Global Plenoptic Camera Market

Market Size in USD Billion

CAGR :

%

USD

4.26 Billion

USD

6.16 Billion

2025

2033

USD

4.26 Billion

USD

6.16 Billion

2025

2033

| 2026 –2033 | |

| USD 4.26 Billion | |

| USD 6.16 Billion | |

|

|

|

|

What is the Global Plenoptic Camera Market Size and Growth Rate?

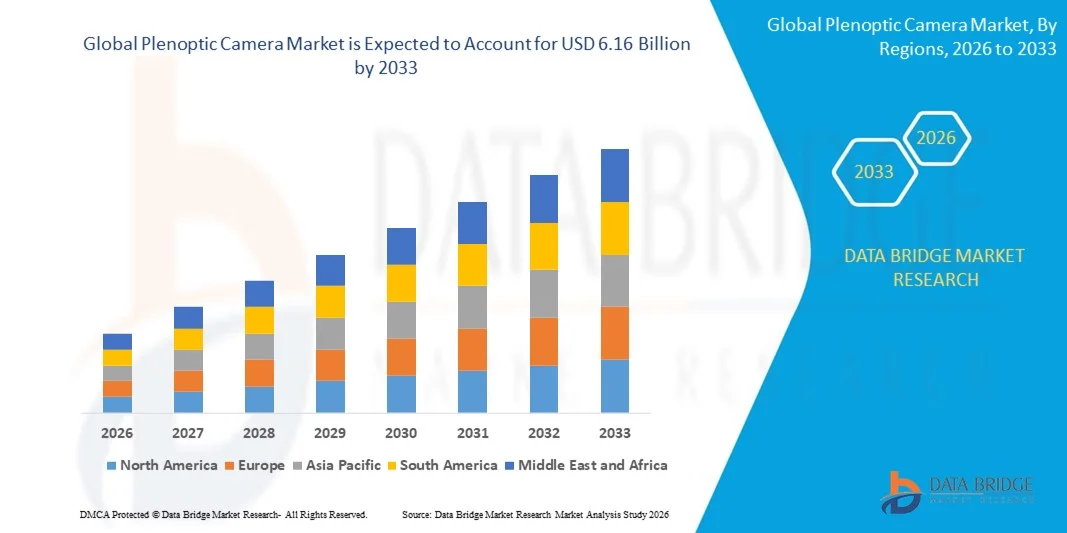

- The global plenoptic camera market size was valued at USD 4.26 billion in 2025 and is expected to reach USD 6.16 billion by 2033, at a CAGR of18.10% during the forecast period

- Increasing growth of the tourism sector across the globe, increasing levels of disposable income of the people along with improving standard of living of the people, high trends towards adventure sports for high focus images, increasing requirement of plenoptic cameras to capture the complete 4D light field on the sensor plane, increasing adoption of plenoptic cameras for robot vision during on-orbit servicing missions, rising number of applications in passive 3D modelling, 3D video recording, depth-guided scene tracking and segmentation and augmented reality are some of the major as well as vital factors which will such asly to augment the growth of the plenoptic camera market

What are the Major Takeaways of Plenoptic Camera Market?

- Increasing expansion of consumer electronics industry along with rising number of technological advancements, surging levels of investment in research and development activities which will further contribute by generating massive opportunities that will lead to the growth of the plenoptic camera market in the above mentioned projected timeframe

- High prices of the product along with increasing production of Smartphone’s and other mobile devices with advanced features which will such asly to act as market restraints factor for the growth of the plenoptic camera in the above mentioned projected timeframe

- Asia-Pacific dominated the plenoptic camera market with a 42.05% revenue share in 2025, driven by rapid expansion in semiconductor design, advanced electronics manufacturing, 5G deployment, and increasing adoption of embedded systems across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by strong R&D in embedded electronics, semiconductor innovation, AI imaging, and computational photography across the U.S. and Canada

- The Standard Plenoptic Camera segment dominated the market with a 44.7% share in 2025, driven by its widespread adoption across AR/VR imaging, 3D reconstruction, and computational photography

Report Scope and Plenoptic Camera Market Segmentation

|

Attributes |

Plenoptic Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plenoptic Camera Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Plenoptic Cameras

- The plenoptic camera market is witnessing strong adoption of compact, lightweight, and high-resolution imaging systems designed to support 3D imaging, depth sensing, and computational photography applications

- Manufacturers are introducing multi-aperture, software-defined, and AI-enabled plenoptic cameras that offer advanced image processing, refocusing capabilities, and compatibility with modern imaging software

- Growing demand for cost-efficient, portable, and field-deployable cameras is driving usage across research labs, AR/VR development, automotive ADAS systems, and industrial inspection

- For instance, companies such as Lytro, Raytrix, and Panasonic have upgraded their plenoptic camera portfolios with enhanced resolution, improved light-field capture, and cloud-enabled imaging analytics

- Increasing need for real-time depth mapping, 3D reconstruction, and high-speed imaging is accelerating the shift toward PC-integrated and AI-enabled plenoptic cameras

- As digital imaging becomes more complex and computationally intensive, plenoptic cameras will remain vital for real-time imaging, immersive AR/VR, and advanced vision systems

What are the Key Drivers of Plenoptic Camera Market?

- Rising demand for high-resolution, multi-aperture cameras to support real-time depth sensing, 3D reconstruction, and AR/VR applications

- For instance, in 2025, leading companies such as Lytro, Raytrix, and Panasonic enhanced their portfolios to support higher resolution, wider field-of-view, and AI-based image processing

- Growing adoption of autonomous vehicles, robotics, consumer electronics, and smart imaging systems is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in computational photography, AI-driven image processing, and light-field capture have strengthened camera performance, portability, and efficiency

- Rising use of AI-enabled sensors, multi-aperture arrays, and high-speed image acquisition systems is creating demand for high-performance plenoptic cameras

- Supported by steady investments in AR/VR, autonomous systems, and imaging R&D, the plenoptic camera market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Plenoptic Camera Market?

- High costs associated with premium, high-resolution, multi-aperture plenoptic cameras restrict adoption among small labs and emerging technology developers

- For instance, during 2024–2025, fluctuations in sensor component prices, specialized optical chips, and longer lead times increased device manufacturing costs for several global vendors

- Complexity in computational imaging, real-time depth processing, and multi-aperture calibration increases the need for skilled engineers and training

- Limited awareness in emerging markets regarding light-field imaging capabilities, AI-based reconstruction, and imaging software integration slows adoption

- Competition from conventional high-resolution cameras, depth sensors, and software-based 3D reconstruction tools creates pricing pressure and reduces product differentiation

- To address these challenges, companies are focusing on cost-optimized designs, AI-enabled software, training resources, and cloud-based analytics to increase global adoption of plenoptic cameras

How is the Plenoptic Camera Market Segmented?

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the plenoptic camera market is segmented into Standard Plenoptic Camera, Focused Plenoptic Camera, and Coded Aperture Camera. The Standard Plenoptic Camera segment dominated the market with a 44.7% share in 2025, driven by its widespread adoption across AR/VR imaging, 3D reconstruction, and computational photography. These cameras offer a balanced combination of light-field capture, depth mapping, and post-capture refocusing capabilities, making them ideal for research labs, industrial imaging, and media production environments. Their compact design, ease of use, and compatibility with modern PC-based imaging software further fuel adoption.

The Coded Aperture Camera segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by rising demand for high-resolution, computationally enhanced imaging in advanced applications such as autonomous vehicles, robotics, and precision medical imaging. Increasing investments in AI-enabled imaging and next-generation 3D capture systems are driving long-term adoption across industrial and commercial sectors.

- By Application

On the basis of application, the plenoptic camera market is segmented into Healthcare, Defence, Media, Building, Industry, and Other. The Media segment dominated the market with a 38.5% share in 2025, supported by strong adoption for cinematic production, VR/AR content creation, live streaming, and professional photography. Plenoptic cameras enable real-time depth mapping, post-capture refocusing, and 3D visualization, making them essential for media studios, film production houses, and content creators.

The Healthcare segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing applications in medical imaging, surgical guidance, telemedicine, and diagnostic visualization. Rising investment in AI-assisted imaging, 3D diagnostics, and minimally invasive procedures is accelerating the adoption of plenoptic cameras across hospitals, research institutes, and medical device companies worldwide.

Which Region Holds the Largest Share of the Plenoptic Camera Market?

- Asia-Pacific dominated the plenoptic camera market with a 42.05% revenue share in 2025, driven by rapid expansion in semiconductor design, advanced electronics manufacturing, 5G deployment, and increasing adoption of embedded systems across China, Japan, India, South Korea, and Southeast Asia

- High-volume production of consumer electronics, automotive ECUs, PCBs, and IoT devices fuels strong demand for Plenoptic Cameras across industrial, automotive, and research applications. Continuous investment in AI hardware, industrial automation, smart devices, and digital infrastructure further strengthens the region’s market leadership

- Leading companies in Asia-Pacific are introducing advanced plenoptic imaging solutions with high-resolution capture, multi-aperture lenses, depth mapping, and cloud-enabled visualization tools, reinforcing technological dominance. Strong government support, local manufacturing capabilities, and competitive pricing boost both domestic and export adoption

China Plenoptic Camera Market Insight

China is the largest contributor to Asia-Pacific due to massive semiconductor investments, world-leading electronics manufacturing capacity, and strong government backing for digital innovation. Rising deployment of high-speed circuits, AI chips, and advanced imaging systems increases demand for plenoptic cameras with multi-aperture and computational imaging features. Local production capacity and scalable pricing further expand adoption across research labs and industrial facilities.

Japan Plenoptic Camera Market Insight

Japan demonstrates steady growth driven by precision electronics manufacturing, advanced telecom infrastructure, and continuous modernization of automotive, industrial, and media systems. High-quality engineering standards and strong adoption of robotics, VR/AR imaging, and embedded systems support the use of premium plenoptic cameras.

India Plenoptic Camera Market Insight

India is emerging as a high-growth hub, supported by expanding semiconductor design centers, rising startup activity, and government-led electronics manufacturing initiatives. Growing requirements in automotive electronics, IoT devices, and research labs drive adoption in testing and prototyping environments. Increasing digital infrastructure and R&D investments accelerate market penetration.

South Korea Plenoptic Camera Market Insight

South Korea contributes significantly due to strong demand for advanced processors, memory devices, high-performance consumer electronics, and 5G systems. Rapid development in AI servers, automotive imaging, and display technologies increases adoption of high-resolution plenoptic cameras with enhanced depth and multi-aperture features. Strong technological innovation and manufacturing capabilities reinforce market growth.

North America Plenoptic Camera Market

North America is projected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by strong R&D in embedded electronics, semiconductor innovation, AI imaging, and computational photography across the U.S. and Canada. High adoption of FPGA-based systems, high-speed digital interfaces, and cloud-enabled imaging solutions drives demand for plenoptic cameras across research labs, automotive testing, aerospace electronics, and academic institutions. Leading companies are introducing advanced cameras with high-resolution capture, multi-aperture imaging, and AI-assisted post-processing to support rapid prototyping, AR/VR, and industrial imaging applications.

U.S. Plenoptic Camera Market Insight

The U.S. is the largest contributor in North America, supported by extensive R&D in AI hardware, embedded systems, and computational photography. Major electronic design labs, media production studios, and automotive imaging centers drive adoption. High investment in AI, robotics, and industrial imaging solutions further propels growth.

Canada Plenoptic Camera Market Insight

Canada contributes to regional growth through expanding electronics clusters, adoption of smart devices, and growing investment in automotive and defense R&D. Universities and research labs increasingly utilize plenoptic cameras for imaging, 3D reconstruction, and VR/AR content creation. Government-supported innovation programs and a skilled workforce strengthen adoption.

Which are the Top Companies in Plenoptic Camera Market?

The plenoptic camera industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Panasonic Corporation (Japan)

- Canon Inc. (Japan)

- Sony Corporation (Japan)

- Google LLC (U.S.)

- Raytrix GmbH (Germany)

- OTOY Inc. (U.S.)

- SAMSUNG (South Korea)

- Axiom Optics (U.S.)

- Avegant Corp (U.S.)

- FoVI 3D (U.S.)

- Japan Display Inc. (Japan)

- Holografika (Hungary)

- Adobe Systems Incorporated (U.S.)

- Toshiba India Pvt. Ltd. (India)

- Ricoh Innovations Corporation (Japan)

- LEIA INC. (U.S.)

- Xiaomi (China)

What are the Recent Developments in Global Plenoptic Camera Market?

- In August 2023, Meta’s virtual reality division announced that it was developing an advanced see-through VR headset equipped with light-field cameras and lenses, offering a significant upgrade in immersive and interactive visualization. This development marks a major step forward for next-generation mixed-reality experiences

- In March 2023, Sony Semiconductor Solutions Corporation (SSS) introduced its new edge AI sensing platform, AITRIOS™, in the U.S., enabling faster deployment of AI-powered sensing solutions using edge devices such as AI cameras. This launch strengthens Sony’s position in edge intelligence and smart imaging technologies

- In March 2023, Sony Corporation unveiled its Retinal Projection Camera Kit, the DSC-HX99 RNV Kit, designed to support visually impaired users in capturing images using advanced projection technology. This innovation expands accessibility and enhances imaging possibilities for low-vision users

- In November 2021, K|Lens, a German start-up, introduced a groundbreaking light-field lens compatible with any full-frame sensor camera, bringing native 3D imaging capability to traditional camera systems. This launch significantly broadened adoption of light-field imaging across photographers and creators

- In April 2021, NASA’s Langley Research Center revealed the development of a new plenoptic camera capable of capturing and processing both 2D and 3D spatial information for precision metrology applications. This advancement contributes to more accurate measurement technologies in scientific and industrial fields

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plenoptic Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plenoptic Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plenoptic Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.