Global Plastic Component Market

Market Size in USD Billion

CAGR :

%

USD

7.72 Billion

USD

18.32 Billion

2025

2033

USD

7.72 Billion

USD

18.32 Billion

2025

2033

| 2026 –2033 | |

| USD 7.72 Billion | |

| USD 18.32 Billion | |

|

|

|

|

What is the Global Plastic Component Market Size and Growth Rate?

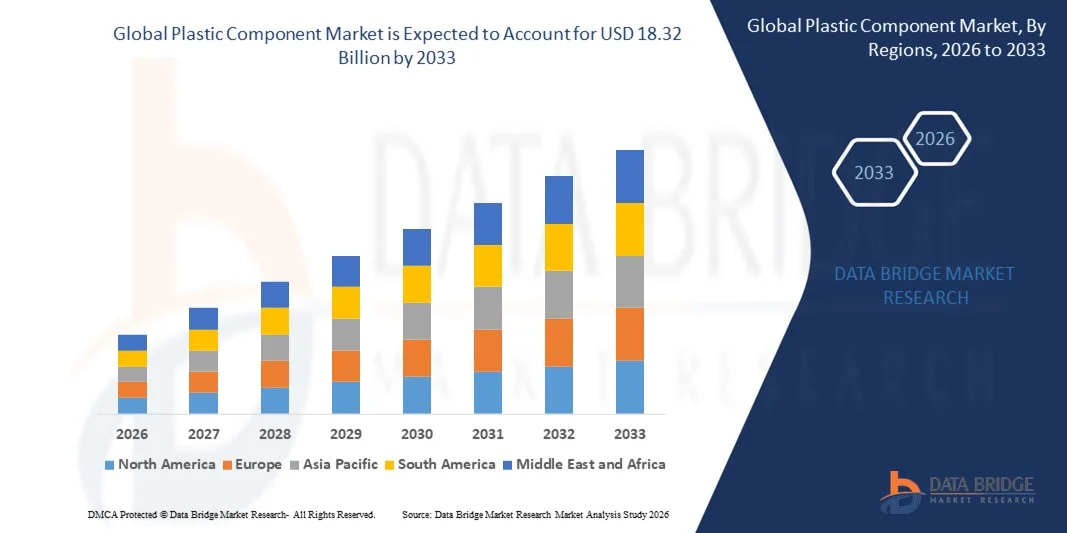

- The global plastic component market size was valued at USD 7.72 billion in 2025 and is expected to reach USD 18.32 billion by 2033, at a CAGR of11.40% during the forecast period

- Rising growth of key end-use industries is a crucial factor accelerating the market growth, also increasing shift in the trend toward replacement of glass and metals, rising urbanization in developing countries, which require more residential buildings and proper transport routes, increasing demand for lightweight vehicles and associated lightweight components in vehicle applications and rising demand of the vehicles due to rise in the population are the major factors among others boosting the plastic component market

What are the Major Takeaways of Plastic Component Market?

- Increasing technological advancements and modernization in the production techniques and rising research and development activities and rising demand from the emerging economies will further create new opportunities for plastic component market

- However, rise in environmental concerns is the major factors among others restraining the market growth, and will further challenge the plastic component market in the forecast period mentioned above

- Asia-Pacific dominated the plastic components market with an estimated 44.8% revenue share in 2025, driven by large-scale automotive production, strong electronics manufacturing ecosystems, rapid industrialization, and expanding infrastructure development across China, Japan, India, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 7.26% from 2026 to 2033, driven by increasing adoption of electric vehicles, advanced manufacturing technologies, and sustainable plastic solutions across the U.S. and Canada

- The Engine Cover segment dominated the market with an estimated 34.6% share in 2025, driven by its extensive use in protecting engine assemblies, reducing noise and vibration, and improving thermal insulation in vehicles and industrial machinery

Report Scope and Plastic Component Market Segmentation

|

Attributes |

Plastic Component Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plastic Component Market?

Increasing Shift Toward Lightweight, High-Performance, and Sustainable Plastic Components

- The plastic components market is witnessing strong adoption of lightweight, high-strength, and precision-molded plastics to replace metal components across automotive, electronics, and industrial applications

- Manufacturers are increasingly introducing engineered plastics, reinforced polymers, and multi-material plastic components that offer enhanced durability, heat resistance, and design flexibility

- Growing focus on compact product designs, energy efficiency, and component miniaturization is accelerating the use of advanced plastic components in EVs, consumer electronics, and medical devices

- For instance, companies such as DuPont, Continental AG, Toyoda Gosei, Marelli, and Motherson are expanding their portfolios of high-performance plastic parts for mobility, electronics, and safety systems

- Rising emphasis on recyclable plastics, bio-based polymers, and circular manufacturing practices is reshaping material selection and component design strategies

- As industries prioritize weight reduction, cost efficiency, and sustainability, Plastic Components remain vital for modern product engineering and scalable manufacturing

What are the Key Drivers of Plastic Component Market?

- Rising demand for lightweight, corrosion-resistant, and cost-effective components across automotive, electronics, aerospace, and industrial machinery

- For instance, in 2025, leading manufacturers such as DuPont, Toyoda Gosei, and Continental AG expanded investments in engineered plastics for EV platforms and next-generation vehicle architectures

- Growing adoption of electric vehicles, consumer electronics, smart appliances, and medical equipment is boosting demand for precision plastic components across the U.S., Europe, and Asia-Pacific

- Advancements in injection molding, extrusion, blow molding, and additive manufacturing have improved production efficiency, design complexity, and component consistency

- Increasing use of high-temperature plastics, flame-retardant polymers, and impact-resistant materials is supporting applications in safety-critical and high-performance environments

- Backed by strong investments in manufacturing automation, material science, and product innovation, the Plastic Components market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Plastic Component Market?

- Volatility in raw material prices, particularly petrochemical-based resins and specialty polymers, impacts production costs and profit margins

- For instance, during 2024–2025, fluctuations in crude oil prices, supply chain disruptions, and regional trade constraints increased resin procurement costs for global manufacturers

- Stringent environmental regulations related to plastic waste, recyclability, and single-use plastics are increasing compliance costs for manufacturers

- Technical challenges in achieving high strength, thermal stability, and recyclability simultaneously limit adoption in certain high-load applications

- Competition from metal alloys, composites, and alternative sustainable materials creates pricing pressure and substitution risks

- To overcome these challenges, companies are focusing on recyclable materials, bio-plastics, lightweight composites, and closed-loop manufacturing models to sustain market growth

How is the Plastic Component Market Segmented?

The market is segmented on the basis of component, material, and vehicle type.

- By Component

On the basis of component, the plastic components market is segmented into Engine Cover, Transmission Cover, Intake Air Modules, Bumper, and Others. The Engine Cover segment dominated the market with an estimated 34.6% share in 2025, driven by its extensive use in protecting engine assemblies, reducing noise and vibration, and improving thermal insulation in vehicles and industrial machinery. Engine covers made from high-performance plastics offer lightweight construction, corrosion resistance, and design flexibility, making them ideal for modern automotive platforms, especially ICE and hybrid vehicles. Increasing focus on under-the-hood weight reduction and cost optimization further supports segment dominance.

The Bumper segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising vehicle production, stricter safety regulations, and increased adoption of impact-absorbing plastic materials. Advancements in energy-absorbing polymers and recyclable plastics are accelerating the replacement of metal bumpers, particularly in passenger vehicles and commercial fleets.

- By Material

Based on material, the plastic components market is segmented into PVC, PU, PP, PE, PA, ABS, and Others. The Polypropylene (PP) segment dominated the market with a 38.2% share in 2025, owing to its excellent balance of lightweight properties, chemical resistance, durability, and cost efficiency. PP is widely used in automotive interiors, engine components, bumpers, and underbody parts, making it a preferred choice for high-volume manufacturing. Its recyclability and compatibility with injection molding further strengthen its adoption across mobility and industrial applications.

The Polyamide (PA) segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for high-strength, heat-resistant, and wear-resistant materials. PA plastics are increasingly used in engine components, intake air modules, and structural parts in EVs and heavy-duty vehicles, where thermal stability and mechanical performance are critical.

- By Vehicle Type

On the basis of vehicle type, the plastic components market is segmented into Trucks, Tractors, Buses, Excavator, Combine Harvester, and Scraper. The Trucks segment dominated the market with a 41.5% share in 2025, supported by high production volumes, widespread use of plastic components in engine covers, bumpers, dashboards, and air intake systems, and growing demand for fuel-efficient commercial vehicles. Lightweight plastic parts help reduce vehicle weight, improve payload capacity, and enhance durability in long-haul and logistics operations.

The Electric and Heavy Construction Equipment segment, particularly Excavators, is expected to grow at the fastest CAGR from 2026 to 2033. Rising infrastructure development, mechanized farming, and mining activities are increasing demand for durable, impact-resistant plastic components that can withstand harsh operating environments while reducing maintenance costs and overall equipment weight.

Which Region Holds the Largest Share of the Plastic Component Market?

- Asia-Pacific dominated the plastic components market with an estimated 44.8% revenue share in 2025, driven by large-scale automotive production, strong electronics manufacturing ecosystems, rapid industrialization, and expanding infrastructure development across China, Japan, India, South Korea, and Southeast Asia

- High demand for lightweight, cost-efficient, and durable plastic components in automotive, consumer electronics, industrial machinery, and construction equipment continues to fuel regional growth

- Presence of extensive manufacturing hubs, availability of raw materials, competitive labor costs, and strong supplier networks reinforce Asia-Pacific’s global leadership

- Continuous investments in EV manufacturing, smart factories, and advanced polymer processing technologies further strengthen long-term market dominance

China Plastic Components Market Insight

China is the largest contributor within Asia-Pacific, supported by massive automotive production capacity, strong electronics exports, and government-backed manufacturing initiatives. High demand for plastic components in EVs, industrial equipment, and consumer appliances accelerates adoption. Rapid expansion of injection molding, extrusion, and composite plastic manufacturing further strengthens domestic and export markets.

Japan Plastic Components Market Insight

Japan shows steady growth driven by advanced automotive engineering, precision manufacturing, and strong adoption of high-performance plastics. Increasing use of lightweight plastic components in hybrid vehicles, electronics housings, and industrial automation systems supports market expansion.

India Plastic Components Market Insight

India is emerging as a key growth hub due to expanding automotive manufacturing, rising construction activity, and government-led initiatives such as Make in India. Increasing adoption of plastic components in commercial vehicles, agricultural machinery, and consumer electronics accelerates market penetration.

North America Plastic Components Market

North America is expected to register the fastest CAGR of 7.26% from 2026 to 2033, driven by increasing adoption of electric vehicles, advanced manufacturing technologies, and sustainable plastic solutions across the U.S. and Canada. Growing focus on lightweight materials, fuel efficiency, and emission reduction is accelerating the replacement of metal parts with engineered plastics. Strong R&D capabilities, advanced material innovation, and rising use of recyclable and bio-based plastics support rapid regional growth

U.S. Plastic Components Market Insight

The U.S. leads regional growth due to strong automotive innovation, expanding EV production, and high demand for advanced plastic components in aerospace, healthcare, and industrial applications. Investments in sustainable materials and automation further drive adoption.

Canada Plastic Components Market Insight

Canada contributes steadily, supported by growing automotive parts manufacturing, industrial equipment production, and increasing use of plastics in construction and medical devices. Emphasis on sustainability and advanced materials strengthens long-term market growth.

Which are the Top Companies in Plastic Component Market?

The plastic component industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Continental AG (Germany)

- Marelli Holdings Co., Ltd (Japan)

- Flex-N-Gate Corporation (U.S.)

- TOYODA GOSEI Co., Ltd (Japan)

- Motherson (India)

- ElringKlinger AG (Germany)

- Hartford Technologies, Inc. (U.S.)

- Abbott Ball Company Inc. (U.S.)

- SMB Bearings (U.K.)

What are the Recent Developments in Global Plastic Component Market?

- In June 2024, Sirmax Group collaborated with Technogym to develop high-performance recycled plastic materials for Technogym’s next-generation Excite fitness product line, supporting sustainable component manufacturing for the global fitness and wellness industry. This collaboration highlights the growing integration of recycled plastics in premium consumer and sports equipment

- In June 2024, WIS Kunststoffe GmbH announced plans to invest €100 million in expanding plastic production capabilities in Kazakhstan, aiming to strengthen its manufacturing footprint and regional supply chain presence. This investment reflects rising demand for plastic components and capacity expansion in emerging industrial markets

- In July 2023, Omega Plastics Group, an injection molding specialist, expanded its production capabilities by adding new injection molding press capacity at both Signal Plastics and Omega Plastics facilities to enhance customer service and solution delivery. This expansion underscores the increasing need for scalable, high-efficiency plastic component manufacturing

- In September 2022, Essentium, Inc. partnered with Braskem to provide manufacturers with an integrated additive manufacturing solution by combining Essentium’s high-speed extrusion 3D printing technology with Braskem’s polyolefin materials. This partnership accelerated affordable, sustainable, and high-volume production of thermoplastic components using advanced manufacturing methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.