Global Point Of Care Molecular Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

11.97 Billion

USD

43.94 Billion

2024

2032

USD

11.97 Billion

USD

43.94 Billion

2024

2032

| 2025 –2032 | |

| USD 11.97 Billion | |

| USD 43.94 Billion | |

|

|

|

|

Point of Care Molecular Diagnostics Market Size

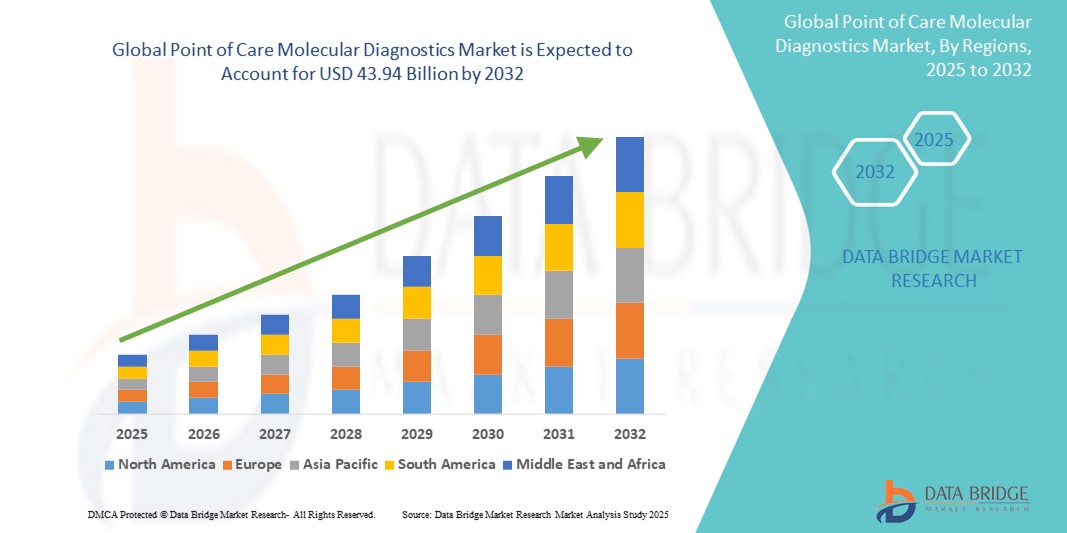

- The global point of care molecular diagnostics market size was valued at USD 11.97 billion in 2024 and is expected to reach USD 43.94 billion by 2032, at a CAGR of 13.40% during the forecast period

- The market growth is primarily driven by the increasing prevalence of infectious diseases, rising demand for rapid and accurate diagnostic testing, and advancements in molecular diagnostic technologies.

- In addition, the expansion of decentralized healthcare, rising adoption of point of care testing in hospitals and clinics, and growing awareness about early disease detection are significantly propelling the market’s expansion worldwide.

Point of Care Molecular Diagnostics Market Analysis

- Point of care molecular diagnostics enable rapid, accurate detection of diseases at or near the patient site, playing a critical role in improving healthcare outcomes in both clinical and remote settings

- The market growth is driven by the increasing prevalence of infectious diseases, rising demand for timely diagnosis, and technological advancements in molecular testing platforms that offer portability, ease of use, and faster results

- North America dominates the point of care molecular diagnostics market with the largest revenue share of 38.5% in 2024, supported by advanced healthcare infrastructure, significant R&D investments, and widespread adoption in hospitals and clinics. The U.S. leads this growth with increasing deployment of molecular diagnostic devices for diseases such as COVID-19, cancer, and genetic disorders

- Asia-Pacific is expected to be the fastest-growing region in the point of care molecular diagnostics market during the forecast period, propelled by improving healthcare access, growing government initiatives for disease control, and rising awareness of early diagnosis in countries such as China, India, and Japan

- The respiratory diseases segment is projected to dominate the market with a significant share of 42.3% in 2024, due to the high demand for rapid and accurate diagnosis of conditions such as COVID-19, influenza, and tuberculosis, which require timely intervention to reduce transmission and improve patient outcomes

Report Scope and Point of Care Molecular Diagnostics Market Segmentation

|

Attributes |

Point of Care Molecular Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Point of Care Molecular Diagnostics Market Trends

“Advancements in Rapid, Portable Testing Technologies”

- A key trend in the global point of care molecular diagnostics market is the growing development and adoption of rapid, portable diagnostic devices that enable quick and accurate testing at or near the patient’s location. This shift is driven by the need for timely diagnosis and treatment, especially in infectious diseases and chronic conditions

- For instance, devices such as Cepheid’s GeneXpert and Abbott’s ID NOW offer compact, easy-to-use platforms capable of delivering molecular diagnostic results within minutes, facilitating faster clinical decision-making. These systems are increasingly deployed in decentralized settings such as clinics, pharmacies, and remote locations

- Integration of advanced microfluidics and isothermal amplification techniques is improving the sensitivity and specificity of point of care molecular tests, reducing dependency on centralized laboratories. This enhances access to molecular diagnostics in underserved areas and emergency situations

- Moreover, connectivity features allowing real-time data sharing with healthcare providers and electronic health records are becoming standard, enabling better patient monitoring and public health responses

- Companies such as Roche Diagnostics and BioFire Diagnostics are investing heavily in R&D to enhance device portability, multiplexing capability, and user-friendly interfaces, aligning with the rising demand for decentralized testing

- The trend towards rapid, on-site molecular diagnostics is transforming healthcare delivery by empowering providers with immediate insights, reducing turnaround times, and improving patient outcomes across diverse clinical settings

Point of Care Molecular Diagnostics Market Dynamics

Driver

“Growing Demand Fueled by the Rise in Respiratory Diseases and the Need for Quick Diagnosis”

- The growing prevalence of respiratory diseases such as COVID-19, influenza, and tuberculosis is significantly driving demand for point of care molecular diagnostics, which provide fast and accurate results critical for timely treatment and infection control

- For instance, in March 2024, Abbott launched the ID NOW COVID-19 rapid molecular test, enabling healthcare providers to deliver results in minutes at the point of care, enhancing patient management and reducing hospital burden

- Rising awareness among healthcare professionals and patients about the benefits of decentralized testing, including faster diagnosis and improved treatment outcomes, is further fueling market growth

- In addition, increasing government initiatives and funding to improve diagnostic infrastructure globally are accelerating the adoption of molecular diagnostic devices at point of care settings

- The ongoing technological advancements in molecular diagnostic platforms, such as portable devices and multiplex testing capabilities, are expanding their applications and driving market penetration across hospitals, clinics, and remote care facilities

Restraint/Challenge

“High Costs and Regulatory Hurdles Limit Market Growth”

- The high cost of advanced point of care molecular diagnostic devices, including consumables and maintenance, poses a significant barrier to adoption, especially in low- and middle-income countries with limited healthcare budgets

- For instance, the expensive nature of rapid molecular testing platforms compared to traditional diagnostic methods has slowed penetration in resource-constrained settings.

- In addition, stringent regulatory requirements and lengthy approval processes for molecular diagnostic products across different regions delay market entry and increase development costs for manufacturers

- Variability in regulatory standards and the need for extensive clinical validation to demonstrate accuracy and reliability can hinder the timely launch of innovative devices

- Moreover, lack of trained personnel and infrastructural challenges in decentralized healthcare settings can restrict effective utilization of point of care molecular diagnostic technologies

- Addressing these challenges through cost reduction strategies, streamlined regulatory pathways, and increased training initiatives will be crucial for accelerating market growth globally

Point of Care Molecular Diagnostics Market Scope

The market is segmented on the basis product and services, technology, test location, application, and end user.

By Product and Services

On the basis of product and services, the POC molecular diagnostics market is segmented into assays and kits, instruments/analyzers, and software and services. The assays and kits segment is expected to hold the largest market share due to continuous development of novel diagnostic tests and essential reagents.

The Instruments/analyzers segment will also see substantial growth, driven by the introduction of compact, portable, and automated devices. These instruments are crucial for enabling sophisticated molecular analysis in decentralized settings, supporting rapid diagnostics.

By Technology

On the basis of technology, the market includes polymerase chain reaction (PCR)-Based, genetic sequencing-based, hybridization-based, microarray-based, isothermal nucleic acid amplification technology (INAAT), and others. PCR-Based technology will dominate due to its high sensitivity and established reliability for various pathogen detections.

Isothermal nucleic acid amplification technology (INAAT) is projected to show the fastest growth. Its rapid results and simpler instrumentation make it highly suitable for resource-limited environments, driving increased adoption across different settings.

By Test Location

On the basis of test location, the POC molecular diagnostics market is segmented into over the counter and point of care. The point of care segment currently holds the dominant share, fueled by the immediate need for rapid diagnoses in clinical settings.

The over the counter segment is expected to grow rapidly, driven by the increasing availability of user-friendly home testing kits. These empower individuals for self-testing, especially for infectious diseases and general health monitoring.

By Application

On the basis of application, the market segments include respiratory diseases, sexually transmitted diseases (STDs), hospital-acquired infections (HAIs), oncology, hepatitis, hematology, prenatal testing, endocrinology, and others. Respiratory diseases will account for a significant share due to continuous demand for rapid detection of pathogens such as influenza and COVID-19.

The Oncology segment is expected to show robust growth, driven by increasing adoption of molecular diagnostics. These tests are vital for early cancer detection, screening, and guiding personalized therapy selections for improved patient outcomes.

By End User

On the basis of end user, the market comprises physician offices, hospital emergency departments and intensive care units (ICUs), research institutes, home-care, decentralized labs, assisted living healthcare facilities, and others. Hospital emergency departments and ICUS represent a major segment, needing rapid and accurate diagnoses for immediate patient management and critical care decisions.

The home-care segment is projected to experience the fastest growth. This is driven by the convenience and empowerment of self-testing solutions, enabling effective chronic disease management and infectious disease monitoring from home.

Point of Care Molecular Diagnostics Market Regional Analysis

- North America dominates the global point of care molecular diagnostics market with the largest revenue share of 38.5% in 2024, driven by advanced healthcare infrastructure, rising prevalence of infectious diseases, and strong adoption of rapid diagnostic technologies

- The region benefits from significant investments in healthcare innovation, widespread use of molecular testing for diseases such as COVID-19, influenza, and tuberculosis, and growing demand for decentralized diagnostics in clinical and home settings

- In addition, high healthcare spending, government support for early disease detection programs, and presence of key market players contribute to North America’s leading position in the point of care molecular diagnostics market globally

U.S. Point of Care Molecular Diagnostics Market Insight

The U.S. dominates the North American point of care molecular diagnostics market, capturing the largest revenue share of approximately 82% in 2024, driven by widespread adoption of rapid diagnostic testing and growing demand for timely disease detection. Increasing prevalence of infectious diseases, government initiatives promoting decentralized healthcare, and technological advancements in molecular diagnostic platforms are key growth factors. The strong focus on point of care testing in hospitals, clinics, and home healthcare settings, along with integration of user-friendly devices and connectivity features, is further accelerating market expansion in the U.S.

Europe Point of Care Molecular Diagnostics Market Insight

The European point of care molecular diagnostics market is expected to grow at a significant CAGR during the forecast period, driven by increasing healthcare decentralization and rising demand for rapid diagnostic solutions. Strict regulatory frameworks aimed at improving patient outcomes and reducing hospital stays are promoting the adoption of POC molecular tests. Additionally, growing awareness of infectious disease management and advancements in portable, easy-to-use diagnostic devices are fueling market growth. Expansion across hospitals, clinics, and outpatient care centers, along with government initiatives supporting early disease detection, further bolsters the market in Europe.

U.K. Point of Care Molecular Diagnostics Market Insight

The U.K. point of care molecular diagnostics market is expected to witness robust growth at a notable CAGR during the forecast period, driven by increasing demand for rapid, accurate diagnostic testing in decentralized healthcare settings. Rising prevalence of infectious diseases and chronic conditions, combined with government initiatives to improve early diagnosis and reduce healthcare costs, are key growth factors. The expansion of outpatient care, urgent care centers, and remote testing capabilities is further propelling adoption. Additionally, advancements in portable molecular diagnostic technologies and growing awareness among healthcare professionals support the market’s positive trajectory in the U.K.

Germany Point of Care Molecular Diagnostics Market Insight

The German point of care molecular diagnostics market is expected to grow steadily at a considerable CAGR during the forecast period, driven by increasing demand for rapid diagnostic solutions in hospitals and outpatient settings. Germany’s advanced healthcare infrastructure, strong focus on innovation, and government support for early disease detection contribute to market expansion. The emphasis on eco-friendly and efficient medical technologies, along with rising awareness of personalized medicine, further boosts adoption of molecular diagnostics in the region.

Asia-Pacific Point of Care Molecular Diagnostics Market Insight

The Asia-Pacific point of care molecular diagnostics market is projected to register the fastest CAGR of over 24% by 2024, fueled by rapid urbanization, expanding healthcare infrastructure, and increasing government initiatives to enhance diagnostic capabilities. Countries such as China, India, and Japan are investing heavily in modern healthcare technologies, accelerating demand for point of care molecular diagnostics. Growing prevalence of infectious diseases and chronic conditions, along with rising disposable incomes and expanding middle-class populations, also drive market growth.

Japan Point of Care Molecular Diagnostics Market Insight

The Japan point of care molecular diagnostics market is witnessing significant growth, supported by the country’s technologically advanced healthcare sector and aging population requiring rapid and accurate diagnostic testing. The rise of smart healthcare initiatives and integration of molecular diagnostics into outpatient clinics and home care settings further stimulate demand. Japan’s focus on precision medicine and increasing healthcare expenditure are also key factors driving market expansion.

China Point of Care Molecular Diagnostics Market Insight

The China point of care molecular diagnostics market accounted for the largest revenue share in Asia-Pacific in 2024, propelled by rapid urbanization, rising healthcare investments, and strong government support for healthcare modernization. China’s expanding middle class and increasing prevalence of infectious diseases and chronic conditions are escalating demand for quick and reliable diagnostic solutions. The country’s robust manufacturing base for molecular diagnostic devices and ongoing development of smart healthcare infrastructure significantly contribute to market growth.

Point of Care Molecular Diagnostics Market Share

The point of care molecular diagnostics industry is primarily led by well-established companies, including:

- Abbott (US)

- Siemens Healthineers AG (Germany)

- Quidel Corporation (US)

- F. Hoffman-La Roche Ltd. (Switzerland)

- Danaher. (US)

- BD (US)

- Chembio Diagnostics (US)

- EKF Diagnostics (UK)

- Trinity Biotech plc (Ireland)

- Instrumentation Laboratory (US)

- Nova Biomedical (US)

- PTS Diagnostics (US)

- Sekisui Diagnostics (US)

- Thermo Fisher Scientific (US)

- bioMérieux S.A. (France)

- DiaSorin S.p.A (Italy)

- AccuBioTech Co., Ltd. (China)

- Meridian Bioscience (US)

- Biocartis Bioscience (Europe)

- GeneSTAT Molecular Diagnostics, LLC (US)

- Terumo Corporation (Japan)

- Grifols, S.A (Spain)

Latest Developments in Global Point of Care Molecular Diagnostics Market

- In February 2025, Avitia launched an AI-powered cancer diagnostics platform, enabling rapid, cost-effective testing at the point of care. This innovation enhances clinical decision-making, reduces costs, and accelerates treatment timelines. Already deployed across North America and Southeast Asia, Avitia’s platform advances precision oncology

- In January 2025, Roche received FDA 510(k) clearance and a CLIA waiver for its cobas liat multiplex assays, enabling point-of-care STI testing. These assays allow clinicians to diagnose chlamydia, gonorrhea, and Mycoplasma genitalium using a single sample, delivering results in 20 minutes. The technology enhances rapid treatment decisions and reduces follow-up delays

- In May 2025, Sherlock Bio has begun clinical trials for its over-the-counter rapid STI test, designed to detect chlamydia and gonorrhea with self-collected swabs. The test delivers results within 30 minutes, improving accessibility and reducing discomfort compared to traditional lab testing. The company aims for a mid-2025 launch, pending FDA approval

- In May 2024, Molbio launched TruSight, an AI-powered point-of-care platform for hematology applications, including complete blood count (CBC), malaria detection, and sickle cell disease screening. Designed for resource-limited settings, TruSight enhances diagnostic accuracy and accessibility, supporting rapid blood analysis with advanced AI algorithms. This innovation aims to improve clinical efficiency while reducing testing barriers

- In December 2024, Labcorp introduced a molecular diagnostic test for the H5N1 bird flu virus, supporting rapid detection amid a multistate outbreak in the U.S. The test, developed with CDC collaboration, enhances public health preparedness by enabling physicians to diagnose infections quickly using nasopharyngeal swabs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.