Global Rfid Market

Market Size in USD Billion

CAGR :

%

USD

9.95 Billion

USD

51.45 Billion

2022

2030

USD

9.95 Billion

USD

51.45 Billion

2022

2030

| 2023 –2030 | |

| USD 9.95 Billion | |

| USD 51.45 Billion | |

|

|

|

|

Radio-Frequency Identification Technology (RFID) Market Analysis and Size

The radio-frequency identification technology (RFID) is getting huge attention across logistic and manufacturing industry day by day. This technology is also deployed in warehousing as keeping the track of the inventory is considered crucial. The rise in use of the technology in manufacturing sector is escalating the growth of global radio-frequency identification technology (RFID) market.

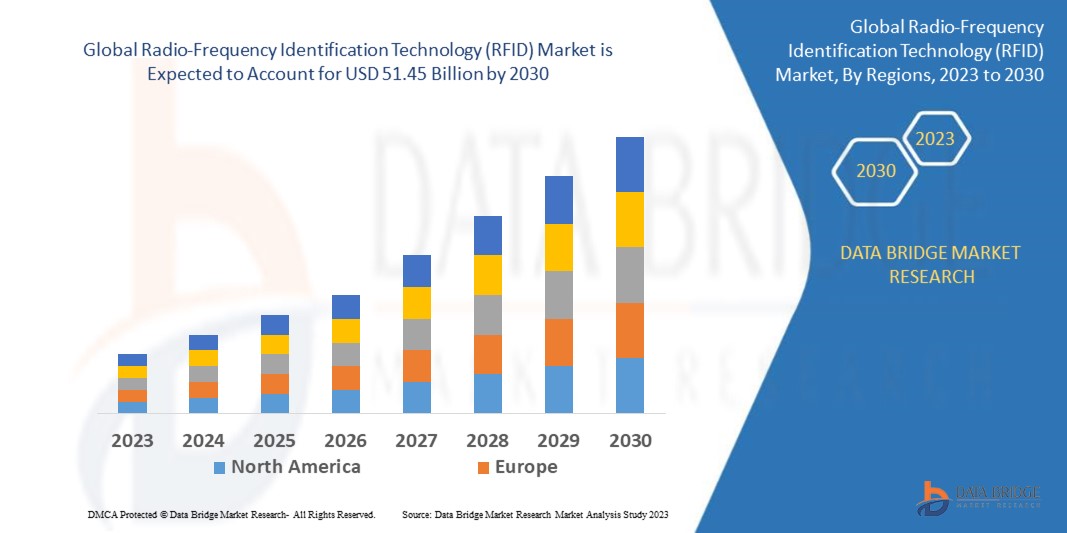

Data Bridge Market Research analyses that the global radio-frequency identification technology (RFID) market which was USD 9.95 billion in 2022, is expected to reach USD 51.45 billion by 2030, and is expected to undergo a CAGR of 22.8% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Radio-frequency identification technology (RFID) Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volume in Units, Pricing in USD |

|

Segments Covered |

Products (Tags, Readers, Software), Tags (Wafer Size, Tag type, Frequency, Application, Form Factor, Material), End User (Industrial, Transportation, Retail, Consumer Package Goods, Healthcare, Education, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Alien Technology, LLC (U.S.), GAO Group Inc. (Canada), Honeywell International Inc. (U.S.), Impinj, Inc. (U.S.), Mobile Aspects, Inc. (U.S.), RF Technologies, Inc. (U.S.), Radianse (U.S.), STID (U.S.), STANLEY Healthcare (U.S.), SATO HOLDINGS CORPORATION. (Japan) Motorola Solutions, Inc. (U.S.), CAEN RFID S.r.l. (Italy), NewAge Industries, Inc. (U.S.), IBM Corporation (U.S.), Siemens (Germany), AMERICAN RFID SOLUTIONS, LLC (U.S.), and 3M (U.S.) |

|

Market Opportunities |

|

Market Definition

Radio frequency identification (RFID) is defined as the technology that makes the use of radio frequency electrostatic fields or electromagnetic fields. The technology assists in identifying objects possessing tags when they come close to a reader. The RFID offers automatic item identification on shipping and receiving applications, and mixed pallets.

Global Radio-frequency identification technology (RFID) Market Dynamics

Drivers

- Requirement of the Accurate Data Unit

The increase in the requirement of accurate data unit, especially in warehouses acts as one of the major factors driving the growth of the global radio-frequency identification technology (RFID) market.

- Security and Access Control

The rise in the use of radio-frequency identification technology for security and access control applications accelerates the market growth.

- Need for Effective Store Handling

The rise in demand for effective store handling across various end use industries, including the manufacturing sector further influences the market.

Opportunity

- Technological advancements in RFID technology

The read range has significantly improved because of increased tag sensitivity, improved reader range, and an increase in RF waves transmit power. This has improved the read range up to 60+ feet for medium inlays. Ten years ago, no one could have imagined that RFID tags can be read from a distance of 60 feet.

Restraint/Challenge

- High Cost Associated with RFID Products

The cost and return on investment (ROI) of using RFID technology are the primary barriers. All RFID components, including RFID tags, readers, hardware, software, and routine maintenance, must be paid for by businesses. Additionally, because clients preferred barcodes to RFID tags, manufacturing firms cannot abandon their current barcode industry. As a result, businesses are paying for both barcodes and RFID to satisfy client demands.

This global radio-frequency identification technology (RFID) market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global radio-frequency identification technology (RFID) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In November 2022, Impinj, Inc. announced the launch of Impinj M780 and M781 RAIN RFID tag chips to connect everyday items including automotive parts, pharmaceuticals, food, and more. The Impinj M780 and M781 tag chips are the latest additions to the Impinj M700 series, adding large memory options to the proven performance, quality and reliability of the M700 product line.

Global Radio-Frequency Identification Technology (RFID) Market Scope

The global radio-frequency identification technology (RFID) market is segmented on the basis of product, tags and end-user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Tags

- Readers

- Software

Tags

- Wafer Size

- Tag Type

- Frequency

- Application

- Form Factor

- Material

End-User

- Industrial

- Transportation

- Retail

- Consumer Package Goods

- Healthcare

- Education

- Others

Global Radio-frequency identification technology (RFID) Market Regional Analysis/Insights

The global radio-frequency identification technology (RFID) market is analyzed and market size insights and trends are provided by country, product, tags, and end-user as referenced above.

The countries covered in the global radio-frequency identification technology (RFID) market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the global radio-frequency identification technology (RFID) market because of the rise in demand for storage and tracker solutions provided by the radio-frequency identification (RFID) within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 because of the surge in the size of high data generation in the region.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Radio-Frequency Identification Technology (RFID) Market Share Analysis

The global radio-frequency identification technology (RFID) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global radio-frequency identification technology (RFID) market.

Some of the major players operating in the global radio-frequency identification technology (RFID) market are:

- Alien Technology, LLC (U.S.)

- GAO Group Inc. (Canada)

- Honeywell International Inc. (U.S.)

- Impinj, Inc. (U.S.)

- Mobile Aspects, Inc. (U.S.)

- RF Technologies, Inc. (U.S.)

- Radianse (U.S.)

- STID (U.S.)

- STANLEY Healthcare (U.S.)

- SATO HOLDINGS CORPORATION. (Japan)

- Motorola Solutions, Inc. (U.S.)

- CAEN RFID S.r.l. (Italy)

- NewAge Industries, Inc. (U.S.)

- IBM Corporation (U.S.)

- Siemens (Germany)

- AMERICAN RFID SOLUTIONS, LLC (U.S.)

- 3M (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.