Global Pandan Tea Market

Market Size in USD Million

CAGR :

%

USD

429.06 Million

USD

715.45 Million

2024

2032

USD

429.06 Million

USD

715.45 Million

2024

2032

| 2025 –2032 | |

| USD 429.06 Million | |

| USD 715.45 Million | |

|

|

|

|

Pandan Tea Market Size

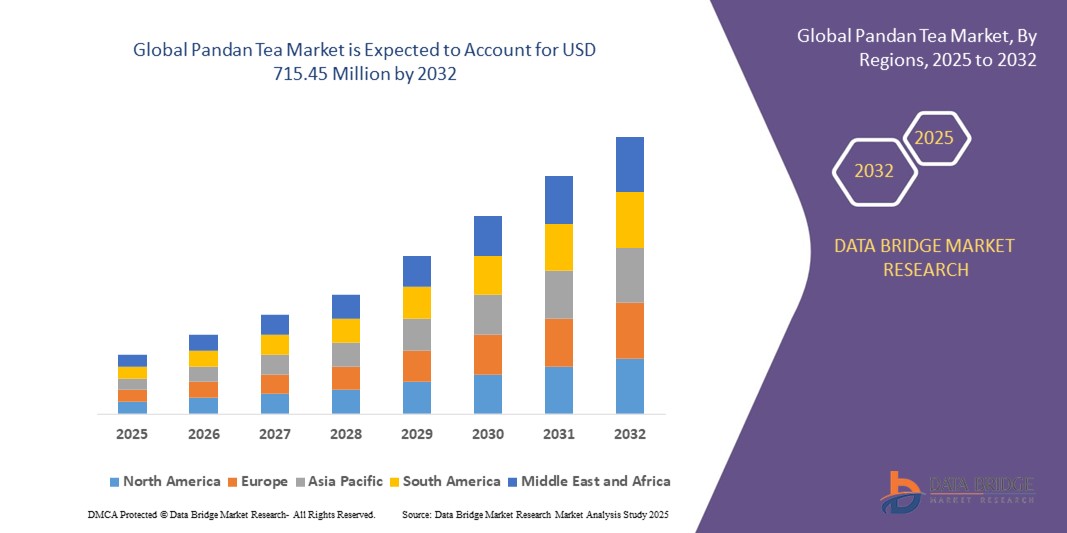

- The global pandan tea market size was valued at USD 429.06 million in 2024 and is expected to reach USD 715.45 million by 2032, at a CAGR of 6.6% during the forecast period

- The market growth is largely fueled by the increasing consumer preference for natural, herbal, and wellness-oriented beverages, driven by rising health awareness and the desire for functional and aromatic tea options in households and foodservice outlets

- Furthermore, growing demand for convenient formats such as tea bags, ready-to-brew sachets, and premium loose leaf products is establishing pandan tea as a versatile and accessible beverage choice. These converging factors are accelerating pandan tea adoption across retail, online, and specialty channels, thereby significantly boosting the industry's growth

Pandan Tea Market Analysis

- Pandan tea is a herbal infusion made from the leaves of the pandan plant, known for its distinctive sweet aroma and natural flavor. It is available in loose leaf, tea bags, and instant formats, catering to diverse consumer preferences and usage occasions

- The escalating demand for pandan tea is primarily fueled by rising awareness of its health benefits, expanding specialty tea offerings, and growing incorporation into cafés, restaurants, and ready-to-drink beverage products. The increasing popularity of Southeast Asian flavors globally is further driving market expansion and consumer adoption

- North America dominated pandan tea market with a share of 23.03% in 2024, due to growing consumer preference for specialty and flavored teas, as well as increasing health-consciousness among residents

- Asia-Pacific is expected to be the fastest growing region in the pandan tea market during the forecast period due to rising disposable incomes, urbanization, and increasing awareness of herbal and wellness teas in countries such as China, Japan, and India

- Tea bags segment dominated the market with a market share of 45.19% in 2024, due to increasing demand for convenience and ready-to-brew options among working professionals and urban households. Tea bags offer easy preparation without compromising much on flavor, making them ideal for busy lifestyles. Their compatibility with office environments, cafes, and quick-service restaurants also boosts adoption. Innovative flavored blends and eco-friendly packaging further drive consumer preference for tea bags, making them the fastest-growing type segment

Report Scope and Pandan Tea Market Segmentation

|

Attributes |

Pandan Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pandan Tea Market Trends

Growing Health Consciousness across the Globe

- The pandan tea market is gaining traction as consumers globally become more health conscious and increasingly shift toward herbal beverages considered beneficial for digestion, relaxation, and overall wellness. This preference is fueling demand across multiple demographics and regions

- For instance, TWG Tea, based in Singapore, has incorporated pandan blends into its specialty offerings targeting wellness-driven consumers. Similarly, boutique Asian tea brands are expanding their portfolios with pandan infusions to leverage rising holistic health demand

- Social media wellness influencers and lifestyle bloggers are promoting pandan tea as a natural remedy for stress, blood sugar regulation, and detoxification. This targeted online advocacy significantly fuels consumer awareness and shapes purchase behavior patterns

- The rising cultural acceptance of Asian ingredients globally is assisting pandan tea in moving beyond regional niches. Positioned as an exotic, functional herbal drink, pandan blends are steadily finding shelf space across Western specialty retailers and cafes

- Premiumization is also influencing the market as companies focus on organic certifications, sustainable sourcing, and artisanal blending. Consumers are willing to pay more for pandan teas marketed as clean-label, ethically sourced, and packed with antioxidants

- The expansion of specialty cafes and direct-to-consumer models has accelerated pandan tea accessibility. E-commerce, subscription boxes, and local market placements are enabling small producers to capture growing global consumer interest in authentic and functional tea varieties

Pandan Tea Market Dynamics

Driver

Rising Popularity of Herbal Tea

- The overall popularity of herbal teas is a leading market driver as health-conscious consumers increasingly replace caffeinated soft drinks with wellness-focused alternatives. Pandan tea benefits from this surge as part of the broader functional beverage category

- For instance, Twinings has expanded its herbal collection with exotic infusions, highlighting shifting global consumer focus from standard caffeinated options to unique restorative blends. Such transitions illustrate the broader acceptance of pandan tea within the wellness beverage space

- The integration of pandan tea into premium hospitality segments including spas, luxury resorts, and wellness retreats is further expanding demand. These outlets are actively adopting pandan-based products to align with customer preference for holistic health lifestyles

- E-commerce growth is strongly enhancing accessibility, with platforms highlighting pandan products through targeted campaigns in tea, wellness, and organic categories. This is creating visibility among younger consumers who actively search for authentic and innovative tea options

- The overlap with functional food and beverage industries is expanding opportunities as pandan tea is increasingly marketed for digestive support, relaxation, and blood sugar control. These attributes resonate with health-driven purchasing patterns worldwide

Restraint/Challenge

Supply Chain and Sourcing Issues Related to Pandan Tea

- Supply chain volatility remains the key challenge as pandan leaves are primarily sourced across Southeast Asia. Climatic fluctuations, harvest limitations, and regional supply bottlenecks disrupt consistent availability and pricing of raw materials for producers

- For instance, small-scale processors in Indonesia have reported significant raw material shortages during peak monsoon periods, impacting export quality and fulfillment. Similar sourcing dependence on Thailand and Malaysia creates vulnerability to regional weather and agricultural trends

- Limited large-scale commercial cultivation of pandan leaves further restricts scalability. Most production remains confined to household farming or cottage industries, preventing consistent raw material pipelines crucial for meeting rising global consumer demand effectively

- Post-harvest processing and preservation of pandan leaves create challenges due to their perishable nature. Inadequate drying, packaging, and logistics infrastructure raises risks of spoilage, limiting shelf life for exporters and affecting brand reliability within foreign markets

- Regulatory hurdles in international markets further complicate supply chains as exporters must comply with food safety, herb import laws, and organic certifications. Meeting these standards raises costs for producers and lengthens time-to-market cycles externally

Pandan Tea Market Scope

The market is segmented on the basis of type, packaging, end-user, and distribution channel.

- By Type

On the basis of type, the pandan tea market is segmented into loose leaf, tea bags, and instant powder. The tea bags segment dominated the largest market revenue share of 45.19% in 2024, driven by increasing demand for convenience and ready-to-brew options among working professionals and urban households. Tea bags offer easy preparation without compromising much on flavor, making them ideal for busy lifestyles. Their compatibility with office environments, cafes, and quick-service restaurants also boosts adoption. Innovative flavored blends and eco-friendly packaging further drive consumer preference for tea bags, making them the fastest-growing type segment.

The loose leaf segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by consumer preference for premium quality and authentic tea experience. Loose leaf pandan tea is perceived to retain natural flavors and aromas better than processed alternatives, appealing to health-conscious and traditional tea drinkers. Its popularity is further strengthened by growing awareness of brewing techniques that maximize health benefits and taste. Specialty tea shops and high-end retailers continue to focus on loose leaf formats, reinforcing its market dominance.

- By Packaging

On the basis of packaging, the pandan tea market is segmented into box, sachet, tin, and bottle. The box packaging segment held the largest market revenue share in 2024, driven by its widespread use in retail and gifting markets. Box packaging provides ease of storage, protection from moisture, and a premium presentation for loose leaf and tea bag products. Many consumers associate boxed packaging with quality and freshness, reinforcing brand trust and repeat purchases. Packaging innovations, including window boxes and attractive artwork, also contribute to sustained demand.

The sachet segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of single-serve portions for convenience and portability. Sachets allow precise brewing and reduce wastage, making them appealing for individual consumption at home, work, or while traveling. Growing awareness of hygienic and eco-friendly sachet packaging further encourages consumer preference, positioning this segment for rapid growth in the coming years.

- By End-User

On the basis of end-user, the pandan tea market is segmented into household, foodservice, and institutional. The household segment dominated the largest market revenue share in 2024, driven by the growing trend of tea consumption as part of daily routines and wellness practices. Home users often prefer pandan tea for its flavor, aroma, and perceived health benefits such as stress relief and digestive support. Rising disposable income and increasing awareness of specialty teas have fueled household consumption. Retail promotions and home brewing guides further support the market share of household consumers.

The foodservice segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in cafes, restaurants, and hotels. Pandan tea is increasingly used in specialty beverages, desserts, and culinary applications, enhancing its appeal to the foodservice industry. Easy-to-serve formats such as tea bags and sachets, along with premium packaging, support commercial adoption. Expanding hospitality and tourism sectors globally are further driving rapid growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the pandan tea market is segmented into supermarkets/hypermarkets, specialty stores, online retail, and convenience stores. The supermarkets/hypermarkets segment held the largest market revenue share in 2024, driven by widespread consumer access and availability of diverse pandan tea variants under organized retail. Bulk purchasing, attractive promotions, and visibility on shelves contribute to strong adoption in this channel. Brand trust and loyalty programs in large retail chains further reinforce dominance.

The online retail segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing digital adoption and growing e-commerce penetration. Online channels offer convenience, doorstep delivery, and access to a wide range of premium and niche pandan tea products. Subscription models, personalized packaging, and influencer-driven marketing strategies are accelerating online sales. The flexibility to compare brands, prices, and reviews further encourages consumers to choose online retail as their preferred purchasing channel.

Pandan Tea Market Regional Analysis

- North America dominated the pandan tea market with the largest revenue share of 23.03% in 2024, driven by growing consumer preference for specialty and flavored teas, as well as increasing health-consciousness among residents

- Consumers in the region highly value the unique aroma, flavor, and perceived wellness benefits of pandan tea, making it a favored choice for daily consumption and gifting

- This widespread adoption is further supported by high disposable incomes, expanding specialty tea stores, and rising e-commerce penetration, establishing pandan tea as a popular beverage in households and foodservice outlets

U.S. Pandan Tea Market Insight

The U.S. pandan tea market captured the largest revenue share in North America in 2024, fueled by rising awareness of herbal teas and increasing demand for natural, plant-based beverages. Consumers are increasingly prioritizing health benefits and authentic taste experiences, which is driving demand for premium loose leaf and tea bag formats. The growing trend of home brewing and specialty cafés serving herbal infusions further propels market growth. Moreover, e-commerce platforms and subscription models are enhancing product accessibility, expanding reach across urban and suburban regions.

Europe Pandan Tea Market Insight

The Europe pandan tea market is projected to expand at a notable CAGR during the forecast period, primarily driven by rising consumer interest in herbal and wellness teas, along with increasing adoption in foodservice and hospitality sectors. Urbanization and health-conscious lifestyles are fostering demand for pandan tea across households and cafés. European consumers are also attracted to sustainable and aesthetically appealing packaging. The market is witnessing growth across premium retail, online channels, and specialty stores, with pandan tea gaining traction as both a daily beverage and a premium product.

U.K. Pandan Tea Market Insight

The U.K. pandan tea market is expected to grow at a significant CAGR during the forecast period, driven by increasing home consumption and rising popularity in cafés and restaurants. Concerns regarding wellness, immunity, and natural beverage choices are encouraging households and foodservice providers to adopt herbal teas, including pandan tea. The U.K.’s well-established retail infrastructure and online sales channels are supporting market expansion, with growing interest in ready-to-brew tea bags and premium loose leaf offerings.

Germany Pandan Tea Market Insight

The Germany pandan tea market is anticipated to expand at a healthy CAGR during the forecast period, fueled by rising awareness of herbal and functional teas among consumers. Germany’s emphasis on wellness, sustainability, and organic products promotes the adoption of pandan tea, particularly in households and specialty stores. Innovative packaging, combined with the integration of pandan tea into cafés, restaurants, and foodservice offerings, is further enhancing market penetration. Consumers are increasingly seeking flavorful, natural alternatives to conventional beverages.

Asia-Pacific Pandan Tea Market Insight

The Asia-Pacific pandan tea market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising disposable incomes, urbanization, and increasing awareness of herbal and wellness teas in countries such as China, Japan, and India. The region’s traditional familiarity with pandan leaves and their use in beverages and culinary applications is supporting adoption. Expansion of retail chains, e-commerce penetration, and government initiatives promoting herbal and natural products are also driving growth..

Japan Pandan Tea Market Insight

The Japan pandan tea market is gaining momentum due to the country’s strong culture of tea consumption and wellness-oriented lifestyles. Consumers value pandan tea for its aroma, flavor, and natural health benefits. The growing trend of herbal infusions in cafés, restaurants, and convenience stores is fueling demand. Moreover, product innovation in packaging and single-serve portions is enhancing convenience, supporting expansion in both household and foodservice sectors.

China Pandan Tea Market Insight

The China pandan tea market accounted for the largest revenue share in Asia Pacific in 2024, driven by the country’s traditional use of pandan in beverages and desserts, rising urbanization, and increasing health awareness. China’s expanding middle class and preference for herbal teas are encouraging demand across households, cafés, and restaurants. The availability of affordable pandan tea options, combined with e-commerce and specialty retail growth, is further propelling market expansion.

Pandan Tea Market Share

The pandan tea industry is primarily led by well-established companies, including:

- ETTE TEA COMPANY (Singapore)

- My Blue Tea (Australia)

- Rishi Tea & Botanicals (U.S.)

- FreshDrinkUS (U.S.)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Tea Too Pty Ltd. (Australia)

- Zhejiang Chunli Tea Co., Ltd. (China)

- WILD & TEA (U.S.)

- Thienthanhtea Ltd (Vietnam)

- Gong Cha (Taiwan)

- Royal T Group Pte Ltd (Singapore)

Latest Developments in Global Pandan Tea Market

- In August 2024, Betoya launched Pandan Leaf Tea, introducing the Southeast Asian herb, widely known as the “vanilla of the East,” in tea bag format for convenient consumption at home and at work. The launch reflects a strategic effort to expand pandan tea accessibility beyond cafés and specialty stores, targeting everyday tea drinkers seeking natural, aromatic, and refreshing beverages. By offering a ready-to-brew format, Betoya is likely to increase consumer penetration, boost retail and e-commerce sales, and strengthen the herbal tea segment in Southeast Asia. This move also positions pandan tea as a convenient wellness-oriented product, catering to growing health-conscious trends and the rising demand for herbal infusions

- In August 2021, LiHO TEA unveiled the Singa-Pandan series, featuring a Pandan Shake paired with cookies and caramel, as part of the Singapore Food Festival 2021. This launch combined traditional pandan flavors with contemporary dessert trends, creating a unique and Instagrammable product experience. The series enhanced LiHO TEA’s product portfolio and also demonstrated the versatility of pandan in beverages and desserts, inspiring other brands to explore premium flavor infusions. The market impact included heightened consumer awareness, increased footfall to cafés, and a surge in seasonal demand for pandan-flavored specialty beverages

- In January 2021, Gong Cha collaborated with Singapore’s ActionCity to commemorate the 25th anniversary of the Japanese character To-fu Oyako by launching a limited-edition pandan-infused drink. The drink, featuring a light green milky base with rose, vanilla, coconut, almond, and pandan, targeted both fans of the character and consumers seeking novel, limited-time beverages. This collaboration served as a strategic marketing tool to boost brand engagement, elevate pandan’s popularity among younger audiences, and drive seasonal sales. It also highlighted the growing trend of integrating local flavors into international bubble tea chains, creating opportunities for further product innovation in pandan-infused drinks

- In June 2020, Starbucks Singapore introduced a Pandan Latte as a limited-time summer offering, blending steamed milk with pandan syrup and a hint of coconut. This product leveraged the brand’s global recognition to introduce pandan flavors to mainstream consumers, increasing visibility and acceptance of herbal and Southeast Asian flavors. The launch stimulated consumer interest in herbal teas and niche beverages, expanding the pandan tea market beyond traditional specialty stores and cafés. It also reinforced the trend of premium, locally inspired offerings in international coffee chains, which drives seasonal sales and encourages flavor experimentation across the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.