutions in the U.S. market. This launch marked an important expansion in digital imaging and workflow automation technology, helping radiologists streamline image storage, retrieval, and interpretation across large hospital systems. The solution emphasized integration capabilities with existing hospital information systems and was positioned to improve diagnostic efficiency and accuracy

- In July 2021, RamSoft, a healthcare IT company, acquired a majority stake in Meddiff Technologies, a provider of advanced medical imaging solutions (including PACS), to expand its product portfolio and accelerate innovation in integrated imaging platforms. This strategic acquisition aimed at enhancing RamSoft’s capabilities in cloud-based PACS and RIS offerings, enabling broader support for teleradiology and remote diagnostic workflows

- In March 2024, Konica Minolta Healthcare Americas announced integration of its Exa Platform with Amazon Web Services (AWS) HealthImaging, creating an enterprise imaging, PACS, RIS, and billing solution with advanced cloud infrastructure support. The integration emphasizes cloud-native scalability, improved data accessibility, and diagnostic zero-footprint viewers, reflecting the industry’s move toward cloud-enabled radiology solutions

- In May 2024, Siemens Healthineers announced a strategic partnership with Qure.ai to integrate AI-powered radiology workflow tools into its PACS/RIS ecosystem across multiple European hospitals, aiming to accelerate case triage, diagnostic consistency, and streamlined reporting through machine-assisted image analysis capabilities. This collaboration highlighted how AI integration continues shaping the future of imaging interpretation and workflow efficiency

- In June 2024, Fujifilm launched its Synapse AI-enabled PACS platform, featuring advanced AI-assisted reading and cloud-ready archiving for hospital networks worldwide. This product launch underlined Fujifilm’s focus on combining artificial intelligence with PACS for faster image interpretation and improved diagnostic workflows

- In October 2024, Siemens Healthineers secured a multi-year enterprise imaging contract with a major U.S. hospital system to replace legacy RIS/PACS with a unified, cloud-ready platform, enhancing cross-site access, interoperability, and operational efficiency. The deal reflected large health systems’ commitments to modernizing radiology infrastructure to support digital transformation

- In February 2025, Agfa-Gevaert Group released a new Radiology Information System (RIS) module that introduced advanced scheduling, reporting automation, and analytics tools for optimized radiology workflow management, aiming to reduce administrative burdens and improve data-driven decision support in clinical settings

- In May 2025, Philips Healthcare announced a partnership with Radiology Partners to deploy IntelliSpace Enterprise across a nationwide radiology network, enabling unified RIS/PACS workflows and cloud-enabled analytics to support distributed imaging operations and tele-radiology collaboration

- In June 2025, GE Healthcare launched a next-generation cloud-based PACS platform with embedded AI features for automated image analysis and reporting, designed to support diagnostic accuracy and workflow efficiency across multi-facility healthcare systems. This technology launch reflected the increasing digitization and AI uptake within radiology departments

- In August 2025, the Institute of Medical Sciences at Banaras Hindu University (IMS-BHU) in India commissioned an indigenously developed PACS integrated with a Hospital Information Management System (HIMS) at its trauma center, enabling fully digital imaging workflows, zero-film records, and free e-X-ray services via WhatsApp for patients. This marked a significant local adoption of PACS technology in public healthcare with cost-efficient digital radiology solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.