Global Peripheral Vascular Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

12.55 Billion

USD

20.52 Billion

2025

2033

USD

12.55 Billion

USD

20.52 Billion

2025

2033

| 2026 –2033 | |

| USD 12.55 Billion | |

| USD 20.52 Billion | |

|

|

|

|

Peripheral Vascular Surgical Devices Market Size

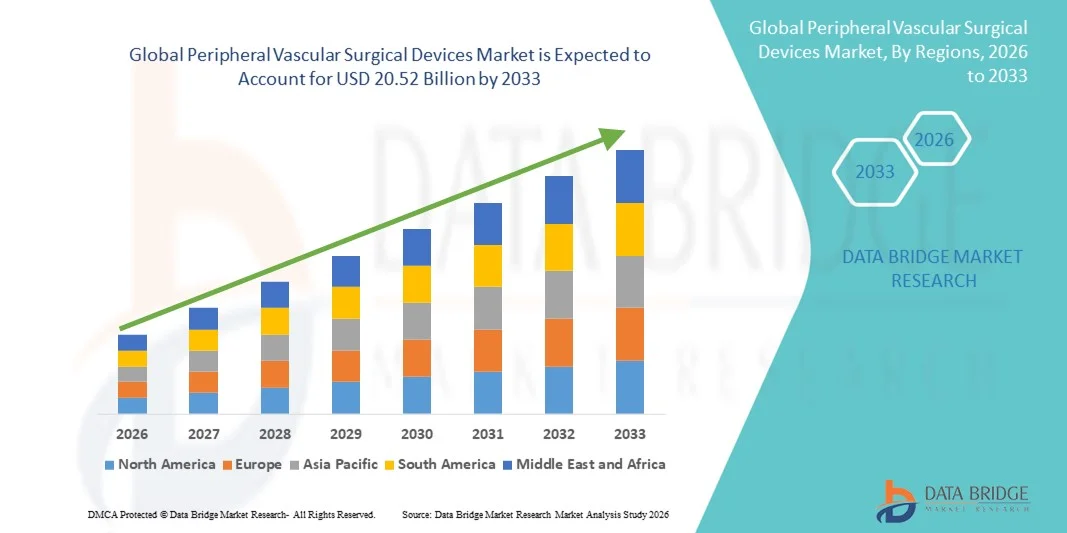

- The global peripheral vascular surgical devices market size was valued at USD 12.55 billion in 2025 and is expected to reach USD 20.52 billion by 2033, at a CAGR of 6.34% during the forecast period

- The market growth is largely fueled by the increasing prevalence of peripheral vascular diseases, rising geriatric population, and growing awareness regarding minimally invasive surgical treatments, leading to higher adoption of advanced vascular surgical devices in both hospital and specialty care settings

- Furthermore, rising demand for efficient, safe, and technologically advanced solutions for vascular interventions is establishing Peripheral Vascular Surgical Devices as a critical choice for treating conditions such as peripheral artery disease, aneurysms, and varicose veins. These converging factors are accelerating the uptake of Peripheral Vascular Surgical Devices solutions, thereby significantly boosting the industry's growth

Peripheral Vascular Surgical Devices Market Analysis

- Peripheral Vascular Surgical Devices, including advanced stents, catheters, and minimally invasive intervention tools, are increasingly vital components in the treatment of peripheral vascular diseases due to their ability to improve patient outcomes, reduce procedure times, and enhance procedural safety in both hospital and specialty care settings

- The escalating demand for these devices is primarily fueled by the rising prevalence of peripheral artery disease, increasing geriatric population, and growing preference for minimally invasive procedures over conventional surgeries

- North America dominated the peripheral vascular surgical devices market with the largest revenue share of 42.5% in 2025, driven by the high incidence of vascular disorders, established healthcare infrastructure, and the presence of major device manufacturers, with the U.S. experiencing substantial adoption of innovative vascular surgical solutions

- Asia-Pacific is expected to be the fastest growing region in the peripheral vascular surgical devices market during the forecast period, registering a CAGR of approximately 9.8%, supported by rising awareness of vascular diseases, increasing healthcare expenditure, and rapid adoption of minimally invasive technologies in emerging countries like China and India

- The Angioplasty Stents segment dominated the largest market revenue share of 35.7% in 2025, driven by their widespread adoption in treating coronary and peripheral artery diseases

Report Scope and Peripheral Vascular Surgical Devices Market Segmentation

|

Attributes |

Peripheral Vascular Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Peripheral Vascular Surgical Devices Market Trends

Shift Toward Minimally Invasive and Advanced Surgical Techniques

- A significant and accelerating trend in the global peripheral vascular surgical devices market is the increasing adoption of minimally invasive and image-guided surgical procedures

- These techniques aim to reduce patient recovery time, minimize complications, and improve procedural accuracy. Hospitals and specialty clinics are increasingly investing in advanced devices such as endovascular catheters, balloon angioplasty systems, and stents to meet the demand for precise vascular interventions

- For instance, in 2024, several leading cardiovascular centers in North America and Europe adopted next-generation peripheral vascular stent systems equipped with improved navigational capabilities, enhancing procedural efficiency and patient outcomes

- The integration of imaging modalities such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) with peripheral vascular devices is providing clinicians with real-time visualization, enabling better decision-making during interventions

- Furthermore, innovations in device materials and coatings are improving long-term patency rates and reducing the risk of restenosis, driving wider adoption of advanced peripheral vascular devices

- This trend toward safer, less invasive, and more precise interventions is transforming treatment protocols and encouraging global healthcare providers to modernize their vascular surgery capabilities

Peripheral Vascular Surgical Devices Market Dynamics

Driver

Rising Incidence of Peripheral Artery Disease and Cardiovascular Disorders

- The growing prevalence of peripheral artery disease (PAD), diabetes-related vascular complications, and other cardiovascular disorders is a key driver for the expansion of the peripheral vascular surgical devices market

- Aging populations, unhealthy lifestyles, and increased sedentary behavior are contributing to the rising incidence of vascular conditions worldwide

- For instance, in 2025, hospitals across Asia-Pacific reported an increase in endovascular procedures to manage critical limb ischemia and other peripheral vascular conditions, resulting in higher demand for specialized catheters, balloons, and stents

- Enhanced awareness of early diagnosis and preventive care, along with the availability of advanced treatment options, is motivating patients to seek timely interventions

- The presence of skilled interventional cardiologists and growing hospital infrastructure, particularly in emerging markets, further supports the adoption of peripheral vascular surgical devices

- In addition, government initiatives and insurance coverage policies promoting cardiovascular health and intervention are contributing to steady market growth

Restraint/Challenge

High Device Costs and Procedural Complexity

- The high cost of advanced peripheral vascular surgical devices and associated interventions is a significant barrier, particularly in developing regions and for smaller healthcare facilities

- The procurement of specialized catheters, stents, and imaging-integrated devices can be expensive, limiting access for some patients

- For instance, hospitals in Latin America and Africa often rely on conventional surgical techniques due to budget constraints and limited availability of modern vascular devices

- Complex procedural requirements and the need for highly trained medical professionals can also slow adoption in regions with limited specialist availability

- Postoperative risks and patient hesitation regarding invasive interventions may further restrain market growth

- Addressing these challenges through cost-effective device development, improved clinician training, and broader healthcare infrastructure development will be essential for sustained market expansion globally

Peripheral Vascular Surgical Devices Market Scope

The market is segmented on the basis of product and end users.

- By Product

On the basis of product, the Peripheral Vascular Surgical Devices market is segmented into Angioplasty Balloons, Angioplasty Stents, Catheters, EVAR Stent Grafts, Inferior Vena Cava (IVC) Filters, Plaque Modification Devices, Hemodynamic Flow Alteration Devices, and Other Devices. The Angioplasty Stents segment dominated the largest market revenue share of 35.7% in 2025, driven by their widespread adoption in treating coronary and peripheral artery diseases. Stents provide long-term vessel patency and are preferred for complex lesions. The segment benefits from technological innovations such as drug-eluting and bioresorbable stents, which reduce restenosis rates. Increasing prevalence of peripheral arterial disease (PAD) globally fuels demand. Hospitals and specialty clinics widely adopt stents due to their proven efficacy. High procedural success rates and minimal invasiveness enhance patient acceptance. Insurance coverage and reimbursement in developed regions support market share. Rising awareness among clinicians regarding post-procedural outcomes further strengthens revenue dominance. Continuous improvements in stent design and flexibility increase usage in difficult anatomies. Patient preference for minimally invasive treatments also supports growth. Growing incidence of diabetes and obesity indirectly drives stent utilization.

The Plaque Modification Devices segment is expected to witness the fastest growth, registering a CAGR of 12.8% from 2026 to 2033, driven by rising adoption of atherectomy and lithotripsy devices for complex vascular lesions. These devices enable safe removal or modification of calcified plaques, improving procedural outcomes. Increasing use in peripheral arterial disease management boosts uptake. Rising geriatric population with higher vascular calcification rates supports adoption. Technological advancements, including directional and orbital atherectomy, fuel growth. Hospitals and interventional cardiology centers prefer these devices for high-risk cases. Integration with imaging systems enhances precision and safety. Awareness campaigns and training programs increase clinician familiarity. Shorter procedure times and reduced complications drive patient preference. Expanding applications in coronary interventions also contribute to growth. Emerging markets with growing PAD prevalence provide additional opportunities.

- By End Users

On the basis of end users, the Peripheral Vascular Surgical Devices market is segmented into Hospitals, Clinics, Ambulatory Surgical Centres, Specialty Clinics, and Others. The Hospitals segment accounted for the largest market revenue share of 48.9% in 2025, driven by high patient volumes and the availability of advanced vascular intervention infrastructure. Hospitals are equipped with cath labs and imaging modalities required for complex procedures. Large-scale treatment facilities prefer stents, catheters, and EVAR devices for critical cases. Trained interventional cardiologists and vascular surgeons enhance adoption. Availability of post-procedure care and emergency support strengthens hospitals’ dominance. Insurance coverage for hospital-based procedures supports market revenue. Rising incidence of cardiovascular diseases globally contributes to high utilization. Integration of minimally invasive techniques in hospitals encourages procedural efficiency. Hospitals often conduct complex hybrid procedures requiring multiple devices. Research collaborations and clinical trials further support device adoption. High patient trust in hospital facilities drives demand.

The Ambulatory Surgical Centres segment is expected to witness the fastest growth, with a CAGR of 11.5% from 2026 to 2033, fueled by the increasing trend of outpatient vascular interventions. These centers offer cost-effective alternatives to hospital-based procedures, with shorter recovery times and lower procedural costs. Adoption of minimally invasive angioplasty and stent procedures in ASCs is rising. Improved imaging systems and portable catheterization labs support growth. Patients prefer ASCs for convenience and reduced hospital stays. Rising number of specialty vascular ASCs in developed regions boosts adoption. Expanding insurance coverage for outpatient procedures also contributes to growth. Focus on patient satisfaction and personalized care accelerates uptake. Availability of trained interventional staff in ASCs ensures procedure safety. Emerging markets are witnessing the establishment of ASCs, supporting market expansion. Increasing awareness of non-invasive vascular treatments drives growth.

Peripheral Vascular Surgical Devices Market Regional Analysis

- North America dominated the peripheral vascular surgical devices market with the largest revenue share of 42.5% in 2025

- Driven by the high incidence of vascular disorders, established healthcare infrastructure, and the presence of major device manufacturers

- The market accounted for a significant portion of the regional market due to substantial adoption of innovative vascular surgical solutions, advanced clinical practices, and ongoing research initiatives

U.S. Peripheral Vascular Surgical Devices Market Insight

The U.S. peripheral vascular surgical devices market captured the largest revenue share within North America in 2025, fueled by the widespread use of advanced vascular surgical devices, increasing prevalence of peripheral vascular diseases, and strong presence of key medical device companies. Growing demand for minimally invasive procedures and continuous innovation in device technology further propels the market in the country.

Europe Peripheral Vascular Surgical Devices Market Insight

The Europe peripheral vascular surgical devices market is projected to expand at a substantial CAGR throughout the forecast period, driven by well-established healthcare infrastructure, increasing prevalence of vascular disorders, and technological advancements in surgical solutions. Countries such as Germany, France, and the U.K. are witnessing strong growth in both hospitals and specialty clinics, supporting adoption of advanced vascular surgical devices.

U.K. Peripheral Vascular Surgical Devices Market Insight

The U.K. peripheral vascular surgical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of vascular diseases, favorable reimbursement policies, and adoption of minimally invasive surgical procedures. The presence of specialty clinics and advanced hospital networks further supports market expansion.

Germany Peripheral Vascular Surgical Devices Market Insight

Germany’s peripheral vascular surgical devices market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare standards, robust research and development infrastructure, and strong emphasis on innovative surgical technologies. The integration of advanced vascular devices in hospitals and specialty clinics is further driving market growth.

Asia-Pacific Peripheral Vascular Surgical Devices Market Insight

The Asia-Pacific peripheral vascular surgical devices market is poised to grow at the fastest CAGR of approximately 9.8% during the forecast period, supported by rising awareness of vascular diseases, increasing healthcare expenditure, and rapid adoption of minimally invasive technologies in emerging countries such as China and India. Expansion of hospital networks, government initiatives, and growing patient population are key factors propelling growth in the region.

Japan Peripheral Vascular Surgical Devices Market Insight

The Japan peripheral vascular surgical devices market is witnessing growth due to increasing prevalence of peripheral vascular diseases, advanced healthcare infrastructure, and a strong focus on minimally invasive surgical procedures. Rising adoption of innovative vascular devices in hospitals and specialty clinics is driving market expansion.

China Peripheral Vascular Surgical Devices Market Insight

China peripheral vascular surgical devices market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising awareness of vascular disorders, expanding healthcare infrastructure, growing patient population, and rapid adoption of minimally invasive technologies. The availability of advanced vascular surgical devices and government support for healthcare modernization are significant growth drivers.

Peripheral Vascular Surgical Devices Market Share

The Peripheral Vascular Surgical Devices industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Boston Scientific Corporation (U.S.)

• Abbott Laboratories (U.S.)

• Terumo Corporation (Japan)

• BD (U.S.)

• Cook Medical (U.S.)

• Cordis (U.S.)

• B. Braun Melsungen AG (Germany)

• Cardinal Health (U.S.)

• Meril Life Sciences (India)

• MicroPort Scientific Corporation (China)

• Getinge AB (Sweden)

• Endologix, Inc. (U.S.)

• WL Gore & Associates (U.S.)

• AngioDynamics, Inc. (U.S.)

• BIOTRONIK (Germany)

• Lepu Medical Technology (China)

• Penumbra, Inc. (U.S.)

• iVascular S.L.U. (Spain)

• Nipro Corporation (Japan)

Latest Developments in Global Peripheral Vascular Surgical Devices Market

- In March 2022, Shockwave Medical Inc. introduced the Shockwave M5+ Peripheral Intravascular Lithotripsy (IVL) catheter, designed to reduce treatment time and expand IVL therapy options for peripheral arterial disease (PAD) by effectively modifying calcified arterial plaque in challenging lesion sites. This product marked a substantial advancement in treating vascular calcification non‑surgically and expanding peripheral IVL use

- In March 2023, Shockwave Medical launched the Shockwave L6 Peripheral IVL catheter, engineered specifically for larger peripheral vessels such as the iliac and common femoral arteries, using targeted lithotripsy to break down calcified plaque and improve procedural outcomes for PAD patients. This innovation broadened the reach of IVL technology in peripheral vascular intervention

- In June 2023, Endologix (now TriReme Medical) received U.S. FDA approval for the Detour System, an endovascular bypass device that restores blood flow around long superficial femoral artery (SFA) blockages without open surgery, expanding endovascular treatment options in the PAD space. This approval provided clinicians additional minimally invasive options beyond conventional angioplasty and stenting

- In October 2023, the CardioFlow FreedomFlow Orbital Atherectomy System won U.S. FDA 510(k) clearance, offering an innovative rotational atherectomy approach to treat severely calcified peripheral arterial lesions and add competition to the PAD plaque modification device landscape. This clearance reinforced the trend toward technologies addressing complex vascular calcification

- In June 2024, Philips received U.S. FDA premarket approval (PMA) for its Duo Venous Stent System targeting venous blockages, including chronic deep vein thrombosis (DVT), significantly enhancing treatment choices for venous disease within the peripheral vascular category. The Duo Venous Stent System aims to improve clinical results and broaden the device portfolio for peripheral venous interventions

- In June 2024, Abbott’s Esprit BTK (Below‑The‑Knee) System, which uses an eluting resorbable scaffold to treat chronic limb‑threatening ischemia (CLTI), received U.S. FDA approval, introducing a novel scaffold platform dedicated to BTK applications and showcasing progress in targeted PAD device solutions. This approval enabled clinical adoption of a next‑generation scaffold approach for severe limb ischemia

- In October 2024, Boston Scientific Corporation completed the acquisition of Silk Road Medical Inc. for approximately USD 1.18 billion, significantly strengthening Boston Scientific’s peripheral vascular technology portfolio by bringing Silk Road’s TransCarotid Artery Revascularization (TCAR) platform and complementary endovascular expertise into the fold. This strategic move bolstered Boston Scientific’s capabilities in both carotid and peripheral intervention segments

- In July 2025, MicroPort Endovastec announced the first commercial use of its Talos Thoracic Stent Graft System in Argentina, successfully treating a Stanford type B aortic dissection using a single personalized graft with reduced risk of spinal cord injury, highlighting advancements in complex vascular graft technology. This real‑world application showcased growing global utilization of advanced stent graft systems for thoracic aortic disease

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.