Global Pulmonary Respiratory Drug Delivery Market

Market Size in USD Million

CAGR :

%

USD

68.19 Million

USD

112.85 Million

2025

2033

USD

68.19 Million

USD

112.85 Million

2025

2033

| 2026 –2033 | |

| USD 68.19 Million | |

| USD 112.85 Million | |

|

|

|

|

Pulmonary/Respiratory Drug Delivery Market Size

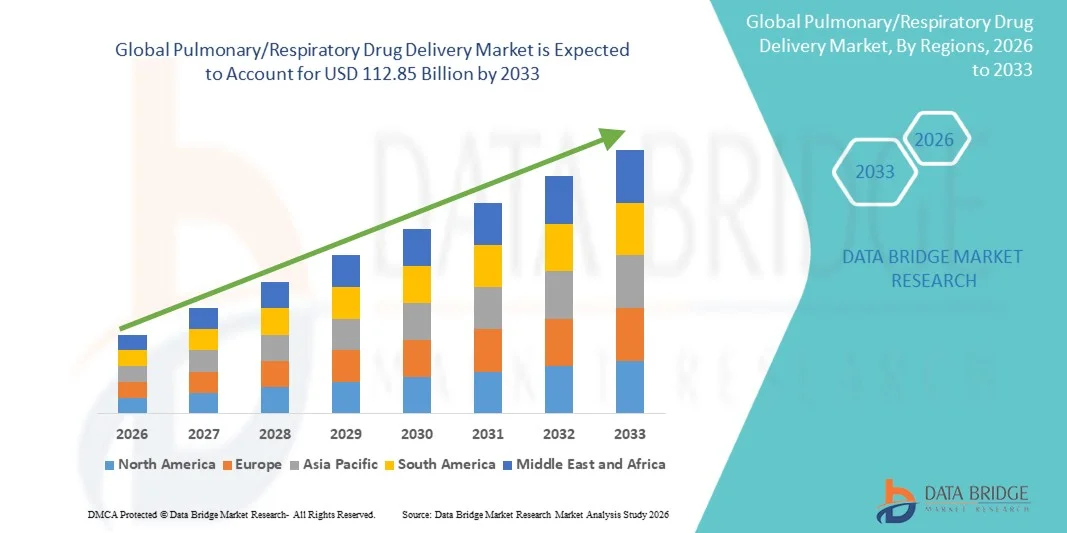

- The global pulmonary/respiratory drug delivery market size was valued at USD 68.19 billion in 2025 and is expected to reach USD 112.85 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory diseases, such as asthma, chronic obstructive pulmonary disease (COPD), and cystic fibrosis, alongside advancements in drug formulation and delivery technologies

- Furthermore, rising awareness among patients and healthcare providers about the benefits of targeted pulmonary drug delivery, such as rapid onset of action, improved bioavailability, and reduced systemic side effects, is driving the adoption of these solutions. These converging factors are accelerating the uptake of Pulmonary/Respiratory Drug Delivery products, thereby significantly boosting the industry's growth

Pulmonary/Respiratory Drug Delivery Market Analysis

- The Pulmonary/Respiratory Drug Delivery market is witnessing significant growth due to increasing prevalence of respiratory diseases such as asthma, COPD, and other chronic lung conditions, driving demand for advanced drug delivery solutions

- Furthermore, technological advancements in inhalers, nebulizers, and other drug delivery devices, coupled with rising awareness of patient-centric care and self-administered treatments, are accelerating market adoption and boosting industry growth

- North America dominated the pulmonary/respiratory drug delivery market with the largest revenue share of 43.5% in 2025, driven by well-established healthcare infrastructure, high R&D expenditure, and the presence of key industry players. The U.S. experienced substantial growth in Pulmonary/Respiratory Drug Delivery solutions, particularly in hospitals, clinics, and home care settings, supported by innovations in inhalers, nebulizers, and advanced drug delivery devices

- Asia-Pacific is expected to be the fastest-growing region in the pulmonary/respiratory drug delivery market during the forecast period, with a CAGR of 24%, owing to increasing prevalence of respiratory disorders, rising healthcare spending, growing pharmaceutical research activities, and expanding patient access to advanced drug delivery technologies in countries such as China, India, and Japan

- The Plain Canisters segment dominated the largest market share of 61% in 2025, driven by their cost-effectiveness, compatibility with most inhaler devices, and widespread use in established therapies for asthma and COPD

Report Scope and Pulmonary/Respiratory Drug Delivery Market Segmentation

|

Attributes |

Pulmonary/Respiratory Drug Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pulmonary/Respiratory Drug Delivery Market Trends

“Advancements in Device Technology and Formulations”

- A major trend in the global Pulmonary/Respiratory Drug Delivery market is the continuous development of advanced inhalation devices, nebulizers, and dry powder inhalers that improve drug delivery efficiency and patient compliance

- For instance, in June 2024, Teva Pharmaceutical launched its latest DPI (dry powder inhaler) designed to optimize dose delivery to the lungs and reduce deposition in the oropharyngeal region

- Modern devices are being engineered for portability, ease of use, and integration with digital health solutions to provide better monitoring of dosage adherence

- Recent innovations focus on minimizing side effects, increasing lung deposition rates, and allowing precision dosing, which is especially crucial for chronic respiratory conditions such as asthma and COPD

- Patients and healthcare providers are increasingly adopting devices with ergonomic designs, pre-measured doses, and improved drug formulations, creating a more patient-friendly approach to respiratory care

- Companies are investing in combination therapies that integrate bronchodilators and corticosteroids within single devices to enhance treatment efficiency

- Ongoing research is targeting biologic drug delivery via inhalation, which could offer new therapeutic options for severe respiratory disorders

- With increasing prevalence of respiratory diseases globally, these device and formulation innovations are reshaping the treatment landscape and improving patient outcomes

Pulmonary/Respiratory Drug Delivery Market Dynamics

Driver

“Rising Prevalence of Respiratory Disorders”

- The increasing incidence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and cystic fibrosis is a key driver for market growth

- For instance, in March 2025, the World Health Organization (WHO) reported a 12% increase in asthma prevalence in adults across North America and Europe over the past five years

- Rising air pollution levels, urbanization, and smoking-related lung damage are contributing to the growing patient population requiring pulmonary drug delivery solutions

- Healthcare providers are focusing on early diagnosis and maintenance therapies to reduce hospitalizations and improve quality of life for patients with chronic respiratory illnesses

- The demand for portable and easy-to-use delivery devices is increasing, particularly among pediatric and geriatric populations, to ensure adherence to prescribed treatments

- Governments and healthcare agencies are promoting awareness programs and subsidized access to inhalation therapies, further driving adoption

- The launch of generic formulations alongside branded devices is improving accessibility and affordability, supporting widespread use across both developed and emerging markets

- Overall, the combination of rising disease prevalence and better healthcare infrastructure is fueling steady demand for pulmonary and respiratory drug delivery solutions

Restraint/Challenge

“High Device Costs and Regulatory Hurdles”

- The high cost of advanced inhalation devices and delivery systems can limit adoption, especially in price-sensitive regions and developing countries

- For instances, advanced smart nebulizers and combination inhalers often cost 30–50% more than traditional inhalers, making them less accessible to lower-income patients

- Stringent regulatory requirements for device approvals and clinical validation can delay product launches, adding to development costs

- Differences in regulatory guidelines across regions, such as FDA approvals in the U.S. versus CE marking in Europe, create complexity for manufacturers expanding globally

- In addition, patient education and proper training are required to ensure correct device usage, as incorrect inhalation technique can significantly reduce therapeutic efficacy

- Healthcare providers and manufacturers must invest in training programs and awareness campaigns, which adds to operational costs

- The combination of device cost, regulatory compliance, and user training requirements can pose temporary barriers to faster market adoption

- Overcoming these challenges requires continued innovation, cost optimization, and harmonized regulatory pathways to sustain long-term market growth

Pulmonary/Respiratory Drug Delivery Market Scope

The market is segmented on the basis of product, canister type, application, distribution channel, and end user.

• By Product

On the basis of product, the Pulmonary/Respiratory Drug Delivery market is segmented into Formulation Type and Device Type. The Formulation Type segment dominated the largest market share of 52% in 2025, driven by the high demand for metered-dose inhalers, dry powder inhalers, and nebulized solutions that ensure precise drug delivery. Formulations with enhanced bioavailability, improved lung deposition, and reduced systemic side effects are preferred in clinical practice. Pharmaceutical companies are increasingly investing in combination therapies, such as corticosteroid-bronchodilator combinations, to improve patient adherence. The segment benefits from established regulatory approvals and widespread availability in hospital and retail channels. Formulations allow for standardized dosing, ease of storage, and compatibility with various delivery devices. Leading manufacturers are focusing on expanding generic and branded options to cater to both developed and emerging markets. Clinical preference for formulations that minimize administration errors further supports this segment. Continuous innovation in excipients and delivery carriers enhances drug stability and shelf life. Patient-centric designs, such as breath-actuated inhalers, further contribute to market adoption. Educational initiatives for patients on proper inhalation techniques are reinforcing the segment's dominance. The growth of chronic respiratory diseases and an increasing geriatric population also underpin the segment’s prominence. Overall, formulation type maintains its position due to broad clinical acceptance and scalability in production.

The Device Type segment is expected to witness the fastest growth with a CAGR of 9.2% from 2026 to 2033, as healthcare providers and patients increasingly prefer portable, user-friendly, and technologically advanced delivery systems. Devices such as portable nebulizers, smart inhalers, and digital adherence monitoring devices are gaining traction. Rising demand in home healthcare settings and increased awareness of proper device usage support growth. Manufacturers are developing ergonomic, lightweight, and battery-efficient devices for better patient compliance. Integration of dose counters and adherence tracking is becoming standard. Adoption is particularly high in emerging markets due to government initiatives and healthcare infrastructure improvements. Device innovations that reduce inhalation errors and improve lung deposition enhance clinical outcomes. The segment benefits from telehealth trends, allowing remote monitoring of patient inhalation patterns. Hospitals and clinics increasingly procure advanced devices to manage chronic respiratory diseases efficiently. Enhanced portability and multi-patient usability further boost adoption. The growing need for personalized therapy and disease management contributes to sustained growth.

• By Canister Type

On the basis of canister type, the market is segmented into Plain Canisters and Coated Canisters. The Plain Canisters segment dominated the largest market share of 61% in 2025, driven by their cost-effectiveness, compatibility with most inhaler devices, and widespread use in established therapies for asthma and COPD. Hospitals and retail pharmacies prefer plain canisters due to their standardization and proven reliability. The segment is supported by extensive manufacturing capacity and regulatory familiarity, allowing quick scalability. Patients benefit from familiar dosing techniques and reduced device handling complexity. Plain canisters are widely available across geographies, including developed and emerging markets. Pharmaceutical companies prioritize plain canisters for generic and branded formulations due to lower production costs. The segment’s leadership is reinforced by clinician preference for predictable performance and stable drug delivery. Simple packaging and ease of storage enhance patient convenience. Educational campaigns emphasize proper priming and handling of plain canisters, further supporting adoption. The segment also benefits from stable demand in hospital procurement contracts and government programs. Overall, plain canisters continue to dominate due to their accessibility, cost efficiency, and clinical trust.

The Coated Canisters segment is expected to witness the fastest growth with a CAGR of 8.7% from 2026 to 2033, driven by enhanced drug stability, extended shelf life, and reduced adherence of drug particles to canister walls. Coated canisters are preferred for specialized formulations and high-value biologic drugs. Rising focus on precision dosing and formulation optimization contributes to adoption. Growth is particularly evident in high-income markets where advanced therapies are prevalent. The segment benefits from increasing use in combination therapies and new inhalation products. Regulatory approvals and proprietary coatings enhance product differentiation. Patients benefit from consistent dosing and reduced wastage. Manufacturers are investing in coating technology to improve device performance and patient outcomes. Expansion in e-commerce channels and direct-to-patient delivery further drives market growth. The adoption of coated canisters aligns with the trend of personalized therapy and improved treatment efficacy.

• By Application

On the basis of application, the market is segmented into Chronic Obstructive Pulmonary Disease (COPD), Asthma, and Cystic Fibrosis. The COPD segment dominated the largest market share of 44% in 2025, driven by the rising prevalence of COPD globally, particularly among aging populations and in regions with high smoking rates. COPD patients require daily maintenance therapies, long-term inhaled medications, and combination drug delivery solutions, increasing overall demand. Healthcare providers prioritize drug delivery solutions that ensure adherence, minimize exacerbations, and optimize lung function. Technological advancements in inhaler and nebulizer design have improved disease management. Government health programs targeting COPD care and hospital reimbursement schemes further support segment dominance. Awareness campaigns on early diagnosis and proper treatment adherence increase utilization of pulmonary drug delivery products. The chronic nature of the disease ensures stable and recurring demand. Clinical trials for novel therapies also strengthen the segment. Hospitals, clinics, and home care settings adopt long-term treatment plans. The growing geriatric population and rising pollution levels are key drivers. COPD management programs emphasizing self-administration and home care strengthen segment leadership.

The Asthma segment is expected to witness the fastest growth with a CAGR of 7.8% from 2026 to 2033, fueled by increasing pediatric and adult asthma prevalence, rising environmental pollution, and awareness programs. Patient-centric devices and user-friendly inhalers improve adherence and drive adoption. Schools and pediatric clinics are incorporating educational initiatives on inhaler usage. The introduction of combination therapies for better symptom control further propels growth. Rapid urbanization and industrialization contribute to higher asthma incidence, especially in emerging economies. Telemedicine and home monitoring programs support increased usage. Innovative device types and formulation options are boosting patient compliance. Market expansion is further supported by e-commerce and retail pharmacy channels. Pharmaceutical investments in asthma therapy development strengthen the segment. Improved delivery technologies ensure better patient outcomes and treatment satisfaction.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Retail Pharmacies, Hospital Pharmacies, and E-Commerce. The Retail Pharmacies segment dominated the largest market share of 47% in 2025, as pharmacies remain the primary point of access for chronic respiratory disease therapies. Retail pharmacies provide wide geographic coverage and convenient patient access. The segment benefits from established pharmaceutical supply chains, insurance reimbursements, and loyalty programs. Healthcare providers often direct patients to retail pharmacies for regular prescription refills. Promotional campaigns, pharmacist guidance, and patient counseling enhance adherence. The segment also supports both branded and generic formulations. Retail accessibility in urban and semi-urban regions further reinforces its dominance. Consumer trust in pharmacist expertise drives preference. Market penetration in emerging economies is expanding due to pharmacy networks.

The E-Commerce segment is expected to witness the fastest growth with a CAGR of 10.1% from 2026 to 2033, driven by rising online pharmaceutical sales, growing digital health adoption, and home delivery convenience. Patients prefer online purchases for chronic therapies, refill subscriptions, and privacy. COVID-19 accelerated adoption of e-pharmacies and home delivery programs. The segment benefits from direct-to-patient marketing strategies, digital adherence tools, and secure online payment platforms. E-commerce penetration is highest in developed regions but rapidly growing in emerging economies.

• By End User

On the basis of end user, the market is segmented into Hospitals, Clinics, and Home Care Settings. The Hospitals segment dominated the largest market share of 53% in 2025, driven by the adoption of advanced pulmonary therapies, chronic disease management programs, and hospital-based monitoring. Hospitals procure a wide range of devices and formulations for inpatient and outpatient care. Integration with electronic medical records and patient monitoring systems ensures treatment adherence. Clinical trials and research programs further reinforce hospital procurement. Hospitals benefit from bulk purchasing and long-term supply contracts. Urban hospitals in high-prevalence regions account for the majority of demand. The segment is supported by insurance coverage and government healthcare schemes.

The Home Care Settings segment is expected to witness the fastest growth with a CAGR of 9.5% from 2026 to 2033, driven by rising remote care adoption, telehealth programs, and increasing self-administration of therapies. Portable nebulizers and inhalers enable home-based management of chronic respiratory diseases. Aging populations, chronic disease prevalence, and patient preference for home care drive growth. Expansion of home healthcare services, digital adherence solutions, and patient education initiatives further support market adoption. Home-based therapy reduces hospital visits and overall treatment costs.

Pulmonary/Respiratory Drug Delivery Market Regional Analysis

- North America dominated the pulmonary/respiratory drug delivery market with the largest revenue share of 43.5% in 2025

- Driven by well-established healthcare infrastructure, high R&D expenditure, and the presence of key industry players

- The market experienced substantial growth in pulmonary/respiratory drug delivery solutions, particularly in hospitals, clinics, and home care settings, supported by innovations in inhalers, nebulizers, and advanced drug delivery devices

U.S. Pulmonary/Respiratory Drug Delivery Market Insight

The U.S. pulmonary/respiratory drug delivery market captured the largest revenue share in 2025 within North America, fueled by growing adoption of innovative inhalation therapies and portable drug delivery systems. Increasing prevalence of respiratory disorders such as asthma, COPD, and cystic fibrosis, along with rising awareness of patient adherence solutions, is driving market expansion. The integration of digital monitoring technologies and smart inhalers further enhances treatment efficiency and patient outcomes.

Europe Pulmonary/Respiratory Drug Delivery Market Insight

The Europe pulmonary/respiratory drug delivery market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing respiratory disease prevalence, rising healthcare expenditure, and stringent regulatory support for advanced drug delivery devices. Growth is observed across hospitals, clinics, and home care applications, with new product launches and innovations supporting market development.

U.K. Pulmonary/Respiratory Drug Delivery Market Insight

The U.K. pulmonary/respiratory drug delivery market is expected to grow at a notable CAGR during the forecast period, fueled by rising awareness of respiratory health and increasing adoption of advanced inhalation devices. Hospitals, clinics, and home care services are increasingly implementing nebulizers, inhalers, and portable delivery systems to enhance patient outcomes.

Germany Pulmonary/Respiratory Drug Delivery Market Insight

The Germany pulmonary/respiratory drug delivery market is anticipated to expand steadily, driven by growing demand for technologically advanced, energy-efficient, and user-friendly drug delivery solutions. Rising prevalence of chronic respiratory conditions, coupled with well-established healthcare infrastructure and government support, is boosting adoption across hospital and home care settings.

Asia-Pacific Pulmonary/Respiratory Drug Delivery Market Insight

The Asia-Pacific pulmonary/respiratory drug delivery market is poised to grow at the fastest CAGR of 24% during the forecast period, fueled by rising respiratory disorder prevalence, increasing healthcare spending, and expanding access to innovative drug delivery devices. Countries such as China, India, and Japan are witnessing substantial adoption of inhalers, nebulizers, and portable monitoring systems, supported by government initiatives and local manufacturing capabilities.

Japan Pulmonary/Respiratory Drug Delivery Market Insight

The Japan pulmonary/respiratory drug delivery market is witnessing rapid growth due to high prevalence of respiratory diseases, an aging population, and rising demand for convenient, efficient drug delivery solutions. Hospitals and home care providers are increasingly adopting advanced inhalation therapies and connected devices for improved patient monitoring and adherence.

China Pulmonary/Respiratory Drug Delivery Market Insight

The China pulmonary/respiratory drug delivery market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, rising middle-class population, and high adoption of modern healthcare technologies. Increased prevalence of respiratory conditions and expanding access to innovative drug delivery devices in hospitals, clinics, and home care settings are key factors supporting market growth

Pulmonary/Respiratory Drug Delivery Market Share

The Pulmonary/Respiratory Drug Delivery industry is primarily led by well-established companies, including:

- GlaxoSmithKline (U.K.)

- AstraZeneca (U.K.)

- Teva Pharmaceutical Industries (Israel)

- Sumitomo Pharma (Japan)

- Sanofi (France)

- Novartis (Switzerland)

- Boehringer Ingelheim (Germany)

- Cipla (India)

- Johnson & Johnson (U.S.)

- AbbVie (U.S.)

- Chiesi Farmaceutici (Italy)

- Medtronic (U.S.)

- ResMed (Australia)

- United Therapeutics (U.S.)

- Handok (South Korea)

- Amneal Pharmaceuticals (U.S.)

- Hikma Pharmaceuticals (Jordan)

- Perrigo Company (U.S.)

- Neopharm (Israel)

Latest Developments in Global Pulmonary/Respiratory Drug Delivery Market

- In June 2024, the U.S. FDA approved Verona Pharma’s inhaled therapy Ohtuvayre for chronic obstructive pulmonary disease (COPD). This non-steroidal inhalation therapy has been shown to improve lung function in patients with moderate to severe COPD, marking a significant advancement in treatment options

- In July 2025, Merck & Co. announced the acquisition of Verona Pharma for approximately $10 billion, incorporating Verona’s inhaled COPD therapy into Merck’s cardiopulmonary portfolio. This move expanded Merck’s presence in the pulmonary drug delivery space and strengthened its pipeline for respiratory therapies

- In April 2025, Regeneron / Sanofi’s Dupixent (dupilumab) received FDA approval as the first biologic therapy for patients with uncontrolled COPD with high eosinophil counts. This approval introduced a novel mechanism of action aimed at reducing airway inflammation beyond standard inhalers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.