Global Physical Identity And Access Management Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

3.08 Billion

2025

2033

USD

1.07 Billion

USD

3.08 Billion

2025

2033

| 2026 –2033 | |

| USD 1.07 Billion | |

| USD 3.08 Billion | |

|

|

|

|

What is the Global Physical Identity and Access Management Market Size and Growth Rate?

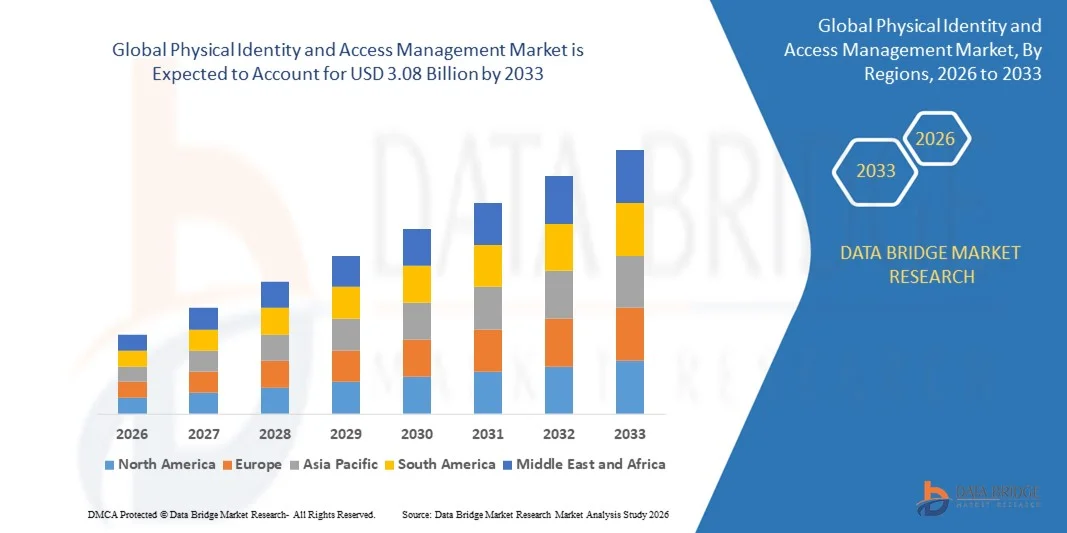

- The global physical identity and access management market size was valued at USD 1.07 billion in 2025 and is expected to reach USD 3.08 billion by 2033, at a CAGR of14.10% during the forecast period

- Rising stringent security compliances and government regulations is a crucial factor accelerating the market growth, also rising demand from organizations for diverse security systems to streamline security management of an entire organization or business

What are the Major Takeaways of Physical Identity and Access Management Market?

- Rising adoption of physical access control systems, growing awareness about data security across the emerging economies and rising government initiatives for standardizing security protocols are shifting from public sectors to private sectors are the major factors among others boosting the physical identity and access management market

- Moreover, rising adoption of physical access control systems, rising need for business intelligence and increasing technological advancements and modernization in the management solutions will further create new opportunities for physical identity and access management market

- North America dominated the physical identity and access management market with a 36.24% revenue share in 2025, driven by early adoption of advanced security technologies, high awareness of access governance, and strong regulatory compliance requirements across enterprises and government institutions in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rapid urbanization, smart city development, expanding enterprise infrastructure, and rising security concerns across China, India, Japan, South Korea, and Southeast Asia

- The Solutions segment dominated the market with a 61.8% share in 2025, driven by widespread adoption of integrated PIAM platforms that combine identity lifecycle management, credential issuance, access control, and compliance monitoring within a single system

Report Scope and Physical Identity and Access Management Market Segmentation

|

Attributes |

Physical Identity and Access Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Physical Identity and Access Management Market?

Increasing Shift Toward Integrated, Cloud-Enabled, and Smart Physical Identity and Access Management Solutions

- The physical identity and access management market is witnessing a strong shift toward integrated and cloud-based PIAM platforms that unify identity lifecycle management, credentialing, and physical access control

- Vendors are introducing AI-enabled, mobile-first, and IoT-integrated PIAM solutions that support real-time monitoring, automated provisioning, and advanced analytics

- Growing demand for scalable, centralized, and interoperable access management systems is driving adoption across enterprises, government facilities, critical infrastructure, and smart buildings

- For instance, companies such as HID Global, Honeywell, Siemens, Accenture, and IBM are enhancing PIAM offerings with biometric authentication, cloud dashboards, and API-based integrations

- Increasing need for compliance, workforce mobility, and enhanced security visibility is accelerating the transition from legacy access systems to modern PIAM platforms

- As organizations prioritize security convergence and digital transformation, Physical Identity and Access Management solutions are becoming critical for secure and efficient access governance

What are the Key Drivers of Physical Identity and Access Management Market?

- Rising demand for secure, centralized, and automated identity management to control physical access across large and distributed facilities

- For instance, in 2025, leading vendors such as HID Global, Siemens, and Honeywell upgraded their PIAM solutions with cloud deployment options, AI-driven analytics, and improved interoperability

- Growing adoption of smart buildings, data centers, airports, healthcare facilities, and industrial sites is boosting demand for advanced physical access control systems across the U.S., Europe, and Asia-Pacific

- Advancements in biometrics, RFID, mobile credentials, and cloud computing have enhanced system accuracy, scalability, and operational efficiency

- Rising focus on regulatory compliance, insider threat mitigation, and zero-trust security frameworks is creating sustained demand for PIAM platforms

- Supported by increasing investments in security infrastructure and digital transformation initiatives, the Physical Identity and Access Management market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Physical Identity and Access Management Market?

- High implementation and integration costs associated with advanced PIAM systems limit adoption among small and medium-sized organizations

- For instance, during 2024–2025, rising hardware costs, system customization requirements, and skilled labor shortages increased total deployment expenses for enterprises

- Complexity in integrating PIAM platforms with legacy access control systems, HR databases, and IT identity management tools creates operational challenges

- Limited awareness in emerging markets regarding PIAM benefits, compliance requirements, and best security practices slows adoption

- Competition from standalone access control systems, legacy badge solutions, and IT-focused IAM platforms creates pricing pressure and slows replacement cycles

- To address these challenges, companies are focusing on modular deployments, cloud-based pricing models, user training, and enhanced interoperability to expand global adoption of Physical Identity and Access Management solutions

How is the Physical Identity and Access Management Market Segmented?

The market is segmented on the basis of types, anatomy, and end-user.

- By Types

On the basis of types, the physical identity and access management market is segmented into Solutions and Services. The Solutions segment dominated the market with a 61.8% share in 2025, driven by widespread adoption of integrated PIAM platforms that combine identity lifecycle management, credential issuance, access control, and compliance monitoring within a single system. Organizations across government, BFSI, and enterprises increasingly deploy solutions to ensure centralized access governance, real-time visibility, and regulatory compliance. Growing demand for cloud-based and AI-enabled PIAM software further strengthens solution adoption.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for consulting, system integration, customization, training, and managed security services. Increasing complexity of PIAM deployments and integration with legacy IT and physical security infrastructure is accelerating reliance on professional and managed services.

- By Anatomy

Based on anatomy, the physical identity and access management market is segmented into Authenticator, Reader, Locks, Doors, Host, Controller, and Card Management System. The Readers segment dominated the market with a 34.6% share in 2025, owing to extensive deployment of card readers, biometric readers, and mobile credential readers across offices, airports, data centers, and industrial facilities. Readers act as the primary interface between users and access systems, driving high installation volumes.

The Authenticator segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of biometric authentication, multi-factor authentication, and mobile-based identity verification. Rising concerns around unauthorized access, insider threats, and identity fraud are pushing organizations to strengthen authentication mechanisms within PIAM architectures.

- By End-User

On the basis of end-user, the physical identity and access management market is segmented into Banking Financial Services & Insurance (BFSI), Aerospace and Defence, Government, Pharmaceutical, Chemical, Telecommunication and IT, and Logistics. The Government segment dominated the market with a 29.4% share in 2025, supported by large-scale deployment of PIAM systems across public offices, transportation hubs, defense facilities, and critical infrastructure. Regulatory compliance, national security concerns, and workforce access control drive sustained demand.

The BFSI segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising security requirements, increasing digitization of banking operations, and the need to protect sensitive assets and data centers. Growing adoption of biometric access and integrated PIAM platforms is accelerating market growth within BFSI institutions.

Which Region Holds the Largest Share of the Physical Identity and Access Management Market?

- North America dominated the physical identity and access management market with a 36.24% revenue share in 2025, driven by early adoption of advanced security technologies, high awareness of access governance, and strong regulatory compliance requirements across enterprises and government institutions in the U.S. and Canada. Widespread deployment of PIAM solutions across corporate campuses, data centers, airports, healthcare facilities, and critical infrastructure continues to fuel market growth

- Leading companies in North America are introducing cloud-based, AI-enabled, and biometric-driven PIAM platforms, enabling centralized identity governance, real-time monitoring, and seamless integration with IT IAM systems

- Strong cybersecurity investments, high enterprise digital maturity, and well-established physical security infrastructure further reinforce the region’s leadership in the global PIAM market

U.S. Physical Identity and Access Management Market Insight

The U.S. is the largest contributor within North America, supported by extensive adoption of PIAM solutions across government buildings, BFSI institutions, data centers, and large enterprises. Increasing focus on zero-trust security models, insider threat mitigation, and compliance with security regulations is driving demand for integrated PIAM platforms. Presence of major technology providers, strong system integrator networks, and high security spending further accelerates market growth across the country.

Canada Physical Identity and Access Management Market Insight

Canada contributes significantly to regional growth, driven by increasing deployment of access management systems across public infrastructure, commercial buildings, and transportation hubs. Rising focus on regulatory compliance, workplace safety, and digital identity convergence is supporting adoption. Government-backed modernization programs and growing investment in smart building technologies further strengthen PIAM implementation nationwide.

Asia-Pacific Physical Identity and Access Management Market

Asia-Pacific is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rapid urbanization, smart city development, expanding enterprise infrastructure, and rising security concerns across China, India, Japan, South Korea, and Southeast Asia. Increasing investments in commercial real estate, transportation infrastructure, and industrial facilities are significantly boosting demand for PIAM solutions. Growing adoption of cloud-based security platforms and biometric access systems is accelerating regional market expansion.

China Physical Identity and Access Management Market Insight

China is the largest contributor within Asia-Pacific due to large-scale smart city projects, expanding commercial infrastructure, and strong government initiatives focused on surveillance and access control modernization. Rising deployment of biometric authentication and centralized access management platforms is driving widespread adoption across public and private sectors.

Japan Physical Identity and Access Management Market Insight

Japan shows steady growth supported by high security standards, advanced building management systems, and increasing adoption of biometric and mobile credential technologies. Demand for reliable and high-accuracy PIAM solutions is driven by transportation hubs, corporate offices, and critical infrastructure facilities.

India Physical Identity and Access Management Market Insight

India is emerging as a high-growth market, driven by rapid infrastructure development, expanding corporate offices, and increasing government focus on digital identity and security modernization. Rising adoption of access control systems across IT parks, airports, and public institutions is accelerating PIAM deployment.

South Korea Physical Identity and Access Management Market Insight

South Korea contributes steadily due to smart infrastructure development, strong technology adoption, and rising security requirements across commercial and industrial facilities. Increasing use of biometric authentication and integrated access management systems supports sustained market growth.

Which are the Top Companies in Physical Identity and Access Management Market?

The physical identity and access management industry is primarily led by well-established companies, including:

- Accenture (Ireland)

- Microsoft (U.S.)

- IBM Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Oracle (U.S.)

- Capgemini (France)

- Happiest Minds (India)

- HCL Technologies Limited (India)

- Infosys Limited (India)

- F5 Networks, Inc. (U.S.)

- Hewlett-Packard Development Company, L.P. (U.S.)

- Siemens (Germany)

- Dell (U.S.)

- Broadcom (U.S.)

- ForgeRock (U.S.)

- Gemalto NV (Netherlands)

- Centrify Corporation (U.S.)

- GlobalSign (Belgium)

- NTT Communications Corporation (Japan)

- Cognizant (U.S.)

What are the Recent Developments in Global Physical Identity and Access Management Market?

- In November 2025, SwiftConnect, a provider of connected access networks, joined the ServiceNow Build Partner Program and launched its ServiceNow Spoke integration on the ServiceNow Store, enabling seamless linkage between ServiceNow’s AI capabilities and physical access infrastructure without requiring a separate PIAM platform, highlighting the growing convergence of IT service management and physical access systems

- In October 2025, Cohesion, a cloud-based smart building and IoT software leader, achieved Elite Partner status in the HID Technology Partner Program, allowing deeper integration of HID’s Origo platform with Cohesion’s SOC 2 Type II and ISO 27001–certified Cloud Access Portal, underscoring the rising importance of certified, enterprise-grade PIAM ecosystems

- In September 2024, RightCrowd partnered with HID to deliver advanced mobile credential technologies that enable secure and seamless digital access using mobile devices, reflecting the accelerating shift toward mobile-first and frictionless physical access management

- In May 2024, 1Password introduced an Extended Access Management solution designed to secure workforce access across all applications and devices while addressing gaps between MDM and IAM, demonstrating increasing demand for unified access security across physical and digital environments

- In September 2023, iLobby launched SecurityOS, a Physical Identity and Access Management solution focused on managing visitor, contractor, and temporary employee access through flexible, policy-based compliance controls, emphasizing the need for stronger governance and visibility in non-employee access management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.