Global Shrimp Feed Market

Market Size in USD Billion

CAGR :

%

USD

2.63 Billion

USD

3.92 Billion

2025

2033

USD

2.63 Billion

USD

3.92 Billion

2025

2033

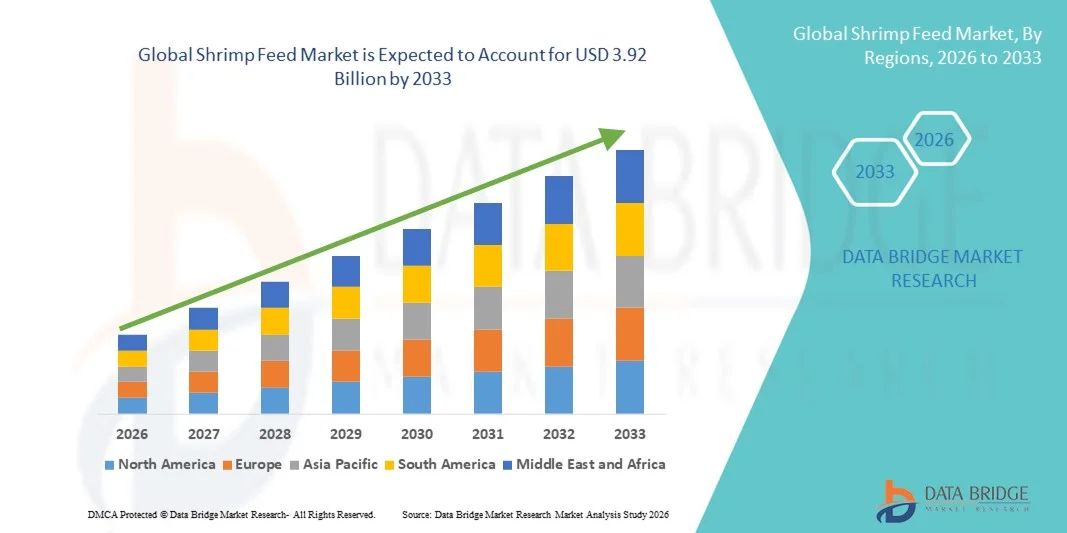

| 2026 –2033 | |

| USD 2.63 Billion | |

| USD 3.92 Billion | |

|

|

|

|

Shrimp Feed Market Size

- The global shrimp feed market size was valued at USD 2.63 billion in 2025 and is expected to reach USD 3.92 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the rising global demand for shrimp driven by increasing seafood consumption and growing preference for protein-rich diets

- Expansion of commercial shrimp farming across Asia-Pacific and Latin America, supported by improved aquaculture practices and higher stocking densities, is contributing to increased feed demand

Shrimp Feed Market Analysis

- The market is witnessing steady growth due to the increasing adoption of formulated feeds over traditional feeding methods to improve yield and reduce mortality rates

- Feed manufacturers are focusing on nutritionally balanced and sustainable feed solutions to address environmental concerns and optimize feed conversion ratios

- Asia-Pacific dominated the shrimp feed market with the largest revenue share in 2025, driven by the strong presence of shrimp aquaculture, rising seafood consumption, and expanding export-oriented shrimp farming activities

- North America region is expected to witness the highest growth rate in the global shrimp feed market, driven by rising aquaculture initiatives, increasing preference for sustainable and functional shrimp feeds, and strong regulatory frameworks supporting quality and safety

- The grower segment held the largest market revenue share in 2025, driven by its extensive use during the longest growth phase of shrimp cultivation. Grower feeds are formulated to support rapid weight gain, efficient feed conversion, and improved survival rates, making them essential for maximizing overall farm productivity across intensive and semi-intensive shrimp farming systems

Report Scope and Shrimp Feed Market Segmentation

|

Attributes |

Shrimp Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shrimp Feed Market Trends

Rising Adoption Of High-Performance And Sustainable Aquafeed Formulations

- The increasing focus on improving shrimp health, growth rates, and feed efficiency is significantly shaping the shrimp feed market, as farmers seek nutritionally balanced and high-performance feed solutions. Advanced shrimp feeds formulated with optimized protein content, essential amino acids, vitamins, and minerals are gaining strong adoption due to their ability to enhance survival rates and reduce feed conversion ratios. This trend supports higher farm productivity and profitability across intensive and semi-intensive shrimp farming systems

- Growing concerns around disease outbreaks and biosecurity are accelerating the demand for functional shrimp feeds enriched with probiotics, prebiotics, immunostimulants, and natural additives. Farmers are increasingly adopting specialized feeds to strengthen shrimp immunity, reduce mortality, and minimize reliance on antibiotics. This has encouraged feed manufacturers to invest in R&D and introduce value-added formulations tailored to different shrimp species and farming conditions

- Sustainability considerations are strongly influencing feed formulation strategies, with rising emphasis on reducing fishmeal dependency and incorporating alternative protein sources such as soybean meal, insect protein, algae, and microbial ingredients. These sustainable inputs help lower environmental impact while ensuring consistent nutritional performance. Feed producers are actively promoting eco-friendly shrimp feed solutions to align with global sustainability goals and responsible aquaculture practices

- For instance, in 2024, BioMar in Denmark and Skretting in Norway expanded their shrimp feed portfolios by introducing functional and low-fishmeal formulations targeted at disease resistance and improved feed efficiency. These products were launched across Asia-Pacific and Latin America to support sustainable shrimp farming and enhance farmer margins. The launches were supported by technical advisory services and on-farm trials to demonstrate performance benefits

- While demand for advanced and sustainable shrimp feed continues to rise, long-term market expansion depends on raw material availability, cost stability, and continuous innovation. Feed manufacturers are focusing on improving digestibility, reducing production costs, and enhancing scalability to ensure wider adoption across small- and medium-scale shrimp farms

Shrimp Feed Market Dynamics

Driver

Rising Demand For High-Yield And Disease-Resistant Shrimp Farming

- Increasing global consumption of shrimp is a key driver for the shrimp feed market, encouraging farmers to maximize production efficiency and output. High-quality shrimp feed plays a critical role in supporting rapid growth, better feed utilization, and consistent harvest cycles, making it an essential input for commercial aquaculture operations. This demand is particularly strong in export-oriented shrimp-producing countries

- Expansion of intensive and super-intensive shrimp farming systems is driving the adoption of nutritionally advanced feeds. These farming models require precisely formulated feeds to maintain water quality, control disease risk, and achieve higher stocking densities. As a result, demand for premium shrimp feed products is rising across major aquaculture regions

- Feed manufacturers are actively collaborating with shrimp farmers and aquaculture institutes to develop customized feed solutions. These partnerships focus on improving feed performance under different environmental conditions and farming practices. Marketing initiatives highlighting productivity gains and cost savings further support market growth

- For instance, in 2023, Cargill in the U.S. and Charoen Pokphand Foods in Thailand reported increased sales of high-performance shrimp feeds designed for intensive farming systems. These products supported improved growth rates and lower mortality, reinforcing farmer confidence and repeat adoption across Asia and Latin America

- Despite strong demand drivers, sustaining growth will require continuous innovation, farmer education, and technical support. Investments in precision nutrition, digital feeding solutions, and sustainable sourcing will be essential to maintain competitiveness and meet evolving industry requirements

Restraint/Challenge

Volatile Raw Material Prices And Environmental Concerns

- Fluctuating prices of key raw materials such as fishmeal, soybean meal, and oils pose a significant challenge for the shrimp feed market. Price volatility affects feed manufacturing costs and profit margins, making it difficult for producers to offer stable pricing to farmers. This challenge is particularly impactful for small-scale farmers operating under tight cost constraints

- Environmental concerns related to overfishing and resource depletion are also restricting the use of traditional marine-based ingredients in shrimp feed. Regulatory pressure and sustainability commitments are forcing feed manufacturers to reformulate products, which can increase R&D and production costs. Ensuring consistent performance while transitioning to alternative ingredients remains a key challenge

- Limited awareness and technical knowledge among farmers in emerging markets further hinder optimal feed utilization. Improper feeding practices can reduce feed efficiency and increase production costs, affecting overall farm profitability. This highlights the need for training programs and on-ground technical support

- For instance, in 2024, shrimp farmers in Vietnam and Indonesia reported margin pressure due to rising feed costs and inconsistent raw material supply. Feed producers supplying brands such as Grobest and De Heus faced challenges in balancing cost, performance, and sustainability, impacting purchasing decisions and feed adoption rates

- Addressing these challenges will require supply chain diversification, investment in alternative protein research, and stronger farmer engagement initiatives. Enhancing feed efficiency, stabilizing input costs, and promoting sustainable aquaculture practices will be critical for unlocking long-term growth in the global shrimp feed market

Shrimp Feed Market Scope

The market is segmented on the basis of type, ingredients, and additives.

- By Type

On the basis of type, the shrimp feed market is segmented into starter, grower, and finisher feed. The grower segment held the largest market revenue share in 2025, driven by its extensive use during the longest growth phase of shrimp cultivation. Grower feeds are formulated to support rapid weight gain, efficient feed conversion, and improved survival rates, making them essential for maximizing overall farm productivity across intensive and semi-intensive shrimp farming systems.

The starter segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing focus on early-stage nutrition and larval survival. Starter feeds with high digestibility and balanced nutrient profiles are gaining popularity as they support healthy development, reduce early mortality, and enhance growth performance during the initial stages of shrimp farming.

- By Ingredients

On the basis of ingredients, the shrimp feed market is segmented into soybean meal, fish meal, wheat flour, fish oil, and others. Fish meal accounted for the largest revenue share in 2025 due to its high protein content, excellent amino acid profile, and strong palatability, which support optimal shrimp growth and feed efficiency. Fish meal remains a critical ingredient in premium shrimp feed formulations, particularly for intensive farming operations.

The soybean meal segment is expected to grow at the fastest rate from 2026 to 2033, driven by rising sustainability concerns and efforts to reduce dependence on marine-based ingredients. Soybean meal is increasingly used as a cost-effective and sustainable protein alternative, supported by advancements in processing techniques that improve digestibility and nutritional performance.

- By Additives

On the basis of additives, the shrimp feed market is segmented into vitamins and proteins, fatty acids, antioxidants, feed enzymes, antibiotics, and others. The vitamins and proteins segment held the largest market share in 2025, as these additives play a crucial role in supporting shrimp growth, immunity, and overall health. Their widespread use is driven by the need to enhance feed quality and improve resistance to environmental stress and diseases.

The feed enzymes segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for improved nutrient absorption and feed efficiency. Feed enzymes help enhance digestibility, reduce waste output, and support sustainable farming practices, making them increasingly attractive to shrimp farmers seeking cost optimization and environmental compliance.

Shrimp Feed Market Regional Analysis

- Asia-Pacific dominated the shrimp feed market with the largest revenue share in 2025, driven by the strong presence of shrimp aquaculture, rising seafood consumption, and expanding export-oriented shrimp farming activities

- Producers in the region emphasize high-quality, nutritionally balanced feed to improve shrimp survival rates, growth performance, and disease resistance, supporting consistent demand across commercial farms

- This dominance is further supported by favorable climatic conditions, availability of coastal farming areas, government support for aquaculture development, and increasing investments in feed formulation technologies, positioning shrimp feed as a critical input for sustainable aquaculture growth

China Shrimp Feed Market Insight

The China shrimp feed market captured a significant revenue share in 2025 within Asia-Pacific, fueled by large-scale shrimp farming operations and strong domestic seafood demand. Feed manufacturers are increasingly focusing on high-protein and functional feed formulations to enhance yield and reduce disease outbreaks. In addition, government initiatives supporting aquaculture modernization and the presence of established feed producers are strengthening market expansion.

Japan Shrimp Feed Market Insight

The Japan shrimp feed market is expected to witness steady growth from 2026 to 2033, driven by advanced aquaculture technologies, strict quality standards, and strong demand for premium seafood. Feed manufacturers emphasize high-quality, functional formulations that enhance shrimp health, feed efficiency, and traceability. The focus on sustainable aquaculture practices and biosecure farming systems continues to support consistent market demand.

North America Shrimp Feed Market Insight

The North America shrimp feed market is expected to witness moderate growth from 2026 to 2033, supported by technological advancements in aquafeed production and rising demand for sustainably farmed shrimp. Producers in the region are focusing on premium and specialty feeds enriched with functional additives to enhance feed efficiency and reduce environmental impact, particularly in controlled and indoor aquaculture systems.

U.S. Shrimp Feed Market Insight

The U.S. shrimp feed market is expected to witness moderate growth from 2026 to 2033 driven by the growing adoption of recirculating aquaculture systems and increasing focus on domestic shrimp production. Feed manufacturers are investing in innovative formulations that support biosecurity, improve feed conversion ratios, and align with sustainability goals, helping strengthen local shrimp farming operations.

Europe Shrimp Feed Market Insight

The Europe shrimp feed market is expected to witness moderate growth from 2026 to 2033, driven by rising interest in alternative protein sources, sustainable aquaculture practices, and controlled shrimp farming projects. European producers prioritize traceability, environmental compliance, and high-quality feed inputs, supporting demand for specialized and eco-friendly shrimp feed solutions.

Germany Shrimp Feed Market Insight

The Germany shrimp feed market is expected to register gradual growth from 2026 to 2033, supported by increasing interest in land-based and recirculating aquaculture systems. German producers prioritize sustainable, low-impact feed formulations with optimized protein sources to meet environmental regulations. Innovation in feed enzymes and alternative ingredients is further contributing to market development.

U.K. Shrimp Feed Market Insight

The U.K. shrimp feed market is expected to register gradual growth from 2026 to 2033, driven by rising investments in indoor shrimp farming and controlled aquaculture facilities. Feed demand is supported by the need for specialized starter and grower feeds that ensure consistent production in limited-space systems. Emphasis on sustainability, quality assurance, and reduced dependency on imports is strengthening the role of advanced shrimp feed solutions in the U.K. market.

Shrimp Feed Market Share

The Shrimp Feed industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Avanti Feeds Ltd. (India)

- BioMar Group A/S (Denmark)

- Cargill, Incorporated (U.S.)

- Charoen Pokphand Foods PCL. (Thailand)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- Growel Feeds Pvt. Ltd. (India)

- Novozymes A/S (Denmark)

- Nutreco (Netherlands)

Latest Developments in Global Shrimp Feed Market

- In September 2025, BioMar (Schouw & Co.) and Innovafeed, product innovation and ingredient integration, announced large-scale incorporation of insect protein into commercial shrimp feed in Ecuador. This development positions black soldier fly meal as a functional ingredient offering health benefits such as antimicrobial properties, strengthening shrimp immunity and accelerating the shift toward sustainable, high-performance feed solutions in the global shrimp feed market

- In December 2024, Thai Union Feedmill, product launch, introduced organic-certified shrimp feed aimed at premium and specialty aquaculture segments. The launch supports residue-free and sustainable shrimp farming, enhancing product differentiation and addressing rising global demand for environmentally responsible and high-quality shrimp feed

- In July 2022, Cargill and Continental Grain Company, acquisition, completed the purchase of Sanderson Farms, expanding protein and feed-related capabilities. This acquisition strengthened Cargill’s integrated agribusiness footprint, supporting long-term supply stability and innovation across global animal nutrition and aquafeed markets

- In June 2024, Avanti Feeds and Indian shrimp exporters, market performance and growth outlook, benefited from expectations of higher global market share for India. Forecasted revenue growth of 8–10% for FY25, combined with supply challenges in Ecuador and Venezuela and potential La Niña impacts, strengthened India’s competitive position in the global shrimp trade

In June 2024, Apex Frozen Foods and Avanti Feeds, financial performance and cost advantage, recorded sharp stock price gains supported by declining feed ingredient prices such as soymeal and fishmeal. Improved profitability enhanced India’s role as a reliable shrimp supplier, reinforcing confidence across the shrimp feed and farming value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.