Global Pain Management Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

84.00 Billion

USD

113.20 Billion

2025

2033

USD

84.00 Billion

USD

113.20 Billion

2025

2033

| 2026 –2033 | |

| USD 84.00 Billion | |

| USD 113.20 Billion | |

|

|

|

|

Pain Management Therapeutics Market Size

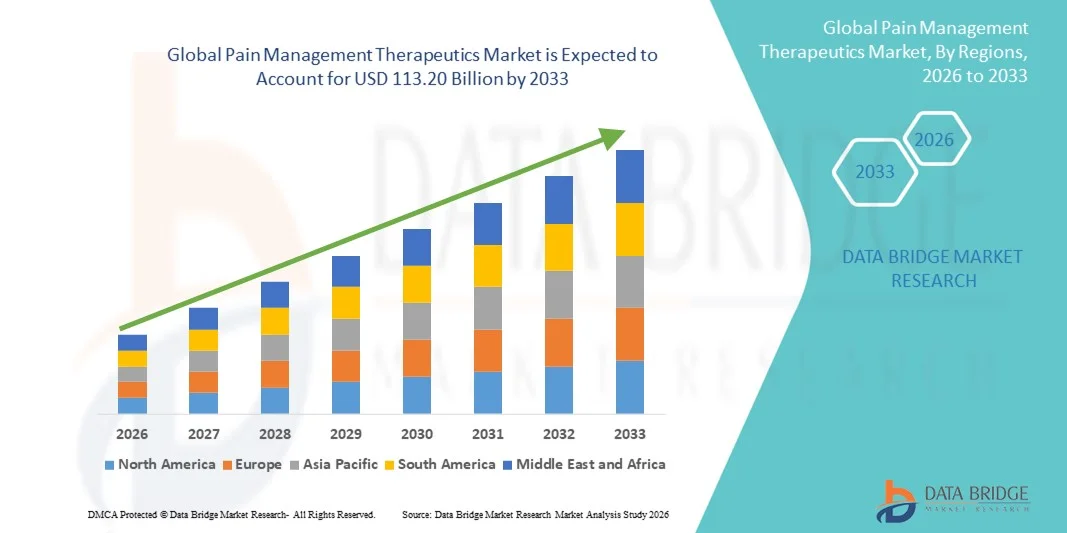

- The global Pain Management Therapeutics market size was valued at USD 84.00 billion in 2025 and is expected to reach USD 113.20 billion by 2033, at a CAGR of 3.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of acute and chronic pain conditions, including arthritis, neuropathic pain, cancer-related pain, and postoperative pain, along with increasing awareness and diagnosis of pain-related disorders across both hospital and outpatient care settings

- Furthermore, growing demand for effective, patient-centric, and long-term pain relief solutions, combined with continuous advancements in pharmacological therapies, drug delivery systems, and non-opioid treatment options, is accelerating the uptake of pain management therapeutics, thereby significantly boosting the overall growth of the market

Pain Management Therapeutics Market Analysis

- Pain management therapeutics, encompassing pharmacological and non-pharmacological treatments for acute and chronic pain, are becoming increasingly essential components of modern healthcare due to the rising prevalence of conditions such as arthritis, cancer-related pain, neuropathic pain, and postoperative pain across both hospital and outpatient settings

- The escalating demand for pain management therapeutics is primarily driven by the growing global burden of chronic pain, an aging population, increasing awareness of pain treatment options, and a rising preference for effective, long-term, and patient-centric pain relief solutions

- North America dominated the pain management therapeutics market with the largest revenue share of 41.3% in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, strong presence of key pharmaceutical players, widespread access to pain clinics, and increasing adoption of both opioid and non-opioid pain therapies, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the pain management therapeutics market during the forecast period, driven by rising healthcare investments, growing awareness of pain management solutions, expanding access to medical care, increasing prevalence of chronic diseases, and rapid development of healthcare infrastructure in countries such as China and India

- The chronic pain segment dominated the largest market revenue share of 64.7% in 2025, driven by the rising global prevalence of long-term conditions such as arthritis, cancer, neuropathic disorders, and fibromyalgia

Report Scope and Pain Management Therapeutics Market Segmentation

|

Attributes |

Pain Management Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pain Management Therapeutics Market Trends

Advancements in Multimodal and Personalized Pain Management Therapies

- A significant and accelerating trend in the global pain management therapeutics market is the growing shift toward multimodal and personalized treatment approaches aimed at improving efficacy and patient outcomes

- Healthcare providers are increasingly combining pharmacological therapies with non-pharmacological and minimally invasive treatment options to address chronic and acute pain conditions more effectively

- For instance, combination therapies that integrate non-opioid analgesics, adjuvant drugs, and interventional pain management techniques are gaining traction for conditions such as neuropathic pain, cancer pain, and musculoskeletal disorders. These approaches help reduce dependence on opioids while enhancing pain relief

- Advances in drug formulation technologies, including extended-release formulations and targeted drug delivery systems, are enabling more consistent pain control with fewer side effects. Such innovations improve patient adherence and overall quality of life

- In addition, the integration of personalized medicine approaches, including biomarker-based therapy selection and patient-specific treatment planning, is becoming increasingly important in pain management. These developments allow clinicians to tailor therapies based on individual patient profiles and pain mechanisms

- The increasing adoption of minimally invasive procedures, such as nerve blocks and implantable pain management devices used alongside therapeutics, further supports comprehensive pain control strategies

- This trend toward more individualized, effective, and patient-centric pain management solutions is reshaping clinical practices and treatment standards worldwide

- Consequently, pharmaceutical companies and healthcare providers are focusing on developing innovative pain management therapeutics that address unmet clinical needs while improving safety and long-term treatment outcomes

Pain Management Therapeutics Market Dynamics

Driver

Rising Prevalence of Chronic Pain and Growing Geriatric Population

- The increasing prevalence of chronic pain conditions, coupled with the rapidly growing global geriatric population, is a major driver fueling the demand for pain management therapeutics. Conditions such as arthritis, lower back pain, neuropathy, and cancer-related pain are becoming more common, particularly among older adults

- For instance, in 2025, several pharmaceutical companies expanded their pain management drug portfolios through new product launches and pipeline developments targeting chronic and age-related pain disorders. Such initiatives are expected to drive market growth during the forecast period

- As life expectancy increases globally, the number of patients requiring long-term pain management solutions continues to rise, boosting demand for both prescription and over-the-counter pain therapeutics

- Increased awareness among patients and healthcare professionals regarding the importance of timely and effective pain management is further accelerating treatment adoption

- In addition, improvements in healthcare infrastructure, greater access to pain clinics, and expanding reimbursement coverage in several regions are supporting the sustained growth of the Pain Management Therapeutics market

Restraint/Challenge

Safety Concerns, Opioid Dependence, and High Treatment Costs

- Safety concerns associated with long-term use of pain management drugs, particularly opioids, present a significant challenge to market growth. Issues such as drug dependence, tolerance, and adverse side effects have led to stricter regulatory scrutiny and cautious prescribing practices

- For instance, heightened regulatory controls and prescribing guidelines aimed at curbing opioid misuse have limited the use of certain pain therapeutics in multiple regions, impacting overall market expansion

- In addition, the high cost of advanced pain management therapies, including novel biologics, combination drugs, and interventional treatment options, can restrict accessibility for price-sensitive patients and healthcare systems

- Concerns related to gastrointestinal, cardiovascular, and neurological side effects associated with some non-opioid pain medications further complicate treatment decisions

- While ongoing research is focused on developing safer and more effective alternatives, overcoming these challenges through innovation, regulatory support, and improved patient education will be critical for ensuring sustained growth in the Pain Management Therapeutics market

Pain Management Therapeutics Market Scope

The market is segmented on the basis of pain type, drug class, and indication.

- By Pain Type

On the basis of pain type, the Pain Management Therapeutics market is segmented into chronic pain and acute pain. The chronic pain segment dominated the largest market revenue share of 64.7% in 2025, driven by the rising global prevalence of long-term conditions such as arthritis, cancer, neuropathic disorders, and fibromyalgia. Chronic pain requires prolonged treatment, leading to sustained demand for pain management therapeutics. Aging populations across developed and emerging economies significantly contribute to this segment’s dominance. Increased diagnosis rates and improved access to pain management therapies further support growth. Patients with chronic pain often require combination drug therapies, increasing overall drug consumption. Long-term prescription use and higher healthcare spending reinforce revenue generation. Growing awareness of chronic pain management also drives treatment adoption. As a result, chronic pain remains the leading pain type segment.

The acute pain segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by the increasing number of surgical procedures, trauma cases, and emergency medical interventions globally. Acute pain management is essential in post-operative care and injury treatment. Rising hospital admissions and outpatient procedures fuel short-term pain medication demand. Technological advances in fast-acting analgesics enhance treatment effectiveness. Growing access to emergency healthcare services also supports segment growth. Increased focus on immediate pain relief protocols accelerates adoption. These factors collectively contribute to the rapid growth of the acute pain segment.

- By Drug Class

On the basis of drug class, the Pain Management Therapeutics market is segmented into NSAIDs, anesthetics, anticonvulsants, anti-migraine drugs, antidepressant drugs, opioids, non-narcotics, and analgesics. The NSAIDs segment accounted for the largest market revenue share of 31.8% in 2025, owing to their widespread use in treating mild to moderate pain and inflammation. NSAIDs are commonly prescribed for arthritis, muscle pain, and post-operative discomfort. Their over-the-counter availability in many countries increases accessibility and consumption. Physicians often prefer NSAIDs as first-line therapy due to their effectiveness and affordability. High patient familiarity further drives adoption. Continuous product availability across retail and hospital pharmacies strengthens market presence. These factors ensure NSAIDs maintain their dominant position.

The anticonvulsants segment is anticipated to grow at the fastest CAGR of 9.6% from 2026 to 2033, driven by rising prevalence of neuropathic pain conditions. These drugs are increasingly prescribed for nerve-related pain disorders. Growing awareness among healthcare providers regarding off-label use supports expansion. Advances in formulation improve tolerability and patient compliance. Increased diagnosis of diabetic neuropathy further fuels demand. Expanding clinical research validates therapeutic efficacy. As neuropathic pain cases rise, anticonvulsants experience accelerated growth.

- By Indication

On the basis of indication, the Pain Management Therapeutics market is segmented into arthritic pain, neuropathic pain, cancer pain, chronic pain, post-operative pain, migraine, fibromyalgia, bone fracture, muscle sprain/strain, acute appendicitis, and other indications. The arthritic pain segment dominated the market with a revenue share of 26.4% in 2025, driven by the growing elderly population and increasing incidence of osteoarthritis and rheumatoid arthritis. Long-term treatment requirements significantly boost drug consumption. Arthritic pain is commonly managed using NSAIDs, analgesics, and corticosteroids. Rising obesity rates further increase arthritis prevalence. Improved diagnosis and early treatment adoption support segment dominance. Regular physician visits contribute to sustained prescriptions. These factors collectively maintain arthritic pain as the leading indication segment.

The neuropathic pain segment is expected to register the fastest CAGR of 10.2% from 2026 to 2033, fueled by increasing cases of diabetes-related nerve damage and neurological disorders. Neuropathic pain often requires specialized drug classes such as anticonvulsants and antidepressants. Growing clinical recognition improves diagnosis rates. Technological advancements in pain assessment tools enhance treatment accuracy. Rising awareness among patients and physicians supports therapy adoption. Increasing research into nerve pain management accelerates innovation. Consequently, neuropathic pain emerges as the fastest-growing indication segment.

Pain Management Therapeutics Market Regional Analysis

- North America dominated the pain management therapeutics market with the largest revenue share of 41.3% in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and the strong presence of key pharmaceutical players

- Widespread access to specialized pain clinics, along with increasing adoption of both opioid and non-opioid pain therapies, is significantly driving market growth across the region

- In addition, growing prevalence of chronic pain conditions such as arthritis, neuropathic pain, and cancer-related pain, coupled with favorable reimbursement policies, is further accelerating demand for pain management therapeutics in both hospital and outpatient settings

U.S. Pain Management Therapeutics Market Insight

The U.S. pain management therapeutics market accounted for the largest revenue share within North America in 2025, driven by a high burden of chronic pain, well-established healthcare systems, and extensive availability of pain management treatments. Increasing adoption of non-opioid alternatives, including NSAIDs, antidepressants, anticonvulsants, and biologics, is shaping market dynamics amid growing concerns over opioid dependency. Furthermore, continuous drug approvals, robust clinical research activity, and increasing awareness of multimodal pain management approaches are significantly contributing to market expansion in the U.S.

Europe Pain Management Therapeutics Market Insight

The Europe pain management therapeutics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by an aging population, rising prevalence of chronic pain disorders, and growing demand for effective and long-term pain relief solutions. Strong public healthcare systems, increasing focus on patient quality of life, and supportive regulatory frameworks are fostering market growth across the region. Additionally, rising adoption of innovative pain management drugs and increased investments in research and development are further strengthening the European market.

U.K. Pain Management Therapeutics Market Insight

The U.K. pain management therapeutics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing awareness of chronic pain conditions and the country’s strong focus on improving pain management standards within the National Health Service (NHS). Growing use of non-opioid pain therapies, coupled with updated clinical guidelines emphasizing safer pain management practices, is driving market growth. Moreover, rising incidence of musculoskeletal disorders and postoperative pain is expected to sustain demand for pain management therapeutics in the U.K.

Germany Pain Management Therapeutics Market Insight

The Germany pain management therapeutics market is expected to expand at a considerable CAGR during the forecast period, fueled by a well-developed healthcare system, increasing prevalence of chronic and neuropathic pain conditions, and strong emphasis on evidence-based treatment approaches. Germany’s focus on innovative pharmaceutical solutions, combined with high healthcare spending and broad insurance coverage, is promoting the adoption of advanced pain management therapeutics across hospitals and specialized pain clinics.

Asia-Pacific Pain Management Therapeutics Market Insight

The Asia-Pacific pain management therapeutics market is expected to grow at the fastest CAGR during the forecast period, driven by rising healthcare investments, expanding access to medical care, and increasing awareness of pain management solutions. The growing prevalence of chronic diseases, rapid development of healthcare infrastructure, and improving diagnostic capabilities are accelerating market growth across the region. Additionally, government initiatives to strengthen healthcare systems and improve treatment accessibility are supporting increased adoption of pain management therapeutics in Asia-Pacific.

Japan Pain Management Therapeutics Market Insight

The Japan pain management therapeutics market is experiencing steady growth due to the country’s rapidly aging population and high prevalence of chronic pain conditions. Strong focus on improving patient outcomes, widespread availability of advanced therapies, and increasing adoption of combination treatment approaches are driving market expansion. Moreover, Japan’s robust pharmaceutical industry and emphasis on innovative drug development continue to support growth in pain management therapeutics.

China Pain Management Therapeutics Market Insight

The China pain management therapeutics market accounted for a significant revenue share in the Asia-Pacific region in 2025, driven by rising healthcare expenditure, expanding middle-class population, and increasing awareness of chronic pain treatment options. Rapid development of healthcare infrastructure, growing availability of prescription pain medications, and government initiatives to improve access to quality healthcare are key factors propelling market growth in China. Additionally, the increasing burden of cancer-related and musculoskeletal pain is expected to further boost demand for pain management therapeutics.

Pain Management Therapeutics Market Share

The Pain Management Therapeutics industry is primarily led by well-established companies, including:

• Pfizer Inc. (U.S.)

• Johnson & Johnson (U.S.)

• AbbVie Inc. (U.S.)

• Novartis AG (Switzerland)

• GSK plc (U.K.)

• Eli Lilly and Company (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Sanofi S.A. (France)

• Bayer AG (Germany)

• Merck & Co., Inc. (U.S.)

• AstraZeneca plc (U.K.)

• Boehringer Ingelheim International GmbH (Germany)

• Amgen Inc. (U.S.)

• Viatris Inc. (U.S.)

• Sun Pharmaceutical Industries Ltd. (India)

• Dr. Reddy’s Laboratories Ltd. (India)

• Cipla Ltd. (India)

• Aurobindo Pharma Ltd. (India)

• Hikma Pharmaceuticals PLC (U.K.)

• Endo International plc (Ireland)

Latest Developments in Global Pain Management Therapeutics Market

- In October 2021, Esteve announced that its combination drug Seglentis (celecoxib/tramadol) was approved by the U.S. FDA as a novel co-crystal form of celecoxib and tramadol for the management of acute pain, marking an important advancement in combination analgesic therapies. Seglentis combines an NSAID with a controlled opioid to provide enhanced pain relief for adults suffering from acute pain. The fixed-dose co-crystal formulation improved dissolution properties and enhanced pharmacokinetics compared with individual drugs, offering clinicians a new option in acute pain management. Its approval reflected ongoing efforts to refine multimodal pain therapy approaches

- In January 2025, Vertex Pharmaceuticals announced that the U.S. Food and Drug Administration had approved JOURNAVX (suzetrigine), a first-in-class non-opioid oral pain therapeutic targeting the NaV1.8 pain signal inhibitor channel for the treatment of moderate-to-severe acute pain in adults, representing the first new class of pain drug approved in over 20 years. This landmark approval offered a potential alternative to traditional opioids by blocking peripheral pain signals without central nervous system addiction risks and marked a significant shift in pain-management treatment strategies

- In May 2025, Eli Lilly announced the acquisition of SiteOne Therapeutics in a deal valued at up to $1 billion, granting Eli Lilly access to SiteOne’s experimental non-opioid pain medicine STC-004, a Nav1.8 inhibitor targeting pain signal transmission, thereby strengthening Lilly’s footprint in non-opioid analgesics. The acquisition reflected a broader industry focus on non-opioid alternatives and expanding portfolios for chronic and acute pain management, aligning with shifting clinical priorities to reduce addiction risks

- In February 2025, Allay Therapeutics reported that the first patient had been dosed in its Phase 2b clinical trial of ATX101, an investigational analgesic intended to provide extended post-surgical pain relief following total knee replacement surgery, signaling progress in next-generation post-operative pain therapeutics. ATX101 aims to reduce reliance on opioids while improving patient recovery outcomes, contributing to innovation in post-surgical pain care

- In May 2025, Viatris announced positive outcome data from its Phase III clinical program of a novel fast-acting meloxicam formulation (MR-107A-02) for moderate-to-severe acute pain, paving the way for a planned NDA submission to the U.S. FDA by year-end 2025. Early clinical results showed effectiveness in acute pain settings, highlighting ongoing development of improved NSAID formulations tailored for rapid relief

- In January 2025, clinical pipeline progress was reported with Tris Pharma achieving positive topline results from its ALLEVIATE-1 Phase III trial of cebranopadol, a first-in-class dual-action pain agent, for moderate-to-severe acute pain following abdominoplasty surgery, signaling broader innovation beyond traditional NSAIDs and opioids. These data suggested potential differentiation in next-generation analgesics with novel mechanisms of action

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.