Global Pulsed Field Ablation Devices Market

Market Size in USD Million

CAGR :

%

USD

970.70 Million

USD

7,356.18 Million

2024

2032

USD

970.70 Million

USD

7,356.18 Million

2024

2032

| 2025 –2032 | |

| USD 970.70 Million | |

| USD 7,356.18 Million | |

|

|

|

|

Pulsed Field Ablation Devices Market Size

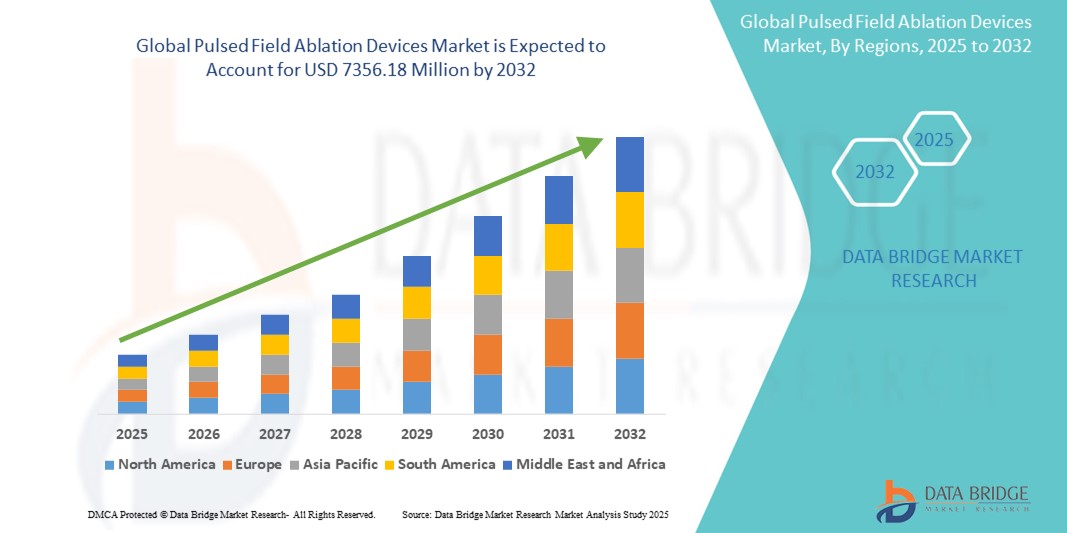

- The global pulsed field ablation devices market size was valued at USD 970.7 million in 2024 and is expected to reach USD 7,356.18 million by 2032, at a CAGR of 28.80% during the forecast period

- This growth is driven by factors such as the technological advancements enhancing precision and safety, expanding clinical applications beyond atrial fibrillation and growing preference for non-thermal ablation techniques

Pulsed Field Ablation Devices Market Analysis

- Pulsed field ablation (PFA) devices are advanced medical tools used for cardiac arrhythmia treatment, offering precise and non-thermal tissue ablation. They are primarily used in procedures such as atrial fibrillation ablation, ventricular tachycardia ablation, and other complex arrhythmia treatments

- The demand for PFA devices is significantly driven by the growing prevalence of cardiac arrhythmias, advancements in ablation technology, and increasing patient preference for minimally invasive procedures. These factors are contributing to the rapid adoption of PFA systems in cardiac electrophysiology

- North America is expected to dominate the pulsed field ablation devices market, accounting for 45.6% market share. This dominance is driven by advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and the strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the pulsed field ablation devices market, with a CAGR of 8.7% driven by rapid expansion in healthcare infrastructure, increasing awareness about heart health, and rising surgical volumes

- Atrial fibrillation segment is expected to dominate the market with a market share of 97.4%, driven by its high prevalence and the growing preference for PFA as a treatment modality

Report Scope and Pulsed Field Ablation Devices Market Segmentation

|

Attributes |

Pulsed Field Ablation Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pulsed Field Ablation Devices Market Trends

“Technological Advancements in Pulsed Field Ablation (PFA) Devices”

- One prominent trend in the evolution of pulsed field ablation devices is the integration of advanced energy delivery systems and real-time imaging technologies, which enhance the precision and safety of cardiac ablation procedures

- These innovations enable more targeted ablation, minimizing collateral tissue damage and reducing the risk of complications compared to traditional thermal ablation methods

- For instance, recent advancements in PFA technology have led to the development of multi-electrode catheters and real-time impedance monitoring systems, which provide physicians with precise control over ablation depth and lesion formation, improving procedural outcomes for patients with complex arrhythmias

- These advancements are transforming the field of cardiac electrophysiology, improving patient outcomes and driving the demand for next-generation PFA devices with cutting-edge ablation and monitoring capabilities

Pulsed Field Ablation Devices Market Dynamics

Driver

“Rising Prevalence of Atrial Fibrillation and Other Cardiac Arrhythmias”

- The increasing prevalence of atrial fibrillation (AF) and other cardiac arrhythmias is significantly contributing to the rising demand for pulsed field ablation (PFA) devices

- As the global population ages, the incidence of AF continues to grow, with older adults being more prone to cardiac rhythm disorders that require advanced ablation procedures

- The need for precise, minimally invasive, and efficient ablation technologies such as PFA is driven by the growing awareness of the risks associated with untreated arrhythmias, including stroke and heart failure

For instance,

- In 2024, a report published by the American Heart Association highlighted that approximately 12.1 million people in the U.S. are expected to have AF by 2030, significantly increasing the demand for innovative ablation technologies such as PFA to manage this growing patient population

- As a result, the demand for PFA devices is expected to surge, driven by the increasing prevalence of AF and the need for safer, more effective cardiac ablation therapies

Opportunity

“Technological Advancements in Pulsed Field Ablation Devices”

- The development of next-generation PFA devices with enhanced precision, safety, and efficiency presents a significant growth opportunity for the market

- Innovations in catheter design, energy delivery systems, and real-time imaging technologies are enhancing the accuracy and outcomes of PFA procedures, making them more appealing to electrophysiologists

- In addition, the integration of artificial intelligence (AI) and machine learning (ML) in PFA systems can further improve patient outcomes by optimizing ablation parameters and reducing procedural complications

For instance,

- In January 2025, a leading medical device manufacturer announced the launch of a new AI-powered PFA system that uses real-time data analytics to guide ablation procedures, reducing treatment times by 30% and improving long-term patient outcomes

- These technological advancements are expected to drive the adoption of PFA devices, supporting market growth in the coming years

Restraint/Challenge

“High Equipment Costs and Limited Reimbursement Policies”

- The high cost of PFA devices and associated technologies poses a significant challenge for the market, particularly for healthcare facilities in developing regions

- PFA systems, which offer advanced features such as precision energy delivery and real-time monitoring, can often range from hundreds of thousands to millions of dollars, creating a substantial financial burden for hospitals

- This high upfront cost can deter smaller clinics and hospitals from adopting PFA technologies, leading to a reliance on conventional ablation methods

For instance,

- In 2024, a report by the Medical Device Manufacturers Association (MDMA) highlighted that the high cost of advanced ablation systems, including PFA devices, can limit their adoption, particularly in regions with underdeveloped healthcare infrastructure and limited reimbursement support

- This financial barrier can restrict market penetration, impacting the overall growth of the PFA devices market

Pulsed Field Ablation Devices Market Scope

The market is segmented on the basis of components, Indication and end use.

|

Segmentation |

Sub-Segmentation |

|

By Components |

|

|

By Indication |

|

|

By End Use |

|

In 2025, the atrial fibrillation is projected to dominate the market with a largest share in indication segment

The atrial fibrillation segment is expected to dominate the pulsed field ablation devices market with the largest share of 97.4% in 2025 due to its high prevalence and growing preference for PFA as a treatment modality. As the leading indication for PFA procedures, the technology's advantages, including reduced collateral damage, shorter procedure times, and improved patient outcomes, have driven its widespread adoption. The increasing global burden of atrial fibrillation further contributes to its market dominance.

The catheters segment is expected to account for the largest share during the forecast period in components market

In 2025, the catheters segment is expected to dominate the pulsed field ablation devices market with the largest market share of 89.6% due to its critical role in delivering pulsed electric fields during cardiac ablation procedures. As the primary component for precise tissue ablation, advancements in catheter technology, including enhanced tissue contact and improved mapping capabilities, enhance outcomes, driving market growth. The increasing demand for minimally invasive procedures and the effectiveness of PFA catheters in treating atrial fibrillation further contribute to their market dominance.

Pulsed Field Ablation Devices Market Regional Analysis

“North America Holds the Largest Share in the Pulsed Field Ablation Devices Market”

- North America is expected to dominate the pulsed field ablation devices market, with 45.6% market share. This dominance is driven by advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and the strong presence of key market players

- U.S. holds a significant share of 38.7% due to the increasing demand for high-precision procedures, the rising prevalence of atrial fibrillation, and continuous advancements in medical technologies such as pulsed field ablation

- The presence of well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthens the market

- In addition, the increasing demand for minimally invasive procedures and improved patient outcomes further fuel market expansion across the region

Asia-Pacific is Projected to Register the Highest CAGR in the Pulsed Field Ablation Devices Market

- Asia-Pacific is expected to witness the highest growth rate in the pulsed field ablation devices market, with a projected CAGR of approximately 8.7%. This growth is driven by rapid expansion in healthcare infrastructure, increasing awareness about heart health, and rising surgical volumes

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population, which is more susceptible to conditions such as atrial fibrillation

- Japan, with its advanced medical technology and increasing number of specialized cardiac surgeons, remains a crucial market for pulsed field ablation devices. The country continues to lead in the adoption of premium medical technologies to enhance the precision and effectiveness of heart surgeries

- India is projected to register the highest CAGR of 7.6% in the pulsed field ablation devices market, driven by expanding healthcare infrastructure, increasing awareness about heart health, and rising surgical volumes

Pulsed Field Ablation Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Biotronik (Germany)

- Smith+Nephew (U.K.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Varian (U.S.)

- ATRICURE, INC. (U.S.)

- CardioFocus (U.S.)

- Imricor (U.S.)

- B. Braun SE (Germany)

- Vygon SAS (France)

- ICU Medical, Inc. (U.S.)

- BD (U.S.)

- Henry Schein, Inc. (U.S.)

Latest Developments in Global Pulsed Field Ablation Devices Market

- In January 2025, Medtronic, a global leader in medical technology, announced the successful completion of its first human trial for pulsed field ablation (PFA) devices, showcasing a breakthrough in cardiac arrhythmia treatment. This development is expected to pave the way for enhanced patient safety and more efficient treatments for atrial fibrillation, with minimal tissue damage compared to traditional methods

- In December 2024, Boston Scientific Corporation presented new clinical trial data at the Heart Rhythm Society 2024 meeting. The data demonstrated the superiority of PFA devices in reducing procedure times and improving patient outcomes for atrial fibrillation treatments. The company also highlighted its upcoming plans to expand its portfolio of PFA devices, focusing on innovations that ensure faster and more precise ablation procedures

- In November 2024, Abbott Laboratories launched an upgraded version of its PFA catheter, featuring enhanced design and precision ablation capabilities. This new catheter technology offers greater tissue contact and improved mapping features, contributing to faster recovery times for patients undergoing atrial fibrillation procedures

- In October 2024, Biotronik unveiled its latest pulsed field ablation generator at the European Heart Rhythm Association (EHRA) conference. The device incorporates advanced energy delivery systems that reduce the risk of collateral damage and improve the efficacy of cardiac ablation procedures, leading to better clinical outcomes in patients with complex arrhythmias

- In September 2024, Johnson & Johnson’s subsidiary, Biosense Webster, received FDA approval for its next-generation PFA system. This system promises to provide higher precision, shorter procedure durations, and improved patient safety profiles for those undergoing ablation treatments for atrial fibrillation. The company is now planning for global expansion of its PFA devices, with focus on training healthcare professionals and improving treatment protocols

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.