Global Smart Implantable Pumps Market

Market Size in USD Billion

CAGR :

%

USD

3.62 Billion

USD

6.59 Billion

2025

2033

USD

3.62 Billion

USD

6.59 Billion

2025

2033

| 2026 –2033 | |

| USD 3.62 Billion | |

| USD 6.59 Billion | |

|

|

|

|

Smart Implantable Pumps Market Size

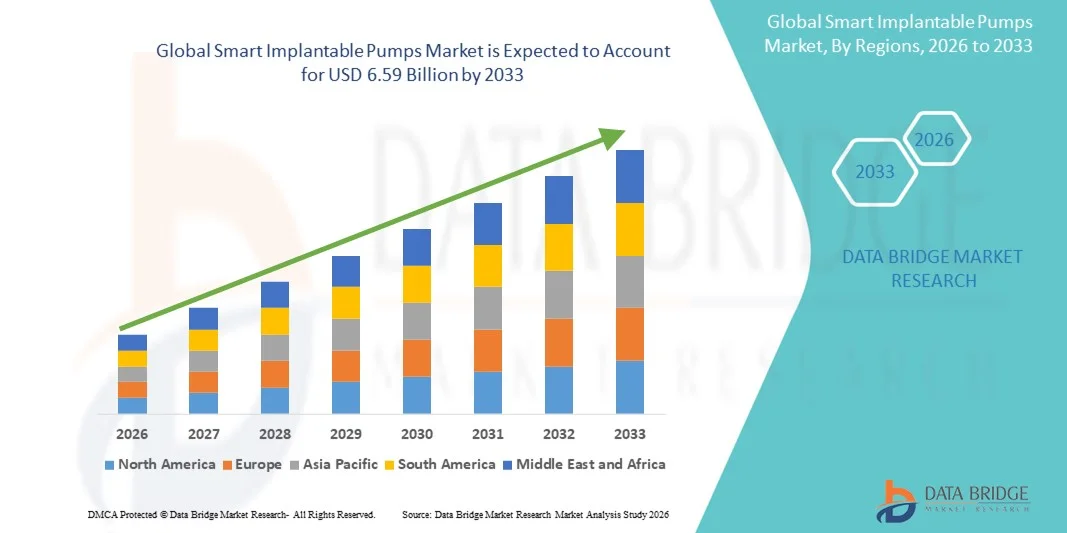

- The global smart implantable pumps market size was valued at USD 3.62 billion in 2025 and is expected to reach USD 6.59 billion by 2033, at a CAGR of 7.79% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced implantable medical devices and continuous technological progress in smart drug-delivery systems, leading to improved treatment precision, remote monitoring, and enhanced patient outcomes in both hospital and home-care settings

- Furthermore, rising demand for minimally invasive therapies, long-term disease management solutions, and user-friendly implantable devices, along with increasing prevalence of chronic conditions such as cancer, diabetes, and neurological disorders, is establishing smart implantable pumps as a preferred therapeutic option. These converging factors are accelerating the uptake of Smart Implantable Pumps solutions, thereby significantly boosting the industry's growth

Smart Implantable Pumps Market Analysis

- Smart implantable pumps, used for precise and controlled drug delivery in the treatment of chronic conditions such as cancer, diabetes, pain management, and neurological disorders, are increasingly vital components of advanced medical care due to their ability to enable continuous dosing, remote monitoring, and improved patient compliance in both hospital and long-term care settings

- The escalating demand for smart implantable pumps is primarily fueled by the rising prevalence of chronic diseases, increasing adoption of minimally invasive medical technologies, advancements in sensor-enabled and programmable drug delivery systems, and growing emphasis on personalized and long-term therapies

- North America dominated the smart implantable pumps market with the largest revenue share of approximately 39.1% in 2025, supported by advanced healthcare infrastructure, high adoption of implantable medical devices, favorable reimbursement policies, and strong presence of leading medical device manufacturers, with the U.S. experiencing substantial growth in oncology, pain management, and insulin delivery applications

- Asia-Pacific is expected to be the fastest-growing region in the smart implantable pumps market during the forecast period due to rising healthcare expenditure, increasing incidence of chronic diseases, expanding access to advanced medical treatments, and growing adoption of implantable therapies across China, India, and Japan

- The pain and spasticity segment accounted for the largest market revenue share of 61.2% in 2025, driven by the increasing prevalence of chronic pain, cancer-related pain, and neurological disorders such as multiple sclerosis and spinal cord injuries

Report Scope and Smart Implantable Pumps Market Segmentation

|

Attributes |

Smart Implantable Pumps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Smart Implantable Pumps Market Trends

Technological Advancements in Smart and Programmable Implantable Pumps

- A significant and accelerating trend in the global smart implantable pumps market is the continuous advancement in programmable, miniaturized, and patient-centric implantable pump technologies designed to improve precision drug delivery and long-term disease management

- For instance, next-generation implantable infusion pumps are increasingly being developed with enhanced programmability and real-time dosage adjustment capabilities, enabling clinicians to tailor drug delivery for conditions such as chronic pain, cancer, diabetes, and neurological disorders

- Manufacturers are focusing on improving battery life, biocompatible materials, and wireless data transmission to enhance device longevity, patient comfort, and post-implantation monitoring

- The integration of smart control interfaces with external monitoring systems is streamlining clinical workflows, allowing healthcare providers to track treatment progress and adjust therapy regimens without invasive procedures

- This trend toward safer, more precise, and patient-friendly implantable pumps is reshaping expectations in chronic disease treatment and encouraging hospitals and specialty clinics to adopt advanced pump systems

- Global adoption is further supported by rising demand for minimally invasive therapies and personalized medicine approaches across developed and emerging healthcare markets

Smart Implantable Pumps Market Dynamics

Driver

Increasing Prevalence of Chronic Diseases and Demand for Targeted Drug Delivery

- The rising global burden of chronic diseases such as diabetes, cancer, cardiovascular disorders, and neurological conditions is a key driver for the growing adoption of smart implantable pumps

- For instance, the increasing number of patients requiring long-term pain management and insulin therapy in North America and Europe has accelerated demand for implantable pumps that offer continuous, controlled, and accurate drug delivery

- Smart implantable pumps provide significant clinical benefits, including reduced dosing errors, improved therapeutic outcomes, and enhanced patient compliance compared to conventional drug delivery methods

- Furthermore, expanding healthcare infrastructure, increasing healthcare expenditure, and growing awareness of advanced treatment options are supporting market growth globally

- The shift toward outpatient care, home-based treatment, and minimally invasive medical devices is further driving the adoption of smart implantable pumps across hospitals and specialty care centers

Restraint/Challenge

High Device Costs and Stringent Regulatory Requirements

- Despite strong demand, the smart implantable pumps market faces challenges related to high development, manufacturing, and implantation costs, which can limit adoption in cost-sensitive healthcare systems

- For instance, advanced implantable pump systems require extensive clinical validation and regulatory approvals, increasing time-to-market and overall costs for manufacturers and healthcare providers

- Stringent regulatory frameworks across regions such as the U.S., Europe, and parts of Asia demand rigorous safety, efficacy, and post-market surveillance, creating additional compliance burdens

- Limited availability of skilled professionals for implantation procedures and device programming in certain regions further restrains market expansion

- Addressing these challenges through cost optimization, streamlined regulatory pathways, and expanded clinician training programs will be essential for sustained global growth in the Smart Implantable Pumps market

Smart Implantable Pumps Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Smart Implantable Pumps market is segmented into perfusion pumps and micro-pumps. The perfusion pumps segment dominated the largest market revenue share of 58.4% in 2025, driven by their extensive use in continuous drug delivery applications such as pain management, chemotherapy, insulin administration, and cardiovascular therapies. Perfusion pumps offer precise flow control, long-term reliability, and programmable dosing, which are critical for chronic disease management. Their widespread adoption in hospitals and specialty clinics further strengthens dominance. Technological advancements such as wireless connectivity, real-time monitoring, and AI-enabled dosing optimization enhance clinical outcomes. High clinical acceptance and proven safety profiles support continued usage. North America led adoption due to strong reimbursement and regulatory approvals. Europe followed with increasing demand for advanced implantable solutions. Growing elderly populations and chronic disease prevalence also fuel demand. As a result, perfusion pumps remain the leading revenue-generating segment.

The micro-pumps segment is expected to witness the fastest growth, registering a CAGR of 21.9% from 2026 to 2033, driven by rising demand for miniaturized, minimally invasive implantable devices. Micro-pumps offer advantages such as compact size, lower power consumption, and enhanced patient comfort. Increasing adoption in targeted drug delivery and personalized medicine accelerates growth. Technological innovations in MEMS and nanotechnology support product development. Growing preference for outpatient and home-based therapies boosts demand. Emerging markets are adopting micro-pumps due to cost efficiency and ease of implantation. Research collaborations and clinical trials further expand adoption. Manufacturers focus on improving battery life and precision. These factors collectively position micro-pumps as the fastest-growing segment.

- By Application

On the basis of application, the Smart Implantable Pumps market is segmented into pain and spasticity, and cardiovascular. The pain and spasticity segment accounted for the largest market revenue share of 61.2% in 2025, driven by the increasing prevalence of chronic pain, cancer-related pain, and neurological disorders such as multiple sclerosis and spinal cord injuries. Smart implantable pumps enable continuous and controlled delivery of analgesics and antispasmodic drugs, improving patient outcomes. Growing acceptance of intrathecal drug delivery systems supports dominance. Hospitals and specialty pain clinics extensively use these devices. Advancements in programmable pumps and remote monitoring enhance safety and efficacy. Favorable reimbursement policies in developed regions further support adoption. North America dominates due to high diagnosis rates and advanced healthcare infrastructure. Increasing geriatric population strengthens demand. These factors collectively drive leadership of this segment.

The cardiovascular segment is projected to witness the fastest CAGR of 20.6% from 2026 to 2033, fueled by the rising burden of cardiovascular diseases worldwide. Implantable pumps support targeted drug delivery for heart failure and related conditions. Increasing adoption of advanced therapies and minimally invasive procedures accelerates growth. Technological innovations improve precision and reduce complications. Growing awareness of early cardiovascular intervention boosts demand. Expansion of cardiology specialty centers supports adoption. Asia-Pacific shows strong growth potential due to rising healthcare investments. Clinical research and regulatory approvals further strengthen uptake. As cardiovascular disease prevalence increases, this segment will grow rapidly.

- By End User

On the basis of end user, the Smart Implantable Pumps market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment dominated the market with a revenue share of 55.7% in 2025, owing to the availability of advanced surgical infrastructure and skilled medical professionals. Hospitals manage complex implant procedures and long-term patient monitoring, making them the primary end users. High patient inflow and strong reimbursement support dominance. Adoption of smart monitoring systems enhances hospital efficiency. Hospitals in North America and Europe lead due to early technology adoption. Integration with electronic health records improves clinical workflow. Rising chronic disease admissions further increase demand. Partnerships between hospitals and device manufacturers strengthen market presence. Consequently, hospitals remain the dominant end-user segment.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 22.3% from 2026 to 2033, driven by the shift toward outpatient procedures and cost-effective healthcare delivery. ASCs offer reduced hospital stays and faster recovery times. Technological advancements enable safe implantation in outpatient settings. Growing patient preference for minimally invasive procedures supports growth. Increasing number of ASCs globally expands access. Favorable reimbursement for outpatient surgeries further accelerates adoption. Emerging economies show strong ASC expansion. Device miniaturization supports suitability for ambulatory settings. These factors collectively drive rapid growth of this segment.

Smart Implantable Pumps Market Regional Analysis

- North America dominated the smart implantable pumps market with the largest revenue share of approximately 39.1% in 2025, supported by advanced healthcare infrastructure, high adoption of implantable medical devices, and favorable reimbursement policies across major therapeutic areas

- The region benefits from a strong presence of leading medical device manufacturers and continuous technological advancements in implantable pump systems used for oncology, pain management, and insulin delivery

- High awareness among clinicians and patients, coupled with early adoption of digitally enabled and programmable implantable pumps, continues to reinforce North America’s leading position in both hospital and specialty care settings

U.S. Smart Implantable Pumps Market Insight

The U.S. smart implantable pumps market accounted for the largest revenue share within North America in 2025, driven by substantial growth in oncology care, chronic pain management, and diabetes treatment. The widespread adoption of advanced implantable infusion technologies, supported by strong clinical research activity and favorable reimbursement frameworks, is accelerating market growth. Additionally, the increasing preference for precise, long-term drug delivery solutions and the rapid integration of smart monitoring features are strengthening demand across hospitals and specialty clinics.

Europe Smart Implantable Pumps Market Insight

The Europe smart implantable pumps market is projected to expand at a steady CAGR during the forecast period, primarily driven by rising prevalence of chronic diseases and increasing demand for minimally invasive treatment solutions. Strong regulatory standards, expanding geriatric population, and growing investments in advanced medical technologies are supporting the adoption of smart implantable pumps across hospitals and specialized care centers. Countries across Western Europe are witnessing increased uptake in pain management and cancer therapy applications.

U.K. Smart Implantable Pumps Market Insight

The U.K. smart implantable pumps market is expected to grow at a notable CAGR over the forecast period, supported by the National Health Service’s focus on advanced therapeutic delivery systems and improved chronic disease management. Increasing use of implantable pumps for cancer pain control and long-term drug administration, along with growing clinical acceptance of smart medical devices, is driving market expansion across the country.

Germany Smart Implantable Pumps Market Insight

The Germany smart implantable pumps market is anticipated to expand at a considerable CAGR, driven by strong healthcare infrastructure, high medical technology adoption, and emphasis on precision-based treatment approaches. Germany’s leadership in medical device innovation and its focus on advanced infusion therapies are supporting the integration of smart implantable pumps in both hospital and outpatient care environments.

Asia-Pacific Smart Implantable Pumps Market Insight

The Asia-Pacific smart implantable pumps market is expected to register the fastest CAGR during the forecast period, fueled by rising healthcare expenditure, increasing incidence of chronic diseases, and expanding access to advanced medical treatments. Rapid improvements in healthcare infrastructure, combined with growing adoption of implantable therapies across China, India, and Japan, are significantly contributing to regional market growth.

Japan Smart Implantable Pumps Market Insight

The Japan smart implantable pumps market is gaining momentum due to the country’s aging population and rising demand for advanced drug delivery solutions. Strong focus on precision medicine, high acceptance of implantable medical technologies, and increasing use of smart pumps for pain management and oncology applications are driving steady market expansion across healthcare facilities.

China Smart Implantable Pumps Market Insight

The China smart implantable pumps market held the largest revenue share in Asia-Pacific in 2025, driven by rapidly expanding healthcare infrastructure, rising prevalence of chronic diseases, and increasing adoption of advanced implantable therapies. Government initiatives to modernize healthcare systems, combined with growing domestic manufacturing capabilities, are accelerating the availability and adoption of smart implantable pump technologies across hospitals and specialty clinics.

Smart Implantable Pumps Market Share

The Smart Implantable Pumps industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Baxter International Inc. (U.S.)

• B. Braun SE (Germany)

• Fresenius Kabi (Germany)

• Terumo Corporation (Japan)

• Insulet Corporation (U.S.)

• Tandem Diabetes Care (U.S.)

• Abbott Laboratories (U.S.)

• Flowonix Medical, Inc. (U.S.)

• Tricumed Medizintechnik GmbH (Germany)

• Codman & Shurtleff (U.S.)

• Micrel Medical Devices SA (Greece)

• Zyno Medical (U.S.)

• Sorin Group (Italy)

• Medallion Therapeutics (U.S.)

• Nevro Corp. (U.S.)

• Nipro Corporation (Japan)

• JMS Co., Ltd. (Japan)

• Moog Medical Devices Group (U.S.)

Latest Developments in Global Smart Implantable Pumps Market

- In May 2024, Medtronic (Ireland/Global) announced a research collaboration with Arecor Therapeutics (UK) to develop a high-concentration, thermostable insulin formulation for next-generation implantable insulin pumps, aimed at improving stability, reducing maintenance requirements, and enhancing usability for patients with diabetes. This partnership is expected to support more efficient long-term diabetes management by improving drug formulations specifically tailored for implantable pump delivery systems

- In August 2024, Flowonix Medical (USA) received FDA approval for its Prometra II programmable pump for intrathecal baclofen therapy in severe spasticity, expanding clinical use of smart implantable pumps for targeted neuromuscular conditions and enabling long-term programmable drug delivery under real-world conditions. This approval highlights regulatory progress for advanced programmable implantable devices in complex chronic therapies

- In February 2025, a preclinical large-animal study published in Neurosurgery demonstrated the safety and precise control of metronomic drug delivery using an implantable smart pump model, supporting progression toward first-in-human clinical trials with enhanced biocompatibility and remote programmability. This preclinical validation marks a significant step toward clinical translation of next-generation biologically responsive pump systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.