Global Precooked Corn Flour Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

4.08 Billion

2025

2033

USD

2.89 Billion

USD

4.08 Billion

2025

2033

| 2026 –2033 | |

| USD 2.89 Billion | |

| USD 4.08 Billion | |

|

|

|

|

Precooked Corn Flour Market Size

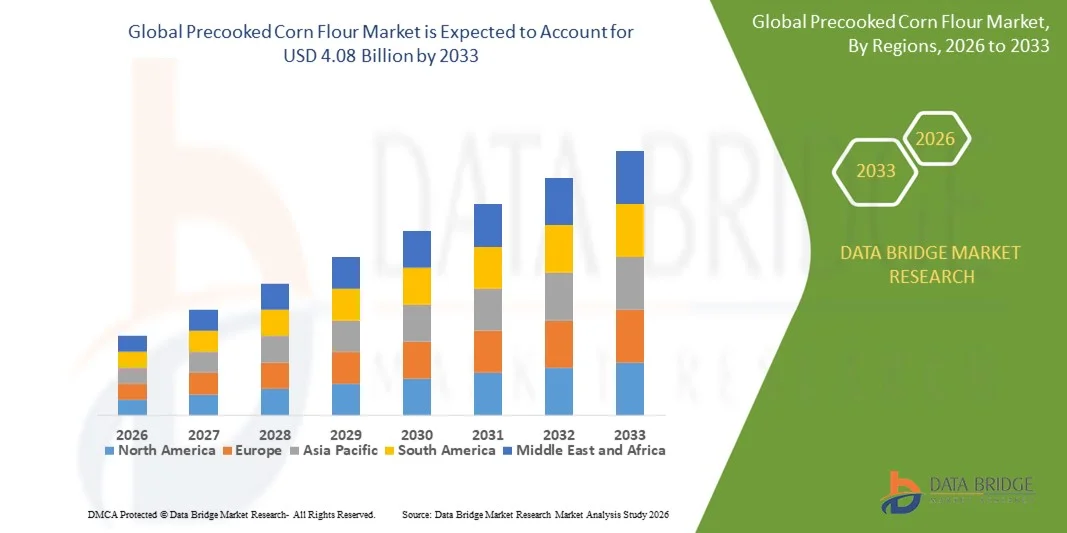

- The global precooked corn flour market size was valued at USD 2.89 billion in 2025 and is expected to reach USD 4.08 billion by 2033, at a CAGR of 4.4% during the forecast period

- The market growth is largely driven by the rising demand for convenience foods, ready-to-cook meals, and time-saving cooking ingredients, supported by changing lifestyles and increasing urbanization across both developed and emerging economies

- Furthermore, growing consumer preference for gluten-free, plant-based, and easily digestible food products is accelerating the adoption of precooked corn flour across household and industrial food applications, thereby significantly supporting overall market expansion

Precooked Corn Flour Market Analysis

- Precooked corn flour, offering ease of preparation, consistent texture, and functional versatility, has become an essential ingredient in bakery, snacks, soups, and RTC foods across residential and commercial food segments

- The increasing demand for precooked corn flour is primarily fueled by the expansion of packaged food industries, rising health awareness related to gluten-free alternatives, and the growing need for efficient food processing solutions

- North America dominated the precooked corn flour market with a share of over 40% in 2025, due to high consumption of convenience foods, gluten-free products, and ready-to-cook meal solutions

- Asia-Pacific is expected to be the fastest growing region in the precooked corn flour market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing consumption of convenience foods

- Conventional segment dominated the market with a market share of 68.5% in 2025, due to its wide availability, cost efficiency, and established supply chains across food processing industries. Conventional precooked corn flour is extensively used by large-scale manufacturers due to consistent quality, longer shelf life, and suitability for mass production. Its strong presence in bakery, snacks, and ready-to-cook foods further supports dominance. Price-sensitive consumers and institutional buyers continue to prefer conventional variants. High penetration in emerging economies also reinforces market leadership

Report Scope and Precooked Corn Flour Market Segmentation

|

Attributes |

Precooked Corn Flour Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Precooked Corn Flour Market Trends

Rising Demand for Convenience and Ready-to-Cook Food Products

- A significant trend in the precooked corn flour market is the increasing consumer preference for convenient and ready-to-cook products, driven by busier lifestyles and the need for quick meal preparation. This trend is expanding the adoption of precooked corn flour in households and foodservice outlets as it reduces cooking time and simplifies recipe execution

- For instance, companies such as Minsa and Gruma offer pre-cooked corn flour products that cater to ready-to-cook meal preparation, including tortillas and arepas. These products enable consistent quality, faster cooking, and widespread accessibility for both domestic and commercial users

- The growth of gluten-free and plant-based diets is further supporting demand, as precooked corn flour serves as a natural alternative to wheat-based flours. Its versatility in baking, snacks, and traditional foods is encouraging broader integration into modern and ethnic recipes

- Rising urbanization and dual-income households are boosting the consumption of convenience foods, positioning precooked corn flour as a preferred ingredient for time-efficient cooking. This is driving innovation in packaging, portion sizes, and pre-mixed blends for immediate use

- Foodservice providers and frozen food manufacturers are increasingly adopting precooked corn flour in ready-made products such as cornmeal-based batters, snacks, and flatbreads. This trend is contributing to higher industrial demand and streamlining product consistency across outlets

- The market is witnessing sustained interest in fortified and nutrient-enriched precooked corn flour formulations that target health-conscious consumers. This trend is reinforcing the role of precooked corn flour as a versatile and functional food ingredient across global cuisines

Precooked Corn Flour Market Dynamics

Driver

Growing Preference for Gluten-Free and Plant-Based Food Ingredients

- The rising adoption of gluten-free and plant-based diets is propelling demand for precooked corn flour, which offers a naturally wheat-free alternative with versatile culinary applications. Consumers increasingly seek products that align with dietary restrictions while retaining traditional flavors and textures

- For instance, Gruma produces gluten-free corn flour under its Maseca brand that caters to both household consumers and commercial food processors. These products facilitate the preparation of tortillas, tamales, and other traditional dishes without compromising dietary needs

- The expansion of plant-based and health-oriented food trends is encouraging product developers to integrate precooked corn flour into bakery mixes, snacks, and frozen foods. This integration enhances nutritional value while satisfying evolving consumer preferences

- Rising consumer awareness regarding clean-label ingredients is increasing the preference for natural and minimally processed flours. This is supporting the market adoption of precooked corn flour as a sustainable and allergen-friendly alternative

- Food manufacturers are leveraging precooked corn flour to create value-added products with high protein or fiber content, targeting health-conscious consumers. This driver is strengthening its market positioning as a functional and inclusive ingredient

Restraint/Challenge

Volatility in Maize Prices and Dependence on Agricultural Yields

- The precooked corn flour market faces challenges due to fluctuations in maize prices and dependency on consistent agricultural yields, which can affect production costs and supply stability. Weather variations and crop diseases may further exacerbate these supply uncertainties

- For instance, Minsa and other major producers have experienced cost pressures when corn harvests are impacted by droughts or pest infestations. These fluctuations can influence pricing strategies and profit margins for both manufacturers and retailers

- Dependence on local and imported maize exposes producers to global commodity price swings, making long-term cost forecasting challenging. This uncertainty can impact product affordability and the willingness of manufacturers to expand production capacity

- Maintaining quality and consistency in precooked corn flour requires sourcing high-grade maize, which is affected by seasonal variations and geographic limitations. Such constraints necessitate careful supply chain management to ensure stable product output

- The market continues to face pressure from rising raw material costs and logistical challenges in securing sufficient maize quantities. These factors collectively limit production scalability and can influence market growth trajectories

Precooked Corn Flour Market Scope

The market is segmented on the basis of nature, product, application, and distribution channel.

- By Nature

On the basis of nature, the precooked corn flour market is segmented into conventional and organic. The conventional segment dominated the market with the largest revenue share of 68.5% in 2025, driven by its wide availability, cost efficiency, and established supply chains across food processing industries. Conventional precooked corn flour is extensively used by large-scale manufacturers due to consistent quality, longer shelf life, and suitability for mass production. Its strong presence in bakery, snacks, and ready-to-cook foods further supports dominance. Price-sensitive consumers and institutional buyers continue to prefer conventional variants. High penetration in emerging economies also reinforces market leadership.

The organic segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising consumer awareness regarding clean-label, non-GMO, and chemical-free food products. Growing preference for organic infant nutrition and health-focused foods supports demand. Increasing availability through modern retail and online platforms improves accessibility. Premium positioning and certification-backed trust further accelerate growth. Expansion of organic farming initiatives also strengthens long-term prospects.

- By Product

On the basis of product, the market is segmented into white corn flour, yellow corn flour, and blue corn flour. White corn flour dominated the market revenue share in 2025 due to its neutral taste, fine texture, and versatility across multiple food applications. It is widely used in soups, sauces, bakery, and traditional food preparations due to high consumer familiarity. Strong adoption in household cooking and foodservice channels supports sustained demand. Its compatibility with both savory and sweet formulations further enhances usage.

Blue corn flour is expected to register the fastest growth during the forecast period, supported by rising interest in nutritionally enriched and visually differentiated food products. Higher antioxidant content and perceived health benefits attract health-conscious consumers. Growing use in premium snacks and specialty bakery items strengthens demand. Increased focus on ethnic and heritage foods also contributes to expansion.

- By Application

On the basis of application, the precooked corn flour market is segmented into soup/sauces and dressings, bakery and confectionery, extruded snacks, infant formula, RTC food, and others. The bakery and confectionery segment dominated the market in 2025, driven by extensive use of precooked corn flour as a functional ingredient for texture, moisture retention, and gluten-free formulations. Rising demand for convenience baked products supports consistent consumption. High usage in both industrial and artisanal baking strengthens market share. Growth in gluten-free product lines further reinforces dominance.

The infant formula segment is projected to witness the fastest growth from 2026 to 2033 due to increasing focus on easy-to-digest and nutritionally safe ingredients. Precooked corn flour offers improved digestibility and controlled consistency, supporting infant nutrition needs. Rising birth rates in developing regions contribute to demand. Strict quality standards and clean-label positioning also support rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hypermarkets/supermarkets, convenience stores, online, and others. Hypermarkets and supermarkets dominated the market revenue share in 2025 due to broad product assortments, strong brand visibility, and consumer trust in organized retail. These channels support bulk purchasing and frequent promotional activities. Easy accessibility and immediate product availability encourage repeat purchases. Strong presence in urban and semi-urban areas further drives sales.

The online segment is expected to grow at the fastest rate during the forecast period, supported by increasing digital grocery adoption and expanding e-commerce penetration. Consumers benefit from wider product choices, organic variants, and doorstep delivery. Subscription-based purchasing models improve repeat sales. Enhanced logistics and cold-chain capabilities further strengthen online channel growth.

Precooked Corn Flour Market Regional Analysis

- North America dominated the precooked corn flour market with the largest revenue share of over 40% in 2025, driven by high consumption of convenience foods, gluten-free products, and ready-to-cook meal solutions

- Consumers in the region value the ease of preparation, consistent quality, and versatility of precooked corn flour across bakery, snacks, and soup applications

- Strong presence of large food manufacturers, advanced processing infrastructure, and high disposable incomes further support widespread adoption in both household and industrial food segments

U.S. Precooked Corn Flour Market Insight

The U.S. captured the largest revenue share within North America in 2025, supported by strong demand for gluten-free bakery products, ethnic foods, and convenient meal solutions. Consumers increasingly prefer precooked corn flour due to time-saving cooking benefits and compatibility with health-focused diets. The expansion of packaged food brands and private-label offerings continues to propel market growth. Rising penetration of organic and clean-label variants further strengthens demand.

Europe Precooked Corn Flour Market Insight

The Europe precooked corn flour market is projected to expand at a steady CAGR during the forecast period, driven by growing demand for gluten-free and plant-based food products. Increasing urban lifestyles and preference for convenient cooking ingredients support adoption. The region shows strong usage in bakery, confectionery, and extruded snack applications. Regulatory emphasis on food quality and labeling further enhances consumer trust.

U.K. Precooked Corn Flour Market Insight

The U.K. market is anticipated to grow at a notable CAGR, supported by rising awareness of gluten intolerance and demand for alternative flours. Increasing consumption of ready-to-cook and home-baking products drives market expansion. Growth of organized retail and online grocery platforms improves product accessibility. The shift toward healthier carbohydrate sources further supports demand.

Germany Precooked Corn Flour Market Insight

Germany is expected to witness considerable growth during the forecast period, driven by strong demand for clean-label, high-quality food ingredients. The country’s focus on food safety, nutrition, and sustainable sourcing supports adoption. Precooked corn flour finds growing usage in industrial baking and specialty food products. Advanced food processing capabilities further strengthen market development.

Asia-Pacific Precooked Corn Flour Market Insight

The Asia-Pacific region is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing consumption of convenience foods. Growing awareness of gluten-free alternatives and expanding food processing industries support market expansion. Rising demand for RTC foods and snacks across emerging economies further accelerates growth.

India Precooked Corn Flour Market Insight

India is witnessing strong growth due to increasing adoption of convenience cooking ingredients and rising demand for packaged foods. Changing dietary habits and growing working population support higher consumption of RTC and snack products. Expanding modern retail and e-commerce channels improve product availability. Use of precooked corn flour in traditional and fusion foods further supports market expansion.

China Precooked Corn Flour Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid growth of the food processing sector and rising demand for convenience foods. Urbanization and changing lifestyles support higher consumption of bakery and snack products. Strong domestic manufacturing capabilities and large-scale distribution networks enhance market penetration. Increasing preference for easy-to-prepare food ingredients continues to drive growth.

Precooked Corn Flour Market Share

The precooked corn flour industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- Goya Foods, Inc. (U.S.)

- LifeLine Foods (U.S.)

- Empresas Polar (Venezuela)

- Harinera del Valle S.A. (Colombia)

- Molino Peila S.p.A. (Italy)

- Anto Natural Foods (U.S.)

- Cool Chile Co (U.S.)

- The Quaker Oats Company (U.S.)

- Bob’s Red Mill Natural Food (U.S.)

- ADM (U.S.)

- Andean Valley Corporation (U.S.)

- Agrindustria Tecco s.r.l (Italy)

- GRUMA, S.A.B. de C.V. (Mexico)

- Mantra Organic (India)

- GEMEF Industries (India)

- Multiflour (India)

- Casalare Pty Ltd (Australia)

- V R Organics (India)

Latest Developments in Global Precooked Corn Flour Market

- In November 2024, P.A.N. (Empresas Polar) launched its new range of ready-to-eat Stuffed Arepas in Spain, strengthening its position in the European precooked corn flour market by expanding into convenient, microwaveable, and gluten-free snack formats. This development supports higher consumer adoption among urban households seeking quick meal solutions and enhances brand penetration in premium ethnic food categories

- In April 2024, Cargill partnered with TechnoServe to roll out the Srishti initiative in Davanagere, Karnataka, positively impacting the precooked corn flour market by improving maize quality and supply consistency through regenerative farming practices. Training 10,000 farmers across 25,000 hectares enhances long-term raw material sustainability and supports stable input availability for food processors

- In early 2024, Gruma introduced a premium whole-grain corn flour, significantly expanding its household consumer base in Mexico and reinforcing its leadership in value-added corn flour products. The large-scale distribution of 24,500 metric tons through established commercial channels strengthened market volume growth and increased consumer preference for nutritionally enhanced variants

- In February 2024, Bunge expanded its corn milling operations in Latin America to support higher production of precooked corn flour for bakery and RTC food manufacturers. This expansion improved regional supply capacity, reduced processing lead times, and supported rising demand from industrial food processors

- In January 2024, Minsa Corporation launched fortified precooked corn flour targeted at institutional and foodservice segments in North America, enhancing its market competitiveness. The focus on improved nutritional profiles and consistent functionality supported increased adoption across large-scale catering and packaged food applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Precooked Corn Flour Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Precooked Corn Flour Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Precooked Corn Flour Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.