Global Psyllium Product Market

Market Size in USD Million

CAGR :

%

USD

330.49 Million

USD

658.53 Million

2025

2033

USD

330.49 Million

USD

658.53 Million

2025

2033

| 2026 –2033 | |

| USD 330.49 Million | |

| USD 658.53 Million | |

|

|

|

|

Psyllium Product Market Size

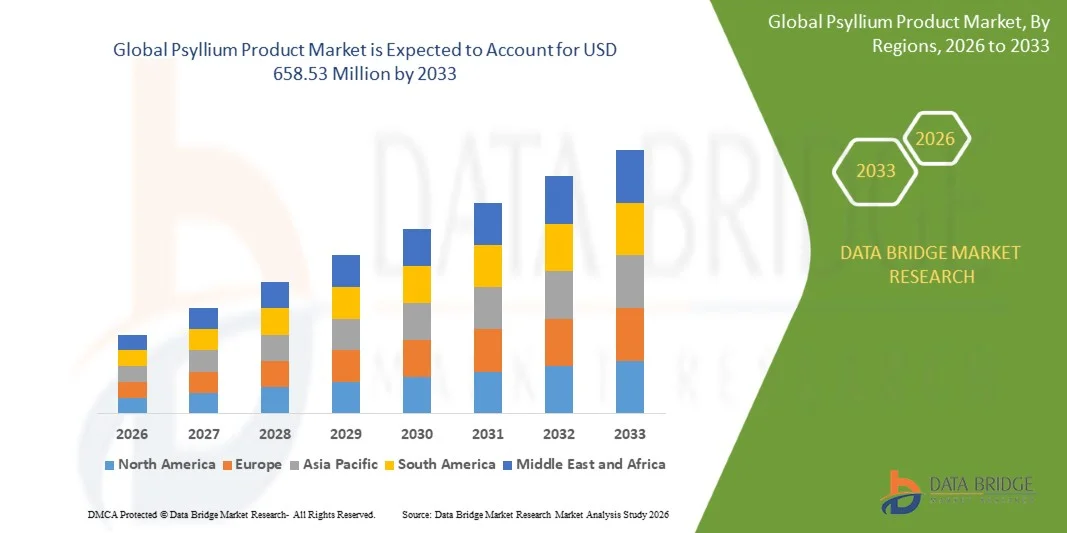

- The global psyllium product market size was valued at USD 330.49 million in 2025 and is expected to reach USD 658.53 million by 2033, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by rising consumer awareness of digestive health and the increasing preference for natural, plant-based dietary fiber solutions across food, pharmaceutical, and nutraceutical applications

- Furthermore, the growing prevalence of lifestyle-related disorders such as constipation, obesity, diabetes, and cardiovascular conditions is reinforcing the demand for psyllium-based products, as these factors collectively accelerate adoption and significantly support overall market expansion

Psyllium Product Market Analysis

- Psyllium products, derived from Plantago ovata seeds and husk, play a critical role in digestive health management, cholesterol reduction, and blood sugar regulation, making them essential ingredients across dietary supplements, pharmaceuticals, and functional food formulations

- The increasing demand for psyllium is primarily driven by the shift toward preventive healthcare, clean-label ingredients, and fiber-enriched diets, along with strong clinical validation and wide acceptance of psyllium as an effective natural soluble fiber source

- North America dominated the psyllium product market with a share of over 40% in 2025, due to strong consumer awareness regarding digestive health, high fiber intake, and preventive healthcare practices

- Asia-Pacific is expected to be the fastest growing region in the psyllium product market during the forecast period due to rising health awareness, increasing disposable incomes, and expanding nutraceutical consumption

- Psyllium husk segment dominated the market with a market share of 45.5% in 2025, due to its high fiber content, superior swelling properties, and broad usage across food, pharmaceutical, and dietary supplement industries. Psyllium husk is widely used for digestive health applications, cholesterol management, and gluten-free formulations. Its natural binding and thickening properties enhance demand in bakery and functional food products. Strong clinical recognition and consumer trust further support segment dominance

Report Scope and Psyllium Product Market Segmentation

|

Attributes |

Psyllium Product Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Psyllium Product Market Trends

“Rising Demand for Natural and Plant-Based Dietary Fiber Ingredients”

- A prominent trend in the psyllium product market is the increasing demand for natural and plant-based dietary fiber ingredients, driven by growing consumer awareness around digestive health and preventive nutrition. Psyllium is gaining strong preference due to its natural origin, high soluble fiber content, and proven health benefits across multiple applications

- For instance, brands such as NOW Foods and Organic India actively offer psyllium-based supplements positioned around clean-label and plant-derived nutrition. These products align with consumer expectations for minimally processed and naturally sourced ingredients that support daily wellness

- The incorporation of psyllium into functional foods and beverages is expanding as manufacturers seek natural fiber solutions to enhance gut health claims. This trend is supporting innovation in fiber-enriched bakery products, beverages, and meal replacements

- Dietary supplement manufacturers are increasingly formulating psyllium into capsules and powders to meet rising demand for convenient fiber intake formats. This is strengthening psyllium’s role in the growing nutraceutical segment

- The preference for plant-based diets and vegan nutrition is further accelerating the adoption of psyllium as an alternative to synthetic fiber ingredients. Consumers perceive psyllium as a safer and more holistic option for long-term health management

- Overall, the rising focus on natural nutrition and digestive wellness is reinforcing psyllium’s position as a key functional ingredient, supporting sustained growth across food, pharmaceutical, and supplement industries

Psyllium Product Market Dynamics

Driver

“Growing Prevalence of Digestive and Lifestyle-Related Health Disorders”

- The increasing prevalence of digestive disorders and lifestyle-related health conditions is a major driver for the psyllium product market, as psyllium is widely recognized for its effectiveness in improving bowel regularity and gut health. Rising cases of constipation, obesity, diabetes, and cardiovascular diseases are encouraging greater fiber consumption

- For instance, pharmaceutical and supplement companies such as Procter & Gamble and Dabur India Ltd. utilize psyllium extensively in digestive health and laxative formulations. These products address common gastrointestinal concerns and support preventive healthcare practices

- Growing medical recommendations for increased dietary fiber intake are boosting the adoption of psyllium-based products across both prescription and over-the-counter segments. Healthcare professionals frequently endorse psyllium for cholesterol and blood sugar management

- The expansion of aging populations, which are more susceptible to digestive issues, is strengthening long-term demand. This driver continues to position psyllium as an essential ingredient in health-focused formulations

- As awareness of fiber’s role in managing chronic conditions grows, the reliance on psyllium products is expected to remain strong, sustaining market momentum

Restraint/Challenge

“Price Volatility of Raw Psyllium Due to Agricultural Dependence”

- The psyllium product market faces challenges related to price volatility, primarily due to its dependence on agricultural production that is highly sensitive to climatic conditions. Variations in rainfall, temperature, and crop yield directly impact raw psyllium availability

- For instance, fluctuations in psyllium cultivation output in major producing regions can disrupt supply chains and affect pricing for processors and exporters. This volatility creates uncertainty for manufacturers relying on consistent raw material supply

- Limited geographical concentration of psyllium farming further intensifies supply risks, as disruptions in key producing areas can have global market implications. Manufacturers often face challenges in maintaining stable production costs

- Rising input costs for farming, processing, and logistics add further pressure on pricing structures. These factors can reduce profit margins, particularly for small and medium-scale producers

- The challenge of balancing raw material cost fluctuations with competitive pricing remains significant for market participants. Managing supply stability while ensuring affordability continues to influence strategic decisions across the psyllium value chain

Psyllium Product Market Scope

The market is segmented on the basis of nature, product type, application, end user, and distribution channel.

• By Nature

On the basis of nature, the psyllium product market is segmented into organic and conventional. The conventional segment dominated the market with the largest revenue share in 2025, supported by its wide availability, cost efficiency, and strong adoption across food processing, pharmaceuticals, and dietary supplement manufacturing. Conventional psyllium products are preferred by large-scale manufacturers due to consistent quality, stable supply chains, and compatibility with mass production requirements. The segment also benefits from established sourcing networks and lower certification costs, which help maintain competitive pricing. These factors continue to strengthen its position across both developed and emerging markets.

The organic segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer preference for clean-label, chemical-free, and sustainably sourced ingredients. Increasing health awareness and demand for organic dietary fiber products are encouraging manufacturers to expand organic psyllium offerings. Regulatory support for organic food products and premium positioning in nutraceuticals further accelerate growth. Growing penetration of organic psyllium in functional foods and wellness products reinforces this upward trend.

• By Product Type

On the basis of product type, the psyllium product market is segmented into psyllium seed, psyllium capsules, psyllium husk, psyllium husk powder, and psyllium industrial powder. The psyllium husk segment dominated the market with the largest share of 45.5% in 2025 due to its high fiber content, superior swelling properties, and broad usage across food, pharmaceutical, and dietary supplement industries. Psyllium husk is widely used for digestive health applications, cholesterol management, and gluten-free formulations. Its natural binding and thickening properties enhance demand in bakery and functional food products. Strong clinical recognition and consumer trust further support segment dominance.

The psyllium husk powder segment is projected to register the fastest growth during the forecast period, fueled by its ease of formulation and versatility across multiple applications. Powdered psyllium allows precise dosing and seamless incorporation into beverages, supplements, and ready-to-mix products. Rising demand for convenient nutrition formats and personalized dietary solutions boosts adoption. Increased use in nutraceuticals and medical nutrition products continues to drive rapid expansion.

• By Application

On the basis of application, the psyllium product market is segmented into residential and commercial. The commercial segment accounted for the largest market share in 2025, driven by extensive utilization in food processing, pharmaceutical manufacturing, and nutraceutical production. Commercial buyers favor psyllium for its functional benefits such as thickening, stabilizing, and fiber enrichment. Large-volume procurement by manufacturers ensures steady demand and long-term supply contracts. Growth in processed food and dietary supplement industries further reinforces segment leadership.

The residential segment is anticipated to grow at the fastest pace from 2026 to 2033, supported by increasing consumer awareness of digestive health and preventive nutrition. Rising adoption of psyllium-based home remedies and dietary supplements drives household-level consumption. Growth of e-commerce platforms and health-focused retail outlets enhances accessibility. Changing lifestyles and emphasis on daily fiber intake contribute to sustained growth.

• By End User

On the basis of end user, the psyllium product market is segmented into food and beverages, pharmaceuticals, dietary supplements, nutraceuticals, cosmetics and personal care, animal feed, and others. The pharmaceuticals segment dominated the market in 2025 due to widespread use of psyllium in laxatives, cholesterol-lowering formulations, and metabolic health treatments. Strong clinical validation and regulatory approvals support its integration into prescription and over-the-counter products. Consistent demand from healthcare providers ensures stable consumption volumes. The segment benefits from increasing prevalence of digestive disorders globally.

The dietary supplements segment is expected to witness the fastest growth over the forecast period, driven by rising preventive healthcare adoption and consumer focus on gut health. Psyllium-based supplements are gaining traction for weight management, heart health, and blood sugar regulation. Expansion of wellness-oriented product portfolios and aggressive marketing strategies support growth. Increasing availability in capsule and powder formats further accelerates demand.

• By Distribution Channel

On the basis of distribution channel, the psyllium product market is segmented into online and offline. The offline segment dominated the market in 2025, supported by strong presence of pharmacies, health stores, supermarkets, and specialty nutrition retailers. Consumers often prefer offline channels for trusted health products due to professional guidance and immediate availability. Established distribution networks and bulk procurement by institutions reinforce segment dominance. Offline sales remain significant in regions with limited digital penetration.

The online segment is projected to grow at the fastest rate from 2026 to 2033, driven by increasing internet penetration and preference for convenient purchasing options. E-commerce platforms offer wider product variety, competitive pricing, and detailed product information. Subscription-based supplement models and direct-to-consumer strategies enhance customer engagement. Growth in digital health awareness campaigns further supports rapid expansion.

Psyllium Product Market Regional Analysis

- North America dominated the psyllium product market with the largest revenue share of over 40% in 2025, driven by strong consumer awareness regarding digestive health, high fiber intake, and preventive healthcare practices

- Consumers in the region highly value psyllium-based products for their proven benefits in gut health, cholesterol management, and blood sugar control, supporting widespread adoption across dietary supplements and pharmaceutical formulations

- This strong demand is further supported by well-established nutraceutical industries, high disposable incomes, and the growing preference for natural and plant-based functional ingredients, positioning psyllium as a key dietary fiber source across both residential and commercial applications

U.S. Psyllium Product Market Insight

The U.S. psyllium product market captured the largest revenue share within North America in 2025, fueled by high consumption of fiber supplements and extensive use in pharmaceutical laxatives and functional foods. Consumers increasingly prioritize digestive wellness and heart health, driving sustained demand for psyllium husk and powder products. The presence of major dietary supplement brands, strong retail distribution networks, and rising adoption of clean-label ingredients further support market growth. In addition, growing prevalence of lifestyle-related disorders continues to reinforce long-term demand.

Europe Psyllium Product Market Insight

The Europe psyllium product market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing focus on digestive health and rising demand for natural fiber ingredients in food and nutraceutical applications. Regulatory support for plant-based and clean-label products encourages manufacturers to incorporate psyllium into functional formulations. Growth in health-conscious populations and aging demographics further supports adoption across dietary supplements and pharmaceutical uses. The region shows strong demand across both Western and Central Europe.

U.K. Psyllium Product Market Insight

The U.K. psyllium product market is anticipated to grow at a notable CAGR, supported by increasing awareness of gut health and preventive nutrition. Rising consumption of fiber-enriched foods and supplements, along with growing vegan and plant-based dietary trends, is accelerating market uptake. The strong presence of health food retailers and expanding online sales channels further improves accessibility. Demand from pharmaceutical and dietary supplement segments remains a key growth driver.

Germany Psyllium Product Market Insight

The Germany psyllium product market is expected to witness considerable growth during the forecast period, driven by high consumer preference for scientifically validated and natural health products. Germany’s strong pharmaceutical and nutraceutical manufacturing base supports consistent demand for psyllium as a functional excipient and active ingredient. Emphasis on digestive wellness, metabolic health, and preventive care reinforces market expansion. The preference for high-quality and organic ingredients further supports growth in premium psyllium products.

Asia-Pacific Psyllium Product Market Insight

The Asia-Pacific psyllium product market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising health awareness, increasing disposable incomes, and expanding nutraceutical consumption. Rapid urbanization and dietary shifts toward fiber-rich foods are boosting demand across emerging economies. The region benefits from being a major cultivation and processing hub for psyllium, improving supply availability and cost efficiency. Growing pharmaceutical and dietary supplement industries further accelerate regional growth.

India Psyllium Product Market Insight

The India psyllium product market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to its position as the leading global producer and exporter of psyllium. Strong domestic availability, coupled with traditional usage of psyllium for digestive health, supports high consumption levels. Expanding export demand from North America and Europe further strengthens market growth. Increasing investments in processing facilities and rising domestic nutraceutical demand continue to reinforce India’s market leadership.

Psyllium Product Market Share

The psyllium product industry is primarily led by well-established companies, including:

- NOW Foods (U.S.)

- Nature’s Sunshine Products of Australia Pty Ltd. (Australia)

- Patanjali Ayurved (India)

- Dabur India Ltd. (India)

- Rama Gum Industries Limited (India)

- Procter & Gamble (U.S.)

- Puritan’s Pride, Inc. (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- Premcem Gums Pvt. Ltd. (India)

- JYOT Overseas Pvt. Ltd. (India)

- Psyllium Labs LLC (U.S.)

- Satnam Psyllium Industries (India)

- Balisana Isabgol (India)

- Gayatri Psyllium Industries (India)

- Shree Mahalaxmi Psyllium Pvt. Ltd. (India)

- Ispasen Remedies (India)

- Shubh Psyllium Industries (India)

- Keyur Industries (India)

- Vraj Psyllium (India)

- Abhyuday Industries (India)

Latest Developments in Global Psyllium Product Market

- In August 2025, Procter & Gamble announced a large-scale investment to establish a dedicated psyllium husk–based drug manufacturing facility in Gujarat, marking a significant expansion of pharmaceutical-grade psyllium production. This move is expected to enhance global supply consistency, strengthen quality control standards, and support rising demand for psyllium-based laxatives and digestive health medicines. The investment also reinforces psyllium’s role as a critical ingredient in regulated healthcare applications, supporting long-term market stability and growth

- In August 2025, Psyllium Market Labs launched a new organic psyllium product range focused on clean-label and plant-based nutrition trends. This development broadens consumer access to certified organic psyllium and supports premium positioning in dietary supplements and functional food formulations. The expansion reflects increasing demand for traceable, sustainably sourced fiber ingredients and contributes to higher value realization within the overall psyllium market

- In 2025, Indian psyllium exporters entered into a multi-year supply agreement with a leading European retail chain, strengthening international trade flows. This agreement improves export visibility, ensures stable offtake for producers, and reinforces India’s dominance in the global psyllium supply chain. The development supports market growth by improving distribution reach and reducing demand uncertainty for large-scale processors

- In 2025, Organic India expanded its psyllium capsule portfolio to cater to consumers seeking convenient and standardized fiber supplementation. The product expansion supports higher adoption among urban and wellness-focused consumers who prefer capsule formats over traditional husk consumption. This development enhances brand competitiveness and accelerates the shift toward value-added psyllium formulations in the dietary supplement segment

- In February 2025, Manitoba Harvest partnered with Brightseed to introduce a bioactive fiber product that incorporates psyllium husk into science-backed gut health solutions. This collaboration highlights innovation in functional ingredient development and expands psyllium’s application beyond conventional fiber uses. The partnership supports increased adoption of psyllium in advanced functional foods and nutraceuticals, strengthening its relevance in the evolving digestive health market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Psyllium Product Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Psyllium Product Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Psyllium Product Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.