Global Process Plants Gas Turbine Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

3.82 Billion

2024

2032

USD

2.47 Billion

USD

3.82 Billion

2024

2032

| 2025 –2032 | |

| USD 2.47 Billion | |

| USD 3.82 Billion | |

|

|

|

|

Process Plants Gas Turbine Market Size

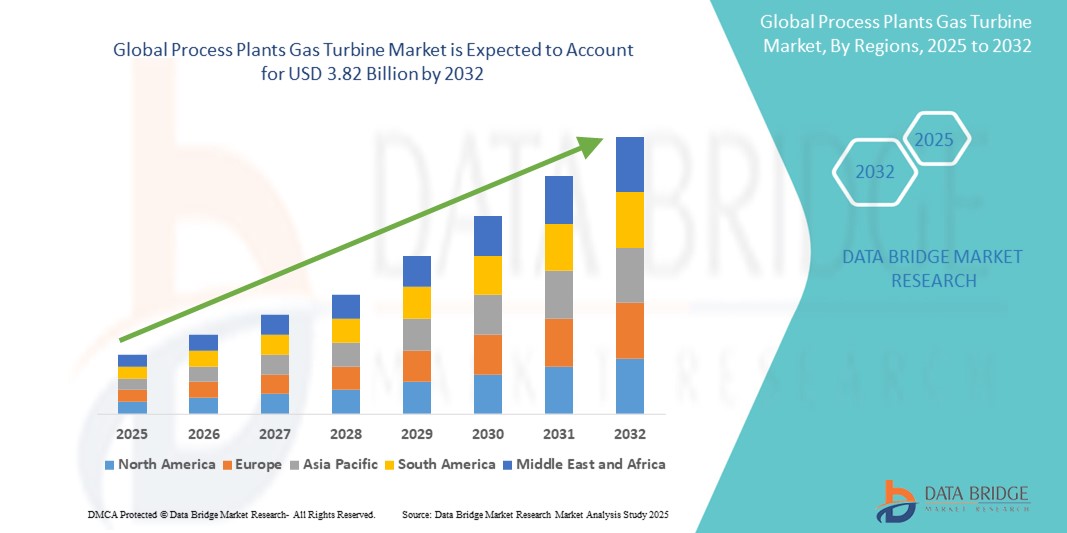

- The global process plants gas turbine market size was valued at USD 2.47 billion in 2024 and is expected to reach USD 3.82 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient and reliable power generation systems within industrial process plants, along with the growing adoption of gas turbines due to their lower emissions and operational flexibility

- The shift towards cleaner energy sources and the expansion of gas-fired power plants in emerging economies are also expected to significantly contribute to market growth

Process Plants Gas Turbine Market Analysis

- Rising emphasis on energy efficiency, coupled with stringent regulatory norms regarding emissions, is encouraging process industries to adopt gas turbines for cogeneration and onsite power requirements

- Technological advancements in turbine designs, such as improved thermal efficiency and hybrid systems, are further boosting deployment in sectors including oil & gas, petrochemicals, and manufacturing

- North America dominated the process plants gas turbine market with the largest revenue share of 39.75% in 2024, driven by the extensive presence of oil & gas facilities and power-intensive industrial plants

- Asia-Pacific region is expected to witness the highest growth rate in the global process plants gas turbine market, driven by increasing industrialization, rising energy demand, and significant infrastructure development across countries such as China, India, and Southeast Asia.

- The heavy-duty gas turbine segment dominated the market with the largest market revenue share in 2024, driven by its high power output and robust design suitable for continuous industrial operations. These turbines are widely preferred in large-scale process plants due to their ability to handle heavy loads and prolonged usage. Their superior durability, lower maintenance frequency, and enhanced fuel efficiency also contribute to their strong demand across oil and gas and petrochemical industries

Report Scope and Process Plants Gas Turbine Market Segmentation

|

Attributes |

Process Plants Gas Turbine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Process Plants Gas Turbine Market Trends

“Integration of Gas Turbines with Combined Heat and Power (CHP) Systems”

- Increasing adoption of gas turbines with CHP systems to enhance energy efficiency across process plants

- CHP integration enables simultaneous generation of electricity and useful heat, optimizing fuel utilization

- Companies are focusing on this technology to reduce carbon emissions and meet sustainability goals

- Particularly beneficial for energy-intensive industries such as chemicals and food processing

- For instance, BASF implemented CHP-integrated gas turbines at its Ludwigshafen plant to improve energy reliability and lower emissions

Process Plants Gas Turbine Market Dynamics

Driver

“Shift Toward Cleaner Energy Sources in Industrial Power Generation”

- Industries are increasingly replacing coal and oil-based systems with cleaner natural gas-powered turbines

- Gas turbines emit lower greenhouse gases, aligning with global decarbonization targets

- Quick start-up capabilities make gas turbines ideal for meeting variable power demands in process plants

- Supportive government regulations and incentives are accelerating this transition globally

- For instance, Siemens Energy deployed high-efficiency gas turbines in Middle Eastern process plants to promote clean energy adoption

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- Gas turbine systems involve substantial upfront costs, including equipment, installation, and infrastructure

- Ongoing maintenance demands skilled personnel and specialized resources, adding to operating expenses

- Smaller industrial units often lack the capital and technical support to adopt this technology

- These financial barriers hinder penetration, especially in cost-sensitive and developing markets

- For instance, Many small manufacturing units in Southeast Asia have avoided adopting gas turbines due to unaffordable initial costs and lack of local expertise

Process Plants Gas Turbine Market Scope

The process plants gas turbine market is segmented into two notable segments based on product and technology.

• By Product

On the basis of product, the process plants gas turbine market is segmented into aero-derivative and heavy-duty gas turbines. The heavy-duty gas turbine segment dominated the market with the largest market revenue share in 2024, driven by its high power output and robust design suitable for continuous industrial operations. These turbines are widely preferred in large-scale process plants due to their ability to handle heavy loads and prolonged usage. Their superior durability, lower maintenance frequency, and enhanced fuel efficiency also contribute to their strong demand across oil and gas and petrochemical industries.

The aero-derivative segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing need for compact, lightweight, and rapidly deployable solutions. Aero-derivative gas turbines offer quick start-up capabilities and are especially favored in industries requiring flexible power generation such as refineries and chemical processing units. Their modularity and easy integration into existing systems further support their rising adoption.

• By Technology

On the basis of technology, the process plants gas turbine market is segmented into open cycle and combined cycle. The combined cycle segment held the largest market revenue share in 2024, driven by its superior efficiency and ability to recover waste heat for additional power generation. This dual-phase approach significantly reduces fuel consumption and emissions, making it a preferred choice for energy-intensive process industries.

The open cycle segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its cost-effectiveness, operational simplicity, and fast response time. Open cycle turbines are particularly suitable for peak load applications and emergency power needs in process plants, offering a reliable solution where rapid deployment is essential.

Process Plants Gas Turbine Market Regional Analysis

- North America dominated the process plants gas turbine market with the largest revenue share of 39.75% in 2024, driven by the extensive presence of oil & gas facilities and power-intensive industrial plants

- The region continues to benefit from increased investments in energy infrastructure modernization and gas-based power generation as part of emission reduction strategies

- Technological advancements and the availability of natural gas further support the deployment of gas turbines across a wide array of process industries, from chemicals to petrochemicals

U.S. Process Plants Gas Turbine Market Insight

The U.S. held the largest market revenue share within North America in 2024, accounting for 83%, bolstered by growing industrial demand for reliable and efficient energy solutions. The country’s expanding shale gas production and investment in gas-fired power plants have significantly contributed to the adoption of gas turbines in process industries. The market is further accelerated by upgrades in existing infrastructure and a strong focus on operational efficiency and emission control, especially in refineries and chemical plants.

Europe Process Plants Gas Turbine Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, supported by the region’s stringent emission regulations and ongoing shift from coal-based to cleaner energy sources in industrial operations. Countries such as Germany and the U.K. are actively adopting gas turbines in process industries to meet carbon neutrality goals. In addition, refurbishment projects and integration of combined heat and power (CHP) systems are fueling demand across key industrial sectors.

Germany Process Plants Gas Turbine Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, attributed to the country’s robust manufacturing and chemical processing base. The government's focus on energy transition (Energiewende) and the increasing use of gas turbines for decentralized power generation contribute to market expansion. Moreover, the adoption of high-efficiency combined cycle systems in industrial facilities is enhancing the competitiveness of gas turbines across the country.

Asia-Pacific Process Plants Gas Turbine Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urban expansion, and increased power demand from sectors such as refining, petrochemicals, and cement. Countries such as China, India, and South Korea are investing heavily in gas-based power projects to complement their industrial development plans. The availability of natural gas and supportive policy frameworks further propel the regional market.

China Process Plants Gas Turbine Market Insight

The China accounted for the largest revenue share in Asia-Pacific in 2024, owing to its expansive industrial base and ongoing initiatives to reduce coal dependency. The Chinese government’s push for cleaner energy solutions in manufacturing and the chemical industry has boosted the adoption of advanced gas turbine technologies. With local manufacturing capabilities and state-backed projects, China continues to lead the regional market.

Japan Process Plants Gas Turbine Market Insight

The Japan is expected to witness the fastest growth rate from 2025 to 2032, driven by efforts to stabilize energy supply through gas-based systems following the decline of nuclear power generation. The country’s focus on energy efficiency and environmental compliance is prompting process industries to invest in advanced, low-emission gas turbines. Moreover, the presence of technologically advanced domestic turbine manufacturers supports innovation and market penetration.

Process Plants Gas Turbine Market Share

The Process Plants Gas Turbine industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Siemens Energy AG (Germany)

- Mitsubishi Power, Ltd. (Japan)

- Ansaldo Energia S.p.A. (Italy)

- Baker Hughes Company (U.S.)

- Solar Turbines Incorporated (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Rolls-Royce plc (U.K.)

- MAN Energy Solutions SE (Germany)

- OPRA Turbines B.V. (Netherlands)

Latest Developments in Global Process Plants Gas Turbine Market

- In February 2025, GE Vernova announced the launch of its next-generation HA gas turbine, a technological advancement focused on improving operational efficiency and reducing carbon emissions. This development supports cleaner energy production in process plants, aligning with global sustainability goals. The new turbine is expected to enhance power output while lowering fuel consumption, offering significant cost and environmental benefits to industrial users

- In 2024, Siemens Energy introduced a cutting-edge digital twin technology designed to optimize the performance of gas turbines. By enabling real-time monitoring and predictive maintenance, this innovation enhances operational reliability and reduces downtime. The integration of this solution is anticipated to boost cost-efficiency for process plants, driving the broader adoption of smart energy systems across the sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.