Global Polypropylene Market

Market Size in USD Billion

CAGR :

%

USD

136.32 Billion

USD

189.45 Billion

2024

2032

USD

136.32 Billion

USD

189.45 Billion

2024

2032

| 2025 –2032 | |

| USD 136.32 Billion | |

| USD 189.45 Billion | |

|

|

|

|

Polypropylene Market Size

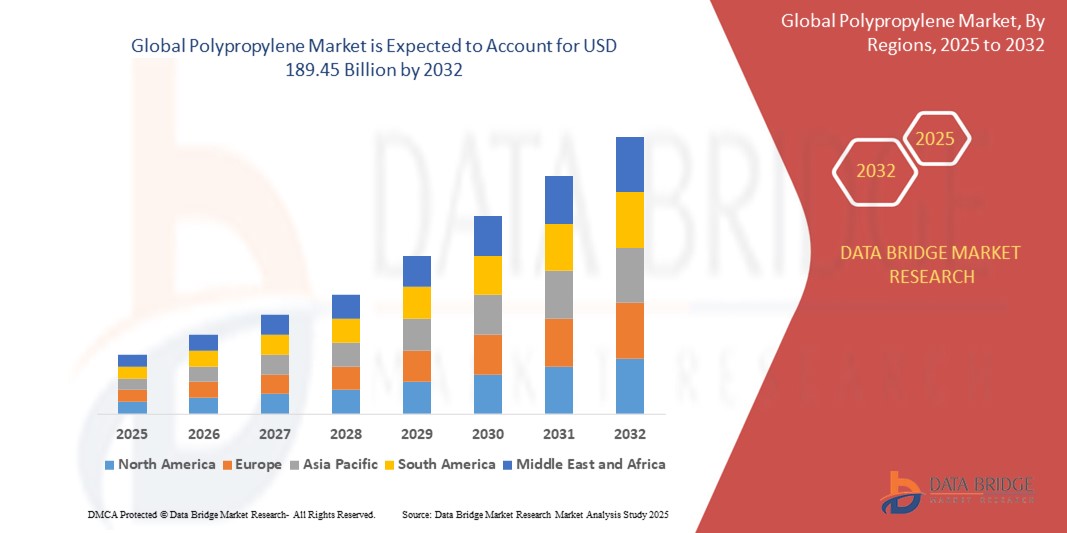

- The global polypropylene market size was valued at USD 136.32 billion in 2024 and is expected to reach USD 189.45 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely driven by the increasing demand for lightweight and durable materials in automotive manufacturing, packaging, and consumer goods industries

- For instance, in February 2024, LyondellBasell announced the expansion of its polypropylene compounding capacity in Germany to meet the growing automotive sector's demand for lightweight materials, especially for electric vehicles

- The adoption of advanced polymerization technologies and process innovations, such as Spherizone and Borstar, is further improving production efficiency and material performance, reinforcing the market's upward trajectory

Polypropylene Market Analysis

- Polypropylene (PP), a versatile thermoplastic polymer, is increasingly critical across various industries such as automotive, packaging, electronics, and consumer goods due to its lightweight, durability, chemical resistance, and cost-effectiveness

- The surging demand for polypropylene is primarily driven by its extensive application in automotive manufacturing, especially for lightweight components that help improve fuel efficiency and reduce CO₂ emissions. For instance, in March 2024, SABIC announced new polypropylene-based materials designed for electric vehicle battery casings to optimize thermal and structural performance

- Asia-Pacific dominates the polypropylene market with the largest revenue share of over 50% in 2024, attributed to robust industrial growth, high polymer consumption in packaging and automotive sectors, and expanding manufacturing activities, particularly in China and India. In January 2024, Indian Oil Corporation commissioned a new polypropylene plant in Gujarat to meet domestic and export demands

- North America is expected to witness significant growth during the forecast period, supported by technological advancements in polymer processing and an increasing focus on sustainability. In February 2024, ExxonMobil introduced new high-performance PP grades for rigid packaging and automotive interiors featuring enhanced recyclability

- The injection molding segment dominates the polypropylene market, accounting for approximately 43% of the total demand in 2024, as it is the preferred technique for producing high-precision components in sectors such as packaging, electronics, and automotive

Report Scope and Polypropylene Market Segmentation

|

Attributes |

Polypropylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Polypropylene Market Trends

“Surge in Demand for Recyclable and Sustainable Polypropylene Solutions”

- A significant and accelerating trend in the global polypropylene market is the growing shift towards recyclable and sustainable polypropylene (PP) materials, driven by increasing environmental regulations, brand commitments to circularity, and consumer demand for eco-friendly products

- For instance, in March 2024, Borealis launched a new line of fully recyclable polypropylene packaging solutions under its Bornewables™ product range, offering reduced carbon footprints and compliance with food contact standards

- Advanced mechanical and chemical recycling technologies are gaining momentum, enabling the transformation of post-consumer PP waste into high-quality resins. Companies such as LyondellBasell and Suez expanded their joint recycling operations in Europe in February 2024, aimed at producing circular PP for packaging and automotive applications

- Brand owners and manufacturers are increasingly adopting mass balance-certified polypropylene, which integrates recycled feedstock into existing production streams without altering material performance. For instance, in January 2024, SABIC supplied certified circular polypropylene to Unilever for use in personal care packaging, aligning with both companies’ sustainability goals

- The integration of bio-based polypropylene is also a growing area of innovation. In April 2024, Braskem expanded its “I’m Green™” portfolio, introducing new grades of bio-based polypropylene made from renewable feedstocks such as sugarcane ethanol

- This trend toward more sustainable, high-performance polypropylene solutions is fundamentally reshaping industry standards and pushing companies to invest in circular economy technologies. As a result, partnerships between resin producers, recyclers, and end-users are accelerating across the packaging, automotive, and consumer goods sectors

- The demand for eco-friendly polypropylene that does not compromise on functionality is rising rapidly across global markets, with regulatory bodies and sustainability-conscious consumers serving as key catalysts for this transformation

Polypropylene Market Dynamics

Driver

“Growing Demand Across Packaging and Automotive Industries”

- The increasing reliance on lightweight, durable, and cost-effective materials across key end-use sectors such as packaging and automotive is a significant driver of demand for polypropylene (PP)

- For instance, in February 2024, ExxonMobil introduced new high-performance polypropylene grades for automotive interior components and rigid packaging, offering enhanced strength-to-weight ratios and superior processability—further reinforcing PP’s relevance in high-performance applications

- As manufacturers face mounting pressure to improve fuel efficiency and reduce emissions, polypropylene’s lightweight nature makes it an ideal alternative to metal and other heavier plastics. This is particularly evident in the automotive industry, where major OEMs are increasingly using PP in battery housings, bumpers, and interior trims

- In addition, the packaging industry is seeing an upsurge in demand for polypropylene due to its excellent chemical resistance, high clarity, and suitability for food contact. In April 2024, BASF SE launched new food-grade polypropylene products that offer enhanced recyclability, targeting the rapidly expanding sustainable packaging segment

- The expanding use of PP in healthcare and consumer goods, driven by sterilization compatibility and chemical inertness, is also contributing to its growing demand. With increased post-pandemic focus on hygiene, polypropylene is being widely used in masks, syringes, and disposable medical gear

- Furthermore, rising investments in polypropylene production capacity are supporting supply-side growth. For instance, in March 2024, Reliance Industries Limited announced plans to boost polypropylene output at its Jamnagar complex to meet the growing domestic and export market demand

Restraint/Challenge

“Environmental Concerns and Regulatory Pressures Regarding Plastic Waste”

- Environmental concerns associated with polypropylene waste and its contribution to global plastic pollution represent a major challenge for market growth. While polypropylene is recyclable, global recycling rates remain low due to inadequate infrastructure and economic barriers in many regions

- For instance, in January 2024, the European Union introduced stricter packaging waste regulations under the Packaging and Packaging Waste Regulation (PPWR), targeting reduced use of single-use plastics—including polypropylene-based packaging—and mandating increased recyclability standards across member states

- These evolving regulatory pressures are compelling manufacturers to rethink their material usage and invest in circular economy initiatives. However, retrofitting production processes to include recycled or bio-based polypropylene often involves high capital investment and complex supply chain adaptations, posing a hurdle for small and mid-sized manufacturers

- Moreover, public perception and environmental activism are increasingly influencing brand choices. Many consumers view polypropylene as part of the single-use plastic problem, despite its recyclability, which is driving demand for alternatives such as biodegradable plastics or paper-based solutions

- While major industry players such as SABIC and Borealis are investing in chemical recycling and sustainable polypropylene grades, technical challenges remain in scaling these solutions economically and maintaining the mechanical properties of recycled materials

- Addressing these issues through policy support, investment in recycling infrastructure, and product innovation will be critical to ensuring polypropylene remains a viable and sustainable material choice in the future

Polypropylene Market Scope

The market is segmented on the basis type, process, chemical structure, end use, and application.

- By Type

On the basis of type, the polypropylene market is segmented into homopolymer and copolymer. The homopolymer segment dominates the largest market revenue share in 2025, driven by its superior strength, stiffness, and chemical resistance, making it highly suitable for packaging, textiles, and automotive components. Homopolymers are particularly favored for their ease of processing and cost-efficiency in high-volume manufacturing applications

The copolymer segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in applications requiring enhanced impact resistance and flexibility. Copolymers, including random and block types, are widely used in automotive bumpers, household goods, and medical devices, offering improved durability and cold weather performance

• By Process

On the basis of process, the polypropylene market is segmented into injection molding, blow molding, extrusion, and others. The injection molding segment held the largest market revenue share in 2025, driven by its widespread application in the production of automotive parts, containers, and consumer goods. Injection molding offers high precision, repeatability, and efficient mass production, making it the preferred choice for complex polypropylene components

The extrusion segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its application in film and sheet production, pipes, and profiles. The process's continuous nature and compatibility with various PP grades make it essential for packaging, construction, and industrial uses

• By Application

On the basis of application, the polypropylene market is segmented into fiber, film and sheet, raffia, foam, tape, and others. The film and sheet segment held the largest market revenue share in 2025, driven by its broad use in food packaging, consumer product wrapping, and labeling. The demand for lightweight, durable, and recyclable packaging materials is significantly boosting this segment

The fiber segment is anticipated to grow rapidly due to its extensive use in nonwoven fabrics, especially in hygiene products, geotextiles, and industrial filters. Polypropylene fibers are valued for their hydrophobic nature, strength, and low density

• By Chemical Structure

On the basis of chemical structure, the market is segmented into isotactic, syndiotactic, and atactic polypropylene. The isotactic segment dominates the market with the highest share in 2025, driven by its superior mechanical properties, crystallinity, and suitability for a broad range of applications including packaging and automotive

The syndiotactic segment is expected to experience notable growth, offering unique properties such as clarity and impact resistance. Its emerging use in specialty packaging and medical applications is creating new market opportunities

• By End Use

On the basis of end use, the polypropylene market is segmented into packaging, building and construction, automotive, furniture, electrical and electronics, medical, consumer products, and others. The packaging segment accounted for the largest market revenue share in 2025, supported by growing demand for lightweight, transparent, and recyclable packaging materials in the food, beverage, and consumer goods industries

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing use of polypropylene in lightweight vehicle components to improve fuel efficiency and reduce emissions. Automakers are adopting PP-based solutions for both interior and exterior parts due to their impact resistance, flexibility, and moldability

Polypropylene Market Regional Analysis

- Asia-Pacific leads the global polypropylene market with the largest revenue share of approximately 50% in 2024, driven by rapid industrialization, expanding packaging and automotive sectors, and increasing demand from emerging economies such as China, India, and Southeast Asia

- Consumers and manufacturers in the region prioritize polypropylene due to its versatility, cost-effectiveness, and recyclability, making it the preferred material for packaging, consumer goods, and automotive components

- The market growth is further supported by the expanding manufacturing base, growing urbanization, and rising disposable incomes, fostering increased usage of polypropylene in applications such as flexible packaging, textiles, and construction materials

Japan Polypropylene Market Insight

The Japan polypropylene market is witnessing steady growth driven by the country’s advanced manufacturing sector and focus on high-quality automotive and electronics industries. Demand for lightweight, durable, and recyclable polypropylene materials is increasing, especially in packaging, automotive parts, and consumer goods. The integration of polypropylene in sustainable packaging solutions and the growing trend toward eco-friendly materials among Japanese manufacturers further supports market expansion. Additionally, rising urbanization and technological adoption in industrial applications contribute to steady polypropylene demand.

China Polypropylene Market Insight

China leads the Asia-Pacific polypropylene market, accounting for the largest revenue share in 2025, fueled by rapid industrial growth, expanding packaging and automotive sectors, and robust demand from consumer goods manufacturing. The government’s push for sustainable plastics and recycling initiatives, alongside increasing domestic production capacities, supports market growth. Polypropylene’s versatility and cost-effectiveness in packaging, textiles, and construction applications remain key drivers in China’s polypropylene consumption.

North America Polypropylene Market Insight

The North America polypropylene market is expected to grow steadily, driven by increased demand from the automotive, packaging, and healthcare sectors. The U.S., as the dominant market, benefits from advanced manufacturing infrastructure and strong emphasis on lightweight materials to improve fuel efficiency in vehicles. Additionally, growing awareness of recyclable polypropylene and adoption of sustainable packaging solutions contribute to market expansion. Technological innovations in polypropylene compounding and recycling processes further fuel market growth.

U.S. Polypropylene Market Insight

The U.S. polypropylene market is characterized by rising demand in automotive, packaging, and healthcare applications. Increasing focus on sustainability and recyclability drives innovations in polypropylene grades and processing technologies. The automotive industry’s shift toward lightweight components to meet fuel economy standards and the expanding use of polypropylene in flexible and rigid packaging underpin market growth. Moreover, rising consumer preference for eco-friendly packaging boosts polypropylene adoption in food and beverage sectors.

Europe Polypropylene Market Insight

The Europe polypropylene market is anticipated to grow at a moderate CAGR, supported by stringent regulations promoting recyclable plastics and sustainable packaging. Germany and the U.K. are key contributors, with strong automotive and packaging industries driving polypropylene demand. The emphasis on reducing carbon footprint and increasing use of bio-based polypropylene variants reflect regional sustainability trends. Increasing demand from construction and electrical & electronics sectors, coupled with ongoing innovation in polypropylene composites, supports steady market expansion.

U.K. Polypropylene Market Insight

The U.K. polypropylene market shows positive growth trends, supported by rising demand from the packaging and automotive sectors. The growing preference for recyclable and lightweight polypropylene materials in consumer goods and transport industries bolsters market demand. Additionally, increasing government initiatives focused on plastic waste reduction encourage polypropylene recycling programs, which enhances the material’s market penetration across multiple applications.

Germany Polypropylene Market Insight

Germany remains a major polypropylene market player in Europe due to its robust automotive, packaging, and electrical industries. Rising demand for high-performance polypropylene grades in automotive lightweighting and eco-friendly packaging drives growth. The country’s focus on sustainability and technological innovation in polypropylene recycling technologies further propels the market. Growing awareness of environmental regulations and consumer preference for green materials positively impact polypropylene consumption.

Asia-Pacific Polypropylene Market Insight

The Asia-Pacific polypropylene market is projected to grow at the fastest CAGR globally in 2025, driven by rapid urbanization, industrial expansion, and rising disposable incomes in countries such as China, India, and Japan. Increasing demand from packaging, automotive, construction, and textile industries fuels growth. Government policies promoting manufacturing growth and sustainable plastics enhance polypropylene market prospects. Moreover, the region's role as a manufacturing hub for polypropylene products improves accessibility and affordability for consumers and industries alike.

Polypropylene Market Share

The polypropylene industry is primarily led by well-established companies, including:

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Exxon Mobil Corporation (U.S.)

- SABIC (Saudi Arabia)

- DuPont (U.S.)

- INEOS AG (Switzerland)

- Formosa Plastics Corporation, U.S.A. (U.S.)

- China Petrochemical Corporation (China)

- LG Chem (South Korea)

- Eastman Chemical Company (U.S.)

- BASF SE (Germany)

- Reliance Industries Limited (India)

- Westlake Corporation Inc. (U.S.)

- Braskem (Brazil)

- Haldia Petrochemicals Limited (India)

- Trinseo (France)

- HPCL-Mittal Energy Limited (HMEL) (India)

- Brahmaputra Cracker And Polymer Limited (BCPL) (India)

- SACO AEI Polymers (U.S.)

Latest Developments in Global Polypropylene Market

- In October 2024, SABIC partnered with B!POD, a business unit of SAES Getters, to integrate ocean-bound plastic (OBP)-based polypropylene resin into container manufacturing. The selected material, SABIC PP 576P, is a high-gloss resin from the TRUCIRCLE™ portfolio, containing approximately 50% OBP feedstock. This collaboration aims to reduce marine plastic waste while maintaining high-performance standards for food vacuum system containers. The OBP is sourced from plastic waste collected within 50 km of shorelines, then processed through advanced recycling methods

- In September 2024, Braskem launched its bio-circular polypropylene (PP) under the brand name WENEW, marking a major advancement in sustainability for the restaurant and snack food industries. This innovative material is derived from used cooking oil (UCO), promoting circularity by repurposing waste oils instead of relying on fossil-based feedstocks. WENEW maintains the same properties and performance as traditional PP, ensuring a seamless transition for manufacturers. The product is ISCC Plus certified and supports environmental sustainability while reducing carbon footprints in food packaging and consumer goods

- In October 2023, ExxonMobil Corporation launched a new polypropylene plant in Baton Rouge, Louisiana, increasing its polypropylene production capacity by 15%. The facility, part of ExxonMobil’s Growing the Gulf initiative, represents a $500 million investment, boosting polypropylene output by 450,000 metric tons per year to meet rising demand for lightweight, durable plastics used in automotive, medical, and packaging applications. This expansion strengthens ExxonMobil’s polyolefins manufacturing footprint along the U.S. Gulf Coast

- In June 2023, Braskem signed a Memorandum of Understanding (MoU) with TotalEnergies to explore collaboration opportunities in the polypropylene sector. This agreement aimed to enhance polypropylene production efficiency and sustainability. The following month, Braskem announced a USD 2.0 billion investment in a new polypropylene plant in Brazil, expected to begin operations in 2026. This facility will strengthen Braskem’s market position and support growing demand for high-performance polymers

- In July 2022, Heartland Polymers, based in Alberta, Canada, successfully commissioned its polypropylene (PP) plant, marking a significant milestone in the polypropylene market. The facility, part of the Heartland Petrochemical Complex, has a planned production capacity of 525,000 tons per year, reinforcing Canada’s role in meeting global demand for this versatile polymer. The plant integrates advanced sustainability measures, reducing greenhouse gas emissions by 65% compared to global PP facilities. This expansion strengthens North America’s polypropylene supply chain, ensuring reliable production and distribution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polypropylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polypropylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polypropylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.