Global Security Analytics Zero Security Market

Market Size in USD Billion

CAGR :

%

USD

38.39 Billion

USD

115.03 Billion

2025

2033

USD

38.39 Billion

USD

115.03 Billion

2025

2033

| 2026 –2033 | |

| USD 38.39 Billion | |

| USD 115.03 Billion | |

|

|

|

|

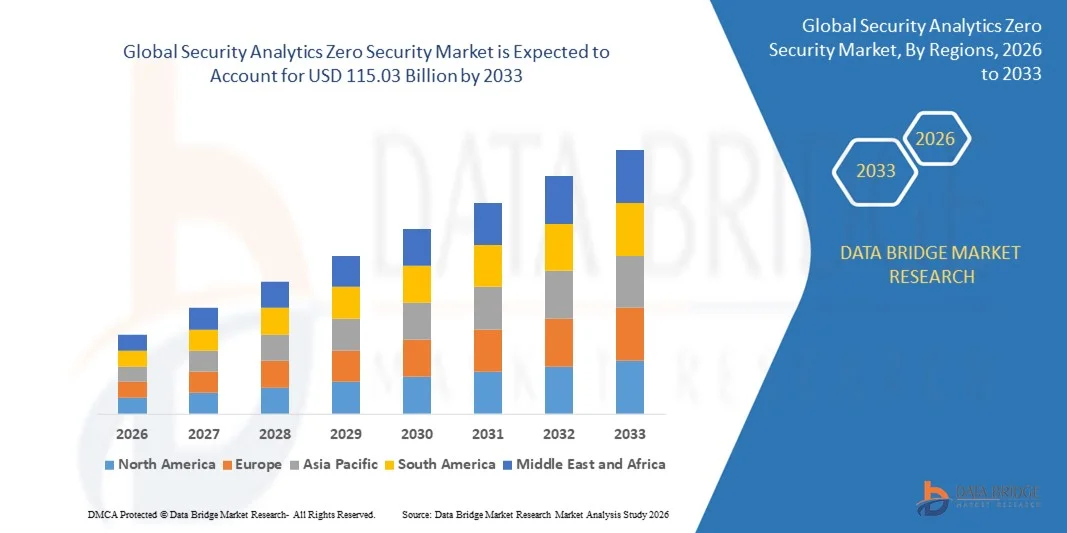

What is the Global Security Analytics Zero Security Market Size and Growth Rate?

- The global security analytics zero security market size was valued at USD 38.39 billion in 2025 and is expected to reach USD 115.03 billion by 2033, at a CAGR of14.70% during the forecast period

- The security analytics zero security market has a huge potential and is expected grow, owing to the rise in regulations for data protection and information security

- In addition, the high frequency of target-based cyber-attacks across the world and the rise in the farm cyber threats from advanced targeted attacks (ATA) or advanced persistent threats (APT) are also largely influencing the growth of the security analytics zero security market

What are the Major Takeaways of Security Analytics Zero Security Market?

- Rise in adoption of mobile devices is another driver anticipated to flourish the security analytics zero security market growth

- In addition, the high demand for cloud computing technologies and internet of things are also expected to boost the growth of the security analytics zero security market in the above mentioned forecast period

- North America dominated the security analytics zero security market with an estimated 43.2% revenue share in 2025, driven by the presence of leading IT enterprises, advanced cybersecurity infrastructure, and rapid adoption of AI-driven security solutions across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.18% from 2026 to 2033, driven by rapid digitalization, growing IT infrastructure, 5G deployment, and increasing adoption of cloud-based and AI-powered security analytics solutions across China, Japan, India, South Korea, and Southeast Asia

- The Cloud deployment segment dominated the market with an estimated 45.2% share in 2025, driven by enterprises’ growing preference for scalable, flexible, and remote-accessible security platforms

Report Scope and Security Analytics Zero Security Market Segmentation

|

Attributes |

Security Analytics Zero Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Security Analytics Zero Security Market?

Increasing Shift Toward Cloud-Enabled, Multi-Factor, and AI-Integrated Security Analytics Solutions

- The security analytics zero security market is witnessing strong adoption of cloud-based, AI-powered, and real-time monitoring platforms designed to support threat detection, identity management, and compliance in enterprise networks

- Vendors are introducing multi-factor authentication, behavior-based analytics, and software-defined security platforms that offer automated alerts, deep visibility, and integration with modern IT ecosystems

- Growing demand for cost-efficient, scalable, and user-friendly security solutions is driving adoption across IT operations, finance, healthcare, retail, and government organizations

- For instance, companies such as Cisco Systems, IBM, Okta, Trend Micro, and Check Point Software have upgraded their platforms with enhanced threat intelligence, multi-tenant support, and AI-driven anomaly detection

- Increasing need for rapid incident response, continuous monitoring, and centralized identity management is accelerating the shift toward cloud-integrated and AI-enhanced platforms

- As digital transformation intensifies, Security Analytics Zero Security solutions remain vital for real-time threat prevention, compliance management, and enterprise-scale security operations

What are the Key Drivers of Security Analytics Zero Security Market?

- Rising demand for advanced identity management, threat detection, and compliance solutions across enterprises of all sizes is driving market growth

- For instance, in 2025, leading companies such as Okta, IBM, and Trend Micro expanded their security analytics portfolios with multi-factor authentication, AI-based anomaly detection, and cloud-native management capabilities

- Growing adoption of cloud computing, IoT networks, remote workforce setups, and smart automation systems is boosting demand for centralized security analytics across the U.S., Europe, and Asia-Pacific

- Advancements in AI-driven monitoring, real-time threat intelligence, and automated response platforms have strengthened operational efficiency, scalability, and decision-making speed

- Increasing cyber risks, ransomware attacks, and complex network environments are creating demand for integrated, high-performance security analytics platforms

- Supported by steady investments in enterprise cybersecurity, cloud infrastructure, and compliance initiatives, the security analytics zero security market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Security Analytics Zero Security Market?

- High costs associated with enterprise-grade, AI-powered, and cloud-integrated security platforms restrict adoption among small organizations and emerging markets

- For instance, during 2024–2025, fluctuations in cybersecurity software pricing, licensing models, and cloud subscription costs increased total deployment expenses for several global vendors

- Complexity in integrating multi-factor authentication, AI monitoring, and cloud-based analytics increases the need for skilled IT professionals and training programs

- Limited awareness in emerging markets regarding security analytics capabilities, compliance requirements, and best practices slows adoption

- Competition from standalone firewalls, antivirus software, SIEM tools, and identity management solutions creates pricing pressure and reduces product differentiation

- To address these challenges, companies are focusing on cost-optimized subscription models, cloud-native architectures, AI-assisted threat detection, and integrated training resources to increase global adoption of security analytics zero security solutions

How is the Security Analytics Zero Security Market Segmented?

The market is segmented on the basis of type, deployment mode, authentication type, organization size, and end user.

- By Deployment Mode

On the basis of deployment mode, the security analytics zero security market is segmented into Cloud and On-Premises. The Cloud deployment segment dominated the market with an estimated 45.2% share in 2025, driven by enterprises’ growing preference for scalable, flexible, and remote-accessible security platforms. Cloud-based solutions offer real-time threat detection, automated updates, and integration with AI-driven analytics, enabling rapid deployment across IT and OT environments. High adoption in finance, healthcare, and IT sectors is further boosting market dominance.

The On-Premises deployment segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by organizations requiring data sovereignty, enhanced control, and compliance with strict regulatory frameworks. Increasing demand from government, defense, and large enterprises for highly secure, locally managed solutions is driving rapid adoption globally.

- By Authentication Type

On the basis of authentication type, the security analytics zero security market is segmented into Single-Factor Authentication (SFA) and Multi-Factor Authentication (MFA). The Multi-Factor Authentication (MFA) segment dominated the market with a 52.6% share in 2025, owing to rising cybersecurity threats, regulatory mandates, and the need for enhanced identity protection in enterprises. MFA combines passwords, biometrics, and token-based verification, significantly reducing the risk of breaches.

The Single-Factor Authentication segment is projected to grow at the fastest CAGR from 2026 to 2033, particularly among SMEs and emerging markets, where cost-effective, easy-to-deploy identity solutions are increasingly adopted to secure cloud applications, remote workforce access, and SaaS platforms.

- By Organization Size

On the basis of organization size, the security analytics zero security market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprise segment dominated the market with a 49.8% share in 2025, driven by extensive IT infrastructure, multi-location networks, and critical reliance on robust security analytics platforms. Large enterprises are increasingly adopting cloud-integrated and AI-enabled solutions for threat detection, compliance, and incident response.

The SME segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising cybersecurity awareness, affordable cloud-based deployments, and regulatory requirements for data protection. SMEs are investing in scalable security analytics platforms to safeguard cloud applications, remote access, and IoT ecosystems.

- By End User

On the basis of end user, the security analytics zero security market is segmented into IT and ITES, Finance and Insurance, Healthcare and Social Assistance, Retail Trade, Utilities, and Others. The Finance and Insurance segment dominated the market with a 38.4% share in 2025, driven by the critical need for real-time threat detection, identity protection, and regulatory compliance. High adoption of cloud and AI-based security platforms ensures secure digital banking, fintech services, and insurance operations.

The Healthcare and Social Assistance segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increased digitization of medical records, telemedicine platforms, and connected healthcare devices. Rising cyber threats in healthcare and strict data privacy regulations are driving the adoption of advanced Security Analytics Zero Security solutions in the sector.

Which Region Holds the Largest Share of the Security Analytics Zero Security Market?

- North America dominated the security analytics zero security market with an estimated 43.2% revenue share in 2025, driven by the presence of leading IT enterprises, advanced cybersecurity infrastructure, and rapid adoption of AI-driven security solutions across the U.S. and Canada. High deployment of cloud platforms, enterprise identity management, and network monitoring tools continues to fuel demand for Security Analytics Zero Security solutions in finance, IT, healthcare, and government sectors

- Leading companies in North America are introducing AI-enabled, multi-factor authentication, and cloud-integrated security analytics platforms, strengthening the region’s technological advantage. Continuous investment in cybersecurity R&D, IoT infrastructure, and high-performance computing drives long-term market expansion

- Strong innovation ecosystems, a skilled IT workforce, and extensive investment in enterprise cybersecurity initiatives further reinforce North America’s market leadership

U.S. Security Analytics Zero Security Market Insight

The U.S. is the largest contributor in North America, supported by widespread adoption of cloud-based security analytics, AI threat detection, and multi-factor authentication solutions across IT, finance, healthcare, telecom, and industrial sectors. Rising cybersecurity threats, regulatory compliance mandates, and demand for advanced incident response platforms intensify adoption. Presence of global cybersecurity leaders and high startup activity further drives market growth.

Canada Security Analytics Zero Security Market Insight

Canada contributes steadily to regional growth, driven by government-backed cybersecurity initiatives, enterprise adoption of cloud-based identity management, and industrial digitalization. Companies and universities increasingly leverage advanced Security Analytics Zero Security solutions for secure IT operations, compliance management, and threat monitoring. Skilled workforce availability and focus on emerging technologies, such as AI and robotics, further strengthen adoption.

Asia-Pacific Security Analytics Zero Security Market

Asia-Pacific is projected to register the fastest CAGR of 8.18% from 2026 to 2033, driven by rapid digitalization, growing IT infrastructure, 5G deployment, and increasing adoption of cloud-based and AI-powered security analytics solutions across China, Japan, India, South Korea, and Southeast Asia. Rising cybersecurity risks in enterprise networks, fintech, and industrial automation are boosting demand.

China Security Analytics Zero Security Market Insight

China is the largest contributor within Asia-Pacific due to massive IT infrastructure investments, strong enterprise adoption of cloud platforms, and government-driven cybersecurity initiatives. Growing deployment of AI-based threat detection, multi-factor authentication, and compliance solutions accelerates demand for Security Analytics Zero Security platforms with high scalability and real-time monitoring capabilities.

Japan Security Analytics Zero Security Market Insight

Japan shows steady growth supported by advanced IT infrastructure, precision manufacturing, and digital transformation in enterprises. Adoption of high-performance security analytics solutions for identity management, cloud security, and AI-based threat detection reinforces premium segment demand.

India Security Analytics Zero Security Market Insight

India is emerging as a key growth hub, driven by rapid expansion of IT and fintech sectors, government-backed digitalization programs, and growing SME cybersecurity adoption. Increasing use of cloud-based, AI-integrated, and multi-factor security solutions in enterprises accelerates market penetration.

South Korea Security Analytics Zero Security Market Insight

South Korea contributes significantly due to strong demand for cloud platforms, AI-powered security solutions, and high-performance enterprise IT infrastructure. Rising adoption of advanced processors, industrial automation, and digital services drives the need for high-accuracy Security Analytics Zero Security platforms. Technological innovation and expanding digital ecosystems support sustained market growth.

Which are the Top Companies in Security Analytics Zero Security Market?

The security analytics zero security industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Akamai Technologies (U.S.)

- Okta (U.S.)

- Trend Micro Incorporated (Japan)

- IBM (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Broadcom (U.S.)

- FireEye, Inc. (U.S.)

- McAfee, LLC (U.S.)

- RSA Security LLC (U.S.)

- Forcepoint (U.S.)

- Centrify Corporation (U.S.)

- Cyxtera Technologies, Inc. (U.S.)

- Illumio (U.S.)

- Sophos Ltd. (U.K.)

- Qnext Corp. (U.S.)

- Google (U.S.)

- Microsoft (U.S.)

- Cloudflare, Inc. (U.S.)

- VMware, Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.