Global Prepacked Chromatography Columns Market

Market Size in USD Billion

CAGR :

%

USD

3.63 Billion

USD

5.89 Billion

2025

2033

USD

3.63 Billion

USD

5.89 Billion

2025

2033

| 2026 –2033 | |

| USD 3.63 Billion | |

| USD 5.89 Billion | |

|

|

|

|

Prepacked Chromatography Columns Market Size

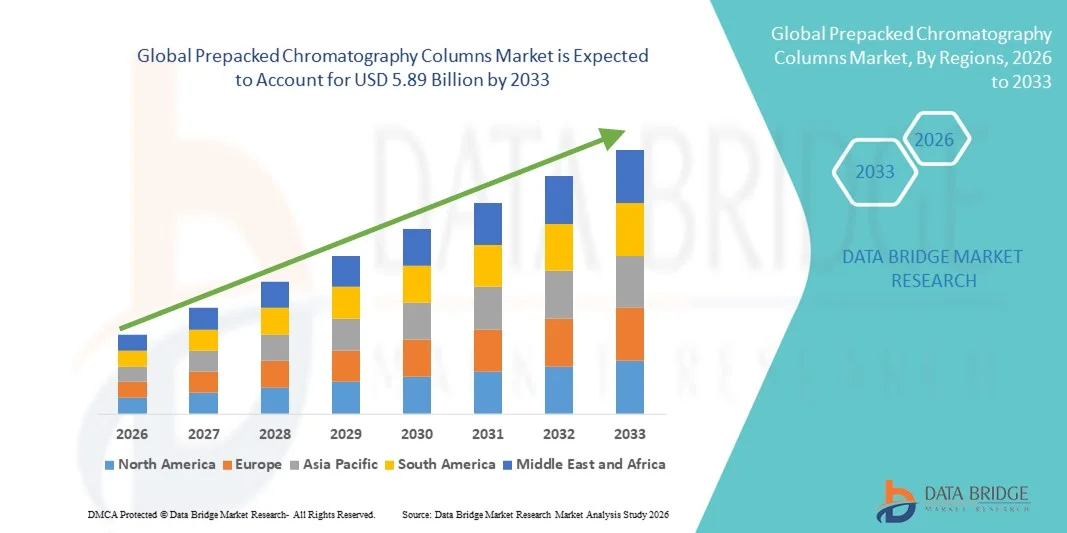

- The global prepacked chromatography columns market size was valued at USD 3.63 billion in 2025 and is expected to reach USD 5.89 billion by 2033, at a CAGR of 6.25% during the forecast period

- The market growth is largely fueled by the increasing demand for biopharmaceutical production, rising investments in biotechnology research, and growing adoption of chromatography techniques for purification and separation processes in pharmaceutical and life sciences industries. Technological advancements in column packing materials, improved resin performance, and enhanced automation in downstream processing are further accelerating market expansion across commercial and research laboratories

- Furthermore, rising demand for ready-to-use, time-efficient, and high-performance purification solutions in drug development and biologics manufacturing is establishing prepacked chromatography columns as essential tools in modern bioprocessing workflows. These converging factors are accelerating the uptake of Prepacked Chromatography Columns solutions, thereby significantly boosting overall market growth

Prepacked Chromatography Columns Market Analysis

- Prepacked chromatography columns, offering ready-to-use and high-performance purification solutions, are increasingly vital components of modern biopharmaceutical manufacturing and research laboratories due to their ability to ensure consistent separation efficiency, reduce setup time, and enhance reproducibility in downstream processing applications

- The escalating demand for prepacked chromatography columns is primarily fueled by the rapid expansion of the biopharmaceutical industry, increasing production of monoclonal antibodies and biologics, rising R&D investments in life sciences, and growing need for standardized, scalable purification technologies that improve operational efficiency and regulatory compliance

- North America dominated the prepacked chromatography columns market with the largest revenue share of 39.2% in 2025, characterized by strong biopharmaceutical manufacturing presence, advanced research infrastructure, significant R&D investments, and the presence of leading biotechnology and pharmaceutical companies, with the U.S. accounting for a major share of regional demand

- Asia-Pacific is expected to be the fastest growing region in the prepacked chromatography columns market during the forecast period, driven by expanding biopharmaceutical production capacity, increasing government support for biotechnology sectors, rising contract research and manufacturing activities, and growing investments in countries such as China, India, South Korea, and Singapore

- The 100–1000 ML Column segment dominated the largest market revenue share of 44.6% in 2025, driven by its broad applicability in pilot-scale production and process development activities

Report Scope and Prepacked Chromatography Columns Market Segmentation

|

Attributes |

Prepacked Chromatography Columns Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Prepacked Chromatography Columns Market Trends

Advancements in Bioprocessing Efficiency and Ready-to-Use Purification Solutions

- A significant and accelerating trend in the global Prepacked Chromatography Columns market is the growing demand for ready-to-use, prevalidated purification solutions that enhance efficiency, reproducibility, and scalability in biopharmaceutical manufacturing. As biologics production expands globally, manufacturers are increasingly adopting prepacked columns to streamline downstream processing and reduce setup time

- For instance, prepacked Protein A affinity chromatography columns are widely used in monoclonal antibody (mAb) purification, enabling high binding capacity and consistent performance without the need for in-house column packing. Similarly, ion-exchange and size-exclusion prepacked columns are being utilized in vaccine and recombinant protein purification processes to ensure batch-to-batch reproducibility and regulatory compliance

- The integration of single-use technologies with prepacked chromatography columns is further transforming bioprocessing workflows. Disposable column systems minimize cross-contamination risks, reduce cleaning validation requirements, and shorten production turnaround times, particularly in contract manufacturing organizations (CMOs)

- In addition, advancements in chromatography media, including high-performance resins with improved flow properties and binding capacities, are enabling faster processing times and higher product yields. These innovations are critical for meeting the growing demand for complex biologics and biosimilars

- The shift toward continuous bioprocessing and automated downstream systems is also supporting the adoption of standardized prepacked columns that can be seamlessly integrated into modular manufacturing platforms

- This trend toward operational efficiency, regulatory compliance, and scalable purification technologies is reshaping downstream bioprocessing strategies across pharmaceutical, biotechnology, and research laboratories worldwide

Prepacked Chromatography Columns Market Dynamics

Driver

Rising Biopharmaceutical Production and Growing Demand for Biologics

- The increasing global production of biologics, including monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins, is a major driver of the Prepacked Chromatography Columns market. As pharmaceutical companies expand their biologics pipelines, efficient and reliable downstream purification solutions are becoming essential

- For instance, the rapid expansion of monoclonal antibody manufacturing facilities has significantly increased demand for prepacked Protein A columns used in antibody capture steps. Similarly, vaccine manufacturers are adopting prepacked ion-exchange columns to ensure high-purity antigen separation and compliance with stringent regulatory standards

- The growth of contract development and manufacturing organizations (CDMOs) is further accelerating market demand, as these facilities prioritize standardized and validated purification systems to support multiple client projects with minimal downtime

- Increasing regulatory emphasis on product consistency and quality assurance is encouraging manufacturers to adopt prepacked columns that offer validated performance parameters and reduced variability compared to manually packed columns

- In addition, expanding research activities in biotechnology and academic institutions are contributing to demand for small-scale prepacked columns used in process development and laboratory-scale purification

- The combined effect of expanding biologics production capacity, rising R&D investments, and the need for efficient purification workflows continues to propel the growth of the Prepacked Chromatography Columns market globally

Restraint/Challenge

High Operational Costs and Limited Reusability

- The relatively high cost of advanced chromatography resins and prepacked column systems presents a significant challenge, particularly for small and mid-sized biotechnology companies operating with limited budgets. Premium affinity resins, such as Protein A media, contribute substantially to overall downstream processing expenses

- For instance, large-scale monoclonal antibody production may require multiple high-capacity prepacked columns with expensive affinity resins, significantly increasing capital expenditure. In addition, single-use prepacked columns, while convenient, often have limited reusability, leading to recurring procurement costs for manufacturers

- Column fouling, resin degradation, and reduced binding efficiency over repeated cycles can impact process economics and product yield. This necessitates frequent monitoring, validation, and potential replacement of chromatography media

- Furthermore, scalability challenges may arise when transitioning from laboratory-scale to commercial-scale production, requiring careful optimization of column dimensions and flow parameters to maintain performance consistency

- Supply chain constraints related to specialized chromatography resins and column hardware components can also disrupt manufacturing timelines, particularly during periods of high global demand

- Addressing these challenges through cost-effective resin innovations, improved column durability, enhanced supply chain resilience, and optimized process development strategies will be essential for sustaining long-term growth in the Prepacked Chromatography Columns market

Prepacked Chromatography Columns Market Scope

The market is segmented on the basis of product type, techniques, application, and end-user.

- By Product Type

On the basis of product type, the Global Prepacked Chromatography Columns Market is segmented into >1 Liter Column, 100–1000 ML Column, and 1–100 ML Column. The 100–1000 ML Column segment dominated the largest market revenue share of 44.6% in 2025, driven by its broad applicability in pilot-scale production and process development activities. These columns are widely used in biopharmaceutical manufacturing for protein purification and monoclonal antibody processing. Their balanced capacity and operational efficiency make them suitable for mid-scale purification workflows. Increasing demand for biologics and biosimilars significantly supports segment growth. Compatibility with automated chromatography systems enhances productivity. Pharmaceutical companies prefer this range for scalability and validation studies. Growing contract research and manufacturing activities further strengthen demand. Improved packing technologies ensure reproducibility and reliability. Rising investment in bioprocess optimization sustains procurement. Expansion of GMP-certified production facilities globally supports revenue contribution. Continuous innovation in resin technologies enhances performance. These factors collectively enabled the segment to maintain leadership in 2025.

The 1–100 ML Column segment is anticipated to witness the fastest growth at a CAGR of 10.9% from 2026 to 2033, driven by increasing R&D activities and laboratory-scale applications. These small-volume columns are ideal for early-stage drug discovery and resin screening. Academic and research institutes widely adopt them for experimental validation. Growing biotechnology startups boost demand for cost-effective small-scale solutions. Their lower sample requirement and operational flexibility enhance usability. Expansion of personalized medicine research supports adoption. Technological advancements improving packing consistency strengthen performance outcomes. Rising focus on rapid protein analysis accelerates usage. Increasing funding for life science research fuels procurement. Easy integration with laboratory chromatography systems enhances workflow efficiency. Growing emphasis on high-throughput screening further supports growth. These combined drivers position the segment for the highest CAGR during the forecast period.

- By Techniques

On the basis of techniques, the market is segmented into Ion Exchange Chromatography, Hydrophobic Stationary Phase Chromatography, Multimodal Chromatography, Affinity Chromatography, and Gel Filtration Chromatography. The Ion Exchange Chromatography segment held the largest revenue share of 32.8% in 2025, owing to its widespread use in protein purification and biomolecule separation. This technique provides high resolution and scalability in bioprocessing applications. Pharmaceutical manufacturers rely on ion exchange methods for monoclonal antibody purification. Cost-effectiveness compared to affinity techniques supports adoption. Strong compatibility with various column sizes enhances flexibility. Growing biologics production globally strengthens demand. Technological improvements in resin chemistry enhance selectivity. High binding capacity improves yield efficiency. Increasing regulatory approvals for biologic drugs sustain usage. Academic and industrial laboratories favor ion exchange for routine separations. Expansion of biosimilar production further accelerates growth. These factors collectively enabled the segment to dominate in 2025.

The Affinity Chromatography segment is projected to witness the fastest growth at a CAGR of 11.4% from 2026 to 2033, driven by rising demand for highly selective purification processes. Increasing monoclonal antibody and recombinant protein production accelerates adoption. Affinity techniques provide superior specificity and purity levels. Advancements in ligand design enhance binding efficiency. Growing focus on precision biologics supports demand. Biopharmaceutical companies prefer affinity columns for downstream processing. Expanding vaccine production further strengthens utilization. Increased investment in biotechnology research boosts uptake. Improved resin stability enhances lifecycle performance. Favorable regulatory approvals for innovative biologics encourage adoption. Rising need for high-purity therapeutics accelerates market expansion. These combined drivers position affinity chromatography as the fastest-growing technique segment.

- By Application

On the basis of application, the market is segmented into Sample Preparation, Resin Screening, Protein Purification, Anion and Cation Exchange, Affinity Chromatography, and Desalting. The Protein Purification segment accounted for the largest market revenue share of 38.5% in 2025, driven by the expanding production of biologics and biosimilars. Prepacked columns are extensively used in downstream processing of therapeutic proteins. Increasing monoclonal antibody production significantly supports demand. Biopharmaceutical companies prioritize high-efficiency purification systems. Rising prevalence of chronic diseases boosts biologic drug development. Continuous advancements in purification protocols enhance yield and quality. Growing contract manufacturing activities strengthen segment contribution. Improved automation in chromatography systems supports scalability. Regulatory emphasis on product purity sustains adoption. Expanding vaccine research further increases utilization. Investment in advanced bioprocess facilities globally reinforces growth. These factors enabled protein purification to dominate in 2025.

The Resin Screening segment is expected to witness the fastest growth at a CAGR of 10.6% from 2026 to 2033, fueled by increasing research on novel biologics and biosimilars. Pharmaceutical companies actively screen resins to optimize purification efficiency. Rising demand for customized purification workflows supports adoption. Expansion of biotechnology startups enhances R&D activities. Small-scale screening columns facilitate rapid experimental validation. Technological advancements improve reproducibility and throughput. Growing academic collaborations drive research funding. Increasing complexity of biologic molecules necessitates advanced screening methods. Expansion of contract research organizations strengthens demand. Rising focus on process optimization supports uptake. Improved data analytics integration enhances performance evaluation. These combined factors position resin screening as a rapidly growing application segment.

- By End-User

On the basis of end-user, the market is segmented into Pharmaceutical Biotechnology, Nutraceuticals, Food & Beverages, Analytical Laboratories, Agriculture & Environment, and Academics & Research. The Pharmaceutical Biotechnology segment dominated with a 49.7% revenue share in 2025, driven by strong biologics manufacturing and drug development pipelines. Rising global demand for monoclonal antibodies and recombinant proteins accelerates adoption. Prepacked chromatography columns are essential for downstream bioprocessing. Increasing investments in biopharmaceutical production facilities strengthen procurement. Regulatory approvals for innovative biologic therapies boost manufacturing volumes. Growing presence of contract development and manufacturing organizations supports expansion. Technological advancements enhance purification efficiency. Strong R&D funding globally sustains demand. Expansion of biosimilar production contributes to revenue stability. High compliance standards encourage use of validated prepacked columns. Increasing global healthcare expenditure further supports growth. These factors collectively ensured dominance in 2025.

The Academics & Research segment is anticipated to witness the fastest growth at a CAGR of 11.1% from 2026 to 2033, driven by expanding life science research activities worldwide. Rising government funding for biotechnology and molecular biology studies supports adoption. Universities increasingly utilize prepacked columns for experimental reproducibility. Growing focus on protein engineering and structural biology strengthens demand. Expansion of collaborative research programs accelerates procurement. Increasing biotechnology startups emerging from academic institutions further boost growth. Availability of small-volume columns enhances research flexibility. Advancements in chromatography instrumentation improve laboratory efficiency. Rising student enrollment in life sciences encourages infrastructure development. Government initiatives promoting innovation ecosystems support funding. Increased publications and patent filings reflect growing research output. These combined drivers position academics and research as the fastest-growing end-user segment during the forecast period.

Prepacked Chromatography Columns Market Regional Analysis

- North America dominated the prepacked chromatography columns market with the largest revenue share of 39.2% in 2025, driven by the strong presence of biopharmaceutical manufacturing facilities, advanced research infrastructure, and substantial investments in life sciences R&D

- The region benefits from a highly developed biotechnology ecosystem and the presence of leading pharmaceutical and biotechnology companies that extensively utilize chromatography technologies for biologics purification, vaccine production, and monoclonal antibody manufacturing

- The market accounts for a major share of regional demand, supported by increasing production of biosimilars and biologics, strong regulatory compliance standards, and early adoption of advanced purification technologies. The growing focus on continuous bioprocessing and single-use systems is further accelerating the demand for prepacked chromatography columns across research laboratories and commercial-scale manufacturing facilities

U.S. Prepacked Chromatography Columns Market Insight

The U.S. prepacked chromatography columns market captured the largest revenue share within North America in 2025, fueled by the country’s dominant biopharmaceutical manufacturing base and strong pipeline of biologic drugs. The presence of major biotechnology firms, contract manufacturing organizations (CMOs), and academic research institutions continues to support high demand for ready-to-use chromatography columns. Increasing investments in monoclonal antibody production, gene therapies, and vaccine development are significantly contributing to market expansion. In addition, stringent FDA regulations emphasizing process validation and reproducibility are encouraging the adoption of standardized and prevalidated chromatography solutions.

Europe Prepacked Chromatography Columns Market Insight

The Europe prepacked chromatography columns market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong pharmaceutical manufacturing capabilities and increasing research activities in biologics and biosimilars. The region’s strict regulatory framework for drug safety and quality promotes the adoption of high-performance purification technologies. Rising collaborations between biotechnology firms and research institutes are also supporting market growth. Furthermore, growing investments in advanced therapeutic research and expansion of biomanufacturing facilities across key European countries are strengthening demand for prepacked chromatography columns.

U.K. Prepacked Chromatography Columns Market Insight

The U.K. prepacked chromatography columns market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding biomedical research activities and increasing investments in biologics development. The country’s strong academic research base and well-established pharmaceutical sector are key growth contributors. Rising focus on cell and gene therapy research, along with government-backed funding initiatives for life sciences innovation, is boosting demand for reliable and efficient purification technologies. Moreover, the increasing presence of contract research organizations (CROs) and bioprocessing facilities is further supporting market growth.

Germany Prepacked Chromatography Columns Market Insight

The Germany prepacked chromatography columns market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced pharmaceutical manufacturing infrastructure and strong emphasis on high-quality production standards. Germany’s growing biosimilar manufacturing sector and increasing exports of biopharmaceutical products are driving demand for efficient and scalable purification solutions. In addition, rising investments in biotechnology research and development, along with the integration of advanced process optimization technologies, are contributing to the steady expansion of the market.

Asia-Pacific Prepacked Chromatography Columns Market Insight

The Asia-Pacific prepacked chromatography columns market is poised to grow at the fastest CAGR during the forecast period, driven by expanding biopharmaceutical production capacity and increasing government support for biotechnology sectors. Countries such as China, India, South Korea, and Singapore are witnessing significant investments in biologics manufacturing and contract research activities. The region’s improving regulatory framework and rising demand for affordable biologic drugs are encouraging the adoption of cost-effective and scalable chromatography solutions. Furthermore, the growing presence of local manufacturers and international collaborations is strengthening the regional market landscape.

Japan Prepacked Chromatography Columns Market Insight

The Japan prepacked chromatography columns market is gaining momentum due to the country’s advanced life sciences research ecosystem and strong focus on innovative drug development. Increasing investments in regenerative medicine, vaccine production, and biologics research are driving demand for high-precision purification technologies. In addition, Japan’s emphasis on quality control and manufacturing efficiency supports the adoption of standardized prepacked chromatography columns across pharmaceutical production facilities and research laboratories.

China Prepacked Chromatography Columns Market Insight

The China prepacked chromatography columns market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s rapidly expanding biopharmaceutical manufacturing sector and strong government backing for biotechnology development. Large-scale investments in biologics production facilities and contract manufacturing services are significantly increasing the demand for chromatography-based purification systems. Moreover, the growing production of biosimilars and vaccines for domestic and export markets, along with the presence of competitive domestic manufacturers, is accelerating the adoption of prepacked chromatography columns in China.

Prepacked Chromatography Columns Market Share

The Prepacked Chromatography Columns industry is primarily led by well-established companies, including:

- Cytiva (U.S.)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Tosoh Corporation (Japan)

- Danaher Corporation (U.S.)

- Repligen Corporation (U.S.)

- Avantor, Inc. (U.S.)

- Purolite Corporation (U.K.)

- Sepax Technologies, Inc. (U.S.)

- YMC Co., Ltd. (Japan)

- Shimadzu Corporation (Japan)

- Pall Corporation (U.S.)

Latest Developments in Global Prepacked Chromatography Columns Market

- In September 2023, Agilent Technologies launched a new portfolio of high-performance prepacked chromatography columns engineered for high-performance liquid chromatography (HPLC) and ultra-performance liquid chromatography (UPLC) applications, featuring advanced stationary phase technology to enhance separation efficiency and reproducibility for pharmaceutical and biotech labs globally

- In August 2023, Waters Corporation introduced a new line of size exclusion chromatography (SEC) columns optimized for improved analysis of large biomolecules such as adeno-associated viral (AAV) vectors, doubling throughput while reducing costs for gene therapy development and analytical workflows

- In February 2024, Thermo Fisher Scientific launched the Dionex Inuvian Ion Chromatography system (which supports prepacked column workflows) to enhance ion separation performance with faster analysis times and improved sensitivity, supporting expanding demands in biopharmaceutical purification and quality control

- In February 2024, Thermo Fisher Scientific enhanced its liquid chromatography portfolio by adding patterned microchip-based technology (μPAC) columns, delivering improved separation performance and sensitivity across complex sample analyses for pharmaceutical and proteomics research environments — broadening the capabilities of prepacked chromatography solutions

- In May 2024, Repligen Corporation launched a single-use prepacked chromatography column system specifically designed for vaccine purification, significantly reducing contamination risk and accelerating throughput in critical biologics manufacturing applications

- In February 2025, Bio-Rad Laboratories introduced new EconoFit Chromatography Column Packs — a cost-effective, easy-use prepacked format with multiple resin types (including mixed-mode and ion exchange) compatible with Bio-Rad NGC chromatography systems and other mainstream platforms, aiding rapid resin scouting and process development

- In September 2025, SkillPak BIO announced its launch of prepacked columns tailored for multi-column continuous chromatography processes, optimized for use with advanced resins like TOYOPEARL and engineered for enhanced productivity with lower operational pressures and higher flow rates in complex purification workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.