Global Smart Oven Market

Market Size in USD Billion

CAGR :

%

USD

11.12 Billion

USD

19.11 Billion

2024

2032

USD

11.12 Billion

USD

19.11 Billion

2024

2032

| 2025 –2032 | |

| USD 11.12 Billion | |

| USD 19.11 Billion | |

|

|

|

|

Smart Oven Market Size

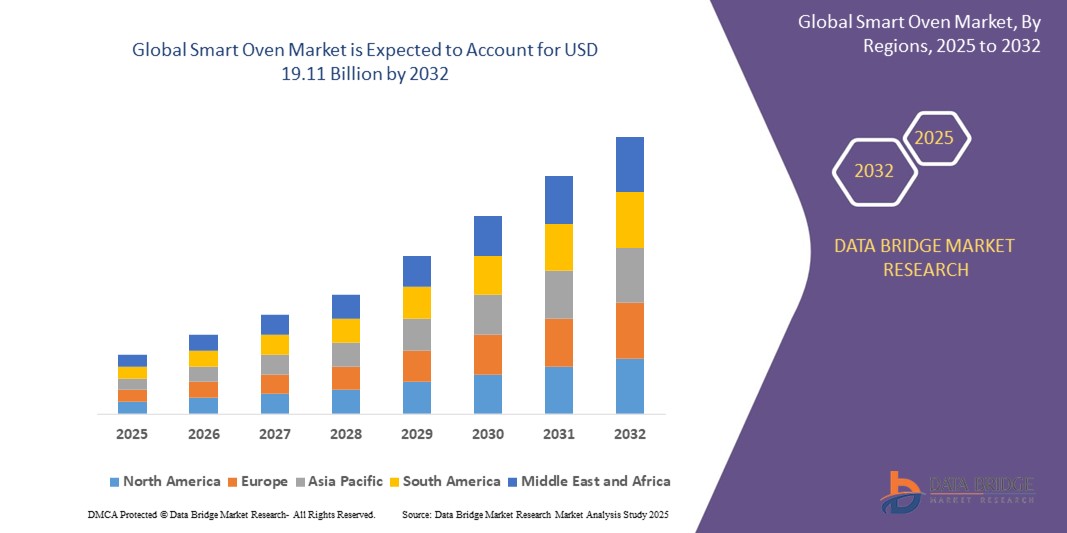

- The global smart oven market size was valued at USD 11.12 billion in 2024 and is expected to reach USD 19.11 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is primarily driven by the increasing adoption of smart kitchen appliances, advancements in connected home technologies, and rising consumer preference for convenient, automated cooking solutions in both household and commercial settings

- Growing demand for energy-efficient, user-friendly, and integrated appliances, coupled with the rise of smart home ecosystems, is positioning smart ovens as a preferred choice for modern kitchens, significantly boosting industry growth

Smart Oven Market Analysis

- Smart ovens, equipped with advanced features such as remote control, voice activation, and integration with smart home systems, are becoming essential components of modern kitchens in both residential and commercial applications due to their convenience, precision, and connectivity

- The surge in demand for smart ovens is fueled by the widespread adoption of smart home technologies, increasing consumer interest in automated cooking solutions, and the need for efficient kitchen appliances in fast-paced lifestyles

- North America dominated the smart oven market with the largest revenue share of 42.5% in 2024, driven by early adoption of smart home technologies, high disposable incomes, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, rising disposable incomes, and increasing demand for smart kitchen appliances in emerging markets

- The multiple functions segment dominated the largest market revenue share of 91.22% in 2024, driven by consumer demand for versatile kitchen appliances that combine various cooking modes in a single unit. This segment offers greater convenience and space-saving benefits

Report Scope and Smart Oven Market Segmentation

|

Attributes |

Smart Oven Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Oven Market Trends

“Increasing Integration of IoT and AI”

- The global smart oven market is experiencing a significant trend toward the integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies

- These technologies enable advanced data processing, offering insights into cooking patterns, energy usage, and appliance performance, enhancing user convenience and efficiency

- AI-powered smart ovens can provide personalized cooking recommendations, optimize cooking times, and suggest recipes based on available ingredients or user preferences

- For instances, companies are developing AI-driven platforms that allow smart ovens to connect with mobile apps for remote monitoring, voice control, and automated cooking adjustments based on real-time data

- This trend is increasing the appeal of smart ovens for both household and commercial users, as it simplifies meal preparation and supports energy-efficient cooking

- IoT connectivity enables seamless integration with other smart home devices, allowing synchronized operations within a smart kitchen ecosystem

Smart Oven Market Dynamics

Driver

“Rising Demand for Connected Kitchen Appliances and Energy Efficiency”

- Growing consumer demand for connected kitchen appliances, such as those offering remote control, recipe guidance, and integration with smart home ecosystems, is a key driver for the global smart oven market

- Smart ovens enhance user convenience through features such as remote preheating, automatic cooking presets, and real-time notifications, appealing to tech-savvy consumers

- Government initiatives promoting energy-efficient appliances, particularly in regions such as Europe and North America, are boosting the adoption of smart ovens with eco-friendly features

- The expansion of IoT and advancements in Wi-Fi and Bluetooth technologies are enabling faster and more reliable connectivity, supporting sophisticated smart oven functionalities

- Manufacturers are increasingly incorporating smart ovens as standard or optional features in modern kitchens to meet consumer expectations for convenience and sustainability

Restraint/Challenge

“High Cost of Implementation and Data Privacy Concerns”

- The high initial costs associated with hardware, software, and integration of smart oven systems can be a barrier to adoption, particularly in cost-sensitive emerging markets

- Retrofitting existing kitchens with smart ovens or integrating them into smart home ecosystems can be complex and expensive

- Data security and privacy concerns are significant challenges, as smart ovens collect and transmit sensitive user data, such as cooking habits and preferences, raising risks of breaches or misuse

- The lack of standardized regulations across countries for data collection, storage, and usage complicates compliance for manufacturers and service providers operating globally

- These factors may deter potential buyers, particularly in regions with high awareness of data privacy or where budget constraints are a key consideration

Smart Oven market Scope

The market is segmented on the basis of type, structure, distribution channel, connectivity, capacity, application, and end user.

- By Type

On the basis of type, the global smart oven market is segmented into single function and multiple functions. The multiple functions segment dominated the largest market revenue share of 91.22% in 2024, driven by consumer demand for versatile kitchen appliances that combine various cooking modes in a single unit. This segment offers greater convenience and space-saving benefits.

The single function segment is anticipated to witness significant growth from 2025 to 2032, particularly for consumers seeking specialized and high-performance ovens for specific cooking needs, such as dedicated smart microwave ovens or smart air fryers.

- By Structure

On the basis of structure, the global smart oven market is segmented into built-in smart ovens and counter-top. The built-in smart ovens segment is expected to hold the largest market revenue share, primarily driven by the increasing trend of modular kitchens and the aesthetic appeal of integrated appliances. Built-in smart ovens offer a seamless look and often come with advanced features and larger capacities.

The counter-top segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their affordability, portability, and ease of installation, making them popular for smaller kitchens, apartments, and as supplementary cooking appliances.

- By Distribution Channel

On the basis of distribution channel, the global smart oven market is segmented into e-commerce websites and electrical appliances stores. The electrical appliances stores segment is expected to hold the largest market revenue share, as consumers often prefer to physically examine smart ovens, compare models, and receive in-person demonstrations and expert advice before making a purchase.

The e-commerce websites segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the convenience of online shopping, competitive pricing, wider product selection, and the increasing penetration of internet and digital payment solutions.

- By Connectivity

On the basis of connectivity, the global smart oven market is segmented into Wi-Fi, NFC (Near Field Communication), Bluetooth, IoT, and others. The Wi-Fi segment is expected to hold the largest market revenue share, owing to its widespread availability and ability to enable comprehensive remote control, monitoring, and integration with smart home ecosystems.

The IoT segment is anticipated to witness significant growth from 2025 to 2032, driven by the increasing adoption of smart home devices and the desire for interconnected appliances that can communicate and automate cooking processes based on user preferences and external factors.

- By Capacity

On the basis of capacity, the global smart oven market is segmented into 20-25 litres, 26-30 litres, and above 30 litres. The 26-30 litres segment is expected to hold the largest market revenue share, driven by its versatility for accommodating most household cooking needs, balancing compact design with sufficient capacity for family meals.

The above 30 litres segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the growing trend of larger families, an increase in gourmet cooking at home, and the demand for ovens capable of handling larger dishes and multiple items simultaneously.

- By Application

On the basis of application, the global smart oven market is segmented into household and commercial service industries. The household segment is expected to hold the largest market revenue share, driven by the increasing disposable income, rising adoption of smart home appliances, and the desire for convenience and efficiency in everyday cooking.

The commercial service industries segment is anticipated to witness rapid growth from 2025 to 2032, fueled by the increasing demand for automation and efficiency in professional kitchens, enabling precise cooking, consistent results, and reduced labor costs in restaurants, cafes, and bakeries.

- By End User

On the basis of end user, the global smart oven market is segmented into restaurants, gourmet cafes, confectionary stores, bakeries, and others. The restaurants segment is expected to hold the largest market revenue share, driven by the high volume of food preparation, the need for consistent cooking results, and the desire to optimize kitchen operations.

The bakeries segment is anticipated to witness significant growth from 2025 to 2032, fueled by the increasing demand for freshly baked goods and the need for precise temperature control and programmable settings to ensure optimal baking results.

Smart Oven Market Regional Analysis

- North America dominated the smart oven market with the largest revenue share of 42.5% in 2024, driven by early adoption of smart home technologies, high disposable incomes, and the presence of key industry players

- Consumers prioritize smart ovens for enhancing cooking convenience, energy efficiency, and integration with IoT ecosystems, particularly in regions with high technology adoption

- Growth is supported by advancements in oven technology, including Wi-Fi, Bluetooth, and IoT connectivity, alongside rising adoption in both household and commercial service industries

U.S. Smart Oven Market Insight

The U.S. smart oven market captured the largest revenue share of 88.9% in 2024 within North America, fueled by strong consumer demand for connected kitchen appliances and growing awareness of energy efficiency and cooking automation benefits. The trend towards smart home integration and increasing adoption of voice-controlled devices further boost market expansion. Manufacturers’ incorporation of smart ovens in premium kitchen setups complements e-commerce and retail sales, creating a diverse product ecosystem.

Europe Smart Oven Market Insight

The Europe smart oven market is expected to witness significant growth, supported by regulatory emphasis on energy efficiency and consumer demand for connected appliances. Consumers seek ovens that offer remote control, precise cooking settings, and integration with smart home systems. The growth is prominent in both household and commercial applications, with countries such as Germany and France showing significant uptake due to rising environmental awareness and urban lifestyles.

U.K. Smart Oven Market Insight

The U.K. market for smart ovens is expected to witness rapid growth, driven by demand for enhanced cooking convenience and energy efficiency in urban and suburban settings. Increased interest in smart home ecosystems and rising awareness of automated cooking benefits encourage adoption. Evolving regulations on energy-efficient appliances influence consumer choices, balancing functionality with compliance.

Germany Smart Oven Market Insight

Germany is expected to witness rapid growth in the smart oven market, attributed to its advanced consumer electronics sector and high consumer focus on cooking precision and energy efficiency. German consumers prefer technologically advanced ovens with Wi-Fi and IoT connectivity that reduce energy consumption and enhance user experience. The integration of these ovens in premium households and commercial kitchens supports sustained market growth.

Asia-Pacific Smart Oven Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding consumer electronics production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of smart oven benefits, including remote monitoring and energy efficiency, is boosting demand. Government initiatives promoting smart home technologies and energy conservation further encourage the use of advanced smart ovens.

Japan Smart Oven Market Insight

Japan’s smart oven market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced ovens that enhance cooking convenience and safety. The presence of major appliance manufacturers and integration of smart ovens in OEM kitchen setups accelerate market penetration. Rising interest in aftermarket smart home solutions also contributes to growth.

China Smart Oven Market Insight

China holds the largest share of the Asia-Pacific smart oven market, propelled by rapid urbanization, rising appliance ownership, and increasing demand for connected kitchen solutions. The country’s growing middle class and focus on smart home integration support the adoption of advanced smart ovens. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Smart Oven Market Share

The smart oven industry is primarily led by well-established companies, including:

- SHARP CORPORATION (Japan)

- AB Electrolux (Sweden)

- Alto-Shaam, Inc. (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Galanz (China)

- Midea Group (China)

- SAMSUNG (South Korea)

- Panasonic Corporation (Japan)

- SMEG S.p.A. (Italy)

- BSH Hausgeräte GmbH (Germany)

- LG Electronics (South Korea)

- Whirlpool Corporation (U.S.)

- Haier Inc. (China)

- Robert Bosch GmbH (Germany)

- Miele (Germany)

What are the Recent Developments in Global Smart Oven Market?

- In May 2024, Samsung Electronics unveiled its Bespoke AI Oven line, integrating advanced artificial intelligence to enhance cooking experiences. These ovens feature internal cameras that can identify dishes and suggest optimal cooking settings, ensuring precision and convenience. AI-powered functionalities also improve energy efficiency and provide personalized recipe recommendations, making meal preparation smarter and more intuitive. The launch aligns with Samsung’s broader Bespoke AI home appliance strategy, emphasizing connectivity and automation

- In April 2024, LG Electronics introduced its latest Signature Kitchen Suite, featuring a built-in oven, free zone induction hob, and downdraft hood. These appliances incorporate advanced AI technologies, optimizing cooking efficiency and convenience. The free zone induction hob allows flexible cookware placement, while the downdraft hood ensures effective ventilation without obstructing kitchen aesthetics. LG’s AI-powered cooking assistant provides precise temperature control, automated recipe suggestions, and real-time monitoring, enhancing the smart kitchen experience.

- In January 2024, Whirlpool Corporation unveiled its latest smart oven innovations at CES, emphasizing enhanced connectivity with smart home devices and advanced sensor technology for precise cooking. These ovens integrate Matter 1.3, a smart home connectivity standard, ensuring seamless interoperability across kitchen and laundry appliances. Whirlpool’s smart ovens offer voice control, multi-step cooking, and touchscreen adaptability, creating a more intuitive kitchen ecosystem

- In September 2023, Miele introduced a new series of smart ovens, featuring specialized cooking programs and a strong focus on energy efficiency. These ovens integrate remote diagnostic capabilities, enabling proactive maintenance and support. Key innovations include Smart Food ID, which identifies dishes and suggests optimal cooking settings, and Smart Browning Control, ensuring precise cooking results. The ovens also feature TasteControl, preventing food from overcooking by rapidly cooling the oven chamber

- In February 2023, Tovala expanded its product lineup with the launch of the Tovala Smart Oven Air Fryer, a cloud-connected appliance designed to automate cooking processes. Available in a sleek stone-gray finish, this multi-function oven features bake, broil, toast, reheat, and air fry modes, ensuring effortless meal preparation. The dual-speed fan enhances crispiness, while QR code scanning simplifies cooking by automatically adjusting settings for Tovala Meals and store-bought foods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.