Global Polyisoprene Pi Surgical Gloves Market

Market Size in USD Billion

CAGR :

%

USD

555.76 Billion

USD

947.78 Billion

2025

2033

USD

555.76 Billion

USD

947.78 Billion

2025

2033

| 2026 –2033 | |

| USD 555.76 Billion | |

| USD 947.78 Billion | |

|

|

|

|

Polyisoprene (PI) Surgical Gloves Market Size

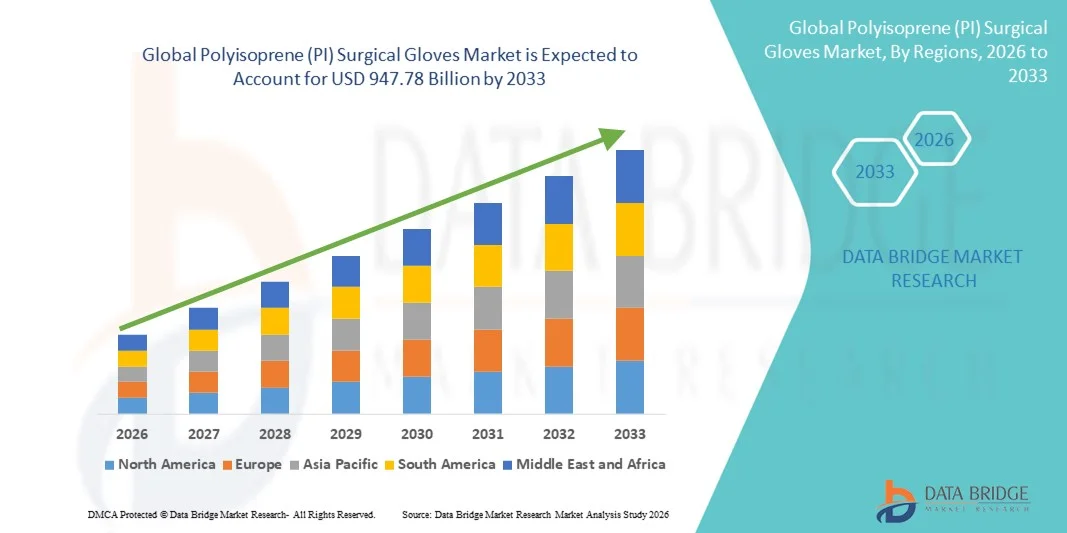

- The global polyisoprene (PI) surgical gloves market size was valued at USD 555.76 billion in 2025 and is expected to reach USD 947.78 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fueled by the rising adoption of polyisoprene surgical gloves due to their superior elasticity, puncture resistance, and latex-free properties, which are increasing their usage across hospitals and surgical centers

- Furthermore, growing demand for high-quality, hypoallergenic, and comfortable surgical gloves is establishing polyisoprene gloves as a preferred alternative to natural rubber latex gloves. These converging factors are accelerating the uptake of Polyisoprene (PI) surgical gloves, thereby significantly boosting the industry’s growth

Polyisoprene (PI) Surgical Gloves Market Analysis

- Polyisoprene (PI) surgical gloves are increasingly vital components of modern healthcare and surgical practices due to their latex-free composition, superior elasticity, high tactile sensitivity, and reduced risk of allergic reactions, making them suitable for both routine and complex surgical procedures

- The escalating demand for PI surgical gloves is primarily fueled by the rising focus on infection prevention, increasing surgical volumes, heightened awareness of latex allergies, and growing preference for premium, high-performance surgical gloves

- North America dominated the polyisoprene (PI) surgical gloves market with the largest revenue share of approximately 36.9% in 2025, supported by advanced healthcare infrastructure, stringent regulatory standards, high surgical procedure volumes, and strong presence of leading global glove manufacturers, with the U.S. contributing the majority of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the polyisoprene (PI) surgical gloves market during the forecast period, registering a higher CAGR due to expanding healthcare infrastructure, rising healthcare expenditure, increasing surgical procedures, and growing adoption of latex-free surgical products across emerging economies

- The with chemical accelerators segment dominated the largest market revenue share of 58.4% in 2025, driven by its widespread use in high-volume surgical and medical procedures. Gloves with chemical accelerators offer faster curing during manufacturing, resulting in cost efficiency and high production output

Report Scope and Polyisoprene (PI) Surgical Gloves Market Segmentation

|

Attributes |

Polyisoprene (PI) Surgical Gloves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Polyisoprene (PI) Surgical Gloves Market Trends

Rising Preference for Latex-Free and Allergy-Safe Surgical Gloves

- A significant and accelerating trend in the global polyisoprene (PI) surgical gloves market is the growing preference for latex-free, allergy-safe surgical gloves, driven by increasing awareness of latex-induced allergic reactions among healthcare professionals and patients

- For instance, hospitals and surgical centers are increasingly replacing natural rubber latex gloves with polyisoprene gloves due to their similar elasticity, tensile strength, and tactile sensitivity without the risk of Type I latex allergies

- Polyisoprene surgical gloves offer superior comfort, excellent fit, and high durability, making them suitable for complex and long-duration surgical procedures

- The shift toward safer glove materials is being reinforced by occupational safety guidelines and hospital procurement policies focused on reducing allergen exposure

- This trend toward safer and more biocompatible surgical gloves is reshaping purchasing decisions across hospitals, ambulatory surgical centers, and specialty clinics

- Consequently, leading glove manufacturers are expanding their polyisoprene glove portfolios to meet rising demand from healthcare providers seeking high-performance, latex-free alternatives

Polyisoprene (PI) Surgical Gloves Market Dynamics

Driver

Growing Demand Due to Rising Surgical Procedures and Healthcare Infrastructure Expansion

- The increasing number of surgical procedures worldwide, driven by rising prevalence of chronic diseases and an aging population, is a major driver for the Polyisoprene (PI) Surgical Gloves market

- For instance, in June 2024, Top Glove Corporation announced capacity expansion initiatives for its synthetic glove manufacturing lines to support rising global demand for high-quality surgical gloves, including polyisoprene-based products

- Expanding healthcare infrastructure, particularly in emerging economies, is increasing the number of hospitals and surgical centers requiring advanced surgical consumables

- Growing awareness of surgical safety and infection prevention is further driving demand for premium surgical gloves

- In addition, increasing government investments in healthcare systems are supporting higher surgical volumes and glove consumption

- These factors collectively contribute to sustained growth in the global polyisoprene surgical gloves market

Restraint/Challenge

High Production Costs and Price Sensitivity in Emerging Markets

- High production costs associated with polyisoprene materials and advanced manufacturing processes pose a significant challenge to market growth

- For instance, fluctuations in synthetic rubber raw material prices and rising energy costs have increased manufacturing expenses for polyisoprene gloves, impacting profit margins for glove manufacturers

- Compared to natural rubber latex and nitrile gloves, polyisoprene surgical gloves are generally priced higher, limiting adoption in cost-sensitive healthcare settings

- Budget constraints in public hospitals and healthcare facilities in developing regions may restrict large-scale adoption of premium gloves

- In addition, price competition from alternative glove materials can impact market penetration

- Overcoming these challenges through cost optimization, economies of scale, and expanded production capacity will be crucial for sustained market growth

Polyisoprene (PI) Surgical Gloves Market Scope

The market is segmented on the basis of chemical accelerators and end users.

- By Chemical Accelerators

On the basis of chemical accelerators, the Polyisoprene (PI) Surgical Gloves market is segmented into with chemical accelerators and without chemical accelerators. The with chemical accelerators segment dominated the largest market revenue share of 58.4% in 2025, driven by its widespread use in high-volume surgical and medical procedures. Gloves with chemical accelerators offer faster curing during manufacturing, resulting in cost efficiency and high production output. These gloves provide superior elasticity, tensile strength, and durability, making them suitable for demanding surgical environments. Hospitals and medical centers continue to prefer accelerator-based PI gloves due to their proven performance and reliability. In addition, their long-standing presence in clinical settings ensures strong user familiarity and acceptance. The availability of a wide range of product options further supports adoption. Established manufacturing processes and lower production costs also contribute to dominance. Despite rising allergy concerns, controlled formulations help mitigate risks. Strong demand from developing healthcare systems further boosts usage. Therefore, gloves with chemical accelerators remained the dominant segment in 2025.

The without chemical accelerators segment is anticipated to witness the fastest CAGR of 12.6% from 2026 to 2033, driven by increasing awareness regarding contact dermatitis and allergic reactions among healthcare professionals. Accelerator-free PI gloves significantly reduce the risk of Type IV hypersensitivity reactions. Growing emphasis on occupational safety and worker well-being is accelerating adoption. Hospitals are increasingly shifting toward hypoallergenic glove solutions. Regulatory bodies and healthcare institutions are promoting safer alternatives, further supporting growth. Advances in manufacturing technologies now allow high-quality accelerator-free gloves without compromising performance. Rising demand from developed markets also contributes to expansion. In addition, premium pricing supports revenue growth. Increased adoption in long-duration surgical procedures further boosts demand. Hence, accelerator-free PI surgical gloves are expected to grow rapidly.

- By End Users

On the basis of end users, the Polyisoprene (PI) Surgical Gloves market is segmented into hospitals, medical centers, ambulatory surgical centers, and others. The hospitals segment accounted for the largest market revenue share of 46.9% in 2025, driven by the high volume of surgical procedures performed globally. Hospitals require large quantities of surgical gloves to maintain infection control and patient safety. Polyisoprene gloves are preferred due to their latex-like comfort without allergy risks. Increasing hospital admissions and surgical interventions support sustained demand. The presence of advanced surgical infrastructure further accelerates usage. Hospitals also benefit from long-term procurement contracts, ensuring consistent consumption. Strict hygiene regulations mandate continuous glove usage. The rising prevalence of chronic diseases requiring surgical treatment further fuels demand. Hospitals prioritize high-quality gloves for critical procedures. Therefore, hospitals remained the dominant end-user segment in 2025.

The ambulatory surgical centers segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by the growing shift toward outpatient and minimally invasive surgeries. ASCs offer cost-effective and efficient surgical services, increasing procedure volumes. Rising preference for same-day surgeries supports glove demand. Polyisoprene gloves are increasingly adopted due to comfort and tactile sensitivity. Expansion of ASCs in both developed and emerging regions accelerates growth. Lower infection risk and faster patient turnover boost procedural frequency. Increasing investments in ambulatory care infrastructure further support expansion. Favorable reimbursement policies also contribute to growth. Therefore, ambulatory surgical centers are expected to be the fastest-growing end-user segment.

Polyisoprene (PI) Surgical Gloves Market Regional Analysis

- North America dominated the polyisoprene (PI) surgical gloves market with the largest revenue share of approximately 36.9% in 2025, supported by advanced healthcare infrastructure, high surgical procedure volumes, and stringent infection control standards

- The region benefits from widespread adoption of latex-free surgical gloves due to rising awareness of latex allergies among healthcare professionals and patients

- Strong regulatory oversight by healthcare authorities ensures consistent demand for high-quality surgical gloves

U.S. Polyisoprene (PI) Surgical Gloves Market Insight

The U.S. polyisoprene (PI) surgical gloves market accounted for the largest revenue share within North America in 2025, driven by high surgical volumes and strong adoption of premium, latex-free surgical products. The country has a well-established hospital network and a growing number of ambulatory surgical centers, supporting consistent glove consumption. Increasing focus on occupational safety for healthcare workers is accelerating the shift toward polyisoprene gloves. Strict FDA regulations and quality standards further reinforce demand for high-performance surgical gloves. In addition, the presence of major manufacturers and distributors ensures a stable supply chain. Rising prevalence of chronic diseases requiring surgical intervention continues to propel market growth in the U.S.

Europe Polyisoprene (PI) Surgical Gloves Market Insight

The Europe polyisoprene (PI) surgical gloves market is projected to expand at a steady CAGR during the forecast period, driven by stringent healthcare regulations and rising emphasis on patient and worker safety. Increasing surgical procedures across public and private healthcare systems support market growth. European healthcare providers are progressively adopting latex-free alternatives to reduce allergy-related risks. Growth in minimally invasive and elective surgeries further boosts glove demand. Strong government healthcare spending and expanding hospital infrastructure contribute to regional expansion. In addition, increasing awareness of infection prevention and control practices sustains long-term market growth.

U.K. Polyisoprene (PI) Surgical Gloves Market Insight

The U.K. polyisoprene (PI) surgical gloves market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising surgical workloads within the National Health Service (NHS). Increasing adoption of latex-free gloves aligns with occupational health and safety guidelines. Growth in outpatient and day-care surgeries further drives glove demand. The U.K.’s focus on reducing hospital-acquired infections strengthens the use of high-quality surgical gloves. In addition, procurement reforms and centralized purchasing systems ensure consistent demand across healthcare facilities. Expanding private healthcare services also contribute to market growth.

Germany Polyisoprene (PI) Surgical Gloves Market Insight

The Germany polyisoprene (PI) surgical gloves market is expected to expand at a considerable CAGR over the forecast period, driven by a strong healthcare system and high surgical procedure volumes. Germany’s emphasis on quality medical supplies and strict compliance with EU medical device regulations supports adoption of premium surgical gloves. Increasing use of latex-free products in hospitals and clinics further drives demand. The country’s aging population contributes to rising surgical interventions. In addition, Germany’s leadership in medical technology and healthcare innovation supports steady market expansion.

Asia-Pacific Polyisoprene (PI) Surgical Gloves Market Insight

The Asia-Pacific polyisoprene (PI) surgical gloves market is expected to grow at the fastest CAGR during the forecast period, driven by rapidly expanding healthcare infrastructure and rising healthcare expenditure across emerging economies. Increasing surgical procedures due to growing population and chronic disease burden significantly boost glove demand. Governments across the region are investing in hospital expansion and infection control measures. Growing awareness of latex allergies is accelerating adoption of polyisoprene gloves. Expansion of medical tourism further supports surgical volumes. In addition, improving access to advanced healthcare services fuels sustained market growth.

Japan Polyisoprene (PI) Surgical Gloves Market Insight

The Japan polyisoprene (PI) surgical gloves market is witnessing steady growth due to the country’s advanced healthcare system and aging population. Japan has a high rate of surgical procedures, particularly in orthopedics, cardiology, and oncology. Strong emphasis on patient safety and infection prevention supports adoption of high-quality surgical gloves. Latex-free products are increasingly preferred to minimize allergic reactions. Technological advancements and strict quality standards further enhance market demand. Continuous investment in healthcare infrastructure supports long-term growth.

China Polyisoprene (PI) Surgical Gloves Market Insight

The China polyisoprene (PI) surgical gloves market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rapid expansion of healthcare infrastructure and increasing surgical volumes. Rising government healthcare spending and hospital modernization initiatives support market growth. Growing awareness of infection control and occupational safety boosts adoption of polyisoprene gloves. The increasing prevalence of chronic diseases and expanding access to surgical care further drive demand. In addition, the presence of domestic manufacturers improves product availability and affordability. China’s expanding healthcare system continues to be a key growth driver in the region.

Polyisoprene (PI) Surgical Gloves Market Share

The Polyisoprene (PI) Surgical Gloves industry is primarily led by well-established companies, including:

• Ansell Limited (Australia)

• Top Glove Corporation Bhd (Malaysia)

• Hartalega Holdings Berhad (Malaysia)

• Kossan Rubber Industries Bhd (Malaysia)

• Cardinal Health, Inc. (U.S.)

• Medline Industries, LP (U.S.)

• Mölnlycke Health Care AB (Sweden)

• Semperit AG Holding (Austria)

• B. Braun Melsungen AG (Germany)

• Kimberly-Clark Corporation (U.S.)

• Dynarex Corporation (U.S.)

• Sri Trang Gloves (Thailand)

• Kanam Latex Industries Pvt. Ltd. (India)

• RFB Latex Limited (Malaysia)

• Rubberex Corporation (Malaysia)

• Shijiazhuang Hongray Group (China)

• Intco Medical Technology Co., Ltd. (China)

• Halyard Health (U.S.)

• Paul Hartmann AG (Germany)

Latest Developments in Global Polyisoprene (PI) Surgical Gloves Market

- In July 2022, Cariflex Pte. Ltd., a subsidiary of DL Chemical Co., initiated construction of the world’s largest polyisoprene latex plant on a 6.1-hectare site in Jurong Island, Singapore, aimed at enhancing global supply capabilities for medical and protective applications — marking a significant capacity expansion in polyisoprene raw material production

- In August 2023, Saravanan Ramasamy’s polyisoprene surgical glove (unified double layer) received 510(k) clearance from the U.S. Food and Drug Administration (FDA) as a sterile, powder-free surgical glove tested for use with chemotherapy drugs and fentanyl, supporting regulatory momentum for specialized glove products

- In November 2024, DL Chemical’s subsidiary inaugurated the world’s largest polyisoprene latex plant on Jurong Island, Singapore, significantly expanding production capacity for high-quality polyisoprene material used in medical and surgical gloves, reinforcing supply resilience for the industry

- In August 2024, U.S. Medical Glove Company (USMGC) acquired a domestic polyisoprene chemical facility in South Carolina, making it the only end-to-end, made-in-America producer of both nitrile and polyisoprene gloves. The facility includes new production lines and raw material output supporting the manufacture of billions of surgical gloves annuall

- In September 2024, Ansell’s GAMMEX PI Plus Glove-in-Glove System won the 2024 World of Safety & Health Asia Award under the Safety & Health Category, recognizing its innovative design that improves surgical safety and efficiency while enhancing wearer comfort and compliance with best practices

- In October 2024, a market research forecast reported that polyisoprene-based surgical gloves were gaining market traction due to allergen-free properties, contributing to broader adoption trends within the double-layered surgical glove segment in global healthcare settings

- In January 2025, Kossan Rubber Industries entered a strategic partnership with Shenzhen Wandewei Technology Co. Ltd. to co-develop and manufacture polyisoprene surgical gloves for the Asia-Pacific market, expanding product development initiatives and regional supply chains

- In July 2025, Ansell announced the expansion of its manufacturing capabilities to increase global production of its surgical and examination gloves, including polyisoprene types, in response to rising global healthcare demand and surgical volume growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.