Global Passive Infrared Sensor Market

Market Size in USD Million

CAGR :

%

USD

804.53 Million

USD

2,495.53 Million

2025

2033

USD

804.53 Million

USD

2,495.53 Million

2025

2033

| 2026 –2033 | |

| USD 804.53 Million | |

| USD 2,495.53 Million | |

|

|

|

|

Passive Infrared Sensor Market Size

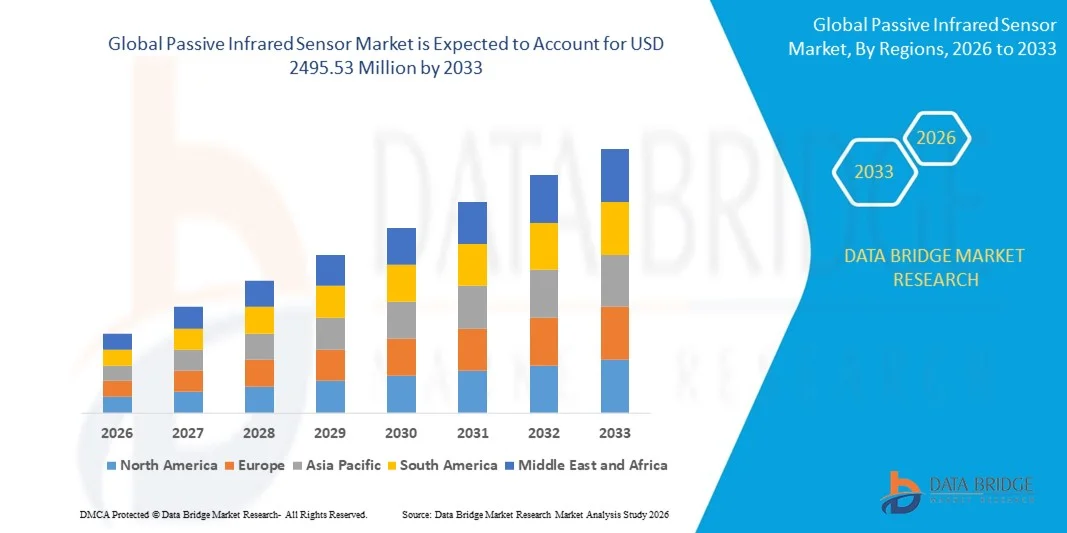

- The global passive infrared sensor market size was valued at USD 804.53 million in 2025 and is expected to reach USD 2495.53 million by 2033, at a CAGR of 15.20% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in smart home, industrial automation, and security systems, leading to increased use of passive infrared sensors for motion detection, occupancy monitoring, and energy-efficient solutions in residential, commercial, and industrial settings

- Furthermore, rising demand for reliable, low-power, and integrated sensing solutions is establishing PIR sensors as essential components in modern automation and safety systems. These converging factors are accelerating the deployment of passive infrared sensor across smart homes, offices, and industrial facilities, thereby significantly boosting market growth

Passive Infrared Sensor Market Analysis

- Passive infrared sensors, offering accurate motion and occupancy detection, are increasingly critical components of modern smart home automation, industrial monitoring, and security systems due to their energy efficiency, ease of integration, and cost-effectiveness

- The escalating demand for PIR sensors is primarily fueled by the widespread adoption of IoT-enabled devices, growing security and safety concerns, and the preference for automated, touchless, and energy-efficient monitoring solutions across residential, commercial, and industrial applications

- North America dominated the passive infrared sensor market with a share of 39.5% in 2025, due to the increasing adoption of smart security systems, building automation, and surveillance solutions

- Asia-Pacific is expected to be the fastest growing region in the passive infrared sensor market during the forecast period due to increasing urbanization, rising industrial automation, and expanding smart home adoption in countries such as China, Japan, and India

- Smoke detector segment dominated the market with a market share of 43% in 2025, due to its critical role in fire safety and early hazard detection across residential and commercial settings. End users often prioritize smoke detectors for their reliability, ease of installation, and proven effectiveness in reducing fire-related risks. The demand is further reinforced by regulatory requirements for fire safety in buildings and the integration of smoke detectors with smart home and security systems, enhancing real-time alerts and emergency response

Report Scope and Passive Infrared Sensor Market Segmentation

|

Attributes |

Passive Infrared Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Passive Infrared Sensor Market Trends

Integration of PIR Sensors in Smart Homes and Industrial Automation

- A significant trend in the passive infrared sensor market is the increasing integration of these sensors into smart home devices and industrial automation systems, driven by growing demand for energy-efficient, automated solutions that enhance safety and operational efficiency. This integration is positioning passive infrared sensor as essential components for motion detection, lighting control, and security applications across residential and commercial sectors

- For instance, companies such as Honeywell and Panasonic incorporate PIR sensors in smart thermostats, security systems, and automated lighting solutions to enable precise motion detection and energy savings. Such implementations enhance convenience, improve safety, and reduce energy consumption in both domestic and industrial environments

- The adoption of PIR sensors is expanding in commercial building automation where motion-based lighting, HVAC control, and occupancy monitoring systems improve energy management and operational workflows. This trend underscores the role of PIR sensors in supporting sustainable and intelligent infrastructure

- In industrial automation, PIR sensors are being deployed for worker safety, automated equipment activation, and monitoring of restricted areas. Their ability to provide reliable motion detection under variable conditions is driving adoption in manufacturing, logistics, and warehousing operations

- The healthcare sector is leveraging PIR sensors in patient monitoring systems, automated lighting, and facility management where movement detection contributes to operational efficiency and safety. This trend is encouraging innovation in sensor-enabled solutions that enhance healthcare service delivery

- The market is witnessing strong growth in smart home ecosystems where PIR sensors are integrated with IoT platforms, voice assistants, and connected devices to enable responsive, automated environments. Rising consumer preference for intelligent, energy-efficient living spaces is reinforcing demand and positioning PIR sensors as vital enablers of home and industrial automation

Passive Infrared Sensor Market Dynamics

Driver

Rising Demand for Energy-Efficient Motion Detection

- The growing emphasis on energy conservation and automation is driving demand for passive infrared sensor that provide reliable motion detection while minimizing power consumption. These sensors are critical in smart lighting, HVAC systems, and security devices where energy efficiency is a key performance metric

- For instance, Legrand integrates PIR sensors into its occupancy-based lighting systems to optimize energy use in commercial and residential buildings. Such applications reduce electricity costs, enhance operational efficiency, and support sustainability initiatives

- The rising adoption of smart homes and connected infrastructure is further boosting demand for PIR sensors capable of seamless integration with IoT platforms. These sensors enable automated responses to occupancy, improving energy management and user convenience

- Industrial sectors are increasingly deploying PIR sensors to automate machinery, lighting, and safety monitoring, reducing energy wastage and improving process efficiency. This is contributing to operational cost savings and environmental sustainability

- The increasing need for reliable, low-power motion detection in both emerging and mature markets continues to drive technological advancements and adoption, solidifying PIR sensors’ role in energy-efficient automation

Restraint/Challenge

High Costs and Integration Complexity

- The passive infrared sensor market faces challenges due to the high costs of high-performance PIR modules and the complexity involved in integrating them with existing automation and IoT systems. These factors can slow adoption, especially among cost-sensitive segments

- For instance, companies such as Schneider Electric note that integrating PIR sensors into large-scale building management systems requires careful design and calibration, which increases deployment time and expenses. Such complexities can limit market penetration in small- and medium-scale projects

- Manufacturing high-precision PIR sensors involves specialized materials and fabrication techniques, which contribute to elevated production costs. These requirements affect pricing strategies and may restrict accessibility for some end-users

- Integration of PIR sensors into multi-sensor systems and connected platforms demands interoperability, firmware optimization, and network compatibility. This technical challenge adds to development costs and requires skilled personnel for implementation

- The market continues to face barriers related to balancing sensor performance with cost-effectiveness, particularly in large-scale deployments. These challenges collectively emphasize the need for streamlined integration processes and cost optimization to expand adoption across industries

Passive Infrared Sensor Market Scope

The market is segmented on the basis of device, range, and application.

- By Device

On the basis of device, the Passive Infrared Sensor market is segmented into smoke detectors, heat detectors, and others. The smoke detector segment dominated the market with the largest market revenue share of 43% in 2025, driven by its critical role in fire safety and early hazard detection across residential and commercial settings. End users often prioritize smoke detectors for their reliability, ease of installation, and proven effectiveness in reducing fire-related risks. The demand is further reinforced by regulatory requirements for fire safety in buildings and the integration of smoke detectors with smart home and security systems, enhancing real-time alerts and emergency response.

The heat detector segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in industrial and commercial applications where temperature-based monitoring is essential. Heat detectors provide reliable detection in environments unsuitable for smoke detectors, such as dusty or high-humidity areas, making them ideal for warehouses, manufacturing units, and server rooms. Their growing popularity is also supported by advancements in sensor sensitivity and integration with automated monitoring systems for enhanced safety management.

- By Range

On the basis of range, the Passive Infrared Sensor market is segmented into short wave, passive infrared sensor, mid-wave passive infrared sensor, and long-wave passive infrared sensor. The passive infrared sensor segment dominated the market with the largest market revenue share in 2025, driven by its versatility and cost-effectiveness for motion detection across consumer and commercial applications. These sensors are widely used for security systems, lighting control, and occupancy monitoring, offering reliable performance in standard temperature environments. The ease of integration with other electronics and smart systems further reinforces their adoption across residential, office, and industrial spaces.

The mid-wave passive infrared sensor segment is expected to witness the fastest CAGR from 2026 to 2033, driven by higher sensitivity and improved detection range suitable for defense, aerospace, and advanced industrial applications. Mid-wave sensors provide precise motion and heat detection in variable temperature conditions, making them indispensable for security surveillance and sophisticated automation solutions. Their growth is also supported by technological advancements in infrared materials and manufacturing, enhancing efficiency and reliability.

- By Application

On the basis of application, the Passive Infrared Sensor market is segmented into consumer electronics, defense and aerospace, healthcare, industrial, and automotive. The consumer electronics segment dominated the market with the largest market revenue share in 2025, driven by increasing demand for smart home devices, automated lighting systems, and personal security solutions. PIR sensors enable energy efficiency and convenience by detecting occupancy and motion, and they are integrated into widely used gadgets such as smart cameras, lighting controllers, and home automation devices. Their affordability, reliability, and compatibility with wireless networks contribute to their continued dominance in consumer applications.

The industrial segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding adoption in process automation, workplace safety, and monitoring systems. Industrial applications leverage PIR sensors for equipment monitoring, intrusion detection, and hazard management, offering precise detection in challenging environments. The segment growth is supported by increased investment in industrial IoT solutions and the push for energy-efficient, automated operational systems that rely on accurate motion and occupancy sensing.

Passive Infrared Sensor Market Regional Analysis

- North America dominated the passive infrared sensor market with the largest revenue share of 39.5% in 2025, driven by the increasing adoption of smart security systems, building automation, and surveillance solutions

- Consumers and businesses in the region highly value the accuracy, reliability, and energy efficiency offered by PIR sensors in motion detection, occupancy monitoring, and safety applications

- This widespread adoption is further supported by high disposable incomes, technologically savvy populations, and stringent safety regulations, establishing PIR sensors as a preferred solution across residential, commercial, and industrial sectors

U.S. Passive Infrared Sensor Market Insight

The U.S. passive infrared sensor market captured the largest revenue share in 2025 within North America, fueled by growing investments in smart home automation, industrial monitoring, and security systems. Adoption is driven by the increasing need for energy-efficient and automated occupancy-based solutions in homes, offices, and commercial complexes. The growing popularity of IoT-connected devices, combined with the demand for real-time monitoring and remote control via mobile applications, further propels the market. In addition, integration with advanced security platforms and cloud-based analytics is significantly contributing to market expansion.

Europe Passive Infrared Sensor Market Insight

The Europe passive infrared sensor market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising investments in building automation, smart security infrastructure, and energy-efficient systems. Increasing urbanization and government initiatives promoting sustainable energy use are fostering adoption. European consumers and businesses are also drawn to the convenience and reliability PIR sensors provide in occupancy monitoring, lighting control, and surveillance applications. The market is witnessing significant growth across commercial buildings, industrial facilities, and residential complexes.

U.K. Passive Infrared Sensor Market Insight

The U.K. passive infrared sensor market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of smart building technologies and energy efficiency initiatives. Concerns regarding security, workplace safety, and operational efficiency are encouraging adoption in commercial and residential projects. The country’s well-established e-commerce and retail infrastructure, combined with government support for smart city initiatives, is expected to continue stimulating market growth.

Germany Passive Infrared Sensor Market Insight

The Germany PIR sensor market is expected to expand at a considerable CAGR during the forecast period, fueled by growing adoption of automated building systems and industrial monitoring solutions. Germany’s focus on energy efficiency, sustainability, and technological innovation promotes the use of PIR sensors in commercial, industrial, and residential environments. Integration with smart home and industrial IoT platforms is becoming increasingly prevalent, with strong preference for reliable, privacy-focused detection solutions.

Asia-Pacific Passive Infrared Sensor Market Insight

The Asia-Pacific passive infrared sensor market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing urbanization, rising industrial automation, and expanding smart home adoption in countries such as China, Japan, and India. Government initiatives promoting digitalization, energy efficiency, and smart infrastructure are accelerating adoption. Moreover, APAC’s emergence as a manufacturing hub for sensor components is enhancing affordability and accessibility, making PIR sensors widely available across residential, commercial, and industrial segments.

Japan Passive Infrared Sensor Market Insight

The Japan passive infrared sensor market is gaining momentum due to the country’s high-tech ecosystem, growing smart home adoption, and demand for convenient, energy-efficient monitoring solutions. Increasing integration of PIR sensors with other IoT devices such as security cameras, lighting systems, and HVAC controls is fueling growth. Japan’s aging population also drives demand for simplified, reliable motion detection solutions in both residential and commercial sectors.

China Passive Infrared Sensor Market Insight

The China passive infrared sensor market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding industrial automation, and growing smart home penetration. China’s push towards smart cities, availability of cost-effective PIR sensor solutions, and strong domestic manufacturing capabilities are key factors driving market growth. Rising adoption across residential, commercial, and industrial applications further solidifies China as a leading market in the region.

Passive Infrared Sensor Market Share

The passive infrared sensor industry is primarily led by well-established companies, including:

- Murata Manufacturing Co., Ltd (Japan)

- Honeywell International Inc (U.S.)

- Lynred (France)

- Hamamatsu Photonics K.K. and its affiliates (Japan)

- OMRON Corporation (Japan)

- Excelitas Technologies Corp (U.S.)

- Nippon Avionics Co., Ltd (Japan)

- NICERA ALL (Japan)

- Zhejiang Dali Technology Co., Ltd (China)

- WUHAN-GUI (China)

- General Dynamics Corporation (U.S.)

- L3Harris Technologies, Inc (U.S.)

- Fluke Corporation (U.S.)

- Leonardo DRS (U.S.)

- Bosch Security Systems, LLC (Germany)

- Axis Communications AB (Sweden)

Latest Developments in Global Passive Infrared Sensor Market

- In March 2025, Honeywell International entered into a strategic partnership with Lutron Electronics to integrate advanced PIR occupancy sensing into commercial building control systems. This collaboration allows PIR sensors to work seamlessly with lighting, HVAC, and energy management platforms, improving operational efficiency and comfort. The partnership accelerates market growth by expanding commercial applications, promoting energy savings, and encouraging adoption of PIR sensors in large-scale automated building infrastructures

- In October 2024, XY Sense launched its wireless Presence PIR sensor, designed to provide real-time occupancy insights for compact office spaces. The sensor features battery-powered LoRaWAN connectivity, enabling easy installation without extensive wiring, and high-accuracy motion detection to optimize space utilization. This development strengthens the market by meeting the growing demand for smart workplace solutions, supporting energy efficiency, and providing actionable data for facility management, thereby increasing adoption of PIR sensors in commercial and flexible office environments

- In June 2024, Omron introduced a high-sensitivity PIR motion sensor module for smart-home and industrial automation applications. The module offers enhanced detection range, improved reliability, and compatibility with a wide variety of control systems. This product launch impacts the market by enabling more accurate motion and occupancy sensing in both consumer and industrial segments, supporting the rising demand for home automation, industrial IoT solutions, and energy-efficient monitoring systems

- In January 2024, Vishay Intertechnology completed the acquisition of a specialized PIR sensor startup to expand its occupancy-sensing and motion detection portfolio. This acquisition strengthens Vishay’s presence in the PIR sensor market, accelerates innovation in detection technology, and broadens its offerings across consumer, commercial, and industrial sectors. The move reinforces competitive positioning while promoting the integration of advanced PIR solutions in smart home, security, and industrial automation systems

- In 2023, Murata Manufacturing launched a digital-output SMD pyroelectric PIR sensor optimized for low-power motion detection in IoT and smart-home devices. The sensor’s compact design and energy efficiency cater to the growing demand for small, battery-operated devices while maintaining high sensitivity. This launch expands market opportunities by enabling PIR sensors in wearable devices, portable electronics, and connected smart-home systems, fueling adoption in both consumer and industrial markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Passive Infrared Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Passive Infrared Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Passive Infrared Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.