Global Rotational Moulding Machines Market

Market Size in USD Million

CAGR :

%

USD

987.40 Million

USD

1,285.22 Million

2025

2033

USD

987.40 Million

USD

1,285.22 Million

2025

2033

| 2026 –2033 | |

| USD 987.40 Million | |

| USD 1,285.22 Million | |

|

|

|

|

Rotational Moulding Machines Market Size

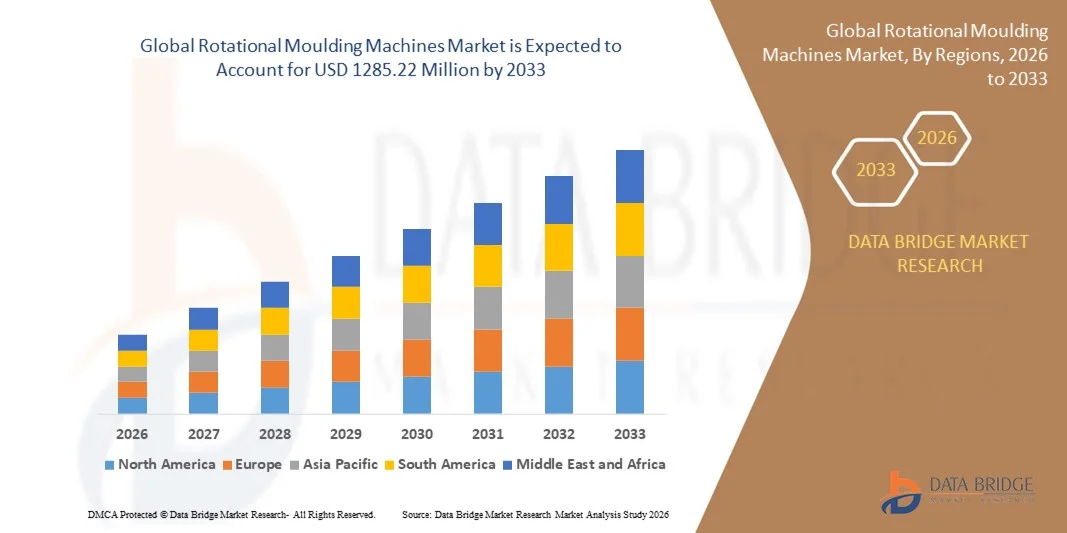

- The global rotational moulding machines market size was valued at USD 987.40 million in 2025 and is expected to reach USD 1285.22 million by 2033, at a CAGR of 3.35% during the forecast period

- The market growth is largely driven by the expanding demand for lightweight, durable, and hollow plastic products across agricultural, automotive, chemical, and industrial applications, supporting wider adoption of rotational moulding machines

- Furthermore, increasing investments in manufacturing automation, coupled with the need for cost-efficient production of large and complex plastic components, are strengthening the role of rotational moulding technology, collectively accelerating market expansion

Rotational Moulding Machines Market Analysis

- Rotational moulding machines, used to manufacture seamless and stress-free plastic products, are becoming increasingly essential in modern manufacturing due to their ability to produce uniform wall thickness components with high design flexibility and minimal material waste

- The rising demand for rotational moulding machines is primarily supported by growth in agriculture and infrastructure development, increasing use of plastic storage solutions, and manufacturers’ preference for efficient, scalable, and low-pressure moulding processes that enhance product durability

- North America dominated the rotational moulding machines market with a share of over 40% in 2025, due to strong demand from automotive, agricultural, and industrial manufacturing sectors

- Asia-Pacific is expected to be the fastest growing region in the rotational moulding machines market during the forecast period due to rapid industrialization, expanding manufacturing capacity, and increasing demand for plastic storage and transportation products

- Four arms segment dominated the market with a market share of around 45% in 2025, due to its ability to handle multiple moulds simultaneously and improve overall production efficiency. Manufacturers prefer four-arm machines for large-scale operations as they enable parallel heating, cooling, and loading processes, reducing cycle time. These machines are widely adopted in high-volume production of tanks, containers, and industrial components where consistency and output stability are critical. The flexibility to run different mould sizes at the same time further strengthens their adoption across diverse end-use industries

Report Scope and Rotational Moulding Machines Market Segmentation

|

Attributes |

Rotational Moulding Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rotational Moulding Machines Market Trends

Adoption of Energy-Efficient Rotational Moulding Machines

- A key trend shaping the rotational moulding machines market is the increasing adoption of energy-efficient machine designs as manufacturers seek to reduce operational costs and comply with stricter environmental standards. Energy consumption during heating and cooling cycles has become a critical focus area, prompting equipment suppliers to innovate in oven design, insulation, and process control systems to enhance efficiency

- For instance, Rotational Molding Corporation has introduced energy-efficient rotational moulding machines that significantly lower power consumption while maintaining consistent product quality. These machines help manufacturers reduce operating expenses and improve sustainability performance, making energy efficiency a decisive factor in equipment selection

- The trend is further supported by growing pressure from end-use industries to lower carbon footprints across manufacturing processes. Energy-efficient rotational moulding machines enable producers of tanks, containers, and industrial components to align with sustainability targets without compromising production output

- Advancements in temperature control systems and optimized airflow technologies are improving heat distribution within ovens, leading to reduced cycle times and lower energy losses. This enhances overall process efficiency and supports higher throughput in large-scale production environments

- Manufacturers are also integrating monitoring systems that track energy usage in real time, allowing operators to optimize machine performance and reduce wastage. This capability is becoming increasingly important for cost-sensitive industries operating at high production volumes

- The rising emphasis on sustainable manufacturing practices across plastics processing industries is reinforcing the adoption of energy-efficient rotational moulding machines. This trend is strengthening long-term demand for technologically advanced equipment that balances productivity, cost efficiency, and environmental responsibility

Rotational Moulding Machines Market Dynamics

Driver

Rising Demand for Durable and Lightweight Plastic Products

- The growing demand for durable and lightweight plastic products across agriculture, automotive, chemical storage, and infrastructure applications is a primary driver for the rotational moulding machines market. Rotational moulding technology enables the production of hollow, seamless, and stress-free components that offer superior strength-to-weight ratios compared to traditional manufacturing methods

- For instance, Persico S.p.a. supplies advanced rotational moulding machines used in the production of large-capacity water tanks and industrial containers that require high durability and uniform wall thickness. These machines support manufacturers in meeting increasing demand for long-lasting plastic products used in demanding environments

- The agricultural sector is driving significant demand for rotationally moulded products such as water storage tanks, silage containers, and livestock equipment due to their resistance to corrosion and harsh weather conditions. This reliance on durable plastic solutions directly increases demand for efficient rotational moulding machinery

- In the automotive sector, manufacturers are adopting rotational moulding to produce lightweight fuel tanks, ducts, and fluid reservoirs that contribute to overall vehicle weight reduction. This shift supports efficiency goals and aligns with broader trends toward lightweight material adoption

- As industries continue to replace metal and traditional materials with high-performance plastics, the need for reliable and scalable rotational moulding equipment remains strong. This sustained demand for lightweight and durable products continues to drive market growth

Restraint/Challenge

High Initial Investment Costs

- High initial investment costs remain a significant challenge for the rotational moulding machines market, particularly for small and mid-sized manufacturers. Advanced multi-arm machines, large ovens, and automation features require substantial capital expenditure, which can limit adoption among cost-sensitive producers

- For instance, four-arm rotational moulding machines offered by manufacturers such as Ferry Industries involve higher upfront costs due to complex mechanical systems and larger production footprints. While these machines deliver higher productivity, the initial financial burden can deter smaller enterprises from upgrading their equipment

- The cost of installation, facility modification, and operator training further increases the total investment required to deploy modern rotational moulding machines. These additional expenses extend payback periods and create hesitation among manufacturers with limited financial flexibility

- Maintenance and energy infrastructure requirements also add to ownership costs, particularly for older facilities that need upgrades to support advanced machines. This creates barriers to adoption in developing regions and among emerging manufacturers

- These cost-related challenges continue to influence purchasing behavior within the market, placing pressure on machine suppliers to offer flexible configurations and cost-effective solutions while maintaining performance and reliability

Rotational Moulding Machines Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the rotational moulding machines market is segmented into two arms, three arms, four arms, and others. The four arms segment dominated the market with the largest revenue share of around 45% in 2025, supported by its ability to handle multiple moulds simultaneously and improve overall production efficiency. Manufacturers prefer four-arm machines for large-scale operations as they enable parallel heating, cooling, and loading processes, reducing cycle time. These machines are widely adopted in high-volume production of tanks, containers, and industrial components where consistency and output stability are critical. The flexibility to run different mould sizes at the same time further strengthens their adoption across diverse end-use industries.

The three arms segment is projected to register the fastest growth from 2026 to 2033, driven by rising demand for balanced cost and productivity solutions. Three-arm machines offer better operational flexibility than two-arm systems while remaining more economical than four-arm configurations. Small and mid-sized manufacturers increasingly adopt these machines to scale production without significantly increasing capital expenditure. Growing customization requirements and shorter production runs also support the accelerated adoption of three-arm rotational moulding machines.

- By Applications

On the basis of applications, the rotational moulding machines market is segmented into automotive, agricultural, chemical, and others. The agricultural segment accounted for the largest market revenue share in 2025, driven by strong demand for water storage tanks, silage containers, and farm equipment components. Rotational moulding machines are preferred in agriculture due to their ability to produce large, hollow, and durable products with uniform wall thickness. Increasing investments in irrigation infrastructure and farm mechanization continue to support sustained demand. The durability and weather resistance of rotationally moulded agricultural products further reinforce segment dominance.

The automotive segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing use of lightweight plastic components for fuel tanks, ducts, and fluid reservoirs. Automotive manufacturers are adopting rotational moulding to reduce component weight while maintaining structural strength and design flexibility. The shift toward electric vehicles also drives demand for specialized plastic enclosures and battery-related components. Advancements in material formulations and precision moulding technologies accelerate the adoption of rotational moulding machines in automotive applications.

Rotational Moulding Machines Market Regional Analysis

- North America dominated the rotational moulding machines market with the largest revenue share of over 40% in 2025, driven by strong demand from automotive, agricultural, and industrial manufacturing sectors

- Manufacturers in the region focus on high-efficiency and automated rotational moulding systems to support large-scale production of tanks, containers, and specialty plastic components

- This dominance is supported by advanced manufacturing infrastructure, early adoption of automation technologies, and the presence of well-established rotational moulding machine manufacturers, positioning North America as a mature and technology-driven market

U.S. Rotational Moulding Machines Market Insight

The U.S. rotational moulding machines market captured the largest revenue share within North America in 2025, fueled by extensive use of rotationally moulded products across agriculture, automotive, and chemical storage applications. Manufacturers increasingly invest in multi-arm machines to improve throughput and reduce production cycles. Strong demand for customized and large-capacity moulded products, along with ongoing modernization of manufacturing facilities, continues to support market expansion. The presence of a robust plastics processing industry further strengthens the U.S. market position.

Europe Rotational Moulding Machines Market Insight

The Europe rotational moulding machines market is projected to expand at a steady CAGR during the forecast period, driven by increasing adoption in automotive components, industrial containers, and infrastructure-related applications. European manufacturers emphasize precision engineering, energy efficiency, and compliance with stringent environmental regulations. Growth in sustainable plastic processing and demand for lightweight yet durable components support the adoption of advanced rotational moulding machines across the region.

U.K. Rotational Moulding Machines Market Insight

The U.K. rotational moulding machines market is expected to grow at a moderate CAGR during the forecast period, supported by demand from water management, agriculture, and industrial storage applications. The focus on upgrading manufacturing capabilities and adopting efficient production technologies is driving machine replacement and new installations. Increasing use of rotational moulding for bespoke and low-stress plastic components also contributes to market growth.

Germany Rotational Moulding Machines Market Insight

The Germany rotational moulding machines market is anticipated to expand at a notable CAGR, driven by the country’s strong industrial base and emphasis on high-quality manufacturing standards. Demand is supported by automotive, chemical, and industrial equipment manufacturers seeking durable and precision-moulded plastic components. Germany’s focus on automation, process optimization, and sustainable manufacturing practices encourages adoption of advanced multi-arm rotational moulding machines.

Asia-Pacific Rotational Moulding Machines Market Insight

The Asia-Pacific rotational moulding machines market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, expanding manufacturing capacity, and increasing demand for plastic storage and transportation products. Growing investments in infrastructure, agriculture, and automotive manufacturing support the adoption of rotational moulding technology. The region’s cost-effective production environment and rising domestic demand position Asia-Pacific as a key growth hub.

China Rotational Moulding Machines Market Insight

The China rotational moulding machines market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to its large manufacturing base and strong demand for industrial, agricultural, and chemical storage products. Expansion of domestic plastics processing industries and increasing use of large-capacity rotationally moulded products support sustained demand. Continuous investments in manufacturing automation and capacity expansion further drive market growth in China.

Japan Rotational Moulding Machines Market Insight

The Japan rotational moulding machines market is witnessing steady growth due to demand for high-precision and durable plastic components used in automotive, industrial, and infrastructure applications. Japanese manufacturers emphasize quality, process control, and efficient material usage. The adoption of advanced rotational moulding systems aligns with the country’s focus on high-performance manufacturing and long-term product reliability.

Rotational Moulding Machines Market Share

The rotational moulding machines industry is primarily led by well-established companies, including:

- Persico S.p.a. (Italy)

- SHANDONG ZHONGTIAN RUBBER & PLASTIC TECHNOLOGY CO., LTD. (China)

- Ferry Industries, Inc. (U.S.)

- Crossfield Excalibur Ltd (U.K.)

- Reinhardt GmbH (Germany)

- Naroto (Japan)

- KOIOSLIN INTERNATIONAL CO., LTD. (China)

- Clips Poly Engineering (India)

- NINGBO LIGHT INDUSTRY MACHINERY & EQUIPMENT IMP. & EXP. CO., LTD. (China)

- Zhejiang Anji Tianyang Rotational Mouding Machinery Co., Ltd. (China)

Latest Developments in Global Rotational Moulding Machines Market

- In December 2025, Persico Group (Italy) introduced an advanced automated rotational moulding system equipped with real-time process monitoring and adaptive temperature control, significantly improving production consistency and reducing material wastage. This development strengthens the competitive landscape by accelerating the shift toward smart manufacturing and reinforces the market’s transition toward high-efficiency, digitally enabled rotational moulding machines that support large-scale and precision-driven production requirements

- In September 2025, Rotational Molding Corporation (U.S.) launched a new range of energy-efficient rotational moulding machines capable of reducing energy consumption by up to 30%, directly addressing rising operational costs for manufacturers. This innovation enhances market competitiveness by aligning equipment performance with sustainability goals, making energy-efficient machines a key purchasing criterion and pushing the broader market toward environmentally responsible manufacturing practices

- In August 2025, Molded Fiber Glass Companies (U.S.) entered a strategic partnership with a leading materials science firm to develop eco-friendly composite materials tailored for rotational moulding applications. This collaboration expands the market’s material innovation landscape by enabling sustainable product development, strengthening demand for rotational moulding solutions compatible with advanced and environmentally responsible composites

- In July 2025, Cannon Group (Italy) unveiled a digital platform integrating AI and IoT technologies into rotational moulding operations to optimize production scheduling and enhance quality control. This initiative accelerates digital transformation across the market, improving operational efficiency and waste reduction while positioning technology-enabled machinery as a differentiating factor among rotational moulding equipment suppliers

- In January 2025, Rotomachinery Group introduced a redesigned rotational moulding machine featuring a split-door, double-motor oven configuration that minimizes rear space requirements. This innovation increases installation flexibility for manufacturers with space-constrained facilities, supporting wider adoption of rotational moulding machines and enhancing market accessibility across diverse factory layouts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rotational Moulding Machines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rotational Moulding Machines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rotational Moulding Machines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.