Global Sauces Market

Market Size in USD Billion

CAGR :

%

USD

58.23 Billion

USD

89.37 Billion

2024

2032

USD

58.23 Billion

USD

89.37 Billion

2024

2032

| 2025 –2032 | |

| USD 58.23 Billion | |

| USD 89.37 Billion | |

|

|

|

|

What is the Global Sauces Market Size and Growth Rate?

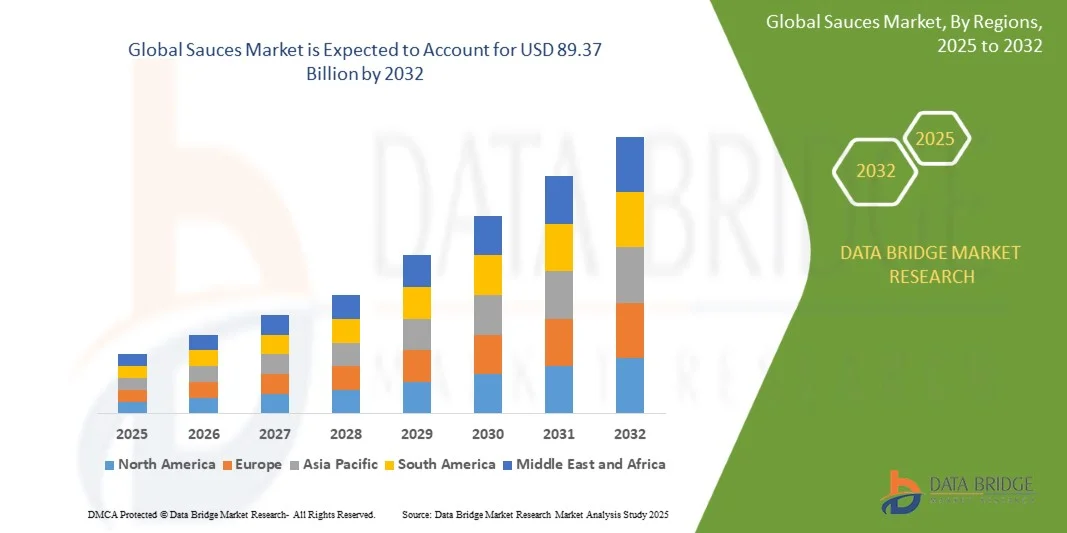

- The global Sauces market size was valued at USD 58.23 billion in 2024 and is expected to reach USD 89.37 billion by 2032, at a CAGR of 5.50% during the forecast period

- The sauces market witness’s continual evolution, driven by consumer preferences and culinary innovation. Advancements in flavor profiles, ingredients, and packaging techniques cater to diverse tastes and convenience needs

- This dynamism benefits consumers with various options, from traditional favorites to novel creations, enhancing culinary experiences and inspiring experimentation in kitchens worldwide

What are the Major Takeaways of Sauces Market?

- As health and wellness trends surge, consumers demand tasty and nutritious sauces. Manufacturers respond by crafting options with lower sodium, sugar, and preservatives, featuring clean label ingredients. This shift reflects consumers' pursuit of improved nutrition, offering producers a significant market growth to develop and promote healthier sauce alternatives

- Europe dominated the Sauces market with the largest revenue share of 40.5% in 2024, driven by strong consumer preference for premium and specialty sauces, increasing disposable incomes, and the growing adoption of Western-style and international cuisines

- The Asia-Pacific Sauces market is poised to grow at the fastest CAGR of 10.12% during the forecast period 2025–2032, driven by rising urbanization, expanding middle-class populations, and growing adoption of international cuisines

- The tomato ketchup segment dominated the market with a revenue share of 38.5% in 2024, driven by its universal appeal, strong brand recognition, and integration into both home cooking and foodservice applications

Report Scope and Sauces Market Segmentation

|

Attributes |

Sauces Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Sauces Market?

Premiumization and Flavor Innovation

- A significant and accelerating trend in the global Sauces market is the rising demand for premium, artisanal, and innovative flavor profiles, driven by evolving consumer preferences for authenticity, health-conscious options, and global cuisines. This shift is reshaping product offerings as brands focus on gourmet ingredients, ethnic flavors, and healthier alternatives

- For instance, Unilever’s Knorr introduced a premium range of sauces with reduced salt and no artificial preservatives, catering to health-conscious consumers while enhancing flavor authenticity. Similarly, Heinz launched limited-edition globally inspired sauces such as Korean Barbecue and Mexican Hot Sauce, capturing consumer interest in cross-cultural flavors

- Innovation in sauces extends to functional benefits, with brands incorporating organic ingredients, plant-based alternatives, and clean-label formulations to meet demand for healthier options. This is supported by rising global interest in vegan diets and sustainability-driven purchasing

- The fusion of traditional sauces with exotic, international flavors offers consumers adventurous taste experiences, further fueling experimentation in home cooking and dining. Through these innovations, sauces are increasingly positioned as versatile meal enhancers

- Companies such as Nestlé and Kraft Heinz are leading this trend by continuously launching limited-edition flavors, healthier formulations, and premiumized product lines to strengthen brand loyalty and attract diverse consumer groups

- As consumer expectations shift towards quality, variety, and health, the demand for premium and innovative sauces is growing rapidly across both retail and foodservice sectors, shaping the future landscape of the global sauces industry

What are the Key Drivers of Sauces Market?

- The increasing consumer preference for convenience, ready-to-eat meals, and home cooking innovations is a significant driver fueling the demand for sauces globally. Rising disposable incomes and lifestyle changes are further accelerating this trend

- For instance, in March 2024, Kraft Heinz announced its expansion into “flavor-forward” meal kits and convenient ready-to-use sauces, highlighting how leading players are responding to consumer demand for convenience-driven products. Such strategies are expected to accelerate market growth in the forecast period

- Health-conscious consumers are seeking sauces with organic, low-sugar, and preservative-free formulations, creating opportunities for clean-label and plant-based options. This shift is pushing brands to develop products that balance taste with nutritional benefits

- Furthermore, the globalization of food culture and the rising popularity of international cuisines are driving the adoption of ethnic sauces such as Asian soy-based sauces, Mexican salsas, and Mediterranean dips, offering a diverse range of choices to consumers

- The rise of e-commerce platforms, meal delivery services, and supermarket chains has boosted sauce accessibility, enabling both established brands and niche players to expand their reach. DIY cooking kits and premium online-only product launches are also gaining momentum

- The convenience of ready-to-use sauces, portion packs, and innovative packaging continues to attract busy consumers, making sauces an essential product category in both residential kitchens and foodservice establishments

Which Factor is Challenging the Growth of the Sauces Market?

- Concerns surrounding health, clean-label requirements, and high competition from local brands pose challenges to the broader sauces market growth. Consumers are becoming increasingly wary of sugar, sodium, and artificial additives commonly found in traditional sauces

- For instance, several health watchdog reports in 2023 highlighted high sugar and sodium levels in packaged sauces, making some consumers hesitant to purchase conventional options. This is pushing brands to rethink formulations while ensuring flavor retention

- Addressing these health concerns through natural ingredients, reduced sodium content, and transparent labeling is crucial for building long-term consumer trust. Companies such as Nestlé and Unilever emphasize “no added preservatives” and “organic certifications” in their marketing strategies to reassure buyers

- In addition, the intense price competition between multinational giants and regional/local sauce producers creates margin pressure. While premium sauces offer growth opportunities, their higher price points compared to regular sauces can be a barrier for price-sensitive consumers, especially in emerging markets

- Supply chain disruptions and raw material price fluctuations (such as tomatoes, soybeans, and spices) further affect product pricing and availability, making it difficult for manufacturers to maintain consistency

- Overcoming these challenges through product reformulation, affordability-focused innovation, and consumer education on health benefits will be vital for ensuring sustained growth in the global sauces market

How is the Sauces Market Segmented?

The market is segmented on the basis of type, product, specialty food-type, packaging, application, and distribution channel.

• By Type

On the basis of type, the Sauces market is segmented into chili/hot sauce, brown sauce, national specialties, tomato ketchup, mustard sauce, soy-based sauce, and others. The tomato ketchup segment dominated the market with a revenue share of 38.5% in 2024, driven by its universal appeal, strong brand recognition, and integration into both home cooking and foodservice applications. Consumers appreciate its versatility across cuisines and meals, making it a staple in households and restaurants globally.

The chili/hot sauce segment is anticipated to witness the fastest CAGR of 18.2% from 2025 to 2032, fueled by rising demand for spicy and exotic flavors, increasing international exposure, and the growing popularity of global cuisines among adventurous consumers.

• By Product

On the basis of product, the market is segmented into table sauces, cooking sauces, dips, and others. The table sauces segment held the largest market share of 41.0% in 2024, attributed to its convenience, ready-to-use nature, and strong household adoption. Table sauces are widely used to enhance meals and are often packaged for single-serving or family use.

The cooking sauces segment is expected to witness the fastest CAGR of 17.5% from 2025 to 2032, driven by increasing home cooking trends, meal kit integrations, and demand for authentic, restaurant-style flavors in households.

• By Specialty Food-Type

On the basis of specialty food-type, the market is segmented into kosher, gluten-free, vegan, low-carb, low-fat, and others. The vegan segment dominated with a 35% revenue share in 2024, reflecting growing health consciousness, ethical dietary preferences, and rising plant-based food adoption. Consumers increasingly prefer plant-based sauces that do not compromise on flavor.

The gluten-free segment is anticipated to grow at the fastest CAGR of 16.8% from 2025 to 2032, supported by rising awareness about celiac disease, digestive health, and demand for allergen-free food products across global markets.

• By Packaging

On the basis of packaging, the market is segmented into glass bottles, squeeze bottles, sachets, jars, and others. The glass bottles segment accounted for the largest market share of 42.3% in 2024, driven by premium perception, better shelf-life, and brand positioning advantages. Consumers often associate glass packaging with quality and freshness.

The sachets segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, fueled by single-use convenience, portability, on-the-go consumption, and growing demand in the foodservice and fast-food sectors.

• By Application

On the basis of application, the market is segmented into dressings, soups and gravies, pasta and noodles, ready-to-eat meals, and others. The ready-to-eat meals segment dominated with a 39.7% revenue share in 2024, driven by rising convenience-focused lifestyles, urbanization, and increasing consumption of pre-packaged meals.

The pasta and noodles segment is expected to witness the fastest CAGR of 18.3% from 2025 to 2032, owing to rising international cuisine consumption, growing adoption of quick-cook meals, and integration of sauces as meal enhancers.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarkets, convenience stores, general stores, online, and others. The supermarkets segment held the largest market share of 45.2% in 2024, attributed to wide product assortment, easy availability, and promotional activities driving bulk purchases.

The online segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by the growth of e-commerce platforms, digital promotions, and consumer preference for doorstep delivery and subscription-based sauce offerings.

Which Region Holds the Largest Share of the Sauces Market?

- Europe dominated the Sauces market with the largest revenue share of 40.5% in 2024, driven by strong consumer preference for premium and specialty sauces, increasing disposable incomes, and the growing adoption of Western-style and international cuisines

- Consumers in the region highly value product quality, authenticity, and health-oriented options, including organic, low-sodium, and gluten-free sauces, boosting market demand

- This widespread adoption is further supported by robust retail infrastructure, high consumer awareness, and established distribution networks, establishing sauces as a preferred choice in both residential and commercial kitchens

U.K. Sauces Market Insight

In the U.K., the Sauces market is experiencing steady growth due to the increasing popularity of home cooking and convenience meals. Consumers are adopting a variety of international and specialty sauces, including organic, gluten-free, and low-sodium options. The rising trend of fusion cuisines and ready-to-eat meals further drives demand, while retail expansion through supermarkets, online platforms, and specialty stores supports accessibility. Health-conscious consumers prefer clean-label products with transparent ingredients, boosting premium and functional sauces. The adoption of sauces in restaurants and foodservice sectors, combined with consumer interest in global flavors, strengthens the U.K.’s position in the European Sauces market.

Germany Sauces Market Insight

Germany’s Sauces market is dominated by premium, organic, and authentic products, reflecting high consumer demand for quality and sustainability. The rising trend of home cooking, international cuisines, and health-conscious choices fuels market expansion. Consumers are increasingly seeking low-sodium, gluten-free, and vegan sauces, while innovations in flavor profiles attract younger demographics. Strong retail infrastructure, including supermarkets, online sales, and specialty stores, ensures widespread availability. In addition, foodservice adoption is increasing across restaurants, cafés, and institutional kitchens. Germany’s emphasis on sustainability, quality certifications, and innovation in flavors cements its leading market share in Europe, driving both domestic and export growth.

Which Region is the Fastest Growing Region in the Sauces Market?

The Asia-Pacific Sauces market is poised to grow at the fastest CAGR of 10.12% during the forecast period 2025–2032, driven by rising urbanization, expanding middle-class populations, and growing adoption of international cuisines. The region’s increasing disposable income, evolving food habits, and exposure to global culinary trends are significantly boosting demand for diverse sauces.

China Sauces Market Insight

China’s Sauces market is growing rapidly, driven by urbanization, rising disposable incomes, and increasing demand for convenient and flavorful meal solutions. Consumers are adopting diverse sauces for ready-to-eat meals, home cooking, and restaurant use. The popularity of Western and fusion cuisines has expanded the variety of sauces, including soy-based, chili, and specialty condiments. Domestic manufacturers, coupled with affordable product options, are increasing accessibility. Online retail, e-commerce platforms, and supermarket chains support distribution, while rising awareness of health-conscious and clean-label products encourages premium adoption. China leads the Asia-Pacific region in revenue share, reflecting both scale and rapid market growth.

Japan Sauces Market Insight

In Japan, the Sauces market is growing due to high urbanization, evolving food habits, and the rising trend of home-prepared meals. Consumers favor convenience, quality, and authentic flavors, leading to the adoption of both traditional Japanese sauces and international varieties such as ketchup, mustard, and hot sauces. Ready-to-eat meals, fusion cuisines, and premium imported sauces further fuel demand. Supermarkets, convenience stores, and online channels provide strong distribution support. Japan’s aging population also encourages easy-to-use, pre-packaged sauces, while the foodservice industry contributes to overall market expansion. These trends make Japan one of the fastest-growing markets in the Asia-Pacific region.

Which are the Top Companies in Sauces Market?

The Sauces industry is primarily led by well-established companies, including:

- Frito-Lay North America, Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- Cargill, Incorporated (U.S.)

- General Mills Inc. (U.S.)

- Nestlé (Switzerland)

- Unilever (U.K.)

- Conagra Brands, Inc. (U.S.)

- Kroger (U.S.)

- Walmart (U.S.)

- CAMPBELL SOUP COMPANY (U.S.)

- Mars, Incorporated (U.S.)

- Hormel Foods Corporation (U.S.)

- McCormick & Company, Inc. (U.S.)

- F.lli Saclà S.p.A. (Italy)

- Levi Roots Reggae Reggae Foods Ltd (U.K.)

- Coles Supermarkets Australia Pty Ltd (Australia)

- McIlhenny Company (U.S.)

- Nando’s (South Africa)

What are the Recent Developments in Sauces Market?

- In June 2023, Kraft Heinz launch six limited-time "Sauce Drops," featuring collaborations with viral sensations such as Rebecca Black and William Hung. These unique sauces, such as Yuzu Wasabi and Black Garlic Ranch, target adventurous eaters and embrace "drop culture," encouraging real-time fan feedback to explore new flavor horizons

- In April 2023, Chick-fil-A expanded its grocery line with 16-ounce bottles of Barbecue and Sweet and Spicy Sriracha sauces, complementing offerings such as Chick-fil-A and Polynesian Sauces. Available at various grocery retailers, this move reflects popular restaurant chains' expansion into the retail sector, diversifying the global sauces market

- In December 2022 ,Mutti, a leading Italian canned tomato company, introducing new pasta sauces such as Marinara and Parmigiano Reggiano PDO to the U.S. market, available in national and local retail chains. The subsequent March 2023 launch of Arrabbiata flavor sauce demonstrated the market' trend toward diversification and innovation, meeting evolving consumer tastes

- In September 2022, Griffith Foods announced its expansion into the Indian market, offering a range of sauces, dressings, and culinary solutions tailored to meet evolving dining preferences. Crafted to resonate with Indian palates, these sauces blend traditional and inventive flavors, reflecting the increasing demand for quality culinary solutions amidst India's anticipated Food Service Industry growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SAUCES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SAUCES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS/ ADOPTION

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SAUCES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONSAND LIMITATIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 GROTH STRATEGIES ADOPTED BY KEY PLAYERS

5.4 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.5 SHOPPING BEHAVIOUR AND DYNAMICS

5.5.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.5.2 RESEARCH

5.5.3 IMPULSIVE

5.5.4 ADVERTISEMENT

5.5.4.1. TTELEVISION ADVERTISEMENT

5.5.4.2. OONLINE ADVERTISEMENT

5.5.4.3. IIN-STORE ADVERTISEMENT

5.5.4.4. OOUTDOOR ADVERTISEMENT

5.6 PRIVATE LABEL VS BRAND ANALYSIS

5.7 PROMOTIONAL ACTIVITIES

5.8 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.9 NEW PRODUCT LAUNCH STRATEGY

5.9.1 NUMBER OF NEW PRODUCT LAUNCH

5.9.1.1. LLINE EXTENSTION

5.9.1.2. NNEW PACKAGING

5.9.1.3. RRE-LAUNCHED

5.9.1.4. NNEW FORMULATION

5.1 CONSUMER LEVEL TRENDS

5.11 MEETING CONSUMER REQUIREMENT

5.12 BRAND COMAPARATIVE ANALYSIS

6 REGULATORY FRAMEWORK & LABELLING, CLAIMS

7 GLOBAL SAUCES MARKET, BY SAUCE TYPE

7.1 OVERVIEW

7.2 TOMATO SAUCES

7.3 PASTA SUACES

7.4 HOLLANDAISE SAUCES

7.5 HOT SAUCES

7.6 BARBEQUE SAUCES

7.7 BUFFALO SAUCE

7.8 MAYONNAISE

7.9 SOY SAUCE

7.1 MUSTARD SAUCE

7.11 CHEESE SAUCE

7.12 CHOCOLATE SAUCES

7.13 OTHERS

8 GLOBAL SAUCES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CHILLED SAUCES

8.3 AMBIENT SAUCES

8.4 FROZEN SAUCES

8.5 OTHERS

9 GLOBAL SAUCES MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 GLOBAL SAUCES MARKET, BY FLAVOURS

10.1 OVERVIEW

10.2 PLANT BASED FLAVOURED

10.2.1 TOMATO

10.2.2 MUSHROOM

10.2.3 HERBS

10.2.4 GARLIC

10.2.5 BASIL

10.2.6 MINT

10.2.7 SPICE AND PEPPER

10.2.8 AVOCADO

10.2.9 OTHERS

10.3 ANIMAL BASED FLAVOURED

10.3.1 PORK

10.3.2 CHICKEN

10.3.3 FISH

10.3.4 OTHERS

10.4 DAIRY FLAVOURED

10.4.1 CHEESE

10.4.2 CREAM

10.4.3 OTHERS

10.5 ALCOHOLIC FLAVOUR

10.6 SMOKED FLAVOUR

10.7 ORIGINAL/NO FLAVOR

10.8 OTHERS

11 GLOBAL SAUCES MARKET, BY BRAND CATEGORY

11.1 OVERVIEW

11.2 BRANDED

11.3 PRIVATE LABEL

12 GLOBAL SAUCES MARKET, BY CLAIMS

12.1 OVERVIEW

12.2 CALORIE FREE

12.3 PRESERVATIVES FREE

12.4 ARTIFICIAL COLORS FREE

12.5 NON GMO

12.6 WITH ALL BAOVE CLAIMS

12.7 NO CLAIMS

13 GLOBAL SAUCES MARKET, BY PACKAGING TYPE

13.1 OVERVIEW

13.2 STAND UP POUCHES

13.3 SACHET

13.4 BOTTLES

13.4.1 PLASTIC (PET)

13.4.2 GLASS

13.5 JARS

13.6 CAN

13.7 OTHERS

14 GLOBAL SAUCES MARKET, BY END USER

14.1 OVERVIEW

14.2 HOUSEHOLD/RETAIL

14.3 FOOD SERVICE PROVIDERS

14.3.1 FOOD SERVICE PROVIDERS, BY TYPE

14.3.1.1. RESTAURANTS

14.3.1.1.1. RESTAURANTS, BY SERVICE CATEGORY

14.3.1.1.1.1 QUICK SERVICE RESTAURANTS

14.3.1.1.1.2 FULL SERVICE RESTAURANTS

14.3.1.2. HOTELS & BARS

14.3.1.3. CAFÉ

14.3.1.4. CATERING

14.3.1.5. OTHERS

14.4 OTHERS (IF ANY)

15 GLOBAL SAUCES MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT

15.3 INDIRECT

15.3.1 STORE-BASED RETAILING

15.3.1.1. CONVENIENCE STORES

15.3.1.2. SUPERMARKETS/HYPERMARKETS

15.3.1.3. SPECIALTY STORES

15.3.1.4. GROCERY STORES

15.3.1.5. OTHERS

15.3.2 NON-STORE RETAILING

15.3.2.1. E-COMMERCE RETAILER

15.3.2.2. COMPANY WEBSITES

16 GLOBAL SAUCES MARKET , BY GEOGRAPHY

GLOBAL SAUCES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 SWITZERLAND

16.2.7 NETHERLANDS

16.2.8 BELGIUM

16.2.9 RUSSIA

16.2.10 TURKEY

16.2.11 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 AUSTRALIA

16.3.6 SINGAPORE

16.3.7 THAILAND

16.3.8 INDONESIA

16.3.9 MALAYSIA

16.3.10 PHILIPPINES

16.3.11 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 UAE

16.5.3 SAUDI ARABIA

16.5.4 KUWAIT

16.5.5 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL SAUCES MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18 GLOBAL SAUCES MARKET, SWOT AND DBMR ANALYSIS

19 GLOBAL SAUCES MARKET, COMPANY PROFILE

19.1 MIZKAN AMERICA, INC.

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHIC PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 BARILLA G. E R. F.LLI S.P.A.

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHIC PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 MARS, INCORPORATED(TM DOLMIO)

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHIC PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 CONAGRA BRANDS, INC

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHIC PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 UNILEVER FOOD SOLUTIONS

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHIC PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 THE KRAFT HEINZ COMPANY

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHIC PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 GENERAL MILLS INC.

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHIC PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 B&G FOODS, INC

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHIC PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 DEL MONTE FOODS INC.

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHIC PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 CONCORD FOODS, LLC

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHIC PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 KROGER CO.

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHIC PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

19.12 EBRO FOODS, S.A. (PANZANI)

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHIC PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 NESTLÉ

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHIC PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENTS

19.14 PREMIER FOODS GROUP LIMITED

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHIC PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENTS

19.15 PULMUONE FOODS USA, INC

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHIC PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENTS

19.16 LASSONDE INDUSTRIES INC

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHIC PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENTS

19.17 GIOVANNI FOOD COMPANY, INC

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHIC PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENTS

19.18 SACLA

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHIC PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENTS

19.19 LIDESTRI FOOD AND DRINK

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHIC PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENTS

19.2 PRIVATE LABEL FOODS

19.20.1 COMPANY OVERVIEW

19.20.2 REVENUE ANALYSIS

19.20.3 GEOGRAPHIC PRESENCE

19.20.4 PRODUCT PORTFOLIO

19.20.5 RECENT DEVELOPMENTS

19.21 NELLINO

19.21.1 COMPANY OVERVIEW

19.21.2 REVENUE ANALYSIS

19.21.3 GEOGRAPHIC PRESENCE

19.21.4 PRODUCT PORTFOLIO

19.21.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 QUESTIONNAIRE

21 CONCLUSION

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Sauces Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sauces Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sauces Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.