Global Recycled Plastic Market

Market Size in USD Billion

CAGR :

%

USD

43.17 Billion

USD

30.12 Billion

2024

2032

USD

43.17 Billion

USD

30.12 Billion

2024

2032

| 2025 –2032 | |

| USD 43.17 Billion | |

| USD 30.12 Billion | |

|

|

|

|

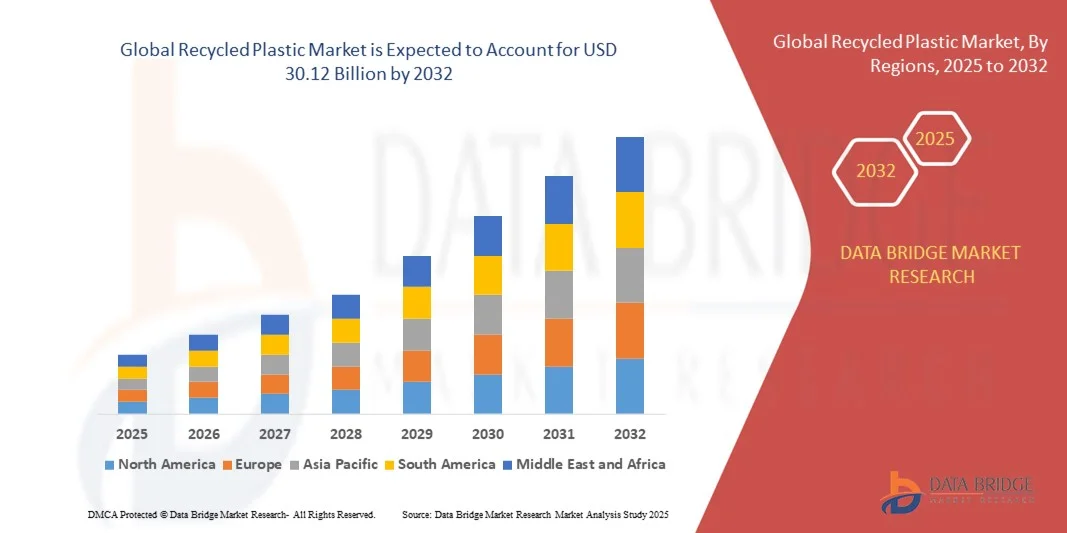

What is the Global Recycled Plastic Market Size and Growth Rate?

- The global recycled plastic market size was valued at USD 43.17 billion in 2024 and is expected to reach USD 30.12 billion by 2032, at a CAGR of 4.6% during the forecast period

- Packaging plays an important role as plastic packaging in food packaging, which protects foods against environmental, chemical, and physical factors that could possibly contaminate all of the food if not packaged correctly

- The essential role of packaging is to protect the product from damage during transit, but packaging also protects the product in the warehouse and retail shoes before the sale of the product. Different types of packaging are used for different types of products

What are the Major Takeaways of Recycled Plastic Market?

- Various governments are implementing supportive policies toward recycled plastic products and materials for several reasons. Concerns and knowledge about how plastic garbage affects the environment are growing

- Plastic pollution is now a significant problem on a global scale, having a negative influence on ecosystems, wildlife, and public health. Governments are aware that encouraging the use of recycled plastic will lessen the amount of plastic trash disposed of in landfills and reduce pollution in the ocean and waterways

- Asia-Pacific dominated the recycled plastic market with the largest revenue share of 46.3% in 2024, driven by high consumption of plastic packaging, textiles, and automotive components, alongside large-scale recycling initiatives

- North America is projected to record the fastest CAGR of 11.5% from 2025 to 2032, driven by stringent government regulations, rising corporate sustainability commitments, and growing adoption of recycled plastics in packaging, automotive, and construction industries

- The bottles segment dominated the Recycled Plastic market with the largest revenue share of 48.5% in 2024, supported by the high consumption of PET bottles in beverages and packaged water

Report Scope and Recycled Plastic Market Segmentation

|

Attributes |

Recycled Plastic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Recycled Plastic Market?

Rising Adoption of Advanced Recycling Technologies

- A significant and accelerating trend in the global recycled plastic market is the adoption of advanced recycling methods such as chemical recycling, AI-driven sorting, and depolymerization technologies, which are enhancing efficiency and yield. This transition is improving the quality and variety of plastics that can be recycled

- For instance, Indorama Ventures is investing heavily in PET chemical recycling plants across Europe, enabling the production of high-quality recycled resins that meet food-grade standards. Similarly, Dow has partnered with Mura Technology to scale advanced recycling facilities for converting plastic waste back into feedstock

- The use of AI and robotics in waste sorting facilities enables better identification of plastic types, reduces contamination, and increases recovery rates. Companies such as AMP Robotics are applying machine learning to improve sorting accuracy and streamline recycling operations

- Advanced recycling also supports circular economy goals, as recycled plastics can now be reprocessed into higher-value applications such as food packaging and automotive parts, reducing dependence on virgin plastics

- This trend is redefining sustainability benchmarks and consumer expectations, as industries seek closed-loop solutions to reduce environmental impact

- The growing emphasis on innovation-driven recycling technologies is expected to significantly boost adoption, helping industries meet regulatory targets and brand sustainability commitments

What are the Key Drivers of Recycled Plastic Market?

- Increasing environmental concerns and the urgent need to reduce plastic waste pollution are major drivers boosting demand for recycled plastics. Rising awareness of sustainability among consumers and businesses is accelerating this shift

- For instance, in May 2024, Coca-Cola Europacific Partners announced that 100% of its PET bottles in Sweden are now made from recycled plastic, aligning with its global circular economy targets. Such commitments by leading companies drive industry growth

- Government policies and regulations promoting the use of recycled content in packaging and manufacturing are pushing companies to adopt recycled plastics at scale. The EU’s Single-Use Plastics Directive and the U.S. Plastics Pact are notable instances

- The growing popularity of eco-friendly products and sustainable packaging solutions among consumers has made recycled plastics essential in industries such as FMCG, automotive, and construction

- Cost-effectiveness is another driver, as recycled plastics often offer price stability compared to volatile crude oil-based virgin resins, making them attractive to manufacturers

- The expansion of circular economy initiatives, rising investment in collection infrastructure, and collaborations between brands and recyclers further fuel the growth of the recycled plastics market worldwide

Which Factor is Challenging the Growth of the Recycled Plastic Market?

- One of the key challenges for the recycled plastic market is the quality inconsistency and contamination issues associated with recycled materials. These concerns make it difficult for manufacturers to maintain product standards, especially for high-performance applications

- For instance, food-grade packaging often requires virgin-quality resins, and recycled plastics may face restrictions due to contamination or safety regulations, limiting their application scope

- High recycling costs compared to virgin plastic production, particularly in regions where crude oil prices are low, can discourage companies from adopting recycled content

- The lack of standardized recycling infrastructure in developing economies and inadequate collection systems further hinder consistent supply of high-quality recycled plastics

- Another challenge is consumer perception, as some buyers still associate recycled products with lower performance or durability, affecting large-scale adoption

- Overcoming these challenges requires greater investment in advanced recycling technologies, stronger regulatory frameworks, and consumer awareness initiatives to boost confidence in recycled plastic products

How is the Recycled Plastic Market Segmented?

The market is segmented on the basis of source, polymer type, and industry.

- By Source

On the basis of source, the recycled plastic market is segmented into bottles, films, fibers, foams, and others. The bottles segment dominated the Recycled Plastic market with the largest revenue share of 48.5% in 2024, supported by the high consumption of PET bottles in beverages and packaged water. Recycling initiatives by major FMCG brands and government mandates to use rPET in packaging have further strengthened this dominance. The growing demand for sustainable and lightweight packaging drives the steady use of recycled bottles in consumer goods.

The fibers segment is projected to record the fastest growth from 2025 to 2032 at a CAGR of 20.3%, fueled by rising demand in the textile and clothing industry for sustainable fabrics. Increasing adoption of recycled polyester fibers (rPET) in sportswear, fashion apparel, and home furnishings is a key growth catalyst. Expanding circular fashion initiatives and consumer preference for eco-friendly fabrics make fibers a major growth driver.

- By Polymer Type

On the basis of polymer type, the recycled plastic market is segmented into Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyurethane (PUR), and others. The PET segment dominated the market with the largest revenue share of 41.7% in 2024, owing to its widespread use in food-grade packaging, beverage bottles, and consumer products. PET’s high recyclability and strong demand from global beverage brands such as Coca-Cola, PepsiCo, and Nestlé continue to sustain its market dominance.

The Polypropylene (PP) segment is expected to witness the fastest CAGR of 18.6% between 2025 and 2032, driven by its extensive use in automotive, packaging, and household products. Innovations in chemical recycling and advanced sorting technologies are expanding PP’s recyclability, making it increasingly attractive for manufacturers. Its cost-effectiveness, lightweight nature, and growing applications across multiple industries are fueling robust growth.

- By Industry

On the basis of industry, the recycled plastic market is segmented into packaging, building & construction, automotive, electrical and electronics, furniture, textile and clothing, aerospace and defence, and others. The packaging segment accounted for the largest revenue share of 52.4% in 2024, driven by strong demand for sustainable food and beverage packaging solutions, especially in PET and HDPE applications. Stringent government regulations mandating recycled content in packaging, alongside rising consumer preference for eco-friendly products, reinforce this dominance.

The automotive segment is projected to witness the fastest CAGR of 19.8% from 2025 to 2032, as manufacturers increasingly adopt recycled plastics for interior and exterior components to meet sustainability targets and reduce carbon emissions. Applications such as dashboards, bumpers, and under-the-hood parts are increasingly relying on recycled polymers. The industry’s focus on circular economy practices, combined with lightweighting needs for EVs, is propelling strong growth in this segment.

Which Region Holds the Largest Share of the Recycled Plastic Market?

- Asia-Pacific dominated the recycled plastic market with the largest revenue share of 46.3% in 2024, driven by high consumption of plastic packaging, textiles, and automotive components, alongside large-scale recycling initiatives

- Strong demand from end-use industries such as packaging and construction, coupled with supportive government policies encouraging circular economy practices, has boosted recycled plastic adoption across the region

- The abundance of plastic waste generation, combined with rapid industrialization and growing sustainability awareness among consumers, has positioned Asia-Pacific as the global leader in the recycled plastic market

China Recycled Plastic Market Insight

The China recycled plastic market accounted for the largest share within Asia-Pacific in 2024, driven by its massive packaging industry, urban population growth, and government-backed plastic recycling mandates. China remains a leading producer and consumer of recycled PET (rPET), widely used in bottles, textiles, and consumer goods. Strong domestic manufacturing capabilities and rising environmental concerns are further propelling market expansion.

Japan Recycled Plastic Market Insight

The Japan recycled plastic market is steadily growing, fueled by its focus on sustainability, waste management, and technological innovation. Japan’s government-led initiatives to reduce plastic waste, combined with a strong demand for recycled fibers in textiles and automotive applications, are driving adoption. In addition, Japan’s mature consumer base places high value on eco-friendly solutions, reinforcing steady demand for recycled plastics across multiple industries.

India Recycled Plastic Market Insight

The India recycled plastic market is emerging as a key growth contributor, supported by rapid urbanization, increasing plastic consumption, and growing awareness of sustainable alternatives. Initiatives such as the Extended Producer Responsibility (EPR) framework are encouraging recycling activities. Expanding packaging and textile industries, coupled with a large pool of local recyclers, are fueling strong growth prospects.

Which Region is the Fastest Growing Region in the Recycled Plastic Market?

North America is projected to record the fastest CAGR of 11.5% from 2025 to 2032, driven by stringent government regulations, rising corporate sustainability commitments, and growing adoption of recycled plastics in packaging, automotive, and construction industries. A high focus on reducing landfill waste and promoting circular economy practices, alongside rising consumer preference for eco-friendly packaging, is accelerating market growth. Major brand commitments by companies such as Coca-Cola, PepsiCo, and Procter & Gamble to increase recycled content in packaging further strengthen the region’s growth outlook.

U.S. Recycled Plastic Market Insight

The U.S. captured the largest revenue share of 79% in North America in 2024, supported by large-scale recycling infrastructure, technological advancements, and strong demand from packaging and automotive sectors. Rising corporate commitments toward recycled content and the growth of advanced recycling facilities are boosting the U.S. market significantly.

Canada Recycled Plastic Market Insight

The Canada recycled plastic market is projected to grow rapidly, driven by strong government regulations banning single-use plastics and encouraging recycled content in packaging. Increasing investments in recycling infrastructure and consumer awareness around sustainability are key drivers in the Canadian market

Which are the Top Companies in Recycled Plastic Market?

The recycled plastic industry is primarily led by well-established companies, including:

- Veolia (France)

- LyondellBasell Industries (U.S.)

- Indorama Ventures (Thailand)

- Dow (U.S.)

- Repsol (Spain)

- Alpek S.A.B. de C.V. (Mexico)

- Far Eastern New Century Corporation (Taiwan)

- Borealis AG (Austria)

- PLASTIPAK HOLDINGS, IN+C. (U.S.)

- KW Plastics (U.S.)

- Ultra-Poly Corporation (U.S.)

- Jayplas (U.K.)

- CUSTOM POLYMERS (U.S.)

- Recycled Plastics UK (U.K.)

- K K Asia (HK) Ltd. (Hong Kong)

- Envision Plastics (U.S.)

- B & B Plastics Inc. (U.S.)

- Granite Peak Plastics (U.S.)

- B. Schoenberg & Co., Inc. (U.S.)

- MBA Polymers Inc. (U.S.)

- Revolution Company (U.S.)

What are the Recent Developments in Global Recycled Plastic Market?

- In January 2024, Republic Services, Inc. inaugurated a new Salt River recycling center spanning 51,000 square feet within the Salt River Pima-Maricopa Indian Community. Designed with modern technology and enhanced capacity, the facility will handle recyclables from nearly 1.4 million residents and over 2,000 businesses, processing up to 40 tons—or eight truckloads—per hour, including cardboard, paper, plastics, metals, and glass. This marks a significant step toward improving recycling efficiency and sustainability in the Valley

- In September 2023, WM announced the launch of a new recycling facility in Cleveland covering 100,000 square feet, with the capacity to process nearly 420 tons of recyclable materials daily. This project forms part of WM’s USD 1 billion enterprise-wide investment in recycling infrastructure, which includes around 40 automated or planned facilities. This initiative underscores WM’s commitment to significantly expanding recycling capacity by 2026

- In April 2023, Biffa completed the acquisition of Esterpet Ltd, a North Yorkshire-based PET plastic recycler. Esterpet processes 25,000 tons of recycled plastic flakes annually into high-purity pellets, adding to Biffa’s closed-loop food-grade recycling capabilities across its Seaham, Redcar, and Washington plants, which together convert more than 165,000 tons each year. This acquisition strengthens Biffa’s position in advanced plastic recycling and sustainable polymer production

- In November 2022, LyondellBasell confirmed plans to establish an advanced recycling plant in Germany, using its proprietary MoReTec technology to convert pre-treated plastic waste into feedstock for new plastics. This move highlights LyondellBasell’s strategic focus on scaling circular solutions within the plastics industry

- In October 2020, Nestlé partnered with Plastic Energy to explore building the first commercial large-scale recycling facility in the U.K. Using Plastic Energy’s advanced technology, the initiative seeks to produce high-quality recycled materials for use in Nestlé products. This collaboration reflects Nestlé’s commitment to sustainable packaging innovation and circularity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Recycled Plastic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recycled Plastic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recycled Plastic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.