Global Robotic Palletizers And De Palletizers Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

4.08 Billion

2025

2033

USD

2.88 Billion

USD

4.08 Billion

2025

2033

| 2026 –2033 | |

| USD 2.88 Billion | |

| USD 4.08 Billion | |

|

|

|

|

Robotic Palletizers and De-palletizers Market Size

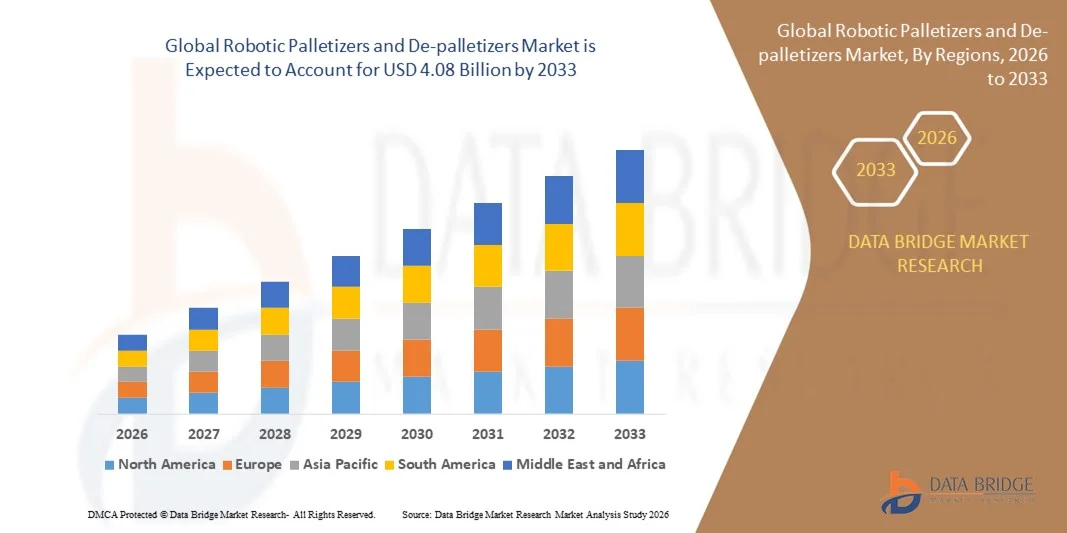

- The global robotic palletizers and de-palletizers market size was valued at USD 2.88 billion in 2025 and is expected to reach USD 4.08 billion by 2033, at a CAGR of 4.45% during the forecast period

- The market growth is largely driven by increasing automation across manufacturing, warehousing, and logistics sectors, with businesses seeking efficient, reliable, and high-speed palletizing and de-palletizing solutions to optimize operational workflows and reduce labor dependency

- Furthermore, rising demand for flexible and scalable robotic solutions capable of handling diverse product types such as boxes, bags, and bundles is encouraging adoption across industries including food and beverages, pharmaceuticals, and consumer goods. These factors are collectively accelerating the deployment of robotic palletizers and de-palletizers, thereby significantly enhancing market growth

Robotic Palletizers and De-palletizers Market Analysis

- Robotic palletizers and de-palletizers, providing automated handling and stacking of products, are becoming essential in modern industrial and logistics operations due to their precision, speed, and ability to reduce workplace injuries while maintaining consistent throughput

- The increasing emphasis on supply chain efficiency, labor cost reduction, and integration with Industry 4.0 and warehouse management systems is fueling demand for advanced robotic solutions. Growing adoption of collaborative robots (cobots) that can operate safely alongside humans is further driving market expansion

- Asia-Pacific dominated the robotic palletizers and de-palletizers market with a share of 35.6% in 2025, due to rapid industrial automation, strong growth in manufacturing output, and expanding food and beverages and consumer goods sectors

- North America is expected to be the fastest growing region in the robotic palletizers and de-palletizers market during the forecast period due to high adoption of automation across manufacturing, logistics, and e-commerce sectors

- Articulated robots segment dominated the market with a market share of 66.49% in 2025, due to their high payload capacity, speed, and flexibility in handling complex palletizing patterns. These robots are widely used in large-scale manufacturing and distribution facilities where high-volume operations demand robust and reliable automation. Their ability to operate continuously with minimal downtime and integrate with advanced control systems reinforces their strong market position

Report Scope and Robotic Palletizers and De-palletizers Market Segmentation

|

Attributes |

Robotic Palletizers and De-palletizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Robotic Palletizers and De-palletizers Market Trends

Rising Adoption of Collaborative and Articulated Robots in Material Handling

- A significant trend in the robotic palletizers and de-palletizers market is the increasing deployment of collaborative and articulated robots across manufacturing, warehousing, and logistics operations. This trend is driven by the growing need for high-speed, accurate, and flexible handling of diverse product types, including boxes, bags, and bundles, which enhances operational efficiency and reduces labor dependency

- For instance, Doosan Robotics and FANUC CORPORATION offer advanced palletizing robots capable of seamless integration with existing warehouse management systems, improving throughput and minimizing human intervention. Such solutions are enabling businesses to achieve higher automation levels while maintaining product safety and operational consistency

- The adoption of collaborative robots (cobots) is rising rapidly as they can safely work alongside human operators without extensive safety fencing, making them ideal for industries seeking flexible and scalable automation. This trend is positioning robotic palletizers and de-palletizers as essential components in modern, automated material handling operations

- Industries including food and beverages, pharmaceuticals, and consumer goods are increasingly implementing robotic palletizing solutions to manage high-volume production and complex packaging formats efficiently. These applications are reinforcing the critical role of robotics in ensuring consistent stacking accuracy, reduced downtime, and labor cost optimization

- Warehouse operators are integrating robotic palletizers with AI and vision systems to improve pattern recognition, product orientation, and error reduction. This technological advancement is accelerating market growth and increasing the adoption of automated pallet handling systems

- The growing emphasis on sustainability and workforce safety is further promoting the use of robotics for repetitive and ergonomically challenging tasks. Robotic palletizers and de-palletizers contribute to safer work environments while improving overall operational reliability

Robotic Palletizers and De-palletizers Market Dynamics

Driver

Increasing Demand for Automation in Warehousing and Manufacturing

- The rising focus on efficiency, speed, and accuracy in logistics and industrial operations is driving the demand for robotic palletizers and de-palletizers. Businesses are adopting these systems to reduce dependency on manual labor, minimize operational errors, and optimize throughput

- For instance, Omron Corporation’s cobot palletizing solutions allow rapid setup and flexible operation across multiple production lines, enhancing productivity in warehouses and manufacturing plants. These solutions are helping companies achieve scalable automation while improving process consistency

- The growth of e-commerce and the need for rapid fulfillment are further boosting automation adoption, with robotic palletizers providing faster handling of diverse product types. This trend supports the increasing integration of robotics into end-to-end supply chain management

- Industries are also seeking solutions that offer integration with warehouse management systems, enabling real-time monitoring, predictive maintenance, and optimized scheduling. This connectivity is strengthening the appeal of robotic palletizers as a critical tool for modernized operations

- The overall focus on cost reduction, operational efficiency, and supply chain reliability is reinforcing investments in automated palletizing systems, driving sustained market expansion

Restraint/Challenge

High Initial Investment and Maintenance Costs

- The robotic palletizers and de-palletizers market faces challenges due to the substantial upfront investment required for purchasing, installing, and configuring advanced robotic systems. High capital expenditure can be a barrier for small and medium-sized enterprises seeking automation

- For instance, implementing articulated robot solutions from companies such as FANUC or KUKA AG involves significant costs for hardware, software integration, and workforce training. These factors can limit adoption among cost-sensitive businesses

- Maintenance and repair of high-precision robots require skilled technicians and specialized components, adding to ongoing operational expenses. This dependency increases total cost of ownership and may deter new adopters

- The market also encounters constraints related to system compatibility, space requirements, and retrofitting into existing operations, which can extend deployment timelines and add complexity

- Fluctuations in industrial activity, labor costs, and technology upgrades further influence the economic feasibility of robotic palletizers, requiring careful planning and investment strategies to balance cost with productivity gains

Robotic Palletizers and De-palletizers Market Scope

The market is segmented on the basis of product type, machine type, place, and application.

- By Product Type

On the basis of product type, the robotic palletizers and de-palletizers market is segmented into boxes/cases, bags/sacks, bundles, and others. The boxes/cases segment dominated the market with the largest revenue share in 2025, driven by their extensive use across food and beverages, pharmaceuticals, and consumer goods industries where standardized packaging is common. Boxes and cases are easier to grip, stack, and align, which enhances operational efficiency and reduces handling errors in automated palletizing systems. The high compatibility of robotic palletizers with rigid box formats and the growing focus on high-speed, high-throughput packaging lines further support the dominance of this segment.

The bags/sacks segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising automation in industries handling bulk materials such as agriculture, chemicals, and construction. Handling bags and sacks manually poses ergonomic and safety challenges, encouraging manufacturers to adopt robotic de-palletizing solutions. Advancements in gripper technology and vision systems have improved robots’ ability to manage flexible and uneven loads, accelerating adoption in this segment.

- By Machine Type

On the basis of machine type, the market is segmented into articulated robots and collaborative robots. The articulated robots segment accounted for the largest market revenue share of 66.49% in 2025, owing to their high payload capacity, speed, and flexibility in handling complex palletizing patterns. These robots are widely used in large-scale manufacturing and distribution facilities where high-volume operations demand robust and reliable automation. Their ability to operate continuously with minimal downtime and integrate with advanced control systems reinforces their strong market position.

The collaborative robots segment is expected to register the fastest growth rate during the forecast period, driven by increasing demand from small and medium-sized enterprises. Collaborative robots offer ease of programming, lower initial investment, and safe operation alongside human workers without extensive safety fencing. Their suitability for low-to-medium throughput applications and space-constrained facilities is accelerating adoption across diverse end users.

- By Place

On the basis of place, the robotic palletizers and de-palletizers market is segmented into factories, distribution centers (DCs), fulfilment centers (FCs), and others. The factories segment dominated the market in 2025, supported by the rapid adoption of automation in manufacturing to improve productivity and reduce labor dependency. In factory environments, robotic palletizers are integral to end-of-line packaging operations, ensuring consistency, speed, and reduced product damage. Continuous production cycles and the need for precise pallet configuration further drive strong demand from factories.

The fulfilment centers segment is projected to witness the fastest growth from 2026 to 2033, driven by the expansion of e-commerce and omnichannel retail. Fulfilment centers require flexible and scalable automation solutions to handle fluctuating order volumes and diverse product sizes. Robotic de-palletizers help streamline inbound logistics and speed up order processing, making them increasingly essential in modern FC operations.

- By Application

On the basis of application, the market is segmented into food and beverages, pharmaceutical, consumer products, tracking and logistics, and industrial packaging. The food and beverages segment held the largest market revenue share in 2025, driven by high production volumes and strict hygiene requirements. Robotic palletizers and de-palletizers enable consistent handling, minimize contamination risks, and support compliance with food safety standards. The need for high-speed, reliable packaging solutions in beverage bottling and packaged food lines sustains strong demand from this segment.

The pharmaceutical segment is expected to grow at the fastest pace during the forecast period, supported by increasing emphasis on precision, traceability, and regulatory compliance. Automated palletizing reduces human contact with sensitive products and ensures accurate handling of standardized pharmaceutical packaging. Growth in global pharmaceutical manufacturing and distribution further accelerates adoption of robotic solutions in this application.

Robotic Palletizers and De-palletizers Market Regional Analysis

- Asia-Pacific dominated the robotic palletizers and de-palletizers market with the largest revenue share of 35.6% in 2025, driven by rapid industrial automation, strong growth in manufacturing output, and expanding food and beverages and consumer goods sectors

- The region’s cost-efficient manufacturing base, rising adoption of Industry 4.0 practices, and increasing investments in warehouse and logistics automation are accelerating market expansion

- Availability of skilled technical labor, supportive government initiatives for smart manufacturing, and rapid expansion of e-commerce and distribution infrastructure are boosting demand for robotic palletizing solutions

China Robotic Palletizers and De-palletizers Market Insight

China held the largest share in the Asia-Pacific market in 2025, supported by its position as a global manufacturing hub and large-scale deployment of industrial automation. Strong investments in smart factories, high-volume food and beverage production, and expanding logistics networks are key growth drivers. Government policies promoting automation and productivity enhancement continue to strengthen market demand.

India Robotic Palletizers and De-palletizers Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion of manufacturing, rising adoption of automation to address labor shortages, and growth in e-commerce fulfilment centers. Government initiatives supporting industrial modernization and increasing investments in food processing and pharmaceutical packaging are driving adoption. The shift toward automated material handling is further accelerating market growth.

Europe Robotic Palletizers and De-palletizers Market Insight

The Europe market is growing steadily, supported by high labor costs, strong emphasis on operational efficiency, and widespread adoption of advanced automation technologies. Strict workplace safety regulations and demand for precision and consistency in packaging operations are encouraging deployment of robotic palletizers. Growth is further supported by modernization of existing manufacturing and logistics facilities.

Germany Robotic Palletizers and De-palletizers Market Insight

Germany’s market is driven by its strong industrial automation ecosystem, leadership in robotics engineering, and high adoption across automotive, food processing, and industrial packaging sectors. The country’s focus on smart manufacturing and efficiency-driven production models supports sustained demand. Strong integration of robotics with digital factory solutions further enhances market growth.

U.K. Robotic Palletizers and De-palletizers Market Insight

The U.K. market benefits from growing automation in logistics, retail distribution, and food and beverage processing. Rising labor costs and increasing demand for flexible palletizing solutions in fulfilment centers are key drivers. Investments in warehouse automation and modernization of supply chain infrastructure continue to support steady market expansion.

North America Robotic Palletizers and De-palletizers Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high adoption of automation across manufacturing, logistics, and e-commerce sectors. Strong focus on productivity improvement, worker safety, and advanced robotics integration is accelerating demand. Increasing investments in smart warehouses and distribution centers are further supporting growth.

U.S. Robotic Palletizers and De-palletizers Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by a mature industrial automation landscape and strong presence of leading robotics suppliers. High demand from food and beverages, pharmaceuticals, and large-scale logistics operations is a major growth factor. Continued investment in advanced manufacturing technologies and warehouse automation reinforces the country’s leading position.

Robotic Palletizers and De-palletizers Market Share

The robotic palletizers and de-palletizers industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- KUKA AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- FANUC CORPORATION (Japan)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Krones AG (Germany)

- Brenton, LLC. (U.S.)

- Remtec Automation, LLC (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- 1 Dan Palletiser A/S. (Denmark)

- American-Newlong, Inc. (U.S.)

- BEUMER GROUP (Germany)

- Chantland MHS Co. (U.S.)

- Clevertech S.p.A. (Italy)

- Flexicell, Inc. (U.S.)

- Delkor Systems, Inc (U.S.)

- Fuji Robotics (Japan)

- PremierTech (Canada)

- Universal Robots (Denmark)

- Yaskawa America, Inc. (U.S.)

Latest Developments in Global Robotic Palletizers and De-palletizers Market

- In June 2024, Doosan Robotics, Inc. entered into a strategic partnership with Rocketfarm AS to strengthen palletizing efficiency by combining Rocketfarm’s Pally software with Doosan’s collaborative robots. This development enhances ease of programming and operational flexibility, enabling faster deployment of cobot-based palletizing across automotive and food and beverage industries. The collaboration supports wider adoption of user-friendly robotic palletizers, particularly among manufacturers seeking scalable and cost-effective automation solutions

- In January 2024, FANUC CORPORATION introduced a new range of palletizing and automation solutions, including the M-950iA/500 palletizing robot and the M-710iD/50M equipped with advanced vision and AI capabilities. These launches improve handling of heavy payloads, complex pallet patterns, and vision-guided operations, strengthening FANUC’s position in high-throughput industrial palletizing. The additions reflect growing market demand for intelligent, high-performance robotic palletizers integrated with digital and IoT-enabled systems

- In October 2023, ABB Ltd. expanded its robotic palletizing portfolio with enhanced software tools and high-speed robots designed to improve flexibility and reduce changeover time in end-of-line packaging. This development supports manufacturers facing rising product variety and shorter production cycles, accelerating adoption in food, beverage, and consumer goods sectors. ABB’s focus on modular and digitally enabled palletizing solutions reinforces market growth driven by efficiency and adaptability

- In July 2023, KUKA AG introduced upgraded palletizing automation solutions featuring improved payload capacity and advanced control software for synchronized material handling. The launch addresses increasing demand from large-scale manufacturing and logistics facilities seeking reliable and precise palletizing operations. This development contributes to market expansion by enabling higher throughput and improved operational consistency

- In March 2023, Omron Corporation launched a collaborative robot palletizing solution built on its NX1 series modular machine controller, aimed at improving flexibility while reducing programming time. The solution’s intuitive palletizing function block allows quick setup and safe human–robot collaboration without safety fencing. This innovation supports broader adoption of cobot palletizers, particularly among small and mid-sized manufacturers seeking easy-to-deploy automation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Robotic Palletizers And De Palletizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotic Palletizers And De Palletizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotic Palletizers And De Palletizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.