Global Radiopharmaceuticals Market

Market Size in USD Billion

CAGR :

%

USD

16.30 Billion

USD

26.98 Billion

2024

2032

USD

16.30 Billion

USD

26.98 Billion

2024

2032

| 2025 –2032 | |

| USD 16.30 Billion | |

| USD 26.98 Billion | |

|

|

|

|

Radiopharmaceuticals Market Size

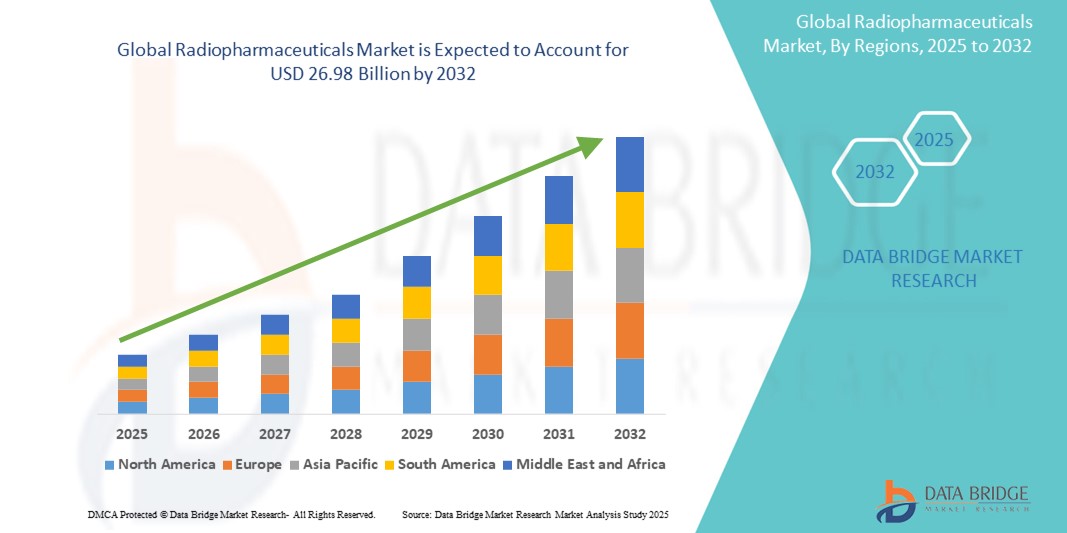

- The global radiopharmaceuticals market was valued at USD 16.30 billion in 2024 and is expected to reach USD 26.98 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.50%, primarily driven by the rising prevalence of cancer and cardiovascular diseases, along with increasing adoption of targeted diagnostic and therapeutic procedures

- This growth is driven by factors such as the advancements in nuclear medicine, growing demand for personalized treatment, and increased investment in radiopharmaceutical research and development

Radiopharmaceuticals Market Analysis

- Radiopharmaceuticals are specialized medicinal formulations containing radioisotopes, used in diagnostics and therapeutics, particularly in oncology, cardiology, and neurology. These compounds enable precise imaging and targeted treatment at a molecular level, significantly improving disease detection and patient outcomes

- The market demand is significantly driven by the rising incidence of cancer and cardiovascular diseases, alongside growing adoption of nuclear medicine and PET/CT imaging technologies. Increased awareness and early disease detection efforts are also contributing to the market’s expansion

- North America the dominant region in the global radiopharmaceuticals market, owing to its strong healthcare infrastructure, high healthcare spending, and presence of key industry players focused on research and development and new product approvals

- For instance, the U.S. has witnessed a notable rise in the use of PET imaging for oncology diagnostics, with government support and clinical trials accelerating the adoption of novel radiotracers and theranostic agents

- Globally, radiopharmaceuticals are considered one of the most vital components in nuclear medicine, ranking just behind imaging equipment in terms of importance. Their role in enabling accurate, non-invasive diagnosis and personalized treatment continues to transform modern healthcare

Report Scope and Radiopharmaceuticals Market Segmentation

|

Attributes |

Radiopharmaceuticals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Radiopharmaceuticals Market Trends

Advancements in Theranostics and Targeted Radiopharmaceuticals

- A prominent trend in the global radiopharmaceuticals market is the rapid advancement in theranostic applications and the development of highly targeted radiopharmaceutical agents

- These innovations are enabling simultaneous diagnosis and treatment, particularly in oncology, by using the same molecular platform to detect and destroy cancer cells with precision

- For instance, theranostic agents such as Lutetium-177 labeled compounds are being used to both visualize and treat neuroendocrine tumors and prostate cancer, offering more personalized and effective care

- The trend also includes the development of radiopharmaceuticals with longer half-lives and improved targeting capabilities, enhancing both patient convenience and clinical outcomes

- These advancements are reshaping nuclear medicine by improving therapeutic efficacy, reducing side effects, and driving demand for next-generation radiopharmaceuticals across global markets

Radiopharmaceuticals Market Dynamics

Driver

Rising Burden of Cancer and Cardiovascular Diseases

- The increasing global prevalence of cancer and cardiovascular diseases is a primary driver for the rising demand for radiopharmaceuticals, which play a crucial role in early diagnosis and targeted treatment of these life-threatening conditions

- As cancer continues to be one of the leading causes of mortality worldwide, the need for precise diagnostic imaging and minimally invasive therapies is pushing healthcare systems to adopt nuclear medicine solutions at a higher rate

- Cardiovascular disorders, particularly coronary artery disease, also rely heavily on radiotracers for imaging techniques such as myocardial perfusion scans, improving diagnostic accuracy and guiding effective treatment plans

- Technological advancements in radiopharmaceuticals, including PET and SPECT imaging, have significantly enhanced the sensitivity and specificity of disease detection, enabling clinicians to make faster and more informed decisions

- The expansion of oncology and cardiology departments across hospitals, paired with growing patient awareness and government initiatives to promote early screening, is further supporting market growth

For instance,

- In October 2022, the World Health Organization (WHO) reported that cancer accounted for nearly 10 million deaths globally in 2020, underscoring the urgent need for advanced diagnostic and therapeutic tools such as radiopharmaceuticals

- According to the American Heart Association, cardiovascular disease remains the leading cause of death globally, with nuclear cardiology playing an increasingly important role in non-invasive diagnosis

- As a result, the growing burden of cancer and heart disease is fueling the demand for radiopharmaceuticals, reinforcing their critical role in modern diagnostic and therapeutic pathways

Opportunity

Expanding Potential Through Artificial Intelligence Integration in Nuclear Imaging

- The integration of artificial intelligence (AI) into nuclear medicine is opening new avenues for radiopharmaceutical applications by enhancing image acquisition, interpretation, and personalized treatment planning

- AI-powered imaging tools can analyze complex PET and SPECT scan data with higher speed and precision, leading to earlier and more accurate detection of diseases such as cancer, Alzheimer’s, and cardiac conditions

- In addition, these systems support automated lesion detection, quantitative analysis, and prognosis prediction, helping clinicians make better-informed decisions and improving patient outcomes

For instance

- In February 2024, a study published in The Journal of Nuclear Medicine highlighted how deep learning algorithms significantly improved the accuracy of PET scan interpretations in detecting early-stage prostate cancer, reducing false positives and streamlining workflow

- In August 2023, according to the European Journal of Nuclear Medicine and Molecular Imaging, AI-based tools were shown to enhance myocardial perfusion imaging by reducing motion artifacts and improving diagnostic confidence in cardiac assessments

- The The synergy between AI and radiopharmaceuticals is also fostering the development of smart theranostic platforms that adapt to patient-specific disease profiles, enabling highly individualized therapy regimens

- As healthcare providers continue to embrace digital transformation, the application of AI in radiopharmaceutical imaging is expected to drive market growth, improve efficiency, and deliver more accurate, cost-effective care on a global scale

Restraint/Challenge

High Cost and Limited Accessibility of Radiopharmaceuticals

- The high cost associated with the production, storage, and distribution of radiopharmaceuticals presents a significant challenge, especially in low- and middle-income countries where nuclear medicine infrastructure is limited or underdeveloped

- Radiopharmaceuticals often require specialized facilities for synthesis and handling due to their short half-lives and radioactive nature, driving up operational and logistics costs for hospitals and diagnostic centers

- This cost barrier can restrict the adoption of advanced nuclear medicine procedures and limit patient access to cutting-edge diagnostic and therapeutic options

For instance

- In October 2023, according to a report published by the International Atomic Energy Agency (IAEA), the high production cost and lack of domestic radioisotope supply in many countries are major factors hindering the widespread adoption of radiopharmaceuticals in clinical practice

- In June 2024, an article in Frontiers in Nuclear Medicine highlighted how healthcare facilities in developing regions often face delays or cancellations in procedures due to the unavailability or unaffordability of radiopharmaceutical agents, impacting patient care and clinical efficiency

- Consequently, these cost-related and logistical challenges can slow market penetration, create disparities in healthcare delivery, and limit the broader global impact of radiopharmaceutical advancements

Radiopharmaceuticals Market Scope

The market is segmented on the basis of type, application, source and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Source |

|

|

By End User |

|

Radiopharmaceuticals Market Regional Analysis

North America is the Dominant Region in the Radiopharmaceuticals Market

- North America leads the global radiopharmaceuticals market, fueled by a highly developed healthcare infrastructure, significant investment in nuclear medicine, and early adoption of innovative diagnostic and therapeutic technologies

- U.S, holds the largest market share due to a high prevalence of cancer and cardiovascular diseases, strong support for clinical research, and favorable regulatory frameworks for the approval of new radiopharmaceutical products

- The presence of major industry players, extensive use of PET and SPECT imaging, and growing awareness about personalized medicine further strengthen the region's leadership

- In addition, the increasing number of nuclear medicine procedures and continuous technological advancements in radiotracers and imaging agents contribute to the robust demand for radiopharmaceuticals across the region

Asia-Pacific is Projected to Register the Highest Growth Rate

- Asia-Pacific is expected to record the highest growth rate in the radiopharmaceuticals market, driven by a growing patient population, improving access to healthcare, and rising investments in nuclear medicine infrastructure

- Countries such as China, India, and Japan are emerging as major markets due to increasing incidences of cancer and cardiovascular diseases, alongside growing awareness of early disease detection and personalized therapy

- Japan is a frontrunner in nuclear medicine adoption with strong research capabilities and government support, while China and India are rapidly expanding their diagnostic imaging capacities to meet rising healthcare demands

- Improved regulatory pathways, expanding collaborations with global pharmaceutical companies, and government initiatives to boost nuclear medicine access are further accelerating market growth across the Asia-Pacific region

Radiopharmaceuticals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novartis AG (Switzerland)

- Siemens Healthineers AG (Germany)

- Bayer AG (Germany)

- GE HealthCare (U.S.)

- Lantheus (U.S.)

- Curium (France)

- Jubilant Radiopharma (Canada)

- Eckert & Ziegler (Germany)

- Cardinal Health (U.S.)

- Telix Pharmaceuticals Limited (Australia)

- Bracco (Italy)

- Lilly (U.S.)

- AstraZeneca (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- GSK plc (U.K.)

- Mallinckrodt (Ireland)

- McKesson Corporation (U.S.)

- Advanced Accelerator Applications SA (France)

- PharmaLogic (U.S.)

Latest Developments in Global Radiopharmaceuticals Market

- In March 2024, AstraZeneca announced the acquisition of Fusion Pharmaceuticals for up to USD 2.4 billion, aiming to advance in the field of radiopharmaceuticals by delivering radioactive isotopes directly to cancer cells

- In May 2024, Intermountain Health and PharmaLogic Holdings Corp. partnered to develop novel radiopharmaceuticals for cancer diagnosis, enhancing diagnostic capabilities in oncology

- In July 2024, Curium submitted a New Drug Application (NDA) for its lutetium-177 (Lu-177) DOTATATE radiopharmaceutical, aiming to treat somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETs)

- In July 2024, Nusano Inc. and PharmaLogic Holdings Corp. entered into a supply agreement to enhance the availability of medical radioisotopes, ensuring a more efficient and reliable supply for pharmaceutical products

- In October 2024, Siemens Healthineers secured a deal to purchase part of Novartis's Advanced Accelerator Applications (AAA) business for over €200 million, bolstering its PET radiopharmaceutical business by supplying critical radioactive chemicals for cancer scans

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.