Global Plastic Corrugated Packaging Market

Market Size in USD Billion

CAGR :

%

USD

3.20 Billion

USD

4.77 Billion

2025

2033

USD

3.20 Billion

USD

4.77 Billion

2025

2033

| 2026 –2033 | |

| USD 3.20 Billion | |

| USD 4.77 Billion | |

|

|

|

|

What is the Global Plastic Corrugated Packaging Market Size and Growth Rate?

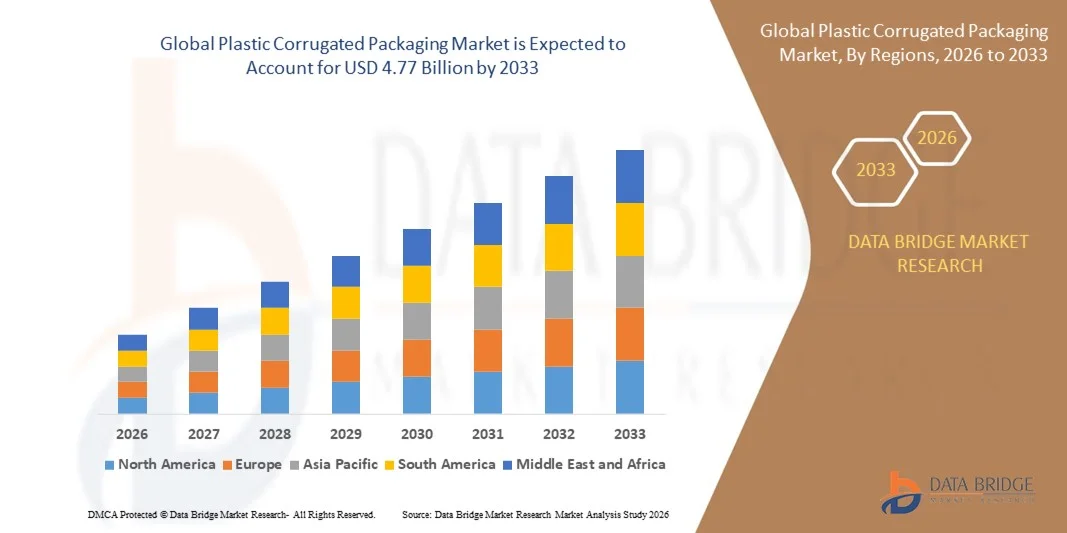

- The global plastic corrugated packaging market size was valued at USD 3.20 billion in 2025 and is expected to reach USD 4.77 billion by 2033, at a CAGR of 5.10% during the forecast period

- Major factors that are expected to boost the growth of the plastics corrugated packaging market are because of the government regulation for the sustainable and environment-friendly packaging

- Furthermore, the rise in the alertness of consumer regarding the ill effect of unsustainable packaging waste is further anticipated to propel the growth of the plastics corrugated packaging market

What are the Major Takeaways of Plastic Corrugated Packaging Market?

- The increase in the need for frozen cigarette foods, dry foods is further estimated to cushion the growth of the plastics corrugated packaging market

- COVID-19 pandemic has shut-down the manufacturing of several products in the plastic corrugated packaging industry because of the lockdown in countries around the world is further projected to impede the growth of the plastics corrugated packaging market in the timeline period

- North America dominated the Plastic Corrugated Packaging market with a 40.9% revenue share in 2025, driven by strong demand for reusable transit packaging, advanced logistics systems, and well-established automotive and industrial manufacturing sectors across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.12% from 2026 to 2033, driven by rapid industrialization, expanding manufacturing capacity, and strong growth in e-commerce and retail sectors across China, India, Japan, South Korea, and Southeast Asia

- The Crates segment dominated the market with a 34.7% share in 2025, driven by strong demand for reusable, impact-resistant, and stackable transit packaging across automotive, agriculture, and industrial supply chains

Report Scope and Plastic Corrugated Packaging Market Segmentation

|

Attributes |

Plastic Corrugated Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plastic Corrugated Packaging Market?

Growing Shift Toward Sustainable, Lightweight, and Reusable Plastic Corrugated Packaging Solutions

- The Plastic Corrugated Packaging market is witnessing strong adoption of lightweight, durable, and recyclable polypropylene (PP) corrugated sheets designed to improve product protection while reducing overall logistics costs

- Manufacturers are introducing customizable, returnable, and collapsible packaging formats that enhance supply chain efficiency and minimize single-use packaging waste

- Increasing demand for eco-friendly alternatives to traditional paperboard and wooden crates is accelerating innovation in reusable transit packaging across automotive, agriculture, electronics, and retail sectors

- For instance, companies such as DS Smith, ORBIS Corporation, Coroplast, and Shish Industries Ltd. are expanding their sustainable packaging portfolios with reusable corrugated plastic containers and customized protective solutions

- Rising focus on circular economy practices, extended producer responsibility (EPR), and regulatory pressure on plastic waste reduction is driving adoption of recyclable and long-life corrugated plastic products

- As industries prioritize durability, moisture resistance, and cost optimization, Plastic Corrugated Packaging will remain essential for efficient storage, transportation, and sustainable logistics operations

What are the Key Drivers of Plastic Corrugated Packaging Market?

- Rising demand for impact-resistant, moisture-proof, and chemically stable packaging solutions across automotive components, pharmaceuticals, food distribution, and industrial goods

- For instance, in 2025, several global manufacturers enhanced their returnable transit packaging systems to improve warehouse efficiency and reduce packaging waste in closed-loop supply chains

- Growing expansion of e-commerce, organized retail, and global trade activities is boosting demand for protective and lightweight bulk packaging solutions across the U.S., Europe, and Asia-Pacific

- Advancements in extrusion technology, anti-static coatings, flame-retardant properties, and UV-resistant formulations have strengthened product performance and expanded industrial applications

- Increasing emphasis on cost reduction in logistics, improved product safety, and reusable packaging models is encouraging long-term adoption among large-scale manufacturers

- Supported by investments in sustainable materials, smart supply chain infrastructure, and industrial automation, the Plastic Corrugated Packaging market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Plastic Corrugated Packaging Market?

- Fluctuations in polypropylene resin prices and raw material supply volatility increase production costs and affect profit margins for manufacturers

- For instance, during 2024–2025, variations in crude oil prices and global polymer supply constraints impacted pricing stability for corrugated plastic sheet producers

- Environmental concerns related to plastic waste management and recycling infrastructure limitations create regulatory and public perception challenges

- Limited awareness in certain developing markets regarding the long-term cost benefits of reusable plastic packaging slows adoption

- Competition from alternative materials such as corrugated paperboard, molded pulp, and biodegradable packaging solutions creates pricing pressure and substitution risks

- To address these challenges, companies are focusing on recyclable material innovation, closed-loop recovery systems, lightweight design optimization, and strategic collaborations to strengthen global adoption of plastic corrugated packaging solutions

How is the Plastic Corrugated Packaging Market Segmented?

The market is segmented on the basis of type, material type, and end-use industry.

- By Type

On the basis of type, the plastic corrugated packaging market is segmented into Folding Boxes, Trays, Crates, Inserts and Dividers, and Bins and Racks. The Crates segment dominated the market with a 34.7% share in 2025, driven by strong demand for reusable, impact-resistant, and stackable transit packaging across automotive, agriculture, and industrial supply chains. Plastic corrugated crates offer high durability, moisture resistance, and long service life, making them ideal for closed-loop logistics and bulk handling applications. Their ability to reduce product damage and optimize warehouse storage supports widespread adoption.

The Folding Boxes segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising e-commerce shipments, retail-ready packaging demand, and need for lightweight, collapsible packaging formats that reduce return logistics costs and improve supply chain efficiency.

- By Material Type

On the basis of material type, the market is segmented into Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), and Polycarbonate (PC) plastics corrugated packaging materials. The Polypropylene (PP) segment dominated the market with a 49.3% share in 2025, owing to its lightweight properties, chemical resistance, flexibility, and cost-effectiveness. PP-based corrugated sheets are widely used in industrial packaging, signage, and reusable transport solutions due to their durability and recyclability.

The Polyethylene (PE) segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for enhanced impact strength, temperature resistance, and moisture-proof packaging across food distribution, medical supplies, and agricultural applications. Growing innovation in polymer engineering further supports material diversification.

- By End Use Industry

On the basis of end-use industry, the plastic corrugated packaging market is segmented into Retail, Advertising, Automotive, Medical, Agriculture, Consumer Electronics, Electricals, Recovery and Recycling, and Other Industrial. The Automotive segment dominated the market with a 31.6% share in 2025, supported by extensive use of reusable corrugated plastic crates, bins, and dividers for component storage, in-plant handling, and just-in-time supply chain operations. High durability and returnable packaging models enhance cost savings and sustainability in automotive manufacturing.

The Retail segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by rapid expansion of organized retail, e-commerce logistics, point-of-sale displays, and protective transit packaging. Increasing emphasis on lightweight, recyclable, and visually customizable packaging solutions continues to accelerate adoption across global retail supply chains.

Which Region Holds the Largest Share of the Plastic Corrugated Packaging Market?

- North America dominated the Plastic Corrugated Packaging market with a 40.9% revenue share in 2025, driven by strong demand for reusable transit packaging, advanced logistics systems, and well-established automotive and industrial manufacturing sectors across the U.S. and Canada. Growing emphasis on sustainable packaging, closed-loop supply chains, and warehouse automation continues to fuel adoption across retail distribution centers, food processing facilities, and automotive plants

- Leading companies in North America are introducing lightweight, recyclable, and customizable corrugated plastic solutions designed to improve durability, reduce transportation costs, and enhance storage efficiency, strengthening the region’s competitive advantage

- Strong environmental regulations, high awareness of circular economy practices, and sustained investment in packaging innovation further reinforce regional market leadership

U.S. Plastic Corrugated Packaging Market Insight

The U.S. is the largest contributor in North America, supported by large-scale automotive production, expanding e-commerce logistics, and growing demand for returnable packaging systems. Increasing use of plastic corrugated crates, bins, and dividers in industrial handling and organized retail supply chains drives consistent market growth.

Canada Plastic Corrugated Packaging Market Insight

Canada contributes steadily due to rising adoption of reusable packaging in agriculture, food distribution, and industrial exports. Growing sustainability initiatives and expansion of regional manufacturing clusters further strengthen demand.

Asia-Pacific Plastic Corrugated Packaging Market

Asia-Pacific is projected to register the fastest CAGR of 7.12% from 2026 to 2033, driven by rapid industrialization, expanding manufacturing capacity, and strong growth in e-commerce and retail sectors across China, India, Japan, South Korea, and Southeast Asia. Increasing demand for cost-effective, lightweight, and moisture-resistant packaging solutions accelerates regional expansion.

China Plastic Corrugated Packaging Market Insight

China leads the region due to its massive manufacturing base, strong export activities, and increasing use of reusable plastic crates in automotive, electronics, and agricultural supply chains.

Japan Plastic Corrugated Packaging Market Insight

Japan shows stable growth supported by advanced industrial automation, high-quality packaging standards, and demand for durable material handling solutions.

India Plastic Corrugated Packaging Market Insight

India is emerging as a high-growth market driven by expanding retail infrastructure, government-backed manufacturing initiatives, and rising agricultural exports.

South Korea Plastic Corrugated Packaging Market Insight

South Korea contributes significantly due to strong electronics manufacturing, automotive exports, and growing adoption of sustainable packaging systems across industrial sectors.

Which are the Top Companies in Plastic Corrugated Packaging Market?

The plastic corrugated packaging industry is primarily led by well-established companies, including:

- DS Smith (U.K.)

- Coroplast (Germany)

- Dynapac Co., Ltd. (Japan)

- FLEXcon Company, Inc. (U.S.)

- Söhner Kunststofftechnik GmbH (Germany)

- Technology Container Corp. (U.S.)

- MDI (U.S.)

- American Containers (U.S.)

- Yamakoh, Co., Ltd. (Japan)

- Samuel Grant Group Ltd (U.K.)

- Amatech Inc. (U.S.)

- Twinplast (U.K.)

- Dongguan Jianxin Plastic Products Co. (China)

- ORBIS Corporation (U.S.)

- Androp Packaging, Inc. (U.S.)

- Shish Industries Ltd. (India)

- Mills Industries (U.S.)

- Classic Enterprises Pvt Ltd (India)

- Packman Packaging Private Limited (India)

- Siddhiplast (India)

What are the Recent Developments in Global Plastic Corrugated Packaging Market?

- In December 2025, Perfection Fresh and Opal initiated a trial of plastic-free packaging for Calypso Mango multipacks across Coles stores in Victoria, introducing kerbside-recyclable corrugated cardboard packs designed to improve branding visibility and maintain fruit freshness through enhanced airflow. The new packaging also incorporates a sturdy carry handle and compact storage efficiency, reinforcing retail sustainability initiatives and strengthening eco-friendly packaging adoption in fresh produce supply chains

- In April 2025, Lieferando partnered with Huhtamaki to introduce sustainable, biodegradable corrugated paper delivery boxes coated with Xampla’s plant-based polymer, ensuring compliance with the Single-Use Plastics Directive and suitability for various food categories, including greasy and high-moisture products. This collaboration highlights the growing shift toward plant-based barrier coatings and regulatory-compliant packaging solutions in the food delivery sector

- In October 2023, GWP Correx launched its innovative Rapitainer returnable packaging solution, a highly durable corrugated plastic container developed to replace single-use cardboard boxes in transit and storage applications. The introduction of Rapitainer strengthens the adoption of reusable transport packaging systems and supports long-term cost efficiency and sustainability goals across industrial supply chains

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Corrugated Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Corrugated Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Corrugated Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.