Global Pharmaceuticals Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

2.30 Billion

2025

2033

USD

1.35 Billion

USD

2.30 Billion

2025

2033

| 2026 –2033 | |

| USD 1.35 Billion | |

| USD 2.30 Billion | |

|

|

|

|

What is the Global Pharmaceuticals Market Size and Growth Rate?

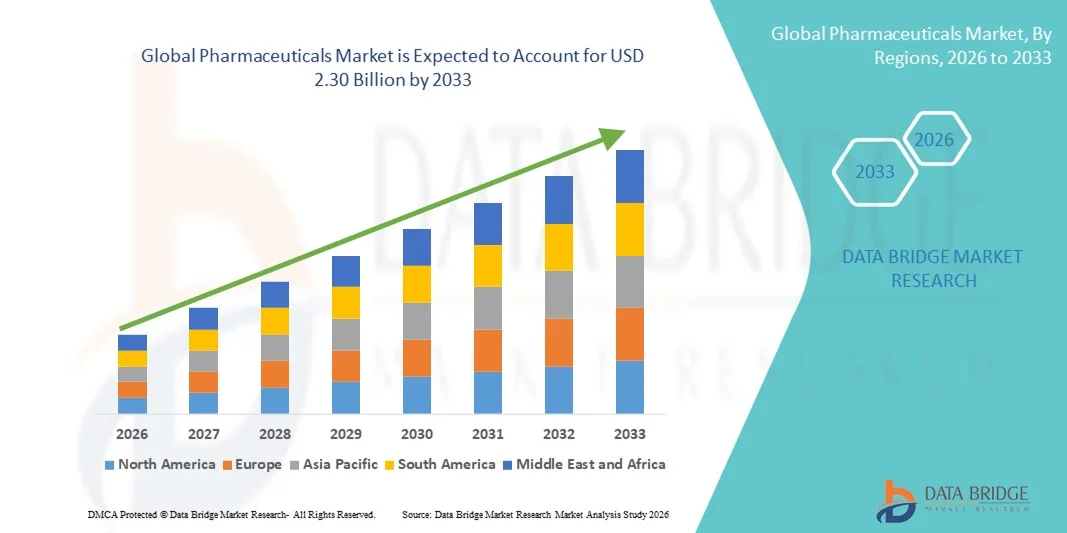

- The global pharmaceuticals market size was valued at USD 1.35 billion in 2025 and is expected to reach USD 2.30 billion by 2033, at a CAGR of 6.95% during the forecast period

- Major factors that are expected to boost the growth of the pharmaceuticals market in the forecast period are the rise in the life expectancy

- Furthermore, the rising presence of chronic and infectious diseases is further anticipated to propel the growth of the pharmaceuticals market

What are the Major Takeaways of Pharmaceuticals Market?

- The short product lifecycles and of advancing blockbuster drugs is further projected to impede the growth of the pharmaceuticals market in the timeline period

- In addition, the substantial increase in the research and development investments in the pharmaceuticals industry will further provide potential opportunities for the growth of the pharmaceuticals market

- North America dominated the pharmaceuticals market with a 41.8% revenue share in 2025, driven by strong R&D infrastructure, high healthcare expenditure, and rapid adoption of advanced biologics, specialty drugs, and precision medicine across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.71% from 2026 to 2033, driven by expanding healthcare infrastructure, rising chronic disease burden, and increasing pharmaceutical manufacturing capacity across China, India, Japan, South Korea, and Southeast Asia

- The Drugs segment dominated the market with a 72.4% share in 2025, driven by high global consumption of prescription and over-the-counter medications for chronic and acute diseases

Report Scope and Pharmaceuticals Market Segmentation

|

Attributes |

Pharmaceuticals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pharmaceuticals Market?

Accelerating Shift Toward Biologics, Personalized Medicine, and Advanced Therapeutics

- The Pharmaceuticals market is witnessing strong adoption of biologics, biosimilars, gene therapies, and mRNA-based treatments designed to address complex and chronic diseases with higher precision and improved patient outcomes

- Manufacturers are increasingly investing in personalized medicine, targeted oncology therapies, and rare disease drug development, supported by advancements in genomics, biomarker identification, and precision diagnostics

- Growing emphasis on digital health integration, AI-driven drug discovery, and decentralized clinical trials is transforming research efficiency and reducing time-to-market

- For instance, leading companies such as Pfizer, Roche, Novartis, and AstraZeneca are expanding pipelines in oncology, immunology, and advanced biologics to strengthen innovation-driven growth

- Increasing need for faster regulatory approvals, adaptive trial designs, and breakthrough therapy designations is accelerating development of high-value specialty drugs

- As global disease burden rises and healthcare systems focus on outcome-based treatment models, Pharmaceuticals will remain central to long-term healthcare innovation and therapeutic advancement

What are the Key Drivers of Pharmaceuticals Market?

- Rising prevalence of chronic diseases such as cancer, diabetes, cardiovascular disorders, and autoimmune conditions is driving sustained demand for innovative and long-term treatment solutions

- For instance, in 2025, several major pharmaceutical companies expanded investments in oncology pipelines, GLP-1 therapies, and immunotherapy platforms to address increasing global patient populations

- Growing aging population across the U.S., Europe, and Asia-Pacific is significantly boosting prescription drug consumption and specialty therapy demand

- Advancements in biotechnology, cell and gene therapy platforms, mRNA technologies, and AI-based drug discovery tools have improved development success rates and therapeutic precision

- Increasing healthcare expenditure, broader insurance coverage, and expansion of emerging market access are strengthening pharmaceutical distribution networks

- Supported by continuous R&D investments, strategic mergers and acquisitions, and global clinical expansion, the pharmaceuticals market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Pharmaceuticals Market?

- High costs associated with drug development, clinical trials, regulatory compliance, and biologics manufacturing create financial pressure and extend commercialization timelines

- For instance, during 2024–2025, pricing regulations, patent expirations, and biosimilar competition impacted revenue streams for several blockbuster drugs globally

- Complex regulatory requirements, safety monitoring standards, and pharmacovigilance obligations increase operational burdens for pharmaceutical manufacturers

- Limited affordability and unequal access to advanced therapies in low- and middle-income countries restrict broader market penetration

- Growing competition from generic drug manufacturers and biosimilar producers creates pricing pressure and margin constraints

- To address these challenges, companies are focusing on cost-efficient manufacturing, strategic collaborations, lifecycle management, digital transformation, and expansion into high-growth therapeutic areas to strengthen global adoption and sustain competitive advantage in the pharmaceuticals market

How is the Pharmaceuticals Market Segmented?

The market is segmented on the basis of type, indication, and distribution channel.

- By Type

On the basis of type, the pharmaceuticals market is segmented into Drugs and Vaccines. The Drugs segment dominated the market with a 72.4% share in 2025, driven by high global consumption of prescription and over-the-counter medications for chronic and acute diseases. Rising prevalence of cancer, cardiovascular disorders, diabetes, and autoimmune conditions continues to fuel strong demand for branded and generic drugs worldwide. Continuous innovation in small molecules, biologics, and specialty therapeutics further strengthens segment dominance.

The Vaccines segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing immunization programs, rising awareness of preventive healthcare, and expansion of mRNA and next-generation vaccine platforms. Government funding, pandemic preparedness initiatives, and global vaccination drives are accelerating long-term vaccine market expansion.

- By Indication

On the basis of indication, the market is segmented into Oncology, Cardiovascular Diseases, Infectious Diseases, Neurology, Metabolic Disorders, Respiratory Diseases, and Others. The Oncology segment dominated the market with a 28.6% share in 2025, driven by increasing cancer incidence, rapid adoption of immunotherapies, targeted therapies, and precision medicine approaches. Strong R&D pipelines and regulatory approvals for breakthrough cancer drugs continue to boost segment growth.

The Metabolic Disorders segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising global prevalence of diabetes and obesity. Growing demand for GLP-1 therapies, insulin innovations, and long-acting metabolic treatments is accelerating segment expansion across developed and emerging markets.

- By Distribution Channel

On the basis of distribution channel, the pharmaceuticals market is segmented into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. The Hospital Pharmacies segment dominated the market with a 46.1% share in 2025, supported by high prescription volumes for specialty drugs, biologics, oncology therapies, and injectable treatments administered in clinical settings. Increasing hospital admissions and advanced treatment procedures contribute significantly to segment leadership.

The Online Pharmacies segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by digital health adoption, e-prescriptions, doorstep delivery services, and competitive pricing models. Rising internet penetration and consumer preference for convenient medicine access are strengthening the digital pharmaceutical distribution ecosystem globally.

Which Region Holds the Largest Share of the Pharmaceuticals Market?

- North America dominated the pharmaceuticals market with a 41.8% revenue share in 2025, driven by strong R&D infrastructure, high healthcare expenditure, and rapid adoption of advanced biologics, specialty drugs, and precision medicine across the U.S. and Canada. The presence of leading pharmaceutical companies, robust regulatory frameworks, and continuous innovation in oncology, immunology, and rare disease treatments continue to fuel regional growth

- Leading companies in North America are investing heavily in gene therapies, mRNA platforms, AI-driven drug discovery, and advanced clinical trial models, strengthening the region’s global pharmaceutical leadership

- High concentration of research institutions, strong patent protection systems, and sustained government and private-sector funding further reinforce long-term market dominance

U.S. Pharmaceuticals Market Insight

The U.S. is the largest contributor in North America, supported by extensive biopharmaceutical R&D, strong presence of global pharmaceutical giants, and high demand for specialty and high-value drugs. Increasing approvals of breakthrough therapies, expansion of oncology pipelines, and growing adoption of personalized medicine significantly drive market expansion.

Canada Pharmaceuticals Market Insight

Canada contributes steadily to regional growth, driven by expanding biotechnology research, supportive healthcare policies, and increasing investment in innovative drug development. Strong collaboration between research institutions and pharmaceutical companies further supports domestic production and clinical advancements.

Asia-Pacific Pharmaceuticals Market

Asia-Pacific is projected to register the fastest CAGR of 7.71% from 2026 to 2033, driven by expanding healthcare infrastructure, rising chronic disease burden, and increasing pharmaceutical manufacturing capacity across China, India, Japan, South Korea, and Southeast Asia. Growing government initiatives to strengthen domestic drug production and improve healthcare access accelerate regional expansion.

China Pharmaceuticals Market Insight

China leads the region due to large-scale pharmaceutical manufacturing, increasing biologics development, and strong government support for innovation-driven drug research. Expanding domestic demand and export activities further boost market growth.

Japan Pharmaceuticals Market Insight

Japan shows steady growth supported by advanced healthcare systems, aging population trends, and strong focus on innovative and specialty drugs. Continuous R&D investment sustains long-term market stability.

India Pharmaceuticals Market Insight

India is emerging as a major growth hub driven by its strong generic drug manufacturing base, expanding biosimilar production, and rising healthcare accessibility. Government-backed initiatives further enhance export competitiveness.

South Korea Pharmaceuticals Market Insight

South Korea contributes significantly through rapid biotechnology advancements, vaccine production capacity, and growing investment in cell and gene therapy research, strengthening the region’s pharmaceutical innovation ecosystem.

Which are the Top Companies in Pharmaceuticals Market?

The pharmaceuticals industry is primarily led by well-established companies, including:

- Pfizer, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- GSK plc. (U.K.)

- AstraZeneca (U.K.)

- Sanofi (France)

- Novo Nordisk A/S (Denmark)

- Lilly (U.S.)

- AbbVie, Inc. (U.S.)

- Sun Pharmaceuticals Industries Ltd. (India)

- Takeda Pharmaceuticals Company Limited. (Japan)

- Cipla Inc. (India)

- Bristol-Myers Squibb Company (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Ipsen (France)

What are the Recent Developments in Global Pharmaceuticals Market?

- In March 2025, Daiichi Sankyo launched Datroway (datopotamab deruxtecan) in Japan for the treatment of adult patients with hormone receptor positive and HER2 negative unresectable or recurrent breast cancer following prior chemotherapy, expanding its oncology portfolio in targeted antibody-drug conjugates. This launch strengthens the company’s presence in advanced breast cancer therapeutics and reinforces innovation in precision oncology treatments

- In February 2025, Medexus Pharmaceuticals announced the commercial availability of GRAFAPEX (treosulfan) for Injection in the U.S., following FDA approvals completed one month earlier and achieving full commercial launch in early 2025. This milestone enhances treatment accessibility in the transplant conditioning segment and supports expansion of specialized oncology care in the U.S. market

- In January 2025, AstraZeneca revealed a CUSD 820 million, USD 570 million, investment in Canada to expand its Toronto facility and create 700 new jobs, with support from Ontario’s CUSD 16.1 million contribution. This investment strengthens research and development capabilities, advances global clinical studies, and reinforces Canada’s life sciences ecosystem

- In January 2025, Daiichi Sankyo secured full intellectual property rights for gatipotuzumab from Glycotope for USD 132.5 million, including milestone payments, supporting development of DS-3939, a TA-MUC1-directed antibody-drug conjugate currently in Phase 1/2 trials for multiple cancers. This acquisition enhances the company’s oncology pipeline and strengthens its innovation strategy in targeted cancer therapies

- In January 2025, Sanofi’s Sarclisa, an anti-CD38 therapy, received regulatory approval in China for newly diagnosed multiple myeloma patients ineligible for transplant, based on positive IMROZ Phase 3 study outcomes. This approval expands treatment options in the Chinese oncology market and reinforces Sanofi’s leadership in hematology therapies

- In January 2025, AstraZeneca Pharma India Limited introduced Breztri Aerosphere in India, marking a major advancement in treatment options for patients with chronic obstructive pulmonary disease. This launch supports improved respiratory care access and strengthens AstraZeneca’s respiratory portfolio expansion in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.