Global Photoresist Ancillaries Market

Market Size in USD Billion

CAGR :

%

USD

4.33 Billion

USD

6.78 Billion

2025

2033

USD

4.33 Billion

USD

6.78 Billion

2025

2033

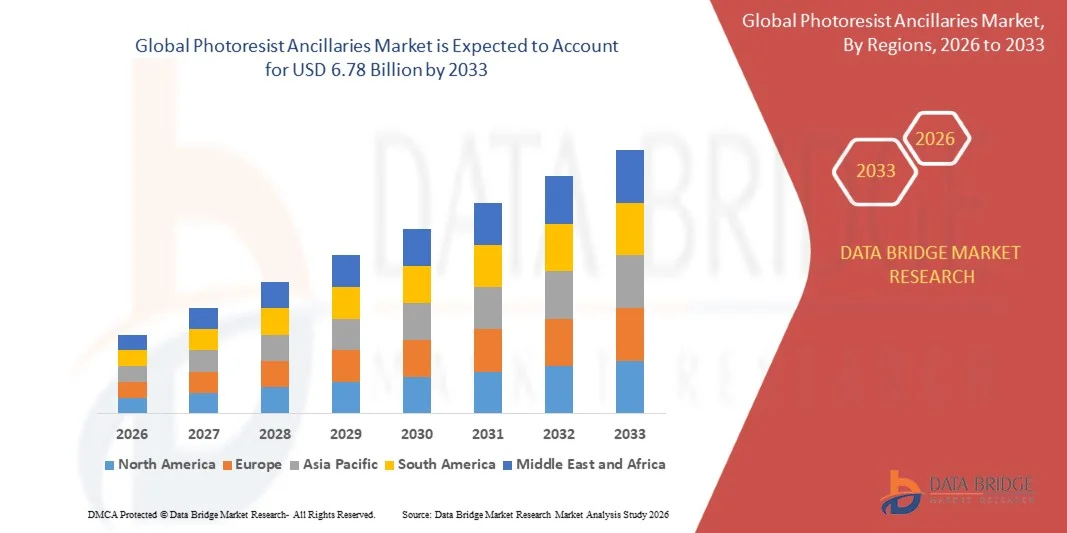

| 2026 –2033 | |

| USD 4.33 Billion | |

| USD 6.78 Billion | |

|

|

|

|

Global Photoresist Ancillaries Market Segmentation, By Photoresist Type (ArF Immersion Photoresist, ArF Dry Photoresist, KrF Photoresist, G-line and I-line Photoresist), Photoresist Ancillaries Type (Anti-reflective Coatings, Remover, Developer, and Others) Application (Semiconductors and ICs, LCDs, Printed Circuit Boards, and Others)- Industry Trends and Forecast to 2033

Photoresist Ancillaries Market Size

- The global photoresist ancillaries market size was valued at USD 4.33 billion in 2025 and is expected to reach USD 6.78 billion by 2033, at a CAGR of 5.75% during the forecast period

- The market growth is largely fuelled by the increasing demand for semiconductors and electronic devices, driving the need for advanced photoresist materials and related ancillary chemicals

- Rising adoption of miniaturized and high-performance integrated circuits is accelerating the use of photoresist ancillaries in wafer fabrication, photolithography, and microelectronics applications

Photoresist Ancillaries Market Analysis

- Growing semiconductor and electronics industries globally are driving the demand for photoresist ancillaries, as these chemicals are essential for precise patterning and device fabrication

- Increasing investments in advanced packaging, MEMS, and nanotechnology applications are contributing to higher consumption of specialty photoresist ancillaries, reinforcing market growth

- North America dominated the photoresist ancillaries market with the largest revenue share in 2025, driven by the presence of major semiconductor manufacturing hubs, technological advancements, and rising demand for integrated circuits and high-performance electronics

- Asia-Pacific region is expected to witness the highest growth rate in the global photoresist ancillaries market, driven by rapid industrialization, expansion of semiconductor fabs, and growing demand for consumer electronics and smart devices

- The ArF Immersion Photoresist segment held the largest market revenue share in 2025, driven by its widespread use in advanced semiconductor manufacturing for high-resolution and miniaturized IC patterns. ArF Immersion Photoresists support smaller feature sizes and high-density circuitry, making them highly preferred among leading semiconductor fabs

Report Scope and Photoresist Ancillaries Market Segmentation

|

Attributes |

Photoresist Ancillaries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Photoresist Ancillaries Market Trends

“Rising Demand for Advanced Semiconductor Manufacturing”

• The growing focus on high-performance and miniaturized semiconductor devices is significantly shaping the photoresist ancillaries market, as manufacturers increasingly prefer chemicals that enhance precision, efficiency, and yield in photolithography processes. Photoresist ancillaries are gaining traction due to their ability to improve coating uniformity, adhesion, and process reliability without compromising device quality. This trend strengthens their adoption across semiconductor fabrication, MEMS, and advanced electronics industries, encouraging suppliers to innovate with new formulations that meet evolving production requirements

• Increasing awareness around device miniaturization, high-density circuitry, and next-generation microelectronics has accelerated the demand for photoresist ancillaries in wafer fabrication, IC packaging, and PCB applications. Electronics manufacturers and technology companies are actively seeking ancillary chemicals that support high-resolution patterning, prompting collaborations between chemical suppliers and semiconductor fabs to enhance functional and process efficiency

• Industry standards and technological advancements are influencing purchasing decisions, with manufacturers emphasizing product quality, process compatibility, and consistency. These factors are helping brands differentiate their offerings in a competitive market while driving the adoption of high-purity and specialty ancillaries. Companies are increasingly using marketing and technical support services to reinforce product value and appeal to semiconductor manufacturers

• For instance, in 2024, Tokyo Ohka Kogyo Co., Ltd. in Japan and Dow in the U.S. expanded their photoresist ancillary product portfolios to support advanced lithography and next-generation semiconductor fabrication. These launches were introduced in response to rising demand for high-performance and miniaturized devices, with distribution across semiconductor fabs, electronics manufacturers, and specialty distributors. The products also emphasized process efficiency, reliability, and compatibility with cutting-edge photolithography technologies

• While demand for photoresist ancillaries is growing, sustained market expansion depends on continuous R&D, high-purity production, and maintaining functional performance comparable to emerging alternatives. Manufacturers are also focusing on improving scalability, supply chain reliability, and developing innovative solutions that balance cost, quality, and technological compatibility for broader adoption

Photoresist Ancillaries Market Dynamics

Driver

“Growing Adoption of Advanced Semiconductor Manufacturing Processes”

• Rising demand for smaller, faster, and higher-performance semiconductor devices is a major driver for the photoresist ancillaries market. Manufacturers are increasingly incorporating high-purity ancillary chemicals to improve lithography precision, coating uniformity, and pattern resolution, which supports device miniaturization and high-density packaging

• Expanding applications in semiconductor fabrication, MEMS, IC packaging, and PCB manufacturing are influencing market growth. Photoresist ancillaries help enhance process reliability, yield, and resolution while maintaining compatibility with advanced lithography equipment, enabling manufacturers to meet the stringent requirements of high-tech electronics

• Chemical suppliers are actively promoting photoresist ancillary solutions through product innovation, technical support, and certifications. These efforts are supported by the growing demand for efficient, high-quality, and reliable chemicals, and they also encourage partnerships between suppliers and semiconductor fabs to optimize process performance and reduce defects

• For instance, in 2023, Merck KGaA in Germany and TOK in Japan reported increased adoption of photoresist ancillary solutions in advanced semiconductor fabrication facilities. This expansion followed higher demand for high-purity chemicals compatible with EUV and DUV lithography processes, driving repeat orders and process differentiation. Both companies also emphasized technical service and process reliability in their campaigns to strengthen customer trust

• Although rising demand for advanced semiconductors supports market growth, wider adoption depends on cost optimization, availability of high-purity chemicals, and scalable production processes. Investment in supply chain efficiency, R&D, and advanced production technologies will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Cost And Stringent Quality Requirements”

• The relatively high cost of photoresist ancillaries compared to conventional chemicals remains a key challenge, limiting adoption among price-sensitive semiconductor manufacturers. High-purity production requirements and complex chemical formulations contribute to elevated pricing. In addition, fluctuations in raw material availability can affect supply stability and market penetration

• Awareness of specialized photoresist ancillaries remains limited among smaller fabs and emerging semiconductor manufacturers, particularly in developing regions. Limited understanding of functional benefits restricts adoption across certain applications, leading to slower uptake in some markets where technical support and training are minimal

• Supply chain and distribution challenges also impact market growth, as high-purity ancillaries require certified suppliers, strict handling procedures, and adherence to rigorous quality standards. Logistical complexities and sensitivity of chemicals increase operational costs. Companies must invest in controlled storage, proper transport, and technical support to maintain product integrity

• For instance, in 2024, distributors in South Korea and India supplying photoresist ancillaries to semiconductor fabs reported slower uptake due to high costs and limited awareness of specialized benefits. Compliance with purity and storage requirements added further barriers. These factors also limited shelf space and prioritization for high-demand facilities

• Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused technical and educational initiatives for manufacturers and end-users. Collaboration with fabs, electronics manufacturers, and certification bodies can help unlock the long-term growth potential of the global photoresist ancillaries market. In addition, developing cost-competitive, high-purity formulations and strengthening marketing strategies around process efficiency and technological compatibility will be essential for widespread adoption

Photoresist Ancillaries Market Scope

The market is segmented on the basis of photoresist type, photoresist ancillaries type, and application.

• By Photoresist Type

On the basis of photoresist type, the photoresist ancillaries market is segmented into ArF Immersion Photoresist, ArF Dry Photoresist, KrF Photoresist, and G-line and I-line Photoresist. The ArF Immersion Photoresist segment held the largest market revenue share in 2025, driven by its widespread use in advanced semiconductor manufacturing for high-resolution and miniaturized IC patterns. ArF Immersion Photoresists support smaller feature sizes and high-density circuitry, making them highly preferred among leading semiconductor fabs.

The KrF Photoresist segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its compatibility with mature semiconductor nodes and cost-effective adoption in various IC fabrication processes. KrF Photoresists are increasingly utilized in MEMS and legacy semiconductor applications, supporting broader market penetration.

• By Photoresist Ancillaries Type

On the basis of photoresist ancillaries type, the market is segmented into Anti-reflective Coatings, Remover, Developer, and Other. The Anti-reflective Coatings segment held the largest revenue share in 2025, as these chemicals improve pattern fidelity and reduce defects during photolithography processes, ensuring high-yield semiconductor production.

The Developer segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising need for precise development solutions in next-generation semiconductor fabrication and high-density IC manufacturing. Developer chemicals enable accurate pattern transfer and enhance process efficiency.

• By Application

On the basis of application, the market is segmented into Semiconductors and ICs, LCDs, Printed Circuit Boards, and Other. The Semiconductors and ICs segment held the largest market revenue share in 2025, fueled by strong demand for microelectronics, high-density ICs, and next-generation integrated circuits.

The Printed Circuit Boards segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for compact and high-performance electronic devices in consumer electronics, automotive, and industrial applications. PCB-related photoresist ancillaries are gaining traction due to their role in ensuring precise and reliable patterning.

Photoresist Ancillaries Market Regional Analysis

• North America dominated the photoresist ancillaries market with the largest revenue share in 2025, driven by the presence of major semiconductor manufacturing hubs, technological advancements, and rising demand for integrated circuits and high-performance electronics

• The region’s strong industrial base, well-established supply chains, and skilled workforce further support the adoption of advanced photoresist ancillaries

• High investments in R&D, government incentives, and the growing trend of miniaturization in electronics are accelerating market growth across semiconductors, ICs, and display applications

U.S. Photoresist Ancillaries Market Insight

The U.S. photoresist ancillaries market captured the largest revenue share in North America in 2025, fueled by the rapid expansion of semiconductor fabrication facilities and the rising demand for high-precision ICs and printed circuit boards. Increasing adoption of advanced photoresist materials, coupled with strong R&D initiatives and government support for semiconductor manufacturing, is driving market growth. The country’s focus on cutting-edge electronics, including microprocessors and memory devices, is further boosting demand for specialized photoresist ancillaries.

Europe Photoresist Ancillaries Market Insight

The Europe photoresist ancillaries market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the expansion of semiconductor manufacturing in countries such as Germany, France, and the Netherlands. Rising investments in industrial automation, electronics, and display technologies are creating increased demand for high-quality photoresist ancillaries. European players are also emphasizing environmentally friendly and sustainable photoresist solutions, contributing to market growth.

U.K. Photoresist Ancillaries Market Insight

The U.K. photoresist ancillaries market is expected to witness steady growth from 2026 to 2033, driven by investments in semiconductor research, electronics manufacturing, and advanced display technologies. The country’s focus on innovation, coupled with collaborations between semiconductor manufacturers and material suppliers, is fostering the adoption of specialized photoresist ancillaries. Increased government initiatives supporting high-tech industries are also positively influencing the market.

Germany Photoresist Ancillaries Market Insight

The Germany photoresist ancillaries market is expected to witness significant growth from 2026 to 2033, fueled by the country’s advanced semiconductor manufacturing infrastructure, strong R&D capabilities, and emphasis on high-precision electronics. German semiconductor companies are increasingly adopting innovative photoresist ancillaries to enhance device performance and meet the growing demand for miniaturized ICs and printed circuit boards. Sustainability and eco-friendly manufacturing practices are also contributing to market expansion.

Asia-Pacific Photoresist Ancillaries Market Insight

The Asia-Pacific photoresist ancillaries market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid expansion of semiconductor manufacturing facilities in China, Japan, South Korea, and Taiwan. Rising demand for smartphones, consumer electronics, and automotive electronics is fueling the adoption of advanced photoresist materials. The region’s favorable government policies, low manufacturing costs, and large-scale production capabilities are further accelerating market growth.

Japan Photoresist Ancillaries Market Insight

The Japan photoresist ancillaries market is expected to witness robust growth from 2026 to 2033 due to the country’s advanced semiconductor ecosystem, high-tech culture, and increasing demand for precision electronics. Adoption of cutting-edge ICs, displays, and semiconductor components is driving the need for specialized photoresist ancillaries. Japan’s focus on innovation, automation, and quality control is contributing to sustained market expansion.

China Photoresist Ancillaries Market Insight

The China photoresist ancillaries market accounted for the largest revenue share in Asia-Pacific in 2025, supported by the country’s massive semiconductor manufacturing base, rapid urbanization, and high adoption of consumer electronics. Government initiatives promoting semiconductor self-reliance, combined with strong domestic manufacturing capabilities and cost-effective production, are key factors driving growth. Increasing demand for ICs, printed circuit boards, and LCDs further fuels the market in China.

Photoresist Ancillaries Market Share

The Photoresist Ancillaries industry is primarily led by well-established companies, including:

- TOKYO OHKA KOGYO CO., LTD (Japan)

- JSR Corporation (Japan)

- Shin‑Etsu Chemical Co., Ltd (Japan)

- Sumitomo Chemical Co., Ltd (Japan)

- Merck KGaA (Germany)

- allresist DE (Germany)

- Fujifilm Corporation (Japan)

- Micro Resist Technology GmbH (Germany)

- Avantor Performance Materials Inc. (U.S.)

- Dongjin Semichem Co., Ltd (South Korea)

- Entegris (U.S.)

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- Kanto Chemical Co., Inc. (Japan)

Latest Developments in Global Photoresist Ancillaries Market

- In August 2025, JSR Corporation (Japan) announced a strategic partnership with a leading semiconductor manufacturer to co-develop next-generation photoresist materials. This collaboration aims to expand JSR’s product portfolio and strengthen its presence in the high-performance segment, enabling the company to address evolving semiconductor fabrication needs and enhance its competitive positioning in the global market

- In September 2025, Dow Inc. (U.S.) launched a new line of environmentally friendly photoresist ancillaries designed to reduce the ecological footprint of semiconductor manufacturing. The initiative supports sustainable production practices, attracts environmentally conscious clients, and positions Dow as a forward-looking leader, potentially boosting its market share in a growing segment focused on green solutions

- In October 2025, Fujifilm Holdings Corporation (Japan) expanded its production capacity for advanced photoresist materials to meet rising demand from the semiconductor industry. The expansion ensures supply chain reliability, strengthens Fujifilm’s ability to serve high-growth segments, and reinforces its market leadership by addressing the increasing needs of semiconductor manufacturers worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Photoresist Ancillaries Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Photoresist Ancillaries Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Photoresist Ancillaries Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.