Global Shopping Cart Market

Market Size in USD Million

CAGR :

%

USD

796.06 Million

USD

5,187.12 Million

2024

2032

USD

796.06 Million

USD

5,187.12 Million

2024

2032

| 2025 –2032 | |

| USD 796.06 Million | |

| USD 5,187.12 Million | |

|

|

|

|

Shopping Cart Market Analysis

The global shopping cart market is experiencing steady growth, driven by the expansion of the retail sector, increasing consumer demand for convenient shopping experiences, and advancements in cart design and materials. The rise of supermarkets, hypermarkets, and e-commerce-integrated physical stores has fueled the need for innovative shopping carts that enhance customer convenience and store efficiency. Manufacturers are focusing on advancements such as lightweight yet durable materials such as stainless steel, plastic hybrids, and aluminum to improve cart longevity and maneuverability. In addition, the integration of smart shopping carts equipped with RFID scanners, barcode readers, and touchscreens is transforming the retail shopping experience by enabling self-checkout and real-time product tracking. The demand for foldable and space-saving carts is also rising, especially in urban areas with limited store space. Sustainability is another key factor, with retailers adopting eco-friendly carts made from recycled materials to reduce their carbon footprint. With the increasing adoption of automation and artificial intelligence in retail, the shopping cart market is expected to witness further technological advancements, making shopping more seamless and efficient while driving market expansion globally.

Shopping Cart Market Size

The shopping cart market size was valued at USD 796.06 million in 2024 and is projected to reach USD 5187.12 million by 2032, with a CAGR of 26.40% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Shopping Cart Market Trends

“Increasing Adoption of Smart Shopping Carts”

One significant trend in the shopping cart market is the increasing adoption of smart shopping carts integrated with RFID scanners, barcode readers, and touchscreen displays to enhance the shopping experience and streamline checkout processes. These technologically advanced carts are gaining traction in supermarkets, hypermarkets, and retail chains, offering customers a more efficient, contactless, and personalized shopping journey. For instance, Amazon Dash Cart utilizes computer vision and sensor fusion to automatically detect and total items, allowing shoppers to skip traditional checkout lines. Similarly, major retailers are investing in AI-powered smart carts that provide real-time promotions, shopping list synchronization, and in-cart payment options, reducing waiting times and improving store efficiency. With the growing demand for automation and digital transformation in retail, the integration of smart shopping carts is expected to drive market growth, offering a seamless, time-saving, and interactive shopping experience while enhancing customer satisfaction and operational efficiency.

Report Scope and Shopping Cart Segmentation

|

Attributes |

Shopping Cart Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Wanzl India Pvt Ltd (India), Sambo Corp. (South Korea), Marmon Retail Solutions (U.S.), Cefla s.c. (Italy), Versacart Systems, Inc. (U.S.), Advance Carts, Inc. (U.S.), NATIONAL CART (U.S.), Patrick van Keulen (Netherlands), Americana Companies (U.S.), Kailiou Commercial Equipment Co., Ltd (China), Shanghai Rongxin Hardware Factory (China), Changshu Yirunda Business Equipment Factory (China), Suzhou Hongyuan Business Equipment Co., Ltd (China), CANADA’S BEST STORE FIXTURES (Canada), R.W. Rogers Company (U.S.), and The Peggs Company, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shopping Cart Market Definition

A shopping cart is a wheeled basket or trolley used by customers in supermarkets, retail stores, and shopping malls to conveniently transport selected goods while shopping. Typically made from metal, plastic, or hybrid materials, shopping carts come in various sizes and designs, including standard carts, basket carts, and tote boxes, to accommodate different shopping needs.

Shopping Cart Market Dynamics

Drivers

- Expansion of the Retail and Supermarket Industry

The continuous expansion of supermarkets, hypermarkets, and retail chains has led to a surge in the demand for shopping carts, as these establishments prioritize customer convenience and efficiency. Large retailers are investing in ergonomic, high-capacity, and durable shopping carts to accommodate bulk purchases and enhance the in-store shopping experience. For instance, Walmart and Costco, two of the largest retail chains, have aggressively expanded their store networks, particularly in emerging markets, which has significantly driven the demand for advanced and sturdy shopping carts. In addition, the shift towards warehouse-style retailing has led to the adoption of larger carts with higher load capacities, supporting the needs of bulk-buying consumers. This trend positions the expansion of the retail and supermarket sector as a major driver for the shopping cart market, as businesses continuously upgrade their cart designs to meet evolving customer demands.

- Rising Adoption of Smart Shopping Carts

The integration of technology in shopping carts is revolutionizing the retail industry by enhancing convenience, improving store efficiency, and reducing checkout times. Smart shopping carts equipped with self-checkout systems, RFID tracking, and digital payment integration are gaining popularity, allowing consumers to scan and pay for items directly while shopping. Retail giants such as Amazon and Kroger have introduced advanced shopping carts such as Amazon Dash Cart, which automatically detects items placed inside, calculates the total, and enables a seamless exit without waiting in checkout lines. These technological advancements improve the overall shopping experience and help retailers reduce labor costs and optimize store operations. As a result, the growing adoption of smart shopping carts is emerging as a crucial market driver, encouraging retailers to invest in innovative, automated, and AI-enabled shopping solutions to stay competitive in the evolving retail landscape.

Opportunities

- Growth in E-Commerce and Omnichannel Retailing

Despite the rapid expansion of e-commerce, physical retail stores remain an integral part of the shopping experience. To stay competitive, brick-and-mortar retailers are embracing omnichannel strategies, integrating both online and offline shopping. Shopping carts are now playing a crucial role in this transformation by enabling hybrid shopping experiences. Retailers are introducing smart carts equipped with barcode scanners and digital connectivity, allowing customers to scan products in-store, add them to their online accounts, and opt for home delivery if needed. For instance, Walmart and Target have implemented app-connected shopping carts that synchronize with online accounts, streamlining the checkout process and enhancing shopping convenience. This trend positions the integration of omnichannel retailing as a major market opportunity, driving innovation in cart designs to offer seamless cross-platform purchasing experiences.

- Increasing Demand for Ergonomic and Lightweight Carts

Retailers are increasingly adopting lightweight, plastic hybrid carts that enhance maneuverability, durability, and sustainability, catering to the evolving needs of consumers. Traditional metal carts are being replaced with compact, foldable, and multi-tier carts, designed for urban stores with limited space and improved ease of use. For instance, IKEA has introduced lightweight, stackable shopping carts that reduce storage space and provide a more efficient in-store experience. In addition, sustainability concerns have led manufacturers to develop recyclable and biodegradable cart materials, aligning with eco-friendly retail initiatives. The demand for ergonomic and sustainable shopping carts presents a lucrative market opportunity, as retailers increasingly prioritize customer comfort, space efficiency, and environmentally responsible solutions to enhance their brand reputation and meet regulatory requirements.

Restraints/Challenges

- High Initial Investment and Maintenance Costs

The production of durable, high-quality shopping carts requires a significant financial commitment, particularly in terms of materials, manufacturing processes, and technological enhancements. Modern shopping carts, especially smart carts equipped with RFID tracking, self-checkout systems, and digital payment integration, further escalate costs, making them difficult to adopt for small and mid-sized retailers with limited budgets. In addition, regular maintenance, repairs, and replacement of damaged carts add to long-term operational expenses. For instance, Walmart and Target collectively spend millions annually on shopping cart maintenance and theft prevention. To mitigate these costs, some retailers have turned to leasing options or durable, cost-effective plastic hybrid carts, but maintaining a balance between affordability and functionality remains a significant hurdle.

- Space Constraints in Urban Retail Stores

As urbanization continues, retail stores in densely populated cities face challenges in accommodating large, traditional shopping carts due to limited floor space and narrow aisles. Many city-based supermarkets, convenience stores, and mini-marts are now shifting toward compact, foldable, or multi-tier basket carts to optimize space without compromising customer convenience. However, the challenge lies in designing carts that maintain sufficient storage capacity while remaining maneuverable in smaller store layouts. For instance, supermarkets in Tokyo and New York have adopted collapsible carts and hybrid basket systems, allowing for a smoother shopping experience in tight spaces. Despite these innovations, striking a balance between cart size, storage efficiency, and ease of use remains a complex issue for urban retailers.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Shopping Cart Market Scope

The market is segmented on the basis of product type, material, wheel, distribution channel, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Roller Basket

- Child Cart

- Tote Box

- Basket Cart

- Others

Material

- Stainless Steel

- Metal / Wire

- Plastic Hybrid

- Others

Wheel

- Three Wheel

- Four Wheel

Application

- Supermarkets

- Shopping Malls

- Others

Distribution Channel

- Online

- Offline

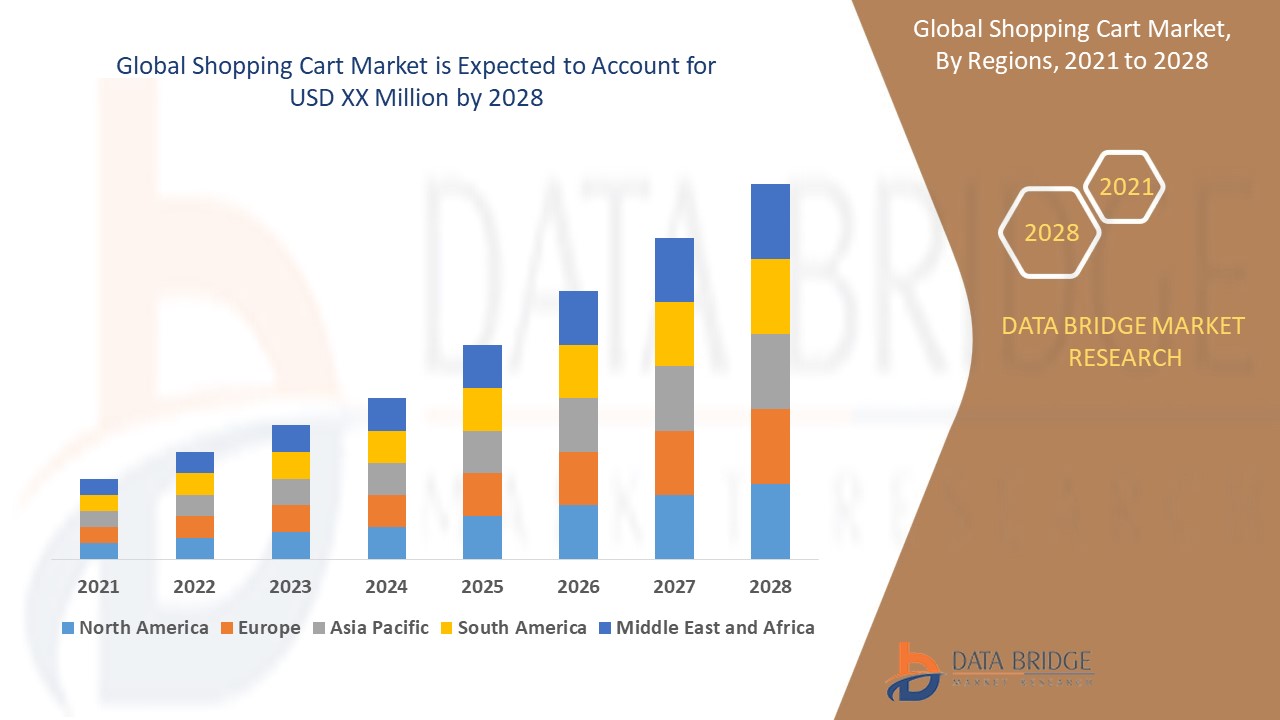

Shopping Cart Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, material, wheel, distribution channel, and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

North America is expected to dominate the shopping cart market, driven by the rapid expansion of the retail sector and the presence of a well-established manufacturing base. The region's strong consumer demand, coupled with the rise of large supermarket chains and shopping malls, is further fueling market growth. In addition, advancements in cart design, including lightweight materials and smart shopping features, are enhancing the shopping experience and increasing adoption. The widespread availability of raw materials and a strong supply chain network also contribute to North America's dominance in the shopping cart market.

Asia-Pacific is anticipated to experience fastest growth in the shopping cart market from 2025 to 2032, driven by the rapid expansion of supermarkets and hypermarkets. The increasing demand for diverse shopping cart designs, including smart and ergonomic models, is further boosting market growth. In addition, the presence of a wide variety of shopping carts, catering to different consumer preferences and retail store requirements, is contributing to market expansion. However, the abundance of counterfeit products in the region presents a challenge, impacting the sales of genuine, high-quality shopping carts.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Shopping Cart Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Shopping Cart Market Leaders Operating in the Market Are:

- Wanzl India Pvt Ltd (India)

- Sambo Corp. (South Korea)

- Marmon Retail Solutions (U.S.)

- Cefla s.c. (Italy)

- Versacart Systems, Inc. (U.S.)

- Advance Carts, Inc. (U.S.)

- NATIONAL CART (U.S.)

- Patrick van Keulen (Netherlands)

- Americana Companies (U.S.)

- Kailiou Commercial Equipment Co., Ltd (China)

- Shanghai Rongxin Hardware Factory (China)

- Changshu Yirunda Business Equipment Factory (China)

- Suzhou Hongyuan Business Equipment Co., Ltd (China)

- CANADA’S BEST STORE FIXTURES (Canada)

- R.W. Rogers Company (U.S.)

- The Peggs Company, Inc. (U.S.)

Latest Developments in Shopping Cart Market

- In December 2024, Walmart Chile collaborated with Shopic to introduce AI-powered smart carts, revolutionizing the retail industry in Chile

- In April 2024, Amazon revealed its plans to extend Dash carts to third-party grocers, expanding its checkout technology beyond Amazon grocery stores and Whole Foods Market

- In January 2024, Microsoft introduced new generative AI and data-driven solutions throughout the shopper journey, enhancing retail experiences with copilot features through Microsoft Cloud for Retail

- In May 2023, grocery smart cart provider Shopic partnered with the Microsoft Experience Center EMEA in Munich to showcase its advanced smart cart technology

- In September 2022, Seattle-based startup Veeve expanded its checkout-free smart shopping cart technology from grocery stores to big-box retailers by introducing an innovative attachment that converts traditional carts into smart carts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Shopping Cart Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shopping Cart Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shopping Cart Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.