Global Photo Detectors Market

Market Size in USD Billion

CAGR :

%

USD

2.04 Billion

USD

11.37 Billion

2025

2033

USD

2.04 Billion

USD

11.37 Billion

2025

2033

| 2026 –2033 | |

| USD 2.04 Billion | |

| USD 11.37 Billion | |

|

|

|

|

Photo Detectors Market Size

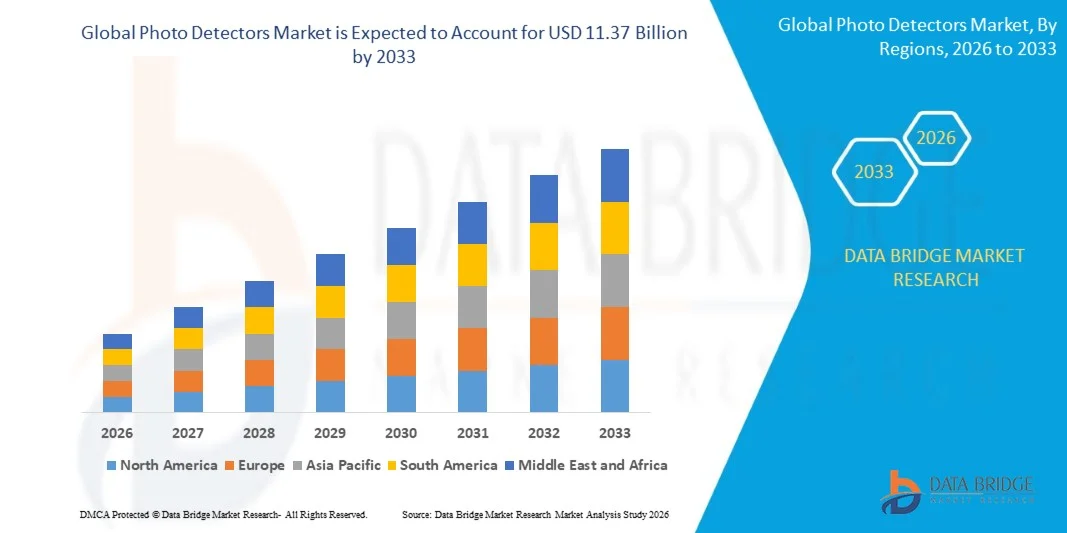

- The global photo detectors market size was valued at USD 2.04 billion in 2025 and is expected to reach USD 11.37 billion by 2033, at a CAGR of 9.56% during the forecast period

- The market growth is largely fuelled by increasing demand for high-speed optical communication, advanced imaging technologies, and LiDAR systems in automotive, consumer electronics, and industrial applications

- Growing adoption of smart devices, autonomous vehicles, and IoT technologies is further driving the need for precise and sensitive photodetection solutions

Photo Detectors Market Analysis

- The market is witnessing rapid growth due to increasing application in optical communication networks, automotive LiDAR, medical imaging, and industrial sensing systems

- Technological advancements in silicon photomultipliers, avalanche photodiodes, and quantum dot-based photodetectors are enhancing performance, reliability, and efficiency, fostering adoption across multiple end-use industries

- North America dominated the photo detectors market with the largest revenue share of 38.5% in 2025, driven by rising adoption of high-speed optical communication networks, industrial automation, and automotive LiDAR systems

- Asia-Pacific region is expected to witness the highest growth rate in the global photo detectors market, driven by rising demand for consumer electronics, automotive LiDAR systems, and industrial automation, coupled with increasing investments in technology manufacturing hubs in countries such as China, Japan, and South Korea

- The photon detector segment held the largest market revenue share in 2025, driven by its high sensitivity, fast response, and suitability for optical communication, LiDAR, and imaging applications. Photon detectors are widely adopted in telecom networks, automotive LiDAR systems, and industrial sensing, making them the preferred choice for high-precision and high-speed applications

Report Scope and Photo Detectors Market Segmentation

|

Attributes |

Photo Detectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Photo Detectors Market Trends

“Rising Adoption Across Optical Communication, Automotive, And Industrial Applications”

• Increasing deployment of photo detectors in optical communication systems is significantly shaping the market, as high-speed data transmission and reliable signal detection are critical for telecommunications infrastructure. Photo detectors are gaining traction due to their ability to offer high sensitivity, fast response, and low noise performance, driving adoption across fiber-optic networks, LiDAR, and imaging applications

• Growing utilization in automotive LiDAR, ADAS, and camera-based safety systems is accelerating demand for photo detectors. As autonomous and connected vehicles proliferate, manufacturers require high-performance photodetectors for distance measurement, obstacle detection, and advanced sensing, prompting collaborations between automotive suppliers and sensor developers to enhance functionality

• Industrial applications, including medical imaging, environmental monitoring, and spectroscopy, are further boosting market growth. Increased awareness of precision sensing and automation across manufacturing, healthcare, and research sectors is driving adoption of reliable photodetection solutions

• For instance, in 2024, Hamamatsu Photonics in Japan and First Sensor AG in Germany expanded their product portfolios with high-sensitivity photodetectors for LiDAR, imaging, and communication applications. These launches addressed rising demand for high-speed, high-accuracy detection systems in both industrial and automotive sectors

• While market adoption is rising, sustained growth depends on advancements in material technology, cost-effective production, and integration with compact systems. Companies are also focusing on improving scalability, reducing power consumption, and developing innovative photodetector solutions to meet growing demand across multiple applications

Photo Detectors Market Dynamics

Driver

“Increasing Demand From Telecommunications And Autonomous Vehicle Technologies”

• Rising demand for high-speed optical communication systems, including 5G networks and IoT infrastructure, is driving the need for advanced photodetectors that provide fast response and low noise performance. Telecommunications providers are upgrading network infrastructure to meet increasing data traffic, and photodetectors are critical in ensuring high-speed, low-latency signal transmission across fiber-optic networks. This trend is also encouraging the development of compact, energy-efficient, and multi-wavelength photodetection devices for next-generation communication systems

• Growing adoption of ADAS and autonomous driving systems in passenger and commercial vehicles is boosting market growth. Photodetectors enhance vehicle safety, collision avoidance, and parking assistance functions by enabling precise real-time object detection and monitoring. Automotive OEMs and Tier-1 suppliers are increasingly integrating multi-channel photodetectors into LiDAR and camera systems, supporting higher accuracy, reliability, and overall vehicle performance, while aligning with stricter global safety regulations

• Industrial automation and medical imaging requirements are further supporting growth, as photodetectors enable precise sensing, real-time monitoring, and reliable data capture. In industrial applications, these devices are used in robotics, assembly lines, and quality inspection systems to enhance efficiency and accuracy. In medical imaging, high-sensitivity photodetectors improve image resolution in modalities such as PET, CT, and fluorescence imaging, enabling early diagnosis and better patient outcomes

• For instance, in 2023, OSI Optoelectronics (U.S.) and Excelitas Technologies (Canada) reported increased incorporation of high-sensitivity photodetectors in automotive LiDAR, communication, and industrial imaging systems, enhancing performance and reliability. These deployments allow manufacturers to offer advanced sensor solutions capable of operating in harsh environments with higher precision. In addition, partnerships between photodetector developers and end-users are enabling tailored solutions that address specific application requirements, such as extended wavelength ranges and improved dynamic range

• Expansion in government and private sector investment for smart infrastructure, autonomous vehicles, and industrial automation is continuously driving the market. Initiatives for smart cities, intelligent transportation systems, and industrial IoT are increasing demand for precise and high-speed photodetection devices. Funding for research and development in photonic technologies is also accelerating the commercialization of innovative photodetector solutions, boosting adoption across multiple sectors

Restraint/Challenge

“High Cost And Complex Integration Compared To Conventional Sensors”

• The relatively higher cost of high-performance photodetectors compared to conventional sensors remains a key challenge, limiting adoption among price-sensitive manufacturers. Complex fabrication processes and material requirements contribute to elevated pricing, affecting market penetration

• Limited awareness and technical expertise in emerging markets restrict adoption, particularly for advanced applications such as LiDAR and high-speed optical communication. Lack of understanding regarding performance benefits can slow integration in certain industries

• Integration challenges also impact market growth, as photodetectors require precise alignment, calibration, and compatibility with electronic systems. Logistical complexities and sensitive handling requirements increase operational costs

• For instance, in 2024, suppliers in India and Southeast Asia reported slower uptake of high-performance photodetectors in industrial and automotive applications due to high costs, limited technical knowledge, and integration difficulties. These factors affected visibility and adoption in price-sensitive and emerging markets

• Overcoming these challenges will require cost-efficient production, technology transfer, and focused educational initiatives for manufacturers and end users. Collaborations with system integrators, automotive suppliers, and telecommunication operators can help unlock the long-term growth potential of the global photo detectors market, while developing cost-competitive and high-performance solutions will be essential for widespread adoption

Photo Detectors Market Scope

The photo detectors market is segmented on the basis of product type, type, and application.

• By Product Type

On the basis of product type, the market is segmented into photon detectors and thermal detectors. The photon detector segment held the largest market revenue share in 2025, driven by its high sensitivity, fast response, and suitability for optical communication, LiDAR, and imaging applications. Photon detectors are widely adopted in telecom networks, automotive LiDAR systems, and industrial sensing, making them the preferred choice for high-precision and high-speed applications.

The thermal detector segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its ability to detect infrared radiation without requiring cooling. Thermal detectors are increasingly used in aerospace, defense, industrial monitoring, and environmental sensing applications, offering cost-effective and reliable detection for a wide range of conditions.

• By Type

On the basis of type, the market is segmented into portable and stationary detectors. The stationary detector segment held the largest share in 2025, due to its widespread use in industrial automation, telecommunications, and medical imaging systems. Stationary detectors offer high accuracy, stability, and continuous operation, making them essential for fixed installations requiring precise monitoring and detection.

The portable detector segment is expected to grow rapidly from 2026 to 2033, driven by demand for handheld devices, field testing, and mobile LiDAR applications. Portable photodetectors provide flexibility, ease of transport, and rapid deployment, making them ideal for on-site inspections, research, and emergency applications.

• By Application

On the basis of application, the market is segmented into consumer electronics, industrial equipment, aerospace and defense, and automobile. The industrial equipment segment held the largest market revenue share in 2025, fueled by the need for precision sensing, automation, and quality control across manufacturing and process industries.

The automobile segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing integration of photodetectors in LiDAR, ADAS, and autonomous driving systems. Photodetectors enhance vehicle safety, enable obstacle detection, and support advanced driver assistance features, creating significant demand from OEMs and automotive suppliers.

Photo Detectors Market Regional Analysis

• North America dominated the photo detectors market with the largest revenue share of 38.5% in 2025, driven by rising adoption of high-speed optical communication networks, industrial automation, and automotive LiDAR systems

• Companies in the region are increasingly deploying photon and thermal detectors in advanced telecom infrastructure, smart factories, and autonomous vehicle applications to improve performance, efficiency, and safety

• This strong adoption is further supported by high R&D investment, technological expertise, and the presence of leading photodetector manufacturers, establishing North America as a key market for innovation and deployment of advanced detection technologies

U.S. Photo Detectors Market Insight

The U.S. photo detectors market captured the largest revenue share in 2025 within North America, fueled by widespread deployment of 5G networks, autonomous driving systems, and industrial automation solutions. The growing integration of photodetectors in LiDAR, ADAS, optical communication, and imaging applications is driving demand from telecom, automotive, and manufacturing sectors. Moreover, government initiatives supporting smart infrastructure, autonomous vehicles, and Industry 4.0 adoption are further accelerating market growth.

Europe Photo Detectors Market Insight

The Europe photo detectors market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing investments in smart infrastructure, renewable energy systems, and aerospace technologies. The region’s focus on innovation, digitalization, and sustainable industrial applications is supporting the adoption of high-sensitivity photon and thermal detectors. European companies are also leveraging collaborations and partnerships to integrate advanced photodetector solutions across consumer electronics, automotive, and defense applications.

U.K. Photo Detectors Market Insight

The U.K. photo detectors market is expected to witness strong growth from 2026 to 2033, driven by rising adoption of optical communication networks, industrial automation, and research in autonomous systems. The government’s emphasis on smart city initiatives and advanced manufacturing technologies is boosting demand for photon and thermal detectors. In addition, the U.K.’s robust technology ecosystem and availability of skilled workforce facilitate rapid deployment of photodetector-based solutions across multiple sectors.

Germany Photo Detectors Market Insight

The Germany photo detectors market is expected to witness the fastest growth from 2026 to 2033, fueled by strong industrial automation, automotive innovation, and aerospace applications. Germany’s focus on high-quality engineering and precision instrumentation encourages adoption of both stationary and portable photodetector systems. Integration of photodetectors in LiDAR, medical imaging, and optical communication networks is further driving growth while aligning with the country’s sustainability and innovation standards.

Asia-Pacific Photo Detectors Market Insight

The Asia-Pacific photo detectors market is expected to witness the highest growth rate from 2026 to 2033, driven by rapid industrialization, urbanization, and rising demand for high-speed optical communication and autonomous vehicles in countries such as China, Japan, and India. The region’s expanding manufacturing base for electronic components and automotive sensors is boosting affordability and accessibility. In addition, government initiatives in smart cities, Industry 4.0, and EV adoption are further enhancing market penetration.

Japan Photo Detectors Market Insight

The Japan photo detectors market is expected to witness robust growth from 2026 to 2033, owing to the country’s high-tech culture, strong automotive and electronics sectors, and demand for precision sensing. Adoption of photon and thermal detectors in LiDAR, industrial robotics, and medical imaging is driving growth. Furthermore, Japan’s emphasis on smart infrastructure, autonomous driving technology, and energy-efficient industrial solutions is fueling widespread market adoption.

China Photo Detectors Market Insight

The China photo detectors market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding middle-class adoption of smart devices, and strong industrial growth. The country is investing heavily in 5G, autonomous vehicles, and smart factory solutions, driving demand for high-performance photodetectors. Availability of cost-effective detectors, strong domestic manufacturers, and government support for digital infrastructure projects are key factors propelling the market in China.

Photo Detectors Market Share

The Photo Detectors industry is primarily led by well-established companies, including:

- Excelitas Technologies Corp. (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- LITE-ON Technology Inc. (Taiwan)

- Mirion Technologies, Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- OSRAM Opto Semiconductors GmbH (Germany)

- Panasonic Corporation (Japan)

- ROHM CO. LTD. (Japan)

- Thorlabs, Inc. (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- Eaton (Ireland)

- Texas Instruments Incorporated (U.S.)

- KEYENCE CORPORATION (Japan)

- Honeywell International Inc. (U.S.)

- Samsung (South Korea)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- NTT Electronics Corporation (Japan)

- Ophir Optronics Solutions Ltd. (U.K.)

- BaySpec, Inc. (U.S.)

- Banpil Photonics, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Photo Detectors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Photo Detectors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Photo Detectors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.