Global Robotic Drilling Market

Market Size in USD Million

CAGR :

%

USD

6.46 Million

USD

11.52 Million

2025

2033

USD

6.46 Million

USD

11.52 Million

2025

2033

| 2026 –2033 | |

| USD 6.46 Million | |

| USD 11.52 Million | |

|

|

|

|

What is the Global Robotic Drilling Market Size and Growth Rate?

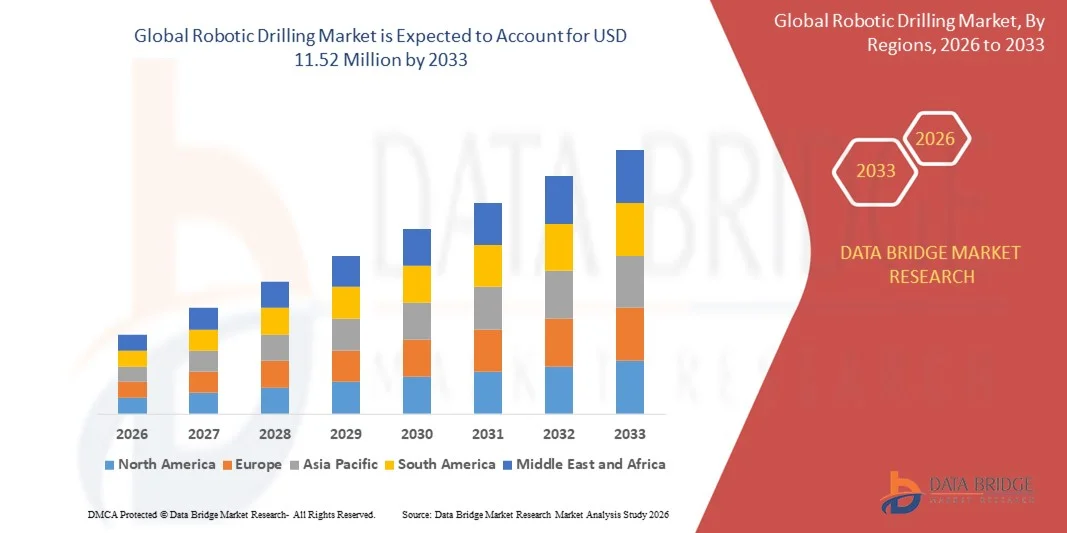

- The global robotic drilling market size was valued at USD 6.46 million in 2025 and is expected to reach USD 11.52 million by 2033, at a CAGR of7.50% during the forecast period

- Rise in application of robotic drilling for oil and gas exploration activities is the root cause fuelling up the robotic drilling market growth rate. Rising industrialization coupled with growing development of unconventional hydrocarbon resources will also directly and positively impact the growth rate of the robotic drilling market

What are the Major Takeaways of Robotic Drilling Market?

- Growth and expansion of oil and gas verticals especially in the emerging economies coupled with surge in the power generation activities will further carve the way for the growth of the robotic drilling market

- Rising advancements in the robotic technology is other indirect determinant which will also foster the robotic drilling market growth rate

- North America dominated the robotic drilling market with the largest revenue share of 38.84% in 2025, driven by high drilling automation adoption across oil & gas operations in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.74% from 2026 to 2033, driven by rising energy demand, expanding offshore exploration, and increasing investment in automated drilling technologies across China, India, Southeast Asia, and Australia

- The Onshore segment dominated the market with a major revenue share in 2025, driven by extensive drilling activities across shale formations, conventional oilfields, mining sites, and large-scale infrastructure projects

Report Scope and Robotic Drilling Market Segmentation

|

Attributes |

Robotic Drilling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Robotic Drilling Market?

Rising Adoption of High-Speed, Compact, and Digitally Integrated Robotic Drilling Systems

- The robotic drillings market is experiencing a strong shift toward high-speed, compact, and digitally controlled drilling systems designed to enhance precision, automation, and operational efficiency

- Manufacturers are increasingly integrating advanced sensors, AI-enabled control software, and real-time monitoring systems to enable accurate drilling in complex industrial environments

- Growing preference for lightweight, modular, and easily deployable robotic drilling units is expanding adoption across oil & gas, mining, construction, and industrial manufacturing sites

- For instance, leading players such as NOV, Weatherford, Schlumberger, and Nabors Industries are upgrading robotic drilling platforms with automated control, data analytics, and remote operation capabilities

- Rising demand for faster drilling cycles, reduced human intervention, and improved safety is accelerating the transition toward intelligent robotic drilling solutions

- As industrial operations become more data-driven and automation-focused, robotic drillings will play a critical role in improving productivity, accuracy, and operational reliability

What are the Key Drivers of Robotic Drilling Market?

- Increasing demand for automated, precise, and cost-efficient drilling solutions to reduce labor dependency and operational risks

- For instance, during 2024–2025, several global drilling technology providers introduced AI-assisted robotic drilling systems with enhanced speed, torque control, and adaptive drilling capabilities

- Rapid adoption of digital oilfields, smart mining operations, and automated construction equipment is boosting demand across North America, Asia-Pacific, and the Middle East

- Technological advancements in robotic arms, machine vision, real-time data processing, and sensor fusion have significantly improved drilling accuracy and efficiency

- Rising complexity of drilling environments, including deepwater, shale, and unconventional reserves, is driving demand for intelligent robotic drilling platform

- Supported by continuous investments in industrial automation, energy infrastructure, and smart manufacturing, the Robotic Drillings market is expected to grow steadily over the long term

Which Factor is Challenging the Growth of the Robotic Drilling Market?

- High initial investment and integration costs associated with advanced robotic drilling systems limit adoption among small and mid-sized operators

- For instance, during 2024–2025, rising costs of precision sensors, control software, and robotic components increased overall system pricing for end users

- Technical complexity in operating and maintaining AI-driven and fully automated drilling systems creates a need for skilled personnel and specialized training

- Limited awareness and slower technology adoption in emerging economies restrict market penetration

- Competition from semi-automated drilling rigs, conventional drilling equipment, and hybrid solutions creates pricing pressure and slows replacement cycles

- To overcome these challenges, companies are focusing on cost-optimized designs, modular systems, operator training programs, and software-driven efficiency improvements to expand adoption of robotic drillings globally

How is the Robotic Drilling Market Segmented?

The market is segmented on the basis of application, installation, component, and end user industry.

- By Application

On the basis of application, the robotic drilling market is segmented into Onshore and Offshore. The Onshore segment dominated the market with a major revenue share in 2025, driven by extensive drilling activities across shale formations, conventional oilfields, mining sites, and large-scale infrastructure projects. Onshore robotic drilling systems are widely adopted due to easier accessibility, lower operational complexity, and faster deployment compared to offshore environments. Increasing automation in land-based oil & gas fields, coupled with rising demand for precision drilling, safety enhancement, and reduced labor dependency, continues to support strong adoption.

The Offshore segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising investments in deepwater and ultra-deepwater exploration projects. Growing focus on remote-operated drilling, harsh-environment automation, and real-time monitoring technologies is accelerating the deployment of robotic drilling solutions across offshore rigs and platforms.

- By Installation

On the basis of installation, the robotic drilling market is segmented into Retrofit and New Builds. The Retrofit segment dominated the market in 2025, accounting for a significant share as operators increasingly upgrade existing drilling rigs with robotic systems to enhance efficiency, safety, and automation without replacing full infrastructure. Retrofit solutions offer cost advantages, reduced downtime, and faster return on investment, making them highly attractive for mature oilfields and aging drilling assets.

The New Builds segment is projected to register the fastest CAGR from 2026 to 2033, supported by rising investments in fully automated drilling rigs and next-generation robotic platforms. New drilling projects are increasingly designed with integrated robotics, AI-driven control systems, and digital monitoring tools from inception. Growing adoption of smart rigs and fully autonomous drilling architectures is expected to accelerate growth in this segment.

- By Component

On the basis of component, the robotic drilling market is segmented into Hardware and Software. The Hardware segment dominated the market with the largest share in 2025, driven by strong demand for robotic arms, sensors, control units, actuators, and drilling automation equipment. Hardware components form the core of robotic drilling systems and are essential for precision control, torque management, and real-time drilling operations. Rising investments in advanced drilling equipment and automation infrastructure continue to support dominance.

The Software segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of AI-based drilling optimization, predictive analytics, digital twins, and remote monitoring platforms. Software solutions enable real-time decision-making, performance optimization, and predictive maintenance, making them critical for next-generation robotic drilling systems.

- By End User Industry

On the basis of end user industry, the robotic drilling market is segmented into Oil and Gas. The Oil and Gas industry dominated the market with a substantial revenue share in 2025, supported by extensive use of robotic drilling systems across upstream exploration, drilling, and production activities. Rising demand for operational efficiency, worker safety, and cost optimization has accelerated adoption of automation and robotics across oilfields and offshore platforms.

The segment is expected to continue strong growth through 2033, driven by increasing investments in unconventional resources, deepwater exploration, and digital oilfield initiatives. Growing focus on reducing non-productive time, enhancing drilling accuracy, and minimizing human exposure to hazardous environments further strengthens the long-term demand for robotic drilling solutions within the oil and gas sector.

Which Region Holds the Largest Share of the Robotic Drilling Market?

- North America dominated the robotic drilling market with the largest revenue share of 38.84% in 2025, driven by high drilling automation adoption across oil & gas operations in the U.S. and Canada. Strong presence of shale exploration, deep drilling projects, and advanced oilfield services has accelerated deployment of robotic drilling systems to improve operational efficiency, safety, and drilling precision

- Leading companies in North America are actively integrating robotics, AI-based control systems, and real-time drilling analytics, enhancing automation across onshore and offshore rigs. Continuous investment in digital oilfields, smart rigs, and autonomous drilling technologies supports sustained regional dominance

- High concentration of oilfield service providers, strong R&D capabilities, and advanced energy infrastructure further reinforce North America’s leadership in robotic drilling adoption

U.S. Robotic Drilling Market Insight

The U.S. is the largest contributor in North America, supported by extensive shale gas exploration, offshore Gulf of Mexico activities, and high investment in drilling automation. Increasing focus on reducing non-productive time, improving worker safety, and enhancing drilling accuracy drives adoption of robotic drilling systems across upstream operations. Presence of major oilfield service companies, advanced drilling technology providers, and strong capital investment continues to propel market growth.

Canada Robotic Drilling Market Insight

Canada contributes significantly to regional growth, driven by robotic drilling adoption across oil sands, onshore drilling projects, and offshore exploration. Increasing focus on automation to manage harsh operating environments, reduce labor dependency, and improve drilling efficiency supports market expansion. Government emphasis on energy innovation and digital transformation further strengthens adoption across Canadian drilling operations.

Asia-Pacific Robotic Drilling Market

Asia-Pacific is projected to register the fastest CAGR of 7.74% from 2026 to 2033, driven by rising energy demand, expanding offshore exploration, and increasing investment in automated drilling technologies across China, India, Southeast Asia, and Australia. Growing focus on improving drilling efficiency, reducing operational risks, and enhancing productivity is accelerating adoption of robotic drilling systems across regional oil & gas projects.

China Robotic Drilling Market Insight

China is the largest contributor in Asia-Pacific, supported by expanding offshore drilling activities, increasing shale gas exploration, and strong government backing for energy security. Rising investment in automation, robotics, and smart drilling technologies drives demand for robotic drilling systems across both onshore and offshore projects.

Japan Robotic Drilling Market Insight

Japan shows steady growth, supported by technological expertise in robotics, automation, and precision engineering. Increasing focus on advanced drilling equipment, offshore energy projects, and automation-driven efficiency improvements supports adoption of robotic drilling technologies.

India Robotic Drilling Market Insight

India is emerging as a key growth market, driven by rising domestic energy demand, offshore exploration projects, and government initiatives to boost oil & gas production. Increasing investments in drilling automation and safety-enhancing technologies accelerate robotic drilling adoption.

South Korea Robotic Drilling Market Insight

South Korea contributes through strong industrial robotics expertise and offshore engineering capabilities. Growing involvement in offshore drilling projects, combined with advanced manufacturing and automation technologies, supports steady market expansion.

Which are the Top Companies in Robotic Drilling Market?

The robotic drilling industry is primarily led by well-established companies, including:

- Huisman Equipment B.V. (Netherlands)

- Drillform Technical Services Ltd. (U.K.)

- DRILLMEC S.p.A. (Italy)

- Nabors Industries Ltd. (U.S.)

- NOV Inc. (U.S.)

- Precision Drilling Corporation (Canada)

- Weatherford (U.S.)

- Exxon Mobil Corporation (U.S.)

- Shell Group of Companies (U.K.)

- Chevron Corporation (U.S.)

- bp p.l.c. (U.K.)

- Saudi Arabian Oil Co. (Saudi Aramco) (Saudi Arabia)

- Valero (U.S.)

- Phillips 66 Company (U.S.)

- Petróleo Brasileiro S.A. (Brazil)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- SKF Evolution (Sweden)

- Siemens (Germany)

- Ensign Energy Services (Canada)

- Sekal AS (Norway)

- Abraj (Oman)

What are the Recent Developments in Global Robotic Drilling Market?

- In January 2026, Sandvik announced the global expansion of its AutoMine autonomous surface drilling systems through a collaboration with Vale, featuring upgraded robotic controls, intelligent navigation, and centralized fleet management. These systems allow remote operation from control centers, enabling continuous, high-precision drilling. This rollout enhances safety, improves productivity, and optimizes resource extraction across complex mining sites, demonstrating the growing impact of autonomous drilling technology

- In September 2025, Helmerich & Payne (H&P), in partnership with NOV, commercially deployed its FlexRobotics drilling system in the Permian Basin, incorporating advanced robotic arms to automate repetitive rig-floor tasks like pipe handling and connection. Designed as a retrofit solution, it allows existing rigs to adopt automation without major modifications. This development increases operational consistency, enhances safety, and reduces manual labor requirements, signaling broader adoption of rig-floor robotics

- In March 2025, Kongsberg Gruppen partnered with Oceaneering International to accelerate autonomous robotic drilling solutions for offshore operations, integrating robotics, digital twin modeling, and intelligent control systems for remote drilling management. The collaboration minimizes offshore personnel exposure while improving precision and reliability in complex marine environments. This initiative underscores the industry's shift toward digitally enabled, low-touch offshore drilling operations

- In February 2025, Halliburton, in collaboration with Sekal AS, launched an automated on-bottom drilling solution, combining real-time downhole automation with advanced drilling control software. The system enables continuous optimization, stable drilling performance, and remote operations without manual intervention. This solution reflects rising demand for software-driven robotics to enhance precision and efficiency in drilling applications

- In February 2024, Siemens introduced the Tecnomatix 2402 software version, offering advanced digital manufacturing tools with integrated robotic applications for drilling and other industrial processes. The software empowers businesses to enhance automation, improve operational efficiency, and accelerate digital transformation. This launch highlights the increasing role of software-enabled robotics in industrial drilling operations

- In December 2023, a consortium of TEGRAD d.o.o., PIRNAR & SAVŠEK d.o.o., and KOVINC d.o.o. announced plans to develop digitized solutions for automated drilling from December 2023 through November 2025, focusing on integrating robotics and digital technologies into drilling workflows. This initiative emphasizes collaborative efforts to advance automation and precision across industrial drilling applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Robotic Drilling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotic Drilling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotic Drilling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.