Global Point Of Sale Pos Payment Technologies Market

Market Size in USD Billion

CAGR :

%

USD

22.33 Billion

USD

77.90 Billion

2025

2033

USD

22.33 Billion

USD

77.90 Billion

2025

2033

| 2026 –2033 | |

| USD 22.33 Billion | |

| USD 77.90 Billion | |

|

|

|

|

Point of Sale (POS) Payment Technologies Market Size

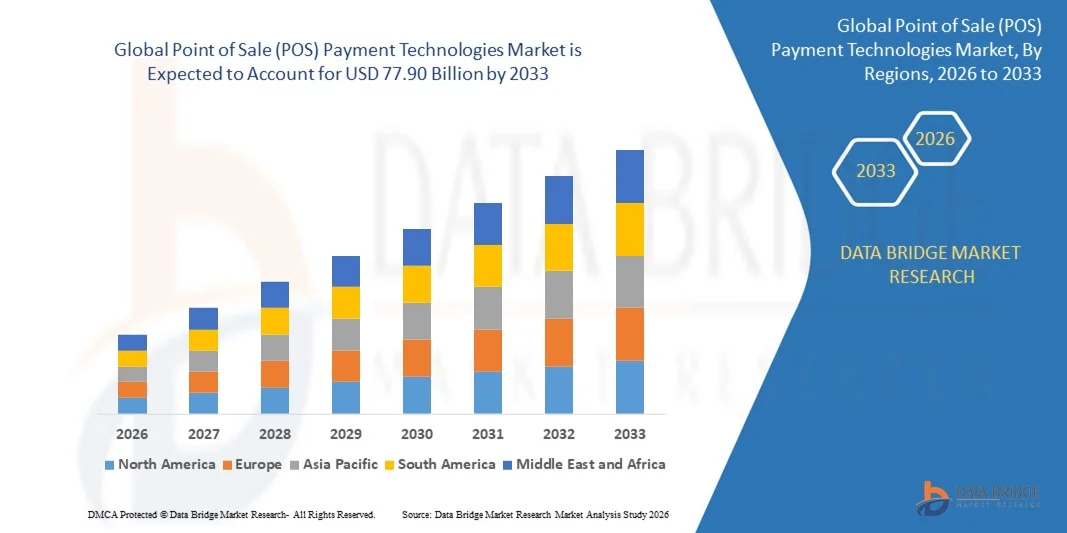

- The global point of sale (POS) payment technologies market size was valued at USD 22.33 billion in 2025 and is expected to reach USD 77.90 billion by 2033, at a CAGR of 16.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital payments and the ongoing technological advancements in POS systems, including mobile, contactless, and cloud-based solutions, which are enhancing transaction speed, security, and operational efficiency for merchants across retail, hospitality, and BFSI sectors

- Furthermore, rising consumer preference for convenient, secure, and seamless payment experiences, coupled with merchant demand for integrated POS solutions that support inventory management, analytics, and loyalty programs, is establishing advanced POS systems as the preferred payment method in modern commerce. These converging factors are accelerating the adoption of POS technologies, thereby significantly boosting the market's expansion

Point of Sale (POS) Payment Technologies Market Analysis

- Point of sale (POS) payment technologies, providing electronic transaction processing for goods and services, are increasingly essential tools for modern businesses due to their ability to facilitate fast, secure, and reliable payments while integrating with backend systems such as inventory, CRM, and accounting software

- The escalating demand for point of sale (POS) payment technologies is primarily driven by the growing shift toward cashless payments, heightened security concerns, expansion of e-commerce and retail automation, and a rising preference among merchants and consumers for mobile, contactless, and omnichannel payment solutions

- North America dominated the point of sale (POS) payment technologies market in 2025, due to a strong adoption of digital payments, increasing retail automation, and the widespread use of mobile and contactless payment solutions

- Asia-Pacific is expected to be the fastest growing region in the point of sale (POS) payment technologies market during the forecast period due to rapid urbanization, smartphone penetration, and digital payment adoption in countries such as China, Japan, and India

- Near-field Communication (NFC) payments segment dominated the market with a market share of 52.9% in 2025, due to its widespread adoption in smartphones and wearable devices, enabling quick and contactless transactions. Retailers and consumers prefer NFC due to its high security standards, ease of use, and compatibility with mobile wallets and banking applications. In addition, NFC payments facilitate seamless integration with loyalty programs and digital offers, enhancing customer experience and engagement. The segment also benefits from growing awareness of contactless payment hygiene, particularly in high-traffic public spaces, contributing to sustained demand

Report Scope and Point of Sale (POS) Payment Technologies Market Segmentation

|

Attributes |

Point of Sale (POS) Payment Technologies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Point of Sale (POS) Payment Technologies Market Trends

Growing Adoption of Contactless and Mobile Payment Solutions

- A significant trend in the POS payment technologies market is the increasing adoption of contactless and mobile payment solutions, driven by the rising demand for faster, secure, and convenient payment experiences across retail, hospitality, and BFSI sectors. This trend is accelerating the deployment of modern POS systems that support NFC, QR codes, and mobile wallets

- For instance, companies such as Verifone and PAX Technology are supplying advanced contactless-enabled terminals that facilitate seamless payments while integrating with inventory management and loyalty programs. These systems improve transaction speed, reduce cash handling, and enhance customer experience

- The adoption of mobile POS devices is growing rapidly as retailers and service providers seek flexible solutions for in-store, curbside, and on-the-go payments. This is positioning POS technologies as critical tools for businesses aiming to provide omnichannel payment options

- Retailers are increasingly integrating POS systems with digital wallets, loyalty programs, and analytics platforms to provide personalized promotions and improve operational efficiency. This trend is driving innovation in software capabilities and user-friendly interfaces

- Hospitality and quick-service restaurants are expanding their use of tablet-based and cloud POS solutions to streamline order management and payment processing. This is reinforcing the preference for mobile and contactless POS systems that enhance both staff efficiency and customer satisfaction

- The market is witnessing strong growth in e-commerce and hybrid retail models where integrated POS platforms unify online and offline transactions. This rising incorporation of digital payment acceptance is reinforcing the overall transition toward a cashless, faster, and more secure retail ecosystem

Point of Sale (POS) Payment Technologies Market Dynamics

Driver

Expansion of Digital Payment Infrastructure and E-Commerce

- The growing investment in digital payment infrastructure and the rapid expansion of e-commerce are driving the demand for advanced POS payment solutions that facilitate seamless transactions across multiple channels. POS systems now offer integrated inventory, CRM, and reporting features that improve merchant efficiency and customer satisfaction

- For instance, Stripe and PayPal provide POS solutions that enable merchants to accept online, mobile, and in-store payments through unified platforms. These systems support omnichannel growth and increase adoption of secure, reliable payment methods

- The rising smartphone penetration and mobile wallet usage are contributing to the shift toward contactless and cashless payments, encouraging merchants to deploy POS systems capable of handling multiple payment types

- Small and medium enterprises are increasingly seeking cloud-based and subscription-enabled POS solutions that reduce upfront costs while offering scalable, feature-rich platforms. The demand for integrated analytics and real-time transaction reporting is enhancing operational insights for merchants, further driving the adoption of modern POS systems

- The expansion of digital payment networks, combined with government initiatives promoting cashless economies in emerging markets, continues to strengthen this driver, positioning POS technologies as essential enablers of global digital commerce

Restraint/Challenge

High Implementation Costs and Integration Complexity

- The POS payment technologies market faces challenges due to the high implementation costs of advanced hardware, software, and network infrastructure required for modern systems. These costs are a significant barrier for small and medium businesses looking to adopt integrated POS solutions

- For instance, deploying cloud-based POS platforms with omnichannel capabilities and secure payment processing requires upfront investment in devices, software licenses, and staff training, which can limit market penetration

- Integration of POS systems with existing inventory, ERP, and financial systems is often complex, requiring technical expertise and extended deployment timelines

- Maintaining data security and compliance with regulations such as PCI DSS adds additional cost and operational complexity, further challenging adoption

- The market continues to face constraints in scaling POS solutions across multiple locations while ensuring seamless connectivity and system reliability. These challenges collectively place pressure on providers to optimize costs and simplify integration to meet growing merchant demand

Point of Sale (POS) Payment Technologies Market Scope

The market is segmented on the basis of POS solutions and end user.

- By POS Solutions

On the basis of POS solutions, the market is segmented into Near-field Communication (NFC) payments, Sound-wave Based Payments, and Magnetic Secure Transmission (MST) payments. The NFC payments segment dominated the market with the largest revenue share of 52.9% in 2025, driven by its widespread adoption in smartphones and wearable devices, enabling quick and contactless transactions. Retailers and consumers prefer NFC due to its high security standards, ease of use, and compatibility with mobile wallets and banking applications. In addition, NFC payments facilitate seamless integration with loyalty programs and digital offers, enhancing customer experience and engagement. The segment also benefits from growing awareness of contactless payment hygiene, particularly in high-traffic public spaces, contributing to sustained demand.

The Sound-wave Based Payments segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by technological advancements that allow secure transactions using acoustic signals without requiring internet connectivity. This solution is particularly appealing in emerging markets and small retail outlets, where traditional network-based POS systems may be limited. Sound-wave payments offer flexibility for smartphones and other devices, providing an alternative for users without NFC-enabled devices. Its adoption is further driven by partnerships with fintech startups and innovative payment solution providers that are actively expanding this technology across commercial and urban settings. The segment’s growth is also supported by increasing consumer trust in digital payments and continuous improvements in security and reliability.

- By End User

On the basis of end user, the point of sale (POS) payment technologies market is segmented into the hospitality and tourism sector, BFSI, media and entertainment, retail sector, education, and IT and telecom. The retail sector dominated the market with the largest revenue share in 2025, owing to the high frequency of transactions and the need for fast, secure, and contactless payment methods in stores, supermarkets, and e-commerce touchpoints. Retailers increasingly integrate POS technologies with inventory management and customer engagement tools, improving operational efficiency and overall shopping experience. For instance, companies such as Square and NCR Corporation have implemented comprehensive point of sale (POS) solutions for retail chains, enhancing payment processing speed and data analytics capabilities. The sector also benefits from the rising preference for digital wallets and mobile payments among urban consumers, driving continuous adoption of advanced point of sale (POS) solutions.

The hospitality and tourism sector is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for seamless payment experiences in hotels, restaurants, and travel services. Contactless POS solutions reduce transaction time and improve guest satisfaction while ensuring security during high-volume transactions. Hospitality providers are adopting innovative POS solutions to streamline payments across multiple touchpoints, including room service, online bookings, and in-venue purchases. For instance, companies such as Toast and Ingenico have launched specialized POS platforms for the hospitality industry, combining payment processing with management and reporting tools. The growth is further supported by rising tourism activity globally and the focus on enhancing customer convenience through integrated digital payment ecosystems.

Point of Sale (POS) Payment Technologies Market Regional Analysis

- North America dominated the point of sale (POS) payment technologies market with the largest revenue share in 2025, driven by a strong adoption of digital payments, increasing retail automation, and the widespread use of mobile and contactless payment solutions

- Merchants and consumers in the region highly value the convenience, speed, and security offered by advanced point of sale (POS) systems, which integrate with inventory management, CRM software, and loyalty programs

- This widespread adoption is further supported by high smartphone penetration, robust e-commerce growth, and a technologically savvy population, establishing point of sale (POS) solutions as a preferred payment method across retail, hospitality, and BFSI sectors

U.S. Point of Sale (POS) Payment Technologies Market Insight

The U.S. point of sale (POS) payment technologies market captured the largest revenue share in 2025 within North America, fueled by the rapid shift towards cashless transactions and increasing adoption of mobile wallets and NFC-based payment systems. Consumers and merchants are prioritizing faster checkout processes and seamless omnichannel payment experiences, driving demand for advanced POS solutions. The growing trend of self-service kiosks and mobile point of sale (POS) terminals in retail and QSRs further propels market growth, and the integration of AI and analytics for personalized promotions and fraud detection significantly enhances adoption.

Europe Point of Sale (POS) Payment Technologies Market Insight

The Europe point of sale (POS) payment technologies market is projected to grow at a substantial CAGR during the forecast period, driven by increasing regulatory support for digital payments and strong consumer preference for contactless and mobile transactions. For instance, Ingenico and Worldline are actively expanding their POS solutions across retail and banking sectors to meet rising demand. The region is witnessing growth in both brick-and-mortar and online retail segments, with point of sale (POS) systems increasingly integrated with loyalty and inventory management solutions. European consumers favor secure, efficient, and easy-to-use payment technologies, fostering adoption across small and large enterprises, while the expansion of digital banking infrastructure and increasing tourism further supports market growth.

U.K. Point of Sale (POS) Payment Technologies Market Insight

The U.K. point of sale (POS) payment technologies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the accelerated shift towards contactless and mobile payments. Consumers and businesses are increasingly adopting point of sale (POS) systems to enhance transaction speed, security, and operational efficiency. For instance, companies such as Square and iZettle are gaining traction by providing mobile and cloud-based point of sale (POS) solutions suitable for SMEs and large retailers. The U.K.’s robust retail and hospitality sectors, combined with growing e-commerce penetration, are expected to sustain market expansion, while the adoption of EMV-compliant and NFC-enabled terminals further supports demand for advanced point of sale (POS) technologies.

Germany Point of Sale (POS) Payment Technologies Market Insight

The Germany point of sale (POS) payment technologies market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong banking infrastructure and consumer preference for secure digital payments. For instance, VeriFone and Wirecard provide integrated point of sale (POS) solutions across retail and hospitality industries, addressing rising demand for seamless and compliant payment methods. Germany’s focus on technological innovation, cashless initiatives, and enterprise automation promotes point of sale (POS) adoption in both small and large enterprises, while the integration of point of sale (POS) systems with inventory management, ERP solutions, and analytics is increasingly common. Growing awareness of fraud prevention and cybersecurity in digital transactions further strengthens market growth.

Asia-Pacific Point of Sale (POS) Payment Technologies Market Insight

The Asia-Pacific point of sale (POS) payment technologies market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, smartphone penetration, and digital payment adoption in countries such as China, Japan, and India. The region’s increasing inclination towards cashless payments, supported by government initiatives such as digital wallets and UPI in India, is driving adoption. For instance, companies such as PAX Technology and Sunmi are leading the expansion of affordable POS hardware and integrated software solutions across the region. Rising e-commerce, retail modernization, and tourism are fueling demand for advanced point of sale (POS) systems, and as APAC becomes a hub for point of sale (POS) technology manufacturing, solutions are becoming more accessible to small and medium-sized businesses.

Japan Point of Sale (POS) Payment Technologies Market Insight

The Japan point of sale (POS) payment technologies market is gaining momentum due to the country’s high-tech culture, preference for contactless payments, and retail automation. Consumers prioritize speed, convenience, and secure transactions, driving point of sale (POS) adoption in retail, hospitality, and transportation sectors. For instance, NEC and Fujitsu are expanding cloud-based and mobile point of sale (POS) solutions to meet growing demand for efficient and integrated payment systems. Integration with loyalty programs, digital wallets, and QR code payments is fueling market growth, and Japan’s aging population is increasingly seeking easy-to-use, secure, and intuitive payment interfaces in both commercial and service sectors.

China Point of Sale (POS) Payment Technologies Market Insight

The China point of sale (POS) payment technologies market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing middle class, and high adoption of digital payments. Consumers increasingly rely on mobile wallets, QR code payments, and integrated POS solutions across retail and foodservice sectors. For instance, companies such as PAX Technology and Newland Payment are providing cost-effective point of sale (POS) terminals and software solutions, supporting widespread adoption. The push towards smart cities and government initiatives to reduce cash usage are further accelerating point of sale (POS) technology adoption, while strong domestic manufacturing capabilities and competitive pricing make point of sale (POS) solutions accessible to a wide consumer and business base.

Point of Sale (POS) Payment Technologies Market Share

The point of sale (POS) payment technologies industry is primarily led by well-established companies, including:

- Mastercard (U.S.)

- Econet Wireless Zimbabwe (Zimbabwe)

- Visa (U.S.)

- Fortumo (Estonia)

- American Express Company (U.S.)

- Boku Inc. (U.S.)

- Airtel India (India)

- Stripe (U.S.)

- PayPal (U.S.)

- Microsoft (U.S.)

- Vodacom (South Africa)

- Google (U.S.)

- PayU (Netherlands)

- Comviva (India)

- Novatti Group Pty Ltd (Australia)

- Paysafe Holdings UK Limited (U.K.)

- Bank of America Corporation (U.S.)

- Wirecard (Germany)

- First Data Corporation (U.S.)

- Paytm (India)

- Apple Inc. (U.S.)

Latest Developments in Global Point of Sale (POS) Payment Technologies Market

- In July 2025, Shift4 Payments completed the acquisition of Global Blue, a move that significantly strengthens its global position in the POS and payments ecosystem. This acquisition allows Shift4 to integrate tax‑refund and currency conversion services into its POS solutions, providing merchants with a comprehensive, all-in-one platform. The expanded capabilities enhance the shopping experience for international customers and increase merchant efficiency, positioning Shift4 as a leader in unified commerce and accelerating the adoption of advanced POS solutions globally

- In July 2025, Fiserv announced that Clover reached a milestone of 4 million POS devices sold globally, marking a significant indicator of market acceptance and trust in modern POS solutions. This achievement reflects strong and growing demand for integrated hardware and software systems that enhance transaction speed, operational efficiency, and data-driven insights for merchants. The milestone reinforces the ongoing trend toward digital transformation in retail and foodservice industries and underlines the expanding adoption of cloud-enabled POS technologies worldwide

- In June 2025, Shift4 announced the acquisition of Smartpay, a leading payment-processing and POS provider in Australia and New Zealand, for approximately US $180 million. This strategic expansion allows Shift4 to tap into a growing APAC market, providing access to Smartpay’s extensive merchant base and regional expertise. The acquisition facilitates rapid deployment of cloud-based POS and integrated payment solutions, driving digital payment adoption and improving operational efficiency for small and medium enterprises in the region

- In March 2025, Fiserv introduced the Clover POS system to the Australian market, extending its globally recognized cloud-based POS solution to a new geography. This development empowers small and medium businesses with integrated payment processing, inventory management, and analytics tools, streamlining operations and improving customer experience. The launch also accelerates the adoption of cloud-based POS systems in the retail and hospitality sectors in Australia, supporting the region’s digital payment ecosystem

- In January 2025, Verifone launched its new “Victa” portfolio of POS devices along with a softPOS solution called “Verifone Tap” and added biometric-enabled payment capabilities. This product innovation enhances the flexibility, security, and convenience of payment acceptance for merchants across retail and hospitality sectors. By offering modern hardware and software that supports emerging consumer preferences such as contactless and mobile payments, Verifone strengthens its competitive position and contributes to the wider adoption of advanced POS technologies worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.