Global Safety Critical Software Testing Market

Market Size in USD Million

CAGR :

%

USD

95.31 Million

USD

2,603.64 Million

2025

2033

USD

95.31 Million

USD

2,603.64 Million

2025

2033

| 2026 –2033 | |

| USD 95.31 Million | |

| USD 2,603.64 Million | |

|

|

|

|

Safety Critical Software Testing Market Size

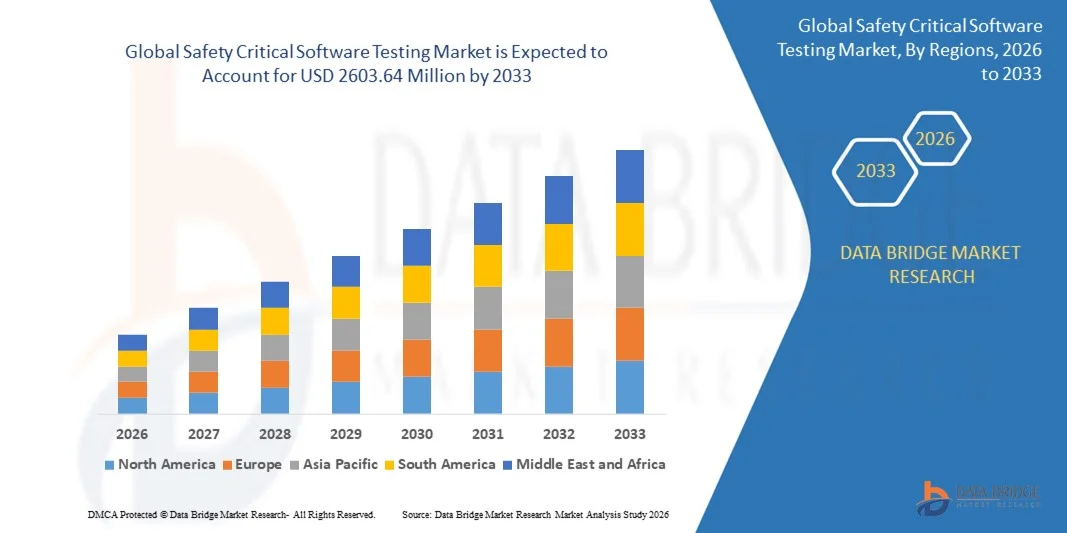

- The global safety critical software testing market size was valued at USD 95.31 million in 2025 and is expected to reach USD 2603.64 million by 2033, at a CAGR of 51.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of safety‑critical software across industries such as automotive, aerospace, healthcare, and industrial automation, driving the need for rigorous testing, verification, and compliance with functional safety standards

- Furthermore, rising regulatory requirements, industry-specific safety standards such as ISO 26262, DO‑178C, and IEC 62304, and growing demand for reliable, error-free software in mission-critical applications are establishing safety critical software testing as an essential component of the software development lifecycle. These converging factors are accelerating the uptake of automated and hybrid testing solutions, thereby significantly boosting the industry’s growth

Safety Critical Software Testing Market Analysis

- Safety critical software testing, which encompasses verification, validation, static and dynamic analysis, and automated compliance checking, is increasingly vital for ensuring the reliability, safety, and performance of software deployed in high-risk applications across sectors such as automotive, aerospace, and healthcare

- The escalating demand for safety critical software testing is primarily fueled by the rapid digital transformation of critical systems, increasing adoption of automated and CI/CD-integrated testing solutions, and growing awareness among enterprises of the importance of compliance, reliability, and risk mitigation in mission-critical software development

- North America dominated the safety critical software testing market with a share of around 40% in 2025, due to the presence of advanced technological infrastructure and stringent regulatory standards for software safety in critical industries such as aerospace, healthcare, and defense

- Asia-Pacific is expected to be the fastest growing region in the safety critical software testing market during the forecast period due to rapid industrialization, technological adoption, and government initiatives promoting software safety and compliance

- Software segment dominated the market with a market share of 62.5% in 2025, due to the increasing demand for advanced testing tools that ensure compliance with safety standards and regulatory requirements. Safety-critical applications often require software solutions that provide automated fault detection, code analysis, and real-time reporting, which enhance reliability and reduce human error. The market sees strong adoption of software solutions due to their ability to integrate seamlessly with existing development pipelines and continuous integration/continuous deployment (CI/CD) workflows

Report Scope and Safety Critical Software Testing Market Segmentation

|

Attributes |

Safety Critical Software Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Safety Critical Software Testing Market Trends

Adoption of Automated and AI-Driven Testing

- A significant trend in the safety critical software testing market is the growing adoption of automated and AI-driven testing solutions, driven by the need to reduce human error and accelerate testing cycles for critical applications. These technologies are enabling more efficient detection of defects in real-time, ensuring software reliability in sectors where failure can have severe consequences

- For instance, companies such as VectorCAST provide automated testing tools that are widely used in aerospace and automotive safety-critical software development, allowing organizations to execute comprehensive unit and integration testing while reducing manual effort

- The integration of AI and machine learning algorithms in testing workflows is improving the prediction of potential failure points and optimizing test coverage. This is positioning AI-driven testing as a vital enabler for continuous verification in complex safety-critical systems

- The increasing complexity of embedded software in sectors such as automotive, defense, and industrial automation is driving the need for advanced testing frameworks that can simulate real-world operational conditions. Such frameworks enhance software robustness and ensure adherence to functional safety standards

- Industries are increasingly leveraging automated regression testing to maintain system reliability during software updates and iterative development. This trend is accelerating deployment timelines while preserving compliance with safety-critical requirements

- The market is witnessing rising interest in cloud-based testing environments and test automation platforms, which allow scalable and collaborative testing for globally distributed development teams. This adoption is reinforcing the transition toward more efficient, accurate, and cost-effective safety-critical software validation

Safety Critical Software Testing Market Dynamics

Driver

Rising Regulatory and Compliance Requirements

- The growing emphasis on safety and regulatory compliance across industries such as automotive, aerospace, and medical devices is driving demand for rigorous software testing practices. Compliance with standards such as ISO 26262, DO-178C, and IEC 61508 is essential to ensure operational safety and avoid legal liabilities

- For instance, Siemens supports compliance verification for ISO 26262 in automotive software development through its Polarion ALM and Simcenter testing tools, helping OEMs validate safety-critical functions across electronic control units

- Organizations are investing in comprehensive testing frameworks that can systematically document verification activities and provide traceability for audits. These frameworks reduce the risk of safety incidents and enhance confidence in software reliability

- The tightening of international safety regulations and increasing scrutiny from certification authorities are compelling companies to adopt advanced testing methodologies. This is creating a consistent need for solutions that ensure compliance while minimizing development delays

- Rising penalties for non-compliance and product recalls are further motivating industries to integrate formal verification, automated testing, and continuous monitoring into their development lifecycles. This sustained regulatory pressure continues to be a primary growth driver for the market

Restraint/Challenge

High Complexity and Integration Costs

- The safety critical software testing market faces challenges due to the high complexity of integrating testing solutions with existing development and operational environments. These implementations often require significant customization and coordination across multiple software modules

- For instance, Wind River provides testing and verification tools for aerospace and defense systems, but deployment and integration involve extensive engineering effort and specialized expertise, increasing overall project costs

- Testing safety-critical software requires adherence to strict standards, sophisticated simulation environments, and comprehensive traceability, all of which elevate operational complexity. These factors make implementation time-consuming and resource-intensive

- The need for skilled personnel capable of managing automated and AI-driven testing frameworks further adds to the cost and complexity for organizations. Training and retaining such talent is often a significant constraint

- Balancing investment in advanced testing tools with budget limitations is an ongoing challenge for companies developing safety-critical applications. These constraints collectively slow adoption rates and affect the overall scalability of testing solutions across industries

Safety Critical Software Testing Market Scope

The market is segmented on the basis of component, type, enterprise size, application, and end-user.

- By Component

On the basis of component, the safety critical software testing market is segmented into software and services. The software segment dominated the market with the largest revenue share of 62.5% in 2025, driven by the increasing demand for advanced testing tools that ensure compliance with safety standards and regulatory requirements. Safety-critical applications often require software solutions that provide automated fault detection, code analysis, and real-time reporting, which enhance reliability and reduce human error. The market sees strong adoption of software solutions due to their ability to integrate seamlessly with existing development pipelines and continuous integration/continuous deployment (CI/CD) workflows.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for specialized testing expertise across various industries. For instance, companies such as TUV SUD provide consultancy and testing services for aviation and automotive software, enabling organizations to meet stringent safety and compliance requirements. Services offer flexibility to organizations that may lack in-house capabilities and allow for customized testing strategies. Growing reliance on third-party service providers to handle complex verification, validation, and certification processes further supports the expansion of this segment.

- By Type

On the basis of type, the market is segmented into manual testing and automated testing. The automated testing segment dominated the market in 2025 with the largest revenue share due to its efficiency, repeatability, and ability to handle complex test cases with minimal human intervention. Automated testing solutions are essential in safety-critical environments as they reduce the risk of human error and accelerate release cycles while ensuring compliance with safety standards. The market sees strong adoption in industries requiring frequent updates and rigorous testing, such as aerospace and healthcare.

The manual testing segment is expected to register the fastest growth from 2026 to 2033, driven by the need for expert human oversight in scenarios where automated tools may not capture subtle system interactions. For instance, companies such as SGS provide specialized manual verification services in railway and defense software systems, ensuring thorough validation. Manual testing is preferred in highly complex or customized systems where intuitive human judgment is critical for safety assurance. The growing integration of manual testing with hybrid testing strategies further boosts its demand.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into SMEs and large enterprises. Large enterprises dominated the market in 2025 with the largest revenue share, driven by their extensive safety-critical software deployments across multiple industries and the resources to invest in advanced testing frameworks. These organizations often prioritize compliance, reliability, and risk mitigation, making large-scale automated testing tools and services crucial for operations. The market sees strong adoption among large enterprises due to their ability to implement end-to-end testing solutions that reduce downtime and enhance product safety.

The SME segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing digital transformation initiatives and adoption of cost-effective testing tools. For instance, companies such as Vector Software provide SME-focused testing solutions that support aviation and medical software compliance. SMEs benefit from flexible and scalable testing offerings that reduce operational risk without heavy upfront investment. Growing awareness of safety standards and regulatory compliance among SMEs is expected to drive significant market expansion.

- By Application

On the basis of application, the market is segmented into management, monitoring, test, and communication. The test segment dominated the market in 2025 with the largest revenue share, driven by the critical need to verify and validate software performance, reliability, and compliance in safety-critical systems. Testing applications ensure that software meets functional requirements under extreme conditions and adheres to industry-specific safety standards. The market sees strong demand for test solutions due to their role in preventing failures that could result in catastrophic consequences in aviation, healthcare, and automotive systems.

The monitoring segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of real-time software monitoring to detect faults, anomalies, and security vulnerabilities. For instance, companies such as IBM provide advanced monitoring solutions that track performance metrics across critical infrastructures. Monitoring applications enable predictive maintenance, risk assessment, and continuous compliance verification. The growing complexity of safety-critical software systems necessitates robust monitoring solutions to maintain operational safety and efficiency.

- By End User

On the basis of end user, the market is segmented into aviation, healthcare, transportation, oil and gas, defense, power and utilities, automotive, government, telecom and IT, chemical, security agencies, and others. The aviation segment dominated the market in 2025 with the largest revenue share due to the stringent safety standards and regulatory requirements governing aircraft software systems. Safety-critical software testing is essential for preventing failures that could lead to catastrophic incidents, and the market sees strong adoption driven by regulatory compliance and risk mitigation.

The healthcare segment is expected to register the fastest growth from 2026 to 2033, driven by the increasing deployment of software in medical devices, patient monitoring systems, and healthcare IT applications. For instance, companies such as Medidata Solutions provide specialized testing services for medical software to ensure patient safety and regulatory compliance. Growing demand for reliable healthcare software, coupled with strict safety standards such as ISO 13485 and IEC 62304, fuels market expansion. The integration of advanced monitoring and testing solutions further accelerates growth in this segment.

Safety Critical Software Testing Market Regional Analysis

- North America dominated the safety critical software testing market with the largest revenue share of around 40% in 2025, driven by the presence of advanced technological infrastructure and stringent regulatory standards for software safety in critical industries such as aerospace, healthcare, and defense

- Organizations in the region highly prioritize compliance, reliability, and risk mitigation, investing in advanced testing tools and services to ensure software safety and performance

- This widespread adoption is further supported by high IT spending, the presence of major software vendors, and the growing emphasis on digital transformation across enterprises, establishing North America as a key hub for safety-critical software testing

U.S. Safety Critical Software Testing Market Insight

The U.S. safety critical software testing market captured the largest revenue share in North America in 2025, fueled by rapid adoption of automation, specialized testing tools, and services across critical sectors such as automotive, aerospace, and healthcare. Enterprises are increasingly implementing solutions to comply with standards including ISO 26262, DO-178C, and IEC 62304 while minimizing operational risks. The growing preference for cloud-based and hybrid testing platforms, along with integration of AI and analytics into testing workflows, continues to drive the market’s expansion.

Europe Safety Critical Software Testing Market Insight

The Europe safety critical software testing market is projected to grow at a substantial CAGR during the forecast period, driven by stringent safety regulations and rising demand for automated and hybrid testing solutions. Enterprises across automotive, aerospace, and healthcare sectors are prioritizing reliability and compliance while upgrading both legacy systems and new software deployments. The market growth is supported by strong industrial infrastructure, emphasis on innovation, and increasing awareness of software safety standards, enabling widespread adoption of advanced testing tools and services.

U.K. Safety Critical Software Testing Market Insight

The U.K. safety critical software testing market is anticipated to expand at a noteworthy CAGR during the forecast period, driven by growing demand for reliable software in aerospace, healthcare, and defense applications. Companies are increasingly adopting automated and service-based testing solutions to enhance efficiency, ensure compliance, and reduce operational risk. The U.K.’s robust IT and software services ecosystem, combined with the focus on innovation and safety-critical applications, continues to stimulate market growth across enterprises.

Germany Safety Critical Software Testing Market Insight

The Germany safety critical software testing market is expected to grow at a considerable CAGR during the forecast period, fueled by the rising need for reliable software in industrial, automotive, and aerospace applications. Enterprises are adopting advanced automated testing tools and hybrid methodologies to enhance compliance with safety standards and reduce system risks. The country’s strong industrial base, technological expertise, and focus on innovation support the widespread implementation of safety-critical software testing solutions.

Asia-Pacific Safety Critical Software Testing Market Insight

The Asia-Pacific safety critical software testing market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, technological adoption, and government initiatives promoting software safety and compliance. Countries such as China, Japan, and India are witnessing increasing investments in aerospace, healthcare, automotive, and energy sectors, fueling demand for specialized testing solutions. Growing awareness of safety standards, combined with availability of cost-effective testing tools and services, is expanding adoption across enterprises of all sizes.

Japan Safety Critical Software Testing Market Insight

The Japan safety critical software testing market is gaining momentum due to high demand for reliable software in automotive, aerospace, and healthcare industries. Adoption of automated testing and integrated monitoring systems is rising as enterprises focus on compliance with international safety standards. Japan’s aging population and increasing emphasis on healthcare and industrial software reliability are further driving market growth across both residential and commercial applications.

China Safety Critical Software Testing Market Insight

The China safety critical software testing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrialization, technological advancement, and expanding aerospace, automotive, and healthcare sectors. The country’s push toward smart cities and advanced digital infrastructure is increasing adoption of software testing solutions to ensure reliability and regulatory compliance. Strong domestic providers and affordable testing platforms are further enabling market expansion and accessibility across industries.

Safety Critical Software Testing Market Share

The safety critical software testing industry is primarily led by well-established companies, including:

- Critical Software (Portugal)

- Hewlett Packard Enterprise Development LP (U.S.)

- Parasoft (U.S.)

- QA SYSTEMS GMBH (Germany)

- Verum Consultants B.V. (Netherlands)

- Rapita Systems Ltd. (U.K.)

- ALD SERVICES (U.K.)

- HOTTINGER BRUEL & KJAER INC. (U.S.)

- Atkins Limited (U.K.)

- imbus AG (Germany)

- General Digital Corporation (U.S.)

- tecmata GmbH (Germany)

- Vector Informatik GmbH (Germany)

- LDRA (U.K.)

- SoHaR (Germany)

- Rockwell Automation, Inc. (U.S.)

Latest Developments in Global Safety Critical Software Testing Market

- In April 2024, Parasoft’s introduction of the new C/C++test CT advanced safety‑critical software testing by providing seamless integration with development environments, CI/CD workflows, and support for frameworks such as GoogleTest while automating compliance and code coverage. This enables organizations to improve test automation efficiency and accelerate time‑to‑market for safety‑critical applications

- In June 2024, QA‑MISRA 24.04 released updated support for MISRA C++:2023 and improved DAX versions alongside Cantata 24.04, which incorporated a new code‑centric approach for automated CI testing. This drives greater adoption of standardized compliance checks and continuous testing practices in safety‑critical software development environments

- In April 2024, LDRA launched domain‑specific productivity packages for its tool suite, offering integrated solutions for functional safety and security standards compliance. This strengthens developers’ ability to streamline verification and validation processes and meet rigorous industry requirements across sectors such as automotive, aerospace, and industrial automation

- In January 2024, RVS 3.20 introduced a new space‑optimized variant called RVSSpace, tailored to meet space software standards such as NASA NPR 7150.2D and ECSS E‑ST‑40C, complete with dedicated analysis profiles. This expands the scope of safety‑critical software testing in aerospace and space exploration by enabling more targeted verification for high‑assurance systems

- In October 2024, LDRA announced extended support for the RISC‑V high‑assurance software quality tool suite, enabling on‑target testing of critical embedded applications and providing developers with verification tools to ensure compliance with functional safety and security standards on emerging processor architectures. This broadens the market’s capability to support next‑generation embedded systems development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.