Global Plastics To Fuel Market

Market Size in USD Billion

CAGR :

%

USD

75.87 Billion

USD

96.86 Billion

2025

2033

USD

75.87 Billion

USD

96.86 Billion

2025

2033

| 2026 –2033 | |

| USD 75.87 Billion | |

| USD 96.86 Billion | |

|

|

|

|

Plastics-To-Fuel Market Size

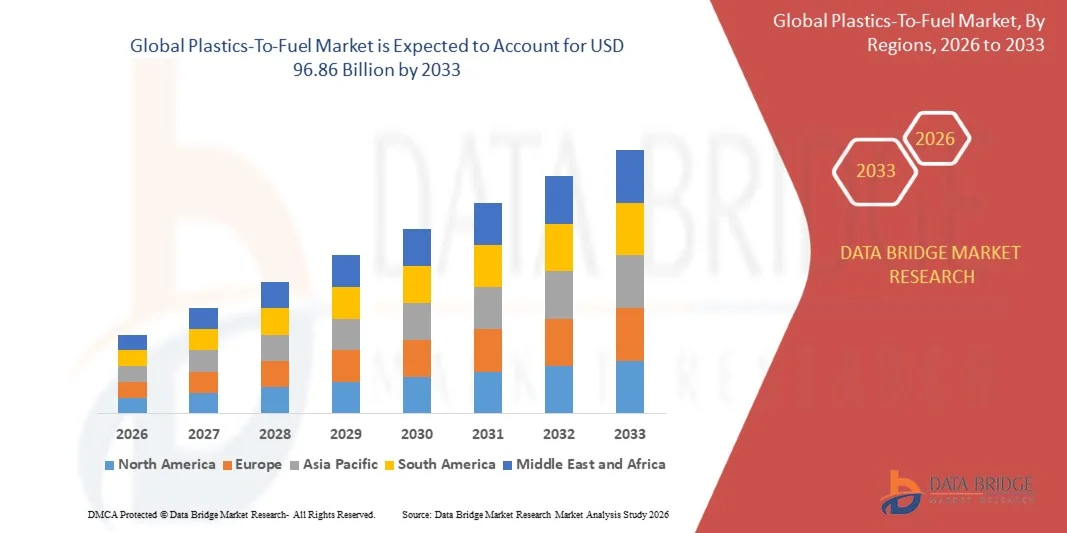

- The global plastics-to-fuel market size was valued at USD 75.87 billion in 2025 and is expected to reach USD 96.86 billion by 2033, at a CAGR of 3.10% during the forecast period

- The market growth is largely fuelled by increasing plastic waste generation and the rising demand for alternative and sustainable fuel sources

- Supportive government regulations and initiatives promoting circular economy and waste-to-energy solutions are driving market adoption

Plastics-To-Fuel Market Analysis

- The market is characterized by growing emphasis on sustainable fuel alternatives to reduce reliance on conventional fossil fuels

- Rising environmental concerns and global efforts to minimize plastic pollution are encouraging the adoption of plastics-to-fuel technologies

- Asia-Pacific dominated the plastics-to-fuel market with the largest revenue share of 50.75% in 2025, driven by rapid industrialization, rising urbanization, and growing energy demand in countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global plastics-to-fuel market, driven by technological advancements, increasing awareness of environmental sustainability, strong regulatory frameworks, and growing demand for alternative fuels in industrial and commercial sectors

- The Polyethylene segment held the largest market revenue share in 2025, driven by its high availability as post-consumer plastic waste and its suitability for conversion into fuel. Polyethylene is widely used in packaging and containers, making it a key feedstock for plastics-to-fuel technologies. Its ease of processing and high calorific value further support its adoption in energy recovery and industrial applications

Report Scope and Plastics-To-Fuel Market Segmentation

|

Attributes |

Plastics-To-Fuel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastics-To-Fuel Market Trends

“Rising Demand for Sustainable Waste-to-Energy Solutions”

• The growing focus on reducing plastic waste and promoting circular economy initiatives is significantly shaping the plastics-to-fuel market, as governments, industries, and consumers increasingly prefer environmentally responsible and resource-efficient solutions. Plastics-to-fuel technologies are gaining traction due to their ability to convert non-recyclable plastics into usable fuels, reducing landfill burden and generating alternative energy. This trend strengthens their adoption across energy, transportation, and industrial sectors, encouraging manufacturers to innovate with more efficient and cleaner conversion technologies

• Increasing awareness around environmental sustainability, energy security, and regulatory compliance has accelerated the demand for plastics-to-fuel solutions. Industries and municipalities are actively seeking technologies that can address plastic pollution while generating valuable energy outputs, prompting companies to invest in advanced pyrolysis and catalytic conversion systems

• Sustainability and regulatory trends are influencing purchasing and investment decisions, with governments and organizations emphasizing eco-friendly operations, emission reduction, and compliance with waste management policies. These factors are helping companies differentiate solutions in a competitive market and build stakeholder trust, while also driving the adoption of certifications and eco-labeling for plastics-to-fuel technologies

• For instance, in 2024, Plastic Energy in Spain and Brightmark Energy in the U.S. expanded their production capacities by incorporating advanced plastics-to-fuel conversion facilities. These projects were introduced in response to rising industrial and municipal demand for waste-to-energy solutions, with operations spanning commercial, industrial, and municipal applications. The produced fuels were also marketed as environmentally responsible alternatives to conventional fossil fuels, enhancing brand reputation and stakeholder engagement

• While demand for plastics-to-fuel solutions is growing, sustained market expansion depends on continuous R&D, cost-effective production, and achieving high conversion efficiency. Manufacturers are also focusing on improving scalability, feedstock management, and developing innovative solutions that balance cost, energy output, and environmental compliance for broader adoption

Plastics-To-Fuel Market Dynamics

Driver

“Growing Focus On Environmental Sustainability And Waste Reduction”

• Rising global awareness about plastic pollution and the need for alternative energy sources is a major driver for the plastics-to-fuel market. Governments, industries, and waste management companies are increasingly investing in technologies that convert non-recyclable plastics into usable fuels, supporting cleaner energy initiatives and circular economy goals

• Expanding applications in power generation, transportation, and industrial fuel sectors are influencing market growth. Plastics-to-fuel solutions help reduce dependency on fossil fuels, minimize landfill usage, and provide energy-efficient alternatives, enabling stakeholders to meet sustainability targets and regulatory compliance requirements

• Energy and industrial companies are actively promoting plastics-to-fuel solutions through strategic investments, facility expansions, and technology partnerships. These efforts are supported by growing environmental regulations, corporate sustainability goals, and increasing adoption of cleaner fuels, and they also encourage collaborations between technology providers and waste management organizations to enhance operational efficiency and fuel quality

• For instance, in 2023, Brightmark Energy in the U.S. and Recycling Technologies in the U.K. reported increased deployment of plastics-to-fuel facilities. This expansion followed higher municipal and industrial demand for alternative fuel solutions, driving adoption and long-term contracts. Both companies also emphasized sustainability and regulatory compliance in marketing campaigns to strengthen credibility and market position

• Although rising environmental and energy-efficiency trends support growth, wider adoption depends on cost optimization, feedstock availability, and scalable production technologies. Investment in supply chain efficiency, advanced conversion processes, and technological innovation will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Production Cost And Limited Feedstock Availability”

• The relatively higher cost of plastics-to-fuel production compared to conventional fossil fuels remains a key challenge, limiting adoption among cost-sensitive industries. Higher raw material costs, complex conversion technologies, and capital-intensive facilities contribute to elevated pricing. In addition, inconsistent availability of suitable plastic waste can further affect operational stability and market penetration

• Awareness and technological readiness remain uneven, particularly in developing markets where waste management infrastructure is still emerging. Limited understanding of conversion technologies and their benefits restricts adoption across certain industrial and municipal sectors. This also leads to slower implementation in regions where educational initiatives on plastics-to-fuel solutions are minimal

• Supply chain and operational challenges also impact market growth, as plastics-to-fuel facilities require reliable feedstock sourcing, quality control, and adherence to stringent environmental standards. Logistical complexities, storage requirements, and regulatory compliance increase operational costs. Companies must invest in efficient collection, sorting, and transportation systems to maintain consistent operations

• For instance, in 2024, plastics-to-fuel facilities in India and Southeast Asia reported slower uptake due to high operational costs, limited access to sorted plastic waste, and regulatory uncertainties. Infrastructure limitations and stringent environmental approvals were additional barriers. These factors also prompted some municipalities and industrial users to rely on conventional waste disposal or fuel sources, affecting market expansion

• Overcoming these challenges will require cost-efficient production methods, expanded feedstock networks, and focused educational initiatives for industries and governments. Collaboration with municipalities, waste management companies, and regulatory bodies can help unlock the long-term growth potential of the global plastics-to-fuel market. Furthermore, developing cost-competitive technologies and strengthening marketing strategies around environmental and energy benefits will be essential for widespread adoption

Plastics-To-Fuel Market Scope

The market is segmented on the basis of type, technology, and end use.

• By Type

On the basis of type, the plastics-to-fuel market is segmented into Polyethylene, Polystyrene, Polyvinyl Chloride, Polyethylene Terephthalate, and Polypropylene. The Polyethylene segment held the largest market revenue share in 2025, driven by its high availability as post-consumer plastic waste and its suitability for conversion into fuel. Polyethylene is widely used in packaging and containers, making it a key feedstock for plastics-to-fuel technologies. Its ease of processing and high calorific value further support its adoption in energy recovery and industrial applications.

The Polypropylene segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for efficient conversion of industrial and packaging waste into usable fuels. Polypropylene-based plastics-to-fuel solutions are gaining traction due to their higher energy content and compatibility with advanced pyrolysis and catalytic technologies. Growth in the manufacturing and packaging sectors is providing a steady supply of polypropylene waste for fuel production.

• By Technology

On the basis of technology, the market is segmented into Catalytic Depolymerization, Pyrolysis, and Gasification. The Pyrolysis segment held the largest revenue share in 2025 due to its efficiency in converting mixed plastic waste into high-energy fuels and its adaptability to a wide range of feedstock. Pyrolysis technologies are widely adopted in industrial applications for power generation, transportation fuels, and chemical feedstocks. Continuous innovation in reactor design and process optimization has improved fuel yield and reduced emissions, further supporting market growth.

The Catalytic Depolymerization segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to produce higher-quality fuels with lower environmental impact. Catalytic processes allow plastics to be converted into liquid fuels similar to conventional diesel and gasoline. Advances in catalysts and process integration are improving energy efficiency and scalability, encouraging wider adoption across industrial and commercial applications.

• By End Use

On the basis of end use, the market is segmented into Crude Oil, Hydrogen, Sulfur, and Others. The Crude Oil segment held the largest market revenue share in 2025, fueled by the high demand for liquid fuels derived from plastic waste as an alternative to conventional petroleum. Crude oil produced from plastics-to-fuel processes is increasingly used in industrial energy, transportation, and petrochemical sectors. The segment benefits from government incentives promoting renewable and alternative energy sources.

The Hydrogen segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising need for clean energy and low-emission fuel alternatives. Hydrogen produced from plastics-to-fuel processes is being adopted in power generation, industrial operations, and transportation applications. Technological advancements in conversion methods and supportive policies for hydrogen energy are accelerating market growth in this segment.

Plastics-To-Fuel Market Regional Analysis

- Asia-Pacific dominated the plastics-to-fuel market with the largest revenue share of 50.75% in 2025, driven by rapid industrialization, rising urbanization, and growing energy demand in countries such as China, Japan, and India

- Government initiatives promoting waste-to-energy projects and environmental sustainability are accelerating market adoption

- Furthermore, APAC is emerging as a manufacturing hub for plastics-to-fuel technologies, increasing affordability and accessibility of solutions across the region

Japan Plastics-To-Fuel Market Insight

The Japan plastics-to-fuel market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s focus on environmental sustainability, energy efficiency, and advanced technological adoption. Industrial and municipal stakeholders are increasingly investing in pyrolysis and catalytic depolymerization plants to convert plastic waste into fuel. In addition, the integration of plastics-to-fuel solutions with renewable energy strategies is fueling growth, while Japan’s aging population and energy-conscious policies are likely to spur demand for efficient and environmentally friendly waste-to-fuel solutions.

China Plastics-To-Fuel Market Insight

The China plastics-to-fuel market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid industrialization, urbanization, and high rates of plastic consumption. China is one of the largest producers of plastic waste, and the adoption of plastics-to-fuel technologies is becoming increasingly popular among municipal, industrial, and commercial operators. Government initiatives promoting smart cities and sustainable energy solutions, along with the presence of domestic technology providers, are key factors propelling market growth in China.

North America Plastics-To-Fuel Market Insight

North America is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrial adoption of waste-to-energy solutions and supportive government initiatives promoting circular economy practices. Consumers and industries in the region are increasingly prioritizing sustainable fuel alternatives and efficient waste management solutions, enhancing the demand for plastics-to-fuel technologies. This widespread adoption is further supported by advanced waste collection infrastructure, high awareness of environmental sustainability, and growing industrial energy needs, establishing plastics-to-fuel as a preferred solution for both municipal and industrial applications

U.S. Plastics-To-Fuel Market Insight

The U.S. plastics-to-fuel is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising plastic waste generation and increasing investments in alternative fuel production. Industries are actively adopting pyrolysis and catalytic depolymerization technologies to convert non-recyclable plastics into usable fuels. Growing regulatory support, combined with corporate sustainability initiatives, is further propelling market growth. In addition, partnerships between waste management firms and technology providers are enhancing operational efficiency and fuel output.

Europe Plastics-To-Fuel Market Insight

The Europe plastics-to-fuel market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations and policies promoting renewable energy and waste-to-energy solutions. Increasing urbanization and industrialization are fostering the adoption of plastics-to-fuel technologies. European stakeholders are also drawn to the dual benefits of reducing plastic pollution and generating alternative fuels. The region is experiencing significant growth across municipal, industrial, and commercial sectors, with plastics-to-fuel plants being incorporated into both new and existing infrastructure.

U.K. Plastics-To-Fuel Market Insight

The U.K. plastics-to-fuel market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict waste management policies and growing emphasis on sustainable energy alternatives. Rising industrial and municipal initiatives to manage plastic waste efficiently are encouraging the adoption of plastics-to-fuel solutions. The country’s strong focus on decarbonization, combined with investments in advanced conversion technologies, is expected to continue driving market expansion.

Germany Plastics-To-Fuel Market Insight

The Germany plastics-to-fuel market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing industrial adoption of alternative fuel solutions and high awareness of environmental sustainability. Germany’s advanced infrastructure and commitment to renewable energy are promoting the establishment of plastics-to-fuel facilities. The integration of these technologies into industrial and municipal operations is also becoming increasingly prevalent, with strong emphasis on regulatory compliance and emission reduction.s

Plastics-To-Fuel Market Share

The Plastics-To-Fuel industry is primarily led by well-established companies, including:

- Vadxx Energy LLC (U.S.)

- RES Polyflow LLC (U.S.)

- Green Envirotec Holdings Corp. (Canada)

- Agilyx (U.S.)

- JBI, Inc. (U.S.)

- Envion AG (Switzerland)

- Shangqiu Sihai Machinery Equipment Co., Ltd. (China)

- Beston (Henan) Machinery Co., Ltd. (China)

- Zhangzhou Qiyu Renewable Energy Technology Co., Ltd. (China)

- CbS Technologies (U.S.)

- POLCYL (France)

- Klean Industries Inc. (Canada)

- Renewlogy (U.S.)

- RESYNERGI (U.K.)

- Rudra Environmental Solutions India Ltd. (India)

- MK Aromatics Limited (India)

- Cassandra Oil AB (Sweden)

- Avantium (Netherlands)

Latest Developments in Plastics-To-Fuel Market

- In January 2025, Agilyx completed the acquisition of a minority stake in GreenDot Global, enhancing its feedstock sourcing capabilities and expanding its circular plastics platform in Europe. This strategic move allows Agilyx to secure a steady supply of plastic waste for conversion into fuels and chemicals, supporting its long-term growth plans. The partnership is expected to strengthen the company’s competitive position in the European market, improve operational efficiency, and encourage wider adoption of sustainable plastics-to-fuel solutions. In addition, this collaboration is likely to accelerate innovations in feedstock management and processing technologies, benefiting the overall industry

- In December 2024, Plastic Energy advanced the commissioning of its advanced recycling facility in the Netherlands, developed in collaboration with SABIC, moving closer to full-scale commercial operations. The facility will enable the conversion of plastic waste into high-quality fuels and feedstocks for the chemical industry, reducing dependency on fossil fuels. This development supports the circular economy by transforming non-recyclable plastics into valuable resources. It is also expected to create new market opportunities for industrial-scale plastic recycling in Europe and encourage investment in similar sustainable technologies. Furthermore, the project highlights the growing importance of partnerships between technology providers and major chemical companies in scaling plastics-to-fuel solutions

- In May 2024, researchers at Ames National Laboratory successfully transformed plastic waste into fuel, demonstrating a scalable and innovative approach to waste-to-energy conversion. The breakthrough showcases advanced chemical and catalytic methods that can efficiently convert various types of plastic waste into usable fuels. This innovation could accelerate industrial adoption by providing a technically feasible and environmentally friendly alternative to traditional waste disposal. It also has the potential to influence global research directions in the plastics-to-fuel sector and promote the development of next-generation technologies. In addition, it strengthens the role of public research institutions in supporting sustainable energy solutions

- In January 2024, Advanced Hydrocarbon Fuels Limited (AHFL) announced plans to deploy its first commercial-scale unit in the U.K., showcasing a revolutionary process to convert plastic into fuel. The unit is expected to provide a practical demonstration of the company’s proprietary technology and its ability to handle significant volumes of plastic waste. By producing sustainable fuels at scale, the project will help reduce plastic pollution and contribute to regional energy security. The deployment is likely to encourage regulatory support, attract further investment in plastics-to-fuel technologies, and stimulate market confidence in industrial-scale applications. In addition, it sets a precedent for future commercial installations across Europe and other regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastics To Fuel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastics To Fuel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastics To Fuel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.