Global Paints Coatings Market

Market Size in USD Billion

CAGR :

%

USD

207.03 Billion

USD

283.55 Billion

2024

2032

USD

207.03 Billion

USD

283.55 Billion

2024

2032

| 2025 –2032 | |

| USD 207.03 Billion | |

| USD 283.55 Billion | |

|

|

|

|

Paints and Coatings Market Size

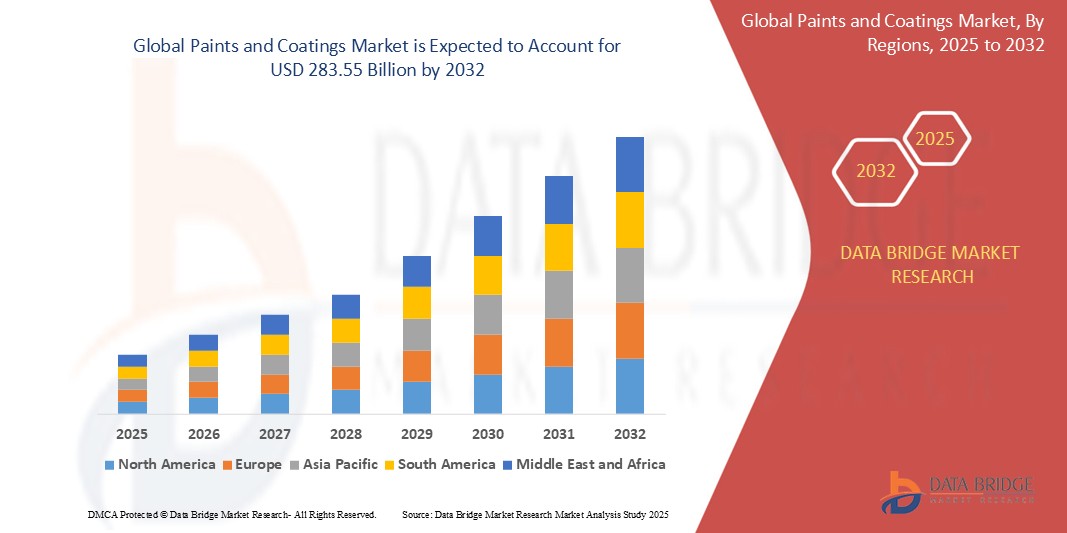

- The global paints and coatings market size was valued at USD 207.03 billion in 2024 and is expected to reach USD 283.55 billion by 2032, at a CAGR of 4.01 % during the forecast period

- This growth is driven by factors such as the rising demand from the construction and automotive industries, increasing infrastructure development in emerging economies, advancements in coating technologies, and growing consumer preference for eco-friendly and sustainable products

Paints and Coatings Market Analysis

- The global paints and coatings market is experiencing steady growth, driven by increasing demand from various sectors such as construction, automotive, and industrial applications. This expansion is further supported by technological advancements in coating formulations and manufacturing processes

- Environmental regulations and growing consumer awareness about sustainability are influencing the market dynamics. Manufacturers are focusing on developing eco-friendly products to meet these demands, leading to innovations in low-emission and bio-based coatings

- Asia-Pacific is expected to dominate the paints and coatings market due to rapid industrialization, urbanization, and strong demand from the construction and automotive sectors.

- Europe is expected to be the fastest growing region in the paints and coatings market during the forecast period due to increased infrastructure development, demand for sustainable coatings, and a strong focus on innovation in the automotive and construction industries.

- The acrylic segment is expected to dominate the paints and coatings market with the largest share of 47.5% in 2025 due to its excellent versatility, durability, and adaptability to various applications. Acrylic coatings offer superior resistance to environmental factors such as UV rays, moisture, and abrasion, making them ideal for both interior and exterior use.

Report Scope and Paints and Coatings Market Segmentation

|

Attributes |

Paints and Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paints and Coatings Market Trends

“Growing Shift Toward Eco-Friendly and Sustainable Coatings”

- The paints and coatings industry are witnessing a clear shift toward eco-friendly and sustainable products, driven by consumer preferences and stricter environmental regulations globally

- Water-based and powder coatings are replacing solvent-based options due to their low emissions

- For instance, PPG Industries has expanded its waterborne coatings line to meet rising demand in the industrial sector

- Companies are heavily investing in bio-based coatings using renewable raw materials such as plant oils

- For instance, Sherwin-Williams introduced its “Harmony” interior paint that contains zero volatile organic compounds and uses natural ingredients

- The automotive and construction sectors are adopting these coatings for environmental compliance

- For instance, BMW uses eco-friendly water-based paints in its manufacturing plants to reduce emissions

- These innovations not only support sustainability but also help improve indoor air quality and reduce health risks, making them increasingly preferred in both residential and commercial applications

Paints and Coatings Market Dynamics

Driver

“Rise in Construction and Infrastructure Projects”

- The global paints and coatings market is largely driven by the rising demand from construction and infrastructure sectors, as expanding cities and population growth create a strong need for residential, commercial, and industrial buildings

- Developing nations are seeing rapid economic growth, which is fueling housing and infrastructure projects

- For instance, India’s Pradhan Mantri Awas Yojana and China's Belt and Road Initiative are increasing paint consumption

- Paints and coatings enhance building aesthetics and provide protection against environmental stressors such as UV exposure, moisture, and corrosion, ensuring longer lifespan and reduced maintenance costs

- Architectural coatings form a major portion of the market, with applications in both interior and exterior surfaces such as walls, ceilings, roofs, and building facades

- In mature regions such as the U.S. and parts of Europe, consistent demand is maintained through renovation and remodeling activities

- For instance, the steady rise in home improvement spending in the U.S. post-pandemic recovery period

Opportunity

“Innovation in Sustainable and High-Performance Coatings”

- A strong global shift toward sustainability is creating new opportunities in the paints and coatings market, as consumers and industries increasingly prefer environmentally friendly and safer products

- Manufacturers are investing in advanced formulations that reduce harm to human health and the environment, including low volatile organic compound, bio-based, and recyclable coatings

- Innovation is accelerating in areas such as self-healing coatings, anti-microbial finishes, and energy-efficient reflective paints

- For instance, AkzoNobel’s Dulux Weathershield and Nippon Paint’s Odour-less AirCare are popular sustainable options

- These innovations are especially valuable in sectors such as healthcare and education, where clean air and hygiene standards are critical

- For instance, hospitals and schools’ benefit from coatings with anti-bacterial and low-emission features

- With global governments supporting green building practices through incentives and regulations, companies focused on sustainable research and development are gaining a competitive edge and future-proofing their market position

Restraint/Challenge

“Volatility in Raw Material Prices”

- The paints and coatings industry faces a major challenge due to the unpredictable pricing of raw materials such as titanium dioxide, solvents, and resins, many of which are tied to fluctuating crude oil markets

- Price spikes in these essential inputs squeeze manufacturers' profit margins, especially for smaller firms that struggle to absorb rising production costs

- For instance, the sharp increase in titanium dioxide prices in 2021 significantly impacted mid-sized manufacturers globally

- Geopolitical instability, trade restrictions, and global events have added to supply chain issues

- For instance, during the COVID-19 pandemic, supply routes were disrupted, and production delays in China led to a shortage of key ingredients in Europe and North America

- Environmental regulations limiting the use of certain chemicals have added further complexity to sourcing raw materials, compelling companies to seek new, compliant alternatives that often come at a higher cost

- To adapt, many manufacturers are exploring alternative materials and entering long-term partnerships with suppliers, but this remains a challenging and ongoing issue for maintaining stable growth

Paints and Coatings Market Scope

The market is segmented on the basis of resin type, technology, and application.

|

Segmentation |

Sub-Segmentation |

|

By Resin Type |

|

|

By Technology |

|

|

By Application |

|

In 2025, the acrylic is projected to dominate the market with a largest share in resin type segment

The acrylic segment is expected to dominate the paints and coatings market with the largest share of 47.5% in 2025 due to its excellent versatility, durability, and adaptability to various applications. Acrylic coatings offer superior resistance to environmental factors such as UV rays, moisture, and abrasion, making them ideal for both interior and exterior use.

The water-based technology is expected to account for the largest share during the forecast period in technology segment

In 2025, the water-based technology segment is expected to dominate the market with the largest market share of 41.3% due to its environmental benefits and compliance with stringent regulations. Water-based coatings have a low environmental impact, with fewer harmful emissions, making them ideal for use in regions with strict environmental policies.

Paints and Coatings Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Paints and Coatings Market”

- Asia Pacific is the dominating region in the global paints and coatings market, holding a significant share of over 43%

- This dominance is largely driven by the rapid industrialization, urbanization, and strong infrastructure development in countries such as China and India

- The region’s expanding construction and automotive industries contribute to a high demand for various coatings, particularly architectural coatings

- China, as a leader in the region, accounts for about 56% of the market share due to its massive construction sector and urbanization initiatives

“Europe is Projected to Register the Highest CAGR in the Paints and Coatings Market”

- Europe is estimated to show lucrative growth in the paints and coatings market over the forecast period, primarily driven by the expansion of the construction sector

- The surge in construction activities across various European countries increases the demand for advanced coatings that offer protection and aesthetic enhancement

- Growing urbanization and a focus on sustainable and energy-efficient buildings further contribute to the rising demand for high-performance paints and coatings

- As new residential, commercial, and infrastructure projects emerge, the need for durable and eco-friendly coatings continues to fuel market growth and innovation in the region

Paints and Coatings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Akzo Nobel N.V. (Netherlands)

- PPG Industries Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- RPM International Inc. (U.S.)

- NIPSEA GROUP (Japan)

- Arkema (France)

- Cardolite Corporation (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Reichhold LLC 2 (U.S.)

- DSM (Netherlands)

- Qualipoly Chemical Corp. (Taiwan)

- Arakawa Chemical Industries,Ltd. (Japan)

- Alberdingk Boley (U.S.)

- Eternal Materials Co.,Ltd. (Taiwan)

- Wacker Chemie AG (Japan)

- DIC CORPORATION (Japan)

Latest Developments in Global Paints and Coatings Market

- In February 2024, Qlayers launched its 10Q coating robot rental program across Europe. This initiative offers companies cost-effective access to advanced robotic coating technology for large industrial surfaces such as storage tanks. The 10Q robot enhances efficiency with a coating speed of up to 200 m²/h, reduces working hours at heights by up to 80%, and minimizes overspray, promoting environmental sustainability. By eliminating the need for upfront capital investment, the rental program makes this innovative solution accessible to a broader range of clients, aligning with stricter overspray regulations and environmental concerns

- In October 2023, Sherwin-Williams announced an agreement to acquire German-based Specialized Industrial Coatings Holding (SIC Holding), which comprises Oskar Nolte GmbH and Klumpp Coatings GmbH. This acquisition aims to enhance Sherwin-Williams' portfolio by integrating innovative foil coatings, radiation-cured, and water-based coatings tailored for the board, furniture, and flooring industries. The move is expected to expand Sherwin-Williams' presence in Europe, Asia, and South America, leveraging SIC Holding's established customer relationships and manufacturing capabilities. The integration of Oskar Nolte and Klumpp Coatings into Sherwin-Williams' Performance Coatings Group is anticipated to accelerate growth in the global industrial wood market, aligning with Sherwin-Williams' strategy to acquire complementary, high-quality, and differentiated businesses

- In December 2022, AkzoNobel completed the acquisition of Lankwitzer Lackfabrik’s aluminum wheel liquid coatings business. This strategic move enhances AkzoNobel’s performance coatings portfolio by integrating Lankwitzer’s approved products for major automotive manufacturers such as Daimler, Audi, VW, Opel, Fiat, and Renault. The acquisition includes a manufacturing site in Leipzig, Germany, and laboratories in Germany and Turkey, expanding AkzoNobel’s global presence. This development allows AkzoNobel to offer a comprehensive liquid and powder aluminum wheel coating solution, reinforcing its position in the automotive market and aligning with its strategic goals. The integration is expected to provide attractive growth prospects for the Leipzig site and its employee’s

- In July 2021, AkzoNobel extended its partnership with Mercedes-Benz for another four years, reinforcing its role as a recommended supplier of vehicle refinish products and services in China and a preferred partner in Indonesia. This collaboration, under AkzoNobel's premium Sikkens brand, was solidified after extensive testing and analysis of the product assortments and services provided. The partnership enables customers to benefit from advanced digital tools such as MIXIT, a cloud-based color retrieval application offering instant access to over two million color formulas, and the compact, hand-held Automatchic spectrophotometer for quicker, more accurate paint jobs with reduced waste. In addition, AkzoNobel's Carbeat digital bodyshop workflow solution enhances production management efficiency and reduces cycle times. For the Chinese market, the company introduced a range of new low VOC products, aligning with industry sustainability trends. This extended partnership underscores AkzoNobel's commitment to providing high-quality, innovative solutions to the automotive industry in these key markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paints Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paints Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paints Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.