Global Performance Tires Market

Market Size in USD Million

CAGR :

%

USD

77.00 Million

USD

221.21 Million

2025

2033

USD

77.00 Million

USD

221.21 Million

2025

2033

| 2026 –2033 | |

| USD 77.00 Million | |

| USD 221.21 Million | |

|

|

|

|

Performance Tires Market Size

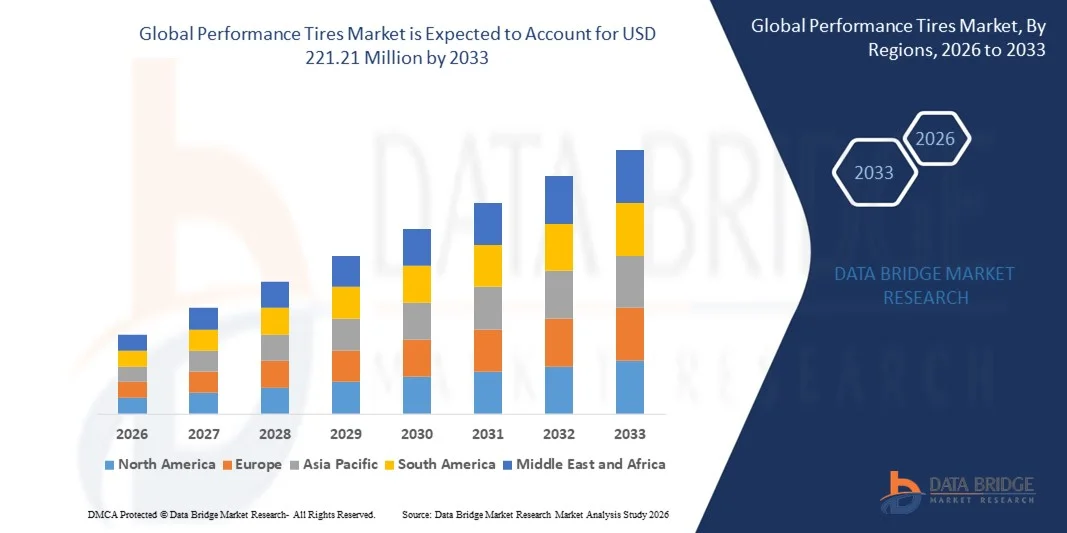

- The global performance tires market size was valued at USD 77.00 million in 2025 and is expected to reach USD 221.21 million by 2033, at a CAGR of 14.10% during the forecast period

- The market growth is largely fuelled by increasing consumer demand for high-performance vehicles and sports cars, requiring tires with superior grip, handling, and stability

- Growing motorsport activities and racing events globally are contributing to the demand for specialized performance tires

Performance Tires Market Analysis

- The market is witnessing strong growth due to rising disposable incomes, increased automotive sales, and the preference for premium and high-performance vehicles

- Technological innovations, such as run-flat tires, asymmetric tread patterns, and smart tire sensors, are shaping the market landscape and enhancing product differentiation

- North America dominated the performance tires market with the largest revenue share of 38.5% in 2025, driven by the high adoption of premium vehicles, growing demand for sports and luxury cars, and increasing awareness of tire performance and safety

- Asia-Pacific region is expected to witness the highest growth rate in the global performance tires market, driven by increasing automotive production, rising demand for passenger cars, SUVs, and two-wheelers, and expanding availability of cost-effective performance tires across emerging economies

- The Z Symbol segment held the largest market revenue share in 2025 driven by its high-speed rating, superior handling capabilities, and widespread adoption among premium passenger vehicles. Z Symbol tires provide balanced performance in both wet and dry conditions, making them suitable for year-round use. They are increasingly preferred by consumers seeking a combination of safety, comfort, and sporty driving experience. The growing luxury car market has further fueled the demand for Z Symbol tires

Report Scope and Performance Tires Market Segmentation

|

Attributes |

Performance Tires Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Performance Tires Market Trends

Rising Demand for High-Performance Vehicles and Advanced Tire Technologies

- The growing focus on high-performance and sports vehicles is significantly shaping the performance tires market, as consumers increasingly prefer tires that offer superior grip, handling, and stability. Performance tires are gaining traction due to their ability to enhance driving experience without compromising safety. This trend strengthens their adoption across passenger cars, luxury vehicles, and motorsports, encouraging manufacturers to innovate with new tire compounds and designs to meet evolving consumer preferences

- Increasing awareness around vehicle safety, speed performance, and driving comfort has accelerated the demand for performance tires in sports cars, SUVs, and premium sedans. Performance-conscious consumers are actively seeking tires with optimized wet and dry traction, prompting brands to focus on advanced materials, tread designs, and durability. This has also led to collaborations between tire manufacturers and automotive OEMs to improve performance and efficiency

- Performance and technological trends are influencing purchasing decisions, with manufacturers emphasizing precision engineering, enhanced tread patterns, and improved tire longevity. These factors are helping brands differentiate products in a competitive market and build consumer trust, while also driving the adoption of premium tire offerings and certifications. Companies are increasingly using marketing campaigns to highlight these benefits to reinforce brand positioning and appeal to performance-oriented consumers

- For instance, in 2024, Michelin in France and Bridgestone in Japan expanded their high-performance tire portfolios by launching new ultra-high-performance tires for sports and luxury vehicles. These launches were introduced in response to rising consumer preference for superior driving performance, with distribution across retail, specialty, and e-commerce channels. The products were also marketed as technologically advanced solutions, enhancing brand loyalty and repeat purchases among target audiences

- While demand for performance tires is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining performance standards comparable to racing or OEM requirements. Manufacturers are also focusing on improving scalability, supply chain efficiency, and developing innovative solutions that balance cost, quality, and environmental compliance for broader adoption

Performance Tires Market Dynamics

Driver

Growing Preference for High-Performance Vehicles and Advanced Tire Technology

- Rising consumer demand for high-performance, sports, and luxury vehicles is a major driver for the performance tires market. Manufacturers are increasingly developing tires that enhance grip, handling, and durability to meet performance requirements. This trend is also pushing research into advanced tire compounds and lightweight designs, supporting product diversification

- Expanding automotive applications in sports cars, premium sedans, SUVs, and motorsports are influencing market growth. Performance tires help improve stability, braking efficiency, and driving experience while maintaining safety standards, enabling manufacturers to meet consumer expectations for high-quality, performance-oriented offerings. The increasing global adoption of high-speed and luxury vehicles further reinforces this trend

- Tire manufacturers are actively promoting performance tire-based innovations through product launches, marketing campaigns, and industry certifications. These efforts are supported by the growing consumer preference for safety, performance, and efficiency, and they also encourage partnerships between automotive OEMs and tire brands to enhance product performance and reduce environmental impact

- For instance, in 2023, Pirelli in Italy and Continental in Germany reported increased adoption of performance tires in sports car and SUV segments. This expansion followed higher consumer demand for advanced grip, handling, and durability, driving repeat purchases and product differentiation. Both companies also highlighted sustainability and advanced material usage in marketing campaigns to strengthen consumer trust and brand loyalty

- Although rising demand for performance vehicles supports growth, wider adoption depends on cost optimization, raw material availability, and scalable production processes. Investment in supply chain efficiency, sustainable material sourcing, and advanced tire manufacturing technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

Higher Cost And Limited Awareness Compared To Conventional Tires

- The relatively higher cost of performance tires compared to standard tires remains a key challenge, limiting adoption among price-sensitive consumers. Advanced materials, specialized tread designs, and complex manufacturing processes contribute to elevated pricing. In addition, fluctuating availability of high-performance tire compounds can further affect cost stability and market penetration

- Consumer awareness remains uneven, particularly in developing markets where high-performance vehicles are still emerging. Limited understanding of functional benefits restricts adoption across certain vehicle segments. This also leads to slower uptake in regions where performance tire education and marketing are minimal

- Supply chain and distribution challenges also impact market growth, as performance tires require specialized logistics and adherence to quality standards. Logistical complexities and careful handling increase operational costs. Companies must invest in proper storage, transportation, and inventory management to maintain product integrity

- For instance, in 2024, distributors in Southeast Asia supplying premium and sports car tires reported slower uptake due to higher prices and limited consumer awareness. Handling requirements and certification compliance were additional barriers. These factors also prompted some retailers to limit shelf space for high-end tires, affecting visibility and sales

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused educational initiatives for consumers and automotive dealers. Collaboration with OEMs, retailers, and certification bodies can help unlock the long-term growth potential of the global performance tires market. Furthermore, developing cost-competitive products and strengthening marketing strategies around performance and safety benefits will be essential for widespread adoption

Performance Tires Market Scope

The market is segmented on the basis of type, application, tire type, sales channel type, design, and vehicle type.

- By Type

On the basis of type, the performance tires market is segmented into V Symbol, Z Symbol, W Symbol, and Y Symbol. The Z Symbol segment held the largest market revenue share in 2025 driven by its high-speed rating, superior handling capabilities, and widespread adoption among premium passenger vehicles. Z Symbol tires provide balanced performance in both wet and dry conditions, making them suitable for year-round use. They are increasingly preferred by consumers seeking a combination of safety, comfort, and sporty driving experience. The growing luxury car market has further fueled the demand for Z Symbol tires.

The W Symbol segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption of high-performance vehicles and the need for tires optimized for wet and variable road conditions. W Symbol tires are known for their enhanced traction, stability, and responsive handling at high speeds. Increasing motorsport activities and enthusiasts upgrading their vehicles are also supporting growth in this segment. In addition, manufacturers are introducing advanced tread designs and compound technologies to improve performance and safety.

- By Application

On the basis of application, the market is segmented into passenger tires and light truck/SUV tires. The passenger tires segment held the largest market share in 2025 due to the growing global fleet of passenger vehicles and the rising consumer preference for comfort, handling, and performance. Passenger tires are widely used for urban commuting and long-distance travel, supporting fuel efficiency and ride quality. Increasing disposable income and changing lifestyles have boosted demand for performance-focused passenger tires.

The light truck/SUV tires segment is projected to witness the fastest growth from 2026 to 2033, driven by the increasing popularity of SUVs and light trucks, which require durable tires with enhanced traction and load-bearing capacity. Consumers are increasingly investing in premium tires to improve vehicle performance on diverse terrains. Growing off-road recreational activities and rising e-commerce delivery fleets also contribute to this segment’s expansion.

- By Tire Type

On the basis of tire type, the market is segmented into racing slick, tread tire, and other tire types. The tread tire segment held the largest revenue share in 2025 due to its versatility, year-round usability, and compatibility with most passenger and performance vehicles. Tread tires are designed to provide optimal grip, braking performance, and durability under varied road conditions. Rising demand for high-performance commuting tires in urban and semi-urban regions has supported the segment’s growth.

Racing slick tires are expected to register the fastest growth from 2026 to 2033, driven by expanding motorsport activities, track events, and increasing adoption of track-oriented vehicles. These tires offer maximum traction and cornering performance under controlled conditions. Enthusiasts and professional racing teams are increasingly seeking specialized tires to gain competitive advantage. The segment is also benefiting from advancements in tire compounds and lightweight designs.

- By Sales Channel Type

On the basis of sales channel type, the market is segmented into OEM and replacement/aftermarket. The OEM segment held the largest market share in 2025 owing to strong partnerships between tire manufacturers and vehicle producers, ensuring original equipment supply for new vehicles. OEM tires offer consistent quality, warranty benefits, and integration with vehicle performance standards. The segment benefits from growing vehicle production, particularly in premium and mid-range categories.

The replacement/aftermarket segment is expected to grow at the fastest rate from 2026 to 2033, driven by increasing vehicle age, rising tire replacement cycles, and growing consumer awareness of performance tire benefits. Consumers are increasingly opting for high-performance tires during replacements to improve handling and safety. Expansion of retail networks and online sales platforms has also facilitated easier access to premium tires, supporting growth in this segment.

- By Design

On the basis of design, the market is segmented into radial and bias. The radial segment dominated the market in 2025 due to its superior performance, longer lifespan, and fuel efficiency advantages over bias tires. Radial tires are preferred for both passenger and commercial vehicles, providing better road contact and handling stability. The growing focus on energy-efficient vehicles and regulatory push for low rolling resistance tires have further reinforced the segment’s dominance

The bias segment is anticipated to witness faster growth from 2026 to 2033, particularly in emerging markets and off-road applications where durability, load-bearing, and resistance to rough surfaces are prioritized. Bias tires are cost-effective and suitable for commercial and industrial vehicles operating under challenging conditions. Increasing construction and mining activities are also contributing to the demand for bias tire designs.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two-wheelers, three-wheelers, and off-the-road (OTR) vehicles. Passenger cars accounted for the largest market revenue share in 2025, driven by the high adoption of performance tires among individual consumers seeking enhanced driving experience. Increasing urbanization, rising disposable income, and interest in sporty vehicles support the segment’s growth.

Two-wheelers and off-the-road vehicles are expected to register the fastest growth from 2026 to 2033, fueled by rising demand for performance-oriented motorcycles, recreational vehicles, and specialized industrial/off-road applications. These vehicles require tires that provide superior traction, stability, and durability under diverse conditions. Expanding tourism, motorsport events, and industrial activities are contributing to the growing adoption of performance tires in these segments.

Performance Tires Market Regional Analysis

- North America dominated the performance tires market with the largest revenue share of 38.5% in 2025, driven by the high adoption of premium vehicles, growing demand for sports and luxury cars, and increasing awareness of tire performance and safety

- Consumers in the region prioritize tires that offer superior handling, traction, and fuel efficiency, alongside enhanced durability and comfort

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and well-established automotive infrastructure, establishing performance tires as a preferred choice for both passenger and light commercial vehicles

U.S. Performance Tires Market Insight

The U.S. performance tires market captured the largest revenue share in 2025 within North America, fueled by the increasing sales of high-performance vehicles and SUVs. Consumers are increasingly focusing on tires that improve handling, braking, and overall vehicle performance. The growing interest in motorsports and track-oriented vehicles further supports the market. In addition, the demand for tire replacement and aftermarket upgrades, combined with strong OEM collaborations, continues to drive growth in the U.S.

Europe Performance Tires Market Insight

The Europe performance tires market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent vehicle safety regulations and rising consumer demand for high-performance and eco-friendly tires. Urbanization, rising disposable incomes, and adoption of connected vehicles are fostering market expansion. European consumers increasingly prefer tires that provide enhanced grip, durability, and fuel efficiency. The market is growing across passenger cars, SUVs, and premium vehicle segments, with performance tires becoming a standard choice for both new and replacement vehicles.

U.K. Performance Tires Market Insight

The U.K. performance tires market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of premium cars and SUVs, coupled with rising awareness of road safety and tire performance. Concerns about fuel efficiency, tire longevity, and driving comfort are encouraging consumers to invest in high-quality tires. The growth is further supported by the strong retail and e-commerce network, enabling easy access to performance tires across the country.

Germany Performance Tires Market Insight

The Germany performance tires market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s well-established automotive industry, high vehicle ownership, and emphasis on advanced engineering and safety. Consumers prefer tires that ensure maximum traction, responsive handling, and energy efficiency. The focus on sustainability and low rolling resistance is boosting demand for premium performance tires. Integration with connected vehicles and advanced automotive technologies is also promoting adoption across passenger and commercial segments.

Asia-Pacific Performance Tires Market Insight

The Asia-Pacific performance tires market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and rising vehicle sales in countries such as China, Japan, and India. Growing consumer preference for high-performance vehicles and motorsport culture is supporting demand. Government initiatives promoting automotive safety and digital infrastructure are further fueling adoption. In addition, the expansion of local tire manufacturers and availability of cost-effective performance tires are making them accessible to a wider population.

Japan Performance Tires Market Insight

The Japan performance tires market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced automotive technology, high vehicle penetration, and consumer focus on efficiency and safety. The demand is driven by sports cars, luxury vehicles, and two-wheelers that require high-performance tires for improved handling and reliability. Integration with connected and automated vehicles is accelerating adoption. Furthermore, Japan’s aging population is contributing to the preference for tires that offer better stability and easier handling.

China Performance Tires Market Insight

The China performance tires market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and strong automotive industry. China is one of the largest markets for passenger cars, SUVs, and commercial vehicles, which drives the demand for performance and replacement tires. Government support for automotive safety standards and smart mobility initiatives is further enhancing market growth. Affordable local and imported tire options are expanding accessibility, supporting both OEM and aftermarket segments.

Performance Tires Market Share

The Performance Tires industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Bridgestone Corporation (Japan)

- Michelin (France)

- The Goodyear Tyre & Rubber Company (U.S.)

- Pirelli & C. S.p.A. (Italy)

- Sumitomo Corporation (Japan)

- Yokohama Tire Corporation (Japan)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- Nokian Tyres plc (Finland)

- CEAT Ltd. (India)

- Toyo Tire Corporation (Japan)

- Shandong Tang Ren Import and Export Trading Co., Ltd. (China)

- Hebei Huichao Machinery Parts Co., Ltd. (China)

- PDW GROUP OFFICIAL SITE (U.K.)

- Jiangxi Deyou Technology Co., Ltd. (China)

- Pengda Rubber Product Factory (China)

- Qingdao Keter Tyre Co. Limited Trading Company (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.