Global Probiotics Market

Market Size in USD Billion

CAGR :

%

USD

78.19 Billion

USD

151.29 Billion

2024

2032

USD

78.19 Billion

USD

151.29 Billion

2024

2032

| 2025 –2032 | |

| USD 78.19 Billion | |

| USD 151.29 Billion | |

|

|

|

|

Probiotics Market Size

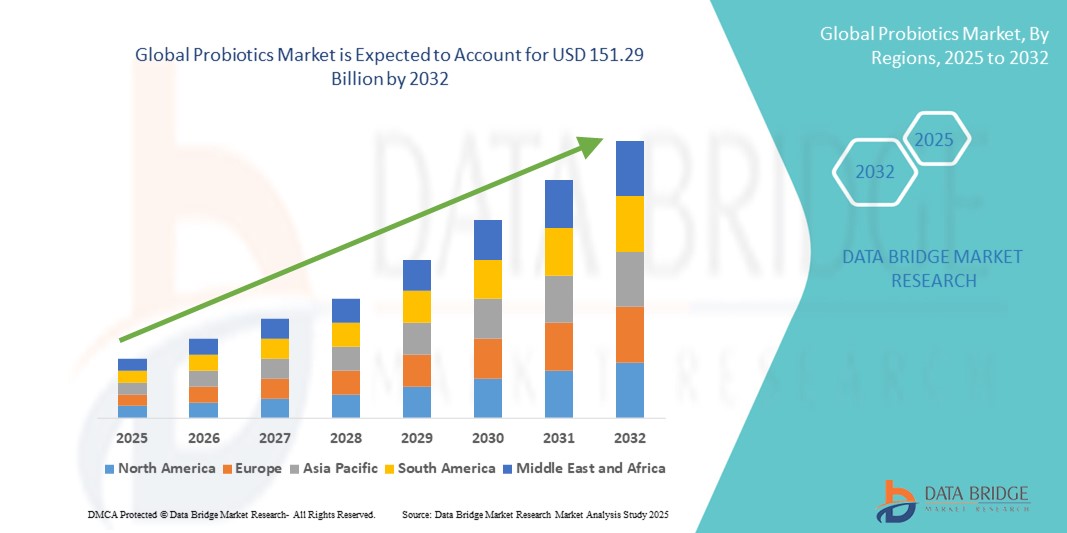

- The global probiotics market size was valued at USD 78.19 billion in 2024 and is expected to reach USD 151.29 billion by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by the increasing awareness of gut health, rising health-consciousness among consumers, and advancements in probiotic formulations, leading to greater adoption across both food and beverage and dietary supplement segments

- Furthermore, rising consumer demand for natural, preventive healthcare solutions and the integration of probiotics into daily wellness routines is establishing probiotics as a key component of functional nutrition. These converging factors are accelerating the uptake of probiotic solutions, thereby significantly boosting the industry's growth

Probiotics Market Analysis

- Probiotics, containing live microorganisms that provide health benefits when consumed in adequate amounts, are increasingly vital components of modern health and wellness routines in both dietary supplements and functional food products due to their benefits for digestive health, immunity, and overall well-being

- The escalating demand for probiotics is primarily fueled by the widespread adoption of preventive healthcare practices, growing consumer awareness regarding gut health, and a rising preference for natural and functional food products

- North America dominated the probiotics market with the largest revenue share of 38.7% in 2024, characterized by early adoption of health supplements, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in probiotics consumption, particularly in fortified foods and beverages, driven by innovations from both established nutraceutical companies and startups focusing on microbiome health

- Asia-Pacific is expected to be the fastest growing region in the probiotics market during the forecast period due to increasing urbanization and rising disposable incomes

- The bacteria segment dominated the probiotics market with a market share of 83.5% in 2024, led by the wide clinical validation and commercial use of strains such as Lactobacillus and Bifidobacterium in human health products

Report Scope and Probiotics Market Segmentation

|

Attributes |

Probiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Probiotics Market Trends

Enhanced Convenience Through Personalized Health Solutions

- A significant and accelerating trend in the global probiotics market is the growing consumer shift toward personalized health and nutrition solutions, with probiotics playing a central role in maintaining gut health, enhancing immunity, and supporting overall well-being

- For instance, advanced probiotic formulations are now being developed to target specific health conditions such as irritable bowel syndrome (IBS), eczema, and immune deficiencies, offering consumers tailored benefits. Leading companies are introducing multi-strain probiotics and synbiotic products that combine probiotics and prebiotics to maximize efficacy

- Innovations in probiotic supplements include the use of encapsulation technologies to improve shelf life and ensure the delivery of live microorganisms to the gut. This enhances the effectiveness of probiotics in supporting microbiome balance and digestive health

- The seamless availability of probiotics across multiple retail channels, including online platforms, pharmacies, and supermarkets, is expanding accessibility and boosting market growth. Consumers are increasingly purchasing probiotic-enriched functional foods, beverages, and dietary supplements to incorporate into their daily routines

- This trend towards more personalized, targeted, and scientifically advanced probiotic products is fundamentally reshaping consumer expectations in the health and wellness industry. Consequently, companies such as Yakult, Danone, and Nestlé are focusing on research-driven innovations to meet the growing demand for customized and high-quality probiotic solutions

- The demand for probiotics that offer tailored health benefits is growing rapidly across both developed and emerging markets, as consumers increasingly prioritize preventive healthcare, digestive health, and overall wellness

Probiotics Market Dynamics

Driver

Growing Need Due to Rising Health Awareness and Preventive Healthcare Adoption

- The increasing prevalence of digestive disorders, rising health consciousness among consumers, and the accelerating adoption of preventive healthcare practices are significant drivers for the heightened demand for probiotics

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced an advancement in IoT-based self-storage security, looking forward to integrating state-of-the-art sensors into the Passport locking solution. Such strategies by key companies are expected to drive the Probiotics industry growth in the forecast period

- As consumers become more aware of the link between gut health and overall well-being, probiotics offer advanced health benefits such as improved digestion, enhanced immune function, and reduced risk of gastrointestinal infections, providing a compelling addition to daily dietary habits

- Furthermore, the growing popularity of functional foods and beverages and the desire for clean-label and natural health products are making probiotics an integral component of modern dietary trends, offering seamless incorporation into daily nutrition

- The convenience of ready-to-consume probiotic supplements, on-the-go probiotic drinks, and the ability to maintain gut health without drastic dietary changes are key factors propelling the adoption of probiotics in both developed and developing markets. The trend towards personalized nutrition and the increasing availability of user-friendly Probiotics options further contribute to market growth

Restraint/Challenge

Concerns Regarding Product Stability and High Initial Costs

- Concerns surrounding the stability and viability of probiotic strains during processing and storage pose a significant challenge to broader market penetration. As probiotics are live microorganisms, they are susceptible to degradation due to heat, moisture, and light, raising anxieties among consumers about product efficacy

- For instance, high-profile reports highlighting inconsistent probiotic counts in commercial products have made some consumers hesitant to adopt probiotic supplements

- Addressing these formulation challenges through advanced encapsulation techniques, improved packaging solutions, and continuous quality testing is crucial for building consumer trust. Companies such as Yakult and Danone emphasize their strain-specific research and clinical validation in their marketing to reassure potential buyers. In addition, the relatively high initial cost of some advanced Probiotics products compared to traditional supplements can be a barrier to adoption for price-sensitive consumers, particularly in developing regions

- While prices are gradually decreasing, the perceived premium for clinically tested, high-quality probiotic formulations can still hinder widespread adoption, especially for those who do not see an immediate health need

- Overcoming these challenges through enhanced formulation technologies, consumer education on probiotic benefits, and the development of more affordable Probiotics options will be vital for sustained market growth

Probiotics Market Scope

The market is segmented on the basis of form, ingredient, application, distribution channel, and end user.

- By Form

On the basis of form, the probiotics market is segmented into liquid and dry. The dry segment dominated the market with the largest revenue share of 58.3% in 2024, driven by its longer shelf life, easier handling, and better suitability for incorporation into dietary supplements, functional foods, and various food formulations. Dry probiotics also benefit from superior stability during transportation and storage, making them ideal for global distribution. Furthermore, the convenience of dry formulations in capsules, tablets, and powders enhances consumer compliance.

The liquid segment is projected to witness the fastest CAGR of 8.7% from 2025 to 2032, fueled by increasing consumer demand for probiotic drinks and dairy-based beverages that offer immediate probiotic delivery and improved bioavailability. The rising popularity of fermented beverages like kombucha and kefir, along with growing health consciousness among younger demographics, supports the robust growth of the liquid probiotic segment. In addition, innovations in packaging and preservation technologies are enabling longer shelf life for liquid probiotics.

- By Ingredient

On the basis of ingredient, the probiotics market is segmented into bacteria and yeast. The bacteria segment held the largest market share of 83.5% in 2024, led by the wide clinical validation and commercial use of well-established strains such as Lactobacillus and Bifidobacterium, which are extensively incorporated in human health products due to their proven benefits in digestive health, immune modulation, and gut flora balance. This segment’s dominance is also supported by ongoing research that continues to identify new bacterial strains with targeted health benefits.

The yeast segment, with a projected CAGR of 9.2% from 2025 to 2032, is gaining traction due to the unique therapeutic properties of Saccharomyces boulardii, particularly its efficacy in managing gastrointestinal disorders like antibiotic-associated diarrhea, Clostridium difficile infections, and irritable bowel syndrome. The segment is also witnessing product innovation, including yeast-based probiotic supplements and synergistic formulations combining yeast and bacterial strains for enhanced health effects.

- By Application

On the basis of application, the probiotics market is segmented into functional food and beverages, dietary supplements, and animal feed. The functional food and beverages segment accounted for the largest revenue share of 46.9% in 2024, as consumers increasingly integrate probiotic-rich foods such as yogurt, kefir, fermented juices, and snack bars into daily diets for their digestive and immune health benefits. The segment benefits from extensive product innovation and expanding retail presence in supermarkets and health food stores.

The animal feed segment is expected to register the fastest growth, with a CAGR of 9.5% from 2025 to 2032, driven by the rising adoption of probiotics as natural alternatives to antibiotics in livestock production. Probiotics are being widely used to improve digestion, enhance immunity, and promote growth performance in poultry, swine, and cattle, reflecting increasing regulatory pressure to reduce antibiotic use in animal agriculture. In addition, growing awareness among pet owners about gut health benefits is boosting probiotic use in companion animals.

- By Distribution Channel

On the basis of distribution channel, the probiotics market is segmented into hypermarkets/supermarkets, pharmacies/drugstores, specialty stores, and online. The hypermarkets/supermarkets segment held the largest market share of 38.1% in 2024, benefiting from large consumer footfall, brand visibility, competitive pricing, and the trust associated with in-store purchases. These retail outlets often provide extensive product variety, enabling consumers to compare and select probiotic products conveniently.

The online segment is forecasted to witness the fastest CAGR of 10.6% from 2025 to 2032, driven by expanding e-commerce ecosystems, increasing internet penetration, and growing consumer preference for the convenience of doorstep delivery. The rising popularity of subscription-based probiotic wellness plans, detailed product information, customer reviews, and targeted digital marketing campaigns are also fueling online sales growth. The COVID-19 pandemic further accelerated consumer adoption of online purchasing for health supplements, a trend expected to continue.

- By End User

On the basis of end user, the probiotics market is segmented into human and animal. The human segment dominated the market with a share of 91.4% in 2024, supported by the widespread use of probiotics for digestive health, immune system support, and overall wellness across all age groups including infants, adults, and the elderly. Increasing consumer awareness about gut microbiome health, combined with rising prevalence of lifestyle-related digestive disorders, is driving demand in this segment. Probiotics are also gaining traction in niche areas such as mental health, skin health, and metabolic wellness.

The animal segment is projected to grow at a CAGR of 8.9% from 2025 to 2032, fueled by the increasing demand for natural feed additives in both companion animals and farm livestock to promote health, improve nutrient absorption, and reduce reliance on antibiotics. Rising pet ownership globally, along with greater focus on animal welfare and sustainable farming practices, supports probiotic adoption in this sector. Moreover, veterinary recommendations and specialized probiotic formulations for different animal species are expanding market opportunities.

Probiotics Market Regional Analysis

- North America dominated the probiotics market with the largest revenue share of 38.7% in 2024, driven by a growing demand for preventive healthcare, increasing consumer awareness regarding gut health, and a high inclination toward functional foods and dietary supplements

- Consumers in the region highly value the convenience, health benefits, and scientifically backed formulations offered by probiotics in various forms such as capsules, yogurts, beverages, and gummies

- This widespread adoption is further supported by high disposable incomes, a health-conscious population, and the growing preference for natural, immunity-boosting solutions, establishing probiotics as a favored component of daily nutrition in both the U.S. and Canada

U.S. Probiotics Market Insight

The U.S. probiotics market captured the largest revenue share of 67% in 2024 within North America, fueled by the swift uptake of functional foods, growing focus on digestive health, and increasing popularity of dietary supplements. Consumers are increasingly prioritizing health maintenance through gut microbiota support, especially amid rising cases of gastrointestinal disorders and immune concerns. The growing preference for clean-label, non-GMO, and clinically proven probiotic products further propels the market. Moreover, the expanding e-commerce channel and availability of diverse probiotic offerings are significantly contributing to the market's expansion.

Europe Probiotics Market Insight

The Europe probiotics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing consumer demand for natural health solutions and regulatory support for functional foods. The increase in aging populations, combined with heightened interest in digestive health, is fostering the adoption of probiotics across the region. European consumers are also drawn to products with clinically validated health claims and sustainable sourcing. The region is experiencing significant growth across retail, pharmacy, and online distribution channels.

U.K. Probiotics Market Insight

The U.K. probiotics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of personalized nutrition and the growing preference for gut-friendly diets. In addition, increasing healthcare costs and consumer focus on prevention rather than treatment are encouraging the uptake of probiotic supplements. The U.K.’s well-established retail infrastructure and awareness campaigns by health organizations are expected to further stimulate market growth.

Germany Probiotics Market Insight

The Germany probiotics market is expected to expand at a considerable CAGR during the forecast period, fueled by strong scientific research, increasing consumer knowledge of the microbiome, and demand for high-quality, eco-conscious products. Germany’s regulatory environment and preference for natural and organic health products support the market for probiotic-enriched foods and nutraceuticals. Growing demand for products that support immunity, especially among elderly populations, is also contributing to the market's momentum.

Asia-Pacific Probiotics Market Insight

The Asia-Pacific probiotics market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing health consciousness in countries such as China, Japan, and India. The region's dietary traditions increasingly align with probiotic consumption, particularly in fermented foods. Furthermore, as APAC emerges as a manufacturing hub for probiotics and related delivery systems, the affordability and accessibility of probiotic products are expanding to a wider consumer base.

Japan Probiotics Market Insight

The Japan probiotics market is gaining momentum due to the country’s strong culture of fermented food consumption, growing senior population, and increasing focus on healthy aging. The Japanese market places a significant emphasis on clinical efficacy, and the adoption of probiotics is driven by both traditional diets and modern dietary supplements. Demand is also growing for advanced formulations such as synbiotics and postbiotics. Moreover, Japan's commitment to innovation and research is helping develop targeted probiotics for specific health outcomes.

China Probiotics Market Insight

The China probiotics market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, growing emphasis on wellness, and increasing awareness of gut health. China stands as one of the largest and fastest-growing markets for functional foods and supplements, with probiotics gaining popularity across all age groups. The push towards health optimization, rising demand for dairy-based probiotics, and strong local manufacturing capabilities are key factors propelling the market in China.

Probiotics Market Share

The Probiotics industry is primarily led by well-established companies, including:

- Yakult Honsha Co., Ltd (Japan)

- Nestlé (Switzerland)

- DuPont (U.S.)

- MORINAGA & CO., LTD (Japan)

- Protexin (U.K.) – Now part of ADM Protexin

- Danone (France)

- Deerland Probiotics and Enzymes, Inc. (U.S.)

- Goerlich Pharma GmbH (Germany)

- SANZYME BIOLOGICS PVT. LTD (India)

- DSM (Netherlands)

- NutraScience Labs (U.S.)

- Kerry Group plc (Ireland)

- Lallemand Inc. (Canada)

- Lonza (Switzerland)

- Winclove Probiotics (Netherlands)

Latest Developments in Global Probiotics Market

- In March 2025, Yakult Danone India Pvt. Ltd., a subsidiary of Yakult Honsha Co., Ltd., launched the #GutIsBusted social media campaign across India to promote awareness about gut health. The initiative used humor and engaging content to educate consumers on the importance of daily probiotic intake and reached audiences in all 28 states and 6 union territories. This campaign reflects Yakult's commitment to strengthening brand visibility and driving consumer engagement in emerging markets

- In July 2025, Danone S.A. reported 4.1% like-for-like sales growth in Q2, surpassing market expectations, largely due to strong performance in China’s probiotics-rich dairy segment, particularly the Activia brand. The company reaffirmed its full-year guidance, highlighting the growing demand for functional food and probiotics in Asia-Pacific markets

- In April 2025, Danone North America announced the winners of its 2024–2025 Gut Microbiome, Yogurt, and Probiotics Fellowship. Two graduate students received $25,000 each to conduct research into the human microbiome and the health benefits of probiotics. This marks the 13th year of Danone’s investment in advancing microbiome science, totaling over USD 500,000 to date

- In February 2025, DSM-Firmenich unveiled five emerging trends at Probiota 2025, including microbiome individuality, precision delivery systems, and next-generation biotics. These insights reinforce DSM’s leadership in innovation and its efforts to deliver tailored probiotic solutions for immunity, cognition, and metabolic health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.