Global Plastic Surgery And Integumentary System Procedures Market

Market Size in USD Billion

CAGR :

%

USD

7.91 Billion

USD

11.93 Billion

2025

2033

USD

7.91 Billion

USD

11.93 Billion

2025

2033

| 2026 –2033 | |

| USD 7.91 Billion | |

| USD 11.93 Billion | |

|

|

|

|

Plastic Surgery and Integumentary System Procedures Market Size

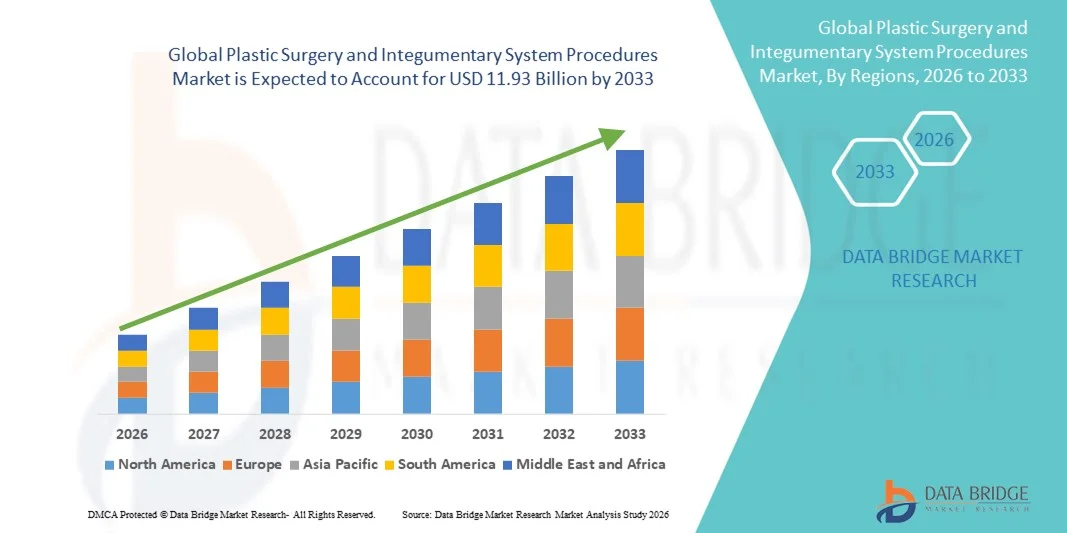

- The global plastic surgery and integumentary system procedures market size was valued at USD 7.91 billion in 2025 and is expected to reach USD 11.93 billion by 2033, at a CAGR of 5.28% during the forecast period

- The market growth is largely fueled by increasing demand for cosmetic and reconstructive procedures, rising disposable incomes, advancements in minimally invasive and non-invasive surgical technologies, and growing awareness of aesthetic enhancements worldwide, leading to higher procedure adoption across both emerging and developed regions

- Furthermore, expanding healthcare infrastructure, the influence of social media on beauty standards, and the preference for secure, effective, and personalized aesthetic solutions are establishing plastic surgery and integumentary system procedures as key components of modern aesthetic and reconstructive healthcare. These converging factors are accelerating the uptake of such procedures, thereby significantly boosting the industry’s growth

Plastic Surgery and Integumentary System Procedures Market Analysis

- Plastic surgery and integumentary system procedures, encompassing diagnostic and therapeutic interventions such as biopsies, skin tests, and grafting techniques, are increasingly vital components of modern healthcare and aesthetic enhancement practices in both medical and clinical settings due to their effectiveness, minimally invasive options, and growing personalization of treatment plans

- The escalating demand for these procedures is primarily fueled by rising disposable incomes, increasing awareness of aesthetic and reconstructive solutions, social media influence on beauty standards, and growing patient preference for minimally invasive and precise procedures with faster recovery times

- North America dominated the market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high patient affordability, and a strong presence of leading hospitals and specialized clinics, with the U.S. experiencing substantial growth in prefilled syringe and excisional biopsy procedures, driven by innovations in diagnostic technologies and procedural efficiency

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period due to increasing urbanization, rising disposable incomes, and growing acceptance of plastic surgery and integumentary procedures among younger populations

- Prefilled syringe biopsy segment dominated the market with a share of 42.5% in 2025, driven by its accuracy, ease of use, and adoption in both hospitals and clinics for diagnostic and therapeutic purposes

Report Scope and Plastic Surgery and Integumentary System Procedures Market Segmentation

|

Attributes |

Plastic Surgery and Integumentary System Procedures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Plastic Surgery and Integumentary System Procedures Market Trends

Advancements in Minimally Invasive and Personalized Procedures

- A significant and accelerating trend in the global plastic surgery and integumentary system procedures market is the growing adoption of minimally invasive techniques such as prefilled syringe biopsies, skin tests, and autograft/allograft procedures, which reduce recovery time and enhance patient comfort

- For instance, prefilled syringe biopsy kits now allow clinicians to collect accurate tissue samples quickly, improving procedural efficiency while reducing patient discomfort. Similarly, innovations in skin grafting techniques provide more precise and tailored outcomes for reconstructive procedures

- Integration of digital imaging, AI-assisted planning, and robotic precision is enabling more personalized procedural strategies, improving surgical accuracy and aesthetic results. For instance, some clinics now use AI-driven imaging to predict optimal graft placement and procedural outcomes

- The seamless combination of minimally invasive techniques with personalized treatment plans enhances patient satisfaction and broadens the accessibility of advanced procedures in both hospital and clinic settings

- This trend towards precision, minimally invasive, and patient-centric procedures is fundamentally reshaping expectations for aesthetic and reconstructive care. Consequently, leading providers are developing AI-assisted, image-guided biopsy and grafting solutions to enhance accuracy and procedural efficiency

- The demand for personalized, less invasive procedures is growing rapidly across both emerging and developed markets, as patients increasingly prioritize safety, comfort, and predictable outcomes

- Telemedicine consultations and digital patient management platforms are becoming integral to pre- and post-procedure care, enabling remote monitoring and follow-ups, which enhances convenience and safety

- Increasing collaboration between medical device manufacturers and hospitals for customized procedural kits and integrated workflow solutions is driving adoption and procedural efficiency across clinics and hospitals globally

Plastic Surgery and Integumentary System Procedures Market Dynamics

Driver

Increasing Demand Due to Rising Awareness and Aesthetic Preferences

- The increasing prevalence of aesthetic consciousness among patients, coupled with rising disposable incomes, is a significant driver for the heightened demand for plastic surgery and integumentary procedures

- For instance, in 2025, a leading U.S. hospital group reported a surge in requests for excisional and incisional biopsies as patients sought early diagnosis combined with cosmetic benefits, highlighting growing procedural adoption

- As patients become more aware of reconstructive and cosmetic options, procedures such as prefilled syringe biopsies, skin tests, and autografts provide safer, faster, and more effective solutions, encouraging greater uptake

- Furthermore, the popularity of social media and online platforms promoting aesthetic enhancement is driving demand for modern procedures, making these interventions a standard part of self-care and wellness routines

- The convenience of minimally invasive techniques, shorter recovery times, and personalized procedural plans are key factors propelling the adoption of these procedures across hospitals and clinics

- Rising geriatric populations and increased focus on post-trauma and post-surgical reconstruction are creating additional demand for integumentary system procedures, particularly autografts and excisional biopsies

- Government and insurance support for reconstructive surgeries in certain regions is facilitating wider accessibility, encouraging patients to opt for both cosmetic and therapeutic interventions

Restraint/Challenge

Procedural Risks and Regulatory Compliance Hurdles

- Concerns surrounding procedural complications, infection risks, and regulatory compliance pose significant challenges to broader market penetration. As procedures involve tissue manipulation and grafting, patients and providers are cautious about safety and outcomes

- For instance, reports of adverse reactions in minor biopsy or graft procedures have made some patients hesitant to adopt advanced interventions, particularly in elective settings

- Addressing these safety concerns through stringent sterilization, procedural protocols, and regulatory adherence is crucial for building patient trust. Leading hospitals emphasize their adherence to international procedural standards to reassure clients

- In addition, the relatively high cost of advanced procedures compared to traditional diagnostic or minor cosmetic interventions can be a barrier to adoption, particularly in developing regions or for price-sensitive patients

- While some minimally invasive solutions are becoming more affordable, premium procedures such as autografts, AI-assisted grafting, or robotic-assisted biopsies still carry higher price points

- Overcoming these challenges through patient education, safety assurances, and cost-optimized procedure options will be vital for sustained market growth

- Limited availability of skilled surgeons and specialized clinical staff in emerging markets restricts adoption and can affect procedural outcomes, creating regional disparities

- Lengthy regulatory approval timelines for new procedural kits, devices, or AI-assisted surgical tools delay market entry, slowing innovation adoption and revenue growth

Plastic Surgery and Integumentary System Procedures Market Scope

The market is segmented on the basis of procedure, operating areas, application, and end-users.

- By Procedure

On the basis of procedure, the market is segmented into prefilled syringe biopsy, excisional biopsy, incisional biopsy, culture and sensitivity (cands), and skin tests. The Prefilled Syringe Biopsy segment dominated the market in 2025 with a market share of 42.5% due to its accuracy, ease of use, and faster sample collection process. Clinicians prefer prefilled syringe biopsies for reducing procedural errors and minimizing patient discomfort during tissue extraction. This segment benefits from growing adoption in both hospitals and clinics, especially in urban regions with advanced healthcare facilities. Prefilled syringes also reduce cross-contamination risks, a crucial factor in diagnostic procedures. The convenience of pre-measured reagents and standardized sampling enhances procedural efficiency, making it a preferred choice among healthcare providers. In addition, their compatibility with minimally invasive techniques and integration with AI-assisted imaging solutions further strengthens market dominance.

The Incisional Biopsy segment is expected to witness the fastest growth during the forecast period, driven by rising demand for precise tissue diagnostics and early detection of dermatological and oncological conditions. Incisional biopsies allow clinicians to extract larger tissue samples, enabling more comprehensive pathological analysis. Growing awareness of skin cancers and other integumentary disorders is encouraging adoption of these procedures across clinics and hospitals. Technological advancements, including minimally invasive instruments and digital pathology support, are enhancing the accuracy and safety of incisional biopsies. Rising investments in early diagnostic solutions in emerging markets are contributing to accelerated growth. Furthermore, integration with telemedicine platforms is enabling remote review and consultation, boosting procedural accessibility.

- By Operating Area

On the basis of operating areas, the market is segmented into eyelids and breast. The Breast segment dominated the market in 2025 due to the high prevalence of reconstructive and cosmetic procedures, including biopsies, grafts, and aesthetic enhancements. Hospitals and specialized clinics are increasingly focusing on breast-related diagnostics and reconstructive surgeries to address both post-mastectomy reconstruction and cosmetic augmentation. Rising awareness about breast health, coupled with government and insurance support for reconstructive procedures, is driving market adoption. Technological advancements such as AI-assisted graft placement and minimally invasive tissue sampling are improving outcomes and patient satisfaction. The segment also benefits from strong procedural standardization, which reduces complication rates and enhances clinician confidence. High patient demand for personalized aesthetic results further reinforces the dominance of this operating area.

The Eyelids segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for both functional and cosmetic eyelid procedures. Blepharoplasty and related biopsies are becoming popular due to aging populations and growing focus on facial aesthetics. Minimally invasive techniques reduce recovery times and scarring, encouraging adoption among younger patients as well. The rise of non-invasive and image-guided procedures is further expanding market reach. Clinics and hospitals are increasingly investing in specialized tools and prefilled biopsy kits for eyelid procedures, supporting faster procedural execution. Social media influence on facial aesthetics is also accelerating demand for eyelid procedures, contributing to rapid growth.

- By Application

On the basis of application, the market is segmented into allografts, autografts, and infections. The Autografts segment dominated the market in 2025 due to their higher success rates, compatibility with the patient’s own tissue, and reduced risk of rejection. Autografts are widely used in reconstructive surgeries, including skin grafting after trauma, burns, or tumor removal, and are increasingly preferred in hospitals with advanced surgical facilities. Rising investments in regenerative medicine and tissue engineering are also supporting market dominance. These procedures are highly customizable and allow for precise graft placement, improving both functional and aesthetic outcomes. The segment benefits from technological advancements such as AI-assisted graft planning and minimally invasive harvesting techniques. Furthermore, training and awareness programs for surgeons are enhancing adoption in both developed and emerging markets.

The Allografts segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for donor tissue procedures in both reconstructive and aesthetic applications. Allografts allow surgeons to access larger graft quantities, making them suitable for complex reconstructions or multi-site procedures. Growing organ and tissue donation awareness, coupled with regulatory support, is enhancing adoption. Technological advancements in sterilization and preservation are increasing safety and success rates of allograft procedures. Hospitals and clinics are increasingly integrating allograft solutions with minimally invasive techniques, reducing patient recovery time. The rising demand in emerging markets for cost-effective tissue solutions further accelerates segment growth.

- By End-User

On the basis of end-user, the market is segmented into hospitals and clinics. The Hospitals segment dominated the market in 2025 due to the availability of advanced surgical infrastructure, trained surgeons, and integrated diagnostic facilities. Hospitals perform high volumes of biopsies, grafts, and other procedures, ensuring consistent revenue streams. Their ability to offer multi-disciplinary care, including pre- and post-procedure monitoring, enhances patient trust and procedural adoption. Technologically advanced hospitals are early adopters of AI-assisted biopsy kits and digital workflow solutions, improving accuracy and efficiency. In addition, hospitals often lead clinical trials for new procedural kits, further consolidating their dominance. Rising patient awareness and preference for hospital-based procedures for complex surgeries strengthen this segment’s market position.

The Clinics segment is expected to witness the fastest growth during the forecast period, driven by the increasing availability of specialized cosmetic and dermatology clinics offering outpatient procedures. Clinics provide convenient access for minimally invasive biopsies, skin tests, and grafting procedures, reducing costs and procedural time for patients. The rising adoption of telemedicine for consultation and follow-ups is boosting clinic-based procedural uptake. Clinics are increasingly investing in prefilled biopsy kits, portable diagnostic tools, and AI-assisted planning systems to improve patient outcomes. The growing trend of aesthetic enhancements in urban populations is driving clinic expansion and service adoption. Furthermore, flexible pricing and personalized procedural plans offered by clinics enhance accessibility, accelerating segment growth.

Plastic Surgery and Integumentary System Procedures Market Regional Analysis

- North America dominated the market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high patient affordability, and a strong presence of leading hospitals and specialized clinics

- Patients and healthcare providers in the region highly value the precision, safety, and personalized outcomes offered by modern procedures such as prefilled syringe biopsies, autografts, and skin tests, which are integrated with minimally invasive and AI-assisted technologies

- This widespread adoption is further supported by advanced healthcare infrastructure, high disposable incomes, skilled surgeons, and strong insurance and regulatory support, establishing hospitals and specialized clinics as key hubs for both elective and therapeutic procedures

U.S. Plastic Surgery and Integumentary System Procedures Market Insight

The U.S. market captured the largest revenue share of 36% in 2025 within North America, fueled by high demand for cosmetic and reconstructive procedures and the widespread availability of advanced healthcare infrastructure. Patients are increasingly prioritizing minimally invasive procedures, prefilled syringe biopsies, and autografts to reduce recovery times and enhance precision. The growing popularity of outpatient clinics and specialized aesthetic centers further propels market adoption. Moreover, integration of AI-assisted imaging, telemedicine consultations, and digital patient management platforms is significantly contributing to procedural efficiency and patient satisfaction. Rising awareness of early diagnostic procedures and the influence of social media on aesthetic preferences also play a key role in market expansion.

Europe Plastic Surgery and Integumentary System Procedures Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing awareness of reconstructive and cosmetic procedures, coupled with stringent healthcare standards. Urbanization and the rising demand for minimally invasive and personalized procedures are fostering market adoption. European patients value procedural safety, efficiency, and predictable outcomes, encouraging hospitals and clinics to adopt advanced diagnostic and grafting techniques. Growth is also supported by insurance coverage for certain reconstructive procedures and government initiatives promoting patient safety. The region is witnessing significant uptake across hospitals, clinics, and outpatient facilities, with procedures increasingly integrated into both new healthcare setups and renovations of existing facilities.

U.K. Plastic Surgery and Integumentary System Procedures Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising patient interest in aesthetic enhancement, reconstructive procedures, and early diagnostic interventions. Increasing concern over post-trauma reconstruction and the desire for minimally invasive solutions are encouraging both hospitals and specialized clinics to expand service offerings. The U.K.’s robust healthcare infrastructure, combined with high disposable incomes and strong telemedicine adoption, is expected to continue supporting market growth. Patients are increasingly opting for key procedures such as prefilled syringe biopsies, skin tests, and autografts to ensure precision, safety, and faster recovery. In addition, regulatory emphasis on procedural safety and the availability of certified professionals further boosts market confidence.

Germany Plastic Surgery and Integumentary System Procedures Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of reconstructive care and rising demand for technologically advanced, eco-conscious solutions. Hospitals and clinics are increasingly adopting minimally invasive biopsies, AI-assisted graft planning, and autograft procedures to enhance surgical precision and patient satisfaction. Germany’s well-developed healthcare infrastructure and strong focus on innovation support the adoption of new procedural techniques. Integration of digital imaging, robotic assistance, and regenerative medicine solutions is becoming increasingly prevalent. Patients are placing high importance on procedural safety, privacy, and efficacy, which aligns with local expectations and drives growth across both cosmetic and therapeutic interventions.

Asia-Pacific Plastic Surgery and Integumentary System Procedures Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and rising awareness of aesthetic and reconstructive care. Countries such as China, India, and Japan are experiencing significant demand for minimally invasive biopsies, autografts, and skin tests. Expansion of private hospitals, specialized clinics, and training programs for surgeons is boosting procedural adoption. Government initiatives promoting healthcare modernization and early diagnostic interventions further support market growth. In addition, the growing influence of social media and cosmetic trends is accelerating interest in aesthetic procedures, while improved affordability and accessibility of procedural kits widen the patient base across the region.

Japan Plastic Surgery and Integumentary System Procedures Market Insight

The Japan market is gaining momentum due to a high-tech culture, increasing urbanization, and growing preference for precision and minimally invasive procedures. Patients prioritize safety, comfort, and predictable outcomes, driving the adoption of prefilled syringe biopsies, skin tests, and autografts. Integration of AI-assisted imaging, telemedicine platforms, and robotic-assisted procedures is fueling market growth. Japan’s aging population further contributes to demand for reconstructive and restorative procedures. Hospitals and specialized clinics are investing in modern diagnostic tools and training, supporting procedural efficiency. The emphasis on patient-centric care and innovative technologies continues to expand the market in both residential cosmetic and therapeutic sectors.

India Plastic Surgery and Integumentary System Procedures Market Insight

The India market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to a rapidly growing middle class, urbanization, and increasing adoption of minimally invasive and reconstructive procedures. Hospitals and clinics are expanding their services to meet rising demand for prefilled syringe biopsies, autografts, and skin tests. The push towards modern healthcare facilities and telemedicine consultations is enabling faster procedural access and follow-up care. Availability of cost-effective procedural kits and local manufacturing of biopsy and grafting equipment enhances affordability. Increasing awareness of aesthetic care and reconstructive surgery, along with social media influence, is accelerating procedure uptake. Furthermore, the growth of medical tourism in India is contributing to revenue generation in specialized plastic surgery and integumentary procedures.

Plastic Surgery and Integumentary System Procedures Market Share

The Plastic Surgery and Integumentary System Procedures industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Sientra, Inc. (U.S.)

- GC Aesthetics (Ireland)

- Lumenis Ltd (Israel)

- Cynosure Inc (U.S.)

- Alma Lasers Ltd (Israel)

- Merz Pharma GmbH & Co. KGaA (Germany)

- GALDERMA (Switzerland)

- Integra LifeSciences Corporation (U.S.)

- POLYTECH Health & Aesthetics GmbH (Germany)

- Establishment Labs Holdings Inc. (Costa Rica)

- Groupe Sebbin SAS (France)

- Hans Biomed Co., Ltd. (South Korea)

- Guangzhou Wanhe Plastic Materials Co., Ltd. (China)

- Cutera, Inc. (U.S.)

- Syneron Medical Ltd. (Israel)

- Zimmer Biomet (U.S.)

- B. Braun SE (Germany)

- Anika Therapeutics, Inc. (U.S.)

- BioHorizons (U.S.)

What are the Recent Developments in Global Plastic Surgery and Integumentary System Procedures Market?

- In December 2025, Allure published a report on the “Over‑40 Nose Job” trend, showing a surge in rhinoplasty procedures among patients aged 40–54, nearly matching the numbers in younger demographics due to modern refined techniques, safer procedures, and broader societal acceptance

- In November 2025, RealSelf released new trend data revealing that cosmetic procedures became fully mainstream in 2025, with patients increasingly opting for natural, balanced results and regenerative treatments. Surgeons reported a dramatic rise in body‑contouring procedures post‑weight loss and a preference for smaller implants or fat‑grafting approaches

- In October 2025, Allure reported the emergence of “Lean Lipo,” a new body‑contouring innovation focused on enhancing natural muscle definition rather than fat removal, using advanced ultrasound‑assisted techniques. This reflects a growing demand for refined aesthetic outcomes with minimal trauma and smooth skin contours

- In October 2025, surgeons in Hyderabad, India highlighted the increasing integration of artificial intelligence (AI) into routine plastic and reconstructive surgery, using AI for early detection of complications, remote assessments, and improved patient outcomes marking a significant technological shift in clinical practice

- In February 2025, the American Society of Plastic Surgeons (ASPS) highlighted the top seven plastic surgery trends for 2025, emphasizing a shift toward subtle, natural results and cutting-edge treatments, such as smaller breast implants and refined surgical planning approaches. This trend reflects evolving patient preferences and innovation in procedural techniques across cosmetic and reconstructive surgery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.