Global Single Use Bioprocessing Market

Market Size in USD Billion

CAGR :

%

USD

37.75 Billion

USD

131.47 Billion

2025

2033

USD

37.75 Billion

USD

131.47 Billion

2025

2033

| 2026 –2033 | |

| USD 37.75 Billion | |

| USD 131.47 Billion | |

|

|

|

|

Single Use Bioprocessing Market Size

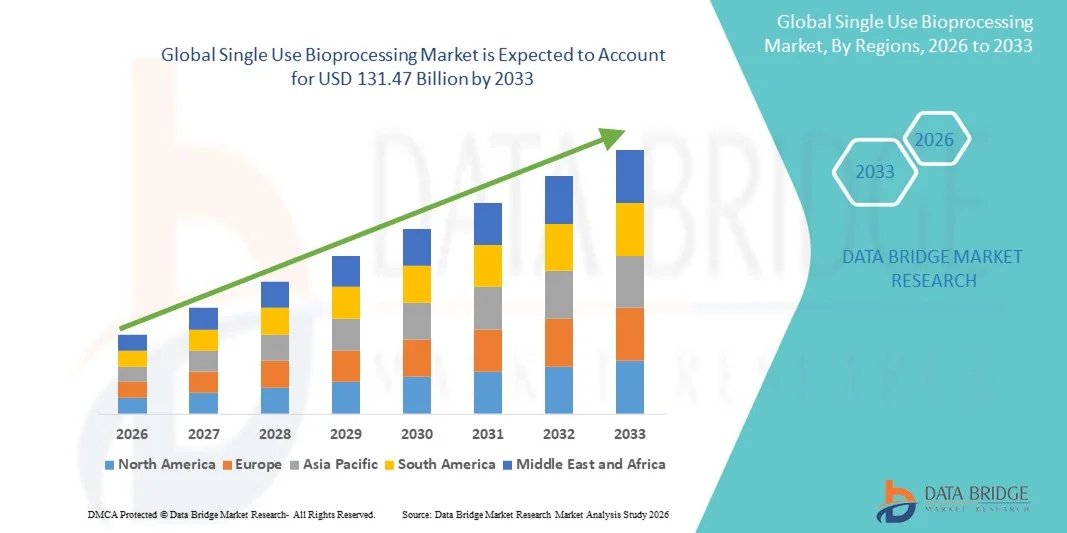

- The global single use bioprocessing market size was valued at USD 37.75 billion in 2025 and is expected to reach USD 131.47 billion by 2033, at a CAGR of 16.88% during the forecast period

- The market growth is largely fueled by the increasing adoption of single-use technologies across biopharmaceutical manufacturing, driven by their benefits such as reduced contamination risks, lower operational costs, faster turnaround times, and greater flexibility in production workflows

- Furthermore, rising demand for efficient, scalable, and clean bioprocessing solutions—especially for vaccine manufacturing, personalized therapies, and biologics production—is establishing single-use systems as a preferred choice over traditional stainless-steel setups. These converging factors are accelerating the uptake of Single Use Bioprocessing solutions, thereby significantly boosting the industry's growth

Single Use Bioprocessing Market Analysis

- Single-use bioprocessing systems, offering disposable components for upstream and downstream biopharmaceutical production, are increasingly vital in modern biologics manufacturing due to their enhanced flexibility, reduced contamination risk, lower capital expenditure, and faster production cycles

- The escalating demand for single-use systems is primarily fueled by the rapid growth of biologics, vaccines, and cell & gene therapies, coupled with the need for scalable, efficient, and cost-effective manufacturing solutions

- North America dominated the single use bioprocessing market with the largest revenue share of approximately 42.3% in 2025, supported by well-established biopharmaceutical infrastructure, high R&D investment, and the presence of key industry players. The U.S. experienced substantial growth due to adoption in both large-scale and flexible manufacturing facilities, along with innovations from leading biotechnology and equipment providers

- Asia-Pacific is expected to be the fastest-growing region in the single use bioprocessing market during the forecast period, registering a high CAGR driven by expanding biopharmaceutical sectors, rising healthcare expenditure, increasing biologics production, and supportive government initiatives in countries such as China, India, and Japan

- The plastic segment dominated with 52.1% share in 2025, driven by cost-effectiveness, chemical compatibility, and disposability of polymer-based components

Report Scope and Single Use Bioprocessing Market Segmentation

|

Attributes |

Single Use Bioprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Single Use Bioprocessing Market Trends

Rising Adoption in Biopharmaceutical and Cell & Gene Therapy Applications

- A major trend in the global Single Use Bioprocessing market is the increasing adoption of single-use technologies in biopharmaceutical manufacturing, especially in upstream and downstream processes.

- The trend is driven by the growing focus on flexible and modular production systems that allow manufacturers to scale quickly while reducing cross-contamination risks.

- Single-use bioreactors, mixers, and disposable filtration systems are replacing conventional stainless steel systems in many small- to mid-scale facilities

- For instance, in 2024, Cytiva expanded its HyPerforma single-use bioreactor platform with higher-volume configurations to support large-scale monoclonal antibody production

- The modular nature of single-use systems allows companies to reduce setup times and cleaning/sterilization requirements, accelerating production cycles

- These technologies also reduce water and energy consumption, supporting sustainability initiatives and lowering operational costs

- The growing pipeline of cell and gene therapies globally is a significant driver, as these therapies often require small-batch, high-complexity production that single-use systems can efficiently accommodate

- Disposable systems also facilitate multi-product facilities, enabling manufacturers to switch production lines with minimal downtime

- The trend is reinforced by regulatory support for single-use adoption, as agencies recognize the sterility and flexibility benefits in advanced therapies

- Overall, single-use bioprocessing is becoming a standard choice in modern biomanufacturing for its cost-efficiency, scalability, and adaptability to complex biologics production

Single Use Bioprocessing Market Dynamics

Driver

Cost Efficiency, Flexibility, and Reduced Contamination Risks

- The growing need for cost-effective and flexible biomanufacturing processes is a key driver of single-use bioprocessing adoption

- Single-use systems eliminate the need for extensive cleaning and sterilization, reducing labor, downtime, and operational costs.

- For instance, in March 2023, Sartorius launched a new line of single-use bag and tubing assemblies optimized for viral vector and mRNA production, enabling rapid facility setup

- The reduced risk of cross-contamination with disposable components is highly valued in multi-product facilities, particularly for biologics and vaccines

- Manufacturers are increasingly seeking modular systems to support varying batch sizes and complex workflows without major infrastructure investment

- The ability to scale production up or down based on demand provides a competitive advantage in fast-evolving biotech markets

- Single-use bioreactors and downstream systems help companies accelerate process development timelines, an essential factor in bringing therapies to market faster

- Environmental considerations, such as lower water and energy use compared to stainless steel, further motivate adoption

- Collaboration between equipment suppliers and contract development and manufacturing organizations (CDMOs) is enhancing availability and awareness of single-use solutions globally

- These advantages collectively drive strong market growth in biopharmaceutical manufacturing, cell & gene therapy, and vaccine production applications

Restraint/Challenge

Concerns Regarding Cost of Materials and Waste Management

- Despite advantages, single-use bioprocessing faces challenges including the recurring cost of consumables and environmental concerns over plastic waste

- The higher material costs compared to traditional stainless steel systems can be a barrier, particularly for large-scale or high-volume operations

- For instance, In 2022, some industry reports highlighted concerns among manufacturers about long-term sustainability and recycling of disposable bioprocessing components

- The need for specialized storage and handling of disposable components adds complexity for some facilities

- Standardization challenges across different vendors’ single-use systems can impact interoperability and workflow integration

- Operators must carefully balance initial setup costs, operational savings, and lifecycle management of disposable material

- Manufacturers are also investing in initiatives for recycling or repurposing single-use plastics to mitigate environmental impact

- Regulatory guidance on validation and quality assurance of single-use systems requires careful implementation, which can slow adoption in some regions

- Addressing these cost and sustainability challenges through improved recycling programs, standardized components, and optimized procurement strategies is vital for continued market expansion

Single Use Bioprocessing Market Scope

The market is segmented on the basis of type, product, method, material, applications, and end user.

- By Type

On the basis of type, the Single Use Bioprocessing market is segmented into upstream, fermentation, and downstream. The upstream segment dominated the market with a revenue share of 41.5% in 2025, primarily driven by the widespread adoption of single-use bioreactors, disposable mixers, and perfusion systems in cell culture and biologics production. Upstream processes provide benefits such as reduced cleaning and sterilization requirements, minimized cross-contamination risks, and greater flexibility for multi-product facilities. The segment sees high demand from monoclonal antibody manufacturers, vaccine developers, and gene therapy companies who require small- to mid-scale, high-quality production systems. Regulatory encouragement for single-use adoption, lower water and energy consumption, and faster setup times further support growth. Investments by major suppliers to expand their upstream offerings in North America and Europe strengthen the market position. Additionally, modular designs allow easy integration with downstream single-use workflows, enhancing overall efficiency. Cost-effectiveness, scalability, and rapid deployment for clinical and commercial batches make upstream solutions indispensable for biopharmaceutical production.

The fermentation segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by increasing applications in microbial bioprocessing and vaccine production. Single-use fermentation systems allow rapid setup, easy monitoring, and flexibility for multiple microbial products without contamination risks. Emerging markets in Asia-Pacific and Latin America are increasingly adopting single-use fermentation solutions to meet rising demand for biosimilars and vaccines. Technological improvements in single-use fermentation vessels and sensors, along with growing outsourcing to CMOs, are accelerating growth. Manufacturers are also focusing on miniaturized and modular fermentation units for academic and research laboratories, further contributing to adoption. Cost efficiency and reduced downtime between batches make single-use fermentation systems attractive. Environmental sustainability and reduced energy consumption compared to stainless-steel systems are additional growth drivers. Expansion of local production facilities in emerging regions enhances accessibility and adoption of these systems.

- By Product

On the basis of product, the market is segmented into tangential-flow filtration devices, simple & peripheral elements, apparatus & plants, and work equipment. The tangential-flow filtration devices segment dominated the market with 36.8% share in 2025, owing to their essential role in concentrating, clarifying, and diafiltering biologics, monoclonal antibodies, and viral vectors. These devices offer high recovery rates, reproducibility, and compatibility with disposable systems, making them critical in both upstream and downstream workflows. Increasing R&D investments in biopharmaceuticals and rising outsourcing to CMOs further propel demand. Filtration devices are widely used for protein concentration, virus removal, and buffer exchange, providing efficiency and reliability in single-use processes. Continuous innovations in membranes and system automation also support market dominance. Major players emphasize modular and scalable designs, allowing integration with various process stages. The growing adoption of rapid bioprocess development for new therapies increases dependency on high-performance filtration devices.

The apparatus & plants segment is projected to grow at the fastest CAGR of 9.2% from 2026 to 2033, driven by the demand for integrated single-use production plants in multi-product facilities. These systems reduce operational complexity and enhance productivity, particularly for patient-specific therapies and small-batch biologics. Flexible, modular plant designs enable manufacturers to scale quickly and optimize facility utilization. The trend of outsourcing production to CDMOs requiring turn-key single-use facilities further fuels growth. Investments in automation, real-time monitoring, and sensor-enabled processes are also driving adoption. Government incentives for vaccine and biologics manufacturing enhance demand. Faster batch turnaround, reduced cleaning, and compliance with regulatory standards make apparatus & plants highly attractive. Adoption is especially strong in developed markets with high biologics production capacity.

- By Method

On the basis of method, the market is segmented into filtration, storage, cell culture, purification, and mixing. The cell culture segment dominated the market with a revenue share of 38.5% in 2025, supported by the widespread use of single-use bioreactors for mammalian, insect, and stem cell cultures. Single-use systems reduce contamination risk, shorten setup times, and provide scalability for monoclonal antibody and vaccine production. Increasing adoption by contract manufacturing organizations and academic research laboratories enhances market share. Regulatory support for flexible manufacturing and reduced cleaning validation cycles also contributes. Advanced sensors, perfusion capabilities, and modular reactor designs improve process efficiency and consistency. Cost-effectiveness and flexibility for multi-product facilities make cell culture the backbone of single-use bioprocessing. Continuous innovations in disposable sensors and bioreactor materials strengthen dominance. The integration with downstream processes improves overall process economy and throughput.

The filtration segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, due to rising demand for efficient virus removal, cell separation, and protein concentration. Single-use filtration systems reduce risk of cross-contamination, improve product yield, and minimize downtime between batches. Growing adoption in vaccine and gene therapy production drives the segment. Innovations in membrane technology, filtration efficiency, and disposable cassette systems further accelerate growth. Expansion of biologics and biosimilar pipelines globally also increases requirement. Integration with modular upstream and downstream systems enhances adoption in contract manufacturing. Cost savings, ease of validation, and reduced facility footprint make filtration a high-growth segment. Rising demand in emerging markets supports further CAGR expansion.

- By Material

On the basis of material, the market is segmented into plastic, silicone, and others. The plastic segment dominated with 52.1% share in 2025, driven by cost-effectiveness, chemical compatibility, and disposability of polymer-based components. Plastic single-use systems reduce cleaning requirements, contamination risks, and facilitate modular production. Benefits include reduced water usage, energy savings, and easier scalability. Broad applicability in bioreactors, tubing, filtration devices, and connectors strengthens its dominance. Regulatory acceptance of polymeric materials in GMP manufacturing also supports the segment. Manufacturers continue investing in high-grade polymer materials for enhanced sterility and process reliability. Plastic’s lightweight nature and adaptability allow integration into complex workflows, improving throughput. Market leadership is further reinforced by established suppliers offering end-to-end plastic-based solutions.

The silicone segment is expected to register the fastest CAGR of 7.8% from 2026 to 2033, due to biocompatibility, flexibility, and suitability for tubing, seals, gaskets, and connectors in disposable systems. Increasing applications in cell therapy and regenerative medicine support growth. High durability, chemical resistance, and sterilization compatibility make silicone ideal for critical fluid pathways. Demand in emerging markets and contract manufacturing facilities drives adoption. Technological innovations in tubing and connector design enhance performance and reduce risk of contamination. Silicone’s integration with disposable bioreactors and filtration systems ensures broader adoption. Manufacturers focus on quality control and GMP compliance to support segment growth.

- By Applications

On the basis of applications, the market is segmented into monoclonal antibody production, vaccine production, plant cell cultivation, patient-specific cell therapies, and others. The monoclonal antibody production segment held the largest revenue share of 44.3% in 2025, as single-use systems are widely used across upstream and downstream processing. Advantages include sterility, scalability, and reduced downtime between batches. Growing biologics pipelines, high demand for therapeutic antibodies, and the ability to produce multiple products in the same facility drive adoption. Single-use solutions improve process flexibility and reduce cleaning validation requirements. Integration with automated upstream and downstream systems enhances productivity. Adoption by CMOs, large pharma, and academic institutions supports dominance. Environmental benefits, including lower water and energy consumption, also contribute.

The patient-specific cell therapies segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, fueled by rising demand for autologous therapies in oncology and regenerative medicine. Single-use solutions allow flexible, small-batch production while maintaining regulatory compliance. Rapid growth in personalized medicine, advanced therapy pipelines, and cell therapy commercialization drives adoption. Benefits include faster setup, reduced contamination risk, and modular scalability. Emerging markets are increasingly investing in infrastructure for patient-specific production. Demand for flexible, automated, and traceable systems supports high CAGR.

- By End User

On the basis of end user, the market is segmented into biopharmaceuticals industry, CMOs & CROs, pharmaceuticals industry, nutraceuticals industry, chemicals industry, academic & research laboratories, and others. The biopharmaceuticals industry segment dominated with 45.5% revenue share in 2025, due to extensive use of single-use bioprocessing in monoclonal antibody, vaccine, and recombinant protein production. Strong R&D pipelines, large-scale manufacturing requirements, and sustainability initiatives contribute to dominance. Single-use systems enable cost reduction, scalability, and regulatory compliance for multiple products. The integration of upstream and downstream single-use systems enhances operational efficiency.

The CMOs & CROs segment is expected to witness the fastest CAGR of 9.7% from 2026 to 2033, driven by the increasing outsourcing of biologics, cell & gene therapy production. Single-use systems reduce setup time, cross-contamination risk, and facility downtime. Contract manufacturers benefit from flexibility and modular design, supporting multi-product manufacturing. The trend toward personalized therapies and small-batch production accelerates adoption. Global expansion of CMOs in North America, Europe, and Asia-Pacific further drives market growth.

Single Use Bioprocessing Market Regional Analysis

- North America dominated the single use bioprocessing market with the largest revenue share of 42.3% in 2025

- Supported by advanced healthcare infrastructure, high adoption of biopharmaceutical manufacturing technologies, strong research funding, and the presence of leading biotechnology and diagnostics companies

- The market accounted for a major share due to increasing use of single-use systems in upstream, downstream, and cell culture processes

U.S. Single Use Bioprocessing Market Insight

The U.S. single use bioprocessing market captured the largest revenue share of 78% in 2025 within North America, fueled by the increasing adoption of disposable bioreactors, filtration devices, and integrated downstream systems across pharmaceutical and biopharmaceutical manufacturing. Demand for flexible production platforms for vaccines, monoclonal antibodies, and cell therapies is driving market expansion.

Europe Single Use Bioprocessing Market Insight

The Europe single use bioprocessing market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in biopharmaceutical R&D, adoption of flexible manufacturing platforms, and stringent regulatory standards promoting contamination-free production. Germany, the U.K., and France are leading the regional adoption, particularly in contract manufacturing organizations (CMOs) and academic research centers.

U.K. Single Use Bioprocessing Market Insight

The U.K. single use bioprocessing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of flexible and disposable bioprocessing systems in both pharmaceutical and biopharmaceutical manufacturing. The demand for monoclonal antibody production, vaccines, and cell-based therapies, combined with strong government support for biopharmaceutical R&D, is encouraging manufacturers and CMOs to invest in single-use technologies.

Germany Single Use Bioprocessing Market Insight

The Germany single use bioprocessing market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s well-developed biopharmaceutical infrastructure, emphasis on sustainable and contamination-free manufacturing, and high adoption of advanced upstream and downstream single-use systems. Germany’s strong presence of CMOs, research institutions, and biopharma companies promotes rapid deployment of single-use bioprocessing technologies across multiple applications, including vaccine production, cell therapy, and monoclonal antibodies

Asia-Pacific Single Use Bioprocessing Market Insight

The Asia-Pacific single use bioprocessing market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid expansion of biopharmaceutical manufacturing, government initiatives supporting modern bioprocessing, and increasing demand for vaccines and cell-based therapies. China and India are key growth markets due to rising local production capacities and investments in single-use technology.

Japan Single Use Bioprocessing Market Insight

The Japan single use bioprocessing market is gaining momentum due to strong government support for biopharmaceutical R&D, increasing adoption of disposable bioreactors, and growing demand for personalized therapies. The focus on contamination-free and cost-efficient manufacturing is boosting adoption in both industrial and research applications.

China Single Use Bioprocessing Market Insight

The China single use bioprocessing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to expanding local biopharmaceutical production, rising demand for vaccines, and increasing adoption of single-use systems in both upstream and downstream processes. Domestic manufacturers are also introducing cost-effective and scalable solutions, driving broader market penetration.

Single Use Bioprocessing Market Share

The Single Use Bioprocessing industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• GE Healthcare (U.S.)

• Sartorius Stedim Biotech (Germany)

• Merck KGaA (Germany)

• Pall Corporation (U.S.)

• Danaher Corporation (U.S.)

• Cytiva (U.S.)

• Bio-Rad Laboratories (U.S.)

• Lonza Group (Switzerland)

• Repligen Corporation (U.S.)

• PBS Biotech (U.S.)

• Eppendorf AG (Germany)

• FUJIFILM Diosynth Biotechnologies (Japan)

• Corning Incorporated (U.S.)

• Applikon Biotechnology (Netherlands)

• CellGenix (Germany)

• Univercells Technologies (Belgium)

• MilliporeSigma (U.S.)

• Hitachi Chemical (Japan)

• Bioengineering AG (Switzerland)

Latest Developments in Global Single Use Bioprocessing Market

- In March 2021, Thermo Fisher Scientific launched its 3,000 L and 5,000 L “HyPerforma DynaDrive” single‑use bioreactors — an innovation touted for scalability, high performance, and suitability for fed‑batch and perfusion processes

- In April 2023, Merck KGaA introduced “Ultimus,” a new single‑use process container film engineered for enhanced strength and leak resistance for disposable bioprocessing assemblies. This aims to improve reliability and contamination control in biopharmaceutical workflows

- In August 2023, Sartorius AG together with Repligen Corporation announced an integrated bioreactor system combining Sartorius’ Biostat stirred‑tank reactors with Repligen’s XCell ATF upstream intensification technology — designed to streamline upstream bioprocessing and intensify perfusion workflows

- In September 2023, Getinge unveiled the “AppliFlex ST GMP,” a next‑generation single‑use bioreactor designed for cGMP‑compliant manufacturing, suitable for mRNA, cell and gene therapies — marking a significant advancement toward regulatory‑ready, disposable bioprocessing platforms

- In March 2024, reports noted that next‑generation single‑use bioreactors with improved mixing and aeration capabilities were launched, offering better scalability and reduced process variability — a step forward for large‑scale biologics and vaccine manufacturing

- In April 2024, Cytiva launched the “Xcellerex magnetic mixer,” a single‑use mixing system available in 2,000 L and 3,000 L capacities — aimed at large‑scale manufacturing of monoclonal antibodies, vaccines, and gene therapies

- In June 2024, the consolidated market analysis for single‑use bioreactors estimated that the global market would expand rapidly — citing rising demand for flexible, scalable, and cost‑effective biomanufacturing solutions across biologics, cell & gene therapies, and vaccines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.