Global Schottky Diode Market

Market Size in USD Billion

CAGR :

%

USD

4.00 Billion

USD

6.00 Billion

2025

2033

USD

4.00 Billion

USD

6.00 Billion

2025

2033

| 2026 –2033 | |

| USD 4.00 Billion | |

| USD 6.00 Billion | |

|

|

|

|

Schottky Diode Market Size

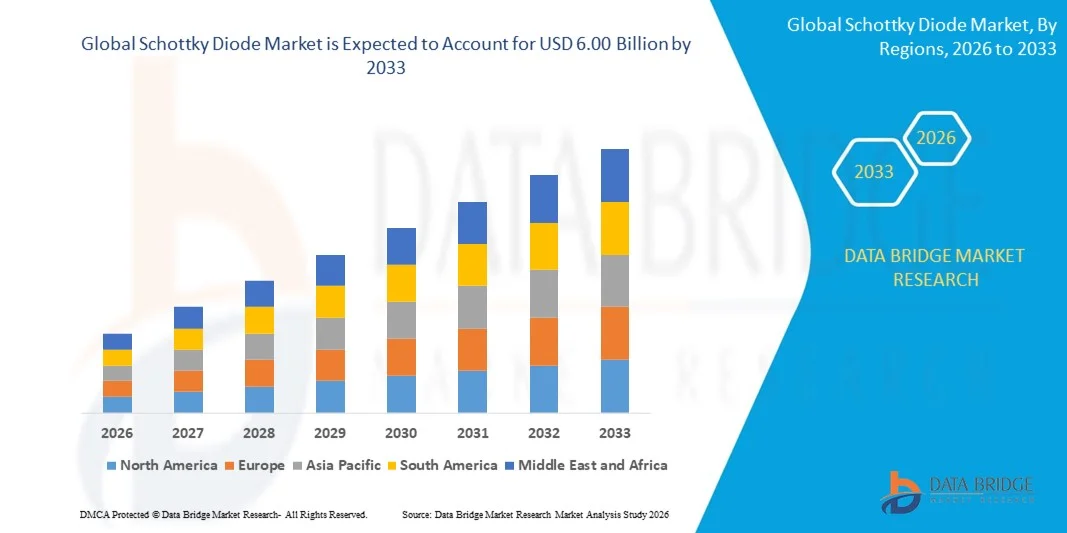

- The global schottky diode market size was valued at USD 4.00 billion in 2025 and is expected to reach USD 6.00 billion by 2033, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by the increasing adoption of energy-efficient power electronics and advanced semiconductor technologies across automotive, industrial, consumer electronics, and renewable energy applications, driving demand for high-performance Schottky diodes

- Furthermore, the rising need for faster switching, lower forward voltage drop, and improved thermal efficiency in devices such as DC-DC converters, inverters, and power management systems is reinforcing the adoption of Schottky diodes. These factors are accelerating the integration of Schottky diodes in modern electronic systems, thereby significantly boosting market expansion

Schottky Diode Market Analysis

- Schottky diodes, known for their low forward voltage drop, fast switching speed, and high efficiency, are increasingly vital components in power rectification, energy conversion, and signal processing across automotive, industrial, and consumer electronics applications

- The escalating demand for Schottky diodes is primarily fueled by the growth of electric vehicles, renewable energy systems, high-performance computing, and communication infrastructure, along with the emphasis on miniaturized, energy-efficient, and high-reliability semiconductor solutions

- North America dominated the schottky diode market in 2025, due to robust semiconductor infrastructure, advanced electronics manufacturing, and strong adoption in automotive, industrial, and energy‑efficient systems

- Asia-Pacific is expected to be the fastest growing region in the schottky diode market during the forecast period due to the region’s dominant electronics manufacturing base and high demand across consumer electronics, automotive electronics, and industrial automation sectors

- SMD segment dominated the market with a market share of 71.5% in 2025, due to its compact size, ease of automated assembly, and suitability for high-density PCB designs. SMD Schottky diodes are widely preferred in modern electronic devices due to their fast switching speed and low forward voltage drop, which improve overall device efficiency. Their compatibility with miniaturized circuits in consumer electronics, automotive electronics, and communication equipment further strengthens their market dominance

Report Scope and Schottky Diode Market Segmentation

|

Attributes |

Schottky Diode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Schottky Diode Market Trends

Rising Adoption of Silicon Carbide (SiC) Schottky Diodes

- A notable trend in the Schottky diode market is the increasing adoption of silicon carbide (SiC) technology, which offers higher efficiency, faster switching speeds, and better thermal performance compared with conventional silicon-based diodes. This trend is largely driven by the growing demand for energy-efficient power electronics across automotive, industrial, and renewable energy applications

- For instance, Wolfspeed (a Cree company) supplies high-performance SiC Schottky diodes used in electric vehicle inverters and solar inverters, supporting higher power density and improved system efficiency. Such diodes are enabling manufacturers to design compact, energy-saving power conversion solutions

- The automotive sector is accelerating the use of SiC Schottky diodes in electric vehicles (EVs) and hybrid electric vehicles (HEVs) to enhance battery efficiency, reduce power losses, and support fast-charging infrastructure. This is positioning Schottky diodes as essential components in the EV powertrain and energy management systems

- Industrial applications are increasingly integrating Schottky diodes in motor drives, power supplies, and uninterruptible power systems (UPS) to minimize energy losses and improve reliability. Their high-temperature tolerance and low forward voltage drop are making them preferred choices for heavy-duty applications

- Renewable energy systems, particularly photovoltaic inverters and wind energy converters, are adopting Schottky diodes to enhance conversion efficiency and reduce heat generation. The trend is fostering innovation in green energy electronics and contributing to sustainable power solutions

- The demand for high-frequency and high-speed power electronics in telecommunications and data centers is also driving Schottky diode adoption, as their fast recovery time reduces switching losses. This is reinforcing the positioning of Schottky diodes as critical enablers of modern energy-efficient electronics

Schottky Diode Market Dynamics

Driver

Increasing Demand for Energy-Efficient Power Electronics

- The growing emphasis on reducing energy consumption in automotive, industrial, and renewable energy sectors is driving demand for Schottky diodes that provide low forward voltage drop, fast switching, and high thermal stability. These features improve overall system efficiency and reduce operational energy costs

- For instance, Infineon Technologies produces SiC Schottky diodes widely used in EV inverters and industrial power supplies, enabling higher energy efficiency and reduced heat generation. These diodes help system designers meet stricter efficiency and emission standards

- The expansion of electric mobility and hybrid industrial machinery is creating increased need for energy-efficient power conversion components. Schottky diodes are central to achieving lower power loss and higher system reliability in such applications

- The surge in renewable energy installations, including solar and wind power, requires high-efficiency diode solutions for inverters and power conditioning systems. This demand is pushing manufacturers to innovate and scale advanced Schottky diode technologies

- Data centers and telecommunication infrastructure are adopting high-speed, low-loss diodes to optimize power distribution and reduce energy costs. The trend toward greener, high-performance data centers continues to reinforce the need for advanced Schottky diodes

Restraint/Challenge

High Manufacturing Costs of Advanced Schottky Diodes

- The Schottky diode market faces challenges due to the high costs associated with manufacturing advanced SiC-based devices, which require specialized substrates, epitaxial growth processes, and precision fabrication equipment. These factors elevate overall production costs and impact pricing strategies

- For instance, STMicroelectronics invests in sophisticated SiC wafer processing and diode assembly lines to produce high-performance Schottky devices. Such advanced manufacturing techniques demand significant capital expenditure and skilled labor, limiting cost flexibility

- The complexity of ensuring consistent quality, reliability, and thermal performance in high-voltage applications further adds to production expenses. These requirements extend development timelines and increase operational overheads

- Raw material availability and high-cost semiconductor substrates contribute to supply-side constraints. Manufacturers must balance the need for superior performance with cost optimization to remain competitive

- Scaling production while maintaining efficiency and performance standards remains challenging, particularly for high-power applications in EVs and industrial systems. This continues to restrain market expansion despite growing demand for energy-efficient Schottky diodes

Schottky Diode Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the Schottky diode market is segmented into SMD, radial-lead, and screw mount. The SMD (Surface-Mount Device) segment dominated the market with the largest revenue share of 71.5% in 2025, driven by its compact size, ease of automated assembly, and suitability for high-density PCB designs. SMD Schottky diodes are widely preferred in modern electronic devices due to their fast switching speed and low forward voltage drop, which improve overall device efficiency. Their compatibility with miniaturized circuits in consumer electronics, automotive electronics, and communication equipment further strengthens their market dominance.

The radial-lead segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in power supply units, inverters, and industrial electronics where robust mechanical strength and high current handling are critical. Radial-lead Schottky diodes offer enhanced thermal performance and durability, making them suitable for high-power and high-reliability applications. Their growing use in industrial automation and renewable energy systems contributes to the segment’s accelerating growth.

- By Application

On the basis of application, the Schottky diode market is segmented into switching, power supply, inverter, driver, LNB mixers, WLAN detector, low barrier detector, 24GHz radar, and others. The power supply segment dominated the market with the largest revenue share in 2025 due to the increasing demand for efficient rectification in AC-DC and DC-DC power converters. Power supply applications benefit from Schottky diodes’ low forward voltage drop, high efficiency, and fast recovery time, which are essential for energy-efficient and compact power systems. Their extensive use in industrial equipment, consumer electronics, and automotive power modules reinforces this dominance.

The switching application segment is expected to witness the fastest growth from 2026 to 2033, driven by its critical role in high-speed circuits and switching power supplies. For instance, companies such as ON Semiconductor leverage Schottky diodes for high-frequency switching applications in computing and communication systems. The fast response time and low power loss of Schottky diodes enhance switching efficiency, making them increasingly favored in industrial automation and modern electronic designs.

- By End User

On the basis of end user, the Schottky diode market is segmented into industrial, automotive, communication, consumer electronics, telecommunication, and others. The industrial segment dominated the market with the largest revenue share in 2025, owing to the extensive use of Schottky diodes in power rectification, inverters, and control circuits in factories and automated processes. Industrial applications benefit from Schottky diodes’ high reliability, thermal stability, and fast switching capabilities, which ensure uninterrupted operation in demanding environments. The segment’s growth is further reinforced by the ongoing adoption of automation and smart manufacturing solutions globally.

The automotive segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the increasing integration of advanced electronics, EVs, and hybrid vehicles requiring efficient power management. For instance, companies such as Infineon utilize Schottky diodes in electric vehicle power electronics to reduce energy loss and improve battery efficiency. The growing trend toward electric mobility, combined with stringent emission regulations and the demand for reliable automotive electronics, is fueling rapid adoption in this segment.

Schottky Diode Market Regional Analysis

- North America dominated the schottky diode market with the largest revenue share in 2025, driven by robust semiconductor infrastructure, advanced electronics manufacturing, and strong adoption in automotive, industrial, and energy‑efficient systems

- North American design and production hubs are pushing demand through innovations in power management, EV electronics, and advanced industrial control applications, encouraging wider use of high‑performance Schottky diodes

- The region’s strong focus on R&D, coupled with incentives such as semiconductor manufacturing initiatives, supports continued market strength, making it a key contributor to global industry revenue. The established presence of major semiconductor companies and a skilled engineering workforce further underpin the region’s leadership in high‑value Schottky diode applications

U.S. Schottky Diode Market Insight

The U.S. Schottky diode market captured a major portion of the North American revenue share in 2025, propelled by rapid adoption of electric vehicles, renewable energy systems, and advanced power electronics that require efficient diode solutions. OEMs and technology manufacturers are integrating Schottky diodes in high‑speed and energy‑efficient circuits, particularly in automotive power converters and industrial automation systems. Continuous investments in semiconductor R&D and manufacturing capacity expansion in the U.S. help sustain strong demand for Schottky components across multiple end‑use sectors.

Europe Schottky Diode Market Insight

The Europe Schottky diode market holds a significant share of the global industry, supported by strong automotive manufacturing, industrial automation, and renewable energy applications. Demand in Europe is bolstered by the region’s emphasis on energy‑efficient technologies and stringent emissions reduction targets, which encourage integration of efficient semiconductor devices such as Schottky diodes into power systems. Countries such as Germany and France are important contributors through advanced engineering sectors and supportive industrial policies that promote high‑performance electronic components usage.

U.K. Schottky Diode Market Insight

The U.K. Schottky diode market is anticipated to grow steadily, driven by investments in industrial electronics, communication systems, and energy‑efficient designs. The region’s advancements in automation, smart infrastructure, and tech innovation create favorable conditions for Schottky diode adoption in both consumer and industrial applications. Furthermore, strong demand for compact, high‑efficiency semiconductor components in power management and communication modules supports regional market expansion.

Germany Schottky Diode Market Insight

The Germany Schottky diode market is expected to grow at a notable pace, fueled by high awareness of advanced electronic solutions and the country’s prominent automotive and industrial sectors. Germany’s emphasis on innovation, sustainability, and quality engineering drives the incorporation of Schottky diodes into power electronics, industrial controllers, and automotive systems. The region’s strong semiconductor supply chain and focus on efficient energy usage further support increasing Schottky diode uptake.

Asia‑Pacific Schottky Diode Market Insight

The Asia‑Pacific Schottky diode market stood as the largest regional segment with an estimated share in 2025, driven by the region’s dominant electronics manufacturing base and high demand across consumer electronics, automotive electronics, and industrial automation sectors. Countries such as China, Japan, and South Korea contribute significantly to this leadership through vast semiconductor production ecosystems and rapid integration of efficient power components. Asia‑Pacific’s role as a global electronics hub encourages extensive Schottky diode deployment in both high‑volume consumer products and emerging technologies, reinforcing its regional dominance.

Japan Schottky Diode Market Insight

The Japan Schottky diode market is gaining momentum owing to the country’s advanced technology culture and strong electronics manufacturing capabilities. Japanese demand emphasizes high‑efficiency solutions for consumer devices, automotive electronics, and industrial equipment, with particular interest in cutting‑edge semiconductor technologies. The integration of Schottky diodes with connected systems and power modules supports growth in both domestic and export‑oriented markets.

China Schottky Diode Market Insight

The China Schottky diode market accounted for a significant portion of the Asia‑Pacific revenue share in 2025, propelled by rapid urbanization, expanding consumer electronics production, and strong domestic demand for efficient power and communication components. China’s position as a leading electronics and semiconductor manufacturing center supports widespread Schottky diode usage in consumer devices, automotive modules, and industrial power systems. The push toward smart manufacturing and integration of semiconductor components into next‑generation technologies further accelerates market growth.

Schottky Diode Market Share

The schottky diode industry is primarily led by well-established companies, including:

- Semiconductor Components Industries, LLC (U.S.)

- Mouser Electronics, Inc. (U.S.)

- ROHM CO., LTD. (Japan)

- Infineon Technologies AG (Germany)

- Microchip Technology Inc. (U.S.)

- Littelfuse, Inc. (U.S.)

- Nexperia (Netherlands)

- Rectron Semiconductor (India)

- Toshiba India Pvt. Ltd. (India)

- TT Electronics (U.K.)

- NXP Semiconductors (Netherlands)

- Shanghai WillSemi (China)

- Diodes Incorporated (U.S.)

- Taiwan Semiconductor (Taiwan)

- WeEn Semiconductors (Taiwan)

Latest Developments in Global Schottky Diode Market

- In June 2025, STMicroelectronics unveiled a new generation of automotive-grade Schottky diodes optimized for 650 V and 1200 V applications, specifically for high-efficiency DC‑DC converters in electric vehicles. These devices provide lower forward voltage and high robustness under automotive conditions, supporting the surge in demand for efficient power electronics in EV powertrains and contributing to wider adoption of high-efficiency semiconductors in the electric mobility sector

- In April 2025, Diodes Incorporated expanded its SiC Schottky portfolio with low figure-of-merit (FOM) 650 V diodes rated from 4 A to 12 A in compact T‑DFN8080‑4 packages, reducing thermal resistance and board space. The design minimizes switching losses and heat dissipation, enhancing system power density and reliability for DC‑DC and AC‑DC conversion in renewable energy, data center, and industrial motor drive applications, reinforcing adoption in energy-efficient power electronics

- In January 2025, Vishay Intertechnology launched 16 new 650 V and 1200 V SiC Schottky diodes in SOT‑227 packages designed for enhanced efficiency, low forward voltage drop, and superior high-frequency switching performance. Supporting currents from 40 A to 240 A, these diodes target photovoltaic systems, industrial UPS units, charging stations, and telecom power modules, addressing the growing need for high-performance, high-efficiency semiconductor components

- In March 2024, Diodes Incorporated announced its SDT2U30CP3 (30 V/2 A), SDT2U40CP3 (40 V/2 A), and SDT2U60CP3 (60 V/2 A) series achieving the industry’s highest current densities in their class, featuring low forward voltage drop and thermal resistance. These high-current trench Schottky rectifiers in a compact chip-scale package (CSP) occupying only 0.84 mm² board space address design challenges for smaller, more efficient portable, mobile, and wearable devices. The series’ versatility for blocking, reverse-polarity protection, boost, and switching applications strengthens Diodes’ position in the growing consumer electronics and wearable device segments

- In May 2023, Vishay Intertechnology introduced 17 new Gen 3 650 V silicon carbide (SiC) Schottky diodes with a merged PIN Schottky (MPS) design, offering high surge current robustness, low forward voltage drop, and minimal reverse leakage. These 4 A to 40 A devices in through-hole and surface-mount packages improve efficiency and reliability in switching power designs, catering to increasing demand in industrial power supplies, renewable energy systems, and telecom power modules

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Schottky Diode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Schottky Diode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Schottky Diode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.